TDCX Inc. (NYSE: TDCX) (“TDCX” or the “Company”), an

award-winning digital customer experience (CX) solutions provider

for technology and blue-chip companies, today announced its

unaudited financial results for the third quarter ended September

30, 2022.

Third Quarter 2022 Financial Highlights

- Total revenue of US$120.5 million, up 16.1% year-on-year

- Profit for the period was US$21.6 million, up 2.3%

year-on-year

- Adjusted Net Income4, which excludes the impact of share-based

compensation for a like-for-like comparison, was US$24.2 million,

up 15.0% year-on-year

- Year-to-date Net Cash from Operating Activities of US$90.8

million, up 53.1% year-on-year

Mr. Laurent Junique, Chief Executive Officer and Founder of

TDCX, said, “We rounded off this quarter with a strong set of

results, fueled by our solid execution capabilities. Our global

expansion plans continue unabated with the addition of two new

campuses, one in Iloilo, Philippines and another in Istanbul,

Türkiye. This brings us to a total of 27 campuses globally as we

continue building our network. We also see greater contribution

from our four newer geographies, namely Colombia, India, Romania

and South Korea, making up close to 10 per cent of the year-on-year

growth in revenue for Q3 2022 against Q3 2021.

“This quarter, we are proud to have had our industry-leading

practices recognized. We were named a leader by global technology

research and advisory firm, ISG, in their ISG Provider Lens™

Contact Center – Customer Experience Services Singapore/Malaysia

2022 report. The report acknowledged our capabilities, positioning

us at the top of the quadrant.

“On the ESG front, we deepened our commitment to bringing

positive transformation to the community with the launch of the

TDCX Foundation. Through the Foundation, we will be able to help

drive greater social impact for disadvantaged communities.”

(US$ million, except for

%)2

Q3 2021

Q3 2022

% Change

Revenue

103.8

120.5

+16.1%

Profit for the period

21.1

21.6

+2.3%

Adjusted Net Income4

21.1

24.2

+15.0%

Adjusted EBITDA1,3

36.9

38.3

+3.9%

Adjusted EBITDA Margins1,3

(%)

35.5

%

31.8

%

Business Highlights

Strong Client Additions

- Signed up 31 new logos since the start of the year, 55% higher

than the 20 logos for the same period in 2021

- 72 clients with campaigns that have been launched as of

September 30, 2022, a 50% increase as compared with 48 launched

clients as of September 30, 2021

- Revenue contribution from new economy5 clients stood at 93% for

9M 2022

ESG Efforts

- Launched the TDCX Foundation as part of our commitment to

support disadvantaged communities

- Supported the launch of Google Cloud’s Point Carbon Zero

Program to catalyze the incubation and adoption of climate fintech

solutions in Asia over the next three years

- Recognized as one of the Circle of Excellence Awardees for the

Sustainability Company of the Year at the Asia CEO Awards 2022

Full Year 2022 Outlook Reiterated at the Mid-point; Range

Narrowed

For the full year 2022, TDCX expects its financial results to

be:

2022 Outlook

Revenue (in millions)

S$655m - S$670m6

(Midpoint unchanged at

S$662.5m;

Range narrowed from S$650m -

S$675m)

Revenue growth (YoY)

Range: 18.0% - 20.7%

(Midpoint unchanged at 19.3%;

Range narrowed from 17.1% -

21.6%)

Adjusted EBITDA margin1,3

Approximately 30.0% - 32.0%

(unchanged)

_____________________

1 Adjusted EBITDA or Adjusted EBITDA margins are supplemental

non-IFRS financial measures and should not be considered in

isolation or as a substitute for financial results reported under

IFRS (see "Reconciliation of non-IFRS financial measures to the

nearest comparable IFRS measures" in the Form 6-K or presentation

slides for more details).

2 FX rate of US$1 = S$1.4340, being the approximate rate in

effect as of September 30, 2022, assumed in converting financials

from SG dollar to US dollar.

3 Adjusted EBITDA represents profit for the period before

interest expense, interest income, income tax expense, depreciation

expense and equity-settled share-based payment expense incurred in

connection with our Performance Share Plan. “Adjusted EBITDA

margin” represents Adjusted EBITDA as a percentage of revenue.

4 “Adjusted Net Income” represents profit for the period before

equity-settled share-based payment expense incurred in connection

with our Performance Share Plan, net of any tax impact of such

adjustments. “Adjusted Net Income margin” represents Adjusted Net

Income as a percentage of revenue.

5 “New economy” refers to high growth industries that are on the

cutting edge of digital technology and are the driving forces of

economic growth.

6 Using the FX rate of US$1 = S$1.4340, being the approximate

rate in effect as of Sep 30, 2022, this equates to US$457m to

US$467m. Using the FX rate of US$1 = US$1.3918, being the

approximate rate in effect as of Jun 30, 2022, this equates to

US$471m to US$481m.

Webcast and Conference Call Information

The TDCX senior management will host a conference call to

discuss the third quarter 2022 unaudited financial results.

