Hudbay Extends Offer for Augusta

TORONTO, ONTARIO--(Marketwired - May 16, 2014) - HudBay Minerals

Inc. ("Hudbay") (TSX:HBM) (NYSE:HBM) announced today that it has

extended its offer to acquire all of the outstanding shares

("Augusta Shares") of Augusta Resource Corporation ("Augusta") not

already owned by Hudbay for consideration per Augusta share of

0.315 of a Hudbay common share (the "Offer") until 5:00 p.m.

(Toronto time) on May 27, 2014.

Hudbay continues to monitor developments with respect to

Augusta's applications for permits required for the Rosemont

project. Hudbay is assessing, among other things, the potential

implications of a letter dated May 13, 2014 that the U.S. Army

Corps of Engineers (the "USACE") is reported to have sent to

Augusta. The USACE letter advises Augusta that, in the context of

its Clean Water Act section 404 permit application, Augusta's

proposed compensatory mitigation is inadequate and USACE staff is

changing its focus from compensatory mitigation to preparing a

final permit decision.

On March 14, 2014, Hudbay waived the condition that there shall

have been validly deposited under the Offer and not withdrawn, at

or prior to the expiration of the Offer, such number of Augusta

Shares that, together with the Augusta Shares already owned by

Hudbay and its affiliates, represents not less than 66 2/3% of the

Augusta Shares (calculated on a fully diluted basis). Hudbay has

not waived any other conditions of the Offer described in Section 4

of the Offer, "Conditions of the Offer", as amended.

How to Tender

Augusta shareholders that have already deposited to the Offer

should not withdraw their shares as deposits are still valid for

acceptance until 5:00 p.m. (Toronto time) on May 27, 2014. Hudbay

encourages Augusta shareholders to read the full details of the

Offer set forth in the take-over bid circular and accompanying

offer documents, including the notices of variation, extension and

change that have been, or will be, mailed to Augusta shareholders

(collectively, the "Offer Documents"), which contain detailed

instructions on how Augusta shareