First Majestic Silver Corp. (AG: NYSE; FR: TSX; FMV:

Frankfurt) ("First Majestic" or the "Company") announces total

production in the second quarter of 2020 reached 3.5 million silver

equivalent ounces consisting of 1.8 million ounces of silver and

15,764 ounces of gold. Quarterly production was impacted following

Mexico’s Ministry of Health’s Federal Decree requiring all

non-essential businesses, including mining, to temporarily suspend

activities throughout most of April and May in response to the

global pandemic. Despite having limited operations in the quarter,

total production was better than expected due to a slower ramp down

at San Dimas compared to the other mining units. In the first half

of 2020, the Company has produced a total of 9.7 million silver

equivalent ounces consisting of 5.0 million ounces of silver and

47,967 ounces of gold.

SECOND QUARTER HIGHLIGHTS

- Total production reached 3.5 million

silver equivalent ounces, consisting of 1.8 million ounces of

silver and 15,764 ounces of gold.

- As of June 30, 2020, the Company

held 970,000 ounces of silver in inventory in anticipation of

realizing higher selling prices in the second half of 2020.

- By quarter end, all operations have returned to near full

production rates following the Mexican Government’s decision to

allow the Company to restart mining activities on May 23,

2020.

- San Dimas received delivery of a new 3,000 tpd High Intensity

Grinding (“HIG”) mill with additional mill modernization components

during the quarter.

- Development activities resumed at Santa Elena’s Ermitaño

project in June and successfully intersected the Ermitaño

vein.

- Civil construction activities resumed in June on the Liquid

Natural Gas (“LNG”) plant at Santa Elena. The LNG generators

and storage tanks are estimated to be delivered to site in the

third quarter.

- At the end of the second quarter, 14 exploration drill rigs

were active across the Company’s projects consisting of 11 rigs at

San Dimas, two rigs at Santa Elena and one rig at La Encantada. The

Company anticipates adding seven additional rigs in the third

quarter with a primary focus on the regional potential around Santa

Elena.

- Preventative controls such as the practice of social

distancing, the cancellation of any non-essential visits to the

mines, comprehensive sanitation measures for the workplace and

company transportation, as well as pre-screening for virus symptoms

remain in effect.

“Despite the temporary shutdown of operations

during the quarter, our production results were better than

anticipated as a result of implementing an extended and safe ramp

down of the San Dimas operation throughout the month of April,”

said Keith Neumeyer, President and CEO. “San Dimas produced a

total of 2.4 million silver equivalent ounces, or 35% lower than

the previous quarter. Total production at the Santa Elena and La

Encantada operations were 63% and 45% lower, respectively, compared

to the prior quarter as a result of suspending operations in early

April.”

Mr. Neumeyer continues, “We began implementing

restart procedures in mid-May following the Ministry of Health’s

announcement that mining activities were now deemed an essential

business throughout Mexico. As of today, our operations are

back to pre-pandemic production rates and our focus for the second

half of 2020 is to try and fully recover the lost ounces due to the

shutdown.”

PRODUCTION TABLE

| |

Q2 |

Q2 |

Y/Y |

Q1 |

Q/Q |

|

2020 |

2019 |

Change |

2020 |

Change |

| Ore

processed/tonnes milled |

333,559 |

736,896 |

-55 |

% |

599,142 |

-44 |

% |

| Total production -

ounces of silver eqv. |

3,505,376 |

6,410,483 |

-45 |

% |

6,195,057 |

-43 |

% |

| Silver ounces

produced |

1,834,575 |

3,193,566 |

-43 |

% |

3,151,980 |

-42 |

% |

|

Gold ounces produced |

15,764 |

33,576 |

-53 |

% |

32,202 |

-51 |

% |

QUARTERLY REVIEWTotal ore

processed during the quarter at the Company's mines amounted to

333,559 tonnes, representing a 44% decrease compared to the

previous quarter. The decrease in tonnes processed compared to the

prior quarter was due to Mexico’s Ministry of Health’s Decree

requiring non-essential businesses to temporarily suspend

activities in response to the global pandemic.

Consolidated silver grades in the quarter

averaged 193 g/t compared to 185 g/t in the previous quarter. This

4% increase was primarily the result of higher grades at San Dimas.

Consolidated gold grades averaged 1.52 g/t compared to 1.74 g/t in

the prior quarter representing a 12% decrease primarily due to

lower gold grades at Santa Elena.

Consolidated silver and gold recoveries were

consistent averaging 89% and 96%, respectively, during the

quarter.

MINE BY MINE PRODUCTION

TABLE

| |

|

|

|

|

|

|

|

|

|

|

Mine |

Ore Processed |

Tonnesper Day |

Ag Grade(g/t) |

Au Grade(g/t) |

AgRecovery |

AuRecovery |

Ag OzProduced |

Au OzProduced |

EquivalentAg Ounces |

|

San Dimas |

114,390 |

1,257 |

318 |

3.38 |

94 |

% |

97 |

% |

1,102,931 |

12,042 |

2,395,633 |

|

Santa Elena |

89,590 |

985 |

83 |

1.34 |

92 |

% |

95 |

% |

222,100 |

3,677 |

595,651 |

|

La Encantada |

129,579 |

1,424 |

158 |

0.01 |

78 |

% |

90 |

% |

509,544 |

45 |

514,092 |

|

Total |

333,559 |

3,665 |

193 |

1.52 |

89 |

% |

96 |

% |

1,834,575 |

15,764 |

3,505,376 |

| |

|

|

|

|

|

|

|

|

|

*Certain amounts shown may not add exactly to the total amount

due to rounding differences.*The following prices were used in the

calculation of silver equivalent ounces: Silver: $16.37 per ounce,

Gold: $1,711 per ounce.

At the San Dimas Silver/Gold

Mine:

- During the quarter, San Dimas produced 1,102,931 ounces of

silver and 12,042 ounces of gold for a total production of

2,395,633 silver equivalent ounces, reflecting a 35% decrease

compared to the prior quarter due to the COVID-19 related

shutdown.

- The mill processed a total of 114,390 tonnes with average

silver and gold grades of 318 g/t and 3.38 g/t, respectively.

- Silver and gold recoveries were slightly higher during the

quarter averaging 94% and 97%, respectively.

- Initial production from the Tayoltita mine began in June and is

expected to ramp-up to 300 tpd by the end of 2020.

- Mill modernization and optimization programs have resumed at

San Dimas, including the mid-May delivery of the 3,000 tpd HIG mill

and several components. As a result of the temporary suspension

during the quarter, assembly and installation of the new HIG mill

is now expected to be completed in the second quarter of

2021.

- In mid-June, production was temporarily suspended due to a

union work stoppage. Following a two-week standstill period, the

Company and union came to a mutually negotiated bonus agreement at

the end of June, and at which time production returned to normal

operating levels.

- A total of 11 drill rigs, consisting of one surface rig and 10

underground rigs, were active at the end of the quarter. Drilling

is currently being focused in the Central, Sinaloa and Tayoltita

blocks.

At the Santa Elena Silver/Gold

Mine:

- During the quarter, Santa Elena produced 222,100 ounces of

silver and 3,677 ounces of gold for a total production of 595,651

silver equivalent ounces, or approximately 63% below the previous

quarter.

- The mill processed a total of 89,590 tonnes, consisting of

58,223 tonnes of underground ore and 31,366 tonnes from the above

ground heap leach pad.

- Silver and gold grades from underground ore averaged 109 g/t

and 1.70 g/t, respectively, while silver and gold grades from the

above ground heap leach pad averaged 32 g/t and 0.62 g/t,

respectively.

- Silver and gold recoveries averaged 92% and 95%, respectively,

during the quarter.

- To help minimize health risks and accommodate Santa Elena

workers that travel from outside communities, the Company

established a temporary camp at Santa Elena. In addition, a second

temporary camp was constructed near Ermitaño to assist with housing

of the development contractors and construction workers.

- Development and construction activities resumed at the Ermitaño

project in June and successfully intersected the Ermitaño vein. At

the end of the quarter, a total of 468 metres of underground

development have been completed and approximately 480 metres of

main ramp and 80 metres of lateral development remain to be

developed in order to access the high-grade portion of the Ermitaño

ore body.

- The LNG power generation plant resumed civil construction

activities in June. Delivery of the LNG generators and storage

tanks are expected to be onsite in the third quarter of 2020. As a

result of the temporary suspension, the LNG plant is now estimated

to be completed and commissioned in the first quarter of 2021.

- Due to the temporary suspension of activities in the quarter,

the Ermitaño pre-feasibility study is now expected to be completed

in the first half of 2021. In addition, initial production from

Ermitaño has been extended to mid-2021.

At the La Encantada Silver

Mine:

- During the quarter, La Encantada

processed 129,579 tonnes of ore and produced 509,544 ounces of

silver, or approximately 45% below the previous quarter.