A live webcast of this conference call will be available on

TDCX’s website. Access information on the conference call and

webcast is as follows:

Date and time:

November 22, 2022, 7:30 AM (U.S. Eastern

Time)

November 22, 2022, 8:30 PM (Singapore /

Hong Kong Time)

Webcast link:

https://events.q4inc.com/earnings/TDCX/Q3-2022

Dial in numbers:

USA Toll Free: +1 855 9796 654

United States (Local): +1 646 664 1960

Singapore: +65 3163 4602

Hong Kong: +852 580 33 413

UK Toll Free +44 0800 640 6441

All other locations: +44 20 3936 2999

Participant Access

Code:

501559

A replay of the conference call will be available at TDCX’s

investor relations website (investors.tdcx.com). An archived

webcast will be available at the same link above.

About TDCX INC.

Singapore-headquartered TDCX provides transformative digital CX

solutions, enabling world-leading and disruptive brands to acquire

new customers, to build customer loyalty and to protect their

online communities.

TDCX helps clients achieve their customer experience aspirations

by harnessing technology, human intelligence and its global

footprint. It serves clients in fintech, gaming, technology, home

sharing and travel, digital advertising and social media, streaming

and e-commerce. TDCX’s expertise and strong footprint in Asia has

made it a trusted partner for clients, particularly high-growth,

new economy companies, looking to tap the region’s growth

potential.

TDCX’s commitment to delivering positive outcomes for our

clients extends to its role as a responsible corporate citizen. Its

Corporate Social Responsibility program focuses on positively

transforming the lives of its people, its communities and the

environment.

TDCX employs more than 17,400 employees across 27 campuses

globally, specifically Singapore, Malaysia, Thailand, Philippines,

Mainland China, Hong Kong, South Korea, Japan, India, Romania,

Spain, Colombia and Türkiye. For more information, please visit

www.tdcx.com.

Convenience Translation

The Company’s financial information is stated in Singapore

dollars, the legal currency of Singapore. Unless otherwise noted,

all translations from Singapore dollars to U.S. dollars and from

U.S. dollars to Singapore dollars in this press release were made

at a rate of S$1.4340 to US$1.00, the approximate rate in effect as

of September 30, 2022. We make no representation that any Singapore

dollar or U.S. dollar amount could have been, or could be,

converted into U.S. dollars or Singapore dollar, as the case may

be, at any particular rate, the rate stated herein, or at all.

Non-IFRS Financial Measure

To supplement our consolidated financial statements, which are

prepared and presented in accordance with IFRS, we use the

following non-IFRS financial measure to help evaluate our operating

performance:

“EBITDA” represents profit for the period before interest

expense, interest income, income tax expense and depreciation

expense. “EBITDA margin” represents EBITDA as a percentage of

revenue. “Adjusted EBITDA” represents profit for the period before

interest expense, interest income, income tax expense, depreciation

expense and equity-settled share-based payment expense incurred in

connection with our Performance Share Plan. “Adjusted EBITDA

margin” represents Adjusted EBITDA as a percentage of revenue. We

believe that EBITDA, EBITDA margin, Adjusted EBITDA and Adjusted

EBITDA margin helps us to identify underlying trends in our

operating results, enhancing our understanding of past performance

and future prospects.

“Adjusted Net Income” represents profit for the period before

equity-settled share-based payment expense incurred in connection

with our Performance Share Plan, net of any tax impact of such

adjustments. “Adjusted Net Income margin” represents Adjusted Net

Income as a percentage of revenue.

The above non-IFRS financial measures have limitations as

analytical tools and should not be considered in isolation or

construed as an alternative to revenue, net income, or any other

measure of performance or as an indicator of our operating

performance. The non-IFRS financial measures presented here may not

be comparable to similarly titled measures presented by other

companies because other companies may calculate similarly titled

measures differently. For more information on the non-IFRS

financial measures, please see the form 6-K section captioned

“Non-IFRS Financial Measures” or the presentation slides.

Safe Harbor Statement

This announcement contains forward-looking statements. These

statements are made under the “safe harbor” provisions of the U.S.

Private Securities Litigation Reform Act of 1995. In some cases,

you can identify these forward-looking statements by the use of

words such as “outlook,” “believes,” “expects,” “potential,”

“continues,” “may,” “will,” “should,” “could,” “seeks,” “predicts,”

“intends,” “trends,” “plans,” “estimates,” “anticipates” or the

negative version of these words or other comparable words. Among

other things, the outlook for the full year, the business outlook

and quotations from management in this announcement, as well as the

Company’s strategic and operational plans, contain forward-looking

statements. The Company may also make written or oral

forward-looking statements in its periodic reports to the U.S.

