False000158568900015856892024-10-232024-10-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): October 23, 2024

Hilton Worldwide Holdings Inc.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-36243 | | 27-4384691 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

7930 Jones Branch Drive, Suite 1100, McLean, Virginia 22102

(Address of Principal Executive Offices) (Zip Code)

(703) 883-1000

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | | HLT | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On October 23, 2024, Hilton Worldwide Holdings Inc. (the "Company") issued a press release announcing the results of the Company’s operations for the quarter ended September 30, 2024. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Current Report on Form 8-K, including Exhibit 99.1 hereto, is being furnished pursuant to Item 2.02 of Form 8-K and shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 101 | | Interactive Data File - XBRL tags are embedded within the Inline XBRL document. |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| HILTON WORLDWIDE HOLDINGS INC. |

| | |

| By: | | /s/ Kevin J. Jacobs |

| Name: | | Kevin J. Jacobs |

| Title: | | Chief Financial Officer and President, Global Development |

Date: October 23, 2024

| | | | | |

| Investor Contact | 7930 Jones Branch Drive |

| Jill Chapman | McLean, VA 22102 |

| +1 703 883 1000 | ir.hilton.com |

| |

| Media Contact | |

| Kent Landers | |

| +1 703 883 3246 | |

Hilton Reports Third Quarter Results

MCLEAN, VA (October 23, 2024) - Hilton Worldwide Holdings Inc. ("Hilton," "the Company," "we," "us" or "our") (NYSE: HLT) today reported its third quarter 2024 results. Highlights include:

•Diluted EPS was $1.38 for the third quarter, and diluted EPS, adjusted for special items, was $1.92

•Net income was $344 million for the third quarter

•Adjusted EBITDA was $904 million for the third quarter

•System-wide comparable RevPAR increased 1.4 percent, on a currency neutral basis, for the third quarter compared to the same period in 2023

•Approved 27,500 new rooms for development during the third quarter, bringing our development pipeline to 492,400 rooms as of September 30, 2024, representing growth of 8 percent from September 30, 2023

•Added a record 36,600 rooms to our system in the third quarter, resulting in 33,600 net additional rooms for the third quarter, contributing to a record net unit growth of 7.8 percent from September 30, 2023

•Repurchased 3.3 million shares of Hilton common stock during the third quarter; bringing total capital return, including dividends, to $764 million for the quarter and $2,422 million year to date through October

•Issued $1.0 billion aggregate principal amount of 5.875% Senior Notes due 2033 in September 2024

•Full year 2024 system-wide RevPAR is projected to increase between 2.0 percent and 2.5 percent on a comparable and currency neutral basis compared to 2023; full year net income is projected to be between $1,405 million and $1,429 million; full year Adjusted EBITDA is projected to be between $3,375 million and $3,405 million

•Full year 2024 capital return is projected to be approximately $3.0 billion

•Net unit growth for 2025 is expected to be between 6.0 percent and 7.0 percent

Overview

Christopher J. Nassetta, President & Chief Executive Officer of Hilton, said, "We were pleased to deliver continued strong bottom line results that exceeded our guidance, despite slower top line growth which was driven by modestly slower macro trends, weather impacts and unfavorable calendar shifts. We continued to demonstrate the strength of our model, opening more rooms than any other quarter in our history, surpassing 8,000 hotels and achieving net unit growth of 7.8 percent."

For the three months ended September 30, 2024, system-wide comparable RevPAR increased 1.4 percent compared to the same period in 2023 due to increases in both occupancy and ADR, and management and franchise fee revenues increased 8.3 percent compared to the same period in 2023.

For the nine months ended September 30, 2024, system-wide comparable RevPAR increased 2.4 percent compared to the same period in 2023 due to increases in both occupancy and ADR, and management and franchise fee revenues increased 10.7 percent compared to the same period in 2023.

For the three months ended September 30, 2024, diluted EPS was $1.38 and diluted EPS, adjusted for special items, was $1.92 compared to $1.44 and $1.67, respectively, for the three months ended September 30, 2023. Net income and Adjusted EBITDA were $344 million and $904 million, respectively, for the three months ended September 30, 2024, compared to $379 million and $834 million, respectively, for the three months ended September 30, 2023.

For the nine months ended September 30, 2024, diluted EPS was $4.09 and diluted EPS, adjusted for special items, was $5.36 compared to $3.74 and $4.53, respectively, for the nine months ended September 30, 2023. Net income and Adjusted EBITDA were $1,034 million and $2,571 million, respectively, for the nine months ended September 30, 2024, compared to $1,001 million and $2,286 million, respectively, for the nine months ended September 30, 2023.

Development

In the third quarter of 2024, we opened 531 hotels, totaling 36,600 rooms, resulting in 33,600 net room additions.(1) During the quarter, NoMad, Graduate by Hilton and Small Luxury Hotels of the World ("SLH") became available for reservations on our booking channels. The addition of SLH hotels brings our hotel portfolio to ten additional countries and territories, allowing our guests to book, earn and redeem Honors points in more sought after destinations. We continued to expand our portfolio in the Asia Pacific market, surpassing 900 hotels in the region and opening our 700th hotel in China. Additionally, our Spark by Hilton brand continues to grow, with more than 20 hotels opening during the third quarter, including the debut of the first Spark hotel in Canada.

We added 27,500 rooms to the development pipeline during the third quarter, and, as of September 30, 2024, our development pipeline totaled 3,525 hotels representing 492,400 rooms throughout 120 countries and territories, including 28 countries and territories where Hilton had no existing hotels.(2) Additionally, of the rooms in the development pipeline, 235,400 were under construction and 280,700 were located outside of the U.S.

Balance Sheet and Liquidity

As of September 30, 2024, we had $11.3 billion of debt outstanding, excluding the deduction for deferred financing costs and discounts, with a weighted average interest rate of 4.84 percent. Excluding all finance lease liabilities and other debt of our consolidated variable interest entities, we had $11.1 billion of debt outstanding with a weighted average interest rate of 4.83 percent and no scheduled maturities until 2027, other than $500 million of outstanding Senior Notes due May 2025. We believe that we have sufficient sources of liquidity and access to debt financing to address the Senior Notes due May 2025 at or prior to their maturity date. As of September 30, 2024, no debt amounts were outstanding under our $2.0 billion senior secured revolving credit facility (the "Revolving Credit Facility"), which had an available borrowing capacity of $1,913 million after considering $87 million of outstanding letters of credit. Total cash and cash equivalents were $1,655 million as of September 30, 2024, including $75 million of restricted cash and cash equivalents.

In September 2024, we issued $1 billion aggregate principal amount of 5.875% Senior Notes due 2033. We intend to use the net proceeds from the issuance for general corporate purposes.

In September 2024, we paid a quarterly cash dividend of $0.15 per share of common stock, for a total of $37 million, bringing total dividend payments for the year to $113 million. In October 2024, our board of directors authorized a regular quarterly cash

(1) Excluding hotels from our strategic partner arrangements, we added 18,300 rooms to our system during the third quarter, and, as of September 30, 2024, our hotel system would have totaled 7,800 hotels representing 1,213,800 rooms, growing 6.1% from September 30, 2023 and 1.3% from the prior quarter.

