September 27, 2023—Triton International Limited (NYSE: TRTN)

(“Triton”) announced today the preliminary results of the elections

made by holders of Triton common shares regarding the form of

consideration they wish to receive in exchange for their Triton

common shares in connection with the pending acquisition of Triton

by Brookfield Infrastructure Partners L.P. (“BIP”) (NYSE: BIP, TSX:

BIP.UN), through its subsidiary Brookfield Infrastructure

Corporation (“BIPC”) and its institutional partners (collectively,

“Brookfield Infrastructure”) (the “Merger”), which is expected to

close on September 28, 2023, subject to customary closing

conditions. The Merger is described (a) in the proxy statement /

joint prospectus (as amended and as supplemented by Triton’s

Current Report on Form 8-K filed with the U.S. Securities and

Exchange Commission (“SEC”) on August 17, 2023, the “Proxy

Statement / Joint Prospectus”) included in the registration

statement of BIPC and BIP (as amended, the “Registration

Statement”), which was declared effective by the SEC on July 6,

2023, and (b) in the Agreement and Plan of Merger, dated April 11,

2023 (the “Merger Agreement”), which is attached to the Proxy

Statement / Joint Prospectus as Annex A.

As previously announced, the deadline for holders of Triton

common shares to have made an election as to the form of

consideration they wish to receive in connection with the Merger

was 5:00 p.m. New York Time on September 26, 2023 (the “Election

Deadline”).

Based on available information as of the Election Deadline, the

preliminary election results were:

- holders of 14,569,497 Triton common shares (which includes

6,486,767 Triton common shares that remain subject to guaranteed

delivery procedures), or approximately 27.27% of the outstanding

common shares, elected to receive the specified mixture of both

cash and shares of class A exchangeable subordinate voting shares

of BIPC (“BIPC Shares”) equal to $68.50 per Triton common share in

cash and the number of BIPC Shares with a value of $16.50 per

Triton common share based on the BIPC Final Share Price (as defined

in the Proxy Statement / Joint Prospectus), subject to the Collar

as described below (the “Per Share Consideration Value”);

- holders of 25,173,485 Triton common shares (which includes

3,056,513 Triton common shares that remain subject to guaranteed

delivery procedures), or approximately 47.11% the of outstanding

Triton common shares, elected to receive all-cash consideration

equal in value to the Per Share Consideration Value;

- holders of 3,129,366 Triton common shares (which includes

23,792 Triton common shares that remain subject to guaranteed

delivery procedures), or approximately 5.86% of the outstanding

Triton common shares, elected to receive all-BIPC Share

consideration equal in value to the Per Share Consideration Value;

and

- holders of 10,560,138 Triton common shares, or approximately

19.76% of the outstanding Triton common shares, elected the no

election option or failed to make a valid election by the Election

Deadline.

The election results set forth above, including the number of

outstanding Triton common shares, do not take into account Triton

restricted common shares, dissenting Triton common shares and

certain Triton common shares that will be contributed to an

affiliate of Thanos Holdings Limited by certain rollover investors,

as such shares were not eligible to make elections to receive the

Merger consideration. The preliminary election results are subject

to a notice of guaranteed delivery procedure. The final election

results may therefore differ from the preliminary election results

and are not expected to be available until following the closing of

the Merger.

The Per Share Consideration Value will be determined based on

the volume-weighted average sales price per BIPC Share on the New

York Stock Exchange (“NYSE”) over the ten consecutive trading days

ending on the second trading day immediately prior to the date of

the closing of the Merger. If the BIPC Final Share Price is greater

than or equal to $42.36 but less than or equal to $49.23 (the

“Collar”), holders of Triton common shares will receive a number of

BIPC Shares between 0.3352 and 0.3895 per common share equal to

$16.50 in value. Holders of Triton common shares will receive

0.3895 BIPC Shares per Triton common share as a portion of the Per

Share Consideration Value if the BIPC Final Share Price is below

$42.36, and 0.3352 BIPC Shares per Triton common share if the BIPC

Final Share Price is above $49.23. Based on the anticipated closing

date of September 28, 2023, the BIPC Final Share Price as of the

close of trading on September 26, 2023 would be $37.64, and the Per

Share Consideration Value would be $68.50 in cash and 0.3895 BIPC

Shares.

