0001360604False00013606042024-10-302024-10-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 30, 2024 (October 30, 2024)

Healthcare Realty Trust Incorporated

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | | | | | | | | | | |

| Maryland | (Healthcare Realty Trust Incorporated) | | 001-35568 | | 20-4738467 | |

| (State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 3310 West End Avenue, Suite 700 | Nashville, | Tennessee | 37203 | | | | (615) | 269-8175 | | | |

| (Address of Principal Executive Office and Zip Code) | | | (Registrant’s telephone number, including area code) | | |

| | | | | | | |

| | |

www.healthcarerealty.com |

| (Internet address) |

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

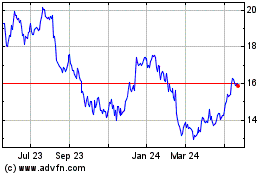

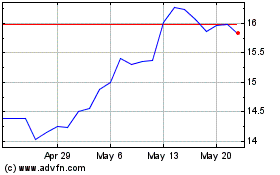

| Class A Common Stock, $0.01 par value per share | | HR | | New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter): | | | | | | | | |

| Healthcare Realty Trust Incorporated | ☐ | Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | | | | | | | | | | | |

| Healthcare Realty Trust Incorporated | ☐ | | |

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

Third Quarter Earnings Press Release

On October 30, 2024, Healthcare Realty Trust Incorporated (the “Company”) issued a press release announcing its earnings for the third quarter ended September 30, 2024. A copy of this press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference in its entirety.

| | | | | |

| Item 7.01 | Regulation FD Disclosure |

Third Quarter Supplemental Information

The Company is furnishing its Supplemental Information for the third quarter ended September 30, 2024, which is also contained on its website (www.healthcarerealty.com). See Exhibit 99.2 to this Current Report on Form 8-K.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits. | | | | | |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | | | | |

|

| | | |

| | Healthcare Realty Trust Incorporated | |

| Date: October 30, 2024 | By: | /s/ Austen B. Helfrich | |

| | | Name: Austen B. Helfrich | |

| | | Title: Interim Chief Financial Officer | |

Ron Hubbard

Vice President, Investor Relations

P: 615.269.8290

News Release

HEALTHCARE REALTY TRUST REPORTS RESULTS FOR THE THIRD QUARTER

NASHVILLE, Tennessee, October 30, 2024 - Healthcare Realty Trust Incorporated (NYSE:HR) today announced results for the third quarter ended September 30, 2024. Net (loss) income attributable to common stockholders for the three months ended September 30, 2024 was $(93.0) million, or $(0.26) per diluted common share.

| | | | | | | | | | | | | | |

| KEY THIRD QUARTER HIGHLIGHTS | | | |

•Normalized FFO per share of $0.39, up 1.2% over the prior year period

•$875 million of proceeds from JV and asset sale transactions through October

•$447 million of share repurchases year-to-date through October

•159,000 square feet, or 49 basis points, of multi-tenant absorption

•431,000 square feet of signed new leases in the quarter, the fifth consecutive quarter above 400,000

•The Company closed joint venture and asset sale transactions since the second quarter totaling $478 million bringing proceeds to approximately $875 million through October, which includes the following:

◦$522 million from joint venture transactions

◦$353 million from asset sales

•The Company has additional transactions under contract and letters of intent that are expected to increase proceeds to approximately $1.1 billion for the year.

•Through October, the Company has repurchased 27.1 million shares totaling $446.8 million at an average price of $16.48 per share.

| | | | | | | | | | | | | | |

| MULTI-TENANT OCCUPANCY AND ABSORPTION |

•Multi-tenant sequential occupancy gains continue to track towards full year 2024 expectations provided in the February 2024 Investor Presentation as shown below:

| | | | | | | | | | | | |

| | | | |

| | | 3Q 2024 | YTD 2024 | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Absorption (SF) | | | 158,720 | 341,473 | | |

| | | | | | |

| | | | | | |

| Change in occupancy (bps) | | | + 49 | + 106 | | |

•The multi-tenant portfolio occupancy rate was 86.5% and the leased percentage was 87.8% at September 30.

•Multi-tenant occupancy has increased by 164 basis points over the trailing-twelve-month period. For the Legacy HTA properties, multi-tenant occupancy has increased by 230 basis points for the same period.

| | | | | |

| HEALTHCAREREALTY.COM | PAGE 1 OF 8 |

•An updated multi-tenant occupancy and NOI bridge can be found on page 5 of the Key Highlights Investor Presentation located on the Company's website.

•Portfolio leasing activity that commenced in the third quarter totaled 1,641,000 square feet related to 455 leases:

◦1,054,000 square feet of renewals

◦587,000 square feet of new and expansion lease commencements

•The Company signed new leases totaling 431,000 square feet in the quarter, the fifth consecutive quarter above 400,000.

•Same Store cash NOI for the third quarter increased 3.1% over the same quarter in the prior year.

•Tenant retention for the third quarter was 80.5%.

•Operating expenses decreased 1.5% over the same quarter in the prior year.

•Third quarter predictive growth measures in the Same Store portfolio include:

◦Average in-place rent increases of 2.8%.

◦Future annual contractual increases of 3.1% for leases commencing in the quarter.

◦Weighted average MOB cash leasing spreads of 3.9% on 847,000 square feet renewed:

▪7% (<0% spread)

▪7% (0-3%)

▪58% (3-4%)

▪28% (>4%)

•As of September 30, 2024, net debt to adjusted EBITDA was 6.7 times. Net debt to adjusted EBITDA is expected to be 6.5 times at the end of the year.

•In October, the Company repaid the remaining $100 million outstanding of Unsecured Term Loan maturing July 2025.

•As of September 30, 2024, the Company had approximately $1.3 billion of availability under its credit facility.

•A dividend of $0.31 per share was paid in August 2024. A dividend of $0.31 per share will be paid on November 27, 2024 to stockholders and OP unitholders of record on November 12, 2024.

| | | | | |

| |

| HEALTHCARE REALTY TRUST INCORPORATED | HEALTHCAREREALTY.COM | PAGE 2 OF 8 |

•The Company's 2024 per share guidance ranges are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | EXPECTED 2024 | |

| | ACTUAL | | PRIOR | | CURRENT | |

| | 3Q 2024 | | YTD | | LOW | HIGH | | LOW | HIGH | | |

| Earnings per share | | $(0.26) | | $(1.49) | | $(1.50) | $(1.40) | | $(1.60) | $(1.59) | | |

| NAREIT FFO per share | | $0.21 | | $0.23 | | $0.77 | $0.82 | | $0.58 | $0.59 | | |

| Normalized FFO per share | | $0.39 | | $1.16 | | $1.53 | $1.58 | | $1.55 | $1.56 | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

•The Company's 2024 guidance range includes activities outlined in the Components of Expected FFO on page 29 of the Supplemental Information.

The 2024 annual guidance range reflects the Company's view of current and future market conditions, including assumptions with respect to rental rates, occupancy levels, interest rates, and operating and general and administrative expenses. The Company's guidance does not contemplate impacts from gains or losses from

dispositions, potential impairments, or debt extinguishment costs, if any. There can be no assurance that the Company's actual results will not be materially higher or lower than these expectations. If actual results vary from these assumptions, the Company's expectations may change.

•On Wednesday, October 30, 2024, at 11:00 a.m. Eastern Time, Healthcare Realty Trust has scheduled a conference call to discuss earnings results, quarterly activities, general operations of the Company and industry trends.

•Simultaneously, a webcast of the conference call will be available to interested parties at https://investors.healthcarerealty.com/corporate-profile/webcasts under the Investor Relations section. A webcast replay will be available following the call at the same address.

•Live Conference Call Access Details:

◦Domestic Toll-Free Number: +1 404-975-4839 access code 470628;

◦All Other Locations: +1 833-470-1428 access code 470628.

•Replay Information:

◦Domestic Toll-Free Number: +1 929-458-6194 access code 780754;

◦All Other Locations: +1 866-813-9403 access code 780754.

Healthcare Realty (NYSE: HR) is a real estate investment trust (REIT) that owns and operates medical outpatient buildings primarily located around market-leading hospital campuses. The Company selectively grows its portfolio through property acquisition and development. As the first and largest REIT to specialize in medical outpatient buildings, Healthcare Realty's portfolio includes over 650 properties totaling nearly 40 million square feet concentrated in 15 growth markets.

