true0001021162False0001021162tgi:PurchaseRights1Member2024-11-122024-11-120001021162us-gaap:CommonStockMember2024-11-122024-11-1200010211622024-11-122024-11-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 12, 2024 |

TRIUMPH GROUP, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

1-12235 |

51-0347963 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

555 E Lancaster Avenue Suite 400 |

|

Radnor, Pennsylvania |

|

19087 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 610 251-1000 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $.001 per share |

|

TGI |

|

New York Stock Exchange LLC |

Purchase rights |

|

N/A |

|

New York Stock Exchange LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 12, 2024, Triumph Group, Inc. issued a press release announcing its financial results for the second quarter of the fiscal year ending March 31, 2025 and conducted a conference call to further discuss the financial results. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Triumph Group, Inc. |

|

|

|

|

Date: |

November 12, 2024 |

By: |

/s/ Thomas A. Quigley, III |

|

|

|

Thomas A. Quigley, III, Vice President, Investor Relations, Mergers & Acquisitions, and Treasurer |

Exhibit 99.1

NEWS RELEASE

|

|

|

|

Contact: Kyle Beeson Director, Communications Phone (610) 251-1000 kbeeson@triumphgroup.com |

|

|

Thomas A. Quigley, III Vice President, Investor Relations, Mergers & Acquisitions and Treasurer Phone (610) 251-1000 tquigley@triumphgroup.com |

TRIUMPH REPORTS STRONG SECOND QUARTER FISCAL 2025 RESULTS

AND RAISES FY25 GUIDANCE

RADNOR, Pa. – November 12, 2024 – Triumph Group, Inc. (NYSE: TGI) ("TRIUMPH" or the “Company”) today reported financial results for its second quarter of fiscal 2025, which ended September 30, 2024.

Second Quarter Fiscal 2025

•Net sales of $287.5 million; sales growth of 1%

•Operating income of $32.4 million with operating margin of 11%; adjusted operating income of $36.0 million with adjusted operating margin of 13%

•Net income from continuing operations of $11.9 million, or $0.15 per diluted share; adjusted net income from continuing operations of $15.4 million, or $0.20 per share

•Adjusted EBITDAP of $42.6 million with Adjusted EBITDAP margin of 15%

•Cash used in operations of ($38.4) million and free cash use of ($44.7) million. Cash and available liquidity was $148 million at September 30th.

Fiscal 2025 Guidance

•Net sales of approximately $1.2 billion

•Increasing operating income to a range of $140.5 million to $145.5 million, reflecting operating margin of 12%

•Increasing Adjusted EBITDAP to a range of $190.0 million to $195.0 million, reflecting Adjusted EBITDAP margin of 16%

•Increasing earnings per diluted share to a range of $0.47 to $0.53, and adjusted earnings per diluted share to a range of $0.70 - $0.76

•Increasing cash flow from operations to a range of $40.0 million to $55.0 million, and free cash flow to a range of $20.0 million to $30.0 million

“TRIUMPH achieved its tenth consecutive quarter of year-over-year sales growth as commercial aftermarket sales from our IP-based business grew by more than 34%, more than offsetting temporary commercial OEM and supply chain headwinds," said Dan Crowley, TRIUMPH's chairman, president and chief executive officer. “We exceeded our cash targets in the quarter through strong operational performance across all our businesses including Interiors where we turned around the business in Q2 through substantial cost reductions and a commercial resolution to bring its profit and cash flow in line with full year expectations."

Mr. Crowley continued, “TRIUMPH is raising its fiscal 2025 earnings and cash flow guidance on strong aftermarket demand and the improvement in Interiors, while maintaining sales guidance despite lower short-term OEM production rates which we expect to recover in our fourth quarter. Our strong aftermarket growth and operating performance, and

historical seasonality will accelerate our free cash flow generation in the second half of FY25. We expect to deliver top and bottom-line growth rates at or above the market as we benefit from continuing strong aftermarket demand.”

Second Quarter Fiscal 2025 Overview

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

($ in millions) |

|

2024 |

|

|

2023 |

|

Commercial OEM |

|

$ |

118.9 |

|

|

$ |

130.6 |

|

Military OEM |

|

|

64.0 |

|

|

|

61.1 |

|

Total OEM Revenue |

|

|

183.0 |

|

|

|

191.6 |

|

|

|

|

|

|

|

|

Commercial Aftermarket |

|

|

50.2 |

|

|

|

39.7 |

|

Military Aftermarket |

|

|

43.8 |

|

|

|

43.6 |

|

Total Aftermarket Revenue |

|

|

93.9 |

|

|

|

83.3 |

|

|

|

|

|

|

|

|

Non-Aviation Revenue |

|

|

10.0 |

|

|

|

9.2 |

|

Amortization of acquired contract liabilities |

|

|

0.6 |

|

|

|

0.6 |

|

Total Net Sales* |

|

$ |

287.5 |

|

|

$ |

284.7 |

|

* Differences due to rounding |

|

|

|

|

|

|

Note> Aftermarket sales include both repair & overhaul services and spare parts sales. |

|

Commercial OEM sales decreased ($11.6) million, or (8.9%) primarily due to decreased sales volume on the Boeing 737, 767, 777 programs, which were partially offset by increased sales on Boeing 787 program and a favorable settlement in Interiors across multiple programs.

