Invitation Homes Inc. (NYSE: INVH) (“Invitation Homes” or the

“Company”), the nation’s premier single-family home leasing and

management company, today announced its First Quarter 2024

financial and operating results.

First Quarter 2024 Highlights

- Year over year, total revenues increased 9.5% to $646 million,

property operating and maintenance costs increased 10.5% to $230

million, net income available to common stockholders increased

18.4% to $142 million, and net income per diluted common share

increased 18.2% to $0.23.

- Year over year, Core FFO per share increased 5.7% to $0.47 and

AFFO per share increased 6.8% to $0.41.

- Same Store NOI increased 4.7% year over year on 5.6% Same Store

Core Revenues growth and 7.4% Same Store Core Operating Expenses

growth.

- Same Store Bad Debt was 1.0% of gross rental revenue,

representing four consecutive quarters of improvement and a year

over year improvement of approximately 80 basis points.

- Same Store Average Occupancy was 97.6%, down 20 basis points

year over year and up 50 basis points from the prior quarter.

- Same Store renewal rent growth of 5.8% and Same Store new lease

rent growth of 0.8% drove Same Store blended rent growth of

4.4%.

- Acquisitions by the Company and the Company's joint ventures

totaled 273 homes for approximately $96 million while dispositions

totaled 399 homes for approximately $157 million.

- As previously announced in January 2024, the Company began

providing professional property and asset management services to

portfolio owners of single-family homes for lease. This was

launched through an inaugural agreement with a third-party

portfolio owner that brought over 14,000 single-family homes onto

the Company’s industry-leading management platform.

- In March 2024, the Company entered into a third-party agreement

to provide property and asset management services for a portfolio

of approximately 3,000 single-family homes for lease, which is

expected to commence May 15, 2024.

Subsequent to quarter end and concurrent with this earnings

release, the Company announced it has entered into a new joint

venture agreement whereby Invitation Homes has made a $37.5 million

investment, representing a 7.2% ownership interest, in a portfolio

of approximately 3,700 single-family homes for lease. The Company

also expects to provide property and asset management services to

those homes and an additional 700 homes beginning in the third

quarter of 2024.

Comments from Chief Executive Officer Dallas Tanner

“We’re pleased to start 2024 with strong operating results and

execution on our growth strategy. This includes first quarter Same

Store average occupancy of 97.6%, net operating income growth of

4.7%, blended lease rate growth of 4.4%, and a substantial

improvement in bad debt year over year. As the nation’s premier

single-family home leasing and management company, the rapid growth

of our third-party management business is attributable to the high

value of our platform, scale, and people. I’d like to thank our

associates for their hard work in making this a seamless transition

to date, as well as extend my appreciation to all of our esteemed

partners for putting their trust in us. We look forward to working

with them and continuing to forge new relationships with those who

desire our industry-leading management experience.”

Glossary & Reconciliations of Non-GAAP Financial and

Other Operating Measures

Financial and operating measures found in the Earnings Release

and Supplemental Information include certain measures used by

Invitation Homes management that are measures not defined under

accounting principles generally accepted in the United States

(“GAAP”). These measures are defined herein and, as applicable,

reconciled to the most comparable GAAP measures.

Financial Results

Net Income, FFO, Core FFO, and AFFO Per

Share — Diluted

Q1 2024

Q1 2023

Net income

$ 0.23

$ 0.20

FFO

0.43

0.42

Core FFO

0.47

0.44

AFFO

0.41

0.38

Net Income

Year over year, net income per common share — diluted for Q1

2024 increased 18.2% to $0.23, primarily due to an increase in gain

on sale of property, net of tax.

Core FFO

Year over year, Core FFO per share for Q1 2024 increased 5.7% to

$0.47, primarily due to NOI growth.

AFFO

Year over year, AFFO per share for Q1 2024 increased 6.8% to

$0.41, primarily due to the increase in Core FFO per share

described above.

Operating Results

Same Store Operating Results

Snapshot

Number of homes in Same Store

Portfolio:

78,487

Q1 2024

Q1 2023

Core Revenues growth (year over year)

5.6

%

Core Operating Expenses growth (year over

year)

7.4

%

NOI growth (year over year)

4.7

%

Average Occupancy

97.6

%

97.8

%

Bad Debt % of gross rental revenue

1.0

%

1.8

%

Turnover Rate

5.2

%

5.2

%

Rental Rate Growth (lease-over-lease):

Renewals

5.8

%

7.8

%

New Leases

0.8

%

5.3

%

Blended

4.4

%

7.1

%

Same Store NOI

For the Same Store Portfolio of 78,487 homes, Same Store NOI for

Q1 2024 increased 4.7% year over year on Same Store Core Revenues

growth of 5.6% and Same Store Core Operating Expenses growth of

7.4%.