- Silver grades and recoveries during

the quarter averaged 158 g/t and 78%, respectively.

- Silver recoveries continue to

exceed historical rates primarily due to optimal blending of

stockpiles and maintaining an efficient pumping level on the

precipitate tanks.

OUTLOOK

The Company is revising its second half and full

year 2020 guidance to reflect changes due to the temporary

suspension of production and sales as well as adjustments to metal

price assumptions, foreign exchange rates, and the fixed exchange

ratio on the San Dimas streaming agreement. Details of the changes

and their expected impacts are presented below:

- Deferred a total of approximately 340,000 tonnes of ore

production, consisting of 1.6 million ounces of silver and 15,000

ounces of gold, due to the temporary shutdown in the second quarter

of 2020

- As of June 30, 2020, the Company held 970,000 ounces of silver

in inventory in anticipation of realizing higher selling prices in

the second half of 2020

- Increased the gold price assumption to $1,700 per ounce (up

from $1,450), reflecting a 100:1 silver to gold ratio

- Increased the MXN:USD ratio assumption to 21:1 (up from

19:1)

- Effective April 1, 2020, the silver to gold fixed exchange

ratio related to the San Dimas streaming agreement with Wheaton

Precious Metals was adjusted to 90:1 (from 70:1) due to the silver

to gold ratio averaging above 90:1 for the previous six months.

This ratio adjustment is expected to have a positive effect on

revenues by approximately $3.0 million for the remainder of 2020,

subject to achieving the mid-point of the new production guidance

and realizing silver and gold prices per ounce of $17.00 and

$1,700, respectively.

As a result of these adjustments, our 2020 total

production remains relatively unchanged at 21.4 to 22.9 million

silver equivalent ounces compared to the prior guidance of 21.5 to

24.0 million silver equivalent ounces. The Company is also

anticipating a reduction in annualized cash costs of approximately

30% due to the higher gold by-product revenues and the weaker

Mexican Peso.

The Company is also providing guidance below on

a mine-by-mine basis for the second half of 2020. Cash cost

and AISC guidance is shown per payable silver ounce. Assumptions

used for calculating silver equivalent ounces are: silver:

$17.00/oz and gold: $1,700/oz.

GUIDANCE FOR SECOND HALF OF

2020

|

Mine |

Silver Oz (M) |

Gold Oz (k) |

Silver Eqv Oz (M) |

Cash Costs ($) |

AISC ($) |

|

San Dimas |

3.3 – 3.6 |

42 – 47 |

7.5 – 8.3 |

(0.95) – 0.23 |

4.72 – 6.55 |

|

Santa Elena |

1.1 – 1.2 |

16 – 18 |

2.7 – 3.0 |

2.53 – 3.72 |

6.75 – 8.43 |

|

La Encantada |

1.7 – 1.8 |

– |

1.7 – 1.8 |

10.86 – 11.56 |

12.82 – 13.75 |

|

Totals: |

6.1 – 6.6 |

58 – 65 |

11.9 – 13.1 |

$2.93 – $3.99 |

$10.57 – $12.49 |

*Certain amounts shown may not add exactly to

the total amount due to rounding differences.*Consolidated AISC

includes general and administrative cost estimates and non-cash

costs of $2.35 to $2.62 per payable silver ounce.

In the second half of 2020, the Company expects

silver production to range between 6.1 to 6.6 million ounces,

representing an increase of approximately 27% when compared to the

first half of 2020. Additionally, total production is now expected

to range between 11.9 to 13.1 million silver equivalent ounces in

the second half of 2020, representing an increase of approximately

29% when compared to the first half of 2020. The increase in

production is primarily due to the operations returning to regular

production rates in the second half of 2020, as well as a higher

contribution of gold credits due to an increase in the gold to

silver ratio.

Cash costs in the second half of 2020 are

expected to be significantly lower to within the range of $2.93 to

$3.99 per ounce, primarily due to higher gold by-product credits at

San Dimas and Santa Elena and the weaker Mexican Peso. In addition,

AISC are expected to be within a range of $10.57 to $12.49 per

ounce in the second half of 2020.

A mine-by-mine breakdown of the revised full

year 2020 production guidance is included in the table below and

assumes the same metal prices and foreign currency assumptions as

stated previously.

