false

0000313143

HAEMONETICS CORP

0000313143

2024-05-22

2024-05-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section

13 or 15(d)

of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event

reported): May 22, 2024

HAEMONETICS CORPORATION

(Exact name of registrant as specified

in its charter)

Commission File Number: 001-14041

| Massachusetts |

|

04-2882273 |

|

(State or other jurisdiction

of incorporation) |

|

(IRS Employer

Identification No.) |

| |

|

125 Summer Street

Boston, MA 02110 |

| (Address of principal executive offices, including zip code) |

781-848-7100

(Registrant’s telephone number,

including area code)

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, $.01 par value per share |

|

HAE |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 |

Regulation FD Disclosure. |

On May 22, 2024, Haemonetics Corporation issued a press release

announcing that it had priced an offering of $600 million aggregate principal amount of convertible senior notes due 2029 in a private

offering pursuant to Rule 144A under the Securities Act of 1933, as amended, and that it has entered into agreements to repurchase

for $185.5 million in cash approximately $200.0 million in aggregate principal amount of its 0.00% Convertible Senior Notes due 2026 in

privately negotiated transactions concurrently with the pricing of the notes in the offering. A copy of the press release is furnished

as Exhibit 99.1 and incorporated herein by reference.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

HAEMONETICS CORPORATION |

| |

|

|

| Date: May 22, 2024 |

By: |

/s/ James C. D’Arecca |

| |

Name: |

James C. D’Arecca |

| |

Title: |

Chief Financial Officer |

Exhibit 99.1

| Investor Contacts: |

| Olga Guyette, Sr. Director-Investor Relations & Treasury |

David Trenk, Manager-Investor Relations |

| (781) 356-9763 |

(203) 733-4987 |

| olga.guyette@haemonetics.com |

david.trenk@haemonetics.com |

| |

| Media Contact: |

| Josh Gitelson, Director-Global Communications |

| (781) 356-9776 |

| josh.gitelson@haemonetics.com |

Haemonetics Prices Upsized Private Placement

of $600 Million Convertible Senior Notes

BOSTON, MA, May 22, 2024

-- Haemonetics Corporation (“Haemonetics”) (NYSE: HAE) today announced the pricing of its offering of $600,000,000 aggregate

principal amount of 2.50% Convertible Senior Notes due 2029 (the “notes”) in a private offering (the “offering”)

to qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”).

The offering size was increased from the previously announced offering size of $525,000,000 aggregate principal amount of notes. The offering

is expected to close on May 28, 2024, subject to customary closing conditions. Haemonetics also granted the initial purchasers of

the notes an option to purchase, for settlement within a period of 13 days from, and including, the date notes are first issued, up to

an additional $100,000,000 principal amount of notes.

The notes will be senior, unsecured obligations of Haemonetics. The

notes will mature on June 1, 2029, unless earlier repurchased, redeemed or converted. Before December 1, 2028, noteholders will

have the right to convert their notes only upon the occurrence of certain events. From and after December 1, 2028, noteholders may

convert their notes at any time at their election until the close of business on the second scheduled trading day immediately before the

maturity date. Haemonetics will settle any conversion amounts of the notes up to the $1,000 principal amount of the notes in cash, and

any conversion amounts in excess of the principal amount in cash, shares of Haemonetics’ common stock or a combination thereof,

at Haemonetics’ election. The initial conversion rate is 8.5385 shares of common stock per $1,000 principal amount of notes, which

represents an initial conversion price of approximately $117.12 per share of common stock. The initial conversion price represents a premium

of approximately 30% over the last reported sale of $90.09 per share of Haemonetics’ common stock on May 22, 2024. The conversion

rate and conversion price will be subject to adjustment upon the occurrence of certain events.

The notes will not be redeemable at Haemonetics’ election before

June 5, 2027. The notes will be redeemable, in whole or in part, for cash at Haemonetics’ option at any time on or after June 5,

2027 and on or before the 50th scheduled trading day immediately before the maturity date, but only if the last reported sale price per

share of Haemonetics’ common stock exceeds 130% of the conversion price for a specified period of time. The redemption price will

be equal to the principal amount of the notes to be redeemed, plus accrued and unpaid special interest, if any, to, but excluding, the

redemption date.

If a “fundamental change” (as defined in the indenture

for the notes) occurs, then noteholders may require Haemonetics to repurchase their notes for cash. The repurchase price will be equal

to the principal amount of the notes to be repurchased, plus accrued and unpaid special interest, if any, to, but excluding, the applicable

repurchase date.

