Nu Skin Enterprises Announces Strategic Transaction of Mavely for $250 Million

January 03 2025 - 5:00AM

Business Wire

Nu Skin Enterprises Inc. (NYSE: NUS) today announced that its

Rhyz Inc. subsidiary completed a strategic transaction with Later,

a portfolio company of Summit Partners. As part of the transaction,

Rhyz sold its Mavely affiliate marketing technology platform to

Later in exchange for approximately $250 million in the form of

cash and a minority equity stake in the combined Later/Mavely

business. Approximately $33 million of such consideration will be

paid to other equity holders in the Mavely business. In connection

with the transaction, Mavely is expected to continue to provide

certain technology and social commerce capabilities to support Nu

Skin’s affiliate marketing business.

“Together, we believe Later and Mavely will provide enhanced

capabilities to our company as we pursue our broader beauty,

wellness and lifestyle ecosystem vision, while the transaction

generates additional capital and resources for us to increase

innovation in our core Nu Skin business and investment in our Rhyz

companies,” said Ryan Napierski, Nu Skin president and CEO. “This

underscores the value of Rhyz to incubate and scale meaningful

businesses with synergistic value across the enterprise.”

This transaction generated an approximate five-times return on

the company’s cumulative investment in Mavely since it was acquired

in 2021. Proceeds from the transaction are expected to be used to

pay down debt and fund additional innovation. The company also

plans to use its strengthened balance sheet to buy back stock under

its existing stock repurchase program, providing value to its

shareholders.

Evercore Group LLC acted as exclusive financial advisor and

Simpson Thacher & Bartlett LLP acted as legal counsel to Nu

Skin Enterprises.

About Nu Skin Enterprises and Rhyz

The Nu Skin Enterprises Inc. (NYSE: NUS) family of companies

includes Nu Skin and Rhyz Inc. Nu Skin is an integrated beauty and

wellness company, powered by a dynamic affiliate opportunity

platform, which operates in nearly 50 markets worldwide. Backed by

40 years of scientific research, the company’s products help people

look, feel and live their best with brands including Nu Skin®

personal care, Pharmanex® nutrition and ageLOC® anti-aging, which

includes an award-winning line of beauty device systems. Formed in

2018, Rhyz is a synergistic ecosystem of consumer, technology and

manufacturing companies focused on innovation within the beauty,

wellness and lifestyle categories.

Important Information Regarding Forward-Looking

Statements: This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended, that represent the company's current

expectations and beliefs. All statements other than statements of

historical fact are “forward-looking statements” for purposes of

federal and state securities laws and include, but are not limited

to, statements regarding the consideration to be retained by the

company and its subsidiaries relating to the transaction,

statements of management’s expectations regarding achievement of

the company’s vision, the future performance and capabilities of

the combined Later/Mavely business, the benefits of the continuing

commercial services arrangement with Mavely, and planned uses of

cash. In some cases, you can identify these statements by

forward-looking words such as "will," “plan,” “believe,” "achieve,"

“expect,” and “anticipate,” the negative of these words and other

similar words.

The forward-looking statements and related assumptions involve

risks and uncertainties that could cause actual results and

outcomes to differ materially from any forward-looking statements

or views expressed herein. These risks and uncertainties include,

but are not limited to, the following:

- the net proceeds to be retained by the company and its

subsidiaries in connection with the closing of the transaction are

subject to adjustments as set forth in the Unit Purchase Agreement

in relation thereto, including post-closing determination of

working capital and other elements of the purchase price, which may

reduce the amount of consideration to be retained by the company

and its subsidiaries;

- risk that the Mavely and Later businesses may encounter

difficulties integrating their businesses or achieving the

synergies that are anticipated from the transaction, or risks

associated with not providing services to the company as currently

anticipated;

- any failure of current or planned initiatives or products to

generate interest among the company’s sales force and customers and

generate sponsoring and selling activities on a sustained

basis;

- risk that direct selling laws and regulations in any of the

company’s markets, including the United States and Mainland China,

may be modified, interpreted or enforced in a manner that results

in negative changes to the company’s business model or negatively

impacts its revenue, sales force or business, including through the

interruption of sales activities, loss of licenses, increased

scrutiny of sales force actions, imposition of fines, or any other

adverse actions or events;

- economic conditions and events globally;

- competitive pressures in the company’s markets;

- risk that epidemics, including COVID-19 and related

disruptions, or other crises could negatively impact our

business;

- adverse publicity related to the company’s business, products,

industry or any legal actions or complaints by the company’s sales

force or others;

- political, legal, tax and regulatory uncertainties, including

trade policies, associated with operating in Mainland China and

other international markets;

- uncertainty regarding meeting restrictions and other government

scrutiny in Mainland China, as well as negative media and consumer

sentiment in Mainland China on our business operations and

results;

- risk of foreign-currency fluctuations and the currency

translation impact on the company’s business associated with these

fluctuations;

- uncertainties regarding the future financial performance of the

businesses the company has acquired;

- risks related to accurately predicting, delivering or

maintaining sufficient quantities of products to support planned

initiatives or launch strategies, and increased risk of inventory

write-offs if the company over-forecasts demand for a product or

changes its planned initiatives or launch strategies;

- regulatory risks associated with the company’s products, which

could require the company to modify its claims or inhibit its

ability to import or continue selling a product in a market if the

product is determined to be a medical device or if the company is

unable to register the product in a timely manner under applicable

regulatory requirements; and

- the company’s future tax-planning initiatives, any prospective

or retrospective increases in duties or tariffs on the company’s

products imported into the company’s markets outside of the United

States, and any adverse results of tax audits or unfavorable

changes to tax laws in the company’s various markets.

The company’s forward-looking statements contained herein are

further qualified by a detailed discussion of associated risks set

forth in the documents filed by the company with the Securities and

Exchange Commission. The forward-looking statements set forth the

company’s beliefs as of the date that such information was first

provided, and the company assumes no duty to update the

forward-looking statements contained in this release to reflect any

change except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250103519791/en/

Media: media@nuskin.com, (801) 345-6397 Investors:

investorrelations@nuskin.com, (801) 345-3577

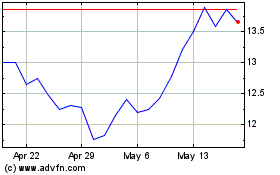

Nu Skin Enterprises (NYSE:NUS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Nu Skin Enterprises (NYSE:NUS)

Historical Stock Chart

From Jan 2024 to Jan 2025