GUIDANCE FOR FULL YEAR 2020

|

Mine |

Silver Oz (M) |

Gold Oz (k) |

Silver Eqv Oz (M) |

Cash Costs ($) |

AISC ($) |

|

San Dimas |

6.0 – 6.4 |

75 – 80 |

13.5 – 14.4 |

0.75 – 1.49 |

7.09 – 8.22 |

|

Santa Elena |

1.9 – 2.0 |

31 – 33 |

4.8 – 5.2 |

3.60 – 4.38 |

8.33 – 9.43 |

|

La Encantada |

3.1 – 3.3 |

– |

3.1 – 3.3 |

10.42 – 10.77 |

12.59 – 13.07 |

|

Totals: |

11.0 – 11.7 |

106 – 113 |

21.4 – 22.9 |

$3.95 – $4.59 |

$12.29 – $13.45 |

*Certain amounts shown may not add exactly to

the total amount due to rounding differences.*Consolidated AISC

includes general and administrative cost estimates and non-cash

costs of $2.81 to $2.99 per payable silver ounce.

For the full year of 2020, the Company now

estimates silver production will range between 11.0 to 11.7 million

ounces compared to the prior guidance of 11.8 to 13.2 million

ounces. Additionally, total production in 2020 is estimated to

range between 21.4 to 22.9 million silver equivalent ounces

compared to the prior guidance of 21.5 to 24.0 million silver

equivalent ounces.

Annual cash costs are now expected to be within

the range of $3.95 to $4.59 per ounce, or approximately 30% below

the previous guidance of $5.76 to $6.97 per ounce, primarily due to

higher gold by-product credits at San Dimas and Santa Elena and the

weaker Mexican Peso. In addition, annual AISC are expected to be

within a range of $12.29 to $13.45 per ounce, or approximately 10%

below the previous guidance of $13.37 to $15.46 per ounce.

REVISED CAPITAL BUDGET

In an effort to maintain its strong balance

sheet, the Company has updated its annual 2020 capital budget to

include the reallocation of development and exploration

expenditures across its operations and investments in innovative

projects. As a result, the Company now plans to invest a total of

$131.8 million, representing a 23% decrease compared with previous

guidance of $171.5 million, on capital expenditures in 2020

consisting of $45.7 million of sustaining investments and $86.1

million of expansionary investments.

The revised 2020 annual budget includes total

capital investments of $54.0 million on underground development,

$27.4 million towards property, plant and equipment, $21.4 million

on exploration and $29.0 million towards automation and efficiency

projects.

In the first half of 2020, the Company completed

15,555 metres of underground development and 50,709 metres of

exploration drilling. Under the revised 2020 budget, the Company is

planning to complete a total of approximately 35,100 metres of

underground development, representing a 9% decrease compared to the

original guidance. In addition, the Company is now planning to

complete a total of approximately 139,000 metres of exploration

drilling in 2020, representing a 28% decrease compared to the

original guidance.

CONFERENCE CALL

The Company will be holding a conference call

and webcast today, July 15, 2020 at 8 am PDT (11 am EDT) to

discuss the quarterly results.

To participate in the conference call, please

dial the following:

| Toll Free Canada & USA: |

|

1-800-319-4610 |

| Outside of Canada & USA: |

|

1-604-638-5340 |

| Toll Free Germany: |

|

0800 180 1954 |

| Toll Free UK: |

|

0808 101 2791 |

Participants should dial in 10 minutes prior to

the conference.

Click on WEBCAST on the First Majestic homepage

as a simultaneous audio webcast of the conference call will be

posted at www.firstmajestic.com.

The conference call will be recorded, and you

can listen to an archive of the conference by calling:

| Canada & USA Toll Free: |

|

1-800-319-6413 |

| Outside Canada & USA: |

|

1-604-638-9010 |

| Access Code: |

|

4820 followed by the # sign |

The replay will be available approximately one

hour after the conference and will available for seven days

following the conference. The replay will also be available

on the Company’s website for one month.

Q2 EARNINGS ANNOUNCEMENT

The Company is planning to release its second

quarter 2020 unaudited financial results on Thursday, August 6,

2020.

ABOUT THE COMPANY

First Majestic is a publicly traded mining

company focused on silver production in Mexico and is aggressively

pursuing the development of its existing mineral property assets.

The Company presently owns and operates the San Dimas Silver/Gold

Mine, the Santa Elena Silver/Gold Mine and the La Encantada Silver

Mine. Production from these mines are projected to be between

11.0 to 11.7 million silver ounces or 21.4 to 22.9 million silver

equivalent ounces in 2020.

