Tejon Ranch Co., or the Company, (NYSE:TRC), a diversified real

estate development and agribusiness company, today announced

financial results for the three and nine-months ended

September 30, 2024.

“In the third quarter of 2024, we continued the momentum in key

areas of the company's real estate portfolio. The company continues

to make progress toward the opening of our first multi-family

apartment community, Terra Vista at Tejon, during the first half of

2025. The company also announced a new joint-venture with Dedeaux

Properties to develop a 510,500 square foot building in Tejon Ranch

Commerce Center. The Outlets at Tejon celebrated their 10th

anniversary and currently is over 90% occupied.” said Gregory S.

Bielli, President & CEO of Tejon Ranch Co.

Commercial/Industrial Real Estate

Highlights

- The Tejon Ranch Commerce Center, or

TRCC, industrial portfolio, through the Company's joint venture

partnerships, consists of 2.8 million square feet of gross

leasable area (GLA), and is 100% leased. In total, TRCC comprises

7.1 million square feet of GLA.

- TRCC commercial portfolio, wholly owned

and through joint venture partnerships, comprises 620,907 square

feet of GLA and is 95% leased.

- Construction of Terra Vista at Tejon

Phase 1, the Company's multi-family residential development located

in TRCC, is underway. Phase 1 includes 228 of the planned 495

residential units, with the first units becoming available in the

first half of 2025 and the remaining units in this phase coming

online soon thereafter. See www.tejonranchliving.com for further

information.

- Construction of a new distribution

facility for Nestlé USA is underway on the east side of TRCC, which

will total more than 700,000 square feet.

- Outlets at Tejon is celebrating its

10-year anniversary in 2024, with occupancy over 90% as of

September 30, 2024.

- On October 4, 2024, a new joint venture

with Dedeaux Properties was formed to develop, manage, and operate

an industrial building of 510,500 square feet of space at

TRCC-East.

Third Quarter

2024 Financial Results

- GAAP net loss attributable to common

stockholders for the third quarter of 2024 was $1.8 million, or net

loss per share attributable to common stockholders, basic and

diluted, of $0.07. For the third quarter of 2023, the Company had

net loss attributable to common stockholders of $0.3 million, or

net loss per share attributable to common stockholders, basic and

diluted, of $0.01.

- The primary driver of this decrease of

$1.5 million was the lack of pistachio crop yield in 2024,

primarily due to insufficient chilling hours, coupled with 2024

being the down-production year following a substantial harvest last

season. Historically, the pistachio harvest begins in the third

quarter, but in 2023, the harvest was delayed due to unusual

weather conditions. This delay impacted the timing of cost

recognition, resulting in lower overall farming costs for the third

quarter of 2023.

- The above decrease was partially offset

by the increase of $2.2 million in Equity in earnings of

unconsolidated joint ventures mainly related to improved fuel

margins at the Company's TA/Petro joint venture.

- Revenues and other income, including

equity in earnings of unconsolidated joint ventures, for the third

quarter of 2024 were $14.6 million, compared with $12.0 million for

the third quarter of 2023.

- The primary driver of this increase was

a $2.2 million increase of equity in earnings of unconsolidated

joint ventures, due to the improved fuel margins at the Company's

TA/Petro joint venture.

- Adjusted EBITDA, a non-GAAP measure,

was $5.6 million for the third quarter ended September 30,

2024, compared with $5.7 million for the same period in 2023.

Tejon Ranch Co. provides Adjusted EBITDA, a non-GAAP financial

measure, because management believes it offers additional

information for monitoring the Company's cash flow performance. A

table providing a reconciliation of Adjusted EBITDA to its most

comparable GAAP measure, as well as an explanation of, and

important disclosures about, this non-GAAP measure, is included in

the tables at the end of this press release.

Year-to-Date Financial Results

- Net loss attributable to common

stockholders for the first nine months of 2024 was $1.8 million, or

net loss per share attributed to common stockholders, basic and

diluted, of $0.07, compared with net income attributable to common

stockholders of $1.7 million, or net income per share attributed to

common stockholders, basic and diluted, of $0.06, for the first

nine months of 2023.

- The primary factor driving this

change was the reduction in operating profits within the farming

segment of $4,365,000 mainly due to 2024 being a down production

year for pistachio crops as stated above.

