UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☒ |

Soliciting Material Pursuant to § 240.14a-12 |

| |

|

Summit Materials, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ |

No fee required. |

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

The

following communication was sent to Summit Materials, Inc. employees holding positions of Vice President or higher by Anne P. Noonan,

President, Chief Executive Officer and Director of Summit Materials, Inc., on November 25, 2024:

This

message is being sent to VP’s and above.

Good morning,

I want to

let you know that we have just issued a press release (link) disclosing that Summit has agreed to be acquired by Quikrete at a price

of $52.50 per share, which is a 36% premium to our unaffected volume weighted average share price over the last 90 days, and a 34.6%

annualized return since we began to develop our Elevate Strategy on September 1, 2020.

This combination,

and the significant value it creates, reflects the safety, operational, commercial and financial success we are achieving through Elevate.

In addition to being a great outcome for all our shareholders, we believe this transaction will create new and exciting opportunities

for our teammates and customers.

In Quikrete,

we have found a strong partner that shares our commitment to safety and innovation.

Here’s

more about Quikrete and the transaction

Quikrete is

a leading building materials company based in Atlanta, Georgia. They are a private, family-owned business founded in 1940. From the original

yellow bag of premixed concrete, today Quikrete’s portfolio of brands includes Quikrete, Spec Mix, Rinker Materials, U.S. Pipe,

Contech Engineered Solutions, Keystone Hardscapes, Pavestone, Custom Building Products, QPR, and other leading brands.

Quikrete services

the U.S. and Canadian commercial construction, residential, and infrastructure markets, and their broad array of products and expertise

allows them to provide nearly every product required for most any type of construction project.

This transaction

combines our strong aggregates, cement, ready-mix, asphalt and construction businesses with Quikrete’s processing and manufacturing

expertise to create an integrated construction materials solutions provider with strong customer relationships and iconic products.

Our Board

and management team are confident that this transaction is the right next step for all our stakeholders, including our teammates, shareholders

and customers. With a complementary portfolio of pre-packaged building solutions, Quikrete is an ideal, like-minded, partner for Summit.

Most importantly,

Quikrete shares our goal to achieve zero harm. In getting to know them, it is clear Quikrete deeply respects our talented team and the

leading company you all have helped build with values of safety, integrity, sustainability and inclusivity. This transaction is a true

testament to our stellar strategic and financial performance, agile operational and commercial execution and the talent of our entire

team.

What this

means for you

While today’s

announcement is an important milestone, it is just the first step in the process and, as of now, our day-to-day remains unchanged. We

remain separate companies until the transaction closes, which is expected to happen in the first half of 2025, subject to approval from

our shareholders and regulatory approvals, as well as other customary closing conditions. Following close of the transaction, Summit

will become part of Quikrete, and our common stock will no longer trade on the NYSE.

I know I can

rely on you all to not allow today’s news to distract you from your normal course work. It is business as usual at Summit and it

is important that we remain focused on continuing to offer customers a single-source provider of construction materials and downstream

products. We need to ensure our teammates remain focused on executing our Elevate Strategy and we must all remain steadfast in our conviction

about our long-term vision and commitment to safety.

Next steps

We are committed

to keeping you informed throughout the process. In the meantime, if you receive calls from the media or others seeking information, please

do not respond. Instead, direct them to Karli Anderson, Executive Vice President, Head of Communications, at karli.anderson@summit-materials.com.

Please do not and please inform your team not to post or comment on social media (including LinkedIn) about the transaction.

Later this

morning we will be hosting a Town Hall where you’ll hear more about this transaction. Please look out for an invitation.

Thank you

for all that you do for Summit. Please continue to put safety first in our journey to zero harm.

Sincerely,

Anne

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This email

includes “forward-looking statements” within the meaning of the federal securities laws, which involve risks and uncertainties.

Forward-looking statements include all statements that do not relate solely to historical or current facts, and you can identify forward-looking

statements because they contain words such as “believes,” “expects,” “may,” “will,” “should,”

“seeks,” “intends,” “trends,” “plans,” “estimates,” “projects”

or “anticipates” or similar expressions that concern our strategy, plans, expectations or intentions. All statements made

relating to our estimated and projected earnings, margins, costs, expenditures, cash flows, growth rates and financial results are forward-looking

statements. Such forward-looking statements include but are not limited to statements about the proposed transaction (the “Transaction”)

between Summit Materials Inc. (“Summit”) and Quikrete Companies, LLC (“Quikrete”), including statements that

are not historical facts. These forward-looking statements are subject to risks, uncertainties and other factors that may cause our actual

results, performance or achievements to be materially different from future results, performance or achievements expressed or implied

by such forward-looking statements. We derive many of our forward-looking statements from our operating budgets and forecasts, which

are based upon many detailed assumptions. While we believe that our assumptions are reasonable, it is very difficult to predict the effect

of known factors, and, of course, it is impossible to anticipate all factors that could affect our actual results. In light of the significant

uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as

a representation by us or any other person that the results or conditions described in such statements or our objectives and plans will

be realized. Important factors could affect our results and could cause results to differ materially from those expressed in our forward-looking

statements, including but not limited to the factors discussed in the section entitled “Risk Factors” in Summit’s Annual

