UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 20, 2023

MAGELLAN MIDSTREAM PARTNERS, L.P.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| Delaware |

|

1-16335 |

|

73-1599053 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

One Williams Center

Tulsa, Oklahoma 74172

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code (918) 574-7000

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of Each Class |

|

Trading

Symbol(s) |

|

Name of Each Exchange

on Which Registered |

| Common Units |

|

MMP |

|

New York Stock Exchange |

| Item 7.01 |

Regulation FD Disclosure. |

On June 20, 2023, Magellan Midstream Partners, L.P. (NYSE: MMP), a Delaware limited partnership (“Magellan”), published an investor

presentation to its website (www.magellanlp.com). The presentation is available from Magellan’s website under the “Investors” tab.

On June 20, 2023, Magellan distributed and published to its website a presentation and list of frequently asked questions (“FAQs”)

relating to Magellan’s proposed merger with ONEOK, Inc., an Oklahoma corporation (NYSE: ONEOK) (“ONEOK”), pursuant to that certain Agreement and Plan of Merger (the “Merger Agreement”), dated May 14, 2023,

by and among Magellan, ONEOK and Otter Merger Sub, LLC, a Delaware limited liability company and a wholly owned subsidiary of ONEOK. Copies of the presentation and FAQs are attached hereto as Exhibit 99.1 and Exhibit 99.2, respectively, and are

incorporated herein by reference.

Cautionary Statement Regarding Forward-Looking Statements

This report includes “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended and

Section 21E of the Securities and Exchange Act of 1934, as amended. All statements, other than statements of historical fact, included in this report that address activities, events or developments that ONEOK or Magellan expects, believes or

anticipates will or may occur in the future are forward-looking statements. Words such as “estimate,” “project,” “predict,” “believe,” “expect,” “anticipate,” “potential,”

“create,” “intend,” “could,” “would,” “may,” “plan,” “will,” “guidance,” “look,” “goal,” “future,” “build,” “focus,”

“continue,” “strive,” “allow” or the negative of such terms or other variations thereof and words and terms of similar substance used in connection with any discussion of future plans, actions, or events identify

forward-looking statements. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements include, but are not limited to, statements regarding the proposed transaction between ONEOK

and Magellan (the “proposed transaction”), the expected closing of the proposed transaction and the timing thereof and as adjusted descriptions of the post-transaction company and its operations, strategies and plans, integration, debt

levels and leverage ratio, capital expenditures, cash flows and anticipated uses thereof, synergies, opportunities and anticipated future performance, including maintaining current ONEOK management, enhancements to investment-grade credit profile,

an expected accretion to earnings and free cash flow, dividend payments and potential repurchases, increase in value of tax attributes and expected impact on EBITDA. Information adjusted for the proposed transaction should not be considered a

forecast of future results. There are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements included in this report. These include the risk that ONEOK’s and Magellan’s

businesses will not be integrated successfully; the risk that cost savings, synergies and growth from the proposed transaction may not be fully realized or may take longer to realize than expected; the risk that the credit ratings of the combined

company or its subsidiaries may be different from what the companies expect; the possibility that shareholders of ONEOK may not approve the issuance of new shares of ONEOK common stock in the proposed transaction or that shareholders of ONEOK or

unitholders of Magellan may not approve the proposed transaction; the risk that a condition to closing of the proposed transaction may not be satisfied, that either party may terminate the Merger Agreement or that the closing of the proposed

transaction might be delayed or not occur at all; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the proposed transaction; the risk that the parties do

not receive regulatory approval of the proposed transaction; the occurrence of any other event, change or other circumstances that could give rise to the termination of the Merger Agreement; the risk that ONEOK may not be able to secure the debt

financing necessary to fund the cash consideration required for the proposed transaction; the risk that changes in ONEOK’s capital structure and governance could have adverse effects on the market value of its securities; the ability of ONEOK

and Magellan to retain customers and retain and hire key personnel and maintain relationships with their suppliers and customers and on ONEOK’s and Magellan’s operating results and business generally; the risk the proposed transaction

could distract management from ongoing business operations or cause ONEOK and/or Magellan to incur substantial costs; the risk of any litigation relating to the proposed transaction; the risk that ONEOK may be unable to reduce expenses or access

financing or liquidity; the impact of the COVID-19 pandemic, any related economic downturn and any related substantial decline in commodity prices; the risk of changes in governmental regulations or

enforcement practices, especially with respect to environmental, health and safety matters; and other important factors that could cause actual results to differ materially from those projected. All such

2

factors are difficult to predict and are beyond ONEOK’s or Magellan’s control, including those detailed in ONEOK’s Annual Reports on Form

10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that are available on ONEOK’s website at www.oneok.com

and on the website of the Securities and Exchange Commission (the “SEC”) at www.sec.gov, and those detailed in Magellan’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that are available on Magellan’s website at www.magellanlp.com and on the website of the SEC. All forward-looking statements

are based on assumptions that ONEOK and Magellan believe to be reasonable but that may not prove to be accurate. Any forward-looking statement speaks only as of the date on which such statement is made, and neither ONEOK nor Magellan undertakes any

obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law. Readers are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date hereof.

No Offer or Solicitation

This report is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any

securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any

such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Important Additional Information Regarding the Merger Will Be Filed with the SEC and Where to Find It

In connection with the proposed transaction between ONEOK and Magellan, ONEOK intends to file with the SEC a registration statement on Form S-4 (the “Registration Statement”) to register the shares of ONEOK’s common stock to be issued in connection with the proposed transaction. The Registration Statement will include a document that

serves as a prospectus of ONEOK and joint proxy statement of ONEOK and Magellan (the “joint proxy statement/prospectus”), and each party will file other documents regarding the proposed transaction with the SEC. INVESTORS AND SECURITY

HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, AND OTHER RELEVANT DOCUMENTS FILED BY ONEOK AND MAGELLAN WITH THE SEC BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION ABOUT ONEOK AND MAGELLAN, THE PROPOSED TRANSACTION, THE RISKS RELATED THERETO AND RELATED MATTERS.

After the Registration

Statement has been declared effective, a definitive joint proxy statement/prospectus will be mailed to shareholders of ONEOK and unitholders of Magellan. Investors will be able to obtain free copies of the Registration Statement and the joint proxy

statement/prospectus, as each may be amended from time to time, and other relevant documents filed by ONEOK and Magellan with the SEC (when they become available) through the website maintained by the SEC at www.sec.gov. Copies of documents filed

with the SEC by ONEOK, including the joint proxy statement/prospectus (when available), will be available free of charge from ONEOK’s website at www.oneok.com under the “Investors” tab. Copies of documents filed with the SEC by

Magellan, including the joint proxy statement/prospectus (when available), will be available free of charge from Magellan’s website at www.magellanlp.com under the “Investors” tab.

Participants in the Solicitation

ONEOK and certain of

its directors, executive officers and other members of management and employees, Magellan, and certain of the directors, executive officers and other members of management and employees of Magellan GP, LLC, which manages the business and affairs of

Magellan, may be deemed to be participants in the solicitation of proxies from ONEOK’s shareholders and the solicitation of proxies from Magellan’s unitholders, in each case with respect to the proposed transaction. Information about

ONEOK’s directors and executive officers is available in ONEOK’s Annual Report on Form 10-K for the 2022 fiscal year filed with the SEC on February 28, 2023 and its definitive proxy statement

for the 2023 annual meeting of stockholders filed with the SEC on April 5, 2023, and in the joint proxy statement/prospectus (when available). Information about Magellan’s directors and executive officers is available in its Annual Report

on Form 10-K for the 2022 fiscal year and its definitive proxy statement for the 2023 annual meeting of unitholders, each filed with the SEC on February 21, 2023, and the joint proxy statement/prospectus

(when available). Other information regarding the participants in the solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the

3

Registration Statement, the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when they become available. Shareholders of

ONEOK, unitholders of Magellan, potential investors and other readers should read the joint proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions.

| Item 9.01. |

Financial Statements and Exhibits. |

|

|

|

| 99.1 |

|

Presentation of Magellan Midstream Partners, L.P. dated June 20, 2023. |

|

|

| 99.2 |

|

Magellan Midstream Partners, L.P. Frequently Asked Questions dated June 20, 2023. |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

4

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Magellan Midstream Partners, L.P. |

|

|

|

|

|

|

|

|

By: |

|

Magellan GP, LLC, |

|

|

|

|

|

|

its general partner |

|

|

|

|

| Date: June 20, 2023 |

|

|

|

By: |

|

/s/ Jeff L. Holman |

|

|

|

|

Name: |

|

Jeff L. Holman |

|

|

|

|

Title: |

|

Executive Vice President, Chief Financial Officer and Treasurer |

ONEOK Merger Considerations June 2023

NYSE: MMP | magellanlp.com Exhibit 99.1

Cautionary statements CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS: This presentation includes “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities and Exchange Act of

1934, as amended. All statements, other than statements of historical fact, included in this presentation that address activities, events or developments that ONEOK, Inc. (“ONEOK” or “OKE”) or Magellan Midstream Partners,

L.P. (“Magellan” or “MMP”) expects, believes or anticipates will or may occur in the future are forward-looking statements. Words such as “estimate,” “project,” “predict,”

“believe,” “expect,” “anticipate,” “potential,” “create,” “intend,” “could,” “would,” “may,” “plan,” “will,”

“guidance,” “look,” “goal,” “future,” “build,” “focus,” “continue,” “strive,” “allow” or the negative of such terms or other variations

thereof and words and terms of similar substance used in connection with any discussion of future plans, actions, or events identify forward-looking statements. However, the absence of these words does not mean that the statements are not

forward-looking. These forward-looking statements include, but are not limited to, statements regarding the proposed transaction between ONEOK and Magellan (the “proposed transaction”), the expected closing of the proposed transaction

and the timing thereof and as adjusted descriptions of the post-transaction company and its operations, strategies and plans, integration, debt levels and leverage ratio, capital expenditures, cash flows and anticipated uses thereof, synergies,

opportunities and anticipated future performance, including maintaining current ONEOK management, enhancements to investment-grade credit profile, an expected accretion to earnings and free cash flow, dividend payments and potential repurchases,

increase in value of tax attributes and expected impact on EBITDA. Information adjusted for the proposed transaction should not be considered a forecast of future results. There are a number of risks and uncertainties that could cause actual results

to differ materially from the forward-looking statements included in this presentation. These include the risk that ONEOK’s and Magellan’s businesses will not be integrated successfully; the risk that cost savings, synergies and growth

from the proposed transaction may not be fully realized or may take longer to realize than expected; the risk that the credit ratings of the combined company or its subsidiaries may be different from what the companies expect; the possibility that

shareholders of ONEOK may not approve the issuance of new shares of ONEOK common stock in the proposed transaction or that shareholders of ONEOK or unitholders of Magellan may not approve the proposed transaction; the risk that a condition to

closing of the proposed transaction may not be satisfied, that either party may terminate the merger agreement relating to the proposed transaction or that the closing of the proposed transaction might be delayed or not occur at all; potential

adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the proposed transaction; the risk that the parties do not receive regulatory approval of the proposed transaction;

the occurrence of any other event, change, or other circumstances that could give rise to the termination of the merger agreement relating to the proposed transaction; the risk that ONEOK may not be able to secure the debt financing necessary to

fund the cash consideration required for the proposed transaction; the risk that changes in ONEOK’s capital structure and governance could have adverse effects on the market value of its securities; the ability of ONEOK and Magellan to retain

customers and retain and hire key personnel and maintain relationships with their suppliers and customers and on ONEOK’s and Magellan’s operating results and business generally; the risk the proposed transaction could distract management

from ongoing business operations or cause ONEOK and/or Magellan to incur substantial costs; the risk of any litigation relating to the proposed transaction; the risk that ONEOK may be unable to reduce expenses or access financing or liquidity; the

impact of the COVID-19 pandemic, any related economic downturn and any related substantial decline in commodity prices; the risk of changes in governmental regulations or enforcement practices, especially with respect to environmental, health and

safety matters; and other important factors that could cause actual results to differ materially from those projected. All such factors are difficult to predict and are beyond ONEOK’s or Magellan’s control, including those detailed in

ONEOK’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that are available on ONEOK’s website at www.oneok.com and on the website of the Securities and Exchange Commission (the

“SEC”) at www.sec.gov, and those detailed in Magellan’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that are available on Magellan’s website at www.magellanlp.com and on the

website of the SEC. All forward-looking statements are based on assumptions that ONEOK and Magellan believe to be reasonable but that may not prove to be accurate. Any forward-looking statement speaks only as of the date on which such statement is

made, and neither ONEOK nor Magellan undertakes any obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law. Readers are cautioned not to

place undue reliance on these forward-looking statements, which speak only as of the date hereof. NON-GAAP FINANCIAL MEASURES: This presentation contains references to certain non-GAAP financial measures. The non-GAAP financial measures presented

may not provide information that is directly comparable to that provided by other companies, as other companies may calculate such financial results differently. ONEOK’s or Magellan’s non-GAAP financial measures are not measurements of

financial performance under GAAP and should not be considered as alternatives to amounts presented in accordance with GAAP. ONEOK or Magellan views these non-GAAP financial measures as supplemental and they are not intended to be a substitute for,

or superior to, the information provided by GAAP financial results.

