Mohawk Valley Momentum Driving 100%

Year-over-Year Growth in EV Revenue

Mohawk Valley Fab Targeted to Reach 25%

Utilization in Q1FY25, One Quarter Ahead of Schedule

Company Plans to Accelerate Shift of Device

Fabrication to 200mm Mohawk Valley Fab, Assess Timing of Closure of

150mm Durham Device Fab

Reducing FY25 net CapEx Spend by $200

Million

Wolfspeed, Inc. (NYSE: WOLF) today announced its results for the

fourth quarter of fiscal 2024 and the full 2024 fiscal year.

Quarterly Financial Highlights (Continuing operations only.

All comparisons are to the fourth quarter of fiscal 2023.)

- Consolidated revenue of approximately $201 million, as compared

to approximately $203 million

- Mohawk Valley Fab contributed approximately $41 million in

revenue

- Power device design-ins of $2.0 billion

- Quarterly design-wins of $0.5 billion

- GAAP gross margin of 1%, compared to 29%

- Non-GAAP gross margin of 5%, compared to 31%

- GAAP and non-GAAP gross margins for the fourth quarter of

fiscal 2024 include the impact of $24 million of underutilization

costs. See "Start-up and Underutilization Costs" below for

additional information.

Full Fiscal Year Financial Highlights (all comparisons are to

fiscal 2023)

- Consolidated revenue of approximately $807 million, as compared

to approximately $759 million

- GAAP gross margin of 10% as compared to 32%

- Non-GAAP gross margin of 13% as compared to 35%

- GAAP and non-GAAP gross margins for fiscal 2024 include the

impact of approximately $124 million of underutilization costs. See

"Start-up and Underutilization Costs" below for additional

information.

“We have two priorities we are focused on: optimizing our

capital structure for both the near term and long term and driving

performance in our state-of-the-art, 200-millimeter fab, and this

quarter was a step forward on both of these priorities,” said

Wolfspeed CEO, Gregg Lowe. “We achieved 20% utilization at Mohawk

Valley in June and continued to see strong revenue growth from that

fab. Our 200mm device fab is currently producing solid results,

which are at significantly lower costs than our Durham 150mm fab.

This improved profitability gives us the confidence to accelerate

the shift of our device fabrication to Mohawk Valley, while we

assess the timing of the closure of our 150mm device fab in Durham.

At the JP, we have also made great progress, installing and

activating initial furnaces in the fourth quarter. We have already

processed the first silicon carbide boules from the JP and the

quality is in line with the high-quality materials coming out of

Building 10.

“At the same time, we are taking proactive steps to slow down

the pace of our CapEx by approximately $200 million in fiscal 2025

and identify areas across our entire footprint to reduce operating

costs. We also remain in constructive talks with the CHIPS office

on a Preliminary Memorandum of Terms for capital grants under the

CHIPS Act. In addition to any potential capital grants from the

CHIPS program, our long-term CapEx plan is expected to generate

more than $1 billion in cash refunds from Section 48D tax credits

from the IRS, of which we’ve already accrued approximately $640

million on our balance sheet,” continued Lowe.

Business Outlook:

For its first quarter of fiscal 2025, Wolfspeed targets revenue

from continuing operations in a range of $185 million to $215

million. GAAP net loss is targeted at $226 million to $194 million,

or $1.79 to $1.54 per diluted share. Non-GAAP net loss from

continuing operations is targeted to be in a range of $138 million

to $114 million, or $1.09 to $0.90 per diluted share. Targeted

non-GAAP net loss excludes $88 million to $80 million of estimated

expenses, net of tax, primarily related to stock-based compensation

expense, amortization of discount and debt issuance costs, net of

capitalized interest, project, transformation and transaction costs

and loss on Wafer Supply Agreement. The GAAP and non-GAAP targets

from continuing operations do not include any estimated change in

the fair value of the shares of common stock of MACOM Technology

Solutions Holdings, Inc. (MACOM) that we acquired in connection

with the sale to MACOM of our RF product line (RF Business

Divestiture).

Start-up and Underutilization Costs:

As part of expanding its production footprint to support

expected growth, Wolfspeed is incurring significant factory

start-up costs relating to facilities the Company is constructing

or expanding that have not yet started revenue generating

production. These factory start-up costs have been and will be

expensed as operating expenses in the statement of operations.