Commercial Aftermarket sales increased $10.4 million, or 26.2%, primarily due to a combination of increased spares sales and repair sales volume across several platforms including the Boeing 787 program.

Military OEM sales increased $3.0 million, or 4.9%, as increased sales volumes on the CH-47 and AH-64 helped offset expected decreases on the V-22 program.

Military aftermarket sales increased $0.2 million, or 0.5%, as increased repairs on the CH-47 platform and a spare parts intellectual property transaction of approximately $5.0 million were partially offset by decreased repair and overhaul sales on the V-22 program.

TRIUMPH's results included the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

($ millions except EPS) |

|

Pre-tax |

|

|

After-tax |

|

|

Diluted EPS |

|

Income from Continuing Operations - GAAP |

|

$ |

9.1 |

|

|

$ |

11.9 |

|

|

$ |

0.15 |

|

Adjustments |

|

|

|

|

|

|

|

|

|

Restructuring costs |

|

|

3.6 |

|

|

|

3.6 |

|

|

|

0.05 |

|

|

|

|

|

|

|

|

|

|

|

Adjusted income from continuing operations - non-GAAP |

|

$ |

12.7 |

|

|

$ |

15.5 |

|

|

$ |

0.20 |

|

|

|

|

|

|

|

|

|

|

|

The number of shares used in computing earnings per share for the second quarter of 2025 was 77.7 million.

Backlog, which represents the next 24 months of actual purchase orders with firm delivery dates or contract requirements, was $1.90 billion, an increase from prior fiscal year end. Our backlog includes increases across all end markets, partially offset by reductions due to the changes in timing of deliveries primarily under the Boeing 737MAX program.

For the second quarter of fiscal 2025, cash flow used in operations was ($38.4) million, which was better than expectations previously provided due to lower than expected working capital and strong aftermarket demand.

Conference Call

TRIUMPH will hold a conference call today, November 12th, at 8:30 a.m. (ET) to discuss the second quarter of fiscal 2025 results. The conference call will be available live and archived on the Company’s website at http://www.triumphgroup.com. A slide presentation will be included with the audio portion of the webcast, and the presentation has been posted on the Company’s website at https://www.triumphgroup.com/filings-financial/quarterly-results. An audio replay will be available from November 12th to November 19th by calling (844) 344-7529 (Domestic) or (412) 317-0088 (International), passcode #6721044.

About TRIUMPH

TRIUMPH, headquartered in Radnor, Pennsylvania, designs, develops, manufactures, repairs and provided spare parts across a broad portfolio of aerospace and defense systems and components. The Company serves the global aviation industry, including original equipment manufacturers and the full spectrum of military and commercial aircraft operators.

More information about TRIUMPH can be found on the Company’s website at www.triumphgroup.com.

Forward Looking Statements

Statements in this release which are not historical facts are forward-looking statements under the provisions of the Private Securities Litigation Reform Act of 1995, including statements of expectations of or assumptions about guidance, financial and operational performance, revenues, earnings per share, cash flow or use, cost savings, operational efficiencies and organizational restructurings and our evaluation of potential adjustments to reported amounts, as described above. All forward-looking statements involve risks and uncertainties which could affect the Company’s actual results and could cause its actual results to differ materially from those expressed in any forward-looking statements made by, or on behalf of, the Company. Further information regarding the important factors that could cause actual results to differ from projected results can be found in Triumph Group’s reports filed with the SEC, including our Annual Report on Form 10-K for the fiscal year ended March 31, 2024.

FINANCIAL DATA (UNAUDITED) ON FOLLOWING PAGES

FINANCIAL DATA (UNAUDITED)

TRIUMPH GROUP, INC. AND SUBSIDIARIES

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|

|

September 30, |

|

|

September 30, |

|

CONDENSED STATEMENTS OF OPERATIONS |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net sales |