Cautionary statements (cont’d)

NO OFFER OR SOLICITATION: This presentation is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor

shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made

except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. IMPORTANT ADDITIONAL INFORMATION REGARDING THE MERGER WILL BE FILED WITH THE SEC AND WHERE TO FIND IT: In connection with the proposed

transaction between ONEOK and Magellan, ONEOK intends to file with the SEC a registration statement on Form S-4 (the “Registration Statement”) to register the shares of ONEOK’s common stock to be issued in connection with the

proposed transaction. The Registration Statement will include a document that serves as a prospectus of ONEOK and joint proxy statement of ONEOK and Magellan (the “joint proxy statement/prospectus”), and each party will file other

documents regarding the proposed transaction with the SEC. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, AND OTHER

RELEVANT DOCUMENTS FILED BY ONEOK AND MAGELLAN WITH THE SEC BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT ONEOK AND MAGELLAN, THE PROPOSED TRANSACTION, THE RISKS RELATED THERETO AND RELATED MATTERS. After the Registration Statement has been

declared effective, a definitive joint proxy statement/prospectus will be mailed to shareholders of ONEOK and unitholders of Magellan. Investors will be able to obtain free copies of the Registration Statement and the joint proxy

statement/prospectus, as each may be amended from time to time, and other relevant documents filed by ONEOK and Magellan with the SEC (when they become available) through the website maintained by the SEC at www.sec.gov. Copies of documents filed

with the SEC by ONEOK, including the joint proxy statement/prospectus (when available), will be available free of charge from ONEOK’s website at www.ONEOK.com under the “Investors” tab. Copies of documents filed with the SEC by

Magellan, including the joint proxy statement/prospectus (when available), will be available free of charge from Magellan’s website at www.magellanlp.com under the “Investors” tab. PARTICIPANTS IN THE SOLICITATION: ONEOK and

certain of its directors, executive officers and other members of management and employees, Magellan, and certain of the directors, executive officers and other members of management and employees of Magellan GP, LLC, which manages the business and

affairs of Magellan, may be deemed to be participants in the solicitation of proxies from ONEOK’s shareholders and the solicitation of proxies from Magellan’s unitholders, in each case with respect to the proposed transaction.

Information about ONEOK’s directors and executive officers is available in ONEOK’s Annual Report on Form 10-K for the 2022 fiscal year filed with the SEC on February 28, 2023 and its definitive proxy statement for the 2023 annual meeting

of stockholders filed with the SEC on April 5, 2023, and in the joint proxy statement/prospectus (when available). Information about Magellan’s directors and executive officers is available in its Annual Report on Form 10-K for the 2022 fiscal

year and its definitive proxy statement for the 2023 annual meeting of unitholders, each filed with the SEC on February 21, 2023, and the joint proxy statement/prospectus (when available). Other information regarding the participants in the

solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Registration Statement, the joint proxy statement/prospectus and other relevant materials to be filed with the SEC

regarding the proposed transaction when they become available. Shareholders of ONEOK, unitholders of Magellan, potential investors and other readers should read the joint proxy statement/prospectus carefully when it becomes available before making

any voting or investment decisions. NO ADVICE: This presentation has been prepared for informational purposes only and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. Magellan unitholders should consult

their own tax and other advisors before making any decisions regarding the proposed transaction.

Rationale for Recommending

Merger

Key points 1 Based on May 12, 2023

closing prices (the trading day prior to announcement of the transaction). ONEOK to acquire MMP in a stock-and-cash transaction: 0.667 shares of OKE + $25.00 cash Represents $67.50 per MMP unit and a 22% premium at announcement1 Captures a full

value today for MMP unitholders that will be difficult to achieve otherwise Premium reflects a robust outlook for MMP’s business not appreciated by the market Results in ~23% ownership in a premier energy infrastructure business with greater

growth potential, asset diversity and scale as well as $200-$400mm+ of annual synergies expected Cash portion of consideration provides immediate proceeds at a fixed value (37% of total)1 Attractive timing from a tax perspective as long-tenured

unitholders are approaching a sharp increase in annual taxes owed Transaction does not create new taxes except those resulting from the premium Annual taxes estimated to increase by >100% for long-tenured holders to ~60% of distributions within a

few years (see slides 12-13) See also the Magellan-ONEOK Merger FAQ for Magellan Unitholders for additional information, available on the investor relations section of our website at www.magellanlp.com/investors/webcasts.aspx

We believe the value created for MMP

unitholders by ownership in the combined entity together with the cash consideration exceeds the expected value that MMP unitholders could likely capture through ownership in MMP standalone, including after taking taxes into consideration1 1 Except

as noted, market data is as of 5/12/2023 (the last trading date prior to announcement). We recognize that the prices of both MMP and OKE will continue to fluctuate prior to the closing of the merger, which we believe is normal following the

announcement of transactions such as this one. However, for purposes of the calculations contained herein, we are utilizing the $63.72 value at the time of announcement for OKE shares (except as noted), which we believe is well within the range of

OKE’s fair value and recent trading levels prior to announcement, and assuming that the current merger arbitrage dynamic is closed as the transaction approaches closing (and so that MMP’s value per unit at closing is $67.50). We further

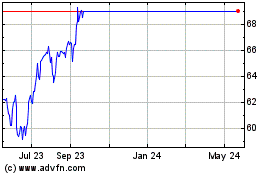

believe OKE shares will become more valuable as a result of the pending transaction. Support the merger: opportunity to capture Magellan’s full value OKE Reference Price1 ANNOUNCE- MENT OKE CURRENT (6/16/23) MEDIAN PRICE TARGET YTD AVERAGE

30-DAY VWAP 52-WEEK LOW 52-WEEK HIGH OKE Share Price $63.72 $60.95 $73.00 $66.08 $64.88 $50.58 $70.93 Implied Offer Value to Magellan Unitholders $67.50 $65.65 $73.69 $69.08 $68.27 $58.74 $72.31 MMP Reference Price (as of 5/12/23) $55.41

$55.41 $59.00 $53.68 $55.19 $45.69 $56.60 Implied Premium to Magellan Unitholders 22% 18% 25% 29% 24% 29% 28%

Enhances organic growth while

mitigating standalone risks Strategic Advantages of Combined Entity Risks of Proceeding Standalone Significantly greater growth potential S&P 500 index inclusion, providing improved shareholder liquidity Platform for greater capital deployment

at attractive returns Enhanced resilience and better positioning to adapt to evolving energy industry Significant opportunity for operational and commercial synergies Large-scale diversification which has proven challenging standalone Ongoing return

of capital through substantial dividends and potential repurchases Strong balance sheet and financial flexibility, retaining investment grade credit Core refined products business is mature with reduced growth opportunities relative to history Risks

of energy transition impacting petroleum product demand over time more than we expect Managing re-contracting / pricing risks around excess crude oil infrastructure capacity Challenges identifying significant organic growth opportunities at

acceptable risk adjusted returns Competitive M&A / auction environment for acquisition opportunities Large-scale growth / M&A requires issuing equity that has been consistently undervalued Sector-leading capital discipline adds value but

also lowers unitholder allocable depreciation and thereby increases unitholder taxes Share repurchases increase value per unit but also lead to higher income per unit thereby raising unitholder taxes

Tax Considerations

Tax considerations for Magellan

unitholders The proposed transaction is a taxable event for MMP unitholders Unitholders’ taxable gain will be calculated based on the value of both the equity and cash received However, other than establishing the timing of the taxable event

and delivering a premium to market that we believe captures MMP’s intrinsic (fair) value, the transaction is not altering unitholders’ existing tax liability1 The return on MMP’s units – like that of all MLPs – is

tax-deferred, not tax free1 The question is generally when, not if, taxes are paid Generally, unitholders owe taxes both: 1) during the period they own units, based on the income (not the distributions) they are allocated from the partnership and 2)

when they sell their units The after-tax cash flow to unitholders can be described as: 1) the cash distributions received each year less the cash taxes owed on allocated income, plus 2) the proceeds upon sale of their units less the cash taxes owed

on such sale Unitholders may minimize existing tax liability through the basis step-up available on transfer of units to heirs upon death However, the further out in time this event occurs, the lower its present value, as in the meantime the

unitholder will owe taxes each year on their share of allocated income Based on historical trading patterns, we believe about 60% of MMP units turn over every 3-5 years – so most unitholders are not holding their units indefinitely We do not

believe the majority of MMP unitholders expect us to manage the company as if all unitholders would hold their units indefinitely 1 While unitholders who plan to transfer units to heirs may minimize tax liability on a future sale, they will still

incur taxes on any income allocated to them while holding units. When evaluating the after-tax merits of the transaction, any complete analysis must compare the after-tax consequences of the transaction with the present value of the after-tax

consequences of the status quo alternative

Tax situation of Magellan

unitholders varies by trade group MMP units belong to “trade groups” that share the month when, and the price at which, they were purchased Unitholders are allocated depreciation each year based primarily on a combination of the price at

which their units were purchased (i.e., how much depreciable basis they started with), and when they were purchased (i.e., how much depreciation has already been allocated to them) The more depreciation that is allocated to each unitholder, the

lower that unitholder’s taxable income each year A unitholder’s basis in an MMP unit generally goes up (down) with the share of income (loss) allocated to that unit, and down by the distributions paid to that unit By lowering a

unitholder’s taxable income, then, depreciation lowers the unitholder’s basis in that unit, thereby increasing the unitholder’s realized gain on eventual sale of that unit 1 This unique tax situation is before accounting for

additional characteristics (tax status, tax bracket, etc.) unique to unitholders within each trade group. As a result, each trade group has a unique tax situation1, both each year (in terms of their share of MMP’s annual taxable income) and

upon any potential sale of units Most MMP units have been owned for a relatively short amount of time MMP management endeavors to make decisions in the best interest of unitholders taken as a whole, given the varied tax positions across our

unitholder base In practice, this means focusing on the fundamental value of the company, vs. the return to any particular trade group

Tax impact of the pending merger

Unitholders generally have an existing deferred tax liability due to the accumulated impact on their tax basis of the historical income/depreciation allocations and distributions, as discussed on the prior slide This deferred tax liability will be

recognized whenever a unit is sold, and generally will grow over time Assumes 06/30/2023 close, maximum federal tax rate, 20% (199A) deduction on partnership income, 5% state rate, ACA tax of 3.8% and $67.50 value at closing. Further, the idea of

comparing the total taxes owed by MMP unitholders on the transaction (~$2.7bn) to the present value of the tax savings that OKE estimates it will receive from the transaction (~$1.5bn) is equally unsound. That logic assumes all MMP unitholders would

die essentially immediately and thereby avoid all of the deferred tax liability they have incurred. Excluding this transaction, most of that ~$2.7bn (except ~$0.7bn generated by the premium offered) would have been realized eventually in any event,

along with additional taxes on future income. The “Gain/Loss Calculator” available at https://www.taxpackagesupport.com/MMP can be used to determine a preliminary estimate of the potential gain as of 12/31/22 (including the allocation

between ordinary income and capital gains) on the sale of your units; however, this tool will not show the increasing estimated taxes you would owe over time from continuing to hold your MMP units, as described on the next page. Comparing the

after-tax proceeds of the transaction with the pre-tax trading price of an MMP unit ignores the unavoidable fact that a unitholder could monetize any trading price only by selling that unit and realizing its existing deferred tax liability Comparing

the premium received to taxes owed is similarly misguided, and for similar reasons 2 A more meaningful and more valid comparison is with the after-tax proceeds a unitholder could have received absent the pending transaction (see table above) The

pre-deal “net proceeds” (highlighted column in table above) reflects the net value of a unitholder’s investment, after accounting for deferred tax liabilities 3 The primary tax impact of the transaction (other than the premium) is

simply when deferred tax liabilities are realized Aside from timing considerations, the transaction does not affect the amount of that deferred tax liability The transaction premium increases a unitholder’s overall tax liability to reflect a

higher gain than a unitholder would have incurred absent the transaction (as would be the case with any premium) Sale at $55.41 (5/12 closing price) Sale at close of merger, $67.50 Increase in net proceeds Approx. taxes owed 1 Wtd Avg. Approx. taxes

owed 1 Wtd Avg. Holding period Range Wtd Avg Net Proceeds Range Wtd Avg Net Proceeds < 5 years $2.50-$11 $ 6.18 $49.23 $5.75-$14.50 $ 9.81 $57.69 $8.46 Between 5-10 years $1.50-$17.75 $ 6.89 $48.52 $6-$22 $ 11.50 $56.00 $7.48 > 10 years

$19-$21 $ 20.50 $34.91 $22-$24.50 $ 23.99 $43.51 $8.60 Average, all periods $1.50-$21 $ 9.69 $45.72 $5.75-$24.50 $ 13.40 $54.10 $8.38

2023E 2026E 2029E Distrib. Rec'd1

Projected income1 Est. tax1 Net cash flow Distrib. Rec'd1 Projected income1 Est. tax1 Net cash flow Distrib. Rec'd1 Projected income1 Est. tax1 Net cash flow Trade group February '01 $ 4.20 $ 3.29 $ 1.26 $ 2.94 $ 4.33 $ 5.28 $ 2.56 $ 1.77 $ 4.46 $

5.21 $ 2.52 $ 1.94 February '11 $ 4.20 $ 2.13 $ 0.82 $ 3.38 $ 4.33 $ 5.25 $ 2.54 $ 1.79 $ 4.46 $ 5.20 $ 2.52 $ 1.94 February '21 $ 4.20 $ (1.07) NA $ 4.20 $ 4.33 $ 1.97 $ - $ 4.33 $ 4.46 $ 2.60 $ 1.26 $ 3.20 Tax impact of ongoing ownership of

Magellan units (status quo) MMP unitholders may hope to avoid realizing their deferred tax liability by not selling their units – but they will continue to owe taxes each year on their allocated share of MMP’s income (not distributions)

Units that have enjoyed many years of tax deferral from depreciation deductions already have a low remaining tax basis This low remaining tax basis provides little remaining opportunity for depreciation to “shield” their share of

MMP’s income, resulting in significant and growing ongoing taxes owed each year and as a result lower after-tax income 1 Projections assume 1%/year distribution growth, 5% state income tax, ACA tax of 3.8%, maximum federal income tax rate and

current law (including 20% 199A deduction on partnership income until expiration at end of 2025 and increase of personal rate to 39.6% in 2026). Share of projected income calculated based on current units outstanding (i.e. excludes additional

repurchases, which would further increase income allocated per unit). Projected income figures illustrative only and do not represent guidance, and are net of unitholder’s specific allocated depreciation. Earlier trade groups have little tax

basis remaining to depreciate, which means the income allocated to them, and the taxes they owe each year, are already significant (~30% of 2023’s ~$4.20 distribution) Based on MMP’s current rate of distribution growth, taxes owed for

units in earliest trade group are estimated to equate to nearly 60% of the distribution within 3 years Unitholders from “middle-aged” trade groups, who currently still have moderate tax basis and “shield” remaining, will soon

experience taxes similar to those incurred by the earliest trade groups, as their depreciable basis dwindles Unitholders of more recent vintage still have significant tax basis to shield their income, resulting in no current tax liability and

suspended losses that can later be used to offset income; they currently also have lower taxes upon a sale. Their situation will change over time, however, ultimately following a similar pattern to earlier trade groups

Tax impact: comparing pending

transaction vs. status quo The impact of the taxes unitholders will owe as a result of the income allocated to them each year is significant relative to the overall value of owning MMP units (potentially as significant as the taxes owed upon a sale

of units) This amount must be considered when comparing the value of holding units against alternative scenarios 1 Any such analysis involves significant uncertainties regarding future business performance, appropriate discount rates and

methodologies. “Upside” cases could of course be used to arrive at conclusions favoring holding, while “downside” cases could result in conclusions more strongly favoring selling; similar dynamics could result from using

different discount rates. Our analysis used assumptions consistent with the ongoing evaluation of MMP’s intrinsic (fair) value that we use to inform our buyback decisions. As part of our evaluation of the merits of the pending transaction, we

estimated the after-tax cash flows across a range of trade groups, and compared the present value to those groups of continuing to hold MMP units with the after-tax value of the pending transaction Our analysis assumed an extended holding period1,

and did not attempt to incorporate the possibility of step-up upon inheritance The long-dated nature of the analysis minimized the impact of the trade off between sale/inheritance In any case, as already noted, trading patterns suggest most

unitholders do not hold their units until death Even those unitholders who are planning on such a basis step-up should consider whether the after-tax cash flows from ownership up until the time of that basis step-up will not more than offset the tax

avoidance value of the step-up Only unitholders who expect to enjoy such a basis step-up relatively soon can be confident of a net positive result The longer the period of time until this date also carries many other uncertainties We estimated that

the after-tax value of the transaction across trade groups was generally superior to that of continuing to hold MMP units1 The present values in both scenarios were inversely related to how long the units have been owned Units that have been held

for longer periods of time generally had higher taxes due on the merger but also hold a higher present value of the ongoing tax burden from ownership Units that have been held for less time generally had lower taxes due on the merger but also hold a

lower present value of the ongoing tax burden from ownership

Tax impact: pending transaction vs.

other alternatives Unitholders who want to continue deferring their tax liability on MMP units for longer should consider whether it is likely that their after-tax proceeds at a future date will be higher As already noted, their deferred tax

liability is generally expected to grow, not decrease, with time (unless they already have a low remaining depreciable basis, which means their current income and taxes are already high) In the meantime, unitholders will continue to owe taxes each

year on their share of MMP’s income Given management’s view that MMP has been consistently undervalued in the public equity market compared to its intrinsic (fair) value, and that management believes that the transaction captures

MMP’s fair long-term value, a unitholder hoping to capture greater value by selling at a future date will have to also hope that MMP’s equity will be re-rated by the market for some reason One cannot assume that a premium comparable to

that currently offered will be available at a future date Vs. conversion to a corporation MMP could convert to a c-corp, thereby allowing unitholders who subsequently sold their stock to incur gains that would be characterized entirely as capital,

as opposed to partly ordinary income and partly capital Capital gains currently have a federal rate of 20.0%, while the current maximum personal rate on partnership income is approximately 29.6% (max. federal personal rate of 37% times 80%, to

reflect 20% deduction for partnership income), resulting in a lower all-in tax rate from selling a c-corp vs. a partnership interest However, such an approach to achieve a lower effective tax rate upon sale would forego at least a portion of the

premium offered in the merger Similarly, as part of our evaluation of the proposal, we considered tax-deferred merger structures, and determined that they were likely to result in a decrease in net proceeds to MMP unitholders as a whole MMP could

convert to a c-corp and unitholders could continue to hold their stock, thereby continuing to defer their deferred gain on sale and avoiding taxes on their share of MMP’s income That option results in MMP incurring significant taxes at the

corporate level (would soon be a full-tax payer with diminishing depreciation shield), and unitholders paying taxes on the dividends they receive It is difficult to predict the impact on MMP’s valuation from such an approach; it could be a

good option in the absence of the pending transaction, depending on, among other things, changes in tax policy Management believes this option involves more risk and uncertainty than the pending transaction Vs. continuing to own MMP for now and

selling later

Key conclusion If an MMP

unitholder plans to sell their units in the future, they will face a similar tax outcome at that time, but this future price is naturally uncertain and cannot be assumed to reflect a premium comparable to that offered in the pending merger MMP

unitholders who plan to hold their units for many years to come would face growing tax liability, regardless of the proposed transaction The present value of these future taxes should be compared with the taxes unitholders would incur as a result of

the proposed transaction MMP unitholders who continue to own stock in the new combined company are expected to benefit from significantly improved diversification and scale, higher growth, increased resilience and synergies, while continuing to

enjoy strong free cash flow generation and a healthy dividend While any evaluation of the transaction must rely on estimates about future performance and developments that are uncertain, our recommendation of the transaction reflects our belief that

the value created by this transaction for MMP unitholders is superior to the value of the standalone alternative, including on an after-tax basis The Pending Transaction Maximizes Value and is in all Unitholders’ Best

Interests

Exhibit 99.2

Magellan-ONEOK Merger FAQ for Magellan Unitholders

June 2023

This FAQ provides additional information

regarding Magellan’s rationale for believing that the ONEOK merger maximizes value for and is in the best interests of unitholders. The Magellan Board took into account these considerations in reaching its decision to unanimously approve and

recommend the merger. Magellan also encourages investors to review the accompanying presentation, available on the investor relations section of our website at www.magellanlp.com/investors/webcasts.aspx.

Key Points

| |

• |

|

ONEOK to acquire Magellan in

stock-and-cash transaction: 0.667 shares of ONEOK + $25.00 cash |

| |

• |

|

Represents $67.50 per Magellan unit and a 22% premium at announcement |

| |

• |

|

Captures a full value today for Magellan unitholders that will be difficult to achieve otherwise

|

| |

• |

|

Premium reflects robust outlook for Magellan’s business not appreciated by the market

|

| |

• |

|

Results in ~23% ownership in a premier energy infrastructure business with greater growth potential,

asset diversity and scale as well as $200-$400+ million of annual synergies expected |

| |

• |

|

Cash portion of consideration provides immediate proceeds at fixed value (37% of total)

|

| |

• |

|

Attractive timing from a tax perspective as long-tenured unitholders are approaching a sharp increase in

annual taxes owed |

| |

• |

|

Transaction does not create new taxes except those resulting from the premium

|

| |

• |

|

Annual taxes are estimated to increase by >100% for long-tenured holders to ~60% of distributions within a

few years |

Benefits of the Transaction for Unitholders and Risks Associated with Continuing with Magellan’s Standalone Plan

| 1. |

Why is this transaction in the best interests of unitholders? |

| |

• |

|

The pending transaction delivers a very attractive and full value to Magellan unitholders (22% premium to May 12th Magellan closing price at announcement). |

| |

• |

|

Beyond the implied premium and cash consideration, the transaction also provides Magellan unitholders with the

opportunity to participate in potential future upside through approximately 23% ownership of the combined company. The combined company’s greater scale and earnings diversity position it for greater growth and value creation across industry

cycles as energy transition and the broader economy continue to evolve. |

| |

• |

|

We believe the combined company will have stronger growth prospects, be more resilient and deliver greater value

than Magellan or ONEOK could have delivered on a standalone basis. |

| |

• |

|

As the Magellan Board considered whether to approve the transaction, it carefully considered, among other things,

the tax implications of the transaction and the impact on Magellan unitholders. Ultimately the Board determined the opportunity in this transaction more than offsets the tax impact. |

| |

• |

|

For the vast majority of unitholders, we expect the cash portion of the consideration to more than cover the

federal tax owed. |

1

| 2. |

Why does Magellan believe that the combined company will provide superior value over the long-term compared

to Magellan remaining independent and pursuing its own path? |

| |

• |

|

In addition to delivering premium value to Magellan unitholders, we believe the combined company will have

stronger growth prospects, be more resilient and deliver greater value than Magellan or ONEOK could have delivered on a standalone basis. |

| |

• |

|

Magellan believes diversifying into other products, particularly NGLs and natural gas, will generate continued

value and growth, as well as strengthen resilience across industry cycles. Diversifying organically would be challenging given existing competitors and had Magellan sought to use acquisitions to diversify, it likely would have required a largescale

transaction, with a premium, and potential use of Magellan’s undervalued equity. The combination provides significant scale and diversification while capturing a premium, vs. paying one. |

| |

• |

|

The combined company will be well positioned to generate value over the long term: |

| |

• |

|

Creates significant opportunities for operational and commercial synergies. |

| |

• |

|

Strengthens resilience across industry cycles. |

| |

• |

|

Significantly enhances growth potential, while retaining strong free cash flow and a commitment to capital

returns and dividends. |

| |

• |

|

Maintains strong balance sheet and financial flexibility. |

| |

• |

|

Provides inclusion in the S&P 500 index, providing improved shareholder liquidity. |

| |

• |

|

Creates platform for capital deployment at attractive returns on capital. |

| |

• |

|

There are also a number of risks associated with continuing as a standalone company over the long term:

|

| |

• |

|

The core refined products business is mature, and there are challenges to growing Magellan’s significant

existing market position. |

| |

• |

|

There is a risk of the energy transition impacting refined petroleum product demand more than we expect.

|

| |

• |

|

Increasingly limited organic growth opportunities at acceptable risk adjusted returns. |

| |

• |

|

Pricing and re-contracting risks associated with excess crude

infrastructure capacity. |

| |

• |

|

There are challenges with diversifying through acquisitions at reasonable price points. |

| |

• |

|

In short, we have significant free cash flow, but there are increasing pressures to near-term organic growth

opportunities. This is likely to result in lower allocable depreciation and higher allocable taxable income to our unitholders, resulting in decreasing after-tax cash flow due to higher taxes. While Magellan

has increased its unit repurchases to optimize returns in this environment, these buybacks lead to fewer units outstanding, which in turn increases the tax burden for unitholders. |

| |

• |

|

We are confident that the combination delivers greater value to unitholders than Magellan is likely to achieve by

continuing to execute its standalone plan, including after taking taxes into consideration. |

2

| 3. |

Why do you believe now is the right time to complete this transaction? |

| |

• |

|

We regularly consider structural and strategic options to unlock value for our unitholders. Through the years,

these alternatives have included converting to a corporation, combining with other companies, creating joint ventures, buying assets and selling assets, among others. We have executed on some of these opportunities where we thought they were value

creating and in the best interests of unitholders. |

| |

• |

|

A potential combination with ONEOK has been considered from time to time over the years, given the clear

strategic and financial benefits of bringing our companies together. This time, the pieces came together and we were pleased to have reached an agreement that maximizes value for Magellan unitholders. |

| |

• |

|

Before unanimously approving this transaction, our Board considered the value delivered through the transaction

and the value of proceeding with our standalone plan, and also considered what other likely actionable paths forward might be available to us. Taking all of this into account and comparing those situations with the opportunity to combine with ONEOK,

we think the pending combination provides more value than the standalone potential in present value terms, even on an after-tax basis. We are confident the transaction is in the best interests of unitholders.

|

| 4. |

Why should I support this transaction if Magellan’s distributions are my primary reason for owning

Magellan? Won’t the combined entity deliver me lower income in the near term? |

| |

• |

|

We believe this transaction is in the best interests of all unitholders, including unitholders who invest in

Magellan primarily for the distribution stream. |

| |

• |

|

For investors focused primarily on the distribution stream, we would highlight: |

| |

• |

|

We expect the combined company to generate higher cash flows through synergies, with more potential to grow the

combined company’s dividend through time. |

| |

• |

|

The combined company’s more diversified assets across the NGL, natural gas, refined products and crude oil

segments will be more stable through time and thus less risky overall than Magellan on a standalone basis. |

| |

• |

|

The combined company will be able to generate more value than either Magellan or ONEOK could standalone because

of the greater scale, diversity, cost savings and other commercial opportunities. |

| |

• |

|

Further, the dividend received from the combined company will be taxed at the preferential dividend tax rate.

This tax rate will be lower than an increasing tax liability at ordinary income rates that our unitholders pay on the income we allocate to them, which will also increase as their tax depreciation shield declines. This point is further explained in

the Tax section of this FAQ (see especially question 8). This increasing taxable income dynamic is important: we estimate that long-tenured unitholders will soon owe taxes each year that are ~60% of the distributions they receive.

|

| |

• |

|

Combining all of these factors, we believe the pending transaction offers a superior value proposition for our

unitholders taken as a whole. We believe your after-tax income stream will be higher from the combined company than from Magellan as a standalone entity over time, and the combination reflects higher resulting

present value for Magellan unitholders, than from Magellan on a standalone basis. |

3

Tax Consideration for Unitholders

| 5. |

Magellan has stated that I already owe and will pay the vast majority of the taxes I would have to pay as a

result of this transaction. How is that the case and why do I owe these taxes? |

| |

• |

|

Returns on an investment in an MLP are tax deferred, not tax free. |

| |

• |

|

You owe these taxes because: |

| |

• |

|

1) The value of your units has appreciated in value while you have held them, or |

| |

• |

|

2) You have previously deferred taxable income and the IRS will collect the related deferred taxes at some point,

either while you continue to hold your units (in the form of higher taxable income allocated to you) or when you sell your units (when you will recognize a gain that will be characterized partly as capital, and partly as ordinary), or

|

| |

• |

|

3) For both of these reasons you will have taxable gains and income |

| |

• |

|

Simply put, when you sell your units, you will owe taxes on the appreciation in value of your units and on the

income that you have deferred from the moment you bought your units. |

| |

• |

|

Even if you don’t sell your units, there is a point in time when you will no longer be able to defer your

tax liability and the current taxes owed each year will increase, as your allocated income is expected to exceed your distributions and these distributions will effectively become largely taxable as ordinary income. |

| |

• |

|

The effect of this transaction is that your existing tax liability will be realized in the year of the

transaction, rather than over time or at some future sale date. |

| |

• |

|

We believe the value of the transaction, including the premium offered, is higher than the value we are likely

to achieve as a standalone company, and as such that you are economically better off. |

| 6. |

Why should I support a transaction that triggers a current tax payment? |

| |

• |

|

You should seek out specific tax advice because each unitholder will have a unique tax situation to consider.

However, the majority of any taxes owed in connection with this transaction are deferred taxes that would eventually be owed to the U.S. Treasury. |

| |

• |

|

Specifically, returns on an investment in an MLP are tax deferred, not tax free. Unitholders who will experience

a significant tax liability related to the transaction have previously benefited from significant tax deferral. Such deferral will be recognized eventually, either upon an eventual sale of Magellan units or over time as more income is allocated to

such unitholders as a result of their having little remaining depreciable tax basis. |

| |

• |

|

Given that this deferred tax liability already exists, it makes sense to support the transaction if you believe

the value received in the transaction is attractive – as the Magellan Board unanimously believes it is. Unless you pass your units to your heirs in the near future, you are going to pay the taxes eventually either through increasing taxes while

you hold the units or when you sell the units at some point in the future. |

| 7. |

Why should I support the transaction if the taxes I owe related to this transaction are greater than the

premium paid to me? |

| |

• |

|

We don’t believe that comparing any taxes owed to the premium received represents an accurate picture either

of the benefits of the pending transaction or of your tax situation in the absence of the transaction. You should compare the total after-tax outcome of this transaction with the after-tax value of your next best alternative. |

| |

• |

|

Comparing the taxes owed to the premium alone assumes that the taxes you owe related to the transaction are new

or incremental to what you otherwise would have owed. As noted above, the reality is that the majority of the taxes you owe as a result of this transaction would be owed whenever you sell your units, or over time for as long as you hold your units.

|

| |

• |

|

The difference in the case of this transaction is that you are receiving a premium above what we believe you

could otherwise realize. |

4

| |

• |

|

The “Gain/Loss Calculator” available at https://www.taxpackagesupport.com/MMP can be used to

determine a preliminary estimate of the potential gain as of 12/31/2022 (including the allocation between ordinary income and capital gains) on the sale of your units; however, this tool will not show the increasing estimated taxes you would owe

over time from continuing to hold your Magellan units. |

| 8. |

Why does Magellan believe that allocated income to unitholders and taxes owed will increase over time?

|

| |

• |

|

Given that your investment in Magellan represents a limited partner interest, it has (along with all other Master

Limited Partnerships) tax attributes that are specific to partnerships. One of those attributes is that you, as a partner, are allocated income based upon your specific ownership in the partnership, and this income is reported to you each year on a

Schedule K-1. Any income allocated to you increases your tax basis, while distributions paid to you and any losses allocated to you decrease your tax basis. |

| |

• |

|

Along with income being allocated to you, you are also allocated deductions, including tax depreciation, which

reduces the total taxable income allocated to you. Shortly after you purchase your units, your equity tax basis is essentially the fair market value of what you paid for the unit. Therefore, shortly after becoming a holder, you receive a relatively

large allocation of depreciation that is commensurate with your purchase price, which significantly reduces the total amount of income allocated to you, typically resulting in net losses that decrease your tax basis. |

| |

• |

|

Over time, as the distributions you receive from Magellan are higher than your allocated share of income, your

tax basis declines. Further, the amount of depreciation you are allocated also declines, ultimately leading to a lower tax basis and an increasing share of taxable income being allocated to you. The implications of this are significant: we

estimate that long-tenured unitholders will soon owe taxes each year that are ~60% of the distributions they receive. |

| |

• |

|

New capital investment made by the partnership can extend or increase the amount of depreciation that is

allocated to you, and thus offset or “shield” taxable income. This new investment has the effect of increasing the depreciation available to be allocated to all unitholders. In periods of high capital investment for the partnership,

therefore, more depreciation is generated. The inverse is also true: when capital spending declines, less depreciation is created for unitholders, and as a result, allocated income and related taxes increase. |

| |

• |

|

Given that we forecast a more limited capital investment environment for our business going forward, along

with the underlying mechanics of income allocation, we generally expect that we will generate more taxable income and less depreciation to allocate to our limited partners going forward, which will result in higher annual taxes owed by our

unitholders. |

| |

• |

|

The execution of our buyback strategy will exacerbate these underlying impacts. By reducing the number of units

outstanding, we will allocate more income to our remaining unitholders, resulting in higher annual taxes owed. |

| |

• |

|

Please see question 2 and 9 for additional information on why we are forecasting a more limited capital

investment environment and increases in share buybacks. |

5

| 9. |

If my allocated income and the taxes related thereto are increasing, why can’t the partnership raise

its distribution to keep up with the tax increases? |

| |

• |

|

We have a long history of continually growing our distribution, and we wouldn’t expect that to change.

However, for the past few years that growth has been much lower than had been the case historically. This reduced growth rate in distributions is a function of two factors. |

| |

• |

|

1) The underlying growth rate of our cash flows used to pay our distribution has slowed, primarily due to the

maturity of our business and historical investments already made by the industry. We need to make sure that the growth in our distribution is supported by our underlying cash flow growth in order to ensure our distribution levels are well matched to

our business fundamentals. |

| |

• |

|

2) We have believed for several years that our units have been undervalued. Accordingly, we believe more value is

created for our unitholders by repurchasing our undervalued units than by aggressively increasing our already attractive distribution. |

| |

• |

|

While we would expect to continue to grow our distribution, we believe the growth rate of our distribution will

remain relatively low for the foreseeable future and that we are likely to continue prioritizing unit repurchases for so long as we see value in doing so. |

| |

• |

|

Finally, there are varied interests among our unitholder base. Unitholders with higher current tax liabilities

may well prefer us to increase our distributions to help cover their expected higher cash taxes. Unitholders that have a higher current tax basis would likely prefer that we continue to aggressively repurchase units to help drive more capital gain

potential as their current taxes are relatively lower. We believe that, on a weighted average basis, there are more unitholders that would prefer us to repurchase units rather than increase distributions for the primary purpose of mitigating

increasing taxable income for those unitholders with lower tax basis. |

| 10. |

If I have passive losses related to my investment in Magellan, can I offset any gains owed upon closing of

this transaction with these losses? If so, how do I determine what passive losses I have and how does this work? |

| |

• |

|

Yes, you can use any available passive loss carryforwards (referred to sometimes as suspended passive losses) to

offset gains generated as a result of this transaction. |

| |

• |

|

You should refer to your tax records and consult your tax advisor to determine what specific offsets may be

available to you, as these offsets may be significant. |

| 11. |

Has something changed with regard to tax rules related to Master Limited Partnerships that make this

transaction uniquely tax inefficient? |

| |

• |

|

No. The general tax characteristics of an MLP have not changed. Those characteristics typically include the

ability of an investor to defer significant income tax liability to future periods or until they sell their units. |

| |

• |

|

This transaction results in a sale of units for a value that we believe is higher than we can otherwise achieve

as a standalone company. As such, investors will recognize the deferred tax liability associated with the unit price appreciation that has occurred over time, as well as the existing income tax liability from having deferred such taxes during their

holding period. |

| |

• |

|

Such an outcome is not unique to this transaction. |

6

| 12. |

What happens when the current law that allows a 20% tax deduction on income allocated to investors of a

publicly traded partnership sunsets in 2025? |

| |

• |

|

The current 20% pass-through deduction put in place in 2018 (199A) will expire at the end of 2025, unless