When a new facility begins revenue generating production, the

operating costs of that facility that were previously expensed as

start-up costs are instead primarily reflected as part of the cost

of production within the cost of revenue, net line item in our

statement of operations. For example, the Mohawk Valley Fab began

revenue generating production at the end of fiscal 2023 and the

costs of operating this facility in fiscal 2024 and going forward

are primarily reflected in cost of revenue, net.

During the period when production begins, but before the

facility is at its expected utilization level, Wolfspeed expects

some of the costs to operate the facility will not be absorbed into

the cost of inventory. The costs incurred to operate the facility

in excess of the costs absorbed into inventory are referred to as

underutilization costs and are expensed as incurred to cost of

revenue, net. These costs are expected to continue to be

substantial as Wolfspeed ramps up the facility to the expected or

normal utilization level.

Wolfspeed incurred $20.5 million of factory start-up costs and

$24.0 million of underutilization costs in the fourth quarter of

fiscal 2024. No underutilization costs were incurred in the fourth

quarter of fiscal 2023.

For the first quarter of fiscal 2025, operating expenses are

expected to include approximately $25 million of factory start-up

costs primarily in connection with materials expansion efforts.

Cost of revenue, net, is expected to include approximately $24

million of underutilization costs in connection with the Mohawk

Valley Fab.

Quarterly Conference Call:

Wolfspeed will host a conference call at 5:00 p.m. Eastern time

today to review the highlights of its fourth quarter results and

its fiscal first quarter 2025 business outlook, including

significant factors and assumptions underlying the targets noted

above.

The conference call will be available to the public through a

live audio web broadcast via the Internet. For webcast details,

visit Wolfspeed's website at investor.wolfspeed.com/events.cfm.

Supplemental financial information, including the non-GAAP

reconciliation attached to this press release, is available on

Wolfspeed's website at investor.wolfspeed.com/results.cfm.

About Wolfspeed, Inc.

Wolfspeed (NYSE: WOLF) leads the market in the worldwide

adoption of silicon carbide technologies. We provide

industry-leading solutions for efficient energy consumption and a

sustainable future. Wolfspeed’s product families include silicon

carbide material and power devices targeted for various

applications such as electric vehicles, fast charging, and

renewable energy and storage. We unleash the power of possibilities

through hard work, collaboration and a passion for innovation.

Learn more at www.wolfspeed.com.

Non-GAAP Financial Measures:

This press release highlights the Company's financial results on

both a GAAP and a non-GAAP basis. The GAAP results include certain

costs, charges and expenses that are excluded from non-GAAP

results. By publishing the non-GAAP measures, management intends to

provide investors with additional information to further analyze

the Company's performance, core results and underlying trends.

Wolfspeed's management evaluates results and makes operating

decisions using both GAAP and non-GAAP measures included in this

press release. Non-GAAP results are not prepared in accordance with

GAAP, and non-GAAP information should be considered a supplement

to, and not a substitute for, financial statements prepared in

accordance with GAAP. Investors and potential investors are

encouraged to review the reconciliation of non-GAAP financial

measures to their most directly comparable GAAP measures attached

to this press release.

Beginning with the fourth quarter of fiscal 2023, the Company no

longer excludes start-up expenses from its non-GAAP measures and

does not exclude underutilization costs from its non-GAAP measures.

Prior period non-GAAP measures have been updated in this press

release to reflect the current presentation of the Company's

non-GAAP measures. As a result of this change, previously published

non-GAAP financial measures for the Company for prior periods which

exclude start-up expenses are not directly comparable to the

non-GAAP measures included herein.

