false

0000097216

0000097216

2024-09-30

2024-09-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported)

September 30, 2024

TEREX CORPORATION

(Exact Name of Registrant as Specified

in Charter)

| Delaware |

1-10702 |

34-1531521 |

| (State or Other Jurisdiction |

(Commission |

(IRS Employer |

| of Incorporation) |

File Number) |

Identification No.) |

| |

301 Merritt 7, 4th Floor |

Norwalk |

Connecticut |

06851 |

| |

(Address of Principal Executive Offices) |

(Zip Code) |

Registrant's telephone number, including area code

(203) 222-7170

| NOT APPLICABLE |

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock ($0.01 par value) |

TEX |

New York Stock Exchange |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). |

|

| |

|

| Emerging growth company |

¨ |

| |

|

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

¨ |

Item 7.01 Regulation FD Disclosure.

On September 30, 2024, Terex Corporation

(“Terex” or the “Company”) issued a press release announcing that it commenced a private offering

(the “Private Offering”) of $750.0 million in aggregate principal amount of senior notes due 2032 (the “Notes”)

in a transaction exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”). The

full text of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Terex

also announced that it is seeking, concurrently with the Private Offering, to amend (the “Amendment”) its existing

credit agreement (i) to increase the size of its revolving credit facilities to $800.0 million from $600.0 million and to extend

the maturity of the revolving credit facilities to the fifth anniversary of the closing of the Acquisition (as defined below) and (ii) to

provide for a new term loan facility which will mature on the seventh anniversary of the closing of the Acquisition and pursuant to which

Terex expects to incur term loans in an aggregate amount of up to $1,250.0 million pursuant to previously announced commitments.

There

can be no assurance that Terex will be able to complete the Private Offering or the Amendment on terms and conditions favorable to it

or at all. The Private Offering and the Amendment are being made in connection with Terex’s previously announced acquisition

(the “Acquisition”) of the subsidiaries and assets of Dover Corporation (“Dover”) that constitute

Dover’s Environmental Solutions Group (“ESG”).

In connection with the proposed Private Offering,

Terex provided potential investors with a preliminary offering memorandum, dated September 30, 2024 (the “Preliminary Offering

Memorandum”), which contains (i) information prepared in connection with the Private Offering not previously disclosed

by Terex and (ii) financial information of ESG as of and for the years ended December 31, 2023 and 2022 and as of and for the

six months ended June 30, 2024 and 2023. This information is included in Exhibit 99.2 attached hereto and is incorporated herein

by reference. The Preliminary Offering Memorandum also contains unaudited pro forma condensed combined financial statements and notes

thereto giving effect to the Acquisition and other transactions described therein. This pro forma financial information is included in

Exhibit 99.3 attached hereto and is incorporated herein by reference.

In

addition, in connection with Terex’s financing of the Acquisition, Dover provided audited combined financial statements of

ESG as of and for the fiscal years ended December 31, 2023 and 2022 and unaudited interim condensed combined financial data as of

June 30, 2024 and for the six months ended June 30, 2024 and 2023. The financial statements of ESG have been carved out of the

financial statements of Dover, and may not necessarily be indicative of the amounts that would have been reflected in ESG's financial

statements had ESG operated independently of Dover. The foregoing audited combined financial statements and unaudited interim condensed

combined financial data of ESG are included in Exhibits 99.4 and 99.5 attached hereto, respectively, and are incorporated herein by reference.

The information in Item

7.01 on this Current Report on Form 8-K and the Exhibits attached hereto are being furnished pursuant to Item 7.01 of Form 8-K and

shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities of that Section, nor shall any such information or exhibits be deemed incorporated

by reference in any filing under the Exchange Act or the Securities Act.

The information furnished

in this Current Report on Form 8-K pursuant to Item 7.01, including the information contained in Exhibits 99.1 and 99.2, is

neither an offer to sell nor a solicitation of an offer to buy any of the Notes or the related guarantees in the Private Offering.

Cautionary Note Concerning Forward-Looking

Statements

This

Current Report on Form 8-K contains forward-looking information (within the meaning of Section 27A of the Securities

Act, Section 21E of the Exchange Act and the Private Securities Litigation Reform Act of 1995) regarding future events or Terex’s

future financial performance that involve certain contingencies and uncertainties. In addition, when included herein, the words “may,”

“expects,” “should,” “intends,” “anticipates,” “believes,” “plans,”

“projects,” “estimates,” “will” and the negatives thereof and analogous or similar expressions are

intended to identify forward-looking statements. However, the absence of these words does not mean that the statement is not forward-looking.

Terex has based these forward-looking statements on current expectations and projections about future events. These statements are not

guarantees of future performance. Such statements are inherently subject to a variety of risks and uncertainties that could cause actual

results to differ materially from those reflected in such forward-looking statements.

Because forward-looking statements involve risks

and uncertainties, actual results could differ materially from those risks reflected in such forward-looking statements. Such risks and

uncertainties, many of which are beyond the control of Terex, include, among others, (1) the consummation and the timing of the Private

Offering and the Amendment, (2) the consummation of the Acquisition and (3) those risks and uncertainties described under the

caption “Risk Factors” in Terex’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023,

filed with the Securities and Exchange Commission (the “SEC”) on February 9, 2024, Terex’s Quarterly Report

on Form 10-Q for the quarterly period June 30, 2024 filed with the SEC on July 31, 2024 and the risk factors in Exhibit 99.2

attached hereto.

Actual events or the actual future results of

Terex may differ materially from any forward-looking statement due to these and other risks, uncertainties and material factors. The forward-looking

statements speak only as of the date hereof. Terex expressly disclaims any obligation or undertaking to release publicly any updates or

revisions to any forward-looking statement included herein to reflect any changes in expectations with regard thereto or any changes in

events, conditions, or circumstances on which any such statement is based.

Item

9.01 Financial Statements and Exhibits.

(d) Exhibits

| |

|

|

| Exhibit Number |

|

Description |

| |

|

| 99.1 |

|

Press release of Terex Corporation issued on September 30, 2024. |

| |

|

| 99.2 |

|

Portions of the Preliminary Offering Memorandum, dated September 30, 2024, prepared in connection with the Private Offering. |

| |

|

| 99.3 |

|

Unaudited Pro Forma Condensed Combined Financial Statements, together with the notes thereto, from the Preliminary Offering Memorandum, dated September 30, 2024, prepared in connection with the Private Offering. |

| |

|

| 99.4 |

|

Audited Combined Financial Statements of ESG as of December 31, 2023 and December 31, 2022 and for the years then ended, together with the notes thereto and the independent auditor’s report thereon. |

| |

|

|

| 99.5 |

|

Unaudited Condensed Combined Financial Statements of ESG as of June 30, 2024 and for the six months ended June 30, 2024 and June 30, 2023. |

| |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: September 30, 2024

| |

By: |

/s/ Julie A. Beck |

| |

|

Julie A. Beck |

| |

|

Senior Vice President and Chief Financial Officer |

Exhibit 99.1

Terex Corporation Announces

Launch of Private Offering of $750 Million of Senior Notes Due 2032

NORWALK,

CT. September 30, 2024--- Terex Corporation (“Terex”) (NYSE:TEX) today announced that it intends to offer, subject to

market and other conditions, $750 million in aggregate principal amount of senior notes due 2032 (the “Notes”) in a private

offering (the “Private Offering”) that is exempt from the registration requirements of the Securities Act of 1933, as amended

(the “Securities Act”).

Terex

intends to use the proceeds from the Private Offering, together with the new term loan borrowings described below and cash on hand, to

consummate Terex’s previously announced acquisition (the “Acquisition”) of the subsidiaries and assets of Dover Corporation

(“Dover”) that constitute Dover’s Environmental Solutions Group (“ESG”), and to pay related fees, costs

and expenses.

The Notes and the related guarantees will be offered

and sold only to persons reasonably believed to be qualified institutional buyers in reliance on Rule 144A under the Securities Act

and to certain non-U.S. persons in transactions outside the United States pursuant to Regulation S under the Securities Act. The Notes

and the related guarantees have not been, and will not be, registered under the Securities Act, or any state securities laws, and may

not be offered or sold in the United States absent registration or an applicable exemption from the registration

requirements of the Securities Act and the rules promulgated thereunder.

