0000884219false00008842192024-09-122024-09-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): September 12, 2024 |

Viad Corp

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware |

001-11015 |

36-1169950 |

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

7000 East 1st Avenue |

|

Scottsdale, Arizona |

|

85251-4304 |

(Address of principal executive offices) |

|

(Zip Code) |

|

Registrant’s telephone number, including area code: (602) 207-1000 |

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $1.50 Par Value |

|

VVI |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure

On September 12, 2024, Viad Corp. (the “Company”) posted an investor presentation on its website at www.viad.com, which will be used during meetings with investors. A copy of the investor presentation is furnished as Exhibit 99.1 hereto.

The information in this report, including Exhibit 99.1, will not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section and it will not be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

Viad Corp |

|

|

(Registrant) |

|

|

|

|

Date: September 12, 2024 |

|

By: |

/s/ Jonathan A. Massimino |

|

|

|

Jonathan A. Massimino |

|

|

Title: |

General Counsel & Corporate Secretary |

INVESTOR PRESENTATION September 2024 Exhibit 99.1

Forward-looking statements This presentation contains a number of forward-looking statements. Words, and variations of words, such as “will,” “may,” “expect,” “would,” “could,” “might,” “intend,” “plan,” “believe,” “estimate,” “anticipate,” “deliver,” “seek,” “aim,” “potential,” “target,” “outlook,” and similar expressions are intended to identify our forward-looking statements. Similarly, statements that describe our business strategy, outlook, objectives, plans, initiatives, intentions or goals also are forward looking statements. These forward-looking statements are not historical facts and are subject to a host of risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from those in the forward-looking statements. Important factors that could cause actual results to differ materially from those described in our forward-looking statements include, but are not limited to, the following: general economic uncertainty in key global markets and a worsening of global economic conditions; travel industry disruptions; the impact of our overall level of indebtedness, as well as our financial covenants, on our operational and financial flexibility; seasonality of our businesses; unanticipated delays and cost overruns of our capital projects, and our ability to achieve established financial and strategic goals for such projects; the importance of key members of our account teams to our business relationships; our ability to manage our business and continue our growth if we lose any of our key personnel; the competitive nature of the industries in which we operate; our dependence on large exhibition event clients; adverse effects of show rotation on our periodic results and operating margins; transportation disruptions and increases in transportation costs; natural disasters, weather conditions, accidents, and other catastrophic events; our exposure to labor cost increases and work stoppages related to unionized employees; our multi-employer pension plan funding obligations; our ability to successfully integrate and achieve established financial and strategic goals from acquisitions; our exposure to cybersecurity attacks and threats; our exposure to currency exchange rate fluctuations; liabilities relating to prior and discontinued operations; sufficiency and cost of insurance coverage; and compliance with laws governing the storage, collection, handling, and transfer of personal data and our exposure to legal claims and fines for data breaches or improper handling of such data. For a more complete discussion of the risks and uncertainties that may affect our business or financial results, please see Item 1A, “Risk Factors,” of our most recent annual report on Form 10-K filed with the SEC. We disclaim and do not undertake any obligation to update or revise any forward-looking statement in this presentation except as required by applicable law or regulation.

NON-GAAP FINANCIAL MEASURES This document includes the presentation of “Adjusted EBITDA”, which is supplemental to results presented under accounting principles generally accepted in the United States of America (“GAAP”) and may not be comparable to similarly titled measures presented by other companies. This non-GAAP measure should be considered in addition to, but not as a substitute for, other similar measures reported in accordance with GAAP. The use of this non-GAAP financial measure is limited, compared to the GAAP measure of net income attributable to Viad, because it does not consider a variety of items affecting Viad’s consolidated financial performance as explained below. Because this non-GAAP measure does not consider all items affecting Viad’s consolidated financial performance, a user of Viad’s financial information should consider net income attributable to Viad as an important measure of financial performance because it provides a more complete measure of the Company’s performance. Adjusted EBITDA is defined by management as net income attributable to Viad before income (loss) from discontinued operations, interest expense and interest income, income taxes, depreciation and amortization, transaction-related costs, attraction start-up costs, restructuring charges, impairment losses, the reduction/increase for income/loss attributable to non-redeemable and redeemable non-controlling interests, and gains or losses from sales of businesses. Adjusted EBITDA is considered a useful operating metric, in addition to net income attributable to Viad, as potential variations arising from non-recurring integration costs, non-cash amortization and depreciation, and non-operational expenses/income are eliminated, thus resulting in an additional measure considered to be indicative of Viad’s consolidated and segment performance. Management believes that the presentation of Adjusted EBITDA provides useful information to investors regarding Viad’s results of operations for trending, analyzing and benchmarking the performance and value of Viad’s business. Forward-Looking Non-GAAP Measures The company has not quantitatively reconciled its guidance for adjusted EBITDA to its respective most comparable GAAP measure because certain reconciling items that impact this metric including, provision for income taxes, interest expense, restructuring or impairment charges, transaction-related costs, and attraction start-up costs have not occurred, are out of the company’s control, or cannot be reasonably predicted. Accordingly, reconciliations to the nearest GAAP financial measure are not available without unreasonable effort. Please note that the unavailable reconciling items could significantly impact the company’s results as reported under GAAP.