Forward Looking Statements:

The schedules attached to this release are an integral part of

the release. This press release contains forward-looking statements

involving risks and uncertainties, both known and unknown, that may

cause Wolfspeed’s actual results to differ materially from those

indicated in the forward-looking statements. Forward-looking

statements by their nature address matters that are, to different

degrees, uncertain, such as statements about our plans to grow the

business, our ability to achieve our targets for the first quarter

of fiscal 2025 and periods beyond, our ability to meet targeted

utilization rates and accelerate the shift of our device

fabrication to the Mohawk Valley Fab, our revenue and market

growth, and our ability to reduce costs and optimize our capital

structure. Actual results could differ materially due to a number

of factors including but not limited to, ongoing uncertainty in

global economic and geopolitical conditions, such as the ongoing

military conflict between Russia and Ukraine and the ongoing

conflicts in the Middle East, changes in progress on infrastructure

development or changes in customer or industrial demand that could

negatively affect product demand, including as a result of an

economic slowdown or recession, collectability of receivables and

other related matters if consumers and businesses defer purchases

or payments, or default on payments; risks associated with our

expansion plans, including design and construction delays, cost

overruns, the timing and amount of government incentives actually

received, including, among other things, any direct grants and tax

credits under the CHIPS Act, issues in installing and qualifying

new equipment and ramping production, poor production process

yields and quality control, and potential increases to our

restructuring costs; our ability to obtain additional funding,

including, among other things, from government funding, public or

private equity offerings, or debt financings, on favorable terms

and on a timely basis, if at all; the risk that we do not meet our

production commitments to those customers who provide us with

capacity reservation deposits or similar payments; the risk that we

may experience production difficulties that preclude us from

shipping sufficient quantities to meet customer orders or that

result in higher production costs, lower yields and lower margins;

our ability to lower costs; the risk that our results will suffer

if we are unable to balance fluctuations in customer demand and

capacity, including bringing on additional capacity on a timely

basis to meet customer demand; the risk that longer manufacturing

lead times may cause customers to fulfill their orders with a

competitor's products instead; product mix; risks associated with

the ramp-up of production of our new products, and our entry into

new business channels different from those in which we have

historically operated; our ability to convert customer design-ins

to design-wins and sales of significant volume, and, if customer

design-in activity does result in such sales, when such sales will

ultimately occur and what the amount of such sales will be; the

risk that the markets for our products will not develop as we

expect, including the adoption of our products by electric vehicle

manufacturers and the overall adoption of electric vehicles; the

risk that the economic and political uncertainty caused by the

tariffs imposed by the United States on Chinese goods, and

corresponding Chinese tariffs and currency devaluation in response,

may negatively impact demand for our products; the risk that we or

our channel partners are not able to develop and expand customer

bases and accurately anticipate demand from end customers,

including production and product mix, which can result in increased

inventory and reduced orders as we experience wide fluctuations in

supply and demand; risks related to international sales and

purchases; risks resulting from the concentration of our business

among few customers, including the risk that customers may reduce

or cancel orders or fail to honor purchase commitments; the risk

that our investments may experience periods of significant market

value and interest rate volatility causing us to recognize fair

value losses on our investment; the risk posed by managing an

increasingly complex supply chain (including managing the impacts

of ongoing supply constraints in the semiconductor industry and

meeting purchase commitments under take-or-pay arrangements with

certain suppliers) that has the ability to supply a sufficient

quantity of raw materials, subsystems and finished products with

the required specifications and quality; risks relating to

outbreaks of infectious diseases or similar public health events,

including the risk of disruptions to our operations, supply chain,

including our contract manufacturers, or customer demand; the risk

we may be required to record a significant charge to earnings if

our remaining goodwill or amortizable assets become impaired; risks

relating to confidential information theft or misuse, including

through cyber-attacks or cyber intrusion; our ability to complete

development and commercialization of products under development;

the rapid development of new technology and competing products that

may impair demand or render our products obsolete; the potential

lack of customer acceptance for our products; risks associated with

ongoing litigation; the risk that customers do not maintain their

favorable perception of our brand and products, resulting in lower

demand for our products; the risk that our products fail to perform

or fail to meet customer requirements or expectations, resulting in

significant additional costs; risks associated with strategic

transactions; the risk that we are not able to successfully execute

or achieve the potential benefits of our efforts to enhance our

value; and other factors discussed in our filings with the

Securities and Exchange Commission (SEC), including our report on

Form 10-K for the fiscal year ended June 25, 2023, and subsequent

reports filed with the SEC. These forward-looking statements

represent Wolfspeed's judgment as of the date of this release.

Except as required under the United States federal securities laws

and the rules and regulations of the SEC, Wolfspeed disclaims any

intent or obligation to update any forward-looking statements after

the date of this release, whether as a result of new information,

future events, developments, changes in assumptions or

otherwise.

Wolfspeed® is a registered trademark of Wolfspeed, Inc.