(2) Excluding hotels from our strategic partner arrangements, we added 26,400 rooms to the development pipeline during the third quarter, and, as of September 30, 2024, our development pipeline would have totaled 3,514 hotels and 491,900 rooms, representing 8% growth from September 30, 2023 and consistent with total development pipeline rooms excluding hotels from our strategic partner arrangements as of June 30, 2024.

dividend of $0.15 per share of common stock to be paid on December 27, 2024 to holders of record of our common stock as of the close of business on November 15, 2024.

During the three months ended September 30, 2024, we repurchased 3.3 million shares of Hilton common stock at an average price per share of $217.15, for a total of $727 million. For the nine months ended September 30, 2024, we repurchased 10.2 million shares of Hilton common stock at an average price per share of $206.29, returning $2,226 million of capital to shareholders, including dividends. Total capital return to shareholders including dividends year-to-date through October was $2,422 million.

The number of shares outstanding as of October 18, 2024 was 243.8 million.

Outlook

Share-based metrics in Hilton's outlook include actual share repurchases through the third quarter but do not include the effect of potential share repurchases thereafter.

Full Year 2024

•System-wide comparable RevPAR, on a currency neutral basis, is projected to increase between 2.0 percent and 2.5 percent compared to 2023.

•Diluted EPS is projected to be between $5.58 and $5.68.

•Diluted EPS, adjusted for special items, is projected to be between $6.93 and $7.03.

•Net income is projected to be between $1,405 million and $1,429 million.

•Adjusted EBITDA is projected to be between $3,375 million and $3,405 million.

•Contract acquisition costs and capital expenditures, excluding amounts reimbursed by third parties, are projected to be between $200 million and $250 million.

•Capital return is projected to be approximately $3.0 billion.

•General and administrative expenses are projected to be between $415 million and $430 million.

•Net unit growth is projected to be between 7.0 percent and 7.5 percent.

Fourth Quarter 2024

•System-wide comparable RevPAR, on a currency neutral basis, is projected to increase between 1.0 percent and 2.0 percent compared to the fourth quarter of 2023.

•Diluted EPS is projected to be between $1.49 and $1.59.

•Diluted EPS, adjusted for special items, is projected to be between $1.57 and $1.67.

•Net income is projected to be between $371 million and $395 million.

•Adjusted EBITDA is projected to be between $804 million and $834 million.

Conference Call

Hilton will host a conference call to discuss third quarter of 2024 results on October 23, 2024 at 9:00 a.m. Eastern Time. Participants may listen to the live webcast by logging on to the Hilton Investor Relations website at https://ir.hilton.com/events-and-presentations. A replay and transcript of the webcast will be available within 24 hours after the live event at https://ir.hilton.com/financial-reporting.

Alternatively, participants may listen to the live call by dialing 1-888-317-6003 in the United States ("U.S.") or 1-412-317-6061 internationally using the conference ID 6226859. Participants are encouraged to dial into the call or link to the webcast at least fifteen minutes prior to the scheduled start time. A telephone replay will be available for seven days following the call. To access the telephone replay, dial 1-877-344-7529 in the U.S. or 1-412-317-0088 internationally using the conference ID 6850988.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include, but are not limited

to, statements related to our expectations regarding the performance of our business, future financial results, liquidity and capital resources and other non-historical statements. In some cases, you can identify these forward-looking statements by the use of words such as "outlook," "believes," "expects," "forecasts," "potential," "continues," "may," "will," "should," "could," "seeks," "projects," "predicts," "intends," "plans," "estimates," "anticipates" or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties including, among others, risks inherent to the hospitality industry; macroeconomic factors beyond our control, such as inflation, changes in interest rates, challenges due to labor shortages or disputes and supply chain disruptions; the loss of key senior management personnel; competition for hotel guests and management and franchise contracts; risks related to doing business with third-party hotel owners; performance of our information technology systems; growth of reservation channels outside of our system; risks of doing business outside of the U.S.; risks associated with conflicts in Eastern Europe and the Middle East and other geopolitical events; and our indebtedness. Additional factors that could cause our results to differ materially from those described in the forward-looking statements can be found under the section entitled "Part I—Item 1A. Risk Factors" of our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, which is filed with the Securities and Exchange Commission (the "SEC") and is accessible on the SEC's website at www.sec.gov. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this press release and in our filings with the SEC. We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

Definitions

See the "Definitions" section for the definition of certain terms used within this press release, including within the schedules.

Non-GAAP Financial Measures

We refer to certain financial measures that are not recognized under U.S. generally accepted accounting principles ("GAAP") in this press release, including: net income, adjusted for special items; diluted EPS, adjusted for special items; EBITDA; Adjusted EBITDA; Adjusted EBITDA margin; net debt; and net debt to Adjusted EBITDA ratio. See the schedules to this press release, including the "Definitions" section, for additional information and reconciliations of such non-GAAP financial measures, as well as the most comparable GAAP financial measures.

About Hilton

Hilton (NYSE: HLT) is a leading global hospitality company with a portfolio of 24 world-class brands comprising more than 8,300 properties and over 1.25 million rooms, in 138 countries and territories. Dedicated to fulfilling its founding vision to fill the earth with the light and warmth of hospitality, Hilton has welcomed over 3 billion guests in its more than 100-year history, was named the No.1 World's Best Workplace by Great Place to Work and Fortune and has been recognized as a global leader on the Dow Jones Sustainability Indices for seven consecutive years. Hilton has introduced industry-leading technology enhancements to improve the guest experience, including Digital Key Share, automated complimentary room upgrades and the ability to book confirmed connecting rooms. Through the award-winning guest loyalty program Hilton Honors, the more than 200 million Hilton Honors members who book directly with Hilton can earn Points for hotel stays and experiences money can't buy. With the free Hilton Honors app, guests can book their stay, select their room, check in, unlock their door with a Digital Key and check out, all from their smartphone. Visit stories.hilton.com for more information, and connect with Hilton on facebook.com/hiltonnewsroom, x.com/hiltonnewsroom, linkedin.com/company/hilton, instagram.com/hiltonnewsroom and youtube.com/hiltonnewsroom.

HILTON WORLDWIDE HOLDINGS INC.

EARNINGS RELEASE SCHEDULES

TABLE OF CONTENTS

HILTON WORLDWIDE HOLDINGS INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in millions, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenues | | | | | | | |

| Franchise and licensing fees | $ | 698 | | | $ | 643 | | | $ | 1,958 | | | $ | 1,769 | |

| Base and other management fees | 88 | | | 81 | | | 287 | | | 247 | |

| Incentive management fees | 66 | | | 63 | | | 204 | | | 197 | |

| Owned and leased hotels | 330 | | | 335 | | | 922 | | | 924 | |

| Other revenues | 58 | | | 45 | | | 179 | | | 126 | |

| 1,240 | | | 1,167 | | | 3,550 | | | 3,263 | |

Other revenues from managed and franchised properties | 1,627 | | | 1,506 | | | 4,841 | | | 4,363 | |

| Total revenues | 2,867 | | | 2,673 | | | 8,391 | | | 7,626 | |

| | | | | | | |

| Expenses | | | | | | | |

Owned and leased hotels | 288 | | | 301 | | | 833 | | | 849 | |

| Depreciation and amortization | 37 | | | 40 | | | 107 | | | 114 | |

| General and administrative | 101 | | | 96 | | | 318 | | | 298 | |

| Other expenses | 26 | | | 26 | | | 93 | | | 80 | |

| 452 | | | 463 | | | 1,351 | | | 1,341 | |

Other expenses from managed and franchised properties | 1,790 | | | 1,557 | | | 5,164 | | | 4,460 | |

| Total expenses | 2,242 | | | 2,020 | | | 6,515 | | | 5,801 | |

| | | | | | | |

Gain (loss) on sales of assets, net | (2) | | | — | | | 5 | | | — | |

| | | | | | | |

| Operating income | 623 | | | 653 | | | 1,881 | | | 1,825 | |

| | | | | | | |

| Interest expense | (140) | | | (113) | | | (412) | | | (340) | |

Loss on foreign currency transactions | (3) | | | (7) | | | (5) | | | (13) | |

| Loss on investments in unconsolidated affiliate | — | | | — | | | — | | | (92) | |