Haemonetics estimates the net proceeds from the offering will be approximately

$584.8 million (or approximately $682.3 million if the initial purchasers fully exercise their option to purchase additional notes), after

deducting the initial purchasers’ discounts and commissions and estimated offering expenses.

Haemonetics expects to use the net proceeds from the offering to (i) pay

the approximately $75.6 million (or approximately $88.2 million if the initial purchasers fully exercise their option to purchase additional

notes) cost of the capped call transactions that it entered into as described below, (ii) repurchase for cash $200.0 million in aggregate

principal amount of its 0.00% Convertible Senior Notes due 2026 (the “2026 notes”) in privately negotiated transactions entered

into concurrently with the pricing of the notes in the offering, (iii) repay the entirety of the $230.0 million balance on the revolving

credit facility pursuant to Haemonetics’ existing credit facility, and (iv) use the remainder of the proceeds for working capital

and other general purposes, which may include additional repurchases of the 2026 notes from time to time following the offering, or the

repayment at maturity, of the 2026 notes.

If the initial purchasers exercise their option to purchase additional

notes, Haemonetics expects to use a portion of the net proceeds from the sale of the additional notes to enter into additional capped

call transactions and the remainder for general corporate purposes, which may include additional repurchases of the 2026 notes from time

to time following the offering, or the repayment at maturity, of the 2026 notes.

In connection with the pricing of the notes, Haemonetics has entered

into privately negotiated capped call transactions with the initial purchasers or their affiliates and other financial institutions (the

“option counterparties”). The capped call transactions will cover, subject to anti-dilution adjustments substantially similar

to those applicable to the notes, the number of shares of Haemonetics’ common stock initially underlying the notes. If the initial

purchasers exercise their option to purchase additional notes, Haemonetics expects to enter into additional capped call transactions with

the option counterparties.

The cap price of the capped call transactions will initially be $180.18

per share, which represents a premium of approximately 100% over the last reported sale price of Haemonetics’ common stock of $90.09

per share on May 22, 2024, and is subject to certain adjustments under the terms of the capped call transactions.

The capped call transactions are expected generally to reduce or offset

the potential dilution to Haemonetics’ common stock upon any conversion of the notes and/or to offset any potential cash payments

Haemonetics is required to make in excess of the principal amount of the converted notes, as the case may be, upon conversion of the notes.

If, however, the market price per share of Haemonetics’ common stock, as measured under the terms of the capped call transactions,

exceeds the cap price of the capped call transactions, there would nevertheless be dilution and/or there would not be an offset of such

potential cash payments, in each case, to the extent that such market price exceeds the cap price of the capped call transactions.

Haemonetics expects that, in connection with establishing their initial

hedges of the capped call transactions, the option counterparties or their respective affiliates will enter into various derivative transactions

with respect to Haemonetics’ common stock and/or purchase shares of Haemonetics’ common stock concurrently with or shortly

after the pricing of the notes. This activity could increase (or reduce the size of any decrease in) the market price of Haemonetics’

common stock or the notes at that time.

In addition, Haemonetics expects that the option counterparties or

their respective affiliates may modify their hedge positions by entering into or unwinding various derivatives with respect to Haemonetics’

common stock and/or purchasing or selling Haemonetics’ common stock or other securities of Haemonetics in secondary market transactions

following the pricing of the notes and from time to time prior to the maturity of the notes (and are likely to do so following any conversion

of the notes, any repurchase of the notes by Haemonetics on any fundamental change repurchase date, any redemption date or any other date

on which the notes are retired by Haemonetics, in each case if Haemonetics exercises its option to terminate the relevant portion of the

capped call transactions, where such termination is at the option of Haemonetics). This activity could also cause or avoid an increase

or a decrease in the market price of Haemonetics’ common stock or the notes, which could affect a noteholder’s ability to

convert the notes, and, to the extent the activity occurs during any observation period related to a conversion of the notes, it could

affect the number of shares, if any, and value of the consideration that noteholders will receive upon conversion of the notes.

Concurrently with the pricing of the notes in the offering, Haemonetics

entered into privately negotiated transactions with certain holders of the 2026 notes to repurchase, for approximately $185.5 million

in cash, $200.0 million aggregate principal amount of its 2026 notes on terms negotiated with each holder (each, a "note repurchase

transaction"). This press release is not an offer to repurchase the 2026 notes, and the offering of the notes is not contingent upon

the repurchase of the 2026 notes.