WOLFSPEED, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(unaudited)

Three months ended

Fiscal years ended

(in millions of U.S. Dollars, except per

share data)

June 30, 2024

June 25, 2023

June 30, 2024

June 25, 2023

Revenue, net

$200.7

$202.7

$807.2

$758.5

Cost of revenue, net

198.3

144.0

729.8

515.6

Gross profit

2.4

58.7

77.4

242.9

Gross margin percentage

1

%

29

%

10

%

32

%

Operating expenses:

Research and development

60.0

43.6

201.9

165.7

Sales, general and administrative

61.6

58.8

246.4

214.3

Factory start-up costs

20.5

39.6

53.8

160.2

Amortization of acquisition-related

intangibles

0.2

0.4

1.1

1.7

Loss on disposal or impairment of other

assets

0.2

0.1

1.2

2.0

Other operating expense

5.8

5.8

18.3

10.8

Total operating expense

148.3

148.3

522.7

554.7

Operating loss

(145.9

)

(89.6

)

(445.3

)

(311.8

)

Operating loss percentage

(73

)%

(44

)%

(55

)%

(41

)%

Non-operating expense (income), net

28.5

1.4

127.2

(52.0

)

Loss before income taxes

(174.4

)

(91.0

)

(572.5

)

(259.8

)

Income tax expense

0.5

0.2

1.1

0.7

Net loss from continuing

operations

(174.9

)

(91.2

)

(573.6

)

(260.5

)

Net loss from discontinued operations

—

(22.1

)

(290.6

)

(69.4

)

Net loss

($174.9

)

($113.3

)

($864.2

)

($329.9

)

Basic and diluted loss per

share

Continuing operations

($1.39

)

($0.73

)

($4.56

)

($2.09

)

Net loss

($1.39

)

($0.91

)

($6.88

)

($2.65

)

Weighted average shares - basic and

diluted (in thousands)

126,245

124,679

125,693

124,374

WOLFSPEED, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(unaudited)

(in millions of U.S. Dollars)

June 30, 2024

June 25, 2023

Assets

Current assets:

Cash, cash equivalents, and short-term

investments

$2,174.6

$2,954.9

Accounts receivable, net

147.4

154.8

Inventories

440.7

284.9

Income taxes receivable

0.5

0.8

Prepaid expenses

56.6

36.8

Other current assets

179.8

131.5

Current assets held for sale from

discontinued operations

—

42.8

Total current assets

2,999.6

3,606.5

Property and equipment, net

3,652.3

2,165.5

Goodwill

359.2

359.2

Intangible assets, net

23.9

23.9

Long-term receivables

2.3

2.6

Other long-term investments

79.3

—

Deferred tax assets

1.1

1.2

Other assets

866.9

303.3

Long-term assets held for sale from

discontinued operations

—

124.5

Total assets

$7,984.6

$6,586.7

Liabilities and Shareholders'

Equity

Current liabilities:

Accounts payable and accrued expenses

$523.6

$534.5

Contract liabilities and

distributor-related reserves

62.3

39.0

Income taxes payable

1.0

9.6

Finance lease liabilities

0.5

0.5

Other current liabilities

77.9

35.7

Current liabilities held for sale from

discontinued operations

—

8.6

Total current liabilities

665.3

627.9

Long-term liabilities:

Long-term debt

3,126.2

1,149.5

Convertible notes, net

3,034.9

3,025.6

Deferred tax liabilities

10.8

3.9

Finance lease liabilities - long-term

8.9

9.2

Other long-term liabilities

256.4

143.4

Long-term liabilities held for sale from

discontinued operations

—

5.3

Total long-term liabilities

6,437.2

4,336.9

Shareholders’ equity:

Common stock

0.2

0.2

Additional paid-in-capital

3,821.9

3,711.0

Accumulated other comprehensive loss

(11.6

)

(25.1

)

Accumulated deficit

(2,928.4

)

(2,064.2

)

Total shareholders’ equity

882.1

1,621.9

Total liabilities and shareholders’

equity

$7,984.6

$6,586.7

WOLFSPEED, INC.

