Hannover Re Estimates Burden of Losses for Wrecked Costa Concordia

January 23 2012 - 4:02AM

Business Wire

As already reported by Hannover Re on 16 January, the incident

involving the Costa Concordia cruise ship will result in a major

loss for the company. The loss expenditure from marine hull

insurance will be in the region of EUR 30 million for the company's

net account. Liability claims are difficult to assess at this point

in time. The assumption is that a market loss running into

triple-digit millions of euros could result. The total loss for

Hannover Re - as a leading marine reinsurer - could therefore be in

the mid-double-digit million euro range.

Please visit: www.hannover-re.com

Hannover Re, with a gross premium of around EUR 11 billion, is

the third-largest reinsurer in the world. It transacts all lines of

non-life and life and health reinsurance and is present on all

continents with around 2,200 staff. The rating agencies most

relevant to the insurance industry have awarded Hannover Re very

strong insurer financial strength ratings (Standard & Poor's

AA- 'Very Strong' and A.M. Best A 'Excellent').

Please note the disclaimer:

www.hannover-re.com/misc/disclaimer-pr-050811

Language: English Company: Hannover Rückversicherung AG

Karl-Wiechert-Allee 50 30625 Hannover Germany Phone:

+49-(0)511-5604-1500 Fax: +49-(0)511-5604-1648 E-mail:

info@hannover-re.com

Internet:

www.hannover-re.com

ISIN: DE0008402215 WKN: 840 221 Listed: Regulierter Markt in

Frankfurt (Prime Standard), Hannover; Freiverkehr in Berlin,

Düsseldorf, Hamburg, München, Stuttgart; Terminb�rse EUREX

Hannover Ruck (TG:HNR1)

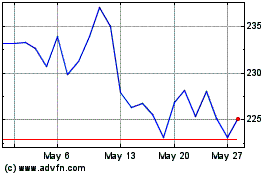

Historical Stock Chart

From Oct 2024 to Nov 2024

Hannover Ruck (TG:HNR1)

Historical Stock Chart

From Nov 2023 to Nov 2024

Real-Time news about Hannover Ruck SE (Tradegate (DE)): 0 recent articles

More Hannover Rückversicherung AG News Articles