SUMMARY 5���10���20 28���30 APPENDIX

INVESTMENT HIGHLIGHTS High-quality businesses with leading and defensible market positions Proven success executing growth strategy and driving strong returns Positioned for strong profitable growth in 2024 and beyond

Exhibition SERVICES & EXPERIENTIAL MARKETING Company ICONIC ATTRACTIONS & HOSPITALITY company Viad is a leading provider of extraordinary experiences OUR MISSION is to drive significant and sustainable growth by delivering extraordinary experiences for our teams, clients, and guests World-class experiences with high-margins Meaningful barriers to entry and strong perennial demand Scalable with significant high-return growth opportunities 2023 Adjusted EBITDA: ~$93 Million Meaningful free cash flow generator with high recurring revenue Market leader in exhibition services Strong growth opportunity in experiential marketing 2023 Adjusted EBITDA: ~$68 Million

Our Strategy to maximize shareholder value Smart allocation of capital Meaningfully scale Pursuit through investment in Refresh, Build, Buy high-return growth opportunities Deliver strong cash flow from GES Exhibitions through simple, user-friendly services and best-in class execution Drive growth through Spiro’s world-class, experiential marketing solutions Continually evaluate options to maximize shareholder value

Creating value with Capital allocation strategy We prioritize being strong stewards of our capital to maximize shareholder value using a balanced approach WHILE MAINTAINING STRONG BALANCE SHEET Invest in high-return growth investments to scale Pursuit’s iconic locations using Refresh, Build, Buy strategy 15%+ IRR minimum hurdle rate for all growth investments Focus on opportunities that are counter seasonal, offer 12-month profitability, fit our growth criteria, and/or that are immediately accretive to EBITDA PURSUIT GROWTH INVESTMENTS DRIVE STRONG FREE CASH FLOW AT GES & REINVEST IN STRONG RETURNS AT PURSUIT SKY LAGOON 2021 BUILD FOREST PARK ALPINE HOTEL 2022 BUILD GOLDEN SKYBRIDGE 2021 BUY GLACIER RAFT COMPANY 2022 BUY GLACIER VIEW LODGE 2019 REFRESH MALIGNE LAKE F&B AND RETAIL 2019 REFRESH $138.8 million in liquidity and 2.4x net leverage ratio as of June 30, 2024 Target net leverage ratio range of 2.5x-3.5x Long-term debt maturities Term Loan B matures in 2028 Revolving Credit Facility matures in 2026

Significant CATALYSTS AND TAILWINDS to DRIVE MEANINGFUL growth CONSOLIDATED ADJUSTED EBITDA ($M) PURSUIT Strong demand for Pursuit’s iconic, unforgettable, inspiring experiences Continued growth of international leisure travel Newer experiences continue to ramp to maturity FlyOver Chicago opened on March 1, 2024 GES Strong demand for GES’ experiential marketing and exhibition services Increased exhibition and event show sizes Improved EBITDA margin expected to hold at or above 8% target Major non-annual shows (2024 revenue up ~$65M vs. 2023) KEY GROWTH DRIVERS ~151-176 * 2024 guidance range includes an estimated reduction of $20 million to $25 million to Adjusted EBITDA related to the Jasper Wildfire Complex (as further discussed in the Pursuit section of this presentation). Pursuit and GES continue to track toward 2024 full year guidance ranges (provided August 2024)

PURSUIT IS An ICONIC ATTRACTIONS �& HOSPITALITY company Pursuit is the owner-operator of inspiring and unforgettable experiences in iconic destinations with strong perennial demand and meaningful barriers to entry HOSPITALITY 41% of FY’23 Revenue 27 Distinctive Lodges 419K Rooms Occupied INTEGRATED F&B, RETAIL, & TRANSPORTATION IN REMARKABLE PLACES Canadian Rockies - Banff NP, Jasper NP, Golden, Waterton Lakes NP Montana - Glacier NP area, Whitefish Alaska - Denali NP area, Kenai Fjords NP area, Seward, Talkeetna Iceland - Reykjavik Other Iconic Destinations - Vancouver, Las Vegas, Chicago ATTRACTIONS 54% of FY’23 Revenue 14 World-Class Experiences 3.5M Visitors

powerful PROVEN growth strategy EXISTING EXPERIENCES NEW EXPERIENCES* REVENUE ($M) ~15% CAGR REFRESH To improve guest experience, market position, and maximize returns BUILD To create new guest experiences and revenue streams with economies of scale and scope BUY Strategic assets that drive guest experience, economies of scale and scope, and immediately improve financial performance * New Experiences comprises the following attractions and lodging properties that were opened or acquired after 2015: Maligne Lake Cruise, CATC Alaska Tourism Corporation, Mountain Park Lodges, West Glacier RV Park & Cabins, Belton Chalet, Basecamp Lodge, Open Top Touring, Sky Lagoon, Golden Skybridge, FlyOver Canada, FlyOver Iceland, FlyOver Las Vegas, Glacier Raft Company, and Forest Park Hotel MORE THAN TRIPLED REVENUE from 2015 to 2023 Pursuit’s proven strategy delivers both organic and inorganic growth