Same Store Core Revenues

Same Store Core Revenues growth for Q1 2024 of 5.6% year over

year was primarily driven by a 4.6% increase in Average Monthly

Rent, an 80 basis point year over year improvement in Bad Debt as a

percentage of gross rental revenue, and a 15.9% increase in other

income, net of resident recoveries, partially offset by a 20 basis

point year over year decline in Average Occupancy.

Same Store Core Operating Expenses

Same Store Core Operating Expenses for Q1 2024 increased 7.4%

year over year, primarily attributable to an 11.8% increase in

fixed expenses that was partially offset by a 0.5% decrease in

controllable expenses. The 11.8% increase in fixed expenses was

primarily attributable to property taxes expense, which for Q1 2024

increased 11.6% year over year. As previously disclosed, due to the

underaccrual of property taxes expense in the first three quarters

of 2023, and the associated catch up in Q4 2023, the Company

expects property taxes expense growth for the first three quarters

of 2024 to be elevated, prior to normalizing in Q4 2024 to result

in the Company’s expected guidance range for FY 2024 property taxes

expense growth of 8% to 10%.

Investment and Property Management Activity

Acquisitions for Q1 2024 totaled 273 homes for approximately $96

million through the Company's various acquisition channels. This

included 257 wholly owned homes for approximately $91 million in

addition to 16 homes for approximately $5 million in the Company's

joint ventures. Dispositions for Q1 2024 included 379 wholly owned

homes for gross proceeds of approximately $148 million and 20 homes

for gross proceeds of approximately $9 million in the Company's

joint ventures.

As previously announced in January 2024, the Company began

providing professional property and asset management services to

portfolio owners of single-family homes for lease. This was

launched through an inaugural agreement with a third-party

portfolio owner that brought over 14,000 single-family homes onto

the Company’s industry-leading management platform.

In March 2024, the Company entered into a third-party agreement

to provide property and asset management services for a portfolio

of approximately 3,000 single-family homes for lease, which is

expected to commence May 15, 2024.

Subsequent to quarter end and concurrent with this earnings

release, the Company announced it has entered into a new joint

venture agreement whereby Invitation Homes has made a $37.5 million

investment, representing a 7.2% ownership interest, in a portfolio

of approximately 3,700 single-family homes for lease. The Company

also expects to provide property and asset management services to

those homes and an additional 700 homes beginning in the third

quarter of 2024.

A summary of the Company’s owned and/or managed homes is

included in the following table:

Summary of Homes Owned and/or Managed

As Of 3/31/2024

Number of Homes Owned and/or

Managed as of 12/31/2023

Acquired or Added In Q1

2024

Disposed or Subtracted In Q1

2024

Number of Homes Owned and/or

Managed as of 3/31/2024

Wholly owned homes

84,567

257

(379)

84,445

Joint venture owned homes

3,848

16

(20)

3,844

Managed-only homes

—

14,278

—

14,278

Total homes owned and/or managed

(1)

88,415

14,551

(399)

102,567

(1)

These figures exclude the additional 7,400

homes described in more detail in the narrative above, as the

management contracts for these homes had not yet commenced as of

March 31, 2024.

Balance Sheet and Capital Markets Activity

As of March 31, 2024, the Company had $1,738 million in

available liquidity through a combination of unrestricted cash and

undrawn capacity on its revolving credit facility. The Company's

total indebtedness as of March 31, 2024 was $8,607 million,

consisting of $6,575 million of unsecured debt and $2,032 million

of secured debt. Net debt / TTM adjusted EBITDAre was 5.4x at March

31, 2024, down from 5.5x as of December 31, 2023. The Company has

no debt reaching final maturity until 2026, and in addition, 99.5%

of its total debt was fixed rate or swapped to fixed rate and 83.6%

of its wholly owned homes were unencumbered as of March 31,

2024.

Subsequent to quarter end and as previously announced on April

29, 2024, the Company’s issuer and issue-level credit ratings were

upgraded by Moody’s Investors Service to ‘Baa2’ from ‘Baa3’ with a

Stable outlook.