|

$ |

287,495 |

|

|

$ |

284,678 |

|

|

$ |

568,511 |

|

|

$ |

548,501 |

|

Cost of sales (excluding depreciation shown below) |

|

|

192,891 |

|

|

|

209,865 |

|

|

|

399,968 |

|

|

|

403,770 |

|

Selling, general & administrative |

|

|

51,123 |

|

|

|

42,137 |

|

|

|

100,501 |

|

|

|

92,631 |

|

Depreciation & amortization |

|

|

7,487 |

|

|

|

7,314 |

|

|

|

14,854 |

|

|

|

14,679 |

|

Legal contingencies loss |

|

|

— |

|

|

|

1,338 |

|

|

|

7,464 |

|

|

|

1,338 |

|

Restructuring costs |

|

|

3,566 |

|

|

|

1,942 |

|

|

|

5,182 |

|

|

|

1,942 |

|

(Gain) loss on sale of assets and businesses, net |

|

|

— |

|

|

|

(409 |

) |

|

|

— |

|

|

|

12,208 |

|

Operating income |

|

|

32,428 |

|

|

|

22,491 |

|

|

|

40,542 |

|

|

|

21,933 |

|

Interest expense and other, net |

|

|

21,869 |

|

|

|

29,833 |

|

|

|

40,853 |

|

|

|

61,935 |

|

Debt modification and extinguishment (gain) loss |

|

|

— |

|

|

|

(688 |

) |

|

|

5,369 |

|

|

|

(4,079 |

) |

Warrant remeasurement gain |

|

|

— |

|

|

|

(544 |

) |

|

|

— |

|

|

|

(8,545 |

) |

Non-service defined benefit expense (income) |

|

|

1,468 |

|

|

|

(820 |

) |

|

|

2,501 |

|

|

|

(1,640 |

) |

Income tax (benefit) expense |

|

|

(2,776 |

) |

|

|

1,019 |

|

|

|

(1,277 |

) |

|

|

2,279 |

|

Income (loss) from continuing operations |

|

|

11,867 |

|

|

|

(6,309 |

) |

|

|

(6,904 |

) |

|

|

(28,017 |

) |

Income from discontinued operations, net of tax |

|

|

— |

|

|

|

5,013 |

|

|

|

4,680 |

|

|

|

8,558 |

|

Net income (loss) |

|

$ |

11,867 |

|

|

$ |

(1,296 |

) |

|

$ |

(2,224 |

) |

|

$ |

(19,459 |

) |

Earnings (loss) per share - basic: |

|

|

|

|

|

|

|

|

|

|

|

|

Earnings (loss) per share - continuing operations |

|

$ |

0.15 |

|

|

$ |

(0.08 |

) |

|

$ |

(0.09 |

) |

|

$ |

(0.39 |

) |

Earnings per share - discontinued operations |

|

|

— |

|

|

|

0.06 |

|

|

|

0.06 |

|

|

|

0.12 |

|

Earnings (loss) per share - basic |

|

$ |

0.15 |

|

|

$ |

(0.02 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.27 |

) |

Weighted average common shares outstanding - basic |

|

|

77,343 |

|

|

|

76,447 |

|

|

|

77,252 |

|

|

|

71,368 |

|

Earnings (loss) per share - diluted: |

|

|

|

|

|

|

|

|

|

|

|

|

Earnings (loss) per share - continuing operations |

|

$ |

0.15 |

|

|

$ |

(0.08 |

) |

|

$ |

(0.09 |

) |

|

$ |

(0.39 |

) |

Earnings per share - discontinued operations |

|

|

— |

|

|

|

0.06 |

|

|

|

0.06 |

|

|

|

0.12 |

|

Earnings (loss) per share - diluted |

|

$ |

0.15 |

|

|

$ |

(0.02 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.27 |

) |

Weighted average common shares outstanding - diluted |

|

|

77,718 |

|

|

|

76,447 |

|

|

|

77,252 |

|

|

|

71,368 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Continued)

FINANCIAL DATA (UNAUDITED)

TRIUMPH GROUP, INC. AND SUBSIDIARIES

(dollars in thousands, except share data)

|

|

|

|

|

|

|

|

|

BALANCE SHEETS |

|

Unaudited

September 30,

2024 |

|

|

March 31,

2024 |

|

Assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

104,893 |

|

|

$ |

392,511 |

|

Accounts receivable, net |

|

|

162,217 |

|

|

|

138,272 |

|

Contract assets |

|

|

84,719 |

|

|

|

74,289 |

|

Inventory, net |

|

|

393,824 |

|

|

|

317,671 |

|

Prepaid and other current assets |

|

|

15,661 |

|

|

|

16,626 |

|

Current assets |

|

|

761,314 |

|

|

|

939,369 |

|

Property and equipment, net |

|

|

148,809 |

|

|

|

144,287 |

|

Goodwill |

|

|

514,976 |

|

|

|

510,687 |

|

Intangible assets, net |

|

|

60,703 |

|

|

|

65,063 |

|

Other, net |

|

|

25,663 |

|

|

|

26,864 |

|

Total assets |

|

$ |

1,511,465 |

|

|

$ |

1,686,270 |

|

Liabilities & Stockholders' Deficit |

|

|

|

|

|

|

Current portion of long-term debt |

|

$ |

8,126 |

|

|

$ |

3,200 |

|

Accounts payable |

|

|

145,566 |

|

|

|

167,349 |

|

Contract liabilities |

|

|

48,055 |

|

|

|

55,858 |

|

Accrued expenses |

|

|

105,876 |

|

|

|

129,855 |

|

Current liabilities |

|

|

307,623 |

|

|

|

356,262 |

|

Long-term debt, less current portion |

|

|

957,620 |

|

|

|

1,074,999 |

|

Accrued pension and post-retirement benefits, noncurrent |

|

|

269,266 |

|

|

|

283,634 |

|

Deferred income taxes, noncurrent |

|

|

7,284 |

|

|

|

7,268 |

|

Other noncurrent liabilities |

|

|

64,858 |

|

|

|

68,521 |

|

Stockholders' Deficit: |

|

|

|

|

|

|

Common stock, $.001 par value, 200,000,000 shares authorized, 77,334,487

and 76,923,691 shares issued and outstanding |

|

|

77 |

|

|

|

77 |

|

Capital in excess of par value |

|

|

1,112,120 |

|

|

|

1,107,750 |

|

Accumulated other comprehensive loss |

|

|

(509,987 |

) |

|

|

(517,069 |

) |

Accumulated deficit |

|

|

(697,396 |

) |

|

|

(695,172 |

) |

Total stockholders' deficit |

|

|

(95,186 |

) |

|

|

(104,414 |

) |

Total liabilities and stockholders' deficit |

|

$ |

1,511,465 |

|

|

$ |

1,686,270 |

|

(Continued)