Demonstrated DECADE OF creating value with refresh, build, buy growth strategy ~$460M INVESTED ~$74M FY’23 EBITDA REFRESH, BUILD, BUY GROWTH INVESTMENTS COMPLETED SINCE 2014 13 MAJOR PROJECTS* ATTRACTIONS VISITORS (M) MORE THAN 2.5X from 2015 to 2023 HOSPITALITY ROOMS OCCUPIED (K) MORE THAN 2.5X from 2015 to 2023 * Major projects are defined as growth investments greater than $5 million that had a first full year of EBITDA contribution in 2014 or later.

The power of a collection�SUCCESS STORY: ALASKA COLLECTION ENTERED ALASKA MARKET Acquired two lodges in and near Denali National Park and Denali Backcountry Adventure sightseeing tour ~$15M INVESTMENT EXPANDED ALASKA FOOTPRINT Acquired Kenai Fjords Tours wildlife and glacier cruise and three lodges in and near Kenai Fjords and Denali National Park ~$45M INVESTMENT ONGOING / FUTURE GROWTH We will drive continuous growth through Refresh, Build, Buy combined with our operational expertise to enhance guest experience and maximize profitable growth In creating a collection, Pursuit enhances the value of iconic, unforgettable, and inspiring experiences Establish position in market with perennial demand, pricing power, and high barriers to entry Expand presence with assets that complement existing portfolio and Pursuit core competencies Fortify position through integrated platform, with opportunities for additional growth through Refresh, Build, Buy strategy WINNING FORMULA 2016 2011 =~$10M Est. EBITDA 2024 +3 LODGES +1 ATTRACTION +2 LODGES +1 SIGHTSEEING TOUR

PURSUIT has a ROBUST pipeline of investment opportunities to accelerate growth INVESTMENT CRITERIA 15%+ IRR hurdle rate Iconic, unforgettable, and inspiring Perennial demand High barriers to entry Attractive EBITDA margins High-quality guest experience Countries with strong ease of doing business BUY ICONIC EXPERIENCES IN NEW GEOGRAPHIES Targeting new iconic locations to build a unique collection of experiences Balance out seasonality and geographic concentration Scale and enhance initial investment through Refresh, Build, Buy within each location BUY ICONIC EXPERIENCES IN EXISTING GEOGRAPHIES Bolt-on acquisitions leverage economies of scale and scope in existing geographies Team maintains a pulse on future “off market” opportunities Foster our reputation as an employer and acquirer of choice in our markets REFRESH & BUILD IN EXISTING GEOGRAPHIES RECENT REFRESH SKY LAGOON EXPANSION Opened Q3 2024 Organic growth opportunities at our high-performing existing experiences We enhance and accelerate the improvement of guest experiences across our collections, which drives growth ~20 identified opportunities representing cumulative total investment of $200M+ organic and inorganic investment opportunities RECENT REFRESH ICE ODYSSEY Opened Q2 2024

WHY WE WILL BE SUCCESSFUL Our MISSION is to connect guests and staff to iconic places through unforgettable inspiring experiences. We believe that collecting memories is far more important than collecting things. Since the beginning of time, human beings share a passion for exploration and the search for remarkable experiences.

+16% US LODGING ROOM REVENUE ON THE BOOKS* (USD $M) +7% CANADIAN LODGING (EXCLUDING JASPER) ROOM REVENUE ON THE BOOKS* (CAD $M) 2022 2023 2024 * Room Revenue on the Books data represents reservations taken to date as of September 9, 2022, 2023, and 2024. 2022 2023 2024 ADR +9% vs. 2023 ADR +6% vs. 2023 % of FY Rooms Available Sold % of FY Rooms Available Sold 75% 72% 74% 65% 69% 73% Lodging pacing is a leading indicator of destination demand and the strength in advanced bookings supports our favorable outlook for both our lodging and attractions PURSUIT’s LODGING BOOKING pace indicates continued growth

