Kemper Corporation (NYSE: KMPR) reported net income of $123.2

million, or $1.85 per diluted share, for the first quarter of 2021,

compared to $64.0 million, or $0.95 per diluted share, for the

first quarter of 2020. In the first quarter of 2021, net income

included a $41.2 million after-tax gain, or $0.62 per diluted

share, attributable to the change in fair value of equity and

convertible securities.

Adjusted Consolidated Net Operating Income1 was $87.2 million,

or $1.31 per diluted share, for the first quarter of 2021, compared

to $162.9 million, or $2.43 per diluted share, for the first

quarter of 2020.

Highlights of the quarter include:

- Specialty P&C earned premiums increased 7% and

policies-in-force (ex. Classic Car) grew ~2%, reflecting headwinds

from continued state shut-downs early in the quarter impacting

shopping behavior

- Underlying Specialty combined ratio was 94%, in line with 1Q’20

as miles driven and corresponding accident frequency are

increasing

- Repurchased shares worth $47 million

- Kemper remains well-positioned to support customers and grow

long-term shareholder value

“I’m pleased to report that Kemper, despite some short-term

headwinds, continued to deliver solid results and intrinsic value

to our shareholders,” said Joseph P. Lacher, Jr., President and

Chief Executive Officer. “This quarter, we continued to generate

double-digit ROE and growth in tangible book value per share

excluding fixed income unrealized gains and losses. Our Specialty

Auto business continues to produce strong earnings, and although we

saw impacts from slower state re-openings, our Specialty Auto

business reported net operating income of $80 million, or 33% over

the prior year quarter, with the top line increasing by 7%. The

business remains well-positioned for attractive long-term growth

and returns.

“Further, since the beginning of the year, we have deployed

roughly $500 million of capital through several actions. These

demonstrate our thoughtful approach to capital deployment. Notable

items include the repurchase of approximately $85 million in stock,

the repayment of a $50 million term loan, an increase in our annual

dividend to $1.24 per share, and the close of our acquisition of

American Access. The strength of Kemper’s business model and our

history of effective strategy execution positions us to navigate

through the pandemic recovery. We feel confident that we will

continue to meet the ongoing needs of our customers, as well as

provide quality results and value creation for our

stakeholders.”

Three Months Ended

(Dollars in Millions, Except Per Share

Amounts) (Unaudited)

Mar 31, 2021

Mar 31, 2020

Net Income

$

123.2

$

64.0

Adjusted Consolidated Net Operating Income

(Loss)1

$

87.2

$

162.9

Impact of Catastrophe Losses and Related

Loss Adjustment Expense (LAE) on Net Income

$

(21.8

)

$

(4.6

)

Diluted Net Income Per Share From:

Net Income

$

1.85

$

0.95

Adjusted Consolidated Net Operating Income

(Loss)1

$

1.31

$

2.43

Impact of Catastrophe Losses and Related

LAE on Net Income Per Share

$

(0.33

)

$

(0.07

)

Capital

Total Shareholders’ Equity at the end of the quarter was

$4,339.1 million, a decrease of $224.3 million, or 5 percent, since

year-end 2020 primarily driven by a decrease in the valuation of

our fixed income bond portfolio, cash dividends and repurchases of

common stock, partially offset by net income. Kemper and its direct

non-insurance subsidiaries ended the quarter with cash and

investments of $607.1 million, and the $400.0 million revolving

credit agreement was undrawn.

During the first quarter of 2021, Kemper paid dividends of $21.0

million.

On February 23, 2021, Kemper announced that its Board of

Directors declared a quarterly dividend of $0.31 per share.

Kemper ended the quarter with a book value per share of $66.74,

a decrease of 4 percent from $69.74 at the end of 2020. Book Value

Per Share Excluding Net Unrealized Gains on Fixed Maturities1 was

$60.00, up 2 percent from $58.67 at the end of 2020.

Revenues

Total revenues for the first quarter of 2021 increased $123.0

million, or 10.0 percent, to $1,352.0 million, compared to the

first quarter of 2020, driven by $55.1 million of higher Specialty

P&C earned premiums and a $170.0 million increase attributable

to the change in fair value of equity and convertible securities.

Specialty P&C earned premiums increased due primarily to higher

premium volume. Net investment income increased $17.5 million to

$103.1 million in the first quarter of 2021 due primarily to the

continued recovery of Alternative Investments and higher levels of

investments in fixed income securities, partially offset by lower

yields on fixed income securities. Net realized investment gains

were $13.8 million in the first quarter of 2021, compared to $16.5

million in the first quarter of 2020. Other income decreased from

$90.3 million to $1.5 million in the first quarter of 2021. The

first quarter of 2020 included a final judgment received by the

Company in connection with an arbitration award against Computer

Sciences Corporation.

Segment Results

Unless otherwise noted, (i) the segment results discussed below

are presented on an after-tax basis, (ii) prior-year development

includes both catastrophe and non-catastrophe losses and LAE, (iii)

catastrophe losses and LAE exclude the impact of prior-year

development, (iv) loss ratio includes loss and LAE, and (v) all

comparisons are made to the prior year quarter unless otherwise

stated.

Three Months Ended

(Dollars in Millions) (Unaudited)

Mar 31, 2021

Mar 31, 2020

Segment Net Operating Income (Loss):

Specialty Property & Casualty

Insurance

$

80.1

$

60.1

Preferred Property & Casualty

Insurance

9.6

18.4

Life & Health Insurance

7.3

22.3

Total Segment Net Operating Income

(Loss)

97.0

100.8

Corporate and Other Net Operating Income

(Loss)

(9.8

)

62.1

Adjusted Consolidated Net Operating Income

(Loss)1

87.2

162.9

Net Income (Loss) From:

Change in Fair Value of Equity and

Convertible Securities

41.2

(93.1

)

Net Realized Gains on Sales of

Investments

10.9

13.0

Impairment Losses

(3.2

)

(9.5

)

Acquisition Related Transaction,

Integration and Other Costs

(12.9

)

(9.3

)

Loss from Early Extinguishment of Debt

—

—

Net Income

$

123.2

$

64.0

The Specialty Property & Casualty Insurance segment reported

net operating income of $80.1 million for the first quarter of

2021, compared to $60.1 million in the first quarter of 2020.

Results improved due primarily to higher premium volume and an

improvement in underlying losses and LAE. The segment’s Underlying

Combined Ratio1 was 93.5 percent, compared to 93.9 percent in the

first quarter of 2020.

The Preferred Property & Casualty Insurance segment reported

net operating income of $9.6 million for the first quarter of 2021,

compared to net operating income of $18.4 million in the first

quarter of 2020. Results deteriorated due primarily to catastrophe

losses and LAE (excluding loss and LAE reserve development),

partially offset by an improvement in underlying losses and LAE.

The Preferred Property & Casualty Insurance segment’s

Underlying Combined Ratio1 improved 1.6 percentage points to 90.7

percent in the first quarter of 2021 due primarily to lower

incurred losses and LAE as well as ongoing profit improvement

actions.

The Life & Health Insurance segment reported net operating

income of $7.3 million for the first quarter of 2021, compared to

$22.3 million in the first quarter of 2020. Results deteriorated

due primarily to an increase in COVID-related mortality, in line

with country-wide trends.

Unaudited condensed consolidated statements of income for the

three months ended March 31, 2021 and 2020 are presented

below.

Three Months Ended

(Dollars in Millions, Except Per Share

Amounts)

Mar 31, 2021

Mar 31, 2020

Revenues:

Earned Premiums

$

1,200.8

$

1,166.4

Net Investment Income

103.1

85.6

Change in Value of Alternative Energy

Partnership Investments2

(15.4

)

—

Other Income

1.5

90.3

Income (Loss) from Change in Fair Value of

Equity and Convertible Securities

52.2

(117.8

)

Net Realized Gains on Sales of

Investments

13.8

16.5

Impairment Losses

(4.0

)

(12.0

)

Total Revenues

1,352.0

1,229.0

Expenses:

Policyholders’ Benefits and Incurred

Losses and Loss Adjustment Expenses

889.5

835.2

Insurance Expenses

283.7

271.6

Loss from Early Extinguishment of Debt

—

—

Interest and Other Expenses

57.2

44.5

Total Expenses

1,230.4

1,151.3

Income from before Income Taxes

121.6

77.7

Income Tax Expense

1.6

(13.7

)

Net Income

$

123.2

$

64.0

Income from Continuing Operations Per

Unrestricted Share:

Basic

$

1.88

$

0.96

Diluted

$

1.85

$

0.95

Net Income Per Unrestricted

Share:

Basic

$

1.88

$

0.96

Diluted

$

1.85

$

0.95

Weighted-average Outstanding (Shares in

Thousands):

Unrestricted Shares - Basic

65,424.6

66,515.9

Unrestricted Shares and Equivalent Shares

- Diluted

66,552.8

66,974.2

Dividends Paid to Shareholders Per

Share

$

0.31

$

0.30

2 The Alternative Energy Partnership

Investments results are included as a pre-tax loss in the Change in

Value of Alternative Energy Partnership Investments of $15.4

million and benefit in income tax expense of $28.6 million for a

net income impact of $13.2 million.

Unaudited business segment revenues for the three months

ended March 31, 2021 and 2020 are presented below.

Three Months Ended

(Dollars in Millions)

Mar 31, 2021

Mar 31, 2020

REVENUES:

Specialty Property & Casualty

Insurance:

Earned Premiums:

Specialty Automobile

$

785.4

$

753.2

Commercial Automobile

92.2

69.3

Total Earned Premiums

877.6

822.5

Net Investment Income

35.0

28.8

Change in Value of Alternative Energy

Partnership Investments

(7.3

)

—

Other Income

0.9

0.9

Total Specialty Property & Casualty

Insurance Revenues

906.2

852.2

Preferred Property & Casualty

Insurance:

Earned Premiums:

Preferred Automobile

103.0

114.9

Homeowners

50.8

56.8

Other Personal

8.4

9.2

Total Earned Premiums

162.2

180.9

Net Investment Income

15.9

9.7

Change in Value of Alternative Energy

Partnership Investments

(4.1

)

—

Total Preferred Property & Casualty

Insurance Revenues

174.0

190.6

Life & Health Insurance:

Earned Premiums:

Life

98.1

97.2

Accident & Health

47.4

49.4

Property

15.5

16.4

Total Earned Premiums

161.0

163.0

Net Investment Income

51.1

51.0

Change in Value of Alternative Energy

Partnership Investments

(4.0

)

—

Other Income

0.1

0.1

Total Life & Health Insurance

Revenues

208.2

214.1

Total Segment Revenues

1,288.4

1,256.9

Income (Loss) from Change in Fair Value of

Equity and Convertible Securities

52.2

(117.8

)

Net Realized Gains on Sales of

Investments

13.8

16.5

Impairment Losses

(4.0

)

(12.0

)

Other

1.6

85.4

Total Revenues

$

1,352.0

$

1,229.0

KEMPER CORPORATION AND

SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS (Dollars in

Millions) (Unaudited)

Mar 31, 2021

Dec 31, 2020

Assets:

Investments:

Fixed Maturities at Fair Value

$

7,479.4

$

7,605.9

Equity Securities at Fair Value

897.4

858.5

Equity Securities at Modified Cost

36.0

40.1

Equity Method Limited Liability

Investments at Cost Plus Cumulative Undistributed Earnings

219.2

204.0

Alternative Energy Partnership

Investments

54.4

21.3

Convertible Securities at Fair Value

42.6

39.9

Short-term Investments at Cost which

Approximates Fair Value

196.9

875.4

Other Investments

896.8

779.0

Total Investments

9,822.7

10,424.1

Cash

547.4

206.1

Receivables from Policyholders

1,260.9

1,194.5

Other Receivables

225.4

222.4

Deferred Policy Acquisition Costs

611.7

589.3

Goodwill

1,114.0

1,114.0

Current Income Tax Assets

65.6

15.6

Other Assets

556.0

575.9

Total Assets

$

14,203.7

$

14,341.9

Liabilities and Shareholders’

Equity:

Insurance Reserves:

Life & Health

$

3,541.6

$

3,527.5

Property & Casualty

1,999.5

1,982.5

Total Insurance Reserves

5,541.1

5,510.0

Unearned Premiums

1,713.0

1,615.1

Policyholder Contract Liabilities

466.5

467.0

Deferred Income Tax Liabilities

227.6

285.7

Accrued Expenses and Other Liabilities

793.8

727.9

Debt at Amortized Cost

1,122.6

1,172.8

Total Liabilities

9,864.6

9,778.5

Shareholders’ Equity:

Common Stock

6.5

6.5

Paid-in Capital

1,802.1

1,805.2

Retained Earnings

2,140.0

2,071.2

Accumulated Other Comprehensive Income

390.5

680.5

Total Shareholders’ Equity

4,339.1

4,563.4

Total Liabilities and Shareholders’

Equity

$

14,203.7

$

14,341.9

Unaudited selected financial information for the Specialty

Property & Casualty Insurance segment follows.

Three Months Ended

(Dollars in Millions)

Mar 31, 2021

Mar 31, 2020

Results

of Operations

Net Premiums Written

$

972.0

$

911.2

Earned Premiums

$

877.6

$

822.5

Net Investment Income

35.0

28.8

Change in Value of Alternative Energy

Partnership Investments

(7.3

)

—

Other Income

0.9

0.9

Total Revenues

906.2

852.2

Incurred Losses and LAE related to:

Current Year:

Non-catastrophe Losses and LAE

650.0

619.8

Catastrophe Losses and LAE

1.7

0.2

Prior Years:

Non-catastrophe Losses and LAE

(1.4

)

5.3

Catastrophe Losses and LAE

0.4

0.2

Total Incurred Losses and LAE

650.7

625.5

Insurance Expenses

170.3

152.1

Other Expenses

—

(0.4

)

Operating Income (Loss)

85.2

75.0

Income Tax Benefit (Expense)

(5.1

)

(14.9

)

Segment Net Operating Income (Loss)

$

80.1

$

60.1

Ratios

Based On Earned Premiums

Current Year Non-catastrophe Losses and

LAE Ratio

74.1

%

75.4

%

Current Year Catastrophe Losses and LAE

Ratio

0.2

—

Prior Years Non-catastrophe Losses and LAE

Ratio

(0.2

)

0.6

Prior Years Catastrophe Losses and LAE

Ratio

—

—

Total Incurred Loss and LAE Ratio

74.1

76.0

Insurance Expense Ratio

19.4

18.5

Combined Ratio

93.5

%

94.5

%

Underlying Combined Ratio1

Current Year Non-catastrophe Losses and

LAE Ratio

74.1

%

75.4

%

Insurance Expense Ratio

19.4

18.5

Underlying Combined Ratio1

93.5

%

93.9

%

Non-GAAP

Measure Reconciliation

Combined Ratio

93.5

%

94.5

%

Less:

Current Year Catastrophe Losses and LAE

Ratio

0.2

—

Prior Years Non-catastrophe Losses and LAE

Ratio

(0.2

)

0.6

Prior Years Catastrophe Losses and LAE

Ratio

—

—

Underlying Combined Ratio1

93.5

%

93.9

%

Unaudited selected financial information for the Preferred

Property & Casualty Insurance segment follows.

Three Months Ended

(Dollars in Millions)

Mar 31, 2021

Mar 31, 2020

Results

of Operations

Net Premiums Written

$

154.4

$

164.1

Earned Premiums

$

162.2

$

180.9

Net Investment Income

15.9

9.7

Change in Value of Alternative Energy

Partnership Investments

(4.1

)

—

Total Revenues

174.0

190.6

Incurred Losses and LAE related to:

Current Year:

Non-catastrophe Losses and LAE

96.2

108.5

Catastrophe Losses and LAE

24.0

4.8

Prior Years:

Non-catastrophe Losses and LAE

0.1

(3.3

)

Catastrophe Losses and LAE

(0.3

)

(1.1

)

Total Incurred Losses and LAE

120.0

108.9

Insurance Expenses

51.0

58.7

Operating Income (Loss)

3.0

23.0

Income Tax Benefit (Expense)

6.6

(4.6

)

Segment Net Operating Income (Loss)

$

9.6

$

18.4

Ratios

Based On Earned Premiums

Current Year Non-catastrophe Losses and

LAE Ratio

59.3

%

59.9

%

Current Year Catastrophe Losses and LAE

Ratio

14.8

2.7

Prior Years Non-catastrophe Losses and LAE

Ratio

0.1

(1.8

)

Prior Years Catastrophe Losses and LAE

Ratio

(0.2

)

(0.6

)

Total Incurred Loss and LAE Ratio

74.0

60.2

Insurance Expense Ratio

31.4

32.4

Combined Ratio

105.4

%

92.6

%

Underlying Combined Ratio1

Current Year Non-catastrophe Losses and

LAE Ratio

59.3

%

59.9

%

Insurance Expense Ratio

31.4

32.4

Underlying Combined Ratio1

90.7

%

92.3

%

Non-GAAP

Measure Reconciliation

Combined Ratio

105.4

%

92.6

%

Less:

Current Year Catastrophe Losses and LAE

Ratio

14.8

2.7

Prior Years Non-catastrophe Losses and LAE

Ratio

0.1

(1.8

)

Prior Years Catastrophe Losses and LAE

Ratio

(0.2

)

(0.6

)

Underlying Combined Ratio1

90.7

%

92.3

%

Unaudited selected financial information for the Life &

Health Insurance segment follows.

Three Months Ended

(Dollars in Millions)

Mar 31, 2021

Mar 31, 2020

Results

of Operations

Earned Premiums

$

161.0

$

163.0

Net Investment Income

51.1

51.0

Change in Value of Alternative Energy

Partnership Investments

(4.0

)

—

Other Income

0.1

0.1

Total Revenues

208.2

214.1

Policyholders’ Benefits and Incurred

Losses and LAE

118.7

100.7

Insurance Expenses

90.3

86.9

Operating Income (Loss)

(0.8

)

26.5

Income Tax Benefit (Expense)

8.1

(4.2

)

Segment Net Operating Income (Loss)

$

7.3

$

22.3

Use of Non-GAAP Financial Measures

Adjusted Consolidated Net Operating Income

(Loss)1

Adjusted Consolidated Net Operating Income (Loss)1 is an

after-tax, non-GAAP financial measure computed by excluding from

Net Income the after-tax impact of 1) income (loss) from

change in fair value of equity and convertible securities, 2) net

realized gains on sales of investments, 3) impairment losses, 4)

acquisition related transaction, integration and other costs, 5)

debt extinguishment, pension and other charges and 6) significant

non-recurring or infrequent items that may not be indicative of

ongoing operations. Significant non-recurring items are excluded

when (a) the nature of the charge or gain is such that it is

reasonably unlikely to recur within two years and (b) there has

been no similar charge or gain within the prior two years. The most

directly comparable GAAP financial measure is Net

Income.

Kemper believes that Adjusted Consolidated Net Operating Income

(Loss)1 provides investors with a valuable measure of its ongoing

performance because it reveals underlying operational performance

trends that otherwise might be less apparent if the items were not

excluded. Income (Loss) from change in fair value of equity and

convertible securities, net realized gains on sales of investments

and impairment losses related to investments included in the

Company’s results may vary significantly between periods and are

generally driven by business decisions and external economic

developments such as capital market conditions that impact the

values of the Company’s investments, the timing of which is

unrelated to the insurance underwriting process. Loss from early

extinguishment of debt is driven by the Company’s financing and

refinancing decisions and capital needs, as well as external

economic developments such as debt market conditions, the timing of

which is unrelated to the insurance underwriting process.

Acquisition related transaction, integration and other costs may

vary significantly between periods and are generally driven by the

timing of acquisitions and business decisions which are unrelated

to the insurance underwriting process. Significant non-recurring

items are excluded because, by their nature, they are not

indicative of the Company’s business or economic trends.

A reconciliation of Net Income to Adjusted Consolidated

Net Operating Income (Loss)1 for the three months ended March 31,

2021 and 2020 is presented below.