Additional information regarding the Company, including this quarter's operations, can be found at www.healthcarerealty.com. In addition to the historical information contained within, this press release contains certain forward-looking statements with respect to the Company. Forward-looking statements are statements that are not descriptions of historical facts and include statements regarding management’s intentions, beliefs, expectations, plans or predictions of the future, within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Because such statements include risks, uncertainties and contingencies, actual results may differ materially and in adverse ways from those expressed or implied by such forward-looking statements. These risks, uncertainties and contingencies include, without limitation, the following: the Company's expected results may not be achieved; failure to realize the expected benefits of the

| | | | | |

| |

| HEALTHCARE REALTY TRUST INCORPORATED | HEALTHCAREREALTY.COM | PAGE 3 OF 8 |

Merger; significant transaction costs and/or unknown or inestimable liabilities; risks related to future opportunities and plans for the Company, including the uncertainty of expected future financial performance and results of the Company; the possibility that, if the Company does not achieve the perceived benefits of the Merger as rapidly or to the extent anticipated by financial analysts or investors, the market price of the Company’s common stock could decline; general adverse economic and local real estate conditions; changes in economic conditions generally and the real estate market specifically; legislative and regulatory changes, including changes to laws governing the taxation of REITs and changes to laws governing the healthcare industry; the availability of capital; changes in interest rates; competition in the real estate industry; the supply and demand for operating properties in the Company’s proposed market areas; changes in accounting principles generally accepted in the US; policies and guidelines applicable to REITs; the availability of properties to acquire; the availability of financing; pandemics and other health concerns, and the measures intended to prevent their spread and the potential material adverse effect these matters may have on the Company’s business, results of operations, cash flows and financial condition. Additional information concerning the Company and its business, including additional factors that could materially and adversely affect the Company’s financial results, include, without limitation, the risks described under Part I, Item 1A - Risk Factors, in the Company’s 2023 Annual Report on Form 10-K and in its other filings with the SEC.

| | | | | |

| |

| HEALTHCARE REALTY TRUST INCORPORATED | HEALTHCAREREALTY.COM | PAGE 4 OF 8 |

| | |

| Consolidated Balance Sheets |

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA |

| | | | | | | | | | | | | | | | | | | | | |

| ASSETS | | | | | | | | | |

| 3Q 2024 | 2Q 2024 | 1Q 2024 | 4Q 2023 | 3Q 2023 | | | | |

| Real estate properties | | | | | | | | | |

| Land | $1,195,116 | | $1,287,532 | | $1,342,895 | | $1,343,265 | | $1,387,821 | | | | | |

| Buildings and improvements | 10,074,504 | | 10,436,218 | | 10,902,835 | | 10,881,373 | | 11,004,195 | | | | | |

| Lease intangibles | 718,343 | | 764,730 | | 816,303 | | 836,302 | | 890,273 | | | | | |

| Personal property | 9,246 | | 12,501 | | 12,720 | | 12,718 | | 12,686 | | | | | |

| Investment in financing receivables, net | 123,045 | | 122,413 | | 122,001 | | 122,602 | | 120,975 | | | | | |

| Financing lease right-of-use assets | 77,728 | | 81,401 | | 81,805 | | 82,209 | | 82,613 | | | | | |

| Construction in progress | 125,944 | | 97,732 | | 70,651 | | 60,727 | | 85,644 | | | | | |

| Land held for development | 52,408 | | 59,871 | | 59,871 | | 59,871 | | 59,871 | | | | | |

| Total real estate investments | 12,376,334 | | 12,862,398 | | 13,409,081 | | 13,399,067 | | 13,644,078 | | | | | |

| Less accumulated depreciation and amortization | (2,478,544) | | (2,427,709) | | (2,374,047) | | (2,226,853) | | (2,093,952) | | | | | |

| Total real estate investments, net | 9,897,790 | | 10,434,689 | | 11,035,034 | | 11,172,214 | | 11,550,126 | | | | | |

Cash and cash equivalents 1 | 22,801 | | 137,773 | | 26,172 | | 25,699 | | 24,668 | | | | | |

| | | | | | | | | |

| Assets held for sale, net | 156,218 | | 34,530 | | 30,968 | | 8,834 | | 57,638 | | | | | |

| Operating lease right-of-use assets | 259,013 | | 261,976 | | 273,949 | | 275,975 | | 323,759 | | | | | |

| Investments in unconsolidated joint ventures | 417,084 | | 374,841 | | 309,754 | | 311,511 | | 325,453 | | | | | |

| Other assets, net and goodwill | 491,679 | | 559,818 | | 605,047 | | 842,898 | | 822,084 | | | | | |

| Total assets | $11,244,585 | | $11,803,627 | | $12,280,924 | | $12,637,131 | | $13,103,728 | | | | | |

| | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | | | | | |

| 3Q 2024 | 2Q 2024 | 1Q 2024 | 4Q 2023 | 3Q 2023 | | | | |

| Liabilities | | | | | | | | | |

| Notes and bonds payable | $4,957,796 | | $5,148,153 | | $5,108,279 | | $4,994,859 | | $5,227,413 | | | | | |

| Accounts payable and accrued liabilities | 197,428 | | 195,884 | | 163,172 | | 211,994 | | 204,947 | | | | | |

| Liabilities of properties held for sale | 7,919 | | 1,805 | | 700 | | 295 | | 3,814 | | | | | |

| Operating lease liabilities | 229,925 | | 230,601 | | 229,223 | | 229,714 | | 273,319 | | | | | |

| Financing lease liabilities | 71,887 | | 75,199 | | 74,769 | | 74,503 | | 74,087 | | | | | |

| Other liabilities | 180,283 | | 177,293 | | 197,763 | | 202,984 | | 211,365 | | | | | |

| Total liabilities | 5,645,238 | | 5,828,935 | | 5,773,906 | | 5,714,349 | | 5,994,945 | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Redeemable non-controlling interests | 3,875 | | 3,875 | | 3,880 | | 3,868 | | 3,195 | | | | | |

| | | | | | | | | |

| Stockholders' equity | | | | | | | | | |

| Preferred stock, $0.01 par value; 200,000 shares authorized | — | | — | | — | | — | | — | | | | | |

| Common stock, $0.01 par value; 1,000,000 shares authorized | 3,558 | | 3,643 | | 3,815 | | 3,810 | | 3,809 | | | | | |

| Additional paid-in capital | 9,198,004 | | 9,340,028 | | 9,609,530 | | 9,602,592 | | 9,597,629 | | | | | |

| Accumulated other comprehensive (loss) income | (16,963) | | 6,986 | | 4,791 | | (10,741) | | 17,079 | | | | | |

| Cumulative net income attributable to common stockholders | 481,155 | | 574,178 | | 717,958 | | 1,028,794 | | 1,069,327 | | | | | |

| Cumulative dividends | (4,150,328) | | (4,037,693) | | (3,920,199) | | (3,801,793) | | (3,684,144) | | | | | |

| Total stockholders' equity | 5,515,426 | | 5,887,142 | | 6,415,895 | | 6,822,662 | | 7,003,700 | | | | | |

| Non-controlling interest | 80,046 | | 83,675 | | 87,243 | | 96,252 | | 101,888 | | | | | |

| Total Equity | 5,595,472 | | 5,970,817 | | 6,503,138 | | 6,918,914 | | 7,105,588 | | | | | |

| Total liabilities and stockholders' equity | $11,244,585 | | $11,803,627 | | $12,280,924 | | $12,637,131 | | $13,103,728 | | | | | |

12Q 2024 cash and cash equivalents includes $96.0 million of proceeds held in a cash escrow account from a portfolio disposition that closed on June 28, 2024 and was received by the Company on July 1, 2024.

| | | | | |

| |

| HEALTHCARE REALTY TRUST INCORPORATED | HEALTHCAREREALTY.COM | PAGE 5 OF 8 |

| | |

| Consolidated Statements of Income |

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| 3Q 2024 | 2Q 2024 | 1Q 2024 | 4Q 2023 | 3Q 2023 | | |

| Revenues | | | | | | | |

Rental income 1 | $306,499 | $308,135 | $318,076 | $322,076 | $333,335 | | |

| Interest income | 3,904 | 3,865 | 4,538 | 4,422 | 4,264 | | |

| Other operating | 5,020 | 4,322 | 4,191 | 3,943 | 4,661 | | |

| 315,423 | 316,322 | 326,805 | 330,441 | 342,260 | | |

| Expenses | | | | | | | |

| Property operating | 120,232 | 117,719 | 121,078 | 121,362 | 131,639 | | |

| General and administrative | 20,124 | 14,002 | 14,787 | 14,609 | 13,396 | | |

Normalizing items 2 | (6,861) | — | — | (1,445) | — | | |

| Normalized general and administrative | 13,263 | 14,002 | 14,787 | 13,164 | 13,396 | | |

| Transaction costs | 719 | 431 | 395 | 301 | 769 | | |

| Merger-related costs | — | — | — | 1,414 | 7,450 | | |

| Depreciation and amortization | 163,226 | 173,477 | 178,119 | 180,049 | 182,989 | | |

| 304,301 | 305,629 | 314,379 | 317,735 | 336,243 | | |

| Other income (expense) | | | | | | | |

| Interest expense before merger-related fair value | (50,465) | (52,393) | (50,949) | (52,387) | (55,637) | | |

| Merger-related fair value adjustment | (10,184) | (10,064) | (10,105) | (10,800) | (10,667) | | |

| Interest expense | (60,649) | (62,457) | (61,054) | (63,187) | (66,304) | | |

| Gain on sales of real estate properties and other assets | 39,310 | 38,338 | 22 | 20,573 | 48,811 | | |

| Gain on extinguishment of debt | — | — | — | — | 62 | | |

| Impairment of real estate assets and credit loss reserves | (84,394) | (132,118) | (15,937) | (11,403) | (56,873) | | |

| Impairment of goodwill | — | — | (250,530) | — | — | | |

| Equity income (loss) from unconsolidated joint ventures | 208 | (146) | (422) | (430) | (456) | | |

| Interest and other (expense) income, net | (132) | (248) | 275 | 65 | 139 | | |

| (105,657) | (156,631) | (327,646) | (54,382) | (74,621) | | |

| Net (loss) income | $(94,535) | $(145,938) | $(315,220) | $(41,676) | $(68,604) | | |

| Net loss (income) attributable to non-controlling interests | 1,512 | 2,158 | 4,384 | 1,143 | 760 | | |

| Net (loss) income attributable to common stockholders | $(93,023) | $(143,780) | $(310,836) | $(40,533) | $(67,844) | | |

| | | | | | | |

| | | | | | | |

| Basic earnings per common share | $(0.26) | $(0.39) | $(0.82) | $(0.11) | $(0.18) | | |

| Diluted earnings per common share | $(0.26) | $(0.39) | $(0.82) | $(0.11) | $(0.18) | | |

| | | | | | | |

| Weighted average common shares outstanding - basic | 358,960 | 372,477 | 379,455 | 379,044 | 378,925 | | |

Weighted average common shares outstanding - diluted 3 | 358,960 | 372,477 | 379,455 | 379,044 | 378,925 | | |

1In 2Q 2024, rental income was reduced by $3.0 million for Steward Health revenue reserves. This consisted of $2.2 million for April and prepetition rent for May as well as $0.8 million for March. In addition, the Company reversed $2.2 million of straight-line rent receivable against rental income.

