Executive summaryPositive Results in

the Half Year to 31 December 2022

- 19% increase in revenues from clinical demand for SCENESSE®

(afamelanotide 16mg).

- 94% increase in NPAT; 67% increase in EBIT.

- Net assets increased by 11%; 16% growth in cash to $140.7

million since the start of the reporting period.

Increases year on year compared to six months to 31/12/21,

unless stated otherwise. All figures reported in Australian

dollars, $.

|

|

31 December 2022 |

31 December 2021 |

Change |

|

Revenues, $ |

29,355,042 |

24,631,266 |

+19.2% |

|

Profit after tax, $ |

11,387,665 |

5,870,380 |

+93.9% |

|

Basic Earnings per share, $ |

0.230 |

0.119 |

+93.3% |

|

Cash, $ |

140,703,376 |

|

+15.8%* |

*Increase from 30 June 2022.

For the six months ended 31 December 2022,

CLINUVEL is pleased to record a 19% increase in its revenues, and

94% increase in net earnings after tax, or $11.39 million.

“Today’s excellent

figures are the result of years of focus and financial discipline,

while operationally facilitating supply of SCENESSE® to patients in

Europe and the USA,” CLINUVEL’s Chief Financial Officer, Mr Darren

Keamy said.

“The number of

prescriptions for, patients receiving, and expert centres

administering the therapy have all increased over the period.

“The performance

exceeds our expectations, thereby precipitating the financial basis

to expand our portfolio of melanocortins, diversify markets, and

become a self-sufficient company.

“Working within our

set budgets, we are now focused on bettering our results for the

financial year end. It is an exciting moment in the history of the

Company.”

Alongside the revenue result, CLINUVEL contained

its expenses during the half year period to achieve a negligible

rise of 1%, furthering its balance sheet. As of 31 December,

CLINUVEL held cash and cash equivalents of over $140 million, a 16%

increase from 30 June, with total assets above $160 million.

“We have actively

managed CLINUVEL’s commercial programs, translating to a steady

increase in liquid assets, as well as earnings per share,” Mr Keamy

said.

“In parallel, we have

made necessary investments to advance clinical research and new

product development, while placing emphasis on cost control. There

is not much debate around prudent fiscal management in a climate of

macroeconomic uncertainty, therefore we keep a balance between

strengthening the Group’s commercial basis and expansion. Most of

all, I am pleased for patients and our shareholders, as our

financial record and stability provides options for pursuing our

long-term objectives.”

Financial performance

The 67% increase in net profit before tax was

the fourteenth consecutive half year profit since the commencement

of CLINUVEL’s commercial operations in June 2016. The 94% rise in

net profit after tax achieved is the highest recorded by the Group

for a December half year.

CLINUVEL is on track to remain within its

projected overall expenditures of $175 million for the five

financial years ending June 2025, excluding investments of a

capital nature. Half-way along this timeline, total expenditures

have reached approximately 41% of the Group’s target.

The Company maintained a balance sheet free from

external borrowings, with a rise in total assets of 11.4% to $160.3

million. CLINUVEL will report its full financial year results in

August 2023.

CLINUVEL’s Appendix 4D Half Yearly Report

is available on the Company’s website,

www.clinuvel.com.

About CLINUVEL PHARMACEUTICALS

LIMITEDCLINUVEL (ASX: CUV; ADR LEVEL 1: CLVLY; BÖRSE

FRANKFURT: UR9) is a global specialty pharmaceutical group focused

on developing and commercialising treatments for patients with

genetic, metabolic, systemic, and life-threatening, acute

disorders, as well as healthcare solutions for the general

population. As pioneers in photomedicine and the family of

melanocortin peptides, CLINUVEL’s research and development has led

to innovative treatments for patient populations with a clinical

need for systemic photoprotection, DNA repair, repigmentation and

acute or life-threatening conditions who lack alternatives.

CLINUVEL’s lead therapy, SCENESSE®

(afamelanotide 16mg), is approved for commercial distribution in

Europe, the USA, Israel and Australia as the world’s first systemic

photoprotective drug for the prevention of phototoxicity

(anaphylactoid reactions and burns) in adult patients with

erythropoietic protoporphyria (EPP). Headquartered in Melbourne,

Australia, CLINUVEL has operations in Europe, Singapore and the

USA. For more information, please go to

https://www.clinuvel.com.

SCENESSE®, PRÉNUMBRA®, and NEURACTHEL® are

registered trademarks of CLINUVEL.

Authorised for ASX release by the Board of

Directors of CLINUVEL PHARMACEUTICALS LTD

Media EnquiriesMonsoon

CommunicationsMr Rudi Michelson, 61 411 402 737,

rudim@monsoon.com.au

Head of Investor Relations Mr

Malcolm Bull, CLINUVEL PHARMACEUTICALS LTD

Investor Enquiries

https://www.clinuvel.com/investors/contact-us

Forward-Looking Statements This

release contains forward-looking statements, which reflect the

current beliefs and expectations of CLINUVEL’s management. Please

see the full disclaimer on CLINUVEL’s website.

www.clinuvel.com

Level 11, 535 Bourke Street, Melbourne,

Victoria, Australia, 3000, T +61 3 9660 4900, F +61 3 9660

A photo accompanying this announcement is available

at https://www.globenewswire.com/NewsRoom/AttachmentNg/5b11aca8-a262-48df-8297-ddb65974ca1c

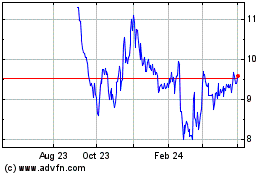

Clinuvel Pharmaceuticals (TG:UR9)

Historical Stock Chart

From Feb 2025 to Mar 2025

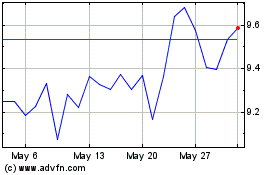

Clinuvel Pharmaceuticals (TG:UR9)

Historical Stock Chart

From Mar 2024 to Mar 2025