FY 2024 Guidance Details

The Company does not provide guidance for the most comparable

GAAP financial measures of net income (loss), total revenues, and

property operating and maintenance expense. Additionally, a

reconciliation of the forward-looking non-GAAP financial measures

of Core FFO per share, AFFO per share, Same Store Core Revenues

growth, Same Store Core Operating Expenses growth, and Same Store

NOI growth to the comparable GAAP financial measures cannot be

provided without unreasonable effort because the Company is unable

to reasonably predict certain items contained in the GAAP measures,

including non-recurring and infrequent items that are not

indicative of the Company's ongoing operations. Such items include,

but are not limited to, impairment on depreciated real estate

assets, net (gain)/loss on sale of previously depreciated real

estate assets, share-based compensation, casualty loss, non-Same

Store revenues, and non-Same Store operating expenses. These items

are uncertain, depend on various factors, and could have a material

impact on the Company's GAAP results for the guidance period.

Full year 2024 guidance remains unchanged from initial guidance

provided in February 2024, as outlined in the table below.

FY 2024 Guidance

FY 2024 Guidance

Ranges

Core FFO per share — diluted

$1.82 to $1.90

AFFO per share — diluted

$1.54 to $1.62

Same Store Core Revenues growth (1)

4.5% to 5.5%

Same Store Core Operating Expenses growth

(2)

5.5% to 7.0%

Same Store NOI growth

3.5% to 5.5%

Wholly owned acquisitions

$600 million to $1,000

million

JV acquisitions

$100 million to $300 million

Wholly owned dispositions

$400 million to $600 million

(1)

Guidance assumes FY 2024 Average Occupancy

is a similar result to FY 2023. Guidance assumes average Bad Debt

for FY 2024 in a range of 65 to 95 basis points.

(2)

Guidance assumes FY 2024 property tax

expense growth in a range of 8% to 10% year over year and FY 2024

insurance expense growth in the mid- to high teens, which has not

been updated at this time to reflect the benefit of the Company’s

recently completed annual insurance policy renewal that implies FY

2024 insurance expense growth of approximately 7.5% year over

year.

Earnings Conference Call Information

Invitation Homes has scheduled a conference call at 11:00 a.m.

Eastern Time on May 1, 2024, to discuss results for the first

quarter of 2024. The domestic dial-in number is 1-888-330-2384, and

the international dial-in number is 1-240-789-2701. The conference

ID is 7714113. A live audio webcast may be accessed at

www.invh.com. A replay of the call will be available through May

31, 2024, and can be accessed by calling 1-800-770-2030 (domestic)

or 1-609-800-9909 (international) and using the playback ID

7714113, or by using the link at www.invh.com.

Supplemental Information

The full text of the Earnings Release and Supplemental

Information referenced in this release are available on Invitation

Homes' Investor Relations website at www.invh.com.

About Invitation Homes

Invitation Homes, an S&P 500 company, is the nation's

premier single-family home leasing and management company, meeting

changing lifestyle demands by providing access to high-quality,

updated homes with valued features such as close proximity to jobs

and access to good schools. The company's mission, “Together with

you, we make a house a home,” reflects its commitment to providing

homes where individuals and families can thrive and high-touch

service that continuously enhances residents' living

experiences.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended (the “Exchange Act”), which include, but are not limited

to, statements related to the Company's expectations regarding the

performance of the Company's business, its financial results, its

liquidity and capital resources, and other non-historical

statements. In some cases, you can identify these forward-looking

statements by the use of words such as “outlook,” “guidance,”

“believes,” “expects,” “potential,” “continues,” “may,” “will,”

“should,” “could,” “seeks,” “projects,” “predicts,” “intends,”

“plans,” “estimates,” “anticipates,” or the negative version of

these words or other comparable words. Such forward-looking

statements are subject to various risks and uncertainties,

including, among others, risks inherent to the single-family rental

industry and the Company's business model, macroeconomic factors

beyond the Company's control, competition in identifying and

acquiring properties, competition in the leasing market for quality

residents, increasing property taxes, homeowners’ association and

insurance costs, poor resident selection and defaults and

non-renewals by the Company's residents, the Company's dependence

on third parties for key services, risks related to the evaluation

of properties, performance of the Company's information technology

systems, risks related to the Company's indebtedness, and risks

related to the potential negative impact of unfavorable global and

United States economic conditions (including inflation and rising

interest rates), uncertainty in financial markets (including as a

result of events affecting financial institutions), geopolitical

tensions, natural disasters, climate change, and public health

crises, on the Company’s financial condition, results of

operations, cash flows, business, associates, and residents.