Securities and Exchange Commission (the “SEC”), in its annual

report to shareholders, in press releases and other written

materials and in oral statements made by its officers, directors or

employees to third parties. Statements that are not historical

facts, including statements about the Company’s beliefs and

expectations, are forward-looking statements. Forward-looking

statements involve inherent risks and uncertainties. A number of

factors could cause actual results to differ materially from those

contained in any forward-looking statement, including but not

limited to the following: the performance of TDCX’s largest

clients; the successful implementation of its business strategy;

its ability to compete effectively; its ability to maintain its

pricing, control costs or continue to grow its business; the

effects of the novel coronavirus (COVID-19) on its business; the

continued service of its founder and certain of its key employees

and management; its ability to attract and retain enough highly

trained employees; its exposure to various risks in Southeast Asia;

its contractual relationship with key clients; clients and

prospective clients’ spending on omnichannel CX solutions; its

spending on employee salaries and benefits expenses; and its

involvement in any disputes, legal, regulatory, and other

proceedings arising out of its business operations. Further

information regarding these and other risks is included in the

Company’s filings with the SEC. All information provided in this

press release and in the attachments is as of the date of this

press release, and the Company undertakes no obligation to update

any forward-looking statement, except as required under applicable

law.

UNAUDITED CONDENSED INTERIM

CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER

COMPREHENSIVE INCOME

For the three months ended

September 30,

2022

2021

US$’000

S$’000

S$’000

Revenue

120,481

172,770

148,798

Employee benefits expense

(78,330

)

(112,325

)

(86,583

)

Depreciation expense

(7,118

)

(10,207

)

(10,409

)

Rental and maintenance

expense

(1,847

)

(2,648

)

(2,063

)

Recruitment expense

(3,105

)

(4,452

)

(3,029

)

Transport and travelling

expense

(269

)

(386

)

(452

)

Telecommunication and technology

expense

(2,148

)

(3,080

)

(2,413

)

Interest expense

(299

)

(429

)

(2,703

)

Other operating expense

(3,898

)

(5,590

)

(3,972

)

Share of profit from an

associate

43

61

35

Interest income

860

1,233

119

Other operating income

4,725

6,775

2,558

Profit before income

tax

29,095

41,722

39,886

Income tax expenses

(7,531

)

(10,799

)

(9,653

)

Profit for the period

21,564

30,923

30,233

Item that may be reclassified

subsequently to profit or loss:

Exchange differences on

translation of foreign operations

(4,797

)

(6,880

)

(2,523

)

Total comprehensive income for

the period

16,767

24,043

27,710

Profit

attributable to:

- Owners of TDCX Inc.

21,563

30,922

30,232

- Non-controlling interests

1

1

1

21,564

30,923

30,233

Total

comprehensive income attributable to:

- Owners of TDCX Inc.

16,766

24,042

27,709

- Non-controlling interests

1

1

1

16,767

24,043

27,710

Basic earnings per share (in US$

or S$) (1)

0.14

0.21

0.24

Diluted earnings per share (in

US$ or S$) (1)

0.14

0.21

0.24

_______________________________

(1) Basic and diluted earnings per

share

For the three months ended

September 30,

2022

2021

Weighted average number of

ordinary shares for the purposes of

basic earnings per share

144,943,516

123,500,000

Weighted average number of

ordinary shares for the purposes of

diluted earnings per share

144,943,516

123,500,000

The translation of Singapore Dollar amounts into United States

Dollar amounts (“USD”) for the unaudited condensed interim

consolidated statement of profit or loss and other comprehensive

income above are included solely for the convenience of readers

outside of Singapore and have been made at the rate of S$1.4340 to

US$1.00, the approximate rate of exchange at September 30, 2022.

Such translations should not be construed as representations that

the Singapore Dollar amounts could be converted into USD at that or

any other rate.

Comparison of the Three Months Ended September 30, 2022 and

2021

Revenue. Our revenue increased by 16.1% to S$172.8

million (US$120.5 million) for the three months ended September 30,

2022 from S$148.8 million for the three months ended September 30,

2021 primarily due to a 13.0% increase in revenue from providing

omnichannel Customer Experience (“CX”) solutions, and a 32.2%

increase in revenue from providing sales and digital marketing

services.

- Our revenues from omnichannel CX solutions increased by 13.0%

to S$100.9 million (US$70.4 million) from S$89.3 million for the

same period of 2021 primarily due to higher business volumes driven

by the expansion of existing campaigns by clients in the fintech

and technology verticals. In addition, business volumes of our key

travel and hospitality clients continue to gain recovery momentum

following the reopening of borders during the first half of

2022.

- Our revenues from sales and digital marketing services

increased by 32.2% to S$42.8 million (US$29.8 million) from S$32.4

million for the same period of 2021 primarily due to the expansion

of existing campaigns for our key digital advertising and media

clients.

- Our revenues from content, trust and safety services increased

by 6.4% to S$28.1 million (US$19.6 million) from S$26.4 million for

the same period of 2021 primarily due to an increase in business

volumes.

- Our revenues from our other service fees increased by 38.5% to

S$1.0 million (US$0.7 million) from S$0.7 million for the same

period of 2021 primarily due to higher business volumes from

existing clients and higher contribution from new clients.

