Dundee Corporation Reports Third Quarter 2009 Results

November 10 2009 - 6:48PM

Marketwired

Dundee Corporation (TSX: DC.A)(TSX: DC.PR.A)(TSX: DC.PR.B)

("Dundee" or the "Company") is pleased to announce that it has

posted its financial results and Management's Discussion and

Analysis for the quarter ended September 30, 2009 on its website

www.dundeecorporation.com and the System for Electronic Document

Analysis and Retrieval ("SEDAR").

Our operating EBITDA for the nine months ended September 30,

2009 as compared to the same period in 2008 amounts to $151.4

million for 2009 and $177.5 million in 2008. Net earnings per share

in 2009 were $0.68 on a fully diluted basis, as compared to a net

loss of $0.15 per share in 2008. With the successful issuance of

$130 million of 6.75% rate reset preferred shares in September of

this year, we have fully repaid amounts owing pursuant to our

revolving term credit facility. We have also renewed our revolving

term credit facility, extending the maturity date to November 9,

2010 and increasing the amount available to $200 million.

The results from our real estate subsidiary, Dundee Realty

Corporation have been outstandingly ahead of budgets developed last

year. Margins from the sale of land, housing and condominiums were

$24 million in the third quarter alone, surpassing the combined

real estate margins earned in the first two quarters of this year.

Propelled by strong buyer demand, housing and condominium

activities outperformed levels originally anticipated and land

sales in western Canada continue to show substantial growth. Dundee

Realty is prudently managing its capital, paying down its operating

line debt from its peak of $103.9 million to $54.4 million, along

with a further $78.8 million reduction in other debt at September

30, 2009.

Our wealth management subsidiary, DundeeWealth Inc., ended the

quarter with $33.6 billion in assets under management. According to

data provided by the Investment Funds Institute of Canada, Dynamic

Funds continued to lead its industry peers in asset gathering

activities in the third quarter of 2009, contributing to an

increase in DundeeWealth's mutual fund market share to 3.56% at

September 30, 2009 from 3.03% at the end of 2008. In the nine

months ended September 30, 2009, DundeeWealth earned EBITDA of

$106.6 million and net earnings of $40.4 million. DundeeWealth's

results include a pre-tax fair value increase related to its

investments in ABCP of $48.9 million, offset by a pre-tax fair

value decrease of $9.5 million related to its portfolio of CLOs.

Although revenues are not yet back to levels reached prior to the

financial crisis, DundeeWealth has reported an upward trend quarter

over quarter this year, while at the same time enjoying the cost

containment initiatives put in place, decreasing SG&A costs by

14% compared to the same period last year. Having paid off all bank

debt subsequent to completion of its $200 million debt financing,

DundeeWealth is in an excellent position to pursue organic growth

and consider acquisition opportunities that fit its core business

model.

At September 30, 2009, Ravensden Asset Management Inc.

("Ravensden"), our recently established asset management

subsidiary, provided sub-advisory and investment services to

approximately $3.2 billion of AUM. Ravensden is also working

towards our initiative to raise up to $1 billion for private equity

investment in the resource sector through Dundee Global Resource

L.P. We have initiated steps in our resource segment to eliminate

any potential future conflicts as we prepare for the launch of, and

our role as advisors to, the Dundee Global Resource L.P., to which

we have committed to provide a $200 million drawdown

subscription.

Dundee Real Estate Asset Management ("DREAM"), the asset

management division of our real estate subsidiary, managed assets

of $3.1 billion at September 30, 2009. DREAM is aggressively

pursuing opportunities offered by foreign investors for Canadian

assets and is also designing products supporting infrastructure

development, potentially through asset management arrangements.

Dundee Corporation is an asset management company dedicated to

private wealth management, real estate and resources that,

combined, reflect approximately $68 billion under management and

administration. Its domestic wealth management activities are

carried out through its 62% controlled subsidiary, DundeeWealth

Inc. Dundee Corporation's real estate activities are conducted

through its 74% owned subsidiary, Dundee Realty Corporation, which

operates as an asset manager of commercial real estate with

activities in a land and housing business in Canada and the United

States. Resource activities are carried out through its

wholly-owned subsidiary, Dundee Resources Limited. Asset management

activities are carried out through Ravensden Asset Management Inc.

and Dundee Real Estate Asset Management ("DREAM").

Contacts: Dundee Corporation Ned Goodman President and Chief

Executive Officer (416) 365-5665 Dundee Corporation Lucie Presot

Vice President and Chief Financial Officer (416) 365-5157

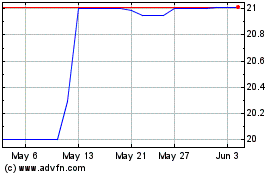

Dundee (TSX:DC.PR.B)

Historical Stock Chart

From Jun 2024 to Jul 2024

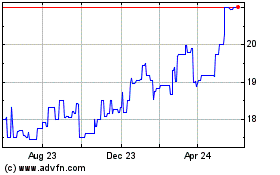

Dundee (TSX:DC.PR.B)

Historical Stock Chart

From Jul 2023 to Jul 2024