Concurrently

with the Private Offering, Terex is also seeking to amend (the “Amendment”) its existing credit agreement (i) to increase

the size of its revolving credit facilities to $800 million from $600 million and to extend the maturity of its revolving credit facilities

to the fifth anniversary of the closing of the Acquisition and (ii) to provide for a new term loan facility which will mature on

the seventh anniversary of the closing of the Acquisition and pursuant to which Terex expects to incur term loans in an aggregate amount

of up to $1,250 million. There can be no assurance that Terex will be able to complete the Private Offering or the Amendment on terms

and conditions favorable to it or at all.

This press

release shall not constitute an offer to sell or the solicitation of an offer to buy the Notes or the related guarantees in any jurisdiction.

Forward

Looking Statements:

This press release contains forward-looking information

(within the meaning of Section 27A of the Securities Act, Section 21E of the Securities Exchange Act of 1934 and the Private

Securities Litigation Reform Act of 1995) regarding future events or Terex’s future financial performance that involve certain contingencies

and uncertainties. In addition, when included in this press release, the words “may,” “expects,” “should,”

“intends,” “anticipates,” “believes,” “plans,” “projects,” “estimates,”

“will” and the negatives thereof and analogous or similar expressions are intended to identify forward-looking statements.

However, the absence of these words does not mean that the statement is not forward-looking. Terex has based these forward-looking statements

on current expectations and projections about future events. These statements are not guarantees of future performance. Such statements

are inherently subject to a variety of risks and uncertainties that could cause actual results to differ materially from those reflected

in such forward-looking statements.

Because forward-looking statements involve risks

and uncertainties, actual results could differ materially from those risks reflected in such forward-looking statements. Such risks and

uncertainties, many of which are beyond the control of Terex, include, among others, (1) the consummation and the timing of the Private

Offering and the Amendment, (2) the consummation of the Acquisition and (3) those risks and uncertainties described under the

caption “Risk Factors” in Terex’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023,

filed with the Securities and Exchange Commission (the “SEC”) on February 9, 2024, Terex’s Quarterly Report on

Form 10-Q for the quarterly period June 30, 2024 filed with the SEC on July 31, 2024 and the risk factors included in Exhibit 99.2

to Terex’s Current Report on Form 8-K filed with the SEC on September 30, 2024.

Actual events or the actual future results of

Terex may differ materially from any forward-looking statement due to these and other risks, uncertainties and material factors. The forward-looking

statements speak only as of the date of this release. Terex expressly disclaims any obligation or undertaking to release publicly any

updates or revisions to any forward-looking statement included in this release to reflect any changes in expectations with regard thereto

or any changes in events, conditions, or circumstances on which any such statement is based.

About

Terex:

Terex is a global manufacturer of materials processing

machinery and aerial work platforms. We design, build and support products used in maintenance, manufacturing, energy, recycling, minerals

and materials management, and construction applications. Certain Terex products and

solutions enable customers to reduce their impact

on the environment including electric and hybrid offerings that deliver quiet and emission-free performance, products that support renewable

energy, and products that aid in the recovery of useful materials from various types of waste. Our products are manufactured in North

America, Europe, Australia and Asia and sold worldwide. We engage with customers through all stages of the product life cycle, from initial

specification to parts and service support. We report our business in the following segments: (i) Materials Processing and (ii) Aerial

Work Platforms.

Contact

Information:

Derek Everitt

VP Investor Relations

Email: InvestorRelations@Terex.com

Exhibit 99.2

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This document may include

forward-looking statements (within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”),

Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Private Securities Litigation

Reform Act of 1995) regarding future events or our future financial performance that involve certain contingencies and uncertainties.

In addition, when included in this document, the words “may,” “expects,” “should,” “intends,”

“anticipates,” “believes,” “plans,” “projects,” “estimates,” “will”

and the negatives thereof and analogous or similar expressions are intended to identify forward-looking statements. However, the absence

of these words does not mean that the statement is not forward-looking. We have based these forward-looking statements on current expectations

and projections about future events. These statements are not guarantees of future performance. Such statements are inherently subject

to a variety of risks and uncertainties that could cause actual results to differ materially from those reflected in such forward-looking

statements. Such risks and uncertainties, many of which are beyond our control, include, among others:

| · | we

may be unable to successfully integrate acquired businesses, including the ESG (as defined

herein) business; |

| · | we

may not realize expected benefits for any acquired businesses, including the ESG business,

within the timeframe anticipated or at all; |

| · | our

operations are subject to a number of potential risks that arise from operating a multinational

business, including political and economic instability and compliance with changing regulatory

environments; |

| · | changes

in the availability and price of certain materials and components, which may result in supply

chain disruptions; |

| · | consolidation

within our customer base and suppliers; |

| · | our

business may suffer if our equipment fails to perform as expected; |

| · | a

material disruption to one of our significant facilities; |

| · | our

business is sensitive to general economic conditions, government spending priorities and

the cyclical nature of markets we serve; |

| · | our

consolidated financial results are reported in United States (“U.S.”) dollars

while certain assets and other reported items are denominated in the currencies of other

countries, creating currency exchange and translation risk; |

| · | our

need to comply with restrictive covenants contained in our debt agreements; |

| · | our

ability to generate sufficient cash flow to service our debt obligations and operate our

business; |

| · | our

ability to access the capital markets to raise funds and provide liquidity; |

| · | the

financial condition of customers and their continued access to capital; |

| · | exposure

from providing credit support for some of our customers; |

| · | we

may experience losses in excess of recorded reserves; |

| · | our

industry is highly competitive and subject to pricing pressure; |

| · | our

ability to successfully implement our strategy and the actual results derived from such strategy; |

| · | increased

cybersecurity threats and more sophisticated computer crime; |

| · | increased

regulatory focus on privacy and data security issues and expanding laws; |

| · | our

ability to attract, develop, engage and retain team members; |

| · | possible

work stoppages and other labor matters; |

| · | litigation,

product liability claims and other liabilities; |

| · | changes

in import/export regulatory regimes, the imposition of tariffs, escalation of global trade

conflicts and unfairly traded imports, particularly from China, could continue to negatively

impact our business; |

| · | compliance

with environmental regulations could be costly and our failure to meet sustainability expectations

or standards or to achieve our sustainability goals could adversely impact our business; |

| · | our

compliance with the U.S. Foreign Corrupt Practices Act and similar worldwide anti-corruption

laws; |

| · | our

ability to comply with an injunction and related obligations imposed by the U.S. Securities

and Exchange Commission (the “SEC”); |

| · | our

levels of indebtedness and debt service obligations, including changes in our credit ratings,

material increases in our cost of borrowing or the failure of financial institutions to fulfill

their commitments to us under committed facilities; |

| · | the

possibility that we may incur additional indebtedness in the future; |

| · | limitations

on operating our business as a result of covenant restrictions under our indebtedness, and

our ability to pay amounts due on the notes offered in the notes offering; |

| · | our

ability to repurchase the notes offered in the notes offering upon a change of control; and |

The above list is not exhaustive.

Some of these factors and additional risks, uncertainties and other factors that may cause our actual results, performance or achievements

to be different from those expressed or implied in our written or oral forward-looking statements may be found under “Risk Factors”

contained in this document and under “Risk Factors” in Terex Corporation’s Annual Report on Form 10-K for the fiscal

year ended December 31, 2023 filed with the SEC on February 9, 2024 (the “2023 10-K”) and Terex Corporation’s Quarterly

Report on Form 10-Q for the quarterly period ended June 30, 2024 filed with the SEC on July 31, 2024 (the “2024 Q2 10-Q”).

Actual events or our actual

future results may differ materially from any forward-looking statement due to these and other risks, uncertainties and significant factors.

The forward-looking statements contained herein speak only as of September 30, 2024. We expressly disclaim any obligation or undertaking

to release publicly any updates or revisions to any forward-looking statement contained in this document to reflect any change in our

expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

BASIS OF PRESENTATION

As used in this document,

unless otherwise specified or the context otherwise requires, “Terex,” “issuer,” “we,” “our,”

“us” and the “Company” refer to Terex Corporation and its consolidated subsidiaries.

