Achieves above guidance results on strong

execution; full-year outlook unchanged

Keysight Technologies, Inc. (NYSE: KEYS) today reported

financial results for the second fiscal quarter ended April 30,

2024.

“Keysight executed well and delivered second quarter results

above the high end of our guidance in a market environment that was

consistent with the prior quarter,” said Satish Dhanasekaran,

Keysight’s President and CEO. “We saw pockets of growth and

stability across multiple end markets even as customer spending

remained constrained. Our full-year outlook is unchanged and

assumes modest order growth in the second half."

Second Quarter Financial Summary

- Revenue was $1.22 billion, compared with $1.39 billion in the

second quarter of 2023.

- GAAP net income was $126 million, or $0.72 per share, compared

with $283 million, or $1.58 per share, in the second quarter of

2023.

- Non-GAAP net income was $247 million, or $1.41 per share,

compared with $380 million, or $2.12 per share in the second

quarter of 2023.

- Cash flow from operations was $110 million, compared to $423

million last year. Free cash flow was $74 million, compared to $370

million in the second quarter of 2023.

- As of April 30, 2024, cash and cash equivalents totaled $1.66

billion.

Reporting Segments

- Communications Solutions Group (CSG) CSG reported revenue of

$840 million in the second quarter, down 10 percent from the prior

year, reflecting a 10 percent decline in commercial communications,

while aerospace, defense, and government decreased 11 percent.

- Electronic Industrial Solutions Group (EISG) EISG reported

revenue of $376 million in the second quarter, down 17 percent from

the prior year, reflecting continued constraint in semiconductor

and manufacturing-related customer spending.

Outlook

Keysight’s third fiscal quarter of 2024 revenue is expected to

be in the range of $1.18 billion to $1.20 billion. Non-GAAP

earnings per share for the third fiscal quarter of 2024 are

expected to be in the range of $1.30 to $1.36, based on a weighted

diluted share count of approximately 175 million shares. Certain

items impacting the GAAP tax rate pertain to future events and are

not currently estimable with a reasonable degree of accuracy;

therefore, no reconciliation of GAAP earnings per share to non-GAAP

has been provided. Further information is discussed in the section

titled “Use of Non-GAAP Financial Measures” below.

Webcast

Keysight’s management will present more details about its second

quarter FY2024 financial results and its third quarter FY2024

outlook on a conference call with investors today at 1:30 p.m. PT.

This event will be webcast in listen-only mode. Listeners may log

on to the call at www.investor.keysight.com under the “Upcoming

Events” section and select “Q2 FY24 Keysight Technologies Inc.

Earnings Conference Call” to participate. The call can also be

accessed by dialing 1-404-975-4839 or 1-833-470-1428 toll-free

(access code 996630). The webcast will remain on the company site

for 90 days.

Forward-Looking Statements

This communication contains forward-looking statements as

defined in the Securities Exchange Act of 1934 and is subject to

the safe harbors created therein. The words "assume," “expect,”

“intend,” “will,” “should,” and similar expressions, as they relate

to the company, are intended to identify forward-looking

statements. These forward-looking statements involve risks and

uncertainties that could significantly affect the expected results

and are based on certain key assumptions of Keysight’s management

and on currently available information. Due to such uncertainties

and risks, no assurances can be given that such expectations or

assumptions will prove to have been correct, and readers are

cautioned not to place undue reliance on such forward-looking

statements, which speak only as of the date hereof. Keysight

undertakes no responsibility to publicly update or revise any

forward-looking statement. The forward-looking statements contained

herein include, but are not limited to, predictions, future

guidance, projections, beliefs, and expectations about the

company’s goals, revenues, financial condition, earnings, and

operations that involve risks and uncertainties that could cause

Keysight’s results to differ materially from management’s current

expectations. Such risks and uncertainties include, but are not

limited to, impacts of global economic conditions such as inflation

or recession, slowing demand for products or services, volatility

in financial markets, reduced access to credit, increased interest

rates; impacts of geopolitical tension and conflict outside of the

U.S., export control regulations and compliance; net zero emissions

commitments; customer purchasing decisions and timing; and order

cancellations.