Other non-operating income (loss), net | 11 | | | 15 | | | (17) | | | 38 | |

| | | | | | | |

| Income before income taxes | 491 | | | 548 | | | 1,447 | | | 1,418 | |

| | | | | | | |

| Income tax expense | (147) | | | (169) | | | (413) | | | (417) | |

| | | | | | | |

| Net income | 344 | | | 379 | | | 1,034 | | | 1,001 | |

| Net income attributable to redeemable and nonredeemable noncontrolling interests | — | | | (2) | | | (4) | | | (7) | |

| Net income attributable to Hilton stockholders | $ | 344 | | | $ | 377 | | | $ | 1,030 | | | $ | 994 | |

| | | | | | | |

| Weighted average shares outstanding: | | | | | | | |

| Basic | 246 | | | 260 | | | 249 | | | 264 | |

| Diluted | 249 | | | 262 | | | 252 | | | 266 | |

| | | | | | | |

| Earnings per share: | | | | | | | |

| Basic | $ | 1.40 | | | $ | 1.45 | | | $ | 4.13 | | | $ | 3.77 | |

| Diluted | $ | 1.38 | | | $ | 1.44 | | | $ | 4.09 | | | $ | 3.74 | |

| | | | | | | |

| Cash dividends declared per share | $ | 0.15 | | | $ | 0.15 | | | $ | 0.45 | | | $ | 0.45 | |

HILTON WORLDWIDE HOLDINGS INC.

COMPARABLE AND CURRENCY NEUTRAL SYSTEM-WIDE HOTEL OPERATING STATISTICS

BY REGION, BRAND AND SEGMENT

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, |

| Occupancy | | ADR | | RevPAR |

| 2024 | | vs. 2023 | | 2024 | | vs. 2023 | | 2024 | | vs. 2023 |

| | | | | | | | | | | | |

| System-wide | 75.3 | % | | 0.3 | % | pts. | | $ | 161.18 | | | 1.0 | % | | $ | 121.40 | | | 1.4 | % |

| | | | | | | | | | | | |

| Region | | | | | | | | | | | | |

| U.S. | 75.4 | % | | 0.2 | % | pts. | | $ | 169.59 | | | 0.8 | % | | $ | 127.83 | | | 1.0 | % |

| Americas (excluding U.S.) | 72.7 | | | 0.4 | | | | 155.80 | | | 3.9 | | | 113.22 | | | 4.4 | |

| Europe | 81.3 | | | 2.3 | | | | 179.46 | | | 4.3 | | | 145.89 | | | 7.3 | |

| Middle East & Africa | 70.5 | | | 2.3 | | | | 143.94 | | | (0.1) | | | 101.48 | | | 3.3 | |

| Asia Pacific | 73.2 | | | (0.5) | | | | 107.81 | | | (2.8) | | | 78.97 | | | (3.4) | |

| | | | | | | | | | | | |

| Brand | | | | | | | | | | | | |

| Waldorf Astoria Hotels & Resorts | 62.5 | % | | 1.9 | % | pts. | | $ | 457.66 | | | 2.2 | % | | $ | 285.89 | | | 5.3 | % |

| Conrad Hotels & Resorts | 75.6 | | | 1.5 | | | | 257.53 | | | 1.1 | | | 194.63 | | | 3.2 | |

| LXR Hotels & Resorts | 63.8 | | | 1.2 | | | | 596.79 | | | (6.8) | | | 380.49 | | | (5.0) | |

| Canopy by Hilton | 73.0 | | | 1.3 | | | | 227.44 | | | 1.3 | | | 166.14 | | | 3.2 | |

| Hilton Hotels & Resorts | 73.8 | | | 0.7 | | | | 190.33 | | | 1.2 | | | 140.44 | | | 2.2 | |

| Curio Collection by Hilton | 74.3 | | | 2.9 | | | | 231.13 | | | 0.1 | | | 171.77 | | | 4.1 | |

| DoubleTree by Hilton | 72.2 | | | 0.2 | | | | 145.63 | | | 0.7 | | | 105.19 | | | 1.0 | |

| Tapestry Collection by Hilton | 71.9 | | | 1.0 | | | | 189.79 | | | 1.5 | | | 136.47 | | | 2.9 | |

| Embassy Suites by Hilton | 76.4 | | | 0.8 | | | | 186.47 | | | 0.5 | | | 142.45 | | | 1.7 | |

| Motto by Hilton | 80.6 | | | 0.4 | | | | 212.37 | | | 1.0 | | | 171.14 | | | 1.5 | |

| Hilton Garden Inn | 74.7 | | | 0.8 | | | | 148.96 | | | 0.3 | | | 111.28 | | | 1.4 | |

| Hampton by Hilton | 75.8 | | | (0.6) | | | | 136.47 | | | 1.0 | | | 103.38 | | | 0.3 | |

| Tru by Hilton | 74.9 | | | 0.7 | | | | 133.72 | | | 0.5 | | | 100.14 | | | 1.5 | |

| Homewood Suites by Hilton | 82.2 | | | — | | | | 163.52 | | | 0.5 | | | 134.40 | | | 0.6 | |

| Home2 Suites by Hilton | 81.0 | | | 0.6 | | | | 141.89 | | | 1.2 | | | 114.92 | | | 1.9 | |

| | | | | | | | | | | | |

| Segment | | | | | | | | | | | | |

| Management and franchise | 75.2 | % | | 0.3 | % | pts. | | $ | 160.32 | | | 0.9 | % | | $ | 120.61 | | | 1.3 | % |

Ownership(1) | 82.3 | | | 2.7 | | | | 224.27 | | | 3.0 | | | 184.52 | | | 6.5 | |

(continued on next page)

HILTON WORLDWIDE HOLDINGS INC.