The following table sets forth our service provided by amount

for the three months ended September 30, 2022 and 2021.

For the three months ended

September 30,

2022

2021

US$’000

S$’000

S$’000

Revenue by service

Omnichannel CX solutions *

70,364

100,902

89,320

Sales and digital marketing

29,846

42,799

32,371

Content, trust and safety *

19,566

28,058

26,377

Other service fees * #

705

1,011

730

Total revenue

120,481

172,770

148,798

* In the second quarter of 2022, we renamed our “content

monitoring and moderation” services as “content, trust and safety”

services which entailed some reclassification of certain of our

revenues from our omnichannel CX solutions services and our other

service fees into content, trust and safety services. Accordingly,

we reclassified our segment revenues for all periods presented

herein on a comparable basis except where otherwise noted. See

“Segment Reclassification” below.

# Other service fees comprise revenue from other business

process services and revenue from other services.

Employee Benefits Expense. Our employee benefits expense

increased by 29.7% to S$112.3 million (US$78.3 million) from S$86.6

million for the same period of 2021 due to higher employee count,

employee wage adjustments pursuant to dynamics of the talent

markets that we operate in and cost of living inflation, and

share-based payment expense arising from the implementation of our

performance share plan in November 2021. Our average number of

employees in the third quarter of 2022 increased 24.5% compared to

the same period of 2021 as a result of business volumes expansion

of current campaigns over the course of 2022, and staffing

requirements of new campaign launches in the first half of

2022.

Depreciation Expense. Our depreciation expense decreased

slightly by 1.9% to S$10.2 million (US$7.1 million) from S$10.4

million for the same period of 2021 primarily due to certain office

renovation assets in Singapore, Thailand and Philippines being

fully depreciated during the period. These were partially offset by

depreciation on capital expenditures invested in new and expansion

capacities to support the growth of our business.

Rental and Maintenance Expense. Our rental and

maintenance expense increased by 28.4% to S$2.6 million (US$1.8

million) from S$2.1 million for the same period of 2021 primarily

due to rental expenses incurred in new site set up in Korea. In

addition, we had to increase our leasing of computer equipment to

cope with the growth in our key clients’ campaigns in the

Philippines, Thailand and Malaysia.

Recruitment Expense. Our recruitment expense expanded by

47.0% to S$4.5 million (US$3.1 million) from S$3.0 million for the

same period of 2021 primarily due to accelerated hiring activities

thereby raising hiring costs to support the campaign needs in our

Malaysia and Singapore offices.

Transport and Travelling Expense. Our transport and

travelling expense decreased by 14.6% to S$0.4 million (US$0.3

million) from S$0.5 million for the same period of 2021 mainly due

to lower accommodation and transportation expenses.

Telecommunication and Technology Expense. Our

telecommunication and technology expense increased by 27.6% to

S$3.1 million (US$2.1 million) from S$2.4 million for the same

period of 2021 primarily in tandem with business volume expansion

of our existing campaigns and new projects’ launches.

Interest Expense. Our interest expense decreased by 84.1%

to S$0.4 million (US$0.3 million) from S$2.7 million for the same

period of 2021 primarily due to reduced bank borrowings during the

period.

Other Operating Expense. Our other operating expense

increased by 40.7% to S$5.6 million (US$3.9 million) from S$4.0

million for the same period of 2021 primarily due to additional

fees incurred in the Philippines arising from the unit exceeding

the work-from-home cap imposed by the local fiscal incentive

administrative body, and increased legal, compliance and

professional fees.

Share of Profit from an Associate. Our share of profit

from an associate was insignificant for the three months ended

September 30, 2022 and 2021.

Interest Income. Our interest income increased by 936.1%

to S$1.2 million (US$0.9 million) from S$0.1 million for the same

period of 2021 primarily due to an increase in interest-bearing

deposits.

Other Operating Income. Our other operating income

increased by 164.9% to S$6.8 million (US$4.7 million) from S$2.6

million for the same period of 2021 primarily due to foreign

exchange gains recognized.

Profit Before Income Tax. As a result of the foregoing,

our profit before income tax increased by 4.6% to S$41.7 million

(US$29.1 million) from S$39.9 million for the corresponding period

of 2021.

Income Tax Expenses. Our income tax expenses increased by

11.9% to S$10.8 million (US$7.5 million) from S$9.7 million for the

same period of 2021. The higher income tax expenses were mainly due

to higher taxes from our subsidiary in Malaysia as a result of a

one-off “prosperity tax” enacted by the local government for fiscal

2022 for the Malaysian operations, suspension of the income tax

break previously availed to the Philippines unit arising from the

unit exceeding the work-from-home cap imposed by the local fiscal

incentive administrative body and higher taxable profits of our

subsidiaries in the Philippines and Thailand.

Profit for the Period. As a result of the foregoing, our

profit for the period increased by 2.3% to S$30.9 million (US$21.6

million) from S$30.2 million for the same period of 2021.