In connection with any note repurchase transaction, Haemonetics expects

that holders of the 2026 notes who have agreed to have their 2026 notes repurchased and who have hedged their equity price risk with respect

to such notes (the “hedged holders”) will unwind all or part of their hedge positions by buying Haemonetics’ common

stock and/or entering into or unwinding various derivative transactions with respect to Haemonetics’ common stock. The amount of

Haemonetics’ common stock to be purchased by the hedged holders or in connection with such derivative transactions may have been

substantial in relation to the historical average daily trading volume of Haemonetics’ common stock. This activity by the hedged

holders could increase (or reduce the size of any decrease in) the market price of Haemonetics’ common stock, including concurrently

with the pricing of the notes, and may have resulted in a higher effective conversion price of the notes.

Additionally, in connection with the issuance of the 2026 notes, Haemonetics

entered into capped call transactions (the “existing option transactions”) with certain financial institutions. Haemonetics

does not intend to unwind or terminate any of the existing option transactions in connection with these note repurchase transactions.

The notes will be sold only to persons reasonably believed to be qualified

institutional buyers pursuant to Rule 144A under the Securities Act. The offer and sale of the notes and any shares of common stock

issuable upon conversion of the notes have not been, and will not be, registered under the Securities Act or any other securities laws,

and unless so registered, the notes and any such shares cannot be offered or sold except pursuant to an applicable exemption from, or

in a transaction not subject to, such registration requirements. This press release does not constitute an offer to sell, or the solicitation

of an offer to buy, the notes or any shares of common stock issuable upon conversion of the notes, nor will there be any offer or sale

of the notes or any such shares, in any state or other jurisdiction in which such offer, sale or solicitation would be unlawful.

About Haemonetics

Haemonetics is a global healthcare company dedicated to providing a

suite of innovative medical products and solutions for customers, to help them improve patient care and reduce the cost of healthcare.

Our technology addresses important medical markets: blood and plasma component collection, the surgical suite, and hospital transfusion

services.

Cautionary Note Regarding Forward-Looking Statements

This press release includes forward-looking statements, including,

among other things, statements regarding the completion, timing and size of the proposed offering, the terms of the notes and the capped

call transactions, the expected use of proceeds, expectations regarding actions of the option counterparties and their respective affiliates,

and repurchase transactions. In addition, other written or oral statements that constitute forward-looking statements may be made by Haemonetics

or on its behalf. Words such as “expect,” “anticipate,” “intend,” “plan,” “believe,”

“could,” “should,” “estimate,” “may,” “target,” “project,” or

variations of such words and similar expressions are intended to identify such forward-looking statements. Forward-looking statements

represent the current expectations of Haemonetics regarding future events and are subject to known and unknown risks and uncertainties

that could cause actual results to differ materially from those implied by the forward-looking statements. Among those risks and uncertainties

are (i) the risk that the offering will not be consummated, (ii) changes as a result of market conditions, including market

interest rates, (iii) fluctuations in the trading price and volatility of Haemonetics’ common stock, (iv) the risk that

the capped call transactions will not become effective with any additional sale of notes, (v) whether and on what terms Haemonetics

may repurchase the remaining 2026 notes, (vi) unanticipated uses of capital, (vii) the impact of general economic, industry

or political conditions in the United States or internationally and (viii) risks relating to Haemonetics’ business, including

those described in Haemonetics’ Annual Report on Form 10-K for the year ended March 30, 2024 and other filings with the

U.S. Securities and Exchange Commission. The forward-looking statements included in this press release speak only as of the date of this

press release, and Haemonetics does not undertake to update the statements included in this press release for subsequent developments,

except as may be required by law.

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

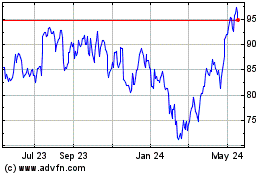

Haemonetics (NYSE:HAE)

Historical Stock Chart

From Jan 2025 to Feb 2025

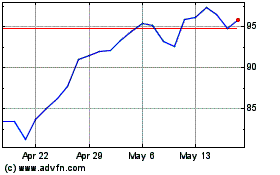

Haemonetics (NYSE:HAE)

Historical Stock Chart

From Feb 2024 to Feb 2025