COMPARABLE AND CURRENCY NEUTRAL SYSTEM-WIDE HOTEL OPERATING STATISTICS

BY REGION, BRAND AND SEGMENT

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, |

| Occupancy | | ADR | | RevPAR |

| 2024 | | vs. 2023 | | 2024 | | vs. 2023 | | 2024 | | vs. 2023 |

| | | | | | | | | | | | |

| System-wide | 72.8 | % | | 0.7 | % | pts. | | $ | 159.92 | | | 1.5 | % | | $ | 116.37 | | | 2.4 | % |

| | | | | | | | | | | | |

| Region | | | | | | | | | | | | |

| U.S. | 73.5 | % | | 0.3 | % | pts. | | $ | 167.83 | | | 0.9 | % | | $ | 123.27 | | | 1.4 | % |

| Americas (excluding U.S.) | 69.9 | | | 1.1 | | | | 156.53 | | | 4.2 | | | 109.46 | | | 5.9 | |

| Europe | 74.7 | | | 2.6 | | | | 166.42 | | | 3.9 | | | 124.34 | | | 7.7 | |

| Middle East & Africa | 70.9 | | | 2.5 | | | | 176.25 | | | 6.3 | | | 125.03 | | | 10.2 | |

| Asia Pacific | 69.5 | | | 0.6 | | | | 108.98 | | | 0.6 | | | 75.69 | | | 1.5 | |

| | | | | | | | | | | | |

| Brand | | | | | | | | | | | | |

| Waldorf Astoria Hotels & Resorts | 63.6 | % | | 3.3 | % | pts. | | $ | 506.54 | | | 0.5 | % | | $ | 321.93 | | | 5.9 | % |

| Conrad Hotels & Resorts | 74.0 | | | 3.5 | | | | 270.50 | | | 3.6 | | | 200.08 | | | 8.6 | |

| LXR Hotels & Resorts | 62.4 | | | 5.0 | | | | 592.74 | | | (5.1) | | | 369.96 | | | 3.1 | |

| Canopy by Hilton | 72.0 | | | 2.4 | | | | 225.84 | | | 1.0 | | | 162.67 | | | 4.5 | |

| Hilton Hotels & Resorts | 71.2 | | | 1.5 | | | | 191.47 | | | 2.1 | | | 136.29 | | | 4.3 | |

| Curio Collection by Hilton | 71.4 | | | 3.5 | | | | 231.15 | | | 0.4 | | | 164.97 | | | 5.5 | |

| DoubleTree by Hilton | 69.7 | | | 1.1 | | | | 144.11 | | | 1.2 | | | 100.50 | | | 2.8 | |

| Tapestry Collection by Hilton | 68.5 | | | 1.4 | | | | 183.76 | | | 0.8 | | | 125.89 | | | 2.9 | |

| Embassy Suites by Hilton | 75.2 | | | 1.5 | | | | 186.06 | | | 0.7 | | | 139.91 | | | 2.7 | |

| Motto by Hilton | 79.9 | | | 2.3 | | | | 207.62 | | | (0.3) | | | 165.79 | | | 2.6 | |

| Hilton Garden Inn | 72.1 | | | 0.8 | | | | 146.31 | | | 0.2 | | | 105.47 | | | 1.3 | |

| Hampton by Hilton | 72.6 | | | (0.6) | | | | 132.56 | | | 1.2 | | | 96.25 | | | 0.4 | |

| Tru by Hilton | 72.7 | | | 0.6 | | | | 131.19 | | | 0.8 | | | 95.41 | | | 1.6 | |

| Homewood Suites by Hilton | 80.2 | | | — | | | | 160.18 | | | 0.7 | | | 128.49 | | | 0.8 | |

| Home2 Suites by Hilton | 78.9 | | | 0.4 | | | | 140.73 | | | 1.0 | | | 111.07 | | | 1.5 | |

| | | | | | | | | | | | |

| Segment | | | | | | | | | | | | |

| Management and franchise | 72.7 | % | | 0.6 | % | pts. | | $ | 159.17 | | | 1.4 | % | | $ | 115.75 | | | 2.3 | % |

Ownership(1) | 77.0 | | | 3.1 | | | | 216.81 | | | 4.7 | | | 166.88 | | | 9.2 | |

____________

(1)Includes hotels owned or leased by entities in which we own a noncontrolling financial interest.

HILTON WORLDWIDE HOLDINGS INC.

PROPERTY SUMMARY

As of September 30, 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Owned / Leased(1) | | Managed | | Franchised / Licensed | | Total |

| Properties | | Rooms | | Properties | | Rooms | | Properties | | Rooms | | Properties | | Rooms |

| Waldorf Astoria Hotels & Resorts | 2 | | | 463 | | | 32 | | | 8,345 | | | — | | | — | | | 34 | | | 8,808 | |

| Conrad Hotels & Resorts | 2 | | | 779 | | | 43 | | | 13,920 | | | 4 | | | 2,496 | | | 49 | | | 17,195 | |

| LXR Hotels & Resorts | — | | | — | | | 5 | | | 935 | | | 8 | | | 1,463 | | | 13 | | | 2,398 | |

| NoMad | — | | | — | | | 1 | | | 91 | | | — | | | — | | | 1 | | | 91 | |

| Signia by Hilton | — | | | — | | | 3 | | | 2,526 | | | — | | | — | | | 3 | | | 2,526 | |

| Canopy by Hilton | — | | | — | | | 10 | | | 1,634 | | | 32 | | | 5,731 | | | 42 | | | 7,365 | |

| Hilton Hotels & Resorts | 46 | | | 15,921 | | | 294 | | | 125,978 | | | 273 | | | 84,122 | | | 613 | | | 226,021 | |

| Curio Collection by Hilton | — | | | — | | | 29 | | | 6,275 | | | 146 | | | 26,508 | | | 175 | | | 32,783 | |

| Graduate by Hilton | — | | | — | | | — | | | — | | | 34 | | | 5,788 | | | 34 | | | 5,788 | |

| DoubleTree by Hilton | — | | | — | | | 168 | | | 46,036 | | | 526 | | | 110,793 | | | 694 | | | 156,829 | |

| Tapestry Collection by Hilton | — | | | — | | | 5 | | | 694 | | | 134 | | | 16,012 | | | 139 | | | 16,706 | |

| Embassy Suites by Hilton | — | | | — | | | 40 | | | 10,551 | | | 230 | | | 51,700 | | | 270 | | | 62,251 | |

| Tempo by Hilton | — | | | — | | | 1 | | | 661 | | | 2 | | | 436 | | | 3 | | | 1,097 | |

| Motto by Hilton | — | | | — | | | — | | | — | | | 8 | | | 1,727 | | | 8 | | | 1,727 | |

| Hilton Garden Inn | — | | | — | | | 122 | | | 24,102 | | | 918 | | | 129,317 | | | 1,040 | | | 153,419 | |

| Hampton by Hilton | — | | | — | | | 53 | | | 8,526 | | | 3,008 | | | 332,341 | | | 3,061 | | | 340,867 | |

| Tru by Hilton | — | | | — | | | — | | | — | | | 274 | | | 26,779 | | | 274 | | | 26,779 | |

| Spark by Hilton | — | | | — | | | — | | | — | | | 67 | | | 6,073 | | | 67 | | | 6,073 | |

| Homewood Suites by Hilton | — | | | — | | | 9 | | | 1,142 | | | 533 | | | 60,935 | | | 542 | | | 62,077 | |

| Home2 Suites by Hilton | — | | | — | | | 2 | | | 210 | | | 721 | | | 78,413 | | | 723 | | | 78,623 | |

Strategic partner hotels(2) | — | | | — | | | — | | | — | | | 400 | | | 18,825 | | | 400 | | | 18,825 | |