This document includes unaudited

historical consolidated financial data for the twelve months ended June 30, 2024 of Terex and unaudited historical combined financial

data for the twelve months ended June 30, 2024 of ESG. This document also includes unaudited pro forma condensed combined financial information

of Terex as of June 30, 2024 and for the year ended December 31, 2023 and the twelve months ended June 30, 2024. The unaudited pro forma

condensed combined balance sheet as of June 30, 2024 has been prepared to give effect to the Transactions (as defined herein) as if they

had occurred on June 30, 2024. The unaudited pro forma condensed combined statement of operations for the twelve months ended June 30,

2024 has been prepared to give effect to the Transactions as if they had occurred on July 1, 2023. The unaudited pro forma condensed

combined statements of operations for the year ended December 31, 2023 have been prepared to give effect to the Transactions as if they

had occurred on January 1, 2023. For further information regarding the basis of presentation of the unaudited historical financial data

for the twelve months ended June 30, 2024 of Terex and ESG, see “Summary Historical Financial Information of Terex” and “Summary

Historical Financial Information of ESG,” respectively. For further information regarding the basis of presentation of the unaudited

pro forma financial information included in this document, see “Summary Pro Forma Financial Information” and our unaudited

pro forma financial statements and related notes included as Exhibit 99.3 to our Current Report on Form 8-K filed with the SEC on September

30, 2024 (the “Unaudited Pro Forma Financial Statements”).

Certain monetary amounts,

percentages and other figures included herein have been subject to rounding adjustments. Accordingly, figures shown as totals in certain

tables may not be the arithmetic aggregation of the figures that precede them, and figures expressed as percentages in the text may not

total 100% or, as applicable, when aggregated may not be the arithmetic aggregation of the percentages that precede them.

NON-GAAP FINANCIAL MEASURES

In this document, we refer

to various U.S. generally accepted accounting principles (“GAAP”) and non-GAAP financial measures. These non-GAAP measures

may not be comparable to similarly titled measures being disclosed by other companies. Management believes that presenting these non-GAAP

financial measures provide investors with additional analytical tools which are useful in evaluating our operating results and the ongoing

performance of our underlying businesses because they (i) provide meaningful supplemental information regarding financial performance

by excluding impact of one-time items and other items affecting comparability between periods, (ii) permit investors to view performance

using the same tools that management uses to budget, make operating and strategic decisions, and evaluate our core operating performance

across periods and (iii) otherwise provide supplemental information that may be useful to investors in evaluating our financial results.

We do not, nor do we suggest that investors consider, such non-GAAP financial measures in isolation from, or as a substitute for, financial

information prepared in accordance with GAAP.

INDUSTRY DATA

Information in this document

concerning industry information, including our general expectations, are based on estimates prepared by us using certain assumptions

and our knowledge of these industries as well as data from third-party sources. We have not independently verified any of the data from

third party sources. Our estimates involve risks and uncertainties and are subject to changes based on various factors, including those

discussed under “Risk Factors” herein and under “Risk Factors” in the 2023 10-K and the 2024 Q2 10-Q.

SUMMARY

This summary highlights

significant aspects of our business, but it is not complete and does not contain all of the information you should consider. You should

carefully read this document, including the information presented under the section herein entitled “Risk Factors” and the

financial statements and related notes in the 2023 10-K and our other periodic and current reports filed with the SEC, and the matters

discussed under “Risk Factors” in the 2023 10-K and the 2024 Q2 10-Q. This summary contains forward-looking statements that

involve risks and uncertainties. Our actual results may differ significantly from the results discussed in the forward-looking statements

as a result of certain factors, including those set forth under the sections entitled “Cautionary Statement Regarding Forward-Looking

Statements” and “Risk Factors” in the 2023 10-K and the 2024 Q2 10-Q, and under the section entitled “Risk Factors.”

Acquisition of ESG

On July 21, 2024, we entered

into a Transaction Agreement (the “Transaction Agreement”) with Dover Corporation (“Dover”). Pursuant to

the Transaction Agreement, we will acquire the subsidiaries and assets of Dover that constitute Dover’s Environmental Solutions

Group (“ESG”), a fully integrated equipment group serving the solid waste and recycling industry, along with associated intellectual

property and other assets used in the ESG business (the “Acquisition”), for consideration of $2,000.0 million. The consideration

will be paid in cash and is subject to post-closing adjustments based upon the level of net working capital and cash and debt in the

ESG business at the closing date. We currently anticipate closing the Acquisition, which is subject to the satisfaction of customary

non-regulatory closing conditions, later this year, although there can be no assurance that the Acquisition will close when anticipated,

or at all. On September 9, 2024, the waiting period under the Hart-Scott-Rodino Antitrust Improvement Act of 1976, as amended, expired.

As a result, no further regulatory approvals or clearances are required to satisfy the closing conditions for the Acquisition.

ESG designs and manufactures

refuse collection vehicles (“RCV”), waste compaction equipment, and associated parts and digital solutions. ESG is comprised

of several brands, including Heil, Marathon, Curotto-Can, and Bayne Thinline, as well as digital solutions offerings 3rd Eye and Soft-Pak,

that serve the solid waste industry. ESG's broad array of turnkey products and services across equipment, digital and aftermarket offerings

are complementary to Terex's businesses, which we expect will allow us to expand our customer base, provide customers with a broader

suite of environmental equipment solutions, and realize economies of scale. ESG has demonstrated a track record of consistent, resilient

growth, estimated to have delivered a long-term organic revenue CAGR greater than 7% from fiscal year 2013 through fiscal year 2023,

supported by key acquisitions, and is estimated to have delivered 5.1% average year-over-year revenue growth from 2008 through 2023,

with an attractive standard deviation of 10.5%, demonstrating a consistent level of growth historically.

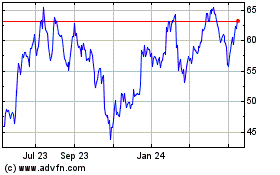

| ESG Financial Profile |

ESG Historical Organic Growth |

|

|

| 1. Based

on revenue for the twelve months ended March 31, 2024 on a historical basis. |

|

In addition, we will seek

to leverage ESG’s strong relationships with major national customers and diversified base of smaller rental, independent and municipal

customers, through a near even mix of distribution through direct and dealer channels. Below is a breakdown of ESG’s revenue mix

for the twelve months ended June 30, 2024 by customer and by refuse collection channel.

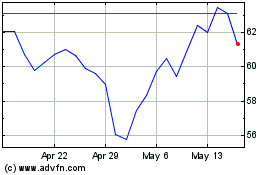

| Refuse Collection Channel |

ESG Customer Breakdown |

|

|

As a result, our acquisition

of ESG is expected to enhance Terex’s scale and diversification and reduce cyclicality. We expect the transaction to deliver financially

accretive revenue growth, free cash flow and EBITDA margins. The combined entity will provide a strong foundation to support our capital

allocation commitment to maintain our long-term net leverage target of below 2.5x by the end of 2025 from an enhanced free cash flow

profile. Our management estimates annual run rate synergies of approximately $25.0 million (excluding approximately $15.0 million of

one-time costs to achieve the anticipated synergies), expected to be achieved by the end of 2026, consisting of an estimated:

| · | $15.0

million in operational and commercial cost-based synergies from pricing optimization, manufacturing

transformation and optimization of cost-out practices and management structure; |

| · | $5.0

million in cost-savings from sourcing synergies through steel and non-steel cost management

actions and shared suppliers; and |

| · | $5.0

million in cost-savings from selling, general and administrative expense synergies. |

We also expect to capitalize

on cross-selling opportunities to enhance net sales by aligning business units across the Company. With ESG’s robust backlog of

approximately $523.0 million as of June 30, 2024, Terex management has visibility into potential revenue to capitalize on in the future.

In the fiscal years ended December 31, 2023 and 2022, ESG realized 167% and 176%, respectively, of its December 31, 2022 and December

31, 2021 backlog, respectively, as revenue.