Share Repurchase Program

On March 14, 2022, we announced that the board of directors had

approved a US$30.0 million share repurchase program. The share

repurchase program commenced on March 14, 2022. The repurchase

program has no expiration date and may be suspended, modified or

discontinued at any time without prior notice. We expect to fund

repurchases under this program with our existing cash balance.

Our proposed repurchases may be made from time to time on the

open market at prevailing market prices, in privately negotiated

transactions, in block trades, and/or through other legally

permissible means, depending on market conditions and in accordance

with applicable rules and regulations and its insider trading

policy. Our board of directors will review the share repurchase

program periodically and may authorize adjustment of its terms and

size. We did not make any repurchase of ADSs in the year ended

December 31, 2021.

From July 1, 2022 to November 21, 2022, we purchased 352,489

ADSs at a cost of US$3.0 million.

Warrant Agreement with Airbnb

On September 2, 2022, we entered into a warrant agreement with

Airbnb Ireland Unlimited Company (“Airbnb”), whereby TDCX Inc.

granted Airbnb warrants to purchase up to 490,000 of the TDCX

Inc.’s American Depositary Shares subject to vesting, adjustment

and other terms and conditions set forth therein. The vesting of

the warrants is subject to satisfaction of certain fee milestones

with respect to services provided to Airbnb under the Master

Services Agreement which commenced August 1, 2021.

Subsequent Event

On October 13, 2022, we completed the restructuring of our Hong

Kong associated company into a wholly-owned subsidiary. This was

funded from our existing cash balance and we believe that such a

restructuring enables TDCX Inc. and its subsidiaries (the “Group”)

to better tap into opportunities in the Greater China area. The

financial impact is not expected to be material.

Segment Reclassification

In the second quarter of 2022, we renamed our “content

monitoring and moderation” services as “content, trust and safety”

services. The change reflects the industry’s broader view that

content moderation services are part of a larger group of services

that includes other trust and safety related services and helps

enhance our ability to track our performance.

Our content, trust and safety services are comprised of content

moderating and monitoring services, trust and safety services and

data annotation services. Content moderation and monitoring service

involves the review of content submission for violation of terms of

use or non-compliant with the specifications and guidelines

provided by our clients. Trust and safety services entails our

dedicated and trained resources in assisting our clients to verify,

detect and prevent incidences of fraudulent use of clients’ tools

so as to promote users’ confidence in using our clients’ platforms

and tools. Data annotation services provided by us serves to

support the development of our clients’ efforts in machine learning

and automation initiatives and projects.

Revenue for trust and safety related services that were

previously classified under omnichannel CX solutions and other

service fees respectively, which can currently be reasonably

identified and quantified, will now be reported as content, trust

and safety services.

Reclassifications and comparative figures

In prior periods, we reported foreign exchange gains or losses

on a net basis under “other operating expenses” line item.

Commencing from the third quarter of 2022, foreign exchange gains

for the relevant quarter is reported under “other operating income”

line item while foreign exchange losses for the relevant quarter is

reported under “other operating expenses” line item. Accordingly,

reclassifications relating to foreign exchange gains and losses

have been made to prior period’s financial statements to enable

comparability with the current period’s financial statements and

therefore, certain line items have been amended in the unaudited

condensed interim consolidated statement of profit or loss and

other comprehensive income. Comparative figures have been adjusted

to conform to the current period’s presentation. The items were

reclassified as follows:

Previously

reported

After

reclassification

S$’000

S$’000

For the

three months ended September 30,

2021:

Other operating income

1,020

2,558

Other operating expenses

(2,434)

(3,972)

For the

nine months ended September 30,

2021:

Other operating income

3,764

5,640

Other operating expenses

(8,578)

(10,454)

NON-IFRS FINANCIAL MEASURES

EBITDA, EBITDA margin, Adjusted EBITDA, Adjusted EBITDA margin,

Adjusted Net Income, Adjusted Net Income margin and Adjusted EPS

are non-IFRS financial measures. TDCX monitors EBITDA, EBITDA

margin, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Net

Income, Adjusted Net Income margin and Adjusted EPS because they

assist the Company in comparing its operating performance on a

consistent basis by removing the impact of items not directly

resulting from its core operations.

EBITDA, EBITDA margin, Adjusted EBITDA and Adjusted EBITDA

margin

“EBITDA” represents profit for the period before interest

expense, interest income, income tax expense, and depreciation

expense. “EBITDA margin” represents EBITDA as a percentage of

revenue. “Adjusted EBITDA” represents profit for the period before

interest expense, interest income, income tax expense, depreciation

expenses, and equity-settled share-based payment expense incurred

in connection with our Performance Share Plan. “Adjusted EBITDA

margin” represents Adjusted EBITDA as a percentage of revenue.