FINANCIAL DATA (UNAUDITED)

TRIUMPH GROUP, INC. AND SUBSIDIARIES

(dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

Operating Activities |

|

|

|

|

|

|

Net loss |

|

$ |

(2,224 |

) |

|

$ |

(19,459 |

) |

Adjustments to reconcile net loss to net cash used in

operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

14,854 |

|

|

|

16,160 |

|

Amortization of acquired contract liability |

|

|

(1,213 |

) |

|

|

(1,165 |

) |

(Gain) loss on sale of assets and businesses |

|

|

(5,018 |

) |

|

|

12,208 |

|

Loss (gain) on modification and extinguishment of debt |

|

|

5,369 |

|

|

|

(4,079 |

) |

Other amortization included in interest expense |

|

|

2,052 |

|

|

|

2,980 |

|

Provision for credit losses |

|

|

329 |

|

|

|

781 |

|

Warrants remeasurement gain |

|

|

— |

|

|

|

(8,532 |

) |

Share-based compensation |

|

|

6,365 |

|

|

|

7,346 |

|

Changes in other assets and liabilities, excluding the effects of

acquisitions and divestitures: |

|

|

|

|

|

|

Trade and other receivables |

|

|

(23,848 |

) |

|

|

22,131 |

|

Contract assets |

|

|

(10,419 |

) |

|

|

(6,426 |

) |

Inventories |

|

|

(75,053 |

) |

|

|

(45,394 |

) |

Prepaid expenses and other current assets |

|

|

953 |

|

|

|

(1,028 |

) |

Accounts payable, accrued expenses, and contract liabilities |

|

|

(46,191 |

) |

|

|

(69,795 |

) |

Accrued pension and other postretirement benefits |

|

|

(2,540 |

) |

|

|

(2,386 |

) |

Other, net |

|

|

(6,344 |

) |

|

|

713 |

|

Net cash used in operating activities |

|

|

(142,928 |

) |

|

|

(95,945 |

) |

Investing Activities |

|

|

|

|

|

|

Capital expenditures |

|

|

(14,458 |

) |

|

|

(11,028 |

) |

Payments on sale of assets and businesses |

|

|

(2,328 |

) |

|

|

(6,785 |

) |

Investment in joint venture |

|

|

— |

|

|

|

(1,527 |

) |

Net cash used in investing activities |

|

|

(16,786 |

) |

|

|

(19,340 |

) |

Financing Activities |

|

|

|

|

|

|

Proceeds from issuance of long-term debt |

|

|

— |

|

|

|

2,000 |

|

Retirement of debt and finance lease obligations |

|

|

(121,594 |

) |

|

|

(19,865 |

) |

Payment of deferred financing costs |

|

|

— |

|

|

|

(1,578 |

) |

Proceeds on issuance of common stock, net of issuance costs |

|

|

— |

|

|

|

79,961 |

|

Premium on redemption of long-term debt |

|

|

(3,600 |

) |

|

|

— |

|

Repurchase of shares for share-based compensation

minimum tax obligation |

|

|

(2,273 |

) |

|

|

(1,282 |

) |

Net cash (used in) provided by financing activities |

|

|

(127,467 |

) |

|

|

59,236 |

|

Effect of exchange rate changes on cash |

|

|

(437 |

) |

|

|

(1,469 |

) |

Net change in cash and cash equivalents |

|

|

(287,618 |

) |

|

|

(57,518 |

) |

Cash and cash equivalents at beginning of period |

|

|

392,511 |

|

|

|

227,403 |

|

Cash and cash equivalents at end of period |

|

$ |

104,893 |

|

|

$ |

169,885 |

|

(Continued)

FINANCIAL DATA (UNAUDITED)

TRIUMPH GROUP, INC. AND SUBSIDIARIES

(dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|

|

September 30, |

|

|

September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Systems & Support |

|

|

|

|

|

|

|

|

|

|

|

|

Net sales to external customer |

|

$ |

249,954 |

|

|

$ |

249,385 |

|

|

$ |

501,934 |

|

|

$ |

476,638 |

|

Inter-segment sales (eliminated in consolidation) |

|

|

— |

|

|

|

411 |

|

|

|

8 |

|

|

|

490 |

|

Segment EBITDAP |

|

|

54,823 |

|

|

|

48,487 |

|

|

|

102,220 |

|

|

|

89,301 |

|

Segment EBITDAP Margin |

|

|

22.0 |

% |

|

|

19.5 |

% |

|

|

20.4 |

% |

|

|

18.8 |

% |

Depreciation & amortization |

|

|

6,385 |

|

|

|

6,225 |

|

|

|

12,764 |

|

|

|

12,412 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interiors |

|

|

|

|

|

|

|

|

|

|

|

|

Net sales to external customer |

|

$ |

37,541 |

|

|

$ |

35,293 |

|

|

$ |

66,577 |

|

|

$ |

71,863 |

|

Inter-segment sales (eliminated in consolidation) |

|

|

3 |

|

|

|

— |

|

|

|

11 |

|

|

|

13 |

|

Segment EBITDAP |

|

|

1,891 |

|

|

|

(2,704 |

) |

|

|

(5,386 |

) |

|

|

(4,597 |

) |

Segment EBITDAP Margin |

|

|

5.0 |

% |

|

|

-7.7 |

% |

|

|

-8.1 |

% |

|

|

-6.4 |

% |

Depreciation & amortization |

|

|

524 |

|

|

|

644 |

|

|

|

1,100 |

|

|

|

1,327 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Continued)