23Q 2024 and 4Q 2023 normalizing items primarily include severance-related costs.

3Potential common shares are not included in the computation of diluted earnings per share when a loss exists, as the effect would be an antidilutive per share amount. As a result, the outstanding limited partnership units in the Company's operating partnership ("OP"), totaling 3,649,637 units were not included.

| | | | | |

| |

| HEALTHCARE REALTY TRUST INCORPORATED | HEALTHCAREREALTY.COM | PAGE 6 OF 8 |

| | |

Reconciliation of FFO, Normalized FFO and FAD 1,2,3 |

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| 3Q 2024 | 2Q 2024 | 1Q 2024 | 4Q 2023 | 3Q 2023 | | | | | | | | | | | | | | | | | | | |

| Net loss attributable to common stockholders | $(93,023) | $(143,780) | $(310,836) | $(40,533) | $(67,844) | | | | | | | | | | | | | | | | | | | |

Net loss attributable to common stockholders/diluted share 3 | $(0.26) | $(0.39) | $(0.82) | $(0.11) | $(0.18) | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Gain on sales of real estate assets | (39,148) | | (33,431) | | (22) | | (20,573) | | (48,811) | | | | | | | | | | | | | | | | | | | | |

| Impairments of real estate assets | 37,632 | | 120,917 | | 15,937 | | 11,403 | | 56,873 | | | | | | | | | | | | | | | | | | | | |

| Real estate depreciation and amortization | 167,821 | | 177,350 | | 181,161 | | 182,272 | | 185,143 | | | | | | | | | | | | | | | | | | | | |

| Non-controlling loss from operating partnership units | (1,372) | | (2,077) | | (4,278) | | (491) | | (841) | | | | | | | | | | | | | | | | | | | | |

| Unconsolidated JV depreciation and amortization | 5,378 | 4,818 | 4,568 | 4,442 | 4,421 | | | | | | | | | | | | | | | | | | | |

| FFO adjustments | $170,311 | $267,577 | $197,366 | $177,053 | $196,785 | | | | | | | | | | | | | | | | | | | |

| FFO adjustments per common share - diluted | $0.47 | $0.71 | $0.51 | $0.46 | $0.51 | | | | | | | | | | | | | | | | | | | |

| FFO | $77,288 | $123,797 | $(113,470) | $136,520 | $128,941 | | | | | | | | | | | | | | | | | | | |

FFO per common share - diluted 4 | $0.21 | $0.33 | $(0.30) | $0.36 | $0.34 | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Transaction costs | 719 | 431 | 395 | 301 | 769 | | | | | | | | | | | | | | | | | | | |

Merger-related costs | — | — | — | 1,414 | 7,450 | | | | | | | | | | | | | | | | | | | |

| Lease intangible amortization | (10) | | 129 | 175 | 261 | 213 | | | | | | | | | | | | | | | | | | | |

| Non-routine legal costs/forfeited earnest money received | 306 | | 465 | | — | | (100) | | — | | | | | | | | | | | | | | | | | | | |

| Debt financing costs | — | — | — | — | (62) | | | | | | | | | | | | | | | | | | | | |

| Restructuring and severance-related charges | 6,861 | — | — | 1,445 | — | | | | | | | | | | | | | | | | | | | |

Credit losses and gains on other assets, net 5 | 46,600 | 8,525 | — | — | — | | | | | | | | | | | | | | | | | | | |

| Impairment of goodwill | — | — | 250,530 | — | — | | | | | | | | | | | | | | | | | | | |

| Merger-related fair value adjustment | 10,184 | 10,064 | 10,105 | 10,800 | 10,667 | | | | | | | | | | | | | | | | | | | |

Unconsolidated JV normalizing items 6 | 101 | 89 | 87 | 89 | 90 | | | | | | | | | | | | | | | | | | | |

| Normalized FFO adjustments | $64,761 | $19,703 | $261,292 | $14,210 | $19,127 | | | | | | | | | | | | | | | | | | | |

| Normalized FFO adjustments per common share - diluted | $0.18 | $0.05 | $0.68 | $0.04 | $0.05 | | | | | | | | | | | | | | | | | | | |

Normalized FFO | $142,049 | $143,500 | $147,822 | $150,730 | $148,068 | | | | | | | | | | | | | | | | | | | |

| Normalized FFO per common share - diluted | $0.39 | $0.38 | $0.39 | $0.39 | $0.39 | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Non-real estate depreciation and amortization | 276 | 313 | 485 | 685 | 475 | | | | | | | | | | | | | | | | | | | |

Non-cash interest amortization, net 7 | 1,319 | 1,267 | 1,277 | 1,265 | 1,402 | | | | | | | | | | | | | | | | | | | |

Rent reserves, net 8 | (27) | 1,261 | (151) | 1,404 | 442 | | | | | | | | | | | | | | | | | | | |

| Straight-line rent income, net | (5,771) | (6,799) | (7,633) | (7,872) | (8,470) | | | | | | | | | | | | | | | | | | | |

| Stock-based compensation | 4,064 | 3,383 | 3,562 | 3,566 | 2,556 | | | | | | | | | | | | | | | | | | | |

Unconsolidated JV non-cash items 9 | (376) | (148) | (122) | (206) | (231) | | | | | | | | | | | | | | | | | | | |

Normalized FFO adjusted for non-cash items | 141,534 | 142,777 | 145,240 | 149,572 | 144,242 | | | | | | | | | | | | | | | | | | | |

| 2nd generation TI | (16,951) | (12,287) | (20,204) | (18,715) | (21,248) | | | | | | | | | | | | | | | | | | | |

| Leasing commissions paid | (10,266) | (10,012) | (15,215) | (14,978) | (8,907) | | | | | | | | | | | | | | | | | | | |

| Building capital | (7,389) | (12,835) | (5,363) | (17,393) | (14,354) | | | | | | | | | | | | | | | | | | | |

| Total maintenance capex | (34,606) | (35,134) | (40,782) | (51,086) | (44,509) | | | | | | | | | | | | | | | | | | | |

| FAD | $106,928 | $107,643 | $104,458 | $98,486 | $99,733 | | | | | | | | | | | | | | | | | | | |

| Quarterly/dividends and OP distributions | $113,770 | $118,627 | $119,541 | $118,897 | $119,456 | | | | | | | | | | | | | | | | | | | |

FFO wtd avg common shares outstanding - diluted 10 | 363,370 | 376,556 | 383,413 | 383,326 | 383,428 | | | | | | | | | | | | | | | | | | | |

1Funds from operations (“FFO”) and FFO per share are operating performance measures adopted by NAREIT. NAREIT defines FFO as “net income (computed in accordance with GAAP) excluding depreciation and amortization related to real estate, gains and losses from the sale of certain real estate assets, gains and losses from change in control, and impairment write-downs of certain real assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity.”

2FFO, Normalized FFO and Funds Available for Distribution ("FAD") do not represent cash generated from operating activities determined in accordance with GAAP and are not necessarily indicative of cash available to fund cash needs. FFO, Normalized FFO and FAD should not be considered alternatives to net income attributable to common stockholders as indicators of the Company's operating performance or as alternatives to cash flow as measures of liquidity.

3Potential common shares are not included in the computation of diluted earnings per share when a loss exists, as the effect would be an antidilutive per share amount.

4For 1Q 2024, basic weighted average common shares outstanding was the denominator used in the per share calculation.

53Q 2024 includes $46.8 million of credit loss reserves and $0.2 million gain on other assets. 2Q 2024 includes $11.2 million of credit loss reserves and $2.2 million write-off of prior period Steward Health straight-line rent, offset by $4.9 million gain on other assets.

6Includes the Company's proportionate share of normalizing items related to unconsolidated joint ventures such as lease intangibles and acquisition and pursuit costs.

7Includes the amortization of deferred financing costs, discounts and premiums, and non-cash financing receivable amortization.

82Q 2024 includes $0.8 million related to the Steward Health revenue reserve for March.

9Includes the Company's proportionate share of straight-line rent, net and rent reserves, net related to unconsolidated joint ventures.

