Brompton Funds Declare Distributions

February 15 2013 - 2:52PM

Marketwired

Brompton Funds (TSX:DGS)(TSX:DGS.PR.A)(TSX:LBS)(TSX:SBC) announces

distributions payable on March 14, 2013 to Class A shareholders of

record at the close of business on February 28, 2013 for each of

the following funds:

Fund Name Ticker Amount Per Share

Dividend Growth Split Corp. DGS $ 0.10

Life & Banc Split Corp. LBS $ 0.10

Brompton Split Banc Corp. SBC $ 0.10

Dividend Growth Split Corp. announces a distribution in the

amount of $0.13125 per preferred share (TSX:DGS.PR.A) payable on

March 14, 2013 to holders of record at the close of business on

February 28, 2013.

About Brompton Funds

Brompton Funds, a division of Brompton Group, is a leading and

experienced investment fund manager. Brompton is focused on meeting

the needs of investors by offering low cost, innovative products

with client friendly terms and supported by strong corporate

governance. For further information, please contact your investment

advisor, call Brompton's investor relations line at 416-642-6000,

(toll-free at 1-866-642-6001) email info@bromptongroup.com or visit

our website at www.bromptongroup.com.

Commissions, trailing commissions, management fees and expenses

all may be associated with investment funds. Please read the Funds'

publicly filed documents which are available from SEDAR at

www.sedar.com. Investment funds are not guaranteed, their values

change frequently and past performance may not be repeated.

Contacts: Brompton Funds Investor Relations 416-642-6000,

(toll-free at 1-866-642-6001)info@bromptongroup.com

www.bromptongroup.com

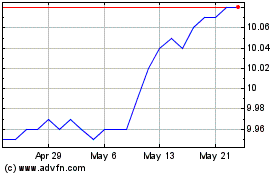

Dividend Growth Split (TSX:DGS.PR.A)

Historical Stock Chart

From Apr 2024 to May 2024

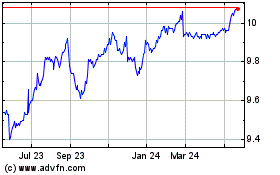

Dividend Growth Split (TSX:DGS.PR.A)

Historical Stock Chart

From May 2023 to May 2024