Accordingly, there are or will be important factors that could

cause actual outcomes or results to differ materially from those

indicated in these statements. The Company believes these factors

include, but are not limited to, those described under Part I. Item

1A. “Risk Factors” of its Annual Report on Form 10-K for the year

ended December 31, 2023 (the “Annual Report”), as such factors may

be updated from time to time in the Company's periodic filings with

the Securities and Exchange Commission (the “SEC”), which are

accessible on the SEC’s website at www.sec.gov. These factors

should not be construed as exhaustive and should be read in

conjunction with the other cautionary statements that are included

in this release, in the Annual Report, and in the Company's other

periodic filings. The forward-looking statements speak only as of

the date of this press release, and the Company expressly disclaims

any obligation or undertaking to publicly update or review any

forward-looking statement, whether as a result of new information,

future developments or otherwise, except to the extent otherwise

required by law.

Consolidated Balance Sheets

($ in thousands, except shares and per

share data)

March 31, 2024

December 31, 2023

(unaudited)

Assets:

Investments in single-family residential

properties, net

$

17,186,871

$

17,289,214

Cash and cash equivalents

738,125

700,618

Restricted cash

209,281

196,866

Goodwill

258,207

258,207

Investments in unconsolidated joint

ventures

238,330

247,166

Other assets, net

579,124

528,896

Total assets

$

19,209,938

$

19,220,967

Liabilities:

Mortgage loans, net

$

1,622,036

$

1,627,256

Secured term loan, net

401,569

401,515

Unsecured notes, net

3,306,873

3,305,467

Term loan facilities, net

3,213,904

3,211,814

Revolving facility

—

—

Accounts payable and accrued expenses

240,538

200,590

Resident security deposits

180,197

180,455

Other liabilities

74,732

103,435

Total liabilities

9,039,849

9,030,532

Equity:

Stockholders’ equity

Preferred stock, $0.01 par value per

share, 900,000,000 shares authorized, none outstanding as of March

31, 2024 and December 31, 2023

—

—

Common stock, $0.01 par value per share,

9,000,000,000 shares authorized, 612,485,098 and 611,958,239

outstanding as of March 31, 2024 and December 31, 2023,

respectively

6,125

6,120

Additional paid-in capital

11,153,703

11,156,736

Accumulated deficit

(1,099,957

)

(1,070,586

)

Accumulated other comprehensive income

74,826

63,701

Total stockholders’ equity

10,134,697

10,155,971

Non-controlling interests

35,392

34,464

Total equity

10,170,089

10,190,435

Total liabilities and equity

$

19,209,938

$

19,220,967

Consolidated Statements of

Operations

($ in thousands, except shares and per

share amounts)

Q1 2024

Q1 2023

(unaudited)

(unaudited)

Revenues:

Rental revenues

$

571,430

$

535,217

Other property income

60,667

51,298

Management fee revenues

13,942

3,375

Total revenues

646,039

589,890

Expenses:

Property operating and maintenance

230,397

208,497

Property management expense

31,237

23,584

General and administrative

23,448

17,452

Interest expense

89,845

78,047

Depreciation and amortization

175,313

164,673

Impairment and other

4,137

1,163

Total expenses

554,377

493,416

Gains (losses) on investments in equity

securities, net

(209

)

88

Other, net

5,973

(1,494

)

Gain on sale of property, net of tax

50,498

29,671

Losses from investments in unconsolidated

joint ventures

(5,138

)

(4,155

)

Net income

142,786

120,584

Net income attributable to non-controlling

interests

(436

)

(342

)

Net income attributable to common

stockholders

142,350

120,242

Net income available to participating

securities

(192

)

(171

)

Net income available to common

stockholders — basic and diluted

$

142,158

$

120,071

Weighted average common shares

outstanding — basic

612,219,520

611,588,465

Weighted average common shares

outstanding — diluted

613,807,166

612,564,298

Net income per common share —

basic

$

0.23

$

0.20

Net income per common share —

diluted

$

0.23

$

0.20

Dividends declared per common

share

$

0.28

$

0.26

Glossary and

Reconciliations

Average Monthly Rent

Average monthly rent represents average monthly rental income

per home for occupied properties in an identified population of

homes over the measurement period, and reflects the impact of

non-service rental concessions and contractual rent increases

amortized over the life of the lease.