10The Company utilizes the treasury stock method, which includes the dilutive effect of nonvested share-based awards outstanding of 760,552 for the three months ended September 30, 2024. Also includes the diluted impact of 3,649,637 OP units outstanding.

| | | | | |

| |

| HEALTHCARE REALTY TRUST INCORPORATED | HEALTHCAREREALTY.COM | PAGE 7 OF 8 |

| | |

| Reconciliation of Non-GAAP Measures |

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA - UNAUDITED |

|

Management considers funds from operations ("FFO"), FFO per share, normalized FFO, normalized FFO per share, and funds available for distribution ("FAD") to be useful non-GAAP measures of the Company's operating performance. A non-GAAP financial measure is generally defined as one that purports to measure historical financial performance, financial position or cash flows, but excludes or includes amounts that would not be so adjusted in the most comparable measure determined in accordance with GAAP. Set forth below are descriptions of the non-GAAP financial measures management considers relevant to the Company's business and useful to investors.

The non-GAAP financial measures presented herein are not necessarily identical to those presented by other real estate companies due to the fact that not all real estate companies use the same definitions. These measures should not be considered as alternatives to net income (determined in accordance with GAAP), as indicators of the Company's financial performance, or as alternatives to cash flow from operating activities (determined in accordance with GAAP) as measures of the Company's liquidity, nor are these measures necessarily indicative of sufficient cash flow to fund all of the Company's needs.

FFO and FFO per share are operating performance measures adopted by the National Association of Real Estate Investment Trusts, Inc. (“NAREIT”). NAREIT defines FFO as “net income (computed in accordance with GAAP) excluding depreciation and amortization related to real estate, gains and losses from the sale of certain real estate assets, gains and losses from change in control, and impairment write-downs of certain real assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity.” The Company defines Normalized FFO as FFO excluding acquisition-related expenses, lease intangible amortization and other normalizing items that are unusual and infrequent in nature. FAD is presented by adding to Normalized FFO non-real estate depreciation and amortization, deferred financing fees amortization, share-based compensation expense and rent reserves, net; and subtracting maintenance capital expenditures, including second generation tenant improvements and leasing commissions paid and straight-line rent income, net of expense. The Company's definition of these terms may not be comparable to that of other real estate companies as they may have different methodologies for computing these amounts. FFO, Normalized FFO and FAD do not represent cash generated from operating activities determined in accordance with GAAP and are not necessarily indicative of cash available to fund cash needs. FFO, Normalized FFO and FAD should not be considered an alternative to net income as an indicator of the Company’s operating performance or as an alternative to cash flow as a measure of liquidity. FFO, Normalized FFO and FAD should be reviewed in connection with GAAP financial measures.

Management believes FFO, FFO per share, Normalized FFO, Normalized FFO per share, and FAD provide an understanding of the operating performance of the Company’s properties without giving effect to certain significant non-cash items, including depreciation and amortization expense. Historical cost accounting for real estate assets in accordance with GAAP assumes that the value of real estate assets diminishes predictably over time. However, real estate values instead have historically risen or fallen with market conditions. The Company believes that by excluding the effect of depreciation, amortization, gains or losses from sales of real estate, and other normalizing items that are unusual and infrequent, FFO, FFO per share, Normalized FFO, Normalized FFO per share and FAD can facilitate comparisons of operating performance between periods. The Company reports these measures because they have been observed by management to be the predominant measures used by the REIT industry and by industry analysts to evaluate REITs and because these measures are consistently reported, discussed, and compared by research analysts in their notes and publications about REITs.

Cash NOI and Same Store Cash NOI are key performance indicators. Management considers these to be supplemental measures that allow investors, analysts and Company management to measure unlevered property-level operating results. The Company defines Cash NOI as rental income and less property operating expenses. Cash NOI excludes non-cash items such as above and below market lease intangibles, straight-line rent, lease inducements, lease termination fees, tenant improvement amortization and leasing commission amortization. Cash NOI is historical and not necessarily indicative of future results.

Same Store Cash NOI compares Cash NOI for stabilized properties. Stabilized properties are properties that have been included in operations for the duration of the year-over-year comparison period presented. Accordingly, stabilized properties exclude properties that were recently acquired or disposed of, properties classified as held for sale, properties undergoing redevelopment, and newly redeveloped or developed properties.

The Company utilizes the redevelopment classification for properties where management has approved a change in strategic direction for such properties through the application of additional resources including an amount of capital expenditures significantly above routine maintenance and capital improvement expenditures.

Any recently acquired property will be included in the same store pool once the Company has owned the property for eight full quarters. Newly developed or redeveloped properties will be included in the same store pool eight full quarters after substantial completion.

| | | | | |

| |

| HEALTHCARE REALTY TRUST INCORPORATED | HEALTHCAREREALTY.COM | PAGE 8 OF 8 |

| | |

3Q2024 |

| Supplemental Information |

| FURNISHED AS OF OCTOBER 30, 2024 - UNAUDITED |

|

|

| | |

| FORWARD LOOKING STATEMENTS & RISK FACTORS |

|

This Supplemental Information report contains disclosures that are “forward-looking statements” as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include all statements that do not relate solely to historical or current facts and can be identified by the use of words and phrases such as “can,” “may,” “payable,” “indicative,” "predictive," “annualized,” “expect,” “expected,” “range of expectations,” "would have been," "budget," "will," "run-rate," and other comparable terms in this report, and include, but are not limited to, statements related to the merger between Healthcare Realty Trust Incorporated (the “Company” or "HR") and Healthcare Trust of America, Inc. (“Legacy HTA”) that closed on July 20, 2022 (the “Merger”). These forward-looking statements are made as of the date of this report and are not necessarily indicative of future performance. These statements are based on the current plans and expectations of Company management and are subject to a number of unknown risks, uncertainties, assumptions and other factors that could cause actual results to differ materially from those described in this release or implied by such forward-looking statements. Such risks and uncertainties include, among other things, the following: the Company’s expected results may not be achieved; failure to realize the expected benefits of the Merger; risks related to future opportunities and plans for the Company, including the uncertainty of expected future financial performance and results of the Company; the possibility that, if the Company does not achieve the perceived benefits of the Merger as rapidly or to the extent anticipated by financial analysts or investors, the market price of the Company’s common stock could decline; pandemics or other health crises, such as COVID-19; increases in interest rates; the availability and cost of capital at expected rates; competition for quality assets; negative developments in the operating results or financial condition of the Company's tenants, including, but not limited to, their ability to pay rent; the Company's ability to reposition or sell facilities with profitable results; the Company's ability to release space at similar rates as vacancies occur; the Company's ability to renew expiring leases; government regulations affecting tenants' Medicare and Medicaid reimbursement rates and operational requirements; unanticipated difficulties and/or expenditures relating to future acquisitions and developments; changes in rules or practices governing the Company's financial reporting; the Company may be required under purchase options to sell properties and may not be able to reinvest the proceeds from such sales at rates of return equal to the return received on the properties sold; uninsured or underinsured losses related to casualty or liability; the incurrence of impairment charges on its real estate properties or other assets; and other legal and operational matters. Other risks, uncertainties and factors that could cause actual results to differ materially from those projected are detailed under the heading “Risk Factors,” in the Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) for the year ended December 31, 2023, under the heading "Risk Factors" and other risks described from time to time thereafter in the Company's SEC filings. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

| | | | | |

| Highlights |

| Salient Facts |

| Corporate Information |

| Balance Sheet |

| Statements of Income |

| FFO, Normalized FFO, & FAD |

| Capital Funding & Commitments |

| Debt Metrics |

| Debt Covenants & Liquidity |

| JV and Disposition Activity |

| Joint Ventures |

| Re/development Activity |

| Portfolio |

| Health Systems |

| MOB Proximity to Hospital |

| Lease Maturity & Occupancy |

| Leasing Statistics |

| Same Store |

| NOI Reconciliations |

| 27 | EBITDA Reconciliations |

| Components of Net Asset Value |

| Components of Expected FFO |

| | | | | |

| |

HEALTHCARE REALTY | 3Q 2024 SUPPLEMENTAL INFORMATION 3 |

Net (loss) income attributable to common stockholders for the three months ended September 30, 2024 was $(93.0) million or $(0.26) per diluted common share.

| | | | | | | | | | | | | | |

| KEY THIRD QUARTER HIGHLIGHTS | | | |

•Normalized FFO per share of $0.39, up 1.2% over the prior year period

•$875 million of proceeds from JV and asset sale transactions through October

•$447 million of share repurchases year-to-date through October

•159,000 square feet, or 49 basis points, of multi-tenant absorption

•431,000 square feet of signed new leases in the quarter, the fifth consecutive quarter above 400,000

•The Company closed joint venture and asset sale transactions since the second quarter totaling $478 million bringing proceeds to approximately $875 million through October, which includes the following:

◦$522 million from joint venture transactions

◦$353 million from asset sales

•The Company has additional transactions under contract and letters of intent that are expected to increase proceeds to approximately $1.1 billion for the year.

•Through October, the Company has repurchased 27.1 million shares totaling $446.8 million at an average price of $16.48 per share.

| | | | | | | | | | | | | | |

| MULTI-TENANT OCCUPANCY AND ABSORPTION | | | |

•Multi-tenant sequential occupancy gains continue to track towards full year 2024 expectations provided in the February 2024 Investor Presentation as shown below:

| | | | | | | | | | | |

| | | | |

| | | 3Q 2024 | YTD 2024 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Absorption (SF) | | | 158,720 | 341,473 | |

| | | | | |

| | | | | |

| Change in occupancy (bps) | | | + 49 | + 106 | |

•The multi-tenant portfolio occupancy rate was 86.5% and the leased percentage was 87.8% at September 30.