In addition to the risks above, other risks that Keysight faces

include those detailed in Keysight’s filings with the Securities

and Exchange Commission on Keysight’s yearly report on Form 10-K

for the period ended October 31, 2023 and Keysight’s quarterly

report on Form 10-Q for the period ended January 31, 2024.

Segment Data

Segment data reflect the results of our reportable segments

under our management reporting system. Segment data are provided on

page 5 of the attached tables.

Use of Non-GAAP Financial Measures

In addition to financial information prepared in accordance with

U.S. GAAP (“GAAP”), this document also contains certain non-GAAP

financial measures based on management’s view of performance,

including:

- Non-GAAP Net Income/Earnings

- Non-GAAP Net Income per share/Earnings per share

- Free Cash Flow

Net Income per share is based on weighted average diluted share

count. See the attached supplemental schedules for reconciliations

of each non-GAAP financial measure to its most directly comparable

GAAP financial measure for both the three and six months ended

April 30, 2024. Following the reconciliations is a discussion of

the items adjusted from our non-GAAP financial measures and the

company’s reasons for including or excluding certain categories of

income or expenses from our non-GAAP results.

About Keysight Technologies

At Keysight (NYSE: KEYS), we inspire and empower innovators to

bring world-changing technologies to life. As an S&P 500

company, we’re delivering market-leading design, emulation, and

test solutions to help engineers develop and deploy faster, with

less risk, throughout the entire product lifecycle. We’re a global

innovation partner enabling customers in communications, industrial

automation, aerospace and defense, automotive, semiconductor, and

general electronics markets to accelerate innovation to connect and

secure the world. Learn more at Keysight Newsroom and

www.keysight.com.

KEYSIGHT TECHNOLOGIES, INC. CONDENSED CONSOLIDATED

STATEMENT OF OPERATIONS (In millions, except per share

data) (Unaudited) PRELIMINARY

Three months ended

Six months ended

April 30,

April 30,

2024

2023

2024

2023

Orders

$

1,219

$

1,319

$

2,439

$

2,619

Revenue

$

1,216

$

1,390

$

2,475

$

2,771

Costs and expenses: Cost of products and services

453

481

899

979

Research and development

228

222

460

449

Selling, general and administrative

361

337

723

675

Other operating expense (income), net

(3

)

(4

)

(5

)

(8

)

Total costs and expenses

1,039

1,036

2,077

2,095

Income from operations

177

354

398

676

Interest income

18

22

41

41

Interest expense

(20

)

(20

)

(40

)

(39

)

Other income (expense), net

—

5

5

14

Income before taxes

175

361

404

692

Provision for income taxes

49

78

106

149

Net income

$

126

$

283

$

298

$

543

Net income per share: Basic

$

0.73

$

1.59

$

1.71

$

3.04

Diluted

$

0.72

$

1.58

$

1.70

$

3.02

Weighted average shares used in computing net income per

share: Basic

174

178

175

178

Diluted

175

179

175

179

Page 1

KEYSIGHT TECHNOLOGIES, INC.

CONDENSED CONSOLIDATED BALANCE SHEET (In millions, except

par value and share data) (Unaudited) PRELIMINARY

April 30,

October 31,

2024

2023

ASSETS Current assets: Cash and cash

equivalents

$

1,657

$

2,472

Accounts receivable, net

809

900

Inventory

1,020

985

Other current assets

482

452

Total current assets

3,968

4,809

Property, plant and equipment, net

769

761

Operating lease right-of-use assets

239

226

Goodwill

2,282

1,640

Other intangible assets, net

609

155

Long-term investments

102

81

Long-term deferred tax assets

668

671

Other assets

351

340

Total assets

$

8,988

$

8,683

LIABILITIES AND EQUITY Current liabilities:

Current portion of long-term debt

$

600

$

599

Accounts payable

268

286

Employee compensation and benefits

309

304

Deferred revenue

578

541

Income and other taxes payable

62

90

Operating lease liabilities

43

40

Other accrued liabilities

134

189

Total current liabilities

1,994

2,049

Long-term debt

1,195

1,195

Retirement and post-retirement benefits

68

64

Long-term deferred revenue

211

216

Long-term operating lease liabilities

201

192

Other long-term liabilities

416

313

Total liabilities

4,085

4,029

Stockholders' Equity: Preferred stock; $0.01 par value; 100

million shares authorized; none issued and outstanding

—

—

Common stock; $0.01 par value; 1 billion shares authorized; issued

and outstanding shares: 201 million and 200 million, respectively

2

2

Treasury stock, at cost; 26.4 million shares and 25.4 million

shares, respectively

(3,119

)