Other(3) | — | | | — | | | 3 | | | 1,414 | | | 12 | | | 2,916 | | | 15 | | | 4,330 | |

| Total hotels | 50 | | | 17,163 | | | 820 | | | 253,040 | | | 7,330 | | | 962,375 | | | 8,200 | | | 1,232,578 | |

Hilton Grand Vacations(4) | — | | | — | | | — | | | — | | | 101 | | | 17,928 | | | 101 | | | 17,928 | |

| Total system | 50 | | | 17,163 | | | 820 | | | 253,040 | | | 7,431 | | | 980,303 | | | 8,301 | | | 1,250,506 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Owned / Leased(1) | | Managed | | Franchised / Licensed | | Total |

| Properties | | Rooms | | Properties | | Rooms | | Properties | | Rooms | | Properties | | Rooms |

| U.S. | — | | | — | | | 188 | | | 81,924 | | | 5,628 | | | 728,192 | | | 5,816 | | | 810,116 | |

| Americas (excluding U.S.) | 1 | | | 405 | | | 72 | | | 18,067 | | | 380 | | | 52,677 | | | 453 | | | 71,149 | |

| Europe | 39 | | | 11,604 | | | 109 | | | 27,513 | | | 652 | | | 82,266 | | | 800 | | | 121,383 | |

| Middle East & Africa | 4 | | | 1,991 | | | 110 | | | 30,478 | | | 36 | | | 6,021 | | | 150 | | | 38,490 | |

| Asia Pacific | 6 | | | 3,163 | | | 341 | | | 95,058 | | | 634 | | | 93,219 | | | 981 | | | 191,440 | |

| Total hotels | 50 | | | 17,163 | | | 820 | | | 253,040 | | | 7,330 | | | 962,375 | | | 8,200 | | | 1,232,578 | |

Hilton Grand Vacations(4) | — | | | — | | | — | | | — | | | 101 | | | 17,928 | | | 101 | | | 17,928 | |

| Total system | 50 | | | 17,163 | | | 820 | | | 253,040 | | | 7,431 | | | 980,303 | | | 8,301 | | | 1,250,506 | |

____________

(1)Includes hotels owned or leased by entities in which we own a noncontrolling financial interest.

(2)Includes hotels that are part of the AutoCamp and Small Luxury Hotels of the World portfolios, which are included in our booking channels and participate in the Hilton Honors guest loyalty program through strategic partnership arrangements.

(3)Includes other hotels in our system that are not distinguished by a specific Hilton brand.

(4)Includes properties under our timeshare brands including Hilton Club, Hilton Grand Vacations Club and Hilton Vacation Club.

HILTON WORLDWIDE HOLDINGS INC.

CAPITAL EXPENDITURES AND CONTRACT ACQUISITION COSTS

(dollars in millions)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | |

| September 30, | | Increase / (Decrease) |

| 2024 | | 2023 | | $ | | % |

Capital expenditures for property and equipment(1) | $ | 17 | | | $ | 35 | | | (18) | | | (51.4) |

Capitalized software costs(2) | 30 | | | 26 | | | 4 | | | 15.4 |

| Total capital expenditures | 47 | | | 61 | | | (14) | | | (23.0) |

Contract acquisition costs, net of refunds | 10 | | | 25 | | | (15) | | | (60.0) |

| Total capital expenditures and contract acquisition costs | $ | 57 | | | $ | 86 | | | (29) | | | (33.7) |

| | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended | | |

| September 30, | | Increase / (Decrease) |

| 2024 | | 2023 | | $ | | % |

Capital expenditures for property and equipment(1) | $ | 48 | | | $ | 109 | | | (61) | | | (56.0) |

Capitalized software costs(2) | 71 | | | 68 | | | 3 | | | 4.4 |

| Total capital expenditures | 119 | | | 177 | | | (58) | | | (32.8) |

Contract acquisition costs, net of refunds(3) | 87 | | | 164 | | | (77) | | | (47.0) |

| Total capital expenditures and contract acquisition costs | $ | 206 | | | $ | 341 | | | (135) | | | (39.6) |

____________

(1)Represents expenditures for hotels, corporate and other property and equipment, which include amounts reimbursed by third parties of $8 million and $10 million for the three months ended September 30, 2024 and 2023, respectively, and $21 million and $14 million for the nine months ended September 30, 2024 and 2023, respectively. Excludes expenditures for FF&E replacement reserves of $14 million and $17 million for the three months ended September 30, 2024 and 2023, respectively, and $38 million and $40 million for the nine months ended September 30, 2024 and 2023, respectively.

(2)Includes $28 million and $24 million of expenditures that were reimbursed to us by third parties for the three months ended September 30, 2024 and 2023, respectively, and $66 million and $63 million for the nine months ended September 30, 2024 and 2023, respectively.

(3)The decrease during the nine months ended September 30, 2024 was primarily due to the timing of certain strategic hotel developments supporting our growth resulting in higher contract acquisition costs during the prior period.

HILTON WORLDWIDE HOLDINGS INC.

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES

NET INCOME AND DILUTED EPS, ADJUSTED FOR SPECIAL ITEMS

(in millions, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

Net income attributable to Hilton stockholders, as reported | $ | 344 | | | $ | 377 | | | $ | 1,030 | | | $ | 994 | |

| Diluted EPS, as reported | $ | 1.38 | | | $ | 1.44 | | | $ | 4.09 | | | $ | 3.74 | |

| Special items: | | | | | | | |

Net other expenses from managed and franchised properties | $ | 163 | | | $ | 51 | | | $ | 323 | | | $ | 97 | |

Purchase accounting amortization(1) | 1 | | | 12 | | | 4 | | | 34 | |

Loss on investments in unconsolidated affiliate(2) | — | | | — | | | — | | | 92 | |

Loss on debt guarantees(3) | — | | | — | | | 50 | | | — | |

FF&E replacement reserves | 14 | | | 17 | | | 38 | | | 40 | |

Loss (gain) on sales of assets, net | 2 | | | — | | | (5) | | | — | |

Tax-related adjustments(4) | — | | | 2 | | | (4) | | | (6) | |

Other adjustments(5) | (4) | | | (3) | | | 13 | | | 6 | |

| Total special items before taxes | 176 | | | 79 | | | 419 | | | 263 | |

Income tax expense on special items | (43) | | | (17) | | | (101) | | | (53) | |

| Total special items after taxes | $ | 133 | | | $ | 62 | | | $ | 318 | | | $ | 210 | |

| | | | | | | |

| Net income, adjusted for special items | $ | 477 | | | $ | 439 | | | $ | 1,348 | | | $ | 1,204 | |

Diluted EPS, adjusted for special items | $ | 1.92 | | | $ | 1.67 | | | $ | 5.36 | | | $ | 4.53 | |

____________

(1)Amounts represent the amortization expense related to finite-lived intangible assets that were recorded at fair value in 2007 when the Company became a wholly owned subsidiary of affiliates of Blackstone Inc. The majority of the related assets were fully amortized as of December 31, 2023, some of which became fully amortized during the three months ended December 31, 2023.

(2)Amount includes losses recognized related to equity and debt financing that we had previously provided to an unconsolidated affiliate with underlying investments in certain hotels that we currently manage or franchise.

(3)Amount includes losses on debt guarantees for certain hotels that we manage, which were recognized in other non-operating income (loss), net.