•Multi-tenant occupancy has increased by 164 basis points over the trailing-twelve-month period. For the Legacy HTA properties, multi-tenant occupancy has increased by 230 basis points for the same period.

•An updated multi-tenant occupancy and NOI bridge can be found on page 5 of the Key Highlights Investor Presentation located on the Company's website.

•Portfolio leasing activity that commenced in the third quarter totaled 1,641,000 square feet related to 455 leases:

◦1,054,000 square feet of renewals

◦587,000 square feet of new and expansion lease commencements

•The Company signed new leases totaling 431,000 square feet in the quarter, the fifth consecutive quarter above 400,000.

| | | | | |

| |

HEALTHCARE REALTY | 3Q 2024 SUPPLEMENTAL INFORMATION 4 |

•Same Store cash NOI for the third quarter increased 3.1% over the same quarter in the prior year.

•Tenant retention for the third quarter was 80.5%.

•Operating expenses decreased 1.5% over the same quarter in the prior year.

•Third quarter predictive growth measures in the Same Store portfolio include:

◦Average in-place rent increases of 2.8%.

◦Future annual contractual increases of 3.1% for leases commencing in the quarter.

◦Weighted average MOB cash leasing spreads of 3.9% on 847,000 square feet renewed:

▪7% (<0% spread)

▪7% (0-3%)

▪58% (3-4%)

▪28% (>4%)

•As of September 30, 2024, net debt to adjusted EBITDA was 6.7 times. Net debt to adjusted EBITDA is expected to be 6.5 times at the end of the year.

•In October, the Company repaid the remaining $100 million outstanding of Unsecured Term Loan maturing July 2025.

•As of September 30, 2024, the Company had approximately $1.3 billion of availability under its credit facility.

•A dividend of $0.31 per share was paid in August 2024. A dividend of $0.31 per share will be paid on November 27, 2024 to stockholders and OP unitholders of record on November 12, 2024.

•The Company's 2024 per share guidance ranges are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | EXPECTED 2024 | |

| | ACTUAL | | PRIOR | | CURRENT | | |

| | 3Q 2024 | | YTD | | LOW | HIGH | | LOW | HIGH | | |

| Earnings per share | | $(0.26) | | $(1.49) | | $(1.50) | $(1.40) | | $(1.60) | $(1.59) | | |

| NAREIT FFO per share | | $0.21 | | $0.23 | | $0.77 | $0.82 | | $0.58 | $0.59 | | |

| Normalized FFO per share | | $0.39 | | $1.16 | | $1.53 | $1.58 | | $1.55 | $1.56 | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

•The Company's 2024 guidance range includes activities outlined in the Components of Expected FFO on page 29 of the Supplemental Information.

The 2024 annual guidance range reflects the Company's view of current and future market conditions, including assumptions with respect to rental rates, occupancy levels, interest rates, and operating and general and administrative expenses. The Company's guidance does not contemplate impacts from gains or losses from

dispositions, potential impairments, or debt extinguishment costs, if any. There can be no assurance that the Company's actual results will not be materially higher or lower than these expectations. If actual results vary from these assumptions, the Company's expectations may change.

| | | | | |

| |

HEALTHCARE REALTY | 3Q 2024 SUPPLEMENTAL INFORMATION 5 |

•On Wednesday, October 30, 2024, at 11:00 a.m. Eastern Time, Healthcare Realty Trust has scheduled a conference call to discuss earnings results, quarterly activities, general operations of the Company and industry trends.

•Simultaneously, a webcast of the conference call will be available to interested parties at https://investors.healthcarerealty.com/corporate-profile/webcasts under the Investor Relations section. A webcast replay will be available following the call at the same address.

•Live Conference Call Access Details:

◦Domestic Toll-Free Number: +1 404-975-4839 access code 470628;

◦All Other Locations: +1 833-470-1428 access code 470628.

•Replay Information:

◦Domestic Toll-Free Number: +1 929-458-6194 access code 780754;

◦All Other Locations: +1 866-813-9403 access code 780754.

| | | | | |

| |

HEALTHCARE REALTY | 3Q 2024 SUPPLEMENTAL INFORMATION 6 |

| | | | | | | | | | | |

| Properties | | |

| | |

| 660 properties totaling 38.7M SF | |

| 67 markets in 35 states | |

| 92% managed by Healthcare Realty | |

| 93% outpatient medical facilities | |

| 60% of NOI in Top 15 Markets | |

| | |

| | |

| Capitalization | |

| | |

| $11.7B enterprise value as of 9/30/24 | |

| $6.5B market capitalization as of 9/30/24 | |

| 359.5M shares/units outstanding as of 9/30/24 | |

| 363.4M diluted WA shares outstanding | |

| $0.31 quarterly dividend per share | |

| BBB/Baa2 S&P/Moody's | |

| 44.3% net debt to enterprise value at 9/30/24 | |

| 6.5x run rate net debt to adjusted EBITDA | |

| | |

1Includes properties held in joint ventures.

| | | | | |

| |

HEALTHCARE REALTY | 3Q 2024 SUPPLEMENTAL INFORMATION 7 |

Healthcare Realty (NYSE: HR) is a real estate investment trust (REIT) that owns and operates medical outpatient buildings primarily located around market-leading hospital campuses. The Company selectively grows its portfolio through property acquisition and development. As of September 30, 2024, the Company was invested in 660 real estate properties in 35 states totaling 38.7 million square feet and had an enterprise value of approximately $11.7 billion, defined as equity market capitalization plus the principal amount of debt less cash. The Company provided leasing and property management services to 92% of its portfolio.

| | |

| EXECUTIVE OFFICERS |

|

| Todd J. Meredith |

| President and Chief Executive Officer |

|

| John M. Bryant, Jr. |

| Executive Vice President and General Counsel |

|

| Ryan E. Crowley |

| Executive Vice President and Chief Investment Officer |

|

| Austen B. Helfrich |

| Interim Chief Financial Officer |

|

| Robert E. Hull |

| Executive Vice President and Chief Operating Officer |

|

| Julie F. Wilson |

| Executive Vice President and Chief Administrative Officer |

|

|

|

|

|

| | | | | |

| ANALYST COVERAGE |

| |

| BMO Capital Markets |

| BTIG, LLC |

| Citi Research |

| Deutsche Bank Securities |

| Green Street Advisors, Inc. |

| J.P. Morgan Securities LLC |

| Jefferies LLC |

| KeyBanc Capital Markets Inc. |

| Raymond James & Associates |

| Scotiabank |

| Wedbush Securities |

| Wells Fargo Securities, LLC |

| |

| |

J. Knox Singleton

Chairman, Healthcare Realty Trust Incorporated

Retired Chief Executive Officer, Inova Health System

Todd J. Meredith

President and Chief Executive Officer

Healthcare Realty Trust Incorporated

John V. Abbott

Retired Chief Executive Officer

Aviation Asset Management Group, General Electric Company

Nancy H. Agee

Retired President and Chief Executive Officer

Carilion Clinic

Thomas N. Bohjalian

Retired Head of U.S. Real Estate

Cohen & Steers

Vicki U. Booth

President and Board Chair

Ueberroth Family Foundation

Ajay Gupta

Chief Executive Officer

Physician Rehabilitation Network

James J. Kilroy

President and Portfolio Manager

Willis Investment Counsel

Jay P. Leupp

Managing Partner and Senior Portfolio Manager

Terra Firma Asset Management, LLC

Peter F. Lyle

Executive Vice President

Medical Management Associates, Inc.

Constance B. Moore

Retired President and CEO

BRE Properties, Inc.

Christann M. Vasquez

Retired Healthcare Executive

David R. Emery (1944-2019)

Chairman Emeritus

Healthcare Realty Trust Incorporated

| | | | | |

| |

HEALTHCARE REALTY | 3Q 2024 SUPPLEMENTAL INFORMATION 8 |

| | |

| Balance Sheet |

| AMOUNTS IN THOUSANDS, EXCEPT PER SHARE DATA |

|

| | | | | | | | | | | | | | | | | | | | | | |

| ASSETS | | | | | | | | | | |

| | | | | | | | |

| 3Q 2024 | 2Q 2024 | 1Q 2024 | 4Q 2023 | 3Q 2023 | | | | | |

| Real estate properties | | | | | | | | | | |

| Land | $1,195,116 | | $1,287,532 | | $1,342,895 | | $1,343,265 | | $1,387,821 | | | | | | |

| Buildings and improvements | 10,074,504 | | 10,436,218 | | 10,902,835 | | 10,881,373 | | 11,004,195 | | | | | | |

| Lease intangibles | 718,343 | | 764,730 | | 816,303 | | 836,302 | | 890,273 | | | | | | |

| Personal property | 9,246 | | 12,501 | | 12,720 | | 12,718 | | 12,686 | | | | | | |

| Investment in financing receivables, net | 123,045 | | 122,413 | | 122,001 | | 122,602 | | 120,975 | | | | | | |

| Financing lease right-of-use assets | 77,728 | | 81,401 | | 81,805 | | 82,209 | | 82,613 | | | | | | |

| Construction in progress | 125,944 | | 97,732 | | 70,651 | | 60,727 | | 85,644 | | | | | | |

| Land held for development | 52,408 | | 59,871 | | 59,871 | | 59,871 | | 59,871 | | | | | | |

| Total real estate investments | 12,376,334 | | 12,862,398 | | 13,409,081 | | 13,399,067 | | 13,644,078 | | | | | | |

| Less accumulated depreciation and amortization | (2,478,544) | | (2,427,709) | | (2,374,047) | | (2,226,853) | | (2,093,952) | | | | | | |

| Total real estate investments, net | 9,897,790 | | 10,434,689 | | 11,035,034 | | 11,172,214 | | 11,550,126 | | | | | | |