FINANCIAL DATA (UNAUDITED)

TRIUMPH GROUP, INC, AND SUBSIDIARES

(dollars in thousands)

Non-GAAP Financial Measure Disclosures

We prepare and publicly release annual audited and quarterly unaudited financial statements prepared in accordance with U.S. GAAP. In accordance with Securities and Exchange Commission (the "SEC") rules, we also disclose and discuss certain non-GAAP financial measures in our public filings and earning releases. Currently, the non-GAAP financial measures that we disclose are Adjusted EBITDA, which is our income (loss) from continuing operations before interest and gains or losses on debt modification and extinguishment, income taxes, amortization of acquired contract liabilities, costs incurred pertaining to shareholder cooperation agreements, consideration payable to customer related to divestitures, legal contingency losses (including legal judgments and settlements), gains/loss on divestitures, gains/losses on warrant remeasurements and warrant-related transaction costs, share-based compensation expense, depreciation and amortization (including impairment of long-lived assets), other non-recurring impairments, and the effects of certain pension charges such as curtailments, settlements, withdrawals, and other early retirement incentives; and Adjusted EBITDAP, which is Adjusted EBITDA, before pension expense or benefit (excluding pension charges already adjusted in Adjusted EBITDA). We disclose Adjusted EBITDA on a consolidated and Adjusted EBITDAP on a consolidated and a reportable segment basis in our earnings releases, investor conference calls and filings with the SEC. The non-GAAP financial measures that we use may not be comparable to similarly titled measures reported by other companies. Also, in the future, we may disclose different non-GAAP financial measures in order to help our investors more meaningfully evaluate and compare our future results of operations with our previously reported results of operations.

We view Adjusted EBITDA and Adjusted EBITDAP as operating performance measures and, as such, we believe that the U.S. GAAP financial measure most directly comparable to such measures is income (loss) from continuing operations. In calculating Adjusted EBITDA and Adjusted EBITDAP, we exclude from income (loss) from continuing operations the financial items that we believe should be separately identified to provide additional analysis of the financial components of the day-to-day operation of our continuing business. We have outlined below the type and scope of these exclusions and the material limitations on the use of these non-GAAP financial measures as a result of these exclusions. Adjusted EBITDA and Adjusted EBITDAP are not measurements of financial performance under U.S. GAAP and should not be considered as a measure of liquidity, as an alternative to income (loss) from continuing operations, or as an indicator of any other measure of performance derived in accordance with U.S. GAAP. Investors and potential investors in our securities should not rely on Adjusted EBITDA or Adjusted EBITDAP as a substitute for any U.S. GAAP financial measure, including income (loss) from continuing operations. In addition, we urge investors and potential investors in our securities to carefully review the reconciliation of Adjusted EBITDA and Adjusted EBITDAP to income (loss) from continuing operations set forth below, in our earnings releases, and in other filings with the SEC and to carefully review the U.S. GAAP financial information included as part of our Quarterly Reports on Form 10-Q and our Annual Reports on Form 10-K that are filed with the SEC, as well as our quarterly earnings releases, and compare the U.S. GAAP financial information with our Adjusted EBITDA and Adjusted EBITDAP.

Adjusted EBITDA and Adjusted EBITDAP are used by management to internally measure our operating and management performance and by investors as a supplemental financial measure to evaluate the performance of our business that, when viewed with our U.S. GAAP results and the accompanying reconciliation, we believe provides additional information that is useful to gain an understanding of the factors and trends affecting our business. We have spent more than 20 years expanding our product and service capabilities, partially through acquisitions of complementary businesses. Due to the expansion of our operations, which included acquisitions, our income (loss) from continuing operations has included significant charges for depreciation and amortization. Adjusted EBITDA and Adjusted EBITDAP exclude these charges and provide meaningful information about the operating performance of our business, apart from charges for depreciation and amortization. We believe the disclosure of Adjusted EBITDA and Adjusted EBITDAP helps investors meaningfully evaluate and compare our performance from quarter to quarter and from year to year. We also believe Adjusted EBITDA and Adjusted EBITDAP are measures of our ongoing operating performance because the isolation of noncash charges, such as depreciation and amortization, and nonoperating items, such as interest, income taxes, pension and other postretirement benefits, provides additional information about our cost structure and, over time, helps track our operating progress. In addition, investors, securities analysts, and others have regularly relied on Adjusted EBITDA and Adjusted EBITDAP to provide financial measures by which to compare our operating performance against that of other companies in our industry.

(Continued)

FINANCIAL DATA (UNAUDITED)

TRIUMPH GROUP, INC. AND SUBSIDIARIES

(dollars in thousands)

Set forth below are descriptions of the financial items that have been excluded from our income (loss) from continuing operations) to calculate Adjusted EBITDA and Adjusted EBITDAP and the material limitations associated with using these non-GAAP financial measures as compared with income (loss) from continuing operations:

•Gains or losses from sale of assets and businesses may be useful for investors to consider because they reflect gains or losses from sale of operating units or other assets. We do not believe these earnings necessarily reflect the current and ongoing cash earnings related to our operations.