- Revenues and other income, for the

first nine months of 2024, including equity in earnings of

unconsolidated joint ventures, totaled $33.2 million, compared with

$35.2 million for the first nine months of 2023. Factors impacting

the year-to-date results include:

- Mineral resources segment revenues

were $7.7 million for the first nine months of 2024, a decrease of

$3.9 million, or 34%, from $11.6 million for the first nine months

of 2023. The reduction in revenues is primarily attributed to a

decline in water sales revenue of $3.4 million due to back-to-back

strong rainfall years in California, which severely limited water

sales opportunities.

- The above decrease was partially offset

by an increase in equity in earnings of unconsolidated joint

ventures, and the main driver of the improved results was related

to higher fuel margins at the TA/Petro joint venture.

Liquidity and Capital Resources

- As of September 30, 2024, total

capitalization, including pro rata share (PRS) of unconsolidated

joint venture debt, was approximately $643.1 million, consisting of

an equity market capitalization of $470.6 million and $172.5

million of debt, and our debt to total capitalization was 26.8%. As

of September 30, 2024, the Company had cash and securities

totaling approximately $41.3 million and $100.1 million available

on its line of credit, for total liquidity of $141.3 million. The

ratio of total debt including pro rata share of unconsolidated

joint venture debt, net of cash and securities, of $131.2 million,

to trailing twelve months adjusted EBITDA of $17.8 million was

7.4x.

2024 Outlook:

The Company will continue to strategically pursue

commercial/industrial development, multi-family development,

leasing, sales, and investment within TRCC and its joint ventures.

The Company also will continue to invest in advancing its

residential projects, including Mountain Village at Tejon Ranch,

Centennial at Tejon Ranch and Grapevine at Tejon Ranch.

California is one of the most highly regulated states in which

to engage in real estate development and, as such, natural delays,

including those resulting from litigation, can be reasonably

anticipated. Accordingly, throughout the next few years, the

Company expects net income to fluctuate from year-to-year based on

the above-mentioned activity, along with commodity prices,

production within its farming and mineral resources segments, and

the timing of land sales and leasing of land within its industrial

developments.

Water sales opportunities each year are impacted by the total

precipitation and snowpack runoff in Northern California from

winter storms, as well as State Water Project, or SWP, allocations.

The current SWP allocation is at 40% of contract amounts.

The Company's farming operations in 2024 continue to be impacted

by higher costs of production, such as fuel costs, fertilizer

costs, pest control costs, and labor costs. The almond industry is

estimating the 2024 almond crop at 2.6 billion pounds. This

estimate along with a lower inventory carry forward has helped to

improve pricing. The late spring rains negatively impacted 2024

grape production as the rains occurred during the grape bloom. The

timing of the rains also increased cultural costs within grapes to

fight higher levels of mildew in the vineyards.

About Tejon Ranch Co.

Tejon Ranch Co. (NYSE: TRC) is a diversified real estate

development and agribusiness company, whose principal asset is its

270,000-acre land holding located approximately 60 miles north of

Los Angeles and 15 miles south of Bakersfield.

More information about Tejon Ranch Co. can be found on the

Company's website at www.tejonranch.com.

Forward Looking Statements:

The statements contained herein, which are not historical facts,

are forward-looking statements based on economic forecasts,

strategic plans and other factors, which by their nature involve

risk and uncertainties. In particular, among the factors that could

cause actual results to differ materially are the following:

business conditions and the general economy, future commodity

prices and yields, external market forces, the ability to obtain

various governmental entitlements and permits, interest rates, and

other risks inherent in real estate and agriculture businesses. For

further information on factors that could affect the Company, the

reader should refer to the Company’s filings with the Securities

and Exchange Commission.

(Financial tables follow)