Jasper Wildfire update Re-affirming estimated 2024 Adjusted EBITDA impact range of $20 million to $25 million provided August 6 Re-opening efforts are progressing Pursuit’s Columbia Icefield Glacier Adventure, Skywalk and Glacier View Lodge re-opened August 9th Icefield attractions visitation has been in line with our recovery expectations (~80% of 2023 levels from Aug 9 – Aug 31) Town of Jasper re-opened to residents and local businesses on August 16th 6 of 8 Pursuit lodges in/near the Jasper townsite have re-opened Primarily accommodating restoration/reconstruction teams and municipal workers in Jasper Honoring contracted itineraries with group and travel trade partners as of September 3rd 1 Pursuit attraction and 2 Pursuit lodges have not yet re-opened: Chateau Jasper is expected to re-open in late September Pyramid Lake Lodge is expected to re-open in late Q4 after addressing insurable damages due to fire protection measures Maligne Lake Cruise will remain closed until 2025 due to Parks Canada road safety measures Jasper National Park remains an iconic destination, and we believe in its strong recovery in 2025 97% of the park was not impacted Jasper is an important itinerary inclusion for travel trade & other long-haul travelers Travel trade remains supportive and interested in returning 18

Jasper Wildfire update 97% of Jasper National Park’s nearly 2.8 million acres were spared from the fire ** Maligne Lake Cruise Forest Park Hotel Pyramid Lake Lodge Town of Jasper ** Maligne Canyon Icewalks operates adjacent to Maligne Canyon Wilderness Kitchen, which was destroyed by the Jasper Wildfire Complex. Town of Jasper Inset POST-FIRE IMAGES Banff WILDFIRE EMERGENCY AREA PURSUIT LODGING PURSUIT ATTRACTION JASPER NATIONAL PARK Chateau Jasper Miette Mountain Cabins Maligne Canyon Icewalks Maligne Lake Cruise Edmonton Forest Park Hotel Marmot Lodge Lobstick Lodge Chateau Jasper Pyramid Lake Lodge The Crimson Columbia Icefield Adventure & Skywalk Glacier View Lodge Banff 19

GES is A LEADING GLOBAL PROVIDER OF EXHIBITION & EXPERIENTIAL MARKETING SERVICES GES is one of the largest global operators in the $128 billion exhibition and experiential marketing sector COMPREHENSIVE, INTEGRATED MARKETING SERVICES TO SUPPORT AND ELEVATE BRANDS Strategy & Creative Marketing & Branding Concept, Planning, & Production Measurement & Analytics 3,600+ annual live events SCALED OPERATOR WITH GLOBAL REACH #1 UK EXHIBITIONS MARKET SHARE #2 US EXHIBITIONS MARKET SHARE 1,500+ blue-chip corporate clients 4,500+ annual brand activations 70+ countries served Source: PQ Media Global Experiential Marketing Forecast 2024-2028 Note: TAM and market share are based on 2024E figures

~8.5% EBITDA MARGIN FY’24 Est. GES HAS TAKEN transformative actions to �improve profitability, increase cash flow, and �build a foundation for ongoing growth Restructured by outsourcing services, changing service delivery model, and simplifying organizational structure Exited low-margin events and sold business to focus on higher margin revenue and stronger free cash flow Exited, sold, and downsized unneeded facility space saving and adopted a more efficient “Hub & Spoke” service model Expanded experiential marketing capabilities and launched Spiro agency to win business from new and existing corporate clients Adjusted EBITDA – Capex ($M) REVENUE ($M) 1,080 888 Up low-double digits vs. 2023 ONGOING STRATEGIC INITIATIVES Greater penetration of higher margin services Amplify growth in attractive new geographic markets Ongoing focus on labor productivity and other operational efficiency initiatives Continued discipline in overhead to leverage improved cost structure 6.6% EBITDA MARGIN FY’19 COMPLETED STRATEGIC INITIATIVES

GES DELIVERs COMPELLING VALUE TO CLIENTS through two brands GES partners with leading global brands to produce exhibitions, conferences, live events, and global marketing programs through end-to-end strategy, creative, design, production, and logistics capabilities GES EXHIBITIONS EXHIBITION SERVICES SPIRO EXPERIENTIAL MARKETING CLIENTS Leading Exhibition Organizers & Exhibitors / Corporate Marketers Global Fortune 500 Companies / Corporate Marketers SERVICES PROVIDED Strategic and logistics solutions to manage the complexity of shows, including strategy, creative & design, registration & engagement, accommodations, logistics & management, material handling, overhead sign hanging, graphics and other rental and labor services Broad range of unique and impactful experiences, including meetings and events, exhibit and program management, environments and permanent installations, brand and product activations, and marketing and measurement MARKET Concentrated with leadership position Fragmented with growth opportunity CONTRACTS 3–5-year long-term, sticky client contracts with 90%+ retention rates Event-by-event and MSAs with long-tenured clients with 90%+ retention rates FREQUENCY Recurring (annual, biennial, triennial, quadrennial, etc.) Recurring or ad-hoc, depending on the client’s marketing initiatives FY’23 REVENUE ~$614M ~$283M 95+ years of exceptional execution and industry experience Differentiated global scale drives client wins and is a barrier to entry Trusted partner to global, blue-chip brands across every sector 90%+ client retention rates with long-standing relationships