Average Occupancy

Average occupancy for an identified population of homes

represents (i) the total number of days that the homes in such

population were occupied during the measurement period, divided by

(ii) the total number of days that the homes in such population

were owned during the measurement period.

Bad Debt

Bad debt represents the Company's reserves for residents'

accounts receivables balances that are aged greater than 30 days,

under the rationale that a resident's security deposit should cover

approximately the first 30 days of receivables. For all resident

receivables balances aged greater than 30 days, the amount reserved

as bad debt is 100% of outstanding receivables from the resident,

less the amount of the resident's security deposit on hand. For the

purpose of determining age of receivables, charges are considered

to be due based on the terms of the original lease, not based on a

payment plan if one is in place. All rental revenues and other

property income, in both Total Portfolio and Same Store Portfolio

presentations, are reflected net of bad debt.

Core Operating Expenses

Core operating expenses for an identified population of homes

reflect property operating and maintenance expenses, excluding any

expenses recovered from residents.

Core Revenues

Core revenues for an identified population of homes reflects

total revenues, net of any resident recoveries.

EBITDA, EBITDAre, and Adjusted EBITDAre

EBITDA, EBITDAre, and Adjusted EBITDAre are supplemental,

non-GAAP measures often utilized to evaluate the performance of

real estate companies. The Company defines EBITDA as net income or

loss computed in accordance with accounting principles generally

accepted in the United States (“GAAP”) before the following items:

interest expense; income tax expense; depreciation and

amortization; and adjustments for unconsolidated joint ventures.

National Association of Real Estate Investment Trusts (“Nareit”)

recommends as a best practice that REITs that report an EBITDA

performance measure also report EBITDAre. The Company defines

EBITDAre, consistent with the Nareit definition, as EBITDA, further

adjusted for gain on sale of property, net of tax, impairment on

depreciated real estate investments, and adjustments for

unconsolidated joint ventures. Adjusted EBITDAre is defined as

EBITDAre before the following items: share-based compensation

expense; severance; casualty losses, net; (gains) losses on

investments in equity securities, net; and other income and

expenses. EBITDA, EBITDAre, and Adjusted EBITDAre are used as

supplemental financial performance measures by management and by

external users of the Company's financial statements, such as

investors and commercial banks. Set forth below is additional

detail on how management uses EBITDA, EBITDAre, and Adjusted

EBITDAre as measures of performance.

The GAAP measure most directly comparable to EBITDA, EBITDAre,

and Adjusted EBITDAre is net income or loss. EBITDA, EBITDAre, and

Adjusted EBITDAre are not used as measures of the Company's

liquidity and should not be considered alternatives to net income

or loss or any other measure of financial performance presented in

accordance with GAAP. The Company's EBITDA, EBITDAre, and Adjusted

EBITDAre may not be comparable to the EBITDA, EBITDAre, and

Adjusted EBITDAre of other companies due to the fact that not all

companies use the same definitions of EBITDA, EBITDAre, and

Adjusted EBITDAre. Accordingly, there can be no assurance that the

Company's basis for computing these non-GAAP measures is comparable

with that of other companies. See below for a reconciliation of

GAAP net income to EBITDA, EBITDAre, and Adjusted EBITDAre.

Funds from Operations (FFO), Core Funds from Operations (Core

FFO), and Adjusted Funds from Operations (AFFO)

FFO, Core FFO, and Adjusted FFO are supplemental, non-GAAP

measures often utilized to evaluate the performance of real estate

companies. FFO is defined by Nareit as net income or loss (computed

in accordance with GAAP) excluding gains or losses from sales of

previously depreciated real estate assets, plus depreciation,

amortization and impairment of real estate assets, and adjustments

for unconsolidated joint ventures.

The Company believes that FFO is a meaningful supplemental

measure of the operating performance of its business because

historical cost accounting for real estate assets in accordance

with GAAP assumes that the value of real estate assets diminishes

predictably over time, as reflected through depreciation and

amortization. Because real estate values have historically risen or

fallen with market conditions, management considers FFO an

appropriate supplemental performance measure as it excludes

historical cost depreciation and amortization, impairment on

depreciated real estate investments, gains or losses related to

sales of previously depreciated homes, as well non-controlling

interests, from GAAP net income or loss.