Congress acts to extend this benefit beyond its expiration date. Whether this will happen is uncertain. |

| |

• |

|

If it were to sunset without extension, the tax liability associated with this transaction or any other sale

would result in even higher taxes being owed. Further, your taxes while holding your units after 2025 would increase as well, as you would not be able to use this offset for annual income allocation subsequent to its expiration. We have assumed the

20% deduction expires in 2025 as provided in current law for purposes of evaluating unitholders’ potential future tax liabilities in our analysis. |

| 13. |

Why should I support this transaction if my plan is to never sell my Magellan units and then pass them on to

my heirs? |

| |

• |

|

This is a difficult question to answer because management cannot guess each of our unitholder’s life

expectancy or investment horizon. |

| |

• |

|

If you were to pass along your units to your heirs, you would minimize any existing tax liability (based on

current tax law). |

| |

• |

|

However, we are charged with maximizing value for all unitholders, and we believe that the total consideration

offered, and the potential value of ownership in the combined company, is superior to what we are likely to achieve on a standalone basis. |

| |

• |

|

The majority of our units turn over every 3 to 5 years, and that indicates to us that the majority of our

unitholders do not plan to hold our units indefinitely. |

| |

• |

|

For unitholders who do plan on holding indefinitely, the longer the holding period (in other words the longer

such unitholders live), the less valuable this mechanism is, as significant and generally increasing taxes will be owed during the ownership period. |

| |

• |

|

As noted in question 8, the implications of this are significant: we estimate that long-tenured unitholders

will soon owe taxes each year that are ~60% of the distributions they receive. |

| 14. |

Would Magellan unitholders be better positioned if Magellan had converted to a Corporation before this

pending merger with ONEOK? |

| |

• |

|

We have always been open-minded about organizational alternatives, including conversion to a corporation.

|

| |

• |

|

We haven’t recommended converting to a corporation to date because it was not clear that Magellan would have

benefited enough through potential price appreciation to offset the certainty of the taxes Magellan would owe in a relatively short period of time, potentially hurting our valuation. |

| |

• |

|

Had we converted to a corporation in advance of this transaction, it is highly unlikely this transaction would

have been executed at these terms, and there is no certainty that this transaction would have come to fruition at all. |

| |

• |

|

It is also important to note that even if Magellan had converted to a corporation before a transaction,

unitholders who face significant taxes on the pending combination would still have been subject to significant capital gains taxes whenever they eventually sold their ONEOK shares as a result of their low remaining basis. Meanwhile, the combined

entity would not receive the benefits of the higher tax basis that it is achieving through the pending transaction, which would negatively impact investors of the combined entity, including legacy Magellan unitholders. |

7

Considering the Value of the Transaction

| 15. |

The merger consideration consists of $25.00 of cash and 0.667 shares of ONEOK stock, which at the time of

the transaction announcement reflected $67.50 in merger consideration. Would you still recommend the transaction if ONEOK’s stock is trading lower when the transaction closes? |

| |

• |

|

Yes, based on Magellan’s due diligence we believe that the combined consideration of cash and approximately

23% ownership of the pro forma company based on the exchange ratio represents a present value to our unitholders that is superior to Magellan standalone. We believe that the ONEOK price of $63.72 at which the exchange ratio was set is fair and has

the potential to increase based on the benefits of the transaction, which would represent additional value to Magellan unitholders. |

| 16. |

Magellan has been one of my favorite investments. I appreciate the company’s discipline and

transparency, and you all have delivered some of the best returns in the industry. Why not continue on as an independent company? |

| |

• |

|

We appreciate the longstanding support Magellan has received from investors and analysts. We couldn’t be

more proud of the work the Magellan team has done over the years in delivering industry-leading returns to our investors, exceptional services to our customers and rewarding careers for our employees. |

| |

• |

|

Magellan is an outstanding company and we believe our assets will be essential to the daily lives of Americans

for decades. But our number one job continues to be maximizing value for our unitholders – and we believe this transaction does that, and that our unitholders would expect us to give them the opportunity to participate in it.

|

| |

• |

|

In arriving at this decision, we employed the same disciplined, thoughtful focus on maximizing risk-adjusted

returns for which Magellan has long been known, and which has delivered the strong returns our investors have enjoyed. Change is never easy, but we believe this offer is one that reflects Magellan’s strength and that our unitholders will find

compelling. |

| |

• |

|

We are excited about the value and opportunities that the combined company will provide. |

8

Cautionary Statement Regarding Forward-Looking Statements

This communication includes “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended and

Section 21E of the Securities and Exchange Act of 1934, as amended. All statements, other than statements of historical fact, included in this communication that address activities, events or developments that ONEOK, Inc. (“ONEOK” or

“OKE”) or Magellan Midstream Partners, L.P. (“Magellan” or “MMP”) expects, believes or anticipates will or may occur in the future are forward-looking statements. Words such as “estimate,” “project,”

“predict,” “believe,” “expect,” “anticipate,” “potential,” “create,” “intend,” “could,” “would,” “may,” “plan,” “will,”

“guidance,” “look,” “goal,” “future,” “build,” “focus,” “continue,” “strive,” “allow” or the negative of such terms or other variations thereof and words and

terms of similar substance used in connection with any discussion of future plans, actions, or events identify forward-looking statements. However, the absence of these words does not mean that the statements are not forward-looking. These

forward-looking statements include, but are not limited to, statements regarding the proposed transaction between ONEOK and Magellan (the “proposed transaction”), the expected closing of the proposed transaction and the timing thereof and

as adjusted descriptions of the post-transaction company and its operations, strategies and plans, integration, debt levels and leverage ratio, capital expenditures, cash flows and anticipated uses thereof, synergies, opportunities and anticipated

future performance, including maintaining current ONEOK management, enhancements to investment-grade credit profile, an expected accretion to earnings and free cash flow, dividend payments and potential repurchases, increase in value of tax

attributes and expected impact on EBITDA. Information adjusted for the proposed transaction should not be considered a forecast of future results. There are a number of risks and uncertainties that could cause actual results to differ materially

from the forward-looking statements included in this communication. These include the risk that ONEOK’s and Magellan’s businesses will not be integrated successfully; the risk that cost savings, synergies and growth from the proposed

transaction may not be fully realized or may take longer to realize than expected; the risk that the credit ratings of the combined company or its subsidiaries may be different from what the companies expect; the possibility that shareholders of

ONEOK may not approve the issuance of new shares of ONEOK common stock in the proposed transaction or that shareholders of ONEOK or unitholders of Magellan may not approve the proposed transaction; the risk that a condition to closing of the