24 GES’ multiple revenue growth levers Note: The US same show metric compares tradeshows that occurred in the same city for both occurrences and generally represents between ~30% and 40% of the total exhibition revenue. Source: U.S. Travel Association; Statista GES US Exhibitions vs. 2019 Pre-Pandemic Occurrence Q2’23 YTD Q2’24 YTD SAME-SHOW* REVENUE SAME-SHOW* SQUARE FOOTAGE Q2’23 YTD Q2’24 YTD GES Exhibitions is driving higher revenue per net square foot of event space through disciplined pricing and compelling exhibitor offerings, and benefiting from increasing show sizes 64 New clients SINCE SPIRO LAUNCH IN Q1’22 Spiro is growing revenue at high-single to low-double digits through expanding its client roster and selling additional services to existing clients Substantial opportunity for future growth as same-show square footage fully recovers Global market leadership and full suite of value-added services are critical differentiators Corporate marketers have a heightened focus on in-person events to drive targeted audience engagement

GES has HIGH RECURRING REVENUE, STRONG VISIBILITY, And a diverse client base Clear line of sight to $900M+ annual recurring revenue ~90% of 2025 Est. GES Revenue is derived from recurring or contracted events and clients under MSA 90%+ retention of clients with >$500K revenue1 25+ years tenure for Top 10 Clients2 1 Contracts/MSAs renewed for 2023 2 Reflects average 3 Represents all Exhibition and Spiro clients with >$1M 2023 gross revenue GES' long-term contracts and exceptional client renewal rates translate to cash flow visibility Largest client is less than 10% of GES’ revenue STRONG CLIENT AND INDUSTRY DIVERSITY DIVERSE End Markets3

GES’ 2025 REVENUE OUTLOOK IS STRONG Expect 2025 revenue to be in line with 2024 with margins of 8%+ REVENUE ($M) KEY DRIVERS Price increases of ~3.5%-6% NSF growth of ~5% Net New Client Wins of ~$25M+ Up low-double digits vs. FY’23 888 ~(65) ~40 ~25+

WHY WE WILL BE SUCCESSFUL Our MISSION is to create the most meaningful and memorable experiences for marketers, organizers and attendees. Live events and other forms of experiential marketing provide a powerful means to drive business growth. We are primed to create what is possible for our clients and to be the industry leader.

Investment Opportunity Summary

CREATING EXTRAORDINARY EXPERIENCES AND STRONG RETURNS 53% 47% Proven Success Executing Growth Strategy and Driving Strong Returns Experienced Management Team Focused on Shareholder Value High-Quality Businesses with Leading and Defensible Market Positions Benefiting from Industry Recovery and Delivering New Growth

Appendix

NON-GAAP FINANCIAL RECONCILIATION Includes costs related to the development of Pursuit's new FlyOver attractions in Las Vegas, Chicago, and Toronto, the Sky Lagoon in Iceland, and the Golden Skybridge and Forest Park Alpine Hotel in Canada. Remeasurement of finance lease obligation represents the non-cash foreign exchange loss/(gain) included within Cost of Services related to the periodic remeasurement of the Sky Lagoon finance lease obligation. Includes inventory write-offs at GES in connection with transitioning to an outsourced model for trade show aisle carpet. Includes non-capitalizable fees and expenses related to Viad’s credit facility refinancing efforts. Corporate Adjusted EBITDA is calculated as Corporate activities expense before depreciation, acquisition-transaction-related costs and other non-recurring costs included within Corporate activities expense. FORWARD-LOOKING NON-GAAP FINANCIAL MEASURES We have also provided the following forward−looking non−GAAP financial measure: Adjusted EBITDA, Adjusted EBITDA Margin, and Free Cash Flow. We do not provide a reconciliation of these forward−looking non−GAAP financial measures to the most directly comparable GAAP financial measures because, due to variability and difficulty in making accurate forecasts and projections and/or certain information not being ascertainable or accessible, not all of the information necessary for quantitative reconciliations is available to us without unreasonable efforts. Consequently, any attempt to disclose such reconciliations would imply a degree of precision that could be confusing or misleading to investors. It is possible that the forward−looking non−GAAP financial measures may be materially different from the corresponding forward-looking non−GAAP financial measure.

NON-GAAP FINANCIAL RECONCILIATION Includes costs related to the development of Pursuit's new FlyOver attractions in Las Vegas, Chicago, and Toronto, the Sky Lagoon in Iceland, and the Golden Skybridge and Forest Park Alpine Hotel in Canada. Remeasurement of finance lease obligation represents the non-cash foreign exchange loss/(gain) included within Cost of Services related to the periodic remeasurement of the Sky Lagoon finance lease obligation. Includes inventory write-offs at GES in connection with transitioning to an outsourced model for trade show aisle carpet.