Additionally, ESG increases

our exposure to the growing waste recycling and scrap end market. Waste is as essential service, and the RCV market is projected to grow

at a CAGR greater than 5% over the next ten years according to a third party study of the waste industry commissioned by Terex in April

2024. With the shift towards recycling driven by environmental trends, equipment with more advanced capabilities is required. ESG’s

business model is anchored by multi-year contracts with recurring volumes and offers potential synergies when combined with Terex Recycling

Systems, ZenRobotics and Ecotec.

Waste and Recycling

End Market Growth

Source: Kaiser Associates Waste Study Commissioned by Terex Management, April 2024

Recent Developments

We have experienced, and

continue to experience, lower than expected sales volume across our business segments due to channels globally making adjustments faster

than anticipated. Customers in our AWP segment are reducing planned deliveries to align their fleet configuration with seasonal rental

demand. In the MP segment, dealers are adjusting their inventory levels as end users gauge the macroeconomic environment. In response

to such conditions, management is taking actions to align our cost structure and production plans accordingly.

SUMMARY PRO FORMA FINANCIAL INFORMATION

The following summary unaudited

pro forma condensed combined financial data has been prepared to reflect the Acquisition and the related financing transactions (together,

the “Transactions”). The following summary unaudited pro forma condensed combined statement of operations data for the twelve

months ended June 30, 2024 give effect to the Transactions as if they had occurred on July 1, 2023. The following summary unaudited pro

forma condensed combined statement of operations data for the year ended December 31, 2023 give effect to the Transactions as if they

had occurred on January 1, 2023. The following summary unaudited pro forma condensed combined balance sheet data give effect to the Transactions

as if they had occurred on June 30, 2024. We derived the unaudited pro forma condensed combined financial data as of and for the twelve

months ended June 30, 2024 and for the year ended December 31, 2023 in the summary table below from, and they should be read together

with, the Unaudited Pro Forma Financial Statements. The summary unaudited pro forma condensed combined statement of operations data for

the twelve months ended June 30, 2024 combines the amounts in our unaudited condensed consolidated statement of operations for the twelve

months ended June 30, 2024 with the amounts in the unaudited statement of operations of ESG for the twelve months ended June 30, 2024.

The summary unaudited pro forma condensed combined financial data is provided for illustrative purposes only and, except as described

below or in the Unaudited Pro Forma Financial Statements, does not reflect the costs of any integration

activities or benefits that may result from the Acquisition or what our consolidated results of operations or consolidated financial

position would have been had the Acquisition occurred on the dates assumed, nor are they indicative of our future consolidated results

of operations or financial position and they are based on the information available at the time of their preparation. Actual results

may differ materially from those reflected in the summary unaudited pro forma condensed combined financial data for a number of reasons,

including, but not limited to, differences between the assumptions used to prepare the unaudited pro forma financial statements and actual

amounts. See the Unaudited Pro Forma Financial Statements.

| | |

Twelve

Months Ended

June 30, 2024 | | |

Year

Ended

December 31, 2023 | |

| | |

| | |

| |

| (in millions) | |

(unaudited) | |

| Statement of Operations Data: | |

| |

| Net sales | |

$ | 6,022.4 | | |

$ | 5,905.1 | |

| Cost of goods sold | |

| (4,619.1 | ) | |

| (4,537.5 | ) |

| Gross profit | |

| 1,403.3 | | |

| 1,367.6 | |

| Selling, general and administrative expenses | |

| (692.1 | ) | |

| (674.2 | ) |

| Income (loss) from operations | |

| 711.2 | | |

| 693.4 | |

| Interest income | |

| 10.1 | | |

| 7.6 | |

| Interest expense | |

| (192.3 | ) | |

| (192.0 | ) |

| Other income (expense) - net | |

| (36.5 | ) | |

| (27.8 | ) |

| Income (loss) from continuing operations before income taxes | |

| 492.5 | | |

| 481.2 | |

| (Provision for) benefit from income taxes | |

| (51.8 | ) | |

| (39.3 | ) |

| Income (loss) from continuing operations | |

| 440.7 | | |

| 441.9 | |

| Gain (loss) on disposition of discontinued operations - net

of tax | |

| (1.0 | ) | |

| 1.3 | |

| Net income (loss) | |

| 439.7 | | |

| 443.2 | |

| | |

June 30,

2024 | |

| (in millions) | |

| (unaudited) | |

| Balance Sheet Data: | |

| | |

| Cash and cash equivalents | |

$ | 246.3 | |

| Receivables | |

| 836.5 | |

| Inventories | |

| 1,316.3 | |

| Property, plant and equipment - net | |

| 680.1 | |

| Total assets | |

| 5,916.5 | |

| Total debt (including current portion) | |

| 2,622.1 | |

| Total stockholders’ equity | |

| 1,805.3 | |

| |

Twelve

Months Ended

June 30, 2024 | | |

Year Ended

December 31, 2023 | |

| | |

| | |

| |

| (in millions) | |

| (unaudited) | |

| Other Data: | |

| | | |

| | |

| Total Pro Forma Cash Interest Expense(1) | |

$ | 183.9 | | |

$ | 183.6 | |

| Total Pro Forma Adjusted EBITDA(2) | |

| 937.3 | | |

| 886.6 | |

| Total Pro Forma Adjusted EBITDA Margin(2) | |

| 15.6 | % | |

| 15.0 | % |

| (1) | Total pro forma cash interest expense for

the twelve months ended June 30, 2024 and the year ended December 31, 2023 represents cash

interest paid during the twelve months ended June 30, 2024 and the year ended December 31,

2023, respectively, as adjusted for the additional estimated cash interest expense associated

with the financing transactions, including the issuance of the notes offered in the notes

offering. On a pro forma basis after giving effect to the Transactions, assuming a weighted

average interest rate of 6.12% on the notes offered in the notes offering and our borrowings

under the new credit facilities, our cash interest expense for the twelve months ended June

30, 2024 and the year ended December 31, 2023 would have been $183.9 million and $183.6 million,

respectively. |

| (2) | Total Pro Forma Adjusted EBITDA and Total

Pro Forma Adjusted EBITDA Margin are non-GAAP measures. We present these measures because

we believe they will be helpful to those reviewing our performance, as they provide information

about our ability to meet debt service, capital expenditure and working capital requirements,

and are also an indicator of profitability. We consider Total Pro Forma Adjusted EBITDA and

Total Pro Forma Adjusted EBITDA Margin to be important supplemental measures of our performance

because these calculations adjust for certain items that we believe are not indicative of

our core operating performance. |

Total Pro Forma Adjusted EBITDA

and Total Pro Forma Adjusted EBITDA Margin have limitations as analytical tools, and do not represent, and should not be considered an

alternative to, net income as defined by GAAP. Among other things, Total Pro Forma Adjusted EBITDA and Total Pro Forma Adjusted EBITDA

Margin:

| · | do

not reflect our cash expenditures, or future requirements, for capital expenditures; |

| · | do

not reflect changes in, or cash requirements for, our working capital needs; |

| · | do

not reflect the significant interest expense, or the cash requirements necessary to service

interest or principal payments, on our debt; and |

| · | do

not reflect any cash requirements to replace in the future assets being depreciated and amortized,

even though depreciation and amortization are non-cash charges that are excluded from these

measures. |

We compensate for these limitations

by relying primarily on our GAAP results and using Total Pro Forma Adjusted EBITDA and Total Pro Forma Adjusted EBITDA Margin only supplementally.