The GAAP measure most directly comparable to Core FFO and

Adjusted FFO is net income or loss. Core FFO and Adjusted FFO are

not used as measures of the Company's liquidity and should not be

considered alternatives to net income or loss or any other measure

of financial performance presented in accordance with GAAP. The

Company's Core FFO and Adjusted FFO may not be comparable to the

Core FFO and Adjusted FFO of other companies due to the fact that

not all companies use the same definition of Core FFO and Adjusted

FFO. Accordingly, there can be no assurance that the Company's

basis for computing these non-GAAP measures is comparable with that

of other companies. See “Reconciliation of FFO, Core FFO, and

Adjusted FFO” for a reconciliation of GAAP net income to FFO, Core

FFO, and Adjusted FFO.

Net Operating Income (NOI)

NOI is a non-GAAP measure often used to evaluate the performance

of real estate companies. The Company defines NOI for an identified

population of homes as rental revenues and other property income

less property operating and maintenance expense (which consists

primarily of property taxes, insurance, HOA fees (when applicable),

market-level personnel expenses, repairs and maintenance, leasing

costs, and marketing expense). NOI excludes: interest expense;

depreciation and amortization; property management expense; general

and administrative expense; impairment and other; gain on sale of

property, net of tax; (gains) losses on investments in equity

securities, net; other income and expenses; management fee

revenues; and income from investments in unconsolidated joint

ventures.

The GAAP measure most directly comparable to NOI is net income

or loss. NOI is not used as a measure of liquidity and should not

be considered as an alternative to net income or loss or any other

measure of financial performance presented in accordance with GAAP.

The Company's NOI may not be comparable to the NOI of other

companies due to the fact that not all companies use the same

definition of NOI. Accordingly, there can be no assurance that the

Company's basis for computing this non-GAAP measure is comparable

with that of other companies.

The Company believes that Same Store NOI is also a meaningful

supplemental measure of the Company's operating performance for the

same reasons as NOI and is further helpful to investors as it

provides a more consistent measurement of the Company's performance

across reporting periods by reflecting NOI for homes in its Same

Store Portfolio.

See below for a reconciliation of GAAP net income to NOI for the

Company's total portfolio and NOI for its Same Store Portfolio.

Recurring Capital Expenditures or Recurring CapEx

Recurring Capital Expenditures or Recurring CapEx represents

general replacements and expenditures required to preserve and

maintain the value and functionality of a home and its systems as a

single-family rental.

Rental Rate Growth

Rental rate growth for any home represents the percentage

difference between the monthly rent from an expiring lease and the

monthly rent from the next lease, and, in each case, reflects the

impact of any amortized non-service rent concessions and amortized

contractual rent increases. Leases are either renewal leases, where

the Company's current resident chooses to stay for a subsequent

lease term, or a new lease, where the Company's previous resident

moves out and a new resident signs a lease to occupy the same

home.

Same Store / Same Store Portfolio

Same Store or Same Store portfolio includes, for a given

reporting period, wholly owned homes that have been stabilized and

seasoned, excluding homes that have been sold, homes that have been

identified for sale to an owner occupant and have become vacant,

homes that have been deemed inoperable or significantly impaired by

casualty loss events or force majeure, homes acquired in portfolio

transactions that are deemed not to have undergone renovations of

sufficiently similar quality and characteristics as the existing

Invitation Homes Same Store portfolio, and homes in markets that

the Company has announced an intent to exit where the Company no

longer operates a significant number of homes.

Homes are considered stabilized if they have (i) completed an

initial renovation and (ii) entered into at least one post-initial

renovation lease. An acquired portfolio that is both leased and

deemed to be of sufficiently similar quality and characteristics as

the existing Invitation Homes Same Store portfolio may be

considered stabilized at the time of acquisition.

Homes are considered to be seasoned once they have been

stabilized for at least 15 months prior to January 1st of the year

in which the Same Store portfolio was established.

The Company believes presenting information about the portion of

its portfolio that has been fully operational for the entirety of a

given reporting period and its prior year comparison period

provides investors with meaningful information about the

performance of the Company's comparable homes across periods and

about trends in its organic business.

Total Homes / Total Portfolio

Total homes or total portfolio refers to the total number of

homes owned, whether or not stabilized, and excludes any properties

previously acquired in purchases that have been subsequently

rescinded or vacated. Unless otherwise indicated, total homes or

total portfolio refers to the wholly owned homes and excludes homes

owned in joint ventures.

Turnover Rate

Turnover rate represents the number of instances that homes in

an identified population become unoccupied in a given period,

divided by the number of homes in such population.