Steve Moster - President & Chief Executive Officer Has served as President and CEO of Viad since 2014 and as President of GES from 2010 to February 2019 and May 2020 to May 2024 Joined Viad in 2004 as GES Vice President of Exhibition Furnishings and his career evolved to various sales and leadership roles within GES company, including Executive Vice President - Products and Services, where he led double-digit revenue growth Holds a Bachelor of Engineering from Vanderbilt University and an MBA from the Tuck School of Business OUR EXPERIENCED EXECUTIVE MANAGEMENT TEAM Ellen Ingersoll - Chief Financial Officer Has served as CFO of Viad since 2002 During her tenure, the Company successfully divested MoneyGram International in 2004 and acquired and integrated more than 15 businesses Holds a B.S. from Arizona State University and is a CPA David Barry - President Pursuit Joined Viad in 2015 and through the repositioning of the Viad Travel and Recreation Group created Pursuit in 2016 Prior to joining the Company, he served as the President and CEO of a financial services and tech company following a three-decade career in hospitality, the ski industry and aviation Experience includes being CEO of the world’s largest heli-skiing company (CMH) and Chief Operating Officer of Intrawest USA (ski resorts, lodging, hospitality) Derek Linde - CHIEF OPERATING OFFICER & President GES Has served as Chief Operating Officer since March 2022, President of GES since June 2024, and as our General Counsel & Corporate Secretary from April 2018 to October 2023 Previously worked at Illinois Tool Works Inc., where he led teams that provided legal and strategic services to the company’s diversified, global business segments. Prior to ITW, Derek was a partner at the international law firm Winston & Strawn LLP Received his J.D. from the Vanderbilt University School of Law and a B.A. from the University of Missouri-Columbia

OUR EXPERIENCED EXECUTIVE MANAGEMENT TEAM Leslie Striedel - Chief Accounting Officer Has served as Chief Accounting Officer of Viad Corp since 2014 Previously served as Vice President of Finance and Administration or similar positions at Colt Defense LLC, and held various roles within finance and accounting in both public and private environments Received her B.S. from the University of Vermont and is a CPA Jon Massimino - General Counsel and Secretary Has served as General Counsel & Corporate Secretary since October 2023, and has taken on roles with increasing responsibility since joining Viad in 2011 Previously counseled a wide variety of clients in private practice based in California Received his J.D. from the Georgetown University Law Center in Washington, D.C., and a B.A. from Westminster University in Salt Lake City, Utah JEFF STELMACH - President SPIRO Joined Viad in 2021 to lead GES’ growth in Brand Experiences Prior to joining the Company, he served as Opus Agency President and has over 30 years of experience building successful event agencies including Opus, Mosaic, Geometry and EMI, and working with some of the biggest brands in business, including Samsung, Coca-Cola, Anheuser-Busch and Oracle Graduated from the University of Notre Dame with degrees in Business and Marketing

OUR MISSION & WHAT WE STAND FOR OUR MISSION Drive significant and sustainable growth by delivering extraordinary experiences for our teams, clients, and guests OUR VISION Create the world’s most extraordinary experiences People First Honesty, Always Future Focused be Extraordinary

PURPOSE OUR ESG Commitment We are committed to delivering extraordinary experiences that support a more sustainable world for generations to come. We protect and improve our world by continuously investing in our people, reducing our environmental impact, and honoring our communities. OUR PILLARS AND INITIATIVES PEOPLE Diversity, Equity, & Inclusion Workplace Safety Fair Labor Practices Our people drive our success. We foster a culture that is equitable and inclusive, celebrates our talent, and prioritizes the safety and wellness of our teams, clients, and guests. We are committed to cultivating an environment where people of all different backgrounds feel a sense of belonging and contribute to our continued success. PLANET Waste & Water Reduction Energy Efficiency Community Involvement We respect, honor, and protect the places where we live and work to help improve our communities and support a more sustainable future for our world. We are focused on minimizing our environmental impact by using responsible business practices and initiatives to eliminate unnecessary waste, reduce water consumption, and use energy more efficiently. Always Honest Compliance & Ethics Program ESG Policies Board Commitment The values of integrity, ethical behavior, and legal compliance are reinforced every day in our businesses through our Always Honest Compliance and Ethics Program adopted by our Board of Directors. Our Board recently strengthened several environmental and social policies, and oversees our risks and opportunities. We are committed to continuous progress on our ESG journey.

FLYOVER COLLECTION Pursuit 2023 Revenue Mix ($350M TOTAL) SKY LAGOON (ICELAND) GLACIER PARK COLLECTION (MONTANA) ALASKA COLLECTION (ALASKA) BANFF JASPER COLLECTION (CANADA) Geographic overview Denotes Iconic Location Denotes FlyOver Location (1) Represents FlyOver Canada, FlyOver Iceland, and FlyOver Las Vegas; FlyOver Chicago opened Mar’24.