(4)Amounts include income tax expenses (benefits) related to the enactment of new tax laws and certain changes in unrecognized tax benefits.

(5)Amount for the nine months ended September 30, 2024 primarily relates to restructuring costs related to one of our leased properties, which was recognized in owned and leased hotels expenses, transaction costs incurred for acquisitions, which were recognized in general and administrative expenses, and transaction costs incurred for the amendment of our senior secured term loan facility (the "Term Loans"), which were recognized in other non-operating income (loss), net. Amounts for all periods include net losses (gains) related to certain of our investments in unconsolidated affiliates, other than the loss included separately in "loss on investments in unconsolidated affiliate," which were recognized in other non-operating income (loss), net.

HILTON WORLDWIDE HOLDINGS INC.

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES

NET INCOME MARGIN AND

ADJUSTED EBITDA AND ADJUSTED EBITDA MARGIN

(dollars in millions)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net income | $ | 344 | | | $ | 379 | | | $ | 1,034 | | | $ | 1,001 | |

| Interest expense | 140 | | | 113 | | | 412 | | | 340 | |

| Income tax expense | 147 | | | 169 | | | 413 | | | 417 | |

| Depreciation and amortization expenses | 37 | | | 40 | | | 107 | | | 114 | |

| EBITDA | 668 | | | 701 | | | 1,966 | | | 1,872 | |

Loss (gain) on sales of assets, net | 2 | | | — | | | (5) | | | — | |

Loss on foreign currency transactions | 3 | | | 7 | | | 5 | | | 13 | |

Loss on investments in unconsolidated affiliate(1) | — | | | — | | | — | | | 92 | |

Loss on debt guarantees(2) | — | | | — | | | 50 | | | — | |

| FF&E replacement reserves | 14 | | | 17 | | | 38 | | | 40 | |

| Share-based compensation expense | 44 | | | 48 | | | 140 | | | 133 | |

| Amortization of contract acquisition costs | 12 | | | 11 | | | 37 | | | 32 | |

Net other expenses from managed and franchised properties | 163 | | | 51 | | | 323 | | | 97 | |

Other adjustments(3) | (2) | | | (1) | | | 17 | | | 7 | |

| Adjusted EBITDA | $ | 904 | | | $ | 834 | | | $ | 2,571 | | | $ | 2,286 | |

____________

(1)Amount includes losses recognized related to equity and debt financing that we had previously provided to an unconsolidated affiliate with underlying investments in certain hotels that we manage or franchise.

(2)Amount includes losses on debt guarantees for certain hotels that we manage, which were recognized in other non-operating income (loss), net.

(3)Amount for the nine months ended September 30, 2024 primarily relates to restructuring costs related to one of our leased properties as well as transaction costs resulting from the amendment of our Term Loans and transaction costs incurred for acquisitions. Amounts for all periods include net losses (gains) related to certain of our investments in unconsolidated affiliates, other than the loss included separately in "loss on investments in unconsolidated affiliate," severance and other items.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Total revenues, as reported | $ | 2,867 | | | $ | 2,673 | | | $ | 8,391 | | | $ | 7,626 | |

Add: amortization of contract acquisition costs | 12 | | | 11 | | | 37 | | | 32 | |

Less: other revenues from managed and franchised properties | (1,627) | | | (1,506) | | | (4,841) | | | (4,363) | |

Total revenues, as adjusted | $ | 1,252 | | | $ | 1,178 | | | $ | 3,587 | | | $ | 3,295 | |

| | | | | | | |

| Net income | $ | 344 | | | $ | 379 | | | $ | 1,034 | | | $ | 1,001 | |

| Net income margin | 12.0 | % | | 14.2 | % | | 12.3 | % | | 13.1 | % |

| | | | | | | |

| Adjusted EBITDA | $ | 904 | | | $ | 834 | | | $ | 2,571 | | | $ | 2,286 | |

| Adjusted EBITDA margin | 72.2 | % | | 70.8 | % | | 71.7 | % | | 69.4 | % |

HILTON WORLDWIDE HOLDINGS INC.

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES

LONG-TERM DEBT TO NET INCOME RATIO AND

NET DEBT AND NET DEBT TO ADJUSTED EBITDA RATIO

(dollars in millions)

(unaudited)

| | | | | | | | | | | |

| September 30, | | December 31, |

| 2024 | | 2023 |

| Long-term debt, including current maturities | $ | 11,164 | | | $ | 9,196 | |

| Add: unamortized deferred financing costs and discounts | 90 | | | 71 | |

Long-term debt, including current maturities and excluding the deduction for unamortized deferred financing costs and discounts | 11,254 | | | 9,267 | |

Less: cash and cash equivalents | (1,580) | | | (800) | |

| Less: restricted cash and cash equivalents | (75) | | | (75) | |

| Net debt | $ | 9,599 | | | $ | 8,392 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended | | Year Ended | | TTM Ended | | |

| September 30, | | December 31, | | September 30, | | |

| 2024 | | 2023 | | 2023 | | 2024 | | |

| Net income | $ | 1,034 | | | $ | 1,001 | | | $ | 1,151 | | | $ | 1,184 | | | |

| Interest expense | 412 | | | 340 | | | 464 | | | 536 | | | |

| Income tax expense | 413 | | | 417 | | | 541 | | | 537 | | | |

| Depreciation and amortization expenses | 107 | | | 114 | | | 147 | | | 140 | | | |

| EBITDA | 1,966 | | | 1,872 | | | 2,303 | | | 2,397 | | | |

Gain on sales of assets, net | (5) | | | — | | | — | | | (5) | | | |

Loss on foreign currency transactions | 5 | | | 13 | | | 16 | | | 8 | | | |

Loss on investments in unconsolidated affiliate(1) | — | | | 92 | | | 92 | | | — | | | |

Loss on debt guarantees(2) | 50 | | | — | | | — | | | 50 | | | |

| FF&E replacement reserves | 38 | | | 40 | | | 63 | | | 61 | | | |

| Share-based compensation expense | 140 | | | 133 | | | 169 | | | 176 | | | |

Impairment losses(3) | — | | | — | | | 38 | | | 38 | | | |

| Amortization of contract acquisition costs | 37 | | | 32 | | | 43 | | | 48 | | | |

Net other expenses from managed and franchised properties | 323 | | | 97 | | | 337 | | | 563 | | | |

Other adjustments(4) | 17 | | | 7 | | | 28 | | | 38 | | | |

| Adjusted EBITDA | $ | 2,571 | | | $ | 2,286 | | | $ | 3,089 | | | $ | 3,374 | | | |

| | | | | | | | | |

| Long-term debt | | | | | | | $ | 11,164 | | | |

| Long-term debt to net income ratio | | | | | | | 9.4 | | | |

| | | | | | | | | |

| Net debt | | | | | | | $ | 9,599 | | | |

| Net debt to Adjusted EBITDA ratio | | | | | | | 2.8 | | | |

____________

(1)Amount includes losses recognized related to equity and debt financing that we had previously provided to an unconsolidated affiliate with underlying investments in certain hotels that we manage or franchise.

(2)Amount includes losses on debt guarantees for certain hotels that we manage, which were recognized in other non-operating income (loss), net.