|

TEJON RANCH CO. AND

SUBSIDIARIESCONSOLIDATED BALANCE

SHEETS(In thousands, except per share data) |

| |

| |

September 30, 2024 |

|

December 31, 2023 |

| |

(unaudited) |

|

|

|

ASSETS |

|

|

|

| Current

Assets: |

|

|

|

|

Cash and cash equivalents |

$ |

27,369 |

|

|

$ |

31,907 |

|

|

Marketable securities - available-for-sale |

|

13,892 |

|

|

|

32,556 |

|

|

Accounts receivable |

|

2,783 |

|

|

|

8,352 |

|

|

Inventories |

|

7,550 |

|

|

|

3,493 |

|

|

Prepaid expenses and other current assets |

|

4,053 |

|

|

|

3,502 |

|

| Total

current assets |

|

55,647 |

|

|

|

79,810 |

|

| Real

estate and improvements - held for lease, net |

|

16,340 |

|

|

|

16,609 |

|

| Real

estate development (includes $123,302 at September 30, 2024

and $119,788 at December 31, 2023, attributable to CFL) |

|

374,341 |

|

|

|

337,257 |

|

| Property

and equipment, net |

|

56,760 |

|

|

|

53,985 |

|

|

Investments in unconsolidated joint ventures |

|

34,429 |

|

|

|

33,648 |

|

| Net

investment in water assets |

|

56,024 |

|

|

|

52,130 |

|

| Other

assets |

|

4,496 |

|

|

|

4,084 |

|

| TOTAL

ASSETS |

$ |

598,037 |

|

|

$ |

577,523 |

|

| |

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

| Current

Liabilities: |

|

|

|

|

Trade accounts payable |

$ |

11,283 |

|

|

$ |

6,457 |

|

|

Accrued liabilities and other |

|

6,565 |

|

|

|

3,214 |

|

|

Deferred income |

|

1,721 |

|

|

|

1,891 |

|

| Total

current liabilities |

|

19,569 |

|

|

|

11,562 |

|

|

Revolving line of credit |

|

59,942 |

|

|

|

47,942 |

|

|

Long-term deferred gains |

|

11,447 |

|

|

|

11,447 |

|

| Deferred

tax liability |

|

8,282 |

|

|

|

8,269 |

|

| Other

liabilities |

|

15,114 |

|

|

|

15,207 |

|

|

Total liabilities |

|

114,354 |

|

|

|

94,427 |

|

|

Commitments and contingencies |

|

|

|

|

Equity: |

|

|

|

|

Tejon Ranch Co. Stockholders’ Equity |

|

|

|

|

Common stock, $0.50 par value per share: |

|

|

|

|

Authorized shares - 50,000,000 |

|

|

|

| Issued

and outstanding shares - 26,814,680 at September 30, 2024 and

26,770,545 at December 31, 2023 |

|

13,408 |

|

|

|

13,386 |

|

|

Additional paid-in capital |

|

347,939 |

|

|

|

345,609 |

|

|

Accumulated other comprehensive loss |

|

(142 |

) |

|

|

(171 |

) |

|

Retained earnings |

|

107,115 |

|

|

|

108,908 |

|

|

Total Tejon Ranch Co. Stockholders’ Equity |

|

468,320 |

|

|

|

467,732 |

|

|

Non-controlling interest |

|

15,363 |

|

|

|

15,364 |

|

| Total

equity |

|

483,683 |

|

|

|

483,096 |

|

| TOTAL

LIABILITIES AND EQUITY |

$ |

598,037 |

|

|

$ |

577,523 |

|

| |

|

TEJON RANCH CO. AND SUBSIDIARIESUNAUDITED

CONSOLIDATED STATEMENTS OF OPERATIONS($ in thousands,

except per share amounts) |

| |

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Revenues: |

|

|

|

|

|

|

|

|

Real estate - commercial/industrial |

$ |

3,002 |

|

|

$ |

3,397 |

|

|

$ |

8,497 |

|

|

$ |

8,706 |

|

|

Mineral resources |

|

3,166 |

|

|

|

3,118 |

|

|

|

7,687 |

|

|

|

11,630 |

|

|

Farming |

|

3,242 |

|

|

|

2,642 |

|

|

|

4,249 |

|

|

|

4,852 |

|

|

Ranch operations |

|

1,446 |

|

|

|

1,052 |

|

|

|

3,518 |

|

|

|

3,384 |

|

|

Total revenues |

|

10,856 |

|

|

|

10,209 |

|

|

|

23,951 |

|

|

|

28,572 |

|

| Costs

and Expenses: |

|

|

|

|

|

|

|

|

Real estate - commercial/industrial |

|

2,088 |

|

|

|

2,137 |

|

|

|

6,005 |

|

|

|

5,517 |

|

|

Real estate - resort/residential |

|

328 |

|

|

|

367 |

|

|

|

2,316 |

|

|

|

1,079 |

|

|

Mineral resources |

|

1,812 |

|

|

|

2,000 |

|

|

|

5,043 |

|

|

|

6,991 |

|

|

Farming |

|

6,252 |

|

|

|

2,157 |

|

|

|

9,406 |

|

|

|

5,644 |

|

|

Ranch operations |

|

1,223 |

|

|

|

1,196 |

|

|

|

3,711 |

|

|

|

3,864 |

|

|

Corporate expenses |

|

2,945 |

|

|

|

2,315 |

|

|

|

8,794 |

|

|

|

6,824 |

|

|

Total expenses |

|

14,648 |

|

|

|

10,172 |

|

|

|

35,275 |

|

|

|

29,919 |

|

|

Operating (loss) income |

|

(3,792 |

) |

|

|

37 |

|

|

|

(11,324 |

) |

|

|

(1,347 |

) |

| Other

Income: |

|

|

|

|

|

|

|

|

Investment income |

|

528 |

|

|

|

700 |

|

|

|

1,843 |

|

|

|

1,775 |

|

|

Other (loss) income, net |

|

(69 |

) |

|

|

(30 |

) |

|

|

(210 |

) |

|

|

272 |

|

|

Total other income, net |

|

459 |

|

|

|

670 |

|

|

|

1,633 |

|

|

|

2,047 |

|

| (Loss)