Report on Form 10-K for the fiscal year ended December 30, 2023, and Quarterly Report on Form 10-Q for the fiscal quarter ended March

30, 2024, each as filed with the Securities and Exchange Commission (“SEC”), and any factors discussed in the section entitled

“Risk Factors” in any of our subsequently filed SEC filings; and the following: (i) the occurrence of any event, change,

or other circumstance that could give rise to the right of one or both of the parties to terminate the definitive transaction agreement

between Summit and Quikrete, including in circumstances requiring Summit to pay a termination fee; (ii) potential litigation relating

to the Transaction that could be instituted against the parties to the definitive transaction agreement or their respective directors

or officers, including the effects of any outcomes related thereto; (iii) the possibility that the Transaction does not close when expected

or at all because required regulatory, shareholder, or other approvals and other conditions to closing are not received or satisfied

on a timely basis or at all; (iv) reputational risk and potential adverse reactions of

customers,

employees or other business partners and the businesses generally, including those resulting from the announcement of the Transaction;

(v) the risk that any announcements relating to the Transaction could have adverse effects on the market price of Summit’s common

stock; (vi) significant transaction costs associated with the Transaction; and (vii) the diversion of management’s attention and

time from ongoing business operations and opportunities on Transaction-related matters.

All subsequent

written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety

by these cautionary statements. Any forward-looking statement that we make herein speaks only as of the date of this communication. We

undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise,

except as required by law.

Additional

Information and Where to Find It

This communication

does not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities. This communication relates

to the Transaction. In connection with the Transaction, Summit plans to file with the SEC a proxy statement on Schedule 14A (the

“Proxy Statement”). This communication is not a substitute for the Proxy Statement or any other document that Summit may

file with the SEC and send to its shareholders in connection with the Transaction. The Transaction will be submitted to Summit’s

shareholders for their consideration. Before making any voting decision, Summit’s shareholders are urged to read all relevant documents

filed or to be filed with the SEC, including the Proxy Statement, as well as any amendments or supplements to those documents, when they

become available, because they will contain important information about Summit and the Transaction.

Summit’s

shareholders will be able to obtain a free copy of the Proxy Statement, as well as other filings containing information about Summit,

free of charge, at the SEC’s website (www.sec.gov). Copies of the Proxy Statement and other documents filed by Summit with

the SEC may be obtained, without charge, by contacting Summit through its website at https://investors.summit-materials.com/corporate-profile/default.aspx.

Participants

in the Solicitation

Summit, its

directors, executive officers and other persons related to Summit may be deemed to be participants in the solicitation of proxies from

Summit’s shareholders in connection with the Transaction. Information about the directors and executive officers of Summit

and their ownership of common stock of Summit is set forth in the section entitled “Our Stockholders—Holdings of Major Stockholders”

in Summit’s proxy statement for its 2024 annual meeting of stockholders, which was filed with the SEC on April 8, 2024 (and which

is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0001621563/000114036124018480/ny20019511x1_def14a.htm). Additional information

regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or

otherwise, will be included in the Proxy Statement and other relevant materials to be filed with the SEC in connection with the Transaction

when they become available. Free copies of these documents may be obtained as described in the preceding paragraph.

Cautionary Note Regarding Forward-Looking Statements

This communication

includes “forward-looking statements” within the meaning of the federal securities laws, which involve risks and uncertainties.

Forward-looking statements include all statements that do not relate solely to historical or current facts, and you can identify

forward-looking statements because they contain words such as “believes,” “expects,” “may,” “will,”

“should,” “seeks,” “intends,” “trends,” “plans,” “estimates,”

“projects” or “anticipates” or similar expressions that concern our strategy, plans, expectations or intentions.

All statements made relating to our estimated and projected earnings, margins, costs, expenditures, cash flows, growth rates and financial

results are forward-looking statements. Such forward-looking statements include but are not limited to statements about the transactions

contemplated by the Agreement and Plan of Merger among Summit Materials, Inc. (the “Company”), Quikrete Holdings, Inc.