For the three months ended

September 30,

2022

2021

US$’000

S$’000

Margin

S$’000

Margin

Revenue

120,481

172,770

—

148,798

—

Profit for the period and net

profit

margin

21,564

30,923

17.9

%

30,233

20.3

%

Adjustments for:

Depreciation expense

7,118

10,207

5.9

%

10,409

7.0

%

Income tax expenses

7,531

10,799

6.3

%

9,653

6.5

%

Interest expense

299

429

0.2

%

2,703

1.8

%

Interest income

(860

)

(1,233

)

(0.7

%)

(119

)

(0.1

%)

EBITDA and EBITDA margin

35,652

51,125

29.6

%

52,879

35.5

%

Adjustment:

Equity-settled share-based

payment expense

2,676

3,837

2.2

%

—

—

Adjusted EBITDA and Adjusted

EBITDA

margin

38,328

54,962

31.8

%

52,879

35.5

%

For the nine months ended

September 30,

2022

2021

US$’000

S$’000

Margin

S$’000

Margin

Revenue

339,923

487,449

—

400,435

—

Profit for the period and net

profit

margin

55,737

79,928

16.4

%

74,996

18.7

%

Adjustments for:

Depreciation expense

20,264

29,059

6.0

%

30,248

7.6

%

Income tax expenses

20,291

29,097

6.0

%

19,687

4.9

%

Interest expense

967

1,387

0.3

%

6,450

1.6

%

Interest income

(1,340

)

(1,922

)

(0.4

%)

(293

)

(0.1

%)

EBITDA and EBITDA margin

95,919

137,549

28.2

%

131,088

32.7

%

Adjustment:

Equity-settled share-based

payment expense

10,706

15,352

3.1

%

—

—

Adjusted EBITDA and Adjusted

EBITDA

margin

106,625

152,901

31.4

%

131,088

32.7

%

Adjusted Net Income and Adjusted Net Income margin

“Adjusted Net Income” represents profit for the period before

equity-settled share-based payment expense incurred in connection

with our Performance Share Plan, net of any tax impact of such

adjustments. “Adjusted Net Income margin” represents Adjusted Net

Income as a percentage of revenue.

For the three months ended

September 30,

2022

2021

US$’000

S$’000

Margin

S$’000

Margin

Profit for the period and net

profit

margin

21,564

30,923

17.9

%

30,233

20.3

%

Adjustment for:

Equity-settled share-based

payment

expense

2,676

3,837

2.2

%

—

—

Adjusted Net Income and Adjusted

Net

Income margin

24,240

34,760

20.1

%

30,233

20.3

%

For the nine months ended

September 30,

2022

2021

US$’000

S$’000

Margin

S$’000

Margin

Profit for the period and net

profit margin

55,737

79,928

16.4

%

74,996

18.7

%

Adjustment for:

Equity-settled share-based

payment

expense

10,706

15,352

3.1

%

—

—

Adjusted Net Income and Adjusted

Net

Income margin

66,443

95,280

19.5

%

74,996

18.7

%

Adjusted EPS

“Adjusted EPS” represents earnings available to shareholders

excluding the impact of equity-settled share-based payment expense.

Adjusted EPS is calculated as earnings available to shareholders

excluding the impact of equity-settled share-based payment expense

divided by the diluted weighted-average number of shares

outstanding.

For the three months ended

September 30,

2022

2021

Amount

Per

Share

Amount

Per

Share

Amount

Per

Share

US$’000

US$

S$’000

S$

S$’000

S$

Earnings available to

shareholders and EPS

21,563

0.14

30,922

0.21

30,232

0.24

Adjustments for:

Equity-settled share-based

payment

expense

2,676

0.01

3,837

0.03

—

—

Earnings available to

shareholders after

adjustments and Adjusted EPS

24,239

0.15

34,759

0.24

30,232

0.24

For the nine months ended

September 30,

2022

2021

Amount

Per

Share

Amount

Per

Share

Amount

Per

Share

US$’000

US$

S$’000

S$

S$’000

S$

Earnings available to

shareholders and EPS

55,736

0.38

79,926

0.55

74,995

0.61

Adjustments for:

Equity-settled share-based

payment

expense

10,706

0.07

15,352

0.11

—

—

Earnings available to

shareholders after

adjustments and Adjusted EPS

66,442

0.45

95,278

0.66

74,995

0.61

The Company believes that non-IFRS financial measures such as

EBITDA, EBITDA margin, Adjusted EBITDA, Adjusted EBITDA margin,

Adjusted Net Income, Adjusted Net Income margin and Adjusted EPS

help us to identify underlying trends in our operating results,

enhancing our understanding of past performance and future

prospects.

While the Company believes that the non-IFRS financial measures

provide useful information to investors in understanding and

evaluating the Company’s results of operations in the same manner

as its management, the Company’s use of non-IFRS financial measures

have limitations as analytical tools and you should not consider

these in isolation or as a substitute for analysis of the Company’s

results of operations or financial condition as reported under

IFRS.