(2,980

)

Additional paid-in-capital

2,580

2,487

Retained earnings

5,909

5,611

Accumulated other comprehensive loss

(469

)

(466

)

Total stockholders' equity

4,903

4,654

Total liabilities and equity

$

8,988

$

8,683

Page 2

KEYSIGHT TECHNOLOGIES, INC.

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS (In

millions) (Unaudited) PRELIMINARY

Six months ended

April 30,

2024

2023

Cash flows from operating activities: Net income

$

298

$

543

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation

62

59

Amortization

76

49

Share-based compensation

82

84

Deferred tax expense (benefit)

(9

)

(2

)

Excess and obsolete inventory-related charges

18

13

Other non-cash expense (income), net

(5

)

(4

)

Changes in assets and liabilities, net of effects of businesses

acquired: Accounts receivable

121

61

Inventory

(50

)

(93

)

Accounts payable

(11

)

(41

)

Employee compensation and benefits

(26

)

(35

)

Deferred revenue

14

81

Income taxes payable

(35

)

(32

)

Interest rate swap agreement termination proceeds

—

107

Prepaid assets

(19

)

(27

)

Other assets and liabilities

(78

)

26

Net cash provided by operating activities(a)

438

789

Cash flows from investing activities: Investments in

property, plant and equipment

(83

)

(113

)

Acquisition of businesses and intangible assets, net of cash

acquired

(556

)

(85

)

Other investing activities

8

(7

)

Net cash used in investing activities

(631

)

(205

)

Cash flows from financing activities: Proceeds from issuance

of common stock under employee stock plans

33

33

Payment of taxes related to net share settlement of equity awards

(28

)

(47

)

Acquisition of non-controlling interests

(458

)

—

Treasury stock repurchases

(139

)

(125

)

Repayment of debt

(24

)

—

Other financing activities

(5

)

(1

)

Net cash used in financing activities

(621

)

(140

)

Effect of exchange rate movements

—

13

Net increase (decrease) in cash, cash equivalents, and

restricted cash

(814

)

457

Cash, cash equivalents, and restricted cash at beginning of period

2,488

2,057

Cash, cash equivalents, and restricted cash at end of period

$

1,674

$

2,514

(a) Cash payments included in operating activities: Interest

payments

$

38

$

37

Income tax paid, net

$

146

$

180

Page 3

KEYSIGHT TECHNOLOGIES, INC. NET

INCOME AND DILUTED EPS RECONCILIATION (In millions, except

per share data) (Unaudited) PRELIMINARY

Three months ended

Six months ended

April 30,

April 30,

2024

2023

2024

2023

Net Income

Diluted EPS

Net Income

Diluted EPS

Net Income

Diluted EPS

Net Income

Diluted EPS

GAAP Net income

$

126

$

0.72

$

283

$

1.58

$

298

$

1.70

$

543

$

3.02

Non-GAAP adjustments: Amortization of acquisition-related balances

37

0.21

25

0.14

75

0.43

48

0.27

Share-based compensation

36

0.21

29

0.16

86

0.49

84

0.47

Acquisition and integration costs

27

0.15

3

0.02

40

0.23

5

0.03

Restructuring and others

23

0.14

14

0.07

38

0.22

15

0.08

Adjustment for taxes(a)

(2

)

(0.02

)

26

0.15

(4

)

(0.03

)

48

0.27

Non-GAAP Net income

$

247

$

1.41

$

380

$

2.12

$

533

$

3.04

$

743

$

4.14

Weighted average shares outstanding - diluted

175

179

175

179

(a) For the three and six months ended April 30, 2024, management

uses a non-GAAP effective tax rate of 17% and for the three and six

months ended April 30, 2023, management uses a non-GAAP effective

tax rate of 12%. Please refer last page for details on the

use of non-GAAP financial measures. Page 4

KEYSIGHT TECHNOLOGIES, INC. SEGMENT RESULTS

INFORMATION (In millions, except where noted)