Experience pursuit BANFF GONDOLA We invite you to experience some of our inspiring Refresh, Build, Buy growth investments in person or through the video links below: REFRESH BUILD BUY GLACIER VIEW LODGE MOUNT ROYAL HOTEL SKY LAGOON FLYOVER ICELAND GOLDEN SKYBRIDGE MALIGNE VALLEY KENAI FJORDS TOURS FLYOVER CHICAGO

Golden Skybridge Opened JUN’21 Open Top Touring Opened SEP’20 Sky lagoon Opened APR’21 Glacier Raft Co Acquired APR’22 BANFF GONDOLA Lake Minnewanka Cruise Maligne Lake Cruise Glacier Adventure Glacier Skywalk Kenai Fjords Tours Pursuit’s iconic location attractions A collection of 10 inspiring and unforgettable, world-class attractions in renowned global travel locations with attractive margins and barriers to entry ADDED 4 High-quality experiences from 2020 to present that continue to ramp

PURSUIT’S Flyover FLYING RIDE EXPERIENCES Multi-sensory flight ride experiences showcasing awe-inspiring scenery with state-of-the-art motion seating, media, and special effects that simulate a true flying experience INVESTMENT HIGHLIGHTS High-quality guest experience and proven concept Attractive EBITDA margins Revenue from incremental passengers after breakeven contributes nearly 100% to EBITDA Ability to show films at other FlyOver locations Low maintenance expenditures Meaningful barriers to entry Broad guest appeal Year-round and not weather dependent TripAdvisor Rating – Top 5 Fun Activities and Games in both Vancouver and Reykjavik VANCOUVER REYKJAVIK LAS VEGAS CHICAGO 61 seats 40 seats 80 seats 2 theaters Acquired 2016 Opened August 2019 Opened September 2021 Opened 2013 Opened March 2024 60 seats

BANFF | JASPER Elk + Avenue Hotel 164 rooms Forest Park Woodland 152 rooms Lobstick Lodge 139 rooms Mount Royal Hotel 133 rooms Chateau Jasper Hotel 119 rooms The Crimson Hotel 99 rooms Forest Park Alpine (opened August 2022) 88 rooms Marmot Lodge 81 rooms Pyramid Lake Lodge 68 rooms Miette Mountain Cabins 56 rooms Glacier View Lodge* 32 rooms 1,131 rooms GLACIER | WATERTON Glacier Park Lodge* 162 rooms Grouse Mountain Lodge 145 rooms St. Mary Village* 116 rooms Prince of Wales Hotel* 86 rooms Apgar Village Lodge & Cabins* 48 rooms West Glacier Village* 18 rooms Glacier Basecamp Lodge 29 rooms Belton Chalet* 27 rooms Motel Lake McDonald* 27 rooms Paddle Ridge* 23 rooms West Glacier RV Park and Cabins* 25 rooms 706 rooms DENALI | KENAI FJORDS Seward Windsong Lodge* 216 rooms Talkeetna Alaskan Lodge* 212 rooms Denali Cabins* 46 rooms Denali Backcountry Lodge* 42 rooms Kenai Fjords Wilderness Lodge* 8 rooms 524 rooms * Denotes a property that operates seasonally (generally closed from October - April) Pursuit’s iconic location HOTELS A collection of 27 inspiring and unforgettable, distinctive hotels with 2,361 rooms in renowned global travel locations with occupancy compression and barriers to entry MORE THAN DOUBLED ROOM NIGHTS AVAILABLE FROM 2019 to PRESENT with NEW HOTELS Note: 2019 to Present New Hotels include the following: Mountain Park Lodges (Q2’19). Belton Chalet (Q2’19), West Glacier RV Park (Q3’19), Glacier Basecamp Lodge (Q1’20), Paddle Ridge / Glacier Raft Co. (Q2’22), and Forest Park Alpine (Q3’22)

Pursuit’s locations have strong perennial demand 9/11 Recession SARS Recession Sources: Alberta Economic Dashboard; U.S. National Park Service COVID-19 PARK VISITATION

Seasonality Pursuit experiences peak activity during the summer months. During 2023, 79% of Pursuit’s revenue was earned in the second and third quarters.