Cash and cash equivalents 1 | 22,801 | | 137,773 | | 26,172 | | 25,699 | | 24,668 | | | | | | |

| | | | | | | | | | |

| Assets held for sale, net | 156,218 | | 34,530 | | 30,968 | | 8,834 | | 57,638 | | | | | | |

| Operating lease right-of-use assets | 259,013 | | 261,976 | | 273,949 | | 275,975 | | 323,759 | | | | | | |

| Investments in unconsolidated joint ventures | 417,084 | | 374,841 | | 309,754 | | 311,511 | | 325,453 | | | | | | |

| Other assets, net and goodwill | 491,679 | | 559,818 | | 605,047 | | 842,898 | | 822,084 | | | | | | |

| Total assets | $11,244,585 | | $11,803,627 | | $12,280,924 | | $12,637,131 | | $13,103,728 | | | | | | |

| | | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | | | | | | |

| | | | | | | | |

| 3Q 2024 | 2Q 2024 | 1Q 2024 | 4Q 2023 | 3Q 2023 | | | | | |

| Liabilities | | | | | | | | | | |

| Notes and bonds payable | $4,957,796 | | $5,148,153 | | $5,108,279 | | $4,994,859 | | $5,227,413 | | | | | | |

| Accounts payable and accrued liabilities | 197,428 | | 195,884 | | 163,172 | | 211,994 | | 204,947 | | | | | | |

| Liabilities of properties held for sale | 7,919 | | 1,805 | | 700 | | 295 | | 3,814 | | | | | | |

| Operating lease liabilities | 229,925 | | 230,601 | | 229,223 | | 229,714 | | 273,319 | | | | | | |

| Financing lease liabilities | 71,887 | | 75,199 | | 74,769 | | 74,503 | | 74,087 | | | | | | |

| Other liabilities | 180,283 | | 177,293 | | 197,763 | | 202,984 | | 211,365 | | | | | | |

| Total liabilities | 5,645,238 | | 5,828,935 | | 5,773,906 | | 5,714,349 | | 5,994,945 | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Redeemable non-controlling interests | 3,875 | | 3,875 | | 3,880 | | 3,868 | | 3,195 | | | | | | |

| | | | | | | | | | |

| Stockholders' equity | | | | | | | | | | |

| Preferred stock, $0.01 par value; 200,000 shares authorized | — | | — | | — | | — | | — | | | | | | |

| Common stock, $0.01 par value; 1,000,000 shares authorized | 3,558 | | 3,643 | | 3,815 | | 3,810 | | 3,809 | | | | | | |

| Additional paid-in capital | 9,198,004 | | 9,340,028 | | 9,609,530 | | 9,602,592 | | 9,597,629 | | | | | | |

| Accumulated other comprehensive (loss) income | (16,963) | | 6,986 | | 4,791 | | (10,741) | | 17,079 | | | | | | |

| Cumulative net income attributable to common stockholders | 481,155 | | 574,178 | | 717,958 | | 1,028,794 | | 1,069,327 | | | | | | |

| Cumulative dividends | (4,150,328) | | (4,037,693) | | (3,920,199) | | (3,801,793) | | (3,684,144) | | | | | | |

| Total stockholders' equity | 5,515,426 | | 5,887,142 | | 6,415,895 | | 6,822,662 | | 7,003,700 | | | | | | |

| Non-controlling interest | 80,046 | | 83,675 | | 87,243 | | 96,252 | | 101,888 | | | | | | |

| Total equity | 5,595,472 | | 5,970,817 | | 6,503,138 | | 6,918,914 | | 7,105,588 | | | | | | |

| Total liabilities and stockholders' equity | $11,244,585 | | $11,803,627 | | $12,280,924 | | $12,637,131 | | $13,103,728 | | | | | | |

12Q 2024 cash and cash equivalents includes $96.0 million of proceeds held in a cash escrow account from a portfolio disposition that closed on June 28, 2024 and was received by the Company on July 1, 2024.

| | | | | |

| |

HEALTHCARE REALTY | 3Q 2024 SUPPLEMENTAL INFORMATION 9 |

| | |

| Statements of Income |

| DOLLARS IN THOUSANDS |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| 3Q 2024 | 2Q 2024 | 1Q 2024 | 4Q 2023 | 3Q 2023 | | | | | | | | | | | | | | |

| Revenues | | | | | | | | | | | | | | | | | | | |

Rental income 1 | $306,499 | $308,135 | $318,076 | $322,076 | $333,335 | | | | | | | | | | | | | | |

| Interest income | 3,904 | 3,865 | 4,538 | 4,422 | 4,264 | | | | | | | | | | | | | | |

| Other operating | 5,020 | 4,322 | 4,191 | 3,943 | 4,661 | | | | | | | | | | | | | | |

| 315,423 | 316,322 | 326,805 | 330,441 | 342,260 | | | | | | | | | | | | | | |

| Expenses | | | | | | | | | | | | | | | | | | | |

| Property operating | 120,232 | 117,719 | 121,078 | 121,362 | 131,639 | | | | | | | | | | | | | | |

| General and administrative | 20,124 | 14,002 | 14,787 | 14,609 | 13,396 | | | | | | | | | | | | | | |

Normalizing items 2 | (6,861) | — | — | (1,445) | — | | | | | | | | | | | | | | |

| Normalized general and administrative | 13,263 | 14,002 | 14,787 | 13,164 | 13,396 | | | | | | | | | | | | | | |

| Transaction costs | 719 | 431 | 395 | 301 | 769 | | | | | | | | | | | | | | |

| Merger-related costs | — | — | — | 1,414 | 7,450 | | | | | | | | | | | | | | |

| Depreciation and amortization | 163,226 | 173,477 | 178,119 | 180,049 | 182,989 | | | | | | | | | | | | | | |

| 304,301 | 305,629 | 314,379 | 317,735 | 336,243 | | | | | | | | | | | | | | |

| Other income (expense) | | | | | | | | | | | | | | | | | | | |

| Interest expense before merger-related fair value | (50,465) | (52,393) | (50,949) | (52,387) | (55,637) | | | | | | | | | | | | | | |

| Merger-related fair value adjustment | (10,184) | (10,064) | (10,105) | (10,800) | (10,667) | | | | | | | | | | | | | | |

| Interest expense | (60,649) | (62,457) | (61,054) | (63,187) | (66,304) | | | | | | | | | | | | | | |

| Gain on sales of real estate properties and other assets | 39,310 | 38,338 | 22 | 20,573 | 48,811 | | | | | | | | | | | | | | |

| Gain on extinguishment of debt | — | — | — | — | 62 | | | | | | | | | | | | | | |

| Impairment of real estate assets and credit loss reserves | (84,394) | (132,118) | (15,937) | (11,403) | (56,873) | | | | | | | | | | | | | | |

| Impairment of goodwill | — | — | (250,530) | — | — | | | | | | | | | | | | | | |

| Equity income (loss) from unconsolidated joint ventures | 208 | (146) | (422) | (430) | (456) | | | | | | | | | | | | | | |

| Interest and other (expense) income, net | (132) | (248) | 275 | 65 | 139 | | | | | | | | | | | | | | |

| (105,657) | (156,631) | (327,646) | (54,382) | (74,621) | | | | | | | | | | | | | | |

| Net (loss) income | $(94,535) | $(145,938) | $(315,220) | $(41,676) | $(68,604) | | | | | | | | | | | | | | |

| Net loss (income) attributable to non-controlling interests | 1,512 | 2,158 | 4,384 | 1,143 | 760 | | | | | | | | | | | | | | |

| Net (loss) income attributable to common stockholders | $(93,023) | $(143,780) | $(310,836) | $(40,533) | $(67,844) | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Basic earnings per common share | $(0.26) | $(0.39) | $(0.82) | $(0.11) | $(0.18) | | | | | | | | | | | | | | |

| Diluted earnings per common share | $(0.26) | $(0.39) | $(0.82) | $(0.11) | $(0.18) | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Weighted average common shares outstanding - basic | 358,960 | 372,477 | 379,455 | 379,044 | 378,925 | | | | | | | | | | | | | | |

Weighted average common shares outstanding - diluted 3 | 358,960 | 372,477 | 379,455 | 379,044 | 378,925 | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| STATEMENTS OF INCOME SUPPLEMENTAL INFORMATION | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| 3Q 2024 | 2Q 2024 | 1Q 2024 | 4Q 2023 | 3Q 2023 | | | | | | | | | | | | | | |

| Interest income | | | | | | | | | | | | | | | | | | | |

| Financing receivables | $2,117 | $2,094 | $2,117 | $2,132 | $2,002 | | | | | | | | | | | | | | |

| Interest on mortgage and mezzanine loans | 1,787 | 1,771 | 2,421 | 2,290 | 2,262 | | | | | | | | | | | | | | |

| Total | $3,904 | $3,865 | $4,538 | $4,422 | $4,264 | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Other operating income | | | | | | | | | | | | | | | | | | | |

| Parking income | $2,363 | $2,463 | $2,545 | $2,392 | $2,751 | | | | | | | | | | | | | | |

| Management fee and miscellaneous income | 2,657 | 1,859 | 1,646 | 1,551 | 1,910 | | | | | | | | | | | | | | |

| Total | $5,020 | $4,322 | $4,191 | $3,943 | $4,661 | | | | | | | | | | | | | | |

1In 2Q 2024, rental income was reduced by $3.0 million for Steward Health revenue reserves. This consisted of $2.2 million for April and prepetition rent for May as well as $0.8 million for March. In addition, the Company reversed $2.2 million of straight-line rent receivable against rental income.