After the final election results are determined, the allocation

of the consideration in the Merger will be calculated using the

formulas set forth in the Merger Agreement.

Following the closing of the Merger, Triton common shares will

be delisted from the NYSE, deregistered under the U.S. Exchange Act

and will cease to be publicly traded.

Triton preference shares issued and outstanding immediately

prior to the Merger closing will remain outstanding as an

obligation of Triton and remain entitled to the same dividends and

other preferences and privileges as prior to the closing of the

Merger. Triton expects that its preference shares will continue to

be listed on the NYSE following the closing of the Merger.

Expected Trading of Triton Common Shares

The last day of trading for Triton common shares (Ticker Symbol:

TRTN; ISIN code: BMG9078F1077; CUSIP: G9078F107) is expected to be

September 27, 2023, subject to the Merger closing as anticipated on

September 28, 2023.

About Triton International Limited

Triton is the world’s largest lessor of intermodal freight

containers. With a container fleet of over 7 million twenty-foot

equivalent units, Triton’s global operations include acquisition,

leasing, re-leasing and subsequent sale of multiple types of

intermodal containers and chassis.

Cautionary Statement Regarding Forward-Looking

Statements

Certain statements in this press release may constitute

“forward-looking statements.” Actual results could differ

materially from those projected or forecast in the forward-looking

statements. The factors that could cause actual results to differ

materially include the following: risks related to the satisfaction

or waiver of the conditions to closing the proposed acquisition in

the anticipated timeframe or at all, including the possibility that

the proposed acquisition does not close; the occurrence of any

event, change or other circumstance or condition that could give

rise to the termination of the Merger Agreement, including

circumstances requiring Triton to pay a termination fee; the

possibility that competing offers are made; risks related to the

ability to realize the anticipated benefits of the proposed

acquisition, including the possibility that the expected benefits

from the acquisition will not be realized or will not be realized

within the expected time period; disruption from the transaction

making it more difficult to maintain business and operational

relationships; continued availability of capital and financing and

rating agency actions; disruptions in the financial markets;

certain restrictions during the pendency of the transaction that

may impact Triton’s ability to pursue certain business

opportunities or strategic transactions; risks related to diverting

management’s attention from Triton’s ongoing business operation;

negative effects of this announcement or the consummation of the

proposed acquisition on the market price of Triton common shares or

BIPC Shares and/or operating results; significant transaction

costs; unknown liabilities; the risk of litigation and/or

regulatory actions related to the proposed acquisition, other

business effects and uncertainties, including the effects of

industry, market, business, economic, political or regulatory

conditions; decreases in the demand for leased containers;

decreases in market leasing rates for containers; difficulties in

re-leasing containers after their initial fixed-term leases;

customers’ decisions to buy rather than lease containers; increases

in the cost of repairing and storing Triton’s off-hire containers;

Triton’s dependence on a limited number of customers and suppliers;

customer defaults; decreases in the selling prices of used

containers; the impact of future global pandemics on Triton’s

business and financial results; risks resulting from the political

and economic policies of the United States and other countries,

particularly China, including, but not limited to, the impact of

trade wars, duties, tariffs or geo-political conflict; risks

stemming from the international nature of Triton’s business,

including global and regional economic conditions, including

inflation and attempts to control inflation, and geopolitical risks

such as the ongoing war in Ukraine; extensive competition in the

container leasing industry and developments thereto; decreases in

demand for international trade; disruption to Triton’s operations

from failures of, or attacks on, Triton’s information technology

systems; disruption to Triton’s operations as a result of natural

disasters; compliance with laws and regulations related to economic

and trade sanctions, security, anti-terrorism, environmental

protection and anti-corruption; the availability and cost of

capital; restrictions imposed by the terms of Triton’s debt

agreements; and changes in tax laws in Bermuda, the United States

and other countries.