Specializing in results-based experiences, we activate, grow, and evolve brands through our hybrid experiential solutions: Marketing & Measurement Pre, At & Post Event Marketing Strategy, Innovation & Intelligence Audience Engagement Immersive Storytelling Content Creation & Management Video Production & Curation Data & Insights Community Facilitation …And More Meetings & Events Keynote Presentations Annual Meetings Corporate Meetings Proprietary Conferences User Conferences Marketing Kick Off Meetings Sales Kick Off Meetings Galas & Award Shows Incentive Meetings Housing & Travel Registration Speaker Support Venue Sourcing VIP Events Event Technology …And More Exhibits & Program Management Brand Standardization Exhibit & Graphic Design Custom/Rental Solutions Fabrication Graphic Production Logistics Management Inventory Management Warehousing Service ordering A/V I&D Staff Training Portable Solutions …And More Environments & �Permanent Installations Customer Experience Centers Visitor Centers Lobby Installations VIP Lounges Museum Displays Chalets/Pavilions Holiday Displays Tech Centers …And More Brand & Product Activations Product Launches Pop-ups Mobile Tours Hospitality Houses Festival Activations Press Activations Sports Marketing Sponsorship Activation Luxury Marketing Guerilla Marketing Social & Digital Marketing …And More What we do

Success stories: Rise at the Paris air show Our team relished challenging the traditional airshow chalet experience of the usual formal meeting rooms, traditional hospitality and passive product displays. We went all in on creating impact for the customer’s first impression creating an amorphic video wall & content as well as integrating the RISE half-scale engine to a digital surface projection story. Leading with tech driven content that helped bring the incredible innovation stories to life, the approach from our creative, technologists and production teams has helped transform the way GE Aerospace thinks about its experiences at air shows and beyond. As a world-leading provider of jet engines, commercial and military aircraft systems, GE Aerospace partnered with Spiro to inspire minds at the Paris Air Show 2023 and bring to life its incredible heritage culminating in the story of RISE – its revolutionary open rotor technology.

Success stories: The need for speed Partnering with iconic luxury brand sponsor Hugo Boss, we designed and built its 5-Star VIP guest experience – the Boss Emotion Club – delivering a full-service event from beginning to end entertaining VIP race fans and A-listers alike with fine dining, entertainment and on and off-track premium experiences. In 2022, we expanded the fan engagement to include the “E-Village” – a brand activation space of immersive Formula E experiences open to every race fan across the season finale race in London getting them closer to the action than ever before. The result? Sustainable design creation, groundbreaking fan engagement and an all-electric premium hospitality experience. Across 14 of the most iconic cities in the world, Formula E is the world’s largest electric motorsport race series combining an incredible racing spectacle with its sustainable global messaging.

Specializing in providing strategic and logistics solutions to leading exhibition and conference organizers and exhibitors through exclusive and discretionary services: Organizers Event planning and production Look and feel design Layout and floor plan designs Furnishings and carpet Show traffic analysis Marketing and strategy Electrical distribution Cleaning Plumbing Overhead rigging Booth rigging Graphics and signage Common area structures Exhibitions: What we do Exhibitors Material handling Electrical distribution Cleaning Plumbing Overhead rigging Booth rigging Exhibitors Creative design and strategy Registration, data analytics, and insights Integrated marketing and pre/post event communications Event surveys Return on investment analysis Online management tools Attendee/exhibit booth traffic analysis Staff training Logistics/transportation Exhibit booth rentals and storage/refurbishment Furnishings and carpet Installation and dismantling labor Event accommodations EXCLUSIVE SERVICES DISCRETIONARY SERVICES

Geographic OVERVIEW Countries GES Serves GES facilities 2023 REVENUE MIX ($888M TOTAL)

Seasonality GES’ exhibition and event activity can vary significantly from quarter to quarter and year to year depending on the frequency and timing of shows. Some shows are not held annually and some shift between quarters. Note: GES revenue changes due to the frequency and timing of major non-annual shows, which include IMTS and MINExpo. IMTS is a biennial show that occurs in the third quarter (cancelled in 2020). MINExpo is quadrennial show that occurs in the third quarter (2020 occurrence postponed to 2021). The Paris Air Show (occurs in the second quarter) and the Farnborough Air Show (occurs in the third quarter) are biennial shows that alternate years. GES REVENUE BY QUARTER ($M)

EXHIBITION INDUSTRY has proven resilient through prior downturns Source: Center for Exhibition Industry Research (CEIR) (1) 2024-2026 CEIR data for the US exhibition industry metrics are forecasted as of April 2024 Live face-to-face events provide a powerful and cost-effective way to drive business growth, from transacting business, to building brand loyalty, and the rich connections created through in-person interactions are irreplaceable 9/11 Recession SARS Recession COVID-19 US Exhibition Industry Metrics(1) Indexed to 2000

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

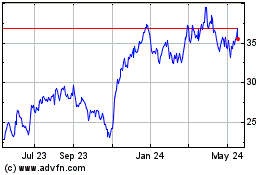

Viad (NYSE:VVI)

Historical Stock Chart

From Nov 2024 to Dec 2024

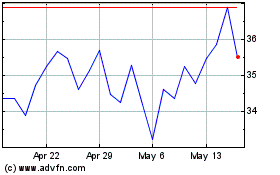

Viad (NYSE:VVI)

Historical Stock Chart

From Dec 2023 to Dec 2024