Special Meeting for HMA Stockholders

Scheduled for January 8, 2014

Community Health Systems, Inc. (NYSE: CYH) (“CHS”) and Health

Management Associates, Inc. (NYSE: HMA) (“HMA”) announced today

that the Registration Statement on Form S-4 relating to the

companies' proposed merger has been declared effective by the

Securities and Exchange Commission (“SEC”).

The Form S-4 contains HMA’s definitive proxy statement relating

to soliciting the required approval of the transaction by HMA

stockholders. HMA is expected to commence the mailing of the

definitive proxy statement to its stockholders on or about November

25, 2013. CHS and HMA encourage HMA stockholders to review the

proxy statement and to vote FOR adoption of the merger agreement at

the HMA special stockholders’ meeting to be held in Naples,

Florida, at 8:00 a.m., local time, on January 8, 2014.

“We are pleased that the SEC has completed its review, and we

can continue to move towards the successful completion of our

acquisition of HMA,” said Wayne T. Smith, chairman, president and

chief executive officer of Community Health Systems, Inc. “We

continue to believe this transaction represents full and fair value

for HMA stockholders, while positioning CHS for long-term growth

that will generate incremental stockholder value and benefit local

communities and patients around the country. We look forward to

working closely with HMA over the coming weeks to secure

stockholder approval of the transaction.”

The transaction is expected to be completed during the first

quarter of 2014 and is subject to approval of HMA stockholders

holding 70 percent of HMA’s outstanding shares, antitrust

clearance, receipt of other regulatory approvals, and the absence

of certain adverse developments.

Under the terms of the transaction, CHS will acquire each issued

and outstanding share of the common stock of HMA for $10.50 in

cash, 0.06942 of a share of CHS common stock, and a Contingent

Value Right, which could yield additional cash consideration of up

to $1.00 per share, depending on the outcome of certain litigation

matters described in the Registration Statement on Form S-4.

On November 13, 2013, HMA announced that its Board of Directors

unanimously recommended that HMA stockholders vote “FOR” the

adoption of the merger agreement. Glenview Capital Management LLC,

which owns approximately 14.3% of the common stock of HMA, also

announced that it intends to vote “FOR” the adoption of the merger

agreement at the special meeting of HMA stockholders.

About CHS

Located in the Nashville, Tennessee, suburb of Franklin,

Community Health Systems, Inc. is one of the largest

publicly-traded hospital companies in the United States and a

leading operator of general acute care hospitals in non-urban and

mid-size markets throughout the country. Through its subsidiaries,

CHS currently owns, leases or operates 135 hospitals in 29 states

with an aggregate of approximately 20,000 licensed beds. Its

hospitals offer a broad range of inpatient and outpatient medical

and surgical services. Shares in Community Health Systems, Inc. are

traded on the New York Stock Exchange under the symbol “CYH.”

About HMA

Health Management Associates, Inc., through its affiliates, owns

and manages hospitals and ambulatory surgery centers in small

cities and selected larger urban markets. HMA currently operates 71

hospitals in 15 states with approximately 10,782 licensed beds.

Shares in Health Management Associates are traded on the New York

Stock Exchange under the symbol “HMA.”

Important Information and Where to Find It

In connection with the proposed transaction, CHS has filed with

the SEC a registration statement on Form S-4 that includes a proxy

statement of HMA and a prospectus of CHS. The registration

statement was declared effective by the SEC on November 22, 2013.

INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION

STATEMENT AND DEFINITIVE PROXY STATEMENT/PROSPECTUS, AND ANY OTHER

RELEVANT DOCUMENTS WHEN THEY BECOME AVAILABLE, BECAUSE THEY CONTAIN

OR WILL CONTAIN IMPORTANT INFORMATION ABOUT CHS, HMA AND THE

MERGER. The definitive proxy statement/prospectus and a form of

proxy will first be mailed to stockholders of HMA on or about

November 25, 2013. These materials and other documents filed with

the SEC will be available at no charge at the SEC’s website at

www.sec.gov. In addition, stockholders will be able to obtain

copies of the definitive proxy statement/prospectus and other

documents filed with the SEC (when they become available) from

CHS’s website at www.chs.net and HMA’s website at www.hma.com or by

directing such request to CHS at 4000 Meridian Boulevard, Franklin,

Tennessee 37067, Attention: Investor Relations, or to HMA at 5811

Pelican Bay Boulevard, Naples, Florida 34108, Attention: Investor

Relations.

CHS, HMA and certain of their respective directors, executive

officers and other persons may be deemed to be participants in the

solicitation of proxies in respect of the merger. Information

regarding CHS’s directors and executive officers is available in

CHS’s proxy statement filed with the SEC on April 5, 2013 in

connection with its 2013 annual meeting of stockholders, and

information regarding HMA’s directors and executive officers is

available in (i) HMA’s proxy statement filed with the SEC on April

8, 2013 in connection with its 2013 annual meeting of stockholders

and (ii) HMA’s consent revocation statement filed with the SEC on

July 19, 2013 in response to the consent solicitation conducted by

Glenview Capital Partners, L.P. and certain of its affiliates.

Other information regarding persons who may be deemed participants

in the proxy solicitation and a description of their direct and

indirect interests, by security holdings or otherwise, will be

contained in the registration statement and proxy

statement/prospectus and other relevant materials to be filed with

the SEC when they become available.

This communication shall not constitute an offer to sell or the

solicitation of an offer to sell or the solicitation of an offer to

buy any securities, nor shall there be any sale of securities in

any jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. No offer of securities

shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act of 1933, as

amended.

Forward-Looking Statements

Certain statements contained in this communication may

constitute “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. These statements

include, but are not limited to, statements regarding the expected

timing of the completion of the merger, the benefits of the merger,

including future financial and operating results, the combined

company’s plans, objectives and expectations and other statements

that are not historical facts. Such statements are based on the

views and assumptions of the management of CHS and HMA and are

subject to significant risks and uncertainties. Actual future

events or results may differ materially from these statements. Such

differences may result from the following factors: the ability to

close the transaction on the proposed terms and within the

anticipated time period, or at all, which is dependent on the

parties’ ability to satisfy certain closing conditions, including

the receipt of governmental approvals and the approval of HMA

stockholders; the risk that the benefits of the transaction,

including cost savings and other synergies, may not be fully

realized or may take longer to realize than expected; the impact of

the transaction on third-party relationships; actions taken by

either of the companies; and changes in regulatory, social and

political conditions, as well as general economic conditions.

Additional risks and factors that may affect results are set forth

in HMA’s and CHS’s filings with the Securities and Exchange

Commission, including each company’s most recent Annual Report on

Form 10-K or Form 10-K/A and Quarterly Report on Form 10-Q or 10

Q/A.

The forward-looking statements speak only as of the date of this

communication. Neither CHS nor HMA undertakes any obligation to

update these statements.

Photos/Multimedia Gallery Available:

http://www.businesswire.com/multimedia/home/20131122005825/en/

Community Health Systems, Inc.Investor Relations:W. Larry

Cash, 615-465-7000Executive Vice President & Chief Financial

OfficerorMedia Relations:Tomi Galin, 615-628-6607Vice President,

Corporate CommunicationsorHealth Management Associates,

Inc.Investor Relations:John Merriwether, 239-598-3131Vice

President, Investor RelationsorMedia Relations:MaryAnn Hodge,

239-598-3131Vice President, Marketing & Communications

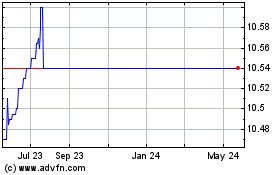

Heartland Media Acquisit... (NYSE:HMA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Heartland Media Acquisit... (NYSE:HMA)

Historical Stock Chart

From Dec 2023 to Dec 2024