Three Months Ended

(Dollars in Millions) (Unaudited)

Mar 31, 2021

Mar 31, 2020

Net Income

$

123.2

$

64.0

Less Net Income (Loss) From:

Change in Fair Value of Equity and

Convertible Securities

41.2

(93.1

)

Net Realized Gains on Sales of

Investments

10.9

13.0

Impairment Losses

(3.2

)

(9.5

)

Acquisition Related Transaction,

Integration and Other Costs

(12.9

)

(9.3

)

Adjusted Consolidated Net Operating Income

(Loss)1

$

87.2

$

162.9

Diluted Adjusted Consolidated Net

Operating Income Per Unrestricted Share1

Diluted Adjusted Consolidated Net Operating Income Per

Unrestricted Share1 is a non-GAAP financial measure computed by

dividing Adjusted Consolidated Net Operating Income (Loss)1

attributed to unrestricted shares by the weighted-average

unrestricted shares and equivalent shares outstanding. The most

directly comparable GAAP financial measure is Diluted Net

Income.

A reconciliation of Diluted Net Income to Diluted Adjusted

Consolidated Net Operating Income Per Unrestricted Share1 for the

three months ended March 31, 2021 and 2020 is presented below.

Three Months Ended

(Unaudited)

Mar 31, 2021

Mar 31, 2020

Diluted Net Income

$

1.85

$

0.95

Less Net Income (Loss) Per Unrestricted

Share From:

Change in Fair Value of Equity and

Convertible Securities

0.62

(1.39

)

Net Realized Gains on Sales of

Investments

0.16

0.19

Impairment Losses

(0.05

)

(0.14

)

Acquisition Related Transaction,

Integration and Other Costs

(0.19

)

(0.14

)

Diluted Adjusted Consolidated Net

Operating Income Per Unrestricted Share1

$

1.31

$

2.43

Book Value Per Share Excluding Net

Unrealized Gains on Fixed Maturities1

Book Value Per Share Excluding Net Unrealized Gains on Fixed

Maturities1 is a ratio that uses a non-GAAP financial measure. It

is calculated by dividing shareholders’ equity after excluding the

after-tax impact of net unrealized gains on fixed income securities

by total Common Shares Issued and Outstanding. Book Value Per Share

is the most directly comparable GAAP financial measure. Kemper uses

the trends in book value per share, excluding the after-tax impact

of net unrealized gains on fixed income securities, in conjunction

with book value per share to identify and analyze the change in net

worth attributable to management efforts between periods. Kemper

believes the non-GAAP financial measure is useful to investors

because it eliminates the effect of items that can fluctuate

significantly from period to period and are generally driven by

economic developments, primarily capital market conditions, the

magnitude and timing of which are not influenced by management.

Kemper believes it enhances understanding and comparability of

performance by highlighting underlying business activity and

profitability drivers.

A reconciliation of the numerator used in the computation of

Book Value Per Share Excluding Net Unrealized Gains on Fixed

Maturities1 and Book Value Per Share at March 31, 2021 and December

31, 2020 is presented below.

(Dollars in Millions) (Unaudited)

Mar 31, 2021

Dec 31, 2020

Shareholders’ Equity

$

4,339.1

$

4,563.4

Net Unrealized Gains on Fixed

Maturities

438.0

724.0

Shareholders’ Equity Excluding Net

Unrealized Gains on Fixed Maturities1

$

3,901.1

$

3,839.4

Underlying Combined Ratio1

Underlying Combined Ratio1 is a non-GAAP financial measure that

is computed by adding the current year non-catastrophe losses and

LAE ratio with the insurance expense ratio. The most directly

comparable GAAP financial measure is the combined ratio, which is

computed by adding total incurred losses and LAE, including the

impact of catastrophe losses and loss and LAE reserve development

from prior years, with the insurance expense ratio. Kemper believes

the Underlying Combined Ratio is useful to investors and is used by

management to reveal the trends in Kemper’s property and casualty

insurance businesses that may be obscured by catastrophe losses and

prior-year reserve development. These catastrophe losses may cause

loss trends to vary significantly between periods as a result of

their incidence of occurrence and magnitude, and can have a

significant impact on incurred losses and LAE and the combined

ratio. Prior-year reserve development is caused by unexpected loss

development on historical reserves. Because reserve development

relates to the re-estimation of losses from earlier periods, it has

no bearing on the performance of the company’s insurance products

in the current period. Kemper believes it is useful for investors

to evaluate these components separately and in the aggregate when

reviewing its underwriting performance. The Underlying Combined

Ratio1 should not be considered a substitute for the combined ratio

and does not reflect the overall underwriting profitability of our

business.

