Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

November 06 2024 - 12:49PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2024

Commission File Number: 001-15092

TURKCELL ILETISIM HIZMETLERI A.S.

(Translation of registrant’s name into English)

Aydınevler Mahallesi

İnönü Caddesi No:20

Küçükyalı

Ofispark

34854 Maltepe

Istanbul, Türkiye

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

x Form 20-F ¨

Form 40-F

Enclosure: A press release dated November 6, 2024, announcing the redemption of the registrant's financing bond.

Istanbul, November 6, 2024

Announcement Regarding the Redemption of the TRFTCELK2417 Financing

Bond

Within the scope of our Company’s announcement

dated August 5, 2024, the redemption and coupon payment of the TRFTCELK2417 coded financing bond with a nominal amount of TRY 800,000,000

and a maturity of 92 days were made on November 6, 2024 (today).

| Board Decision Date |

: 27.05.2024 |

| |

|

| Related Issue Limit Info |

|

| |

|

| Currency Unit |

: TRY |

| Limit |

: 8,000,000,000 |

| Issue Limit Security Type |

: Debt Securities |

| Sale Type |

: Private Placement-Sale to Qualified Investor |

| Domestic / Overseas |

: Domestic |

| Capital Markets Board Approval Date |

: 28.06.2024 |

| |

|

| Capital Market Instrument To Be Issued Info |

|

| |

|

| Type |

: Financing Bond |

| Maturity Date |

: 06.11.2024 |

| Maturity (Day) |

: 92 |

| Sale Type |

: Sale to Qualified Investor |

| Intended Nominal Amount |

: 800,000,000 |

| Intended Maximum Nominal Amount |

: 800,000,000 |

| The country where the issue takes place |

: Türkiye |

| Approval Date of Tenor Issue Document |

: 28.06.2024 |

| Title of Intermediary Brokerage House |

: Ziraat Yatırım Menkul Değerler A.Ş. |

| Central Securities Depository |

: Central Securities Depository of Türkiye |

| Starting Date of Sale |

: 05.08.2024 |

| Ending Date of Sale |

: 05.08.2024 |

| Nominal Value of Capital Market Instrument Sold |

: 800,000,000 |

| Maturity Starting Date |

: 06.08.2024 |

| Issue Price |

: 1 |

| Interest Rate Type |

: Floating Rate |

| Floating Rate Reference |

: TLREF |

| Additional Return (%) |

: 0.65 |

| Traded in the Stock Exchange |

: Yes |

| Payment Type |

: TRY Payment |

| ISIN Code |

: TRFTCELK2417 |

| Coupon Number |

: 1 |

| Currency Unit |

: TRY |

| Coupon Payment Frequency |

: Single Coupon |

| |

|

|

Redemption Plan of Capital Market Instrument Sold

| Coupon Number |

Payment Date |

Record Date* |

Payment Date |

Interest Rate - Periodic (%) |

Interest Rate – Annual Simple

(%) |

Interest Rate – Annual Compound (%) |

Payment Amount |

Exchange Rate |

Was the Payment Made? |

| 1 |

06.11.2024 |

05.11.2024 |

06.11.2024 |

13.5841 |

53.8933 |

65.7549 |

108,672,800.00 |

|

Yes |

| Principal / Maturity Date Payment Amount |

06.11.2024 |

05.11.2024 |

06.11.2024 |

|

|

|

800,000,000.00 |

|

Yes |

*The date on which the right-holders are determined.

Issuer Rating Note

| Rating Company |

Rating Note |

Rating Date |

Is it Investment Grade? |

|

JCR AVRASYA

DERECELENDİRME A.Ş. |

Long Term National Rating AAA (Trk) |

29.05.2024 |

Yes |

For more information:

Turkcell Investor Relations

investor.relations@turkcell.com.tr

Tel: + 90 212 313 1888

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, Turkcell Iletisim Hizmetleri A.S. has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

| |

TURKCELL ILETISIM HIZMETLERI A.S. |

| |

|

|

| Date: November 6, 2024 |

By: |

/s/ Özlem Yardım |

| |

|

|

| |

|

Name: |

Özlem Yardım |

| |

|

Title: |

Investor Relations Corporate Finance Director |

| |

TURKCELL ILETISIM HIZMETLERI A.S. |

| |

|

|

| Date: November 6, 2024 |

By: |

/s/ Kamil Kalyon |

| |

|

|

| |

|

Name: |

Kamil Kalyon |

| |

|

Title: |

Chief Financial Officer |

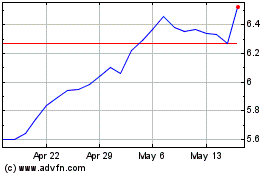

Turkcell lletism Hizmetl... (NYSE:TKC)

Historical Stock Chart

From Jan 2025 to Feb 2025

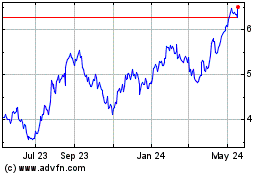

Turkcell lletism Hizmetl... (NYSE:TKC)

Historical Stock Chart

From Feb 2024 to Feb 2025