Reconciliation of FFO, Core FFO, and

AFFO

($ in thousands, except shares and per

share amounts) (unaudited)

FFO Reconciliation

Q1 2024

Q1 2023

Net income available to common

stockholders

$

142,158

$

120,071

Net income available to participating

securities

192

171

Non-controlling interests

436

342

Depreciation and amortization on real

estate assets

171,918

162,084

Impairment on depreciated real estate

investments

60

178

Net gain on sale of previously depreciated

investments in real estate

(50,498

)

(29,671

)

Depreciation and net gain on sale of

investments in unconsolidated joint ventures

2,519

2,121

FFO

$

266,785

$

255,296

Core FFO Reconciliation

Q1 2024

Q1 2023

FFO

$

266,785

$

255,296

Non-cash interest expense related to

amortization of deferred financing costs, loan discounts, and

non-cash interest expense from derivatives (1)

9,217

9,132

Share-based compensation expense

7,900

6,498

Severance expense

90

153

Casualty losses, net (1)

4,082

988

(Gains) losses on investments in equity

securities, net

209

(88

)

Core FFO

$

288,283

$

271,979

AFFO Reconciliation

Q1 2024

Q1 2023

Core FFO

$

288,283

$

271,979

Recurring capital expenditures (1)

(37,122

)

(37,293

)

AFFO

$

251,161

$

234,686

Net income available to common

stockholders

Weighted average common shares outstanding

— diluted

613,807,166

612,564,298

Net income per common share — diluted

$

0.23

$

0.20

FFO, Core FFO, and AFFO

Weighted average common shares and OP

Units outstanding — diluted

615,987,206

614,536,039

FFO per share — diluted

$

0.43

$

0.42

Core FFO per share — diluted

$

0.47

$

0.44

AFFO per share — diluted

$

0.41

$

0.38

(1)

Includes the Company's share from

unconsolidated joint ventures.

Reconciliation of Total Revenues to

Same Store Core Revenues, Quarterly

(in thousands) (unaudited)

Q1 2024

Q4 2023

Q3 2023

Q2 2023

Q1 2023

Total revenues (Total

Portfolio)

$

646,039

$

624,321

$

617,695

$

600,372

$

589,890

Management fee revenues

(13,942

)

(3,420

)

(3,404

)

(3,448

)

(3,375

)

Total portfolio resident recoveries

(37,795

)

(35,050

)

(36,641

)

(32,776

)

(31,966

)

Total Core Revenues (Total

Portfolio)

594,302

585,851

577,650

564,148

554,549

Non-Same Store Core Revenues

(35,863

)

(34,767

)

(33,416

)

(25,689

)

(25,568

)

Same Store Core Revenues

$

558,439

$

551,084

$

544,234

$

538,459

$

528,981

Reconciliation of Property Operating

and Maintenance Expenses to Same Store Core Operating Expenses,

Quarterly

(in thousands) (unaudited)

Q1 2024

Q4 2023

Q3 2023

Q2 2023

Q1 2023

Property operating and maintenance

expenses (Total Portfolio)

$

230,397

$

228,542

$

229,488

$

213,808

$

208,497

Total Portfolio resident recoveries

(37,795

)

(35,050

)

(36,641

)

(32,776

)

(31,966

)

Core Operating Expenses (Total

Portfolio)

192,602

193,492

192,847

181,032

176,531

Non-Same Store Core Operating Expenses

(13,781

)

(13,439

)

(13,071

)

(9,985

)

(10,053

)

Same Store Core Operating

Expenses

$

178,821

$

180,053

$

179,776

$

171,047

$

166,478

Reconciliation of Net Income to Same

Store NOI, Quarterly

(in thousands) (unaudited)

Q1 2024

Q4 2023

Q3 2023

Q2 2023

Q1 2023

Net income available to common

stockholders

$

142,158

$

129,368

$

131,637

$

137,698

$

120,071

Net income available to participating

securities

192

178

181

166

171

Non-controlling interests

436

395

403

418

342

Interest expense

89,845

90,049

86,736

78,625

78,047

Depreciation and amortization

175,313

173,159

170,696

165,759

164,673

Property management expense

31,237

25,246

23,399

23,580

23,584

General and administrative

23,448

22,387

22,714

19,791

17,452

Impairment and other

4,137

3,069

2,496

1,868

1,163

Gain on sale of property, net of tax

(50,498

)

(49,092

)

(57,989

)

(46,788

)

(29,671

)

(Gains) losses on investments in equity

securities, net

209

(237

)