income from operations before equity in earnings of unconsolidated

joint ventures and income tax |

|

(3,333 |

) |

|

|

707 |

|

|

|

(9,691 |

) |

|

|

700 |

|

| Equity

in earnings of unconsolidated joint ventures, net |

|

3,329 |

|

|

|

1,161 |

|

|

|

7,611 |

|

|

|

4,616 |

|

| (Loss)

income before income tax |

|

(4 |

) |

|

|

1,868 |

|

|

|

(2,080 |

) |

|

|

5,316 |

|

| Income

tax expense (benefit) |

|

1,832 |

|

|

|

2,215 |

|

|

|

(286 |

) |

|

|

3,619 |

|

| Net

(loss) income |

|

(1,836 |

) |

|

|

(347 |

) |

|

|

(1,794 |

) |

|

|

1,697 |

|

| Net loss

attributable to non-controlling interest |

|

— |

|

|

|

(6 |

) |

|

|

(1 |

) |

|

|

(3 |

) |

| Net

(loss) income attributable to common stockholders |

$ |

(1,836 |

) |

|

$ |

(341 |

) |

|

$ |

(1,793 |

) |

|

$ |

1,700 |

|

| Net

(loss) income per share attributable to common stockholders,

basic |

$ |

(0.07 |

) |

|

$ |

(0.01 |

) |

|

$ |

(0.07 |

) |

|

$ |

0.06 |

|

| Net

(loss) income per share attributable to common stockholders,

diluted |

$ |

(0.07 |

) |

|

$ |

(0.01 |

) |

|

$ |

(0.07 |

) |

|

$ |

0.06 |

|

| |

Non-GAAP Financial Measure

This press release includes references to the Company’s non-GAAP

financial measure “EBITDA.” EBITDA represents the Company's share

of consolidated net income in accordance with GAAP, before

interest, taxes, depreciation, and amortization, plus the allocable

portion of EBITDA of unconsolidated joint ventures accounted for

under the equity method of accounting based upon economic ownership

interest, and all determined on a consistent basis in accordance

with GAAP. EBITDA is a non-GAAP financial measure and is used by

the Company and others as a supplemental measure of performance.

Tejon Ranch uses Adjusted EBITDA to assess the performance of the

Company's core operations, for financial and operational decision

making, and as a supplemental or additional means of evaluating

period-to-period comparisons on a consistent basis. Adjusted EBITDA

is calculated as EBITDA, excluding stock compensation expense. The

Company believes Adjusted EBITDA provides investors relevant and

useful information because it permits investors to view income from

operations on an unlevered basis before the effects of taxes,

depreciation and amortization, and stock compensation expense. By

excluding interest expense and income, EBITDA and Adjusted EBITDA

allow investors to measure the Company's performance independent of

its capital structure and indebtedness and, therefore, allow for a

more meaningful comparison of the Company's performance to that of

other companies, both in the real estate industry and in other

industries. The Company believes that excluding charges related to

share-based compensation facilitates a comparison of its operations

across periods and among other companies without the variances

caused by different valuation methodologies, the volatility of the

expense (which depends on market forces outside the Company's

control), and the assumptions and the variety of award types that a

company can use. EBITDA and Adjusted EBITDA have limitations as

measures of the Company's performance. EBITDA and Adjusted EBITDA

do not reflect Tejon Ranch's historical cash expenditures or future

cash requirements for capital expenditures or contractual

commitments. While EBITDA and Adjusted EBITDA are relevant and

widely used measures of performance, they do not represent net

income or cash flows from operations as defined by GAAP, and they

should not be considered as alternatives to those indicators in

evaluating performance or liquidity. Further, the Company's

computation of EBITDA and Adjusted EBITDA may not be comparable to

similar measures reported by other companies.

|

TEJON RANCH CO.Non-GAAP Financial

Measures(Unaudited) |

| |

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

($ in thousands) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net (loss) income |

