Linedata Services Launches Enhanced Reporting Module To Provide Robust Transparency and Disclosure

August 11 2008 - 10:45AM

Business Wire

Linedata Services (Bloomberg: LIN.FP), announced today that it has

launched an enhanced reporting package for both the award-winning

LongView Trading Order Management System (OMS) and Linedata

Compliance, the premier investment compliance system for the

buy-side. This Linedata reporting module is accessible from both of

these platforms or via the Internet, and empowers business users to

create their own reports, and create detailed process tracking

internally. The new reporting module meets growing demands by

investors for the buy-side to provide enhanced customization around

reporting in order to increase transparency and disclosure.

�Buy-side investors have seen a realignment of investor

expectations in recent months, as wild fluctuations in the market

make for a greater focus on transparency and process,� said Jack

Wiener, Executive Vice President of business development for the

North America region. �Fund managers love volatility because it

creates a major opportunity for profit, but investors need

additional assurances from the buy-side in the form of increased

reporting of exposures. The Linedata reporting module makes it easy

for the buy-side to provide those assurances, so they can focus on

taking advantage of investment opportunities.� Other functionality

in the Linedata reporting module includes: Preconfigured and

extensible data libraries Drag and drop report builder Customizable

dashboard views Trend analysis Scheduling Flexible delivery

mechanisms (ftp, email, network directory, etc.) Report packages;

and, Document browser to retrieve previously generated reports �The

reporting module is a highly flexible, intuitive, and customizable

solution that can be delivered via an application service provider

model,� said Annie Morris, North America Managing Director for

Linedata Services. �This module is the strongest reporting solution

on the market today. Combined with Linedata Compliance and LongView

Trading, it keeps Linedata ahead of the market for innovation,

service, and transparency.� Notes to Editors About Linedata

Services Linedata Services (Bloomberg: LIN:FP) is the�global leader

for investment software, solutions, and support. Linedata combines

technological innovation, financial strength, and a deep

understanding of�the Asset Management, Leasing & Credit

Finance, and Insurance & Savings industries. Linedata Services�

asset management division provides comprehensive, scalable

solutions to the buy-side,�to manage the entire investment process

from pre-trade to post-settlement. Linedata is unique�in offering a

full front- to back-office solution via enterprise installation, or

as an Application Service Provider (�software as services� or

�service bureau� delivery), and has 20 years experience delivering

ASP solutions. Headquartered in France, Linedata Services achieved

revenues of EUR 164.8 million in 2007, has offices worldwide and

services more than 800 clients across 50 countries. For more

information visit Linedata Services corporate site at

www.linedata.com. About Linedata Compliance Linedata Compliance is

a global, enterprise-wide compliance monitoring and breach

management solution that focuses on the complex business

requirements and workflows of compliance officers, asset managers

and fund administrators. The robust, real-time system offers

advanced pre- and post-trade compliance checking, comprehensive

monitoring and flexible reporting capabilities across all markets,

regulatory agencies, and asset types. Linedata Compliance also

provides comprehensive monitoring of investment restrictions

including client, firm, prospectus, and regulatory mandates.

Linedata Compliance offers unrivalled speed, flexibility, and

scalability by using an N-tier, multi-threaded architecture.

Linedata compliance is both a scalable, and an affordable solution

or firms of all sizes; the system may be operated as a stand-alone

compliance product or integrated with existing front and back

office systems, and is offered both as a hosted (ASP) and deployed

solution. About LongView Trading LongView Trading is Linedata

Services� powerful, electronic, global, multi-asset class order

management system developed to support the needs of portfolio

managers, traders, compliance officers and operations personnel.

The comprehensive system provides portfolio modelling, electronic

trading, pre-trade compliance and unparalleled access to liquidity.

Through numerous partnerships and seamless integration, LongView

offers customers access to the liquidity sources of their choice.

Unique technology and a commitment to broker neutrality has won

LongView ten of the top 25 global asset management firms, and more

than 150 clients worldwide. It has also won the loyalty of all its

clients, which named the platform Best Buy-Side OMS for 2008.

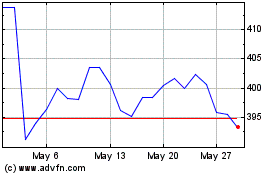

Linde (TG:LIN)

Historical Stock Chart

From Nov 2024 to Dec 2024

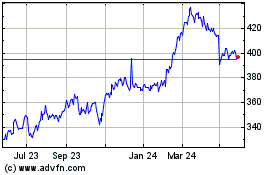

Linde (TG:LIN)

Historical Stock Chart

From Dec 2023 to Dec 2024