The following table provides

an unaudited reconciliation of Terex Adjusted EBITDA and ESG Adjusted EBITDA to Total Pro Forma Adjusted EBITDA and of Total Pro Forma

Revenue to Total Pro Forma Adjusted EBITDA Margin. For reconciliations of Terex Adjusted EBITDA and ESG Adjusted EBITDA to their nearest

GAAP financial measures, please see “Summary Historical Financial Information of Terex” and “Summary Historical Financial

Information of ESG.”

| | |

Twelve

Months Ended

June 30, 2024 | | |

Year Ended

December 31, 2023 | |

| | |

| | |

| |

| (in millions) | |

(unaudited) | |

| Terex Adjusted EBITDA | |

$ | 738.3 | | |

$ | 737.5 | |

| ESG Adjusted EBITDA | |

| 174.0 | | |

| 149.1 | |

| Synergies(a) | |

| 25.0 | | |

| — | |

| Total Pro Forma Adjusted EBITDA | |

| 937.3 | | |

| 886.6 | |

| Total Pro Forma Revenue | |

| 6,022.4 | | |

| 5,905.1 | |

| Total Pro Forma Adjusted EBITDA Margin | |

| 15.6 | % | |

| 15.0 | % |

| (a) | Our management estimates annual run rate synergies of approximately

$25.0 million (excluding approximately $15.0 million of one-time costs to achieve the anticipated synergies), expected to be achieved

by the end of 2026, consisting of an estimated: (i) $15.0 million in operational and commercial cost-based synergies from pricing optimization,

manufacturing transformation and optimization of cost-out practices and management structure, (ii) $5.0 million in cost-savings from

sourcing synergies through steel and non-steel cost management actions and shared suppliers and (iii) $5.0 million in cost-savings from

selling, general and administrative expense synergies. |

SUMMARY HISTORICAL FINANCIAL

INFORMATION OF TEREX

The summary historical consolidated

financial data of Terex for the twelve months ended June 30, 2024, has been calculated by adding the unaudited consolidated financial

statements for the six months ended June 30, 2024 to the audited consolidated financial statements for the year ended December 31, 2023

and then subtracting the unaudited consolidated financial statements for the six months ended June 30, 2023. The summary historical consolidated

financial data as of December 31, 2022 and 2023 and for each of the years in the three-year period ended December 31, 2023 have been

derived from our audited historical consolidated financial statements and related notes as presented in the 2023 10-K. The summary historical

consolidated financial data as of December 31, 2021 has been derived from our audited historical consolidated financial information as

presented in our Annual Report on Form 10-K for the year ended December 31, 2021. The summary historical consolidated financial data

as of June 30, 2024 and for the six months ended June 30, 2023 and 2024 have been derived from our unaudited interim historical consolidated

financial statements as presented in the 2024 Q2 10-Q. The summary historical consolidated financial data as of June 30, 2023 has been

derived from our unaudited consolidated financial statements as presented in our Quarterly Report on Form 10-Q for the quarterly period

ended June 30, 2023. The unaudited interim historical consolidated financial statements have been prepared on the same basis as the audited

historical consolidated financial statements and, in the opinion of our management, include all adjustments, consisting only of normal

and recurring adjustments, necessary for a fair presentation of the information set forth herein. Interim financial results are not necessarily

indicative of the results expected for the full fiscal year or any future reporting period. You should read the summary historical consolidated

financial data below together with our historical consolidated financial statements and related notes thereto and the information under

the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in the

2023 10-K and the 2024 Q2 10-Q.

| | |

Twelve

Months

Ended June | | |

Year Ended

December

31, | | |

Six Months Ended

June 30, | |

| |

30, 2024 | | |

| 2021 | | |

| 2022 | | |

| 2023 | | |

| 2023 | | |

| 2024 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| (in millions) | |

| (unaudited) | | |

| | | |

| | | |

| | | |

| (unaudited) | |

| Statement of Operations Data: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net sales | |

$ | 5,186.9 | | |

$ | 3,886.8 | | |

$ | 4,417.7 | | |

$ | 5,151.5 | | |

$ | 2,638.8 | | |

$ | 2,674.2 | |

| Cost of goods sold | |

| (4,006.2 | ) | |

| (3,129.4 | ) | |

| (3,546.5 | ) | |

| (3,974.9 | ) | |

| (2,017.2 | ) | |

| (2,048.5 | ) |

| Gross profit | |

| 1,180.7 | | |

| 757.4 | | |

| 871.2 | | |

| 1,176.6 | | |

| 621.6 | | |

| 625.7 | |

| Selling, general and administrative expenses | |

| (550.4 | ) | |

| (429.4 | ) | |

| (451.2 | ) | |

| (540.1 | ) | |

| (264.0 | ) | |

| (274.3 | ) |

| Income (loss) from operations | |

| 630.3 | | |

| 328.0 | | |

| 420.0 | | |

| 636.5 | | |

| 357.6 | | |

| 351.4 | |

| Interest income | |

| 10.1 | | |

| 3.7 | | |

| 2.8 | | |

| 7.6 | | |

| 3.1 | | |

| 5.6 | |

| Interest expense | |

| (63.6 | ) | |

| (51.5 | ) | |

| (49.1 | ) | |

| (63.3 | ) | |

| (30.3 | ) | |

| (30.6 | ) |

| Loss on early extinguishment of debt | |

| — | | |

| (29.4 | ) | |

| (0.3 | ) | |

| — | | |

| — | | |

| — | |

| Other income (expense) – net | |

| (11.5 | ) | |

| 13.0 | | |

| (6.8 | ) | |

| (1.1 | ) | |

| (5.4 | ) | |

| (15.8 | ) |

| Income (loss) from continuing operations before income taxes | |

| 565.3 | | |

| 263.8 | | |

| 366.6 | | |

| 579.7 | | |

| 325.0 | | |

| 310.6 | |

| (Provision for) benefit from income taxes | |

| (69.1 | ) | |

| (46.3 | ) | |

| (66.4 | ) | |

| (63.0 | ) | |

| (55.3 | ) | |

| (61.4 | ) |

| Income (loss) from continuing operations | |

| 496.2 | | |

| 217.5 | | |

| 300.2 | | |

| 516.7 | | |

| 269.7 | | |

| 249.2 | |

| Gain (loss) on disposition of discontinued

operations – net of tax | |

| (1.0 | ) | |

| 3.4 | | |

| (0.2 | ) | |

| 1.3 | | |

| 2.3 | | |

| — | |

| Net income (loss) | |

| 495.2 | | |

| 220.9 | | |

| 300.0 | | |

| 518.0 | | |

| 272.0 | | |

| 249.2 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Statement of Cash Flows Data: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Depreciation and amortization | |

$ | 61.4 | | |

$ | 50.2 | | |

$ | 47.2 | | |

$ | 56.4 | | |

$ | 24.9 | | |

$ | 30.0 | |

| Stock-based compensation expense | |

| 44.3 | | |

| 33.1 | | |

| 30.3 | | |

| 43.6 | | |

| 17.3 | | |

| 18.0 | |

| Capital expenditures | |

| (147.3 | ) | |

| (59.7 | ) | |

| (109.6 | ) | |

| (127.2 | ) | |

| (39.1 | ) | |

| (59.2 | ) |

| Proceeds from sale of capital assets | |

| 0.2 | | |

| 1.9 | | |

| 0.2 | | |

| 33.6 | | |

| 33.5 | | |

| 0.1 | |

| | |

December

31, | | |

June 30, | |

| | |

2021 | | |

2022 | | |

2023 | | |

2023 | | |

2024 | |

| | |

| | |

| | |

| | |

| | |

| |

| (in millions) | |

| | |

| | |

| | |

(unaudited) | |

| Balance Sheet Data: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 266.9 | | |

$ | 304.1 | | |

$ | 370.7 | | |

$ | 297.7 | | |

$ | 319.3 | |

| Receivables, net | |

| 507.7 | | |

| 547.5 | | |

| 547.8 | | |

| 681.2 | | |

| 719.4 | |

| Inventories | |

| 813.5 | | |

| 988.4 | | |

| 1,186.0 | | |

| 1,122.0 | | |

| 1,232.8 | |

| Property, plant and equipment – net | |

| 429.6 | | |

| 465.6 | | |

| 569.8 | | |

| 490.7 | | |

| 574.5 | |

| Total assets | |

| 2,863.5 | | |

| 3,118.1 | | |

| 3,615.5 | | |

| 3,415.2 | | |

| 3,779.5 | |

| Total debt (including current portion) | |

| 674.1 | | |

| 775.5 | | |

| 623.2 | | |

| 736.7 | | |

| 665.6 | |

| Total stockholders’ equity | |

| 1,109.6 | | |

| 1,181.2 | | |

| 1,672.3 | | |

| 1,432.2 | | |

| 1,823.9 | |

| | |

Twelve

Months

Ended June 30, | | |

Year Ended

December

31, | | |

Six Months Ended

June 30, | |

| |

| 2024 | | |

| 2021 | | |

| 2022 | | |

| 2023 | | |

| 2023 | | |

| 2024 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| (in millions) | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other Data (unaudited): | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cash interest expense | |