499

(524

)

(88

)

Other, net (1)

(5,973

)

(5,533

)

2,533

3,941

1,494

Management fee revenues

(13,942

)

(3,420

)

(3,404

)

(3,448

)

(3,375

)

Losses from investments in unconsolidated

joint ventures

5,138

6,790

4,902

2,030

4,155

NOI (Total Portfolio)

401,700

392,359

384,803

383,116

378,018

Non-Same Store NOI

(22,082

)

(21,328

)

(20,345

)

(15,704

)

(15,515

)

Same Store NOI

$

379,618

$

371,031

$

364,458

$

367,412

$

362,503

(1)

Includes interest income and other

miscellaneous income and expenses.

Reconciliation of Net Income to

Adjusted EBITDAre

(in thousands, unaudited)

Trailing Twelve Months (TTM)

Ended

Q1 2024

Q1 2023

March 31, 2024

December 31, 2023

Net income available to common

stockholders

$

142,158

$

120,071

$

540,861

$

518,774

Net income available to participating

securities

192

171

717

696

Non-controlling interests

436

342

1,652

1,558

Interest expense

89,845

78,047

345,255

333,457

Interest expense in unconsolidated joint

ventures

5,235

4,578

18,912

18,255

Depreciation and amortization

175,313

164,673

684,927

674,287

Depreciation and amortization of

investments in unconsolidated joint ventures

2,927

2,475

10,921

10,469

EBITDA

416,106

370,357

1,603,245

1,557,496

Gain on sale of property, net of tax

(50,498

)

(29,671

)

(204,367

)

(183,540

)

Impairment on depreciated real estate

investments

60

178

309

427

Net gain on sale of investments in

unconsolidated joint ventures

(381

)

(330

)

(1,719

)

(1,668

)

EBITDAre

365,287

340,534

1,397,468

1,372,715

Share-based compensation expense

7,900

6,498

30,905

29,503

Severance

90

153

914

977

Casualty losses, net (1)

4,082

988

11,294

8,200

(Gains) losses on investments in equity

securities, net

209

(88

)

(53

)

(350

)

Other, net (2)

(5,973

)

1,494

(5,032

)

2,435

Adjusted EBITDAre

$

371,595

$

349,579

$

1,435,496

$

1,413,480

(1)

Includes the Company's share from

unconsolidated joint ventures.

(2)

Includes interest income and other

miscellaneous income and expenses.

Reconciliation of Net Debt / Trailing Twelve Months (TTM)

Adjusted EBITDAre

(in thousands, except for ratio)

(unaudited)

As of

As of

March 31, 2024

December 31, 2023

Mortgage loans, net

$

1,622,036

$

1,627,256

Secured term loan, net

401,569

401,515

Unsecured notes, net

3,306,873

3,305,467

Term loan facility, net

3,213,904

3,211,814

Revolving facility

—

—

Total Debt per Balance Sheet

8,544,382

8,546,052

Retained and repurchased certificates

(87,477

)

(87,703

)

Cash, ex-security deposits and letters of

credit (1)

(764,359

)

(713,898

)

Deferred financing costs, net

42,049

45,518

Unamortized discounts on note payable

20,716

21,376

Net Debt (A)

$

7,755,311

$

7,811,345

For the TTM Ended

For the TTM Ended

March 31, 2024

December 31, 2023

Adjusted EBITDAre (B)

$

1,435,496

$

1,413,480

Net Debt / TTM Adjusted EBITDAre (A /

B)

5.4x

5.5x

(1)

Represents cash and cash equivalents and

the portion of restricted cash that excludes security deposits and

letters of credit

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240430143308/en/

Investor Relations Contact Scott McLaughlin 844.456.INVH

(4684) IR@InvitationHomes.com

Media Relations Contact Kristi DesJarlais 972.421.3587

Media@InvitationHomes.com

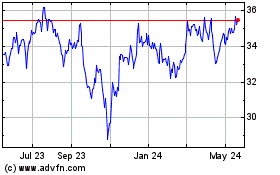

Invitation Homes (NYSE:INVH)

Historical Stock Chart

From Feb 2025 to Mar 2025

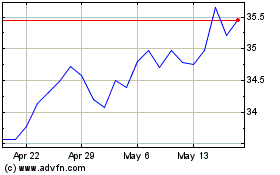

Invitation Homes (NYSE:INVH)

Historical Stock Chart

From Mar 2024 to Mar 2025