(Unaudited) PRELIMINARY Communications

Solutions Group Percent Q2'24 Q2'23

Inc/(Dec) Revenue

$ 840

$ 937

(10)%

Gross margin, %

68%

68%

Income from operations

$ 223

$ 266

Operating margin, %

27%

28%

Electronic Industrial Solutions Group

Percent Q2'24 Q2'23 Inc/(Dec) Revenue

$ 376

$ 453

(17)%

Gross margin, %

58%

64%

Income from operations

$ 71

$ 157

Operating margin, %

19%

35%

Segment revenue and income from operations are consistent

with the respective non-GAAP financial measures as discussed on

last page. Page 5

KEYSIGHT TECHNOLOGIES, INC.

REVENUE BY END MARKET (In millions)

(Unaudited) PRELIMINARY Percent

Q2'24 Q2'23 Inc/(Dec) Aerospace, Defense and

Government

$ 277

$ 310

(11)%

Commercial Communications

563

627

(10)%

Electronic Industrial

376

453

(17)%

Total Revenue

$ 1,216

$ 1,390

(13)%

Page 6

KEYSIGHT TECHNOLOGIES, INC. FREE

CASH FLOW (In millions) (Unaudited)

PRELIMINARY

Three months ended

Six months ended

April 30,

April 30,

2024

2023

2024

2023

Net cash provided by operating activities

$

110

$

423

$

438

$

789

Less: Investments in property, plant and equipment

(36

)

(53

)

(83

)

(113

)

Free cash flow

$

74

$

370

$

355

$

676

Please refer last page for details on the use of non-GAAP

financial measures. Page 7

Non-GAAP Financial Measures

Management uses both GAAP and non-GAAP financial measures to

analyze and assess the overall performance of the business, to make

operating decisions and to forecast and plan for future periods. We

believe that our investors benefit from seeing our results “through

the eyes of management” in addition to seeing our GAAP results.

This information enhances investors’ understanding of the

continuing performance of our business and facilitates comparison

of performance to our historical and future periods. Our

non-GAAP financial measures may not be comparable to similarly

titled measures used by other companies, including industry peer

companies, limiting the usefulness of these measures for

comparative purposes. These non-GAAP measures should be

considered supplemental to and not a substitute for financial

information prepared in accordance with GAAP. The discussion below

presents information about each of the non-GAAP financial measures

and the company’s reasons for including or excluding certain

categories of income or expenses from our non-GAAP results. In

future periods, we may exclude such items and may incur income and

expenses similar to these excluded items. Accordingly, adjustments

for these items and other similar items in our non-GAAP

presentation should not be interpreted as implying that these items

are non-recurring, infrequent or unusual. Non-GAAP Revenue

generally relates to an acquisition and includes recognition of

acquired deferred revenue that was written down to fair value in

purchase accounting. Management believes that excluding fair value

purchase accounting adjustments more closely correlates with the

ordinary and ongoing course of the acquired company’s operations

and facilitates analysis of revenue growth and business trends. We

may not have non-GAAP revenue in all periods. Core Revenue

is GAAP/non-GAAP revenue (as applicable) excluding the impact of

foreign currency changes and revenue associated with material

acquisitions or divestitures completed within the last twelve

months. We exclude the impact of foreign currency changes as

currency rates can fluctuate based on factors that are not within

our control and can obscure revenue growth trends. As the nature,

size and number of acquisitions can vary significantly from period

to period and as compared to our peers, we exclude revenue

associated with recently acquired businesses to facilitate

comparisons of revenue growth and analysis of underlying business

trends. Free cash flow includes net cash provided by

operating activities adjusted for investments in property, plant

& equipment. Non-GAAP Income from Operations, Non-GAAP

Net Income and Non-GAAP Diluted EPS may include the following types

of adjustments:

- Acquisition-related Items: We exclude the impact of certain

items recorded in connection with business combinations from our

non-GAAP financial measures that are either non-cash or not normal,

recurring operating expenses due to their nature, variability of

amounts and lack of predictability as to occurrence or timing.