$ | 61.6 | | |

$ | 48.2 | | |

$ | 46.8 | | |

$ | 61.3 | | |

$ | 29.3 | | |

$ | 29.6 | |

| Terex EBITDA(1) | |

| 689.7 | | |

| 374.6 | | |

| 465.0 | | |

| 690.9 | | |

| 381.6 | | |

| 380.4 | |

| Terex Adjusted

EBITDA(1) | |

| 738.3 | | |

| 407.1 | | |

| 496.1 | | |

| 737.5 | | |

| 395.8 | | |

| 396.6 | |

| Terex Adjusted

EBITDA Margin(1) | |

| 14.2 | % | |

| 10.5 | % | |

| 11.2 | % | |

| 14.3 | % | |

| 15.0 | % | |

| 14.8 | % |

| (1) | Terex EBITDA, Terex Adjusted EBITDA and Terex

Adjusted EBITDA Margin are non-GAAP measures. We present these measures because we believe

they will be helpful to those reviewing our performance, as they provide information about

our ability to meet debt service, capital expenditure and working capital requirements, and

are also an indicator of profitability. We consider Terex EBITDA, Terex Adjusted EBITDA and

Terex Adjusted EBITDA Margin to be important supplemental measures of our performance because

these calculations adjust for certain items that we believe are not indicative of our core

operating performance. |

Terex EBITDA, Terex Adjusted EBITDA

and Terex Adjusted EBITDA Margin have limitations as analytical tools, and do not represent, and should not be considered an alternative

to, net income as defined by GAAP. Among other things, Terex EBITDA, Terex Adjusted EBITDA and Terex Adjusted EBITDA Margin:

| · | do

not reflect our cash expenditures, or future requirements, for capital expenditures; |

| · | do

not reflect changes in, or cash requirements for, our working capital needs; |

| · | do

not reflect the significant interest expense, or the cash requirements necessary to service

interest or principal payments, on our debt; and |

| · | do

not reflect any cash requirements to replace in the future assets being depreciated and amortized,

even though depreciation and amortization are non-cash charges that are excluded from these

measures. |

We compensate for these limitations

by relying primarily on our GAAP results and using Terex EBITDA, Terex Adjusted EBITDA and Terex Adjusted EBITDA Margin only supplementally.

The following table provides

an unaudited reconciliation of net income to Terex EBITDA and Terex Adjusted EBITDA and of net sales to Terex Adjusted EBITDA Margin:

| | |

Twelve

Months Ended | | |

Year Ended

December

31, | | |

Six Months Ended

June 30, | |

| |

| June 30, 2024 | | |

| 2021 | | |

| 2022 | | |

| 2023 | | |

| 2023 | | |

| 2024 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| (in millions) | |

| (unaudited) | | |

| | | |

| | | |

| | | |

| (unaudited) | |

| Net income | |

$ | 495.2 | | |

$ | 220.9 | | |

$ | 300.0 | | |

$ | 518.0 | | |

$ | 272.0 | | |

$ | 249.2 | |

| (Gain) loss on disposition of discontinued operations - net of tax | |

| 1.0 | | |

| (3.4 | ) | |

| 0.2 | | |

| (1.3 | ) | |

| (2.3 | ) | |

| — | |

| Income (loss) from continuing operations | |

| 496.2 | | |

| 217.5 | | |

| 300.2 | | |

| 516.7 | | |

| 269.7 | | |

| 249.2 | |

| Provision for (benefit from) income taxes | |

| 69.1 | | |

| 46.3 | | |

| 66.4 | | |

| 63.0 | | |

| 55.3 | | |

| 61.4 | |

| Interest & Other (income) expense | |

| 65.0 | | |

| 34.8 | | |

| 53.1 | | |

| 56.8 | | |

| 32.6 | | |

| 40.8 | |

| Loss on early extinguishment of debt | |

| — | | |

| 29.4 | | |

| 0.3 | | |

| — | | |

| — | | |

| — | |

| Income (loss) from operations | |

| 630.3 | | |

| 328.0 | | |

| 420.0 | | |

| 636.5 | | |

| 357.6 | | |

| 351.4 | |

| Depreciation | |

| 57.0 | | |

| 44.3 | | |

| 42.3 | | |

| 51.8 | | |

| 22.6 | | |

| 27.8 | |

| Amortization | |

| 4.4 | | |

| 5.6 | | |

| 4.9 | | |

| 4.6 | | |

| 2.4 | | |

| 2.2 | |

| Non-cash interest costs | |

| (2.0 | ) | |

| (3.3 | ) | |

| (2.2 | ) | |

| (2.0 | ) | |

| (1.0 | ) | |

| (1.0 | ) |

| Terex EBITDA | |

$ | 689.7 | | |

$ | 374.6 | | |

$ | 465.0 | | |

$ | 690.9 | | |

$ | 381.6 | | |

$ | 380.4 | |

| Non-service cost portion of pension

(expense)(a) | |

| (5.1 | ) | |

| (0.6 | ) | |

| (0.2 | ) | |

| (5.2 | ) | |

| (2.6 | ) | |

| (2.5 | ) |

| Other miscellaneous income /

(expense)(b) | |

| (3.9 | ) | |

| 12.8 | | |

| (3.4 | ) | |

| 5.3 | | |

| (1.9 | ) | |

| (11.1 | ) |

| Severance and restructuring fees(c) | |

| 6.8 | | |

| 5.8 | | |

| 1.7 | | |

| 3.7 | | |

| 0.5 | | |

| 3.6 | |

| Asset impairment charges(d)

| |

| 0.3 | | |

| 6.3 | | |

| 1.1 | | |

| 0.3 | | |

| 0.2 | | |

| 0.2 | |

| Share based compensation(e)

| |

| 44.3 | | |

| 33.1 | | |

| 30.3 | | |

| 43.6 | | |

| 17.3 | | |

| 18.0 | |

| Foreign exchange (gains)

/ losses(f) | |

| (1.3 | ) | |

| 4.6 | | |

| (3.5 | ) | |

| 2.7 | | |

| (0.3 | ) | |

| (4.3 | ) |

| (Gain) / loss on sale of

assets(g) | |

| 0.2 | | |

| (7.4 | ) | |

| 0.1 | | |

| (3.3 | ) | |

| (3.5 | ) | |

| — | |

| Equity investment mark-to-market(h)

| |

| 1.8 | | |

| (1.4 | ) | |

| 2.7 | | |

| (5.7 | ) | |

| 1.3 | | |

| 8.8 | |

| Acquisition fees(i)

| |

| 2.3 | | |

| 0.8 | | |

| 0.3 | | |

| 0.5 | | |

| 0.5 | | |

| 2.3 | |

| Letter of credit fees and

franchise tax(j) | |

| 3.2 | | |

| 2.3 | | |

| 2.0 | | |

| 3.2 | | |

| 1.2 | | |

| 1.2 | |

| Office relocation gain

and sale initiatives(k) | |

| — | | |

| (16.0 | ) | |

| — | | |

| 1.5 | | |

| 1.5 | | |

| — | |

| TFS

portfolio sale / financing reserve release(l) | |

| — | | |

| (7.8 | ) | |

| — | | |

| — | | |

| — | | |

| — | |

| Terex Adjusted EBITDA | |

| 738.3 | | |

| 407.1 | | |

| 496.1 | | |

| 737.5 | | |

| 395.8 | | |

| 396.6 | |

| Net sales | |

$ | 5,186.9 | | |

$ | 3,886.8 | | |

$ | 4,417.7 | | |

$ | 5,151.5 | | |

$ | 2,638.8 | | |

$ | 2,674.2 | |

| Terex Adjusted EBITDA Margin | |

| 14.2 | % | |

| 10.5 | % | |

| 11.2 | % | |

| 14.3 | % | |

| 15.0 | % | |

| 14.8 | % |

| (a) | Represents the portion

of pension expense that is a non-service cost. |

| (b) | Represents other miscellaneous

income or expense that is not core to Terex’s business. |

| (c) | Represents miscellaneous

severance and restructuring fees incurred. |

| (d) | Represents long-lived

asset impairment charges including in the Selling, general and administrative expenses line