$ |

(1,836 |

) |

|

$ |

(347 |

) |

|

$ |

(1,794 |

) |

|

$ |

1,697 |

|

|

Net loss attributable to non-controlling interest |

|

— |

|

|

|

(6 |

) |

|

|

(1 |

) |

|

|

(3 |

) |

| Interest, net |

|

|

|

|

|

|

|

|

Consolidated |

|

(528 |

) |

|

|

(700 |

) |

|

|

(1,843 |

) |

|

|

(1,775 |

) |

|

Our share of interest expense from unconsolidated joint

ventures |

|

1,532 |

|

|

|

1,216 |

|

|

|

4,625 |

|

|

|

3,618 |

|

| Total interest, net |

|

1,004 |

|

|

|

516 |

|

|

|

2,782 |

|

|

|

1,843 |

|

| Income tax expense

(benefit) |

|

1,832 |

|

|

|

2,215 |

|

|

|

(286 |

) |

|

|

3,619 |

|

| Depreciation and

amortization: |

|

|

|

|

|

|

|

|

Consolidated |

|

1,216 |

|

|

|

1,028 |

|

|

|

3,137 |

|

|

|

3,003 |

|

|

Our share of depreciation and amortization from unconsolidated

joint ventures |

|

1,695 |

|

|

|

1,393 |

|

|

|

4,989 |

|

|

|

4,005 |

|

| Total depreciation and

amortization |

|

2,911 |

|

|

|

2,421 |

|

|

|

8,126 |

|

|

|

7,008 |

|

| EBITDA |

|

3,911 |

|

|

|

4,811 |

|

|

|

8,829 |

|

|

|

14,170 |

|

| Stock compensation

expense |

|

1,732 |

|

|

|

864 |

|

|

|

4,086 |

|

|

|

2,369 |

|

| Adjusted

EBITDA |

$ |

5,643 |

|

|

$ |

5,675 |

|

|

$ |

12,915 |

|

|

$ |

16,539 |

|

| |

| |

| |

|

Summary of Outstanding Debt as of

September 30, 2024 (Unaudited) |

| |

| |

| |

|

Entity/Borrowing |

Amount |

% Share |

PRS Debt |

|

Revolving line-of-credit |

$ |

59,942 |

100% |

|

$ |

59,942 |

|

| Petro

Travel Plaza Holdings, LLC |

|

11,984 |

60% |

|

|

7,190 |

|

|

TRCC/Rock Outlet Center, LLC |

|

20,626 |

50% |

|

|

10,313 |

|

| TRC-MRC

1, LLC |

|

21,642 |

50% |

|

|

10,821 |

|

| TRC-MRC

2, LLC |

|

21,414 |

50% |

|

|

10,707 |

|

| TRC-MRC 3, LLC |

|

32,952 |

50% |

|

|

16,476 |

|

| TRC-MRC 4, LLC |

|

61,144 |

50% |

|

|

30,572 |

|

| TRC-MRC 5, LLC |

|

52,984 |

50% |

|

|

26,492 |

|

| Total |

$ |

282,688 |

|

$ |

172,513 |

|

| |

|

Capitalization and Debt Ratios(Unaudited) |

| |

|

|

September 30, 2024 |

|

Period End Share Price |

$ |

17.55 |

|

| Outstanding Shares |

|

26,814,680 |

| Equity Market Capitalization

as of Reporting Date |

$ |

470,598 |

|

| Total Debt including PRS

Unconsolidated Joint Venture Debt |

$ |

172,513 |

|

| Total Capitalization |

$ |

643,111 |

|

| Debt to total

capitalization |

|

26.8 |

% |

| Net debt, including PRS

unconsolidated joint venture debt, to TTM adjusted EBITDA |

|

7.4 |

| |

|

|

|

Tejon Ranch Co.Brett A. Brown, 661-248-3000Executive Vice

President, Chief Financial Officer

Tejon Ranch Co.Nicholas Ortiz 661-663-4212Senior Vice President,

Corporate Communications & Public Affairs

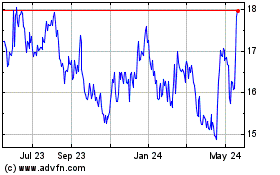

Tejon Ranch (NYSE:TRC)

Historical Stock Chart

From Dec 2024 to Jan 2025

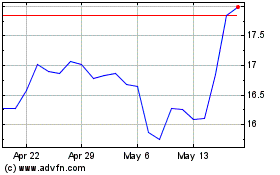

Tejon Ranch (NYSE:TRC)

Historical Stock Chart

From Jan 2024 to Jan 2025