These risks, as well as other risks associated with the proposed

transaction, are more fully discussed in the Proxy Statement /

Joint Prospectus included in the Registration Statement, which was

declared effective by the SEC on July 6, 2023. Discussions of

additional risks and uncertainties are contained in Triton’s

filings with the SEC, all of which are available at

https://sec.gov. These filings identify and address other important

risks and uncertainties that could cause actual events and results

to differ materially from those contained in the forward-looking

statements. Forward-looking statements speak only as of the date

they are made. Readers are cautioned not to put undue reliance on

forward-looking statements, and Triton assumes no obligation to,

and do not intend to, update or revise these forward-looking

statements, whether as a result of new information, future events,

or otherwise, unless required by law. Triton does not give any

assurance that it will achieve its expectations.

Additional Information and Where to Find It

In connection with the proposed transaction, BIP and BIPC filed

the Registration Statement, including a joint prospectus of BIP and

BIPC and a definitive proxy statement of Triton. The Registration

Statement was declared effective by the SEC on July 6, 2023, and

the definitive proxy statement was filed by Triton on July 6, 2023.

Each of BIP, BIPC and Triton may also file other relevant documents

with the SEC and, in the case of BIP and BIPC, with the applicable

Canadian securities regulatory authorities, regarding the proposed

acquisition. This communication is not a substitute for the

Registration Statement, the Proxy Statement / Joint Prospectus or

any other document that BIP, BIPC or Triton may file with the SEC

and, in the case of BIP and BIPC, with the applicable Canadian

securities regulatory authorities, with respect to the proposed

transaction. The definitive Proxy Statement / Joint Prospectus has

been mailed to holders of Triton common shares of record as of July

3, 2023. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE

REGISTRATION STATEMENT, THE PROXY STATEMENT / JOINT PROSPECTUS, ANY

AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS AND ANY OTHER RELEVANT

DOCUMENTS THAT MAY BE FILED WITH THE SEC OR APPLICABLE CANADIAN

SECURITIES REGULATORY AUTHORITIES CAREFULLY AND IN THEIR ENTIRETY

IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL

CONTAIN IMPORTANT INFORMATION ABOUT BIPC, TRITON AND THE PROPOSED

TRANSACTION.

Investors and security holders will be able to obtain copies of

these materials (if and when they are available) and other

documents containing important information about BIP, BIPC, Triton

and the proposed transaction, once such documents are filed with

the SEC free of charge through the website maintained by the SEC at

https://sec.gov. Copies of documents filed with the SEC or

applicable Canadian securities regulatory authorities by BIP and

BIPC will be made available free of charge on BIP and BIPC’s

website at

https://bip.brookfield.com/bip/reports-filings/regulatory-filings.

Copies of documents filed with the SEC by Triton will be made

available free of charge on Triton’s investor relations website at

https://tritoninternational.com/investors.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230927339184/en/

For Triton: Media Lisa Friedman Senior Managing Director

Teneo +1 (347) 714-4675 Email: lisa.friedman@teneo.com Investor

Relations Andrew Kohl Vice President Corporate Strategy &

Investor Relations +1 (914) 697-2900 Email: akohl@trtn.com

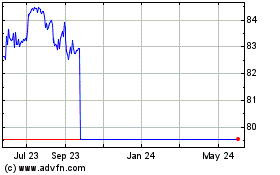

Triton (NYSE:TRTN)

Historical Stock Chart

From Dec 2024 to Jan 2025

Triton (NYSE:TRTN)

Historical Stock Chart

From Jan 2024 to Jan 2025