•Warrants remeasurement gains or losses and Warrant-related transaction costs may be useful for investors to consider because they reflect the mark-to-market changes in the fair value of our Warrants and the costs associated with Warrants issuance. We do not believe these earnings necessarily reflect the current and ongoing cash earnings related to our operations.

•Consideration payable to a customer related to a divestiture may be useful for investors to consider because it reflects consideration paid to facilitate the ultimate sale of operating units. We do not believe these charges necessarily reflect the current and ongoing cash earnings related to our operations.

•Shareholder cooperation expenses may be useful for investors to consider because they represent certain costs of corporate governance that may be incurred periodically when reaching cooperative agreements with shareholders. We do not believe these charges necessarily reflect the current and ongoing cash earnings related to our operations.

•Legal contingencies loss, when applicable, may be useful for investors to consider because it reflects gains or losses from legal disputes with third parties. We do not believe these gains or losses reflect the current and ongoing earnings related to our operations.

•Non-service defined benefit income or expense from our pension and other postretirement benefit plans (inclusive of certain pension related transactions such as curtailments, settlements, withdrawal, and early retirement or other incentives) may be useful for investors to consider because they represent the cost of postretirement benefits to plan participants, net of the assumption of returns on the plan's assets and are not indicative of the cash paid for such benefits. We do not believe these earnings necessarily reflect the current and ongoing cash earnings related to our operations.

•Amortization of acquired contract liabilities may be useful for investors to consider because it represents the noncash earnings on the fair value of off-market contracts acquired through acquisitions. We do not believe these earnings necessarily reflect the current and ongoing cash earnings related to our operations.

•Amortization expense and nonrecurring asset impairments (including goodwill and intangible asset impairments) may be useful for investors to consider because it represents the estimated attrition of our acquired customer base and the diminishing value of trade names, product rights, licenses, or, in the case of goodwill, other assets that are not individually identified and separately recognized under U.S. GAAP, or, in the case of nonrecurring asset impairments, the impact of unusual and nonrecurring events affecting the estimated recoverability of existing assets. We do not believe these charges necessarily reflect the current and ongoing cash charges related to our operating cost structure.

•Depreciation may be useful for investors to consider because it generally represents the wear and tear on our property and equipment used in our operations. We do not believe these charges necessarily reflect the current and ongoing cash charges related to our operating cost structure.

•Share-based compensation may be useful for investors to consider because it represents a portion of the total compensation to management and the board of directors. We do not believe these charges necessarily reflect the current and ongoing cash charges related to our operating cost structure.

(Continued)

FINANCIAL DATA (UNAUDITED)

TRIUMPH GROUP, INC. AND SUBSIDIARIES

(dollars in thousands)

•The amount of interest expense and other, as well as debt extinguishment gains or losses, we incur may be useful for investors to consider and may result in current cash inflows or outflows. However, we do not consider the amount of interest expense and other and debt extinguishment gains or losses to be a representative component of the day-to-day operating performance of our business.

•Income tax expense may be useful for investors to consider because it generally represents the taxes which may be payable for the period and the change in deferred income taxes during the period and may reduce the amount of funds otherwise available for use in our business. However, we do not consider the amount of income tax expense to be a representative component of the day-to-day operating performance of our business.

Management compensates for the above-described limitations of using non-GAAP measures by using a non-GAAP measure only to supplement our GAAP results and to provide additional information that is useful to gain an understanding of the factors and trends affecting our business.

The following table shows our Adjusted EBITDA and Adjusted EBITDAP reconciled to our income (loss) from continuing operations for the indicated periods (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|

|

September 30, |

|

|

September 30, |

|

Adjusted Earnings before Interest, Taxes, Depreciation,

Amortization, and Pension (Adjusted EBITDAP): |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Income (loss) from continuing operations |

|

$ |

11,867 |

|

|

$ |

(6,309 |

) |

|

$ |

(6,904 |

) |

|

$ |

(28,017 |

) |

Add-back: |

|

|

|

|

|

|

|

|

|

|

|

|

Income tax (benefit) expense |

|

|

(2,776 |

) |

|

|

1,019 |

|

|

|

(1,277 |

) |

|

|

2,279 |

|

Interest expense and other, net |

|

|

21,869 |

|

|

|

29,833 |

|

|

|

40,853 |

|

|

|

61,935 |

|

Debt modification and extinguishment (gain) loss |

|

|

— |

|

|

|

(688 |

) |

|

|

5,369 |

|

|

|

(4,079 |

) |

Warrant remeasurement gain |

|

|

— |

|

|

|

(544 |

) |

|

|

— |

|

|

|

(8,545 |

) |

Legal contingencies loss |

|

|

— |

|

|

|

1,338 |

|

|

|

7,464 |

|

|

|

1,338 |

|

Shareholder cooperation expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,905 |