23Q 2024 and 4Q 2023 normalizing items primarily include severance-related costs.

3Potential common shares are not included in the computation of diluted earnings per share when a loss exists, as the effect would be an antidilutive per share amount. As a result, the outstanding limited partnership units in the Company's operating partnership ("OP"), totaling 3,649,637 units were not included.

| | | | | |

| |

HEALTHCARE REALTY | 3Q 2024 SUPPLEMENTAL INFORMATION 10 |

| | |

FFO, Normalized FFO, & FAD 1,2,3 |

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| 3Q 2024 | 2Q 2024 | 1Q 2024 | 4Q 2023 | 3Q 2023 | | | | | | | | | | | | | | | | | | |

| Net loss attributable to common stockholders | $(93,023) | $(143,780) | $(310,836) | $(40,533) | $(67,844) | | | | | | | | | | | | | | | | | | |

Net loss attributable to common stockholders per diluted share 3 | $(0.26) | $(0.39) | $(0.82) | $(0.11) | $(0.18) | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Gain on sales of real estate assets | $(39,148) | $(33,431) | $(22) | $(20,573) | $(48,811) | | | | | | | | | | | | | | | | | | |

| Impairments of real estate assets | 37,632 | | 120,917 | | 15,937 | | 11,403 | | 56,873 | | | | | | | | | | | | | | | | | | | |

| Real estate depreciation and amortization | 167,821 | | 177,350 | | 181,161 | | 182,272 | | 185,143 | | | | | | | | | | | | | | | | | | | |

| Non-controlling loss from operating partnership units | (1,372) | | (2,077) | | (4,278) | | (491) | | (841) | | | | | | | | | | | | | | | | | | | |

| Unconsolidated JV depreciation and amortization | 5,378 | 4,818 | 4,568 | 4,442 | 4,421 | | | | | | | | | | | | | | | | | | |

| FFO adjustments | $170,311 | $267,577 | $197,366 | $177,053 | $196,785 | | | | | | | | | | | | | | | | | | |

| FFO adjustments per common share - diluted | $0.47 | $0.71 | $0.51 | $0.46 | $0.51 | | | | | | | | | | | | | | | | | | |

| FFO | $77,288 | $123,797 | $(113,470) | $136,520 | $128,941 | | | | | | | | | | | | | | | | | | |

FFO per common share - diluted 4 | $0.21 | $0.33 | $(0.30) | $0.36 | $0.34 | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Transaction costs | 719 | 431 | 395 | 301 | 769 | | | | | | | | | | | | | | | | | | |

Merger-related costs | — | — | — | 1,414 | 7,450 | | | | | | | | | | | | | | | | | | |

| Lease intangible amortization | (10) | | 129 | | 175 | | 261 | | 213 | | | | | | | | | | | | | | | | | | | |

| Non-routine legal costs/forfeited earnest money received | 306 | | 465 | | — | | (100) | | — | | | | | | | | | | | | | | | | | | |

| Debt financing costs | — | — | — | — | (62) | | | | | | | | | | | | | | | | | | |

| Restructuring and severance-related charges | 6,861 | — | — | 1,445 | — | | | | | | | | | | | | | | | | | | |

Credit losses and gains on other assets, net 5 | 46,600 | 8,525 | — | — | — | | | | | | | | | | | | | | | | | | |

| Impairment of goodwill | — | — | 250,530 | — | — | | | | | | | | | | | | | | | | | | |

| Merger-related fair value adjustment | 10,184 | 10,064 | 10,105 | 10,800 | 10,667 | | | | | | | | | | | | | | | | | | |

Unconsolidated JV normalizing items 6 | 101 | 89 | 87 | 89 | 90 | | | | | | | | | | | | | | | | | | |

| Normalized FFO adjustments | $64,761 | $19,703 | $261,292 | $14,210 | $19,127 | | | | | | | | | | | | | | | | | | |

| Normalized FFO adjustments per common share - diluted | $0.18 | $0.05 | $0.68 | $0.04 | $0.05 | | | | | | | | | | | | | | | | | | |

Normalized FFO | $142,049 | $143,500 | $147,822 | $150,730 | $148,068 | | | | | | | | | | | | | | | | | | |

| Normalized FFO per common share - diluted | $0.39 | $0.38 | $0.39 | $0.39 | $0.39 | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Non-real estate depreciation and amortization | 276 | 313 | 485 | 685 | 475 | | | | | | | | | | | | | | | | | | |

Non-cash interest amortization, net 7 | 1,319 | 1,267 | 1,277 | 1,265 | 1,402 | | | | | | | | | | | | | | | | | | |

Rent reserves, net 8 | (27) | 1,261 | (151) | 1,404 | 442 | | | | | | | | | | | | | | | | | | |

| Straight-line rent income, net | (5,771) | (6,799) | (7,633) | (7,872) | (8,470) | | | | | | | | | | | | | | | | | | |

| Stock-based compensation | 4,064 | 3,383 | 3,562 | 3,566 | 2,556 | | | | | | | | | | | | | | | | | | |

Unconsolidated JV non-cash items 9 | (376) | (148) | (122) | (206) | (231) | | | | | | | | | | | | | | | | | | |

Normalized FFO adjusted for non-cash items | 141,534 | 142,777 | 145,240 | 149,572 | 144,242 | | | | | | | | | | | | | | | | | | |

| 2nd generation TI | (16,951) | (12,287) | (20,204) | (18,715) | (21,248) | | | | | | | | | | | | | | | | | | |

| Leasing commissions paid | (10,266) | (10,012) | (15,215) | (14,978) | (8,907) | | | | | | | | | | | | | | | | | | |

| Building capital | (7,389) | (12,835) | (5,363) | (17,393) | (14,354) | | | | | | | | | | | | | | | | | | |

| Total maintenance capex | (34,606) | (35,134) | (40,782) | (51,086) | (44,509) | | | | | | | | | | | | | | | | | | |

| FAD | $106,928 | $107,643 | $104,458 | $98,486 | $99,733 | | | | | | | | | | | | | | | | | | |

| Quarterly dividends and OP distributions | $113,770 | $118,627 | $119,541 | $118,897 | $119,456 | | | | | | | | | | | | | | | | | | |

FFO wtd avg common shares outstanding - diluted 10 | 363,370 | 376,556 | 383,413 | 383,326 | 383,428 | | | | | | | | | | | | | | | | | | |

1Funds from operations (“FFO”) and FFO per share are operating performance measures adopted by NAREIT. NAREIT defines FFO as “net income (computed in accordance with GAAP) excluding depreciation and amortization related to real estate, gains and losses from the sale of certain real estate assets, gains and losses from change in control, and impairment write-downs of certain real assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity.”

2FFO, Normalized FFO and Funds Available for Distribution ("FAD") do not represent cash generated from operating activities determined in accordance with GAAP and are not necessarily indicative of cash available to fund cash needs. FFO, Normalized FFO and FAD should not be considered alternatives to net income attributable to common stockholders as indicators of the Company's operating performance or as alternatives to cash flow as measures of liquidity.

3Potential common shares are not included in the computation of diluted earnings per share when a loss exists, as the effect would be an antidilutive per share amount.

4For 1Q 2024, basic weighted average common shares outstanding was the denominator used in the per share calculation.

53Q 2024 includes $46.8 million of credit loss reserves and $0.2 million gain on other assets. 2Q 2024 includes $11.2 million of credit loss reserves and $2.2 million write-off of prior period Steward Health straight-line rent, offset by $4.9 million gain on other assets.

6Includes the Company's proportionate share of normalizing items related to unconsolidated joint ventures such as lease intangibles and acquisition and pursuit costs.

7Includes the amortization of deferred financing costs, discounts and premiums, and non-cash financing receivable amortization.

82Q 2024 includes $0.8 million related to the Steward Health revenue reserve for March.

9Includes the Company's proportionate share of straight-line rent, net and rent reserves, net related to unconsolidated joint ventures.

