Singapore Fines Credit Suisse for Bankers' Misconduct

December 27 2023 - 11:28PM

Dow Jones News

By Jiahui Huang

Singapore imposed a penalty of 3.9 million Singapore dollars

(US$3.0 million) on Credit Suisse for failing to prevent or detect

misconduct by its relationship managers.

Credit Suisse bankers in Singapore had provided customers with

inaccurate or incomplete post-trade disclosures, which led to

clients being charged spreads above bilaterally agreed rates for 39

over-the-counter bond transactions, the Monetary Authority of

Singapore said in a statement on Thursday.

The MAS said its review of pricing and disclosure practices in

the private-banking industry found that Credit Suisse had failed to

implement adequate controls to prevent or detect the bankers'

misconduct.

Credit Suisse has admitted liability, paid the fine and

separately compensated affected clients, it said.

"We are pleased to resolve this past matter with the MAS

following a series of independent reviews," a Singapore-based

Credit Suisse spokesperson said. The bank has taken steps to

enhance its policies, procedures and controls to mitigate any

recurrence, the spokesperson said.

Write to Jiahui Huang at jiahui.huang@wsj.com

(END) Dow Jones Newswires

December 28, 2023 00:13 ET (05:13 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

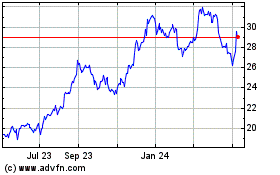

UBS (NYSE:UBS)

Historical Stock Chart

From May 2024 to Jun 2024

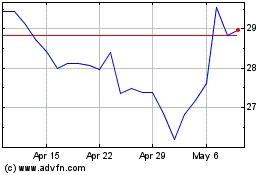

UBS (NYSE:UBS)

Historical Stock Chart

From Jun 2023 to Jun 2024