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(unaudited)

Fiscal years ended

(in millions of U.S. Dollars)

June 30, 2024

June 25, 2023

Operating activities:

Net loss

($864.2

)

($329.9

)

Net loss from discontinued operations

(290.6

)

(69.4

)

Net loss from continuing operations

(573.6

)

(260.5

)

Adjustments to reconcile net loss to cash

used in operating activities of continuing operations:

Depreciation and amortization

181.0

145.6

Amortization of debt issuance costs and

discount, net of non-cash capitalized interest

28.4

7.5

Stock-based compensation

84.9

72.7

Gain on equity investment

(18.5

)

—

Loss on disposal or impairment of

long-lived assets, including loss on disposal portion of factory

start-up costs

1.2

3.8

Amortization of premium on investments,

net

(27.5

)

(4.7

)

Deferred income taxes

0.2

0.5

Changes in operating assets and

liabilities:

Accounts receivable, net

7.4

(4.6

)

Inventories

(152.3

)

(93.1

)

Prepaid expenses and other assets

(124.7

)

(20.8

)

Accounts payable

(45.8

)

27.0

Accrued salaries and wages and other

liabilities

(50.2

)

(0.7

)

Contract liabilities and

distributor-related reserves

18.2

25.1

Net cash used in operating activities of

continuing operations

(671.3

)

(102.2

)

Net cash used in operating activities of

discontinued operations

(54.3

)

(40.4

)

Cash used in operating

activities

(725.6

)

(142.6

)

Investing activities:

Purchases of property and equipment

(2,274.0

)

(949.6

)

Purchases of patent and licensing

rights

(5.9

)

(4.9

)

Proceeds from sale of property and

equipment

0.4

1.7

Purchases of short-term investments

(1,601.1

)

(1,191.0

)

Proceeds from maturities of short-term

investments

1,448.4

637.2

Proceeds from sale of short-term

investments

237.9

110.1

Reimbursement of property and equipment

purchases from long-term incentive agreement

178.5

155.5

Proceeds from sale of business

75.6

101.8

Net cash used in investing activities of

continuing operations

(1,940.2

)

(1,139.2

)

Net cash used in investing activities of

discontinued operations

(3.1

)

(7.8

)

Cash used in investing

activities

(1,943.3

)

(1,147.0

)

Financing activities:

Proceeds from long-term debt

borrowings

2,000.0

1,200.0

Proceeds from convertible notes

—

1,750.0

Payments of debt issuance costs

(46.0

)

(82.1

)

Cash paid for capped call transactions

—

(273.9

)

Proceeds from issuance of common stock

23.4

23.8

Tax withholding on vested equity

awards

(18.0

)

(19.2

)

Payments on long-term debt borrowings,

including finance lease obligations

(0.4

)

(0.5

)

Commitment fees on long-term incentive

agreement

(1.0

)

(1.0

)

Cash provided by financing

activities

1,958.0

2,597.1

Effects of foreign exchange changes on

cash and cash equivalents

(0.2

)

—

Net change in cash and cash

equivalents

(711.1

)

1,307.5

Cash and cash equivalents, beginning of

period

1,757.0

449.5

Cash and cash equivalents, end of

period

$1,045.9

$1,757.0

Product Line Revenue

Three months ended

Fiscal years ended

(in millions of U.S. Dollars)

June 30, 2024

June 25, 2023

June 30, 2024

June 25, 2023

Power Products

$104.6

$107.1

$415.6

$409.2

Materials Products

96.1

95.6

391.6

349.3

Total

$200.7

$202.7

$807.2

$758.5

Non-GAAP Measures of Financial Performance

To supplement the Company's consolidated financial statements

presented in accordance with generally accepted accounting

principles, or GAAP, Wolfspeed uses non-GAAP measures of certain

components of financial performance. These non-GAAP measures

include non-GAAP gross margin, non-GAAP operating (loss) income,

non-GAAP non-operating income (expense), net, non-GAAP net (loss)

income, non-GAAP diluted (loss) earnings per share, EBITDA,

adjusted EBITDA and free cash flow. These measures are presented

for continuing operations only.

Reconciliation to the nearest GAAP measure of all historical

non-GAAP measures included in this press release can be found in

the tables included with this press release.