(3)Amounts for the year ended December 31, 2023 are related to certain hotel properties under operating leases and are for the impairment of a lease intangible asset, operating lease ROU assets and property and equipment.

(4)Amounts for the nine months ended September 30, 2024 and the year ended December 31, 2023 include expenses resulting from the amendments of our Term Loans in June 2024 and November 2023, respectively. Amount for the nine months ended September 30, 2024 also includes transaction costs incurred for acquisitions and restructuring costs related to one of our leased properties. Amounts for all periods include net losses (gains) related to certain of our investments in unconsolidated affiliates, other than the loss included separately in "loss on investments in unconsolidated affiliate," severance and other items.

HILTON WORLDWIDE HOLDINGS INC.

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES

OUTLOOK: NET INCOME AND DILUTED EPS, ADJUSTED FOR SPECIAL ITEMS

(in millions, except per share data)

(unaudited)

| | | | | | | | | | | |

| Three Months Ending |

| December 31, 2024 |

| Low Case | | High Case |

Net income attributable to Hilton stockholders | $ | 368 | | | $ | 392 | |

Diluted EPS(1) | $ | 1.49 | | | $ | 1.59 | |

Special items(2): | | | |

| FF&E replacement reserves | $ | 20 | | | $ | 20 | |

Purchase accounting amortization | 1 | | | 1 | |

Other adjustments | 4 | | | 4 | |

| Total special items before taxes | 25 | | | 25 | |

| Income tax expense on special items | (5) | | | (5) | |

| Total special items after taxes | $ | 20 | | | $ | 20 | |

| | | |

| Net income, adjusted for special items | $ | 388 | | | $ | 412 | |

Diluted EPS, adjusted for special items(1) | $ | 1.57 | | | $ | 1.67 | |

| | | | | | | | | | | |

| Year Ending |

| December 31, 2024 |

| Low Case | | High Case |

Net income attributable to Hilton stockholders | $ | 1,398 | | | $ | 1,422 | |

Diluted EPS(1) | $ | 5.58 | | | $ | 5.68 | |

Special items(2): | | | |

Net other expenses from managed and franchised properties | $ | 323 | | | $ | 323 | |

| Purchase accounting amortization | 5 | | | 5 | |

Loss on debt guarantees | 50 | | | 50 | |

| FF&E replacement reserves | 58 | | | 58 | |

Gain on sales of assets, net | (5) | | | (5) | |

Tax related adjustments | (4) | | | (4) | |

| Other adjustments | 17 | | | 17 | |

| Total special items before taxes | 444 | | | 444 | |

| Income tax expense on special items | (106) | | | (106) | |

| Total special items after taxes | $ | 338 | | | $ | 338 | |

| | | |

| Net income, adjusted for special items | $ | 1,736 | | | $ | 1,760 | |

Diluted EPS, adjusted for special items(1) | $ | 6.93 | | | $ | 7.03 | |

____________(1)Does not include the effect of potential share repurchases.

(2)See "—Net Income and Diluted EPS, Adjusted for Special Items" for details of these special items.

HILTON WORLDWIDE HOLDINGS INC.

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES

OUTLOOK: ADJUSTED EBITDA

(in millions)

(unaudited)

| | | | | | | | | | | |

| Three Months Ending |

| December 31, 2024 |

| Low Case | | High Case |

Net income | $ | 371 | | | $ | 395 | |

| Interest expense | 155 | | | 155 | |

| Income tax expense | 164 | | | 175 | |

| Depreciation and amortization expenses | 37 | | | 37 | |

| EBITDA | 727 | | | 762 | |

| FF&E replacement reserves | 20 | | | 20 | |

| Share-based compensation expense | 34 | | | 34 | |

| Amortization of contract acquisition costs | 13 | | | 13 | |

Other adjustments(1) | 10 | | | 5 | |

| Adjusted EBITDA | $ | 804 | | | $ | 834 | |

| | | | | | | | | | | |

| Year Ending |

| December 31, 2024 |

| Low Case | | High Case |

Net income | $ | 1,405 | | | $ | 1,429 | |

| Interest expense | 567 | | | 567 | |

| Income tax expense | 577 | | | 588 | |

| Depreciation and amortization expenses | 144 | | | 144 | |

| EBITDA | 2,693 | | | 2,728 | |

Gain on sales of assets, net | (5) | | | (5) | |

Loss on foreign currency transactions | 5 | | | 5 | |

Loss on debt guarantees | 50 | | | 50 | |

| FF&E replacement reserves | 58 | | | 58 | |

| Share-based compensation expense | 174 | | | 174 | |

| Amortization of contract acquisition costs | 50 | | | 50 | |

Net other expenses from managed and franchised properties | 323 | | | 323 | |

Other adjustments(1) | 27 | | | 22 | |

| Adjusted EBITDA | $ | 3,375 | | | $ | 3,405 | |

____________(1)See "—Net Income Margin and Adjusted EBITDA and Adjusted EBITDA Margin" for details of these adjustments.

HILTON WORLDWIDE HOLDINGS INC.

DEFINITIONS

Trailing Twelve Month Financial Information

This press release includes certain unaudited financial information for the trailing twelve months ("TTM") ended September 30, 2024, which is calculated as the nine months ended September 30, 2024 plus the year ended December 31, 2023 less the nine months ended September 30, 2023. This presentation is not in accordance with GAAP. However, we believe that this presentation provides useful information to investors regarding our recent financial performance, and we view this presentation of the four most recently completed fiscal quarters as a key measurement period for investors to assess our historical results. In addition, our management uses TTM information to evaluate our financial performance for ongoing planning purposes.

Net Income (Loss), Adjusted for Special Items, and Diluted EPS, Adjusted for Special Items

Net income (loss), adjusted for special items, and diluted earnings (loss) per share ("EPS"), adjusted for special items, are not recognized terms under GAAP and should not be considered as alternatives to net income (loss), diluted EPS or other measures of financial performance or liquidity derived in accordance with GAAP. In addition, our definition of net income (loss), adjusted for special items, and diluted EPS, adjusted for special items, may not be comparable to similarly titled measures of other companies.

Net income (loss), adjusted for special items, and diluted EPS, adjusted for special items, are included to assist investors in performing meaningful comparisons of past, present and future operating results and as a means of highlighting the results of our ongoing operations.

EBITDA, Adjusted EBITDA, Net Income (Loss) Margin and Adjusted EBITDA Margin

EBITDA reflects net income (loss), excluding interest expense, a provision for income tax benefit (expense) and depreciation and amortization expenses. Adjusted EBITDA is calculated as EBITDA, as previously defined, further adjusted to exclude certain items, including gains, losses, revenues and expenses in connection with: (i) asset dispositions for both consolidated and unconsolidated investments; (ii) foreign currency transactions; (iii) debt restructurings and retirements; (iv) furniture, fixtures and equipment ("FF&E") replacement reserves required under certain lease agreements; (v) share-based compensation; (vi) reorganization, severance, relocation and other expenses; (vii) non-cash impairment; (viii) amortization of contract acquisition costs; (ix) the net effect of our cost reimbursement revenues and expenses included in other revenues and other expenses from managed and franchised properties; and (x) other items.

Net income (loss) margin represents net income (loss) as a percentage of total revenues. Adjusted EBITDA margin represents Adjusted EBITDA as a percentage of total revenues, adjusted to exclude the amortization of contract acquisition costs and other revenues from managed and franchised properties.