These amounts may include non-cash items such as the amortization

of acquired intangible assets and amortization of items associated

with fair value purchase accounting adjustments, including

recognition of acquired deferred revenue (see Non-GAAP Revenue

above). We also exclude other acquisition and integration costs

associated with business acquisitions that are not normal recurring

operating expenses and legal, accounting and due diligence costs.

We exclude these charges to facilitate a more meaningful evaluation

of our current operating performance and comparisons to our past

operating performance.

- Share-based Compensation Expense: We exclude share-based

compensation expense from our non-GAAP financial measures because

share-based compensation expense can vary significantly from period

to period based on the company’s share price, as well as the

timing, size and nature of equity awards granted. Management

believes the exclusion of this expense facilitates the ability of

investors to compare the company’s operating results with those of

other companies, many of which also exclude share-based

compensation expense in determining their non-GAAP financial

measures.

- Restructuring and others: We exclude incremental expenses

associated with restructuring initiatives, usually aimed at

material changes in the business or cost structure. Such costs may

include employee separation costs, asset impairments,

facility-related costs, contract termination fees, and costs to

move operations from one location to another. These activities can

vary significantly from period to period based on the timing, size

and nature of restructuring plans; therefore, we do not consider

such costs to be normal, recurring operating expenses. We also

exclude “others”, not normal, recurring, cash operating

income/expenses from our non-GAAP financial measures. Such items

are evaluated on an individual basis, based on both quantitative

and qualitative factors and generally represent items that we do

not anticipate occurring as part of our normal business. While not

all-inclusive, examples of such items would include net unrealized

gains on equity investments still held, significant non-recurring

events like realized gains or losses associated with our employee

benefit plans, costs and recoveries related to unusual events, gain

on sale of assets/divestitures, adjustment attributable to

non-controlling interest, etc. We believe that these costs do not

reflect expected future operating expenses and do not contribute to

a meaningful evaluation of the company’s current operating

performance or comparisons to our operating performance in other

periods.

- Estimated Tax Rate: We utilize a consistent methodology for

long-term projected non-GAAP tax rate. When projecting this

long-term rate, we exclude any tax benefits or expenses that are

not directly related to ongoing operations and which are either

isolated or cannot be expected to occur again with any regularity

or predictability. Additionally, we evaluate our current long-term

projections, current tax structure and other factors, such as

existing tax positions in various jurisdictions and key tax

holidays in major jurisdictions where Keysight operates. This tax

rate could change in the future for a variety of reasons, including

but not limited to significant changes in geographic earnings mix

including acquisition activity, or fundamental tax law changes in

major jurisdictions where Keysight operates. The above reasons also

limit our ability to reasonably estimate the future GAAP tax rate

and provide a reconciliation of the expected non-GAAP earnings per

share for the third quarter of fiscal 2024 to the GAAP

equivalent.

Management recognizes these items can have a material impact on our

cash flows and/or our net income. Our GAAP financial statements,

including our Condensed Consolidated Statement of Cash Flows,

portray those effects. Although we believe it is useful for

investors to see core performance free of special items, investors

should understand that the excluded costs are actual expenses that

may impact the cash available to us for other uses. To gain a

complete picture of all effects on the company’s profit and loss

from any and all events, management does (and investors should)

rely upon the Condensed Consolidated Statement of Operations

prepared in accordance with GAAP. The non-GAAP measures focus

instead upon the core business of the company, which is only a

subset, albeit a critical one, of the company’s performance.

Page 8

Source: IR-KEYS

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240520584461/en/

INVESTOR CONTACT: Jason Kary +1 707-577-6916

jason.kary@keysight.com

MEDIA CONTACT: Andrea Mueller + 1 408-218-4754

andrea.mueller@keysight.com

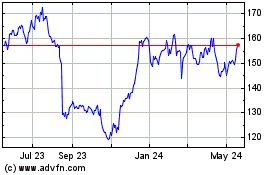

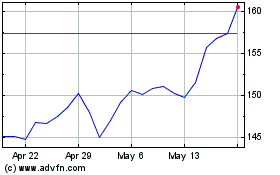

Keysight Technologies (NYSE:KEYS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Keysight Technologies (NYSE:KEYS)

Historical Stock Chart

From Nov 2023 to Nov 2024