Non-GAAP measures presented in this press release are not in

accordance with or an alternative to measures prepared in

accordance with GAAP and may be different from non-GAAP measures

used by other companies. In addition, these non-GAAP measures are

not based on any comprehensive set of accounting rules or

principles. Non-GAAP measures have limitations in that they do not

reflect all of the amounts associated with Wolfspeed's results of

operations as determined in accordance with GAAP. These non-GAAP

measures should only be used to evaluate Wolfspeed's results of

operations in conjunction with the corresponding GAAP measures.

Wolfspeed believes that these non-GAAP measures, when shown in

conjunction with the corresponding GAAP measures, enhance

investors' and management's overall understanding of the Company's

current financial performance and the Company's prospects for the

future, including cash flows available to pursue opportunities to

enhance shareholder value. In addition, because Wolfspeed has

historically reported certain non-GAAP results to investors, the

Company believes the inclusion of non-GAAP measures provides

consistency in the Company's financial reporting.

For its internal budgeting process, and as discussed further

below, Wolfspeed's management uses financial statements that do not

include the items listed below and the income tax effects

associated with the foregoing. Wolfspeed's management also uses

non-GAAP measures, in addition to the corresponding GAAP measures,

in reviewing the Company's financial results.

Wolfspeed excludes the following items from one or more of its

non-GAAP measures when applicable:

Stock-based compensation expense. This expense consists of

expenses for stock options, restricted stock, performance stock

awards and employee stock purchases through its Employee Stock

Purchase Program. Wolfspeed excludes stock-based compensation

expenses from its non-GAAP measures because they are non-cash

expenses that Wolfspeed does not use to evaluate core operating

performance.

Amortization or impairment of acquisition-related intangibles.

Wolfspeed incurs amortization or impairment of acquisition-related

intangibles in connection with acquisitions. Wolfspeed excludes

these items because they are non-cash expenses that Wolfspeed does

not use to evaluate core operating performance.

Project, transformation and transaction costs. The Company has

incurred professional services fees and other costs associated with

completed and potential acquisitions and divestitures, as well as

internal transformation programs focused on optimizing the

Company's administrative processes. Wolfspeed excludes these items

because Wolfspeed believes they are not reflective of the ongoing

operating results of Wolfspeed's business.

Severance costs. The Company has incurred costs in conjunction

with the termination of key executive personnel. Wolfspeed excludes

these items because Wolfspeed believes they have no direct

correlation to the ongoing operating results of Wolfspeed's

business.

Loss (gain) on legal proceedings. In the third quarter of fiscal

2024, Wolfspeed recognized customs duties totaling approximately

$7.7 million for alleged undervalued duties related to transactions

by the Company's former Lighting Products business unit from 2012

to 2017. In fiscal 2023, Wolfspeed received an arbitration award in

relation to a former customer failing to fulfill contractual

obligations to purchase a certain amount of product over a period

of time. Wolfspeed excludes these items because Wolfspeed believes

they are not reflective of the ongoing operating results of

Wolfspeed's business.

Amortization of discount and debt issuance costs, net of

capitalized interest. The issuance of the Company's convertible

senior notes in April 2020, February 2022 and November 2022, the

sale of the Company's 2030 senior secured notes in June 2023, and

the receipt of deposits in connection with an unsecured customer

refundable deposit agreement in July 2023 and in the second half of

fiscal 2024 results in amortization of discount and debt issuance

costs. Wolfspeed excludes amortization of discount and debt

issuance costs from its non-GAAP measures because they are non-cash

expenses that Wolfspeed does not use to evaluate core operating

performance.

Loss (gain) on Wafer Supply Agreement. In connection with the

completed sale of the LED Products business unit to SMART Global

Holdings, Inc., and its wholly owned subsidiary, the Company

entered into a Wafer Supply and Fabrication Services Agreement (the

Wafer Supply Agreement), pursuant to which the Company supplies

CreeLED, Inc. with certain silicon carbide materials and

fabrication services for up to four years. Wolfspeed excludes the

financial impact of this agreement because Wolfspeed believes it is

not reflective of the ongoing operating results of Wolfspeed's

business.

Gain (loss) on equity investment. The Company received shares of

MACOM common stock in connection with the RF Business Divestiture.

These shares are accounted for under fair value accounting with

changes in the fair value of the shares being recognized in income.

Wolfspeed excludes the impact of these gains or losses from its

non-GAAP measures because Wolfspeed believes it is not reflective

of the ongoing operating results of Wolfspeed's business.