We believe that EBITDA, Adjusted EBITDA and Adjusted EBITDA margin provide useful information to investors about us and our financial condition and results of operations for the following reasons: (i) these measures are among the measures used by our management team to evaluate our operating performance and make day-to-day operating decisions and (ii) these measures are frequently used by securities analysts, investors and other interested parties as a common performance measure to compare results or estimate valuations across companies in our industry. Additionally, these measures exclude certain items that can vary widely across different industries and among competitors within our industry. For instance, interest expense and income taxes are dependent on company specifics, including, among other things, capital structure and operating jurisdictions, respectively, and, therefore, could vary significantly across companies. Depreciation and amortization expenses, as well as amortization of contract acquisition costs, are dependent upon company policies, including the method of acquiring and depreciating assets and the useful lives that are assigned to those depreciating or amortizing assets for accounting purposes. For Adjusted EBITDA, we also exclude items such as: (i) FF&E replacement reserves for leased hotels to be consistent with the treatment of capital expenditures for property and equipment, where depreciation of such capitalized assets is reported within depreciation and amortization expenses; (ii) share-based compensation, as this could vary widely among companies due to the different plans in place and the usage of them; and (iii) other items that are not reflective of our operating performance, such as amounts related to debt restructurings and debt retirements and reorganization and related severance costs, to enhance period-over-period comparisons of our ongoing operations. Further, Adjusted EBITDA excludes the net effect of our cost reimbursement revenues and expenses, classified in other revenues from managed and franchised properties and other expenses from managed and franchised properties, respectively, as we contractually do not operate the related programs to generate a profit or loss over the life of these programs. The direct reimbursements from hotel owners are billable and reimbursable as the costs are incurred and have no net effect on net income (loss). The fees we recognize related to the indirect reimbursements may be recognized before or after the related expenses are incurred, causing timing differences between the recognition of the costs incurred and the related reimbursement from hotel owners, with the net effect impacting net income (loss) in the reporting period. However, the expenses incurred related to the indirect reimbursements are expected to equal the revenues earned from the indirect reimbursements over time, and, therefore, the net effect of our cost reimbursement revenues and expenses is not used by management to evaluate our operating performance or make operating decisions.

EBITDA, Adjusted EBITDA and Adjusted EBITDA margin are not recognized terms under GAAP and should not be considered as alternatives, either in isolation or as a substitute, for net income (loss), net income (loss) margin or other measures of financial performance or liquidity, including cash flows, derived in accordance with GAAP. Further, EBITDA, Adjusted EBITDA and Adjusted EBITDA margin have limitations as analytical tools, may not be comparable to similarly titled measures of other companies and should not be considered as other methods of analyzing our results as reported under GAAP.

Net Debt, Long-Term Debt to Net Income Ratio and Net Debt to Adjusted EBITDA Ratio

Long-term debt to net income ratio is calculated as the ratio of Hilton's long-term debt, including current maturities, to net income. Net debt is calculated as: long-term debt, including current maturities and excluding the deduction for unamortized deferred financing costs and discounts; reduced by: (i) cash and cash equivalents and (ii) restricted cash and cash equivalents. Net debt to Adjusted EBITDA ratio is calculated as the ratio of Hilton's net debt to Adjusted EBITDA. Net debt and net debt to Adjusted EBITDA ratio, presented herein, are non-GAAP financial measures that the Company uses to evaluate its financial leverage.

Net debt should not be considered as a substitute to debt presented in accordance with GAAP, and net debt to Adjusted EBITDA ratio should not be considered as an alternative to measures of financial condition derived in accordance with GAAP. Net debt and net debt to Adjusted EBITDA ratio may not be comparable to similarly titled measures of other companies. We believe net debt and net debt to Adjusted EBITDA ratio provide useful information about our indebtedness to investors as they are frequently used by securities analysts, investors and other interested parties to compare the indebtedness between companies.

Comparable Hotels

We define our comparable hotels as those that: (i) were active and operating in our system for at least one full calendar year, have not undergone a change in brand or ownership type during the current or comparable periods and were open January 1st of the previous year; and (ii) have not undergone large-scale capital projects, sustained substantial property damage, encountered business interruption or for which comparable results were not available. We exclude strategic partner hotels from our comparable hotels. Of the 8,200 hotels in our system as of September 30, 2024, 400 hotels were strategic partner hotels and 6,150 hotels were classified as comparable hotels. Our 1,650 non-comparable hotels as of September 30, 2024 included (i) 844 hotels that were added to our system after January 1, 2023 or that have undergone a change in brand or ownership type during the current or comparable periods reported and (ii) 806 hotels that were removed from the comparable group for the current or comparable periods reported because they underwent or are undergoing large-scale capital projects, sustained substantial property damage, encountered business interruption or comparable results were otherwise not available.

Occupancy

Occupancy represents the total number of room nights sold divided by the total number of room nights available at a hotel or group of hotels for a given period. Occupancy measures the utilization of available capacity at a hotel or group of hotels. Management uses occupancy to gauge demand at a specific hotel or group of hotels in a given period. Occupancy levels also help management determine achievable Average Daily Rate ("ADR") pricing levels as demand for hotel rooms increases or decreases.

ADR

ADR represents hotel room revenue divided by the total number of room nights sold for a given period. ADR measures the average room price attained by a hotel, and ADR trends provide useful information concerning the pricing environment and the nature of the customer base of a hotel or group of hotels. ADR is a commonly used performance measure in the industry, and we use ADR to assess pricing levels that we are able to generate by type of customer, as changes in rates charged to customers have different effects on overall revenues and incremental profitability than changes in occupancy, as described above.

Revenue per Available Room ("RevPAR")

RevPAR is calculated by dividing hotel room revenue by the total number of room nights available to guests for a given period. We consider RevPAR to be a meaningful indicator of our performance as it provides a metric correlated to two primary and key drivers of operations at a hotel or group of hotels, as previously described: occupancy and ADR. RevPAR is also a useful indicator in measuring performance over comparable periods for comparable hotels.

References to occupancy, ADR and RevPAR are presented on a comparable basis, based on the comparable hotels as of September 30, 2024, and references to ADR and RevPAR are presented on a currency neutral basis, unless otherwise noted. As such, comparisons of these hotel operating statistics for the three and nine months ended September 30, 2024 and 2023 use the foreign currency exchange rates used to translate the results of the Company's foreign operations within its unaudited condensed consolidated financial statements for the three and nine months ended September 30, 2024, respectively.

Pipeline

Rooms under construction include rooms for hotels under construction or in the process of conversion to our system.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

hlt_CoverPageAbstract |

| Namespace Prefix: |

hlt_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

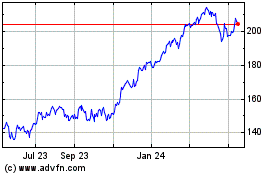

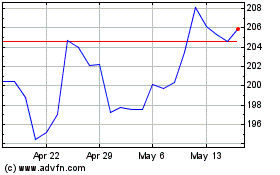

Hilton Worldwide (NYSE:HLT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Hilton Worldwide (NYSE:HLT)

Historical Stock Chart

From Feb 2024 to Feb 2025