TDCX’s non-IFRS financial measures do not reflect all items of

income and expense that affect the Company’s operations or not

represent the residual cash flow available for discretionary

expenditures. Further, these non-IFRS measures may differ from the

non-IFRS information used by other companies, including peer

companies, and therefore their comparability may be limited. The

Company compensates for these limitations by reconciling the

non-IFRS financial measures to the nearest IFRS performance

measure, all of which should be considered when evaluating

performance. The Company encourages you to review the company’s

financial information in its entirety and not rely on any single

financial measure.

The translation of Singapore Dollar amounts into United States

Dollar amounts for the unaudited condensed interim consolidated

statement of profit or loss and other comprehensive income above

are included solely for the convenience of readers outside of

Singapore and have been made at the rate of S$1.4340 to US$1.00,

the approximate rate of exchange at September 30, 2022. Such

translations should not be construed as representations that the

Singapore Dollar amounts could be converted into USD at that or any

other rate.

UNAUDITED CONDENSED INTERIM

CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER

COMPREHENSIVE INCOME

For the nine months ended

September 30,

2022

2021

US$’000

S$’000

S$’000

Revenue

339,923

487,449

400,435

Employee benefits expense

(224,226

)

(321,540

)

(242,009

)

Depreciation expense

(20,264

)

(29,059

)

(30,248

)

Rental and maintenance

expense

(5,084

)

(7,290

)

(7,740

)

Recruitment expense

(7,529

)

(10,797

)

(7,544

)

Transport and travelling

expense

(677

)

(971

)

(985

)

Telecommunication and technology

expense

(5,963

)

(8,551

)

(6,333

)

Interest expense

(967

)

(1,387

)

(6,450

)

Other operating expense

(9,039

)

(12,962

)

(10,454

)

Share of profit from an

associate

94

135

78

Interest income

1,340

1,922

293

Other operating income

8,420

12,076

5,640

Profit before income

tax

76,028

109,025

94,683

Income tax expenses

(20,291

)

(29,097

)

(19,687

)

Profit for the period

55,737

79,928

74,996

Item that may be reclassified

subsequently to profit or loss:

Exchange differences on

translation of foreign operations

1,219

1,747

(3,676

)

Total comprehensive income for

the period

56,956

81,675

71,320

Profit

attributable to:

- Owners of the Group

55,736

79,926

74,995

- Non-controlling interests

1

2

1

55,737

79,928

74,996

Total

comprehensive income attributable to:

- Owners of the Group

56,955

81,673

71,319

- Non-controlling interests

1

2

1

56,956

81,675

71,320

Basic earnings per share (in US$

or S$) (1)

0.38

0.55

0.61

Diluted earnings per share (in

US$ or S$) (1)

0.38

0.55

0.61

_______________________________

- Basic and diluted earnings per share

For the nine months ended

September 30,

2022

2021

Weighted average number of

ordinary shares for the purposes of basic

earnings per share

145,425,637

123,500,000

Weighted average number of

ordinary shares for the purposes of diluted

earnings per share

145,425,637

123,500,000

The translation of Singapore Dollar amounts into United States

Dollar amounts (“USD”) for the unaudited condensed interim

consolidated statement of profit or loss and other comprehensive

income above are included solely for the convenience of readers

outside of Singapore and have been made at the rate of S$1.4340 to

US$1.00, the approximate rate of exchange at September 30, 2022.

Such translations should not be construed as representations that

the Singapore Dollar amounts could be converted into USD at that or

any other rate.