Income tax adjustment. This amount reconciles GAAP tax (benefit)

expense to a calculated non-GAAP tax (benefit) expense utilizing a

non-GAAP tax rate. The non-GAAP tax rate estimates an appropriate

tax rate if the listed non-GAAP items were excluded. This

reconciling item adjusts non-GAAP net (loss) income to the amount

it would be if the calculated non-GAAP tax rate was applied to

non-GAAP (loss) income before income taxes.

Wolfspeed may incur some of these same expenses, including

income taxes associated with these expenses, in future periods.

In addition to the non-GAAP measures discussed above, Wolfspeed

also uses free cash flow as a measure of operating performance and

liquidity. Free cash flow represents operating cash flows from

continuing operations, less net purchases of property and equipment

and patent and licensing rights. Wolfspeed considers free cash flow

to be an operating performance and a liquidity measure that

provides useful information to management and investors about the

amount of cash generated by the business after the purchases of

property and equipment, a portion of which can then be used to,

among other things, invest in Wolfspeed's business, make strategic

acquisitions and strengthen the balance sheet. A limitation of the

utility of free cash flow as a measure of operating performance and

liquidity is that it does not represent the residual cash flow

available to the company for discretionary expenditures, as it

excludes certain mandatory expenditures such as debt service.

WOLFSPEED, INC. Reconciliation of

GAAP to Non-GAAP Measures - Continuing Operations Only (in

millions of U.S. Dollars, except per share amounts and

percentages) (unaudited)

Non-GAAP Gross Margin

Three months ended

Fiscal years ended

June 30, 2024

June 25, 2023

June 30, 2024

June 25, 2023

GAAP gross profit

$2.4

$58.7

$77.4

$242.9

GAAP gross margin percentage

1

%

29

%

10

%

32

%

Adjustments:

Stock-based compensation expense

8.5

3.5

28.5

20.3

Non-GAAP gross profit

$10.9

$62.2

$105.9

$263.2

Non-GAAP gross margin percentage

5

%

31

%

13

%

35

%

Non-GAAP Operating Loss

Three months ended

Fiscal years ended

June 30, 2024

June 25, 2023

June 30, 2024

June 25, 2023

GAAP operating loss

($145.9

)

($89.6

)

($445.3

)

($311.8

)

GAAP operating loss percentage

(73

)%

(44

)%

(55

)%

(41

)%

Adjustments:

Stock-based compensation expense:

Cost of revenue, net

8.5

3.5

28.5

20.3

Research and development

2.3

2.4

11.4

11.2

Sales, general and administrative

10.2

10.5

45.0

41.2

Total stock-based compensation expense

21.0

16.4

84.9

72.7

Amortization of acquisition-related

intangibles

0.2

0.4

1.1

1.7

Project, transformation and transaction

costs

5.8

4.5

18.3

7.4

Executive severance costs

—

1.5

—

3.4

Total adjustments to GAAP operating

loss

27.0

22.8

104.3

85.2

Non-GAAP operating loss

($118.9

)

($66.8

)

($341.0

)

($226.6

)

Non-GAAP operating loss percentage

(59

)%

(33

)%

(42

)%

(30

)%

Non-GAAP Non-Operating (Expense) Income, net

Three months ended

Fiscal years ended

June 30, 2024

June 25, 2023

June 30, 2024

June 25, 2023

GAAP non-operating (expense) income,

net

($28.5

)

($1.4

)

($127.2

)

$52.0

Adjustments:

Loss (gain) on legal proceedings

—

—

7.7

(50.3

)

Gain on equity investment

(11.2

)

—

(18.5

)

—

Amortization of discount and debt issuance

costs, net of capitalized interest

6.8

2.3

28.4

7.5

Loss on Wafer Supply Agreement

4.9

6.3

25.3

13.6

Non-GAAP non-operating (expense) income,

net

($28.0

)

$7.2

($84.3

)

$22.8

Non-GAAP Net Loss

Three months ended

Fiscal years ended

June 30, 2024

June 25, 2023

June 30, 2024

June 25, 2023

GAAP net loss

($174.9

)

($91.2

)

($573.6

)

($260.5

)

Adjustments:

Stock-based compensation expense

21.0

16.4

84.9

72.7

Amortization of acquisition-related

intangibles

0.2

0.4

1.1

1.7

Project, transformation and transaction

costs

5.8

4.5

18.3

7.4

Executive severance costs

—

1.5

—

3.4

Loss (gain) on legal proceedings

—

—

7.7

(50.3

)

Gain on equity investment

(11.2

)

—

(18.5

)

—

Amortization of discount and debt issuance

costs, net of capitalized interest

6.8

2.3

28.4

7.5

Loss on Wafer Supply Agreement

4.9

6.3

25.3

13.6

Total adjustments to GAAP net loss before

provision for income taxes

27.5

31.4

147.2

56.0

Income tax adjustment - benefit

(expense)

35.4

14.9

100.5

50.8

Non-GAAP net loss

($112.0

)

($44.9

)

($325.9

)

($153.7

)

Non-GAAP diluted loss per share

($0.89

)

($0.36

)

($2.59

)

($1.24

)

Non-GAAP weighted average shares (in

thousands)

126,245

124,679

125,693

124,374

Adjusted EBITDA

Three months ended

Fiscal years ended

June 30, 2024

June 25, 2023

June 30, 2024

June 25, 2023

GAAP net loss

($174.9

)

($91.2

)

($573.6

)

($260.5

)

Reconciling items to EBITDA (Non-GAAP)

Income tax expense

0.5

0.2

1.1

0.7

Interest expense (income)

34.7

(4.2

)

111.3

(15.6

)

Depreciation

44.0

39.7

175.5

139.7

Amortization

1.3

1.4

5.5

5.9

EBITDA (Non-GAAP)

(94.4

)

(54.1

)

(280.2

)

(129.8

)

Reconciling items to adjusted EBITDA

(Non-GAAP)

Stock based compensation

21.0

16.4

84.9

72.7

Project, transformation and transaction

costs

5.8

4.5

18.3

7.4

Executive severance costs

—

1.5

—

3.4

Loss (gain) on legal proceedings

—

—

7.7

(50.3

)

Gain on equity investment

(11.2

)

—

(18.5

)

—

Loss on Wafer Supply Agreement

4.9

6.3

25.3

13.6

Adjusted EBITDA (Non-GAAP)

($73.9

)

($25.4

)

($162.5

)

($83.0

)

Free Cash Flow

Three months ended

Fiscal years ended

June 30, 2024

June 25, 2023

June 30, 2024

June 25, 2023

Net cash used in operating activities

($239.5

)

($38.7

)

($671.3

)

($102.2

)

Less: PP&E spending, net of

reimbursements from long-term incentive agreement

(644.2

)

(400.2

)

(2,095.5

)

(794.1

)

Less: Patents spending

(1.6

)

(1.3

)

(5.9

)

(4.9

)

Total free cash flow

($885.3

)

($440.2

)

($2,772.7

)

($901.2

)

WOLFSPEED, INC.

Business Outlook Unaudited

GAAP to Non-GAAP Reconciliation

Three Months Ended

(in millions of U.S. Dollars)

September 29, 2024

GAAP net loss from continuing

operations outlook range

($226) to ($194)

Adjustments:

Stock-based compensation expense

26

Amortization of discount and debt issuance

costs, net of capitalized interest

7

Project, transformation and transaction

costs

6

Loss on Wafer Supply Agreement

7

Total adjustments to GAAP net loss before

provision for income taxes

46

Income tax adjustment

42 to 34

Non-GAAP net loss from continuing

operations outlook range

($138) to ($114)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240821004874/en/

Tyler Gronbach Wolfspeed, Inc. Vice President of External

Affairs Phone: 919-407-4820 investorrelations@wolfspeed.com

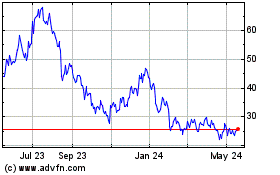

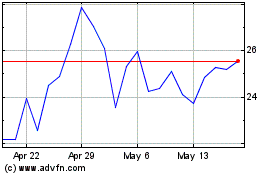

Wolfspeed (NYSE:WOLF)

Historical Stock Chart

From Nov 2024 to Dec 2024

Wolfspeed (NYSE:WOLF)

Historical Stock Chart

From Dec 2023 to Dec 2024