|

(Gain) loss on sales of assets and businesses, net |

|

|

— |

|

|

|

(409 |

) |

|

|

— |

|

|

|

12,208 |

|

Share-based compensation |

|

|

3,350 |

|

|

|

3,724 |

|

|

|

6,365 |

|

|

|

7,346 |

|

Amortization of acquired contract liabilities |

|

|

(622 |

) |

|

|

(590 |

) |

|

|

(1,213 |

) |

|

|

(1,165 |

) |

Depreciation and amortization |

|

|

7,487 |

|

|

|

7,314 |

|

|

|

14,854 |

|

|

|

14,679 |

|

Adjusted Earnings before Interest, Taxes, Depreciation

and Amortization ("Adjusted EBITDA") |

|

$ |

41,175 |

|

|

$ |

34,688 |

|

|

$ |

65,511 |

|

|

$ |

59,884 |

|

Non-service defined benefit expense (income) (excluding settlements) |

|

|

1,468 |

|

|

|

(820 |

) |

|

|

2,501 |

|

|

|

(1,640 |

) |

Adjusted Earnings before Interest, Taxes, Depreciation

and Amortization, and Pension ("Adjusted EBITDAP") |

|

$ |

42,643 |

|

|

$ |

33,868 |

|

|

$ |

68,012 |

|

|

$ |

58,244 |

|

Net sales |

|

$ |

287,495 |

|

|

$ |

284,678 |

|

|

$ |

568,511 |

|

|

$ |

548,501 |

|

Income (loss) from continuing operations margin |

|

|

4.1 |

% |

|

|

(2.2 |

%) |

|

|

(1.2 |

%) |

|

|

(5.1 |

%) |

Adjusted EBITDAP margin |

|

|

14.9 |

% |

|

|

11.9 |

% |

|

|

12.0 |

% |

|

|

10.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

(Continued)

FINANCIAL DATA (UNAUDITED)

TRIUMPH GROUP, INC. AND SUBSIDIARIES

(dollars in thousands)

Non-GAAP Financial Measure Disclosures (continued)

Adjusted income from continuing operations, before income taxes, adjusted income from continuing operations and adjusted income from continuing operations per diluted share, before non-recurring costs have been provided for consistency and comparability. These measures should not be considered in isolation or as alternatives to income from continuing operations before income taxes, income from continuing operations and income from continuing operations per diluted share presented in accordance with GAAP. The following tables reconcile income from continuing operations before income taxes, income from continuing operations, and income from continuing operations per diluted share, before non-recurring costs.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, 2024 |

|

(amounts in '000s, except per share amounts) |

|

Pre-Tax |

|

|

After-Tax |

|

|

Diluted EPS |

|

Income from continuing operations - GAAP |

|

$ |

9,091 |

|

|

$ |

11,867 |

|

|

$ |

0.15 |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

Restructuring costs |

|

|

3,566 |

|

|

|

3,566 |

|

|

|

0.05 |

|

Adjusted income from continuing operations - non-GAAP |

|

$ |

12,657 |

|

|

$ |

15,433 |

|

|

$ |

0.20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended

September 30, 2024 |

|

|

Fiscal Year 2025

Diluted EPS

Guidance |

|

|

Pre-Tax |

|

|

After-Tax |

|

|

Diluted EPS |

|

|

|

Loss from continuing operations - GAAP |

|

$ |

(8,181 |

) |

|

$ |

(6,904 |

) |

|

$ |

(0.09 |

) |

|

$0.47 - $0.53 |

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

Legal contingencies loss |

|

|

7,464 |

|

|

|

7,464 |

|

|

|

0.10 |

|

|

0.10 |

Restructuring costs |

|

|

5,182 |

|

|

|

5,182 |

|

|

|

0.07 |

|

|

0.07 |

Debt extinguishment loss |

|

|

5,369 |

|

|

|

5,369 |

|

|

|

0.07 |

|

|

0.07 |

Adjusted income from continuing operations - non-GAAP* |

|

$ |

9,834 |

|

|

$ |

11,111 |

|

|

$ |

0.14 |

|

|

$0.70 - $0.76 |

*Difference due to rounding. |

|

|

|

|

|

|

|

|

|

|

|

(Continued)

FINANCIAL DATA (UNAUDITED)

TRIUMPH GROUP, INC. AND SUBSIDIARIES

(dollars in thousands)

Non-GAAP Financial Measure Disclosures (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, 2023 |