(“Purchaser”) and Soar Subsidiary, Inc. (the “Merger”), including statements that are not historical

facts. These forward-looking statements are subject to risks, uncertainties and other factors that may cause our actual results, performance

or achievements to be materially different from future results, performance or achievements expressed or implied by such forward-looking

statements. We derive many of our forward-looking statements from our operating budgets and forecasts, which are based upon many detailed

assumptions. While we believe that our assumptions are reasonable, it is very difficult to predict the effect of known factors, and, of

course, it is impossible to anticipate all factors that could affect our actual results. In light of the significant uncertainties inherent

in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by us

or any other person that the results or conditions described in such statements or our objectives and plans will be realized. Important

factors could affect our results and could cause results to differ materially from those expressed in our forward-looking statements,

including but not limited to the factors discussed in the section entitled “Risk Factors” in the Company’s Annual Report

on Form 10-K for the fiscal year ended December 30, 2023, and Quarterly Report on Form 10-Q for the fiscal quarter ended March 30, 2024,

each as filed with the SEC, and any factors discussed in the section entitled “Risk Factors” in any of our subsequently filed

SEC filings; and the following: (i) the occurrence of any event, change, or other circumstance that could give rise to the right of one

or both of the parties to terminate the definitive transaction agreement between the Company and Purchaser, including in circumstances

requiring the Company to pay a termination fee; (ii) potential litigation relating to the Merger that could be instituted against the

parties to the definitive transaction agreement or their respective directors or officers, including the effects of any outcomes related

thereto; (iii) the possibility that the Merger does not close when expected or at all because required regulatory, shareholder, or other

approvals and other conditions to closing are not received or satisfied on a timely basis or at all; (iv) reputational risk and potential

adverse reactions of customers, employees or other business partners and the businesses generally, including those resulting from the

announcement of the Merger; (v) the risk that any announcements relating to the Merger could have adverse effects on the market price

of the Company’s common stock; (vi) significant transaction costs associated with the Merger; and (vii) the diversion of management’s

attention and time from ongoing business operations and opportunities on Merger-related matters. All subsequent written and oral forward-looking

statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by these cautionary statements.

Any forward-looking statement that we make herein speaks only as of the date of this Schedule 14A.

We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or

otherwise, except as required by law.

Additional Information and Where to Find It

This communication

does not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities. This communication relates

to the Merger. In connection with the Merger, the Company plans to file with the Securities and Exchange Commission (“SEC”)

a proxy statement on Schedule 14A (the “Proxy Statement”). This Schedule 14A is not a substitute for the Proxy Statement

or any other document that the Company may file with the SEC and send to its shareholders in connection with the Merger. The Merger will

be submitted to the Company’s shareholders for their consideration. Before making any voting decision, the Company’s shareholders

are urged to read all relevant documents filed or to be filed with the SEC, including the Proxy Statement, as well as any amendments or

supplements to those documents, when they become available, because they will contain important information about the Company and the

Merger.

The Company’s

shareholders will be able to obtain a free copy of the Proxy Statement, as well as other filings containing information about the Company,

free of charge, at the SEC’s website (www.sec.gov). Copies of the Proxy Statement and other documents filed by the Company with

the SEC may be obtained, without charge, by contacting the Company through its website at https://investors.summit-materials.com/corporate-profile/default.aspx.

Participants in the Solicitation

The Company, its directors, executive

officers and other persons related to the Company may be deemed to be participants in the solicitation of proxies from the Company’s

shareholders in connection with the Merger. Information about the directors and executive officers of the Company and their ownership

of common stock of the Company is set forth in the section entitled “Our Stockholders—Holdings of Major Stockholders”

in the Company’s proxy statement for its 2024 annual meeting of stockholders, which was filed with the SEC on April 8, 2024 (and

which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0001621563/000114036124018480/ny20019511x1_def14a.htm).Additional

information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security

holdings or otherwise, will be included in the Proxy Statement and other relevant materials to be filed with the SEC in connection with

the Merger when they become available. Free copies of these documents may be obtained as described in the preceding paragraph.

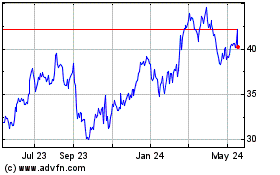

Summit Materials (NYSE:SUM)

Historical Stock Chart

From Dec 2024 to Jan 2025

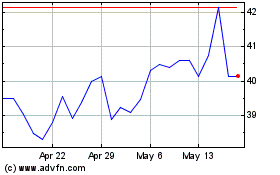

Summit Materials (NYSE:SUM)

Historical Stock Chart

From Jan 2024 to Jan 2025