item. |

| (e) | Represents the aggregate

amount of all non-cash compensation charges incurred during the period arising from the issuance

of stock-based compensation awards. |

| (f) | Represents all non-cash

adjustments made to translate foreign assets and liabilities for changes in foreign exchange

rates. |

| (g) | Represents the gain associated

with the sale of assets. |

| (h) | Represents mark-to-market

gains or losses recorded on equity investments. |

| (i) | Represents non-recurring

acquisition fees. |

| (j) | Represents the aggregate

amount of letter of credit fees and income / franchise tax expense incurred during the period. |

| (k) | Represents gains or losses

associated with office relocation and sale initiatives. |

| (l) | Represents non-recurring,

non-operational impact of Terex Financial Services. |

SUMMARY HISTORICAL FINANCIAL INFORMATION

OF ESG

The summary historical combined

financial data of ESG for the twelve months ended June 30, 2024, has been calculated by adding the unaudited combined financial statements

for the six months ended June 30, 2024 to the audited combined financial statements for the year ended December 31, 2023 and then subtracting

the unaudited consolidated financial statements for the six months ended June 30, 2023. The summary historical combined financial data

as of December 31, 2022 and 2023 and for the fiscal years ended December 31, 2022 and 2023 have been derived from ESG’s audited

historical combined financial statements and related notes. The summary historical combined financial data as of June 30, 2024 and for

the six months ended June 30, 2023 and 2024 have been derived from ESG’s unaudited interim condensed combined financial statements.

The unaudited interim historical condensed combined financial statements have been prepared on the same basis as the audited combined

financial statements and, in the opinion of ESG’s management, include all adjustments, consisting only of normal and recurring

adjustments, necessary for a fair statement of the information set forth therein. Interim financial results are not necessarily indicative

of the results expected for the full fiscal year or any future reporting period. You should read the summary historical combined financial

data below together with ESG’s historical combined financial statements and related notes thereto.

| | |

Twelve Months

Ended June 30, | | |

Year Ended

December 31, | | |

Six Months Ended

June 30, | |

| |

2024 | | |

2022 | | |

2023 | | |

2023 | | |

2024 | |

| | |

| | |

| | |

| | |

| | |

| |

| (in millions) | |

| (unaudited) | | |

| | | |

| | | |

| (unaudited) | |

| Statement of Income Data: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Revenue | |

$ | 835.5 | | |

$ | 660.8 | | |

$ | 753.6 | | |

$ | 357.8 | | |

$ | 439.7 | |

| Cost of goods and services | |

| (600.5 | ) | |

| (501.2 | ) | |

| (550.2 | ) | |

| (261.2 | ) | |

| (311.5 | ) |

| Gross profit | |

| 235.0 | | |

| 159.6 | | |

| 203.4 | | |

| 96.6 | | |

| 128.2 | |

| Selling, general and administrative expenses | |

| (90.9 | ) | |

| (71.9 | ) | |

| (84.2 | ) | |

| (41.7 | ) | |

| (48.4 | ) |

| Operating income | |

| 144.1 | | |

| 87.7 | | |

| 119.2 | | |

| 54.9 | | |

| 79.8 | |

| Interest expense | |

| (24.7 | ) | |

| (13.0 | ) | |

| (23.6 | ) | |

| (11.3 | ) | |

| (12.4 | ) |

| Other income (expense), net | |

| — | | |

| (2.0 | ) | |

| 0.6 | | |

| 0.3 | | |

| (0.4 | ) |

| Income before provision for income taxes | |

| 119.4 | | |

| 72.7 | | |

| 96.2 | | |

| 43.9 | | |

| 67.0 | |

| Provision for income taxes | |

| (28.8 | ) | |

| (16.1 | ) | |

| (23.0 | ) | |

| (10.7 | ) | |

| (16.4 | ) |

| Net income | |

| 90.6 | | |

| 56.6 | | |

| 73.2 | | |

| 33.2 | | |

| 50.6 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Statement of Cash Flows Data: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Depreciation and amortization | |

$ | 11.7 | | |

$ | 11.9 | | |

$ | 12.4 | | |

$ | 6.5 | | |

$ | 5.9 | |

| Stock-based compensation | |

| 0.7 | | |

| 0.7 | | |

| 0.7 | | |

| 0.6 | | |

| 0.6 | |

| Capital expenditures | |

| (15.2 | ) | |

| (9.9 | ) | |

| (9.2 | ) | |

| (3.5 | ) | |

| (9.5 | ) |

| Proceeds from sale of property, plant and equipment | |

| 0.3 | | |

| — | | |

| 0.3 | | |

| — | | |

| — | |

| | |

December 31, | | |

June 30, | |

| | |

2022 | | |

2023 | | |

2024 | |

| (in millions) | |

| | |

| | |

(unaudited) | |

| Balance Sheet Data: | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

$ | — | | |

$ | — | | |

$ | — | |

| Receivables, net | |

| 97.3 | | |

| 110.9 | | |

| 117.1 | |

| Inventories, net | |

| 84.8 | | |

| 81.4 | | |

| 76.5 | |

| Property, plant and equipment – net | |

| 50.7 | | |

| 53.3 | | |

| 62.3 | |

| Total assets | |

| 418.5 | | |

| 427.0 | | |

| 433.5 | |

| Total debt (including current portion) | |

| 472.3 | | |

| 487.2 | | |

| 493.5 | |

| Total stockholders’ equity | |

| (53.8 | ) | |

| (60.2 | ) | |

| (60.0 | ) |

| | |

Twelve Months

Ended June 30, | | |

Year Ended

December 31, | | |

Six Months Ended

June 30, | |

| |

2024 | | |

2022 | | |

2023 | | |

2023 | | |

2024 | |

| (in millions) | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other Data (unaudited): | |

| | | |

| | | |

| | | |

| | | |

| | |

| ESG EBITDA(1) | |

$ | 155.8 | | |

$ | 97.6 | | |

$ | 132.2 | | |

$ | 61.7 | | |

$ | 85.3 | |

| ESG Adjusted

EBITDA(1) | |

| 174.0 | | |

| 110.6 | | |

| 149.1 | | |

| 70.9 | | |

| 95.8 | |

| ESG Adjusted

EBITDA Margin(1) | |

| 20.8 | % | |

| 16.7 | % | |

| 19.8 | % | |

| 19.8 | % | |

| 21.8 | % |

| (1) | ESG EBITDA, ESG Adjusted EBITDA and

ESG Adjusted EBITDA Margin are non-GAAP measures. We present these measures because we believe

they will be helpful to those reviewing ESG’s performance, as they provide information

about ESG’s ability to meet debt service, capital expenditure and working capital requirements,

and are also an indicator of profitability. We consider ESG EBITDA, ESG Adjusted EBITDA and

ESG Adjusted EBITDA Margin to be important supplemental measures of ESG’s performance

because the calculations adjust for certain items that we believe are not indicative of our

core operating performance. |

ESG EBITDA, ESG Adjusted EBITDA and

ESG Adjusted EBITDA Margin have limitations as analytical tools, and do not represent, and should not be considered an alternative to,

net income as defined by GAAP. Among other things, ESG EBITDA, ESG Adjusted EBITDA and ESG Adjusted EBITDA Margin:

| · | do

not reflect ESG’s cash expenditures, or future requirements, for capital expenditures; |

| · | do

not reflect changes in, or cash requirements for, ESG’s working capital needs; |

| · | do

not reflect the significant interest expense, or the cash requirements necessary to service

interest or principal payments, on ESG’s debt; and |

| · | do

not reflect any cash requirements to replace in the future assets being depreciated and amortized,

even though depreciation and amortization are non-cash charges that are excluded from these

measures. |

We compensate for these limitations

by relying primarily on ESG’s GAAP results and using ESG EBITDA, ESG Adjusted EBITDA and ESG Adjusted EBITDA Margin only supplementally.