|

|

|

Pre-Tax |

|

|

After-Tax |

|

|

Diluted EPS |

|

Loss from continuing operations - GAAP |

|

$ |

(5,290 |

) |

|

$ |

(6,309 |

) |

|

$ |

(0.08 |

) |

|

|

|

|

|

|

|

|

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

Legal contingencies loss |

|

|

1,338 |

|

|

|

1,338 |

|

|

|

0.02 |

|

Gain on sale of assets and businesses, net |

|

|

(409 |

) |

|

|

(409 |

) |

|

|

(0.01 |

) |

Restructuring costs |

|

|

1,942 |

|

|

|

1,942 |

|

|

|

0.03 |

|

Debt modification and extinguishment gain |

|

|

(688 |

) |

|

|

(688 |

) |

|

|

(0.01 |

) |

Adjusted loss from continuing operations - non-GAAP |

|

$ |

(3,107 |

) |

|

$ |

(4,126 |

) |

|

$ |

(0.05 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended

September 30, 2023 |

|

|

|

Pre-Tax |

|

|

After-Tax |

|

|

Diluted EPS |

|

Loss from continuing operations - GAAP |

|

$ |

(25,738 |

) |

|

$ |

(28,017 |

) |

|

$ |

(0.39 |

) |

|

|

|

|

|

|

|

|

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

Shareholder cooperation expenses |

|

|

1,905 |

|

|

|

1,905 |

|

|

|

0.03 |

|

Loss on sale of assets and businesses, net |

|

|

12,208 |

|

|

|

12,208 |

|

|

|

0.17 |

|

Restructuring costs |

|

|

1,942 |

|

|

|

1,942 |

|

|

|

0.03 |

|

Debt modification and extinguishment gain |

|

|

(4,079 |

) |

|

|

(4,079 |

) |

|

|

(0.06 |

) |

Legal contingencies loss |

|

|

1,338 |

|

|

|

1,338 |

|

|

|

0.02 |

|

Adjusted loss from continuing operations - non-GAAP* |

|

$ |

(12,424 |

) |

|

$ |

(14,703 |

) |

|

$ |

(0.21 |

) |

*Difference due to rounding. |

|

|

|

|

|

|

|

|

|

Adjusted Operating Income is defined as GAAP Operating Income, less expenses/gains associated with the Company's transformation, such as restructuring expenses, gains/losses on divestitures, impairments of goodwill and other assets. Management believes that this is useful in evaluating operating performance, but this measure should not be used in isolation. The following table reconciles our Operating income to Adjusted Operating income as noted above.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

|

Six Months Ended

September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Operating income - GAAP |

|

$ |

32,428 |

|

|

$ |

22,491 |

|

|

$ |

40,542 |

|

|

$ |

21,933 |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

(Gain) loss on sale of assets and businesses, net |

|

|

— |

|

|

|

(409 |

) |

|

|

— |

|

|

|

12,208 |

|

Legal contingencies loss |

|

|

— |

|

|

|

1,338 |

|

|

|

7,464 |

|

|

|

1,338 |

|

Restructuring costs (cash based) |

|

|

3,566 |

|

|

|

1,942 |

|

|

|

5,182 |

|

|

|

1,942 |

|

Shareholder cooperation expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,905 |

|

Adjusted operating income - non-GAAP |

|

$ |

35,994 |

|

|

$ |

25,362 |

|

|

$ |

53,188 |

|

|

$ |

39,326 |

|

Adjusted operating margin - non-GAAP |

|

|

12.5 |

% |

|

|

8.9 |

% |

|

|

9.4 |

% |

|

|

7.2 |

% |

(Continued)

FINANCIAL DATA (UNAUDITED)

TRIUMPH GROUP, INC. AND SUBSIDIARIES

(dollars in thousands)

Non-GAAP Financial Measure Disclosures (continued)

|

|

|

|

|

|

Fiscal 2025 |

|

($ in millions) |

|

Guidance |

|

Income from continuing operations, before taxes |

|

$43.5-$48.5 |

|

Adjustments: |

|

|

|

Interest expense and other, net |

|

~$92.0 |

|

Non-service defined benefit expense |

|

~$5.0 |

|

Depreciation & Amortization |

|

~$32.0 |

|

Amortization of acquired contract liabilities |

|

~($3.0) |

|

Share-based compensation |

|

~$13.0 |

|

Legal contingencies loss |

|

~$7.5 |

|

Adjusted EBITDAP - non-GAAP |

|

$190.0 - $195.0 |

|

Cash provided by operations, is provided for consistency and comparability. We also use free cash flow as a key factor in planning for and consideration of strategic acquisitions and the repayment of debt. This measure should not be considered in isolation, as a measure of residual cash flow available for discretionary purposes, or as an alternative to operating results presented in accordance with GAAP. The following table reconciles cash used in operations to free cash use.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

|

Six Months Ended

September 30, |

|

|

Fiscal 2025

Guidance |

$ in millions |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

Cash (use) flow from operating activities |

|

$ |

(38.4 |

) |

|

$ |

(32.2 |

) |

|

$ |

(142.9 |

) |

|

$ |

(95.9 |

) |

|

$ 40.0 - $ 55.0 |

Less: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

|

(6.3 |

) |

|

|

(4.6 |

) |

|

|

(14.5 |

) |

|

|

(11.0 |

) |

|

$ (20.0) - $ (25.0) |

Free cash (use) flow* |

|

$ |

(44.7 |

) |

|

$ |

(36.9 |

) |

|

$ |

(157.4 |

) |

|

$ |

(107.0 |

) |

|

$ 20.0 - $ 30.0 |

* Differences due to rounding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

v3.24.3

Document And Entity Information

|

Nov. 12, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 12, 2024

|

| Entity Registrant Name |

TRIUMPH GROUP, INC.

|

| Entity Central Index Key |

0001021162

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

51-0347963

|

| Entity File Number |

1-12235

|

| Entity Address, Address Line One |

555 E Lancaster Avenue

|

| Entity Address, Address Line Two |

Suite 400

|

| Entity Address, City or Town |

Radnor

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

19087

|

| City Area Code |

610

|

| Local Phone Number |

251-1000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $.001 per share

|

| Trading Symbol |

TGI

|

| Security Exchange Name |

NYSE

|

| Purchase Rights [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Purchase rights

|

| No Trading Symbol Flag |

true

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tgi_PurchaseRights1Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

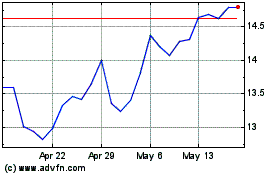

Triumph (NYSE:TGI)

Historical Stock Chart

From Jan 2025 to Feb 2025

Triumph (NYSE:TGI)

Historical Stock Chart

From Feb 2024 to Feb 2025