UNAUDITED CONDENSED INTERIM

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As of September 30, 2022

As of

December 31,

2021

US$’000

S$’000

S$’000

ASSETS

Current assets

Cash and cash equivalents

269,485

386,441

313,147

Fixed and pledged deposits

4,633

6,644

8,860

Trade receivables

61,114

87,637

92,561

Contract assets

43,409

62,249

49,365

Other receivables

9,984

14,317

13,220

Financial assets measured at fair

value through profit or

loss

19,436

27,871

23,983

Income tax receivable

23

33

17

Total current assets

408,084

585,192

501,153

Non-current assets

Pledged deposits

404

579

456

Other receivables

5,762

8,263

4,771

Plant and equipment

28,517

40,893

39,709

Right-of-use assets

22,149

31,761

33,160

Deferred tax assets

1,692

2,427

1,943

Investment in an associate

316

453

318

Total non-current assets

58,840

84,376

80,357

Total assets

466,924

669,568

581,510

LIABILITIES AND EQUITY

Current liabilities

Other payables

37,136

53,253

39,096

Bank loans

381

547

13,847

Lease liabilities

11,411

16,363

14,550

Provision for reinstatement

cost

2,369

3,397

3,663

Derivative financial

liability

1,177

1,688

-

Income tax payable

12,160

17,437

14,715

Total current liabilities

64,634

92,685

85,871

Non-current

liabilities

Bank loans

-

-

2,963

Lease liabilities

12,779

18,325

21,361

Provision for reinstatement

cost

3,535

5,069

4,384

Derivative financial

liability

2,578

3,697

-

Defined benefit obligation

1,519

2,178

1,718

Deferred tax liabilities

357

512

1,507

Total non-current liabilities

20,768

29,781

31,933

Capital, reserves and

non-controlling interests

Share capital

13

19

19

Reserves

160,885

230,708

227,181

Retained earnings

220,609

316,353

236,486

Equity attributable to owners of

the Group

381,507

547,080

463,686

Non-controlling interests

15

22

20

Total equity

381,522

547,102

463,706

Total liabilities and

equity

466,924

669,568

581,510

The translation of Singapore Dollar amounts into United States

Dollar amounts for the unaudited condensed interim consolidated

statement of financial position above are included solely for the

convenience of readers outside of Singapore and have been made at

the rate of S$1.4340 to US$1.00, the approximate rate of exchange

at September 30, 2022. Such translations should not be construed as

representations that the Singapore Dollar amounts could be

converted into USD at that or any other rate.

UNAUDITED CONDENSED INTERIM

CONSOLIDATED STATEMENT OF CASH FLOWS

For the nine months ended

September 30,

2022

2021

US$’000

S$’000

S$’000

Operating activities

Profit before income tax

76,028

109,025

94,683

Adjustments for:

Depreciation expense

20,264

29,059

30,248

Gain on early termination of

right-of-use assets

—

—

(84

)

Reversal of allowance on trade

and other receivables

—

—

(488

)

Changes in fair value of

derivatives

—

—

193

Equity-settled share-based

payment expense

10,706

15,352

—

Provision for reinstatement

cost

694

995

(2

)

Bank loan transaction cost

29

41

464

Interest income

(1,340

)

(1,922

)

(293

)

Interest expense

967

1,387

6,450

Retirement benefit service

cost

395

566

464

(Gain) / Loss on disposal of

plant and equipment

(1

)

(1

)

155

Share of profit from an

associate

(94

)

(135

)

(78

)

Operating cash flows before

movements in working capital

107,648

154,367

131,712

Trade receivables

499

716

(22,526

)

Contract assets

(11,283

)

(16,180

)

(3,798

)

Other receivables

(1,672

)

(2,399

)

(4,117

)

Other payables

13,547

19,427

5,493

Cash generated from

operations

108,739

155,931

106,764

Interest received

1,340

1,922

293

Income tax paid

(19,259

)

(27,617

)

(22,003

)

Net cash from operating

activities

90,820

130,236

85,054

Investing activities

Purchase of plant and

equipment

(13,599

)

(19,501

)

(18,268

)

Proceeds from sales of plant and

equipment

35

50

106

Payment for restoration of

office

—

—

(431

)

Increase in fixed deposits

1,210

1,735

645

Increase in pledged deposits

—

—

(12

)

Dividend income from

associate

—

—

13

Investment in financial assets

measured at fair value

through profit or loss

—

—

(23,754

)

Net cash used in investing

activities

(12,354

)

(17,716

)

(41,701

)

Financing activities

Dividends paid

(29

)

(41

)

(176

)

Drawdown of bank loan

—

—

252,654

Distribution to founder

—

—

(252,033

)

Repayment of lease

liabilities

(10,060

)

(14,426

)

(14,795

)

Interest paid

(148

)

(212

)

(5,104

)

Repayment of bank loan

(11,321

)

(16,234

)

(15,208

)

Repurchase of American Depositary

Shares

(9,477

)

(13,590

)

—

Proceeds from issuance of

shares

—

—

16

Net cash used in financing

activities

(31,035

)

(44,503

)

(34,646

)

Net increase in cash and cash

equivalents

47,431

68,017

8,707

Effect of foreign exchange rate

changes on cash held in

foreign currencies

3,681

5,277

(1,631

)

Cash and cash equivalents at

beginning of period

218,373

313,147

59,807

Cash and cash equivalents at

end of period

269,485

386,441

66,883

The translation of Singapore Dollar amounts into United States

Dollar amounts for the unaudited condensed interim consolidated

statement of cash flows above are included solely for the

convenience of readers outside of Singapore and have been made at

the rate of S$1.4340 to US$1.00, the approximate rate of exchange

at September 30, 2022. Such translations should not be construed as

representations that the Singapore Dollar amounts could be

converted into USD at that or any other rate.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221122005338/en/

For enquiries: Investors / Analysts: Jason Lim

lim.jason@tdcx.com

Media: Eunice Seow eunice.seow@tdcx.com

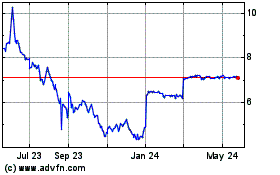

TDCX (NYSE:TDCX)

Historical Stock Chart

From Nov 2024 to Dec 2024

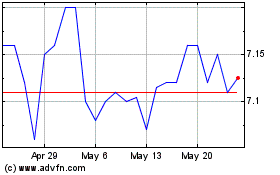

TDCX (NYSE:TDCX)

Historical Stock Chart

From Dec 2023 to Dec 2024