The following table provides an unaudited

reconciliation of net income to ESG EBITDA and ESG Adjusted EBITDA and of revenue to ESG Adjusted EBITDA Margin:

| | |

Twelve Months

Ended June 30, | | |

Year Ended

December 31, | | |

Six Months Ended

June 30, | |

| |

2024 | | |

2022 | | |

2023 | | |

2023 | | |

2024 | |

| | |

| | |

| | |

| | |

| | |

| |

| (in millions) | |

| (unaudited) | | |

| | | |

| | | |

| (unaudited) | |

| Net income | |

$ | 90.6 | | |

$ | 56.6 | | |

$ | 73.2 | | |

$ | 33.2 | | |

$ | 50.6 | |

| Interest expense | |

| 24.7 | | |

| 13.0 | | |

| 23.6 | | |

| 11.3 | | |

| 12.4 | |

| Provision for income taxes | |

| 28.8 | | |

| 16.1 | | |

| 23.0 | | |

| 10.7 | | |

| 16.4 | |

| Depreciation and amortization | |

| 11.7 | | |

| 11.9 | | |

| 12.4 | | |

| 6.5 | | |

| 5.9 | |

| ESG EBITDA | |

| 155.8 | | |

| 97.6 | | |

| 132.2 | | |

| 61.7 | | |

| 85.3 | |

| Equipment warranty normalization(a)

| |

| 1.9 | | |

| (0.6 | ) | |

| 3.4 | | |

| 2.4 | | |

| 0.9 | |

| Insurance adjustment(b)

| |

| 0.8 | | |

| — | | |

| — | | |

| — | | |

| 0.8 | |

| Out of period adjustments from

purchase accounting(c) | |

| (0.2 | ) | |

| (2.2 | ) | |

| (0.1 | ) | |

| 0.1 | | |

| — | |

| Inventory reserve expense normalization

(d) | |

| (0.1 | ) | |

| 0.8 | | |

| — | | |

| 0.8 | | |

| 0.7 | |

| Non-operational (income) expense

items(e) | |

| — | | |

| — | | |

| 0.1 | | |

| 0.1 | | |

| — | |

| Restructuring costs(f)

| |

| 1.4 | | |

| 2.8 | | |

| 0.7 | | |

| — | | |

| 0.7 | |

| Corporate allocations(g)

| |

| 14.5 | | |

| 12.0 | | |

| 12.8 | | |

| 5.8 | | |

| 7.5 | |

| Other(h)

| |

| (0.1 | ) | |

| 0.2 | | |

| — | | |

| — | | |

| (0.1 | ) |

| ESG Adjusted EBITDA | |

| 174.0 | | |

| 110.6 | | |

| 149.1 | | |

| 70.9 | | |

| 95.8 | |

| Revenue | |

$ | 835.5 | | |

$ | 660.8 | | |

$ | 753.7 | | |

$ | 357.9 | | |

$ | 439.7 | |

| ESG Adjusted EBITDA Margin | |

| 20.8 | % | |

| 16.7 | % | |

| 19.8 | % | |

| 19.8 | % | |

| 21.8 | % |

| (a) | ESG incurred elevated

warranty expenses related to certain non-recurring issues in 2023. This adjustment normalizes

warranty expenses by using historical actual warranty settlements as a percentage of total

equipment revenue. |

| (b) | In connection with the

Acquisition, ESG received a true up from Dover related to health and wellness insurance.

This adjustment adjusts the timing of receipt of the true up in order to present historical

financials on a comparable basis. |

| (c) | Adjusts for certain out

of period items resulting from liabilities recorded in purchase accounting that were subsequently

reversed resulting in non-recurring gains in certain periods. |

| (d) | During the periods presented,

the ESG business had certain inventory reserve accruals and releases due to specifically

identified inventory write-downs. This adjustment normalizes such inventory reserve expenses

by multiplying ESG’s cost of goods and services for the applicable period by an amount

representing the historical percentage of ESG’s inventory reserve expenses to cost

of goods sold. |

| (e) | Adjustments to remove

non-operating gains and losses related to sale of fixed assets and sub-lease arrangements. |

| (f) | Adjustment to remove

non-recurring rightsizing and restructuring expenses. |

| (g) | Adjustment to remove

corporate allocations from Dover which are not related to standalone ESG operations. |

| (h) | Adjustment

to exclude the P&L impact associated with entities (ESG China and UK Pension Ltd) that

were outside the perimeter of the acquired ESG business along with other immaterial reconciliation

items. |

Risks

Related to the Acquisition

Our actual financial position and results

of operations may differ materially from the unaudited pro forma financial data included herein.

The unaudited pro forma financial

data included herein is presented for illustrative purposes only and is not necessarily indicative of what our actual financial position

or results of operations would have been had the Transactions been completed on the dates indicated. The unaudited pro forma financial

data has been derived from our audited and unaudited financial statements and ESG’s audited and unaudited financial statements,

and reflects assumptions and adjustments that are based upon preliminary estimates and our successful completion of the Transactions.

The assets and liabilities of ESG have been measured at fair value based on various preliminary estimates using assumptions that our

management believes are reasonable utilizing information currently available. The process for estimating the fair value of acquired assets

and assumed liabilities requires the use of judgment in determining the appropriate assumptions and estimates. These estimates will be

revised as additional information becomes available and as additional analyses are performed. Accordingly, the final acquisition accounting

adjustments may differ materially from the pro forma adjustments reflected herein. The assumptions used in preparing the unaudited pro

forma financial data, including assumptions as to the successful completion of the Transactions may not prove to be accurate, and other

factors may adversely affect our financial condition or results of operations following the closing of the Acquisition.

We may be unable

to successfully integrate acquired businesses, including ESG. We may not realize the anticipated benefits of such acquisitions, including

the acquisition of ESG.

From

time to time, we engage in strategic transactions involving risks, including the possible failure to successfully integrate and realize

the expected benefits of such transactions. We have consummated many acquisitions in the past and anticipate making additional acquisitions

in the future. On July 21, 2024, we entered into the Transaction Agreement with Dover to acquire ESG for $2,000.0 million. Our ability

to realize the anticipated benefits of the Acquisition, including the expected tax benefits and synergies, will depend, to a large extent,

on our ability to integrate the businesses of both companies. In addition, the consummation of the Acquisition is not assured and is

subject to certain conditions, including customary non-regulatory closing conditions.

The

management of both companies will be required to devote significant attention and resources to the integration process, which may disrupt

the business of either or both of the companies and, if implemented ineffectively, could preclude realization of the full benefits we

expect. The risks associated with the Acquisition and our other past or future acquisitions include:

| · | the

business culture of the acquired business may not match well with our culture; |

| · | we

may acquire or assume unexpected liabilities that are not uncovered in our diligence processes; |

| · | faulty

assumptions may be made regarding the integration process; |

| · | unforeseen

difficulties may arise in integrating operations and systems; |

| · | we

may fail to retain, motivate and integrate key management and other employees of the acquired

business; |

| · | higher

than expected finance costs may arise due to unforeseen changes in tax, trade, environmental,

labor, safety, payroll or pension policies in any jurisdiction in which the acquired business

conducts its operations; |

| · | we

and the acquired business may experience problems in retaining customers and integrating

customer bases; and |

| · | a

large acquisition could stretch our resources and divert management’s attention from

existing operations. |

The

successful integration of any previously acquired or newly acquired business also requires us to implement effective internal control

processes in these acquired businesses, which may be burdensome and divert management’s attention, particularly with businesses

like ESG that are not stand-alone public reporting companies. While we believe we have successfully integrated acquisitions to date,

we cannot ensure that previously acquired or newly acquired companies, including ESG, will operate profitably, that the intended beneficial

effect from these acquisitions will be realized and that we will not encounter difficulties in implementing effective internal control