FOR FURTHER INFORMATION contact

info@firstmajestic.com, visit our website at www.firstmajestic.com

or call our toll-free number 1.866.529.2807.

FIRST MAJESTIC SILVER CORP.

"signed"

Keith Neumeyer, President & CEO

Cautionary Note Regarding Forward Looking

Statements

This press release contains “forward‐looking

information” and "forward-looking statements” under applicable

Canadian and U.S. securities laws (collectively, “forward‐looking

statements”). These statements relate to future events or the

Company's future performance, business prospects or opportunities

that are based on forecasts of future results, estimates of amounts

not yet determinable and assumptions of management made in light of

management's experience and perception of historical trends,

current conditions and expected future developments.

Forward-looking statements include, but are not limited to,

statements with respect to: the Company’s business strategy; future

planning processes; commercial mining operations; cash flow;

budgets; the timing and amount of estimated future production;

recovery rates; mine plans and mine life; the future price of

silver and other metals; costs of production; costs and timing of

the development of new deposits; capital projects and exploration

activities and the possible results thereof. Assumptions may

prove to be incorrect and actual results may differ materially from

those anticipated. Consequently, guidance cannot be guaranteed. As

such, investors are cautioned not to place undue reliance upon

guidance and forward-looking statements as there can be no

assurance that the plans, assumptions or expectations upon which

they are placed will occur. All statements other than statements of

historical fact may be forward‐looking statements. Statements

concerning proven and probable mineral reserves and mineral

resource estimates may also be deemed to constitute forward‐looking

statements to the extent that they involve estimates of the

mineralization that will be encountered as and if the property is

developed, and in the case of measured and indicated mineral

resources or proven and probable mineral reserves, such statements

reflect the conclusion based on certain assumptions that the

mineral deposit can be economically exploited. Any statements that

express or involve discussions with respect to predictions,

expectations, beliefs, plans, projections, objectives or future

events or performance (often, but not always, using words or

phrases such as “seek”, “anticipate”, “plan”, “continue”,

“estimate”, “expect”, “may”, “will”, “project”, “predict”,

“forecast”, “potential”, “target”, “intend”, “could”, “might”,

“should”, “believe” and similar expressions) are not statements of

historical fact and may be “forward‐looking statements”.

Actual results may vary from forward-looking

statements. Forward-looking statements are subject to known and

unknown risks, uncertainties and other factors that may cause

actual results to materially differ from those expressed or implied

by such forward-looking statements, including but not limited to:

the duration and effects of the coronavirus and COVID-19, and any

other pandemics on our operations and workforce, and the effects on

global economies and society, risks related to the integration of

acquisitions; actual results of exploration activities; conclusions

of economic evaluations; changes in project parameters as plans

continue to be refined; commodity prices; variations in ore

reserves, grade or recovery rates; actual performance of plant,

equipment or processes relative to specifications and expectations;

accidents; labour relations; relations with local communities;

changes in national or local governments; changes in applicable

legislation or application thereof; delays in obtaining approvals

or financing or in the completion of development or construction

activities; exchange rate fluctuations; requirements for additional

capital; government regulation; environmental risks; reclamation

expenses; outcomes of pending litigation; limitations on insurance

coverage as well as those factors discussed in the section entitled

"Description of the Business - Risk Factors" in the Company's most

recent Annual Information Form, available on www.sedar.com, and

Form 40-F on file with the United States Securities and Exchange

Commission in Washington, D.C. Although First Majestic

has attempted to identify important factors that could cause actual

results to differ materially from those contained in

forward-looking statements, there may be other factors that cause

results not to be as anticipated, estimated or intended.

The Company believes that the expectations

reflected in these forward‐looking statements are reasonable, but

no assurance can be given that these expectations will prove to be

correct and such forward‐looking statements included herein should

not be unduly relied upon. These statements speak only as of the

date hereof. The Company does not intend, and does not assume any

obligation, to update these forward-looking statements, except as

required by applicable laws.

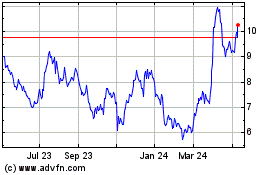

First Majestic Silver (TSX:FR)

Historical Stock Chart

From Jan 2025 to Feb 2025

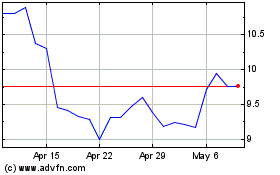

First Majestic Silver (TSX:FR)

Historical Stock Chart

From Feb 2024 to Feb 2025