1 Non-GAAP financial measure. All Non-GAAP financial measures

are denoted with footnote 1 throughout this release. See “Use of

Non-GAAP Financial Measures” for additional information.

Conference Call

Kemper will discuss its first quarter 2021 results in a

conference call on Thursday, April 29th, at 5:00 p.m. Eastern (4:00

p.m. Central) Time. Kemper’s conference call will be accessible via

the internet and by telephone. The phone number for Kemper’s

conference call is 844.826.3041. To listen via webcast,

register online at the investor section of kemper.com at least 15

minutes prior to the webcast to download and install any necessary

software.

A replay of the call will be available online at the investor

section of kemper.com.

More detailed financial information can be found in Kemper’s

Investor Financial Supplement and Earnings Call Presentation for

the first quarter of 2021, which is available at the investor

section of kemper.com.

About Kemper

The Kemper family of companies is one of the nation’s leading

specialized insurers. With $14.2 billion in assets, Kemper is

improving the world of insurance by providing affordable and

easy-to-use personalized solutions to individuals, families and

businesses through its Auto, Personal Insurance, Life and Health

brands. Kemper serves over 6.3 million policies, is represented by

more than 30,000 agents and brokers, and has over 9,500 associates

dedicated to meeting the ever-changing needs of its customers.

Learn more about Kemper at the Company’s website,

kemper.com.

Caution Regarding Forward-Looking Statements

This press release may contain or incorporate by reference

information that includes or is based on forward-looking statements

within the meaning of the safe-harbor provisions of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements give expectations or forecasts of future events and can

be identified by the fact that they relate to future actions,

performance or results rather than strictly to historical or

current facts.

Any or all forward-looking statements may turn out to be wrong,

and, accordingly, readers are cautioned not to place undue reliance

on such statements, which speak only as of the date of this press

release. Forward-looking statements involve a number of risks and

uncertainties that are difficult to predict and are not guarantees

of future performance. Among the general factors that could cause

actual results and financial condition to differ materially from

estimated results and financial condition are those factors listed

in periodic reports filed by Kemper with the Securities and

Exchange Commission (“SEC”). The COVID-19 outbreak and subsequent

global pandemic (“Pandemic”) is an extraordinary event that creates

unique uncertainties and risks. Kemper cannot provide any

assurances as to the impacts of the Pandemic and related economic

conditions on the Company’s operating and financial results.

No assurances can be given that the results and financial

condition contemplated in any forward-looking statements will be

achieved or will be achieved in any particular timetable. Kemper

assumes no obligation to publicly correct or update any

forward-looking statements as a result of events or developments

subsequent to the date of this press release, including any such

statements related to the Pandemic. The reader is advised, however,

to consult any further disclosures Kemper makes on related subjects

in its filings with the SEC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210429006043/en/

Investors: Christine Patrick 312.661.4803 or cpatrick@kemper.com Media: Barbara Ciesemier

312.661.4521 or bciesemier@kemper.com

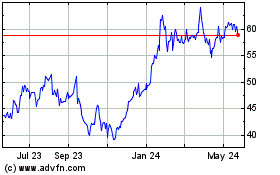

Kemper (NYSE:KMPR)

Historical Stock Chart

From Oct 2024 to Nov 2024

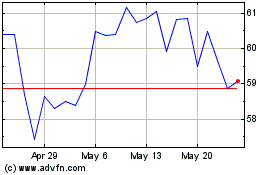

Kemper (NYSE:KMPR)

Historical Stock Chart

From Nov 2023 to Nov 2024