10The Company utilizes the treasury stock method, which includes the dilutive effect of nonvested share-based awards outstanding of 760,552 for the three months ended September 30, 2024. Also includes the diluted impact of 3,649,637 OP units outstanding.

| | | | | |

| |

HEALTHCARE REALTY | 3Q 2024 SUPPLEMENTAL INFORMATION 11 |

| | |

| Capital Funding & Commitments |

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ACQUISITION AND RE/DEVELOPMENT FUNDING | | | | | | | |

| 3Q 2024 | 2Q 2024 | 1Q 2024 | 4Q 2023 | 3Q 2023 | | | | | | | | | | | | | | |

Acquisitions 1 | $— | $— | $— | $— | $11,450 | | | | | | | | | | | | | | |

Re/development 2 | 44,590 | 44,796 | 21,580 | 32,272 | 30,945 | | | | | | | | | | | | | | |

1st generation TI & acquisition capex 3 | 15,677 | 13,010 | 12,421 | 7,632 | 9,013 | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| MAINTENANCE CAPITAL EXPENDITURES FUNDING | |

| 3Q 2024 | 2Q 2024 | 1Q 2024 | 4Q 2023 | 3Q 2023 | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| 2nd generation TI | $16,951 | $12,287 | $20,204 | $18,715 | $21,248 | | | | | | | | | | | | | | |

| Leasing commissions paid | 10,266 | 10,012 | 15,215 | 14,978 | 8,907 | | | | | | | | | | | | | | |

| Building capital | 7,389 | 12,835 | 5,363 | 17,393 | 14,354 | | | | | | | | | | | | | | |

| $34,606 | $35,134 | $40,782 | $51,086 | $44,509 | | | | | | | | | | | | | | |

| % of Cash NOI | | | | | | | |

| 2nd generation TI | 8.8 | % | 6.2 | % | 10.1 | % | 9.2 | % | 10.4 | % | | | | | | | | | | | | | | |

| Leasing commissions paid | 5.3 | % | 5.0 | % | 7.6 | % | 7.3 | % | 4.4 | % | | | | | | | | | | | | | | |

| Building capital | 3.8 | % | 6.5 | % | 2.7 | % | 8.5 | % | 7.0 | % | | | | | | | | | | | | | | |

| 17.9 | % | 17.7 | % | 20.4 | % | 25.0 | % | 21.8 | % | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

LEASING COMMITMENTS 4 | |

| 3Q 2024 | 2Q 2024 | 1Q 2024 | 4Q 2023 | 3Q 2023 | | | | | | | | | | | | | | |

| Renewals | | | | | | | | | | | | | | | | | | | |

| Square feet | 909,844 | 788,862 | 1,454,998 | 582,239 | 625,762 | | | | | | | | | | | | | | |

| 2nd generation TI/square foot/lease year | $1.91 | $1.81 | $2.39 | $1.89 | $1.76 | | | | | | | | | | | | | | |

| Leasing commissions/square foot/lease year | $1.36 | $1.33 | $0.90 | $1.66 | $1.48 | | | | | | | | | | | | | | |

| Renewal commitments as a % of annual net rent | 12.2 | % | 13.6 | % | 13.8 | % | 12.7 | % | 13.1 | % | | | | | | | | | | | | | | |

WALT (in months) 5 | 50.3 | 52.3 | 60.5 | 43.1 | 42.1 | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| New leases | | | | | | | | | | | | | | | | | | | |

| Square feet | 462,756 | 252,795 | 337,357 | 315,243 | 344,524 | | | | | | | | | | | | | | |

| 2nd generation TI/square foot/lease year | $7.18 | $6.90 | $7.32 | $5.98 | $5.57 | | | | | | | | | | | | | | |

| Leasing commissions/square foot/lease year | $1.91 | $1.98 | $1.68 | $1.72 | $1.81 | | | | | | | | | | | | | | |

| New lease commitments as a % of annual net rent | 39.9 | % | 43.3 | % | 42.8 | % | 33.4 | % | 32.1 | % | | | | | | | | | | | | | | |

WALT (in months) 5 | 94.7 | 82.6 | 92.8 | 90.2 | 85.8 | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| All | | | | | | | | | | | | | | | | | | | |

| Square feet | 1,372,600 | 1,041,657 | 1,792,355 | 897,482 | 970,286 | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Leasing commitments as a % of annual net rent | 24.0 | % | 22.6 | % | 20.5 | % | 21.9 | % | 22.6 | % | | | | | | | | | | | | | | |

WALT (in months) 5 | 65.3 | 59.6 | 66.6 | 59.6 | 57.6 | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

1Acquisitions include properties acquired through joint ventures at the Company's ownership percentage.

2Re/development funding includes capital spend on re/developments, development completions and unstabilized properties.

3Acquisition capex includes near-term fundings underwritten as part of recent acquisitions. 1st generation tenant improvements for re/developments are excluded.

4Reflects leases commencing in the quarter. Excludes recently acquired or disposed properties, development completions, construction in progress, land held for development, corporate property, redevelopment properties, unstabilized properties, planned dispositions and assets classified as held for sale.

5WALT = weighted average lease term.

| | | | | |

| |

HEALTHCARE REALTY | 3Q 2024 SUPPLEMENTAL INFORMATION 12 |

| | |

Debt Metrics1 |

| DOLLARS IN THOUSANDS |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SUMMARY OF INDEBTEDNESS AS OF SEPTEMBER 30, 2024 | |

| PRINCIPAL BALANCE | BALANCE 1 | MATURITY DATE 2 | MONTHS TO MATURITY 2 | INTEREST EXPENSE | CONTRACTUAL INTEREST EXPENSE | CONTRACTUAL RATE | EFFECTIVE RATE | FAIR VALUE MERGER ADJUSTED |

| SENIOR NOTES | $250,000 | $249,771 | 5/1/2025 | 7 | | $2,470 | $2,422 | 3.88 | % | 4.12 | % | |

| 600,000 | 584,836 | 8/1/2026 | 22 | | 7,214 | 5,251 | 3.50 | % | 4.94 | % | Y |

| 500,000 | 486,990 | 7/1/2027 | 33 | | 5,788 | 4,687 | 3.75 | % | 4.76 | % | Y |

| 300,000 | 297,877 | 1/15/2028 | 40 | | 2,785 | 2,719 | 3.63 | % | 3.85 | % | |

| 650,000 | 583,329 | 2/15/2030 | 65 | | 7,701 | 5,037 | 3.10 | % | 5.30 | % | Y |

| 299,500 | 297,086 | 3/15/2030 | 66 | | 1,928 | 1,797 | 2.40 | % | 2.72 | % | |

| 299,785 | 296,214 | 3/15/2031 | 78 | | 1,593 | 1,536 | 2.05 | % | 2.25 | % | |

| 800,000 | 662,721 | 3/15/2031 | 78 | | 8,455 | 4,000 | 2.00 | % | 5.13 | % | Y |

| $3,699,285 | $3,458,824 | | 50 | | $37,934 | $27,449 | 2.97 | % | 4.44 | % | |

| TERM LOANS | $100,000 | $99,740 | 7/20/2025 | 10 | | $3,593 | $3,593 | SOFR + 1.04% | 6.24 | % | |

| 200,000 | 199,833 | 5/31/2026 | 20 | | 3,240 | 3,240 | SOFR + 1.04% | 6.24 | % | |

| 150,000 | 149,753 | 6/1/2026 | 20 | | 2,430 | 2,430 | SOFR + 1.04% | 6.24 | % | |

| 300,000 | 299,975 | 10/31/2026 | 25 | | 4,860 | 4,860 | SOFR + 1.04% | 6.24 | % | |

| 200,000 | 199,605 | 7/20/2027 | 33 | | 3,240 | 3,240 | SOFR + 1.04% | 6.24 | % | |

| 300,000 | 298,603 | 1/20/2028 | 39 | | 4,860 | 4,860 | SOFR + 1.04% | 6.24 | % | |

| $1,250,000 | $1,247,509 | | 27 | | $22,223 | $22,223 | | 6.24 | % | |

| $1.5B CREDIT FACILITY | $206,000 | $206,000 | 10/31/2027 | 37 | | $2,147 | $2,147 | SOFR + 0.94% | 5.79 | % | |

| | | | | | | | | |

| MORTGAGES | $45,622 | $45,463 | various | 19 | | $501 | $511 | 4.04 | % | 4.17 | % | |

| $5,200,907 | $4,957,796 | | 44 | $62,805 | $52,330 | 3.88 | % | 4.94 | % | $2,550,000 |

| Less cash | (22,801) | | | | | | | | | |

| Net debt | $5,178,106 | | | | | | | | |

| Interest rate swaps | (3,789) | (3,789) | | | |

| Interest cost capitalization | (1,295) | — | | | |

| Unsecured credit facility fee & deferred financing costs | 1,994 | 767 | | | |

| | | | | |

| Financing right-of-use asset amortization | 934 | — | | | |

| | | | | $60,649 | $49,308 | | | |

| | | | | | | | | | | | | | | | | | | | | |

DEBT MATURITIES SCHEDULE AS OF SEPTEMBER 30, 2024 |

| | PRINCIPAL PAYMENTS | | |

| | BANK

LOANS | SENIOR NOTES | MORTGAGE NOTES | TOTAL | | WA RATE |

| 2024 | | | | $343 | $343 | | 3.94 | % |

| 2025 | | $100,000 | $250,000 | 16,375 | 366,375 | | 4.54 | % |

| 2026 | | 650,000 | 600,000 | 28,904 | 1,278,904 | | 4.90 | % |

| 2027 | | 406,000 | 500,000 | | 906,000 | | 4.76 | % |

| 2028 | | 300,000 | 300,000 | | 600,000 | | 4.93 | % |

| | | | | | | |

| Thereafter | | | 2,049,285 | | 2,049,285 | | 2.41 | % |

| Total | | $1,456,000 | $3,699,285 | $45,622 | $5,200,907 | | 3.88 | % |

Net debt | | | | | $5,178,106 | | |

Fixed rate debt balance | | $1,075,000 | $3,699,285 | $45,622 | $4,819,907 | | |

% fixed rate debt, net of cash | | 93 | % | | |

Company share of JV net debt | | $30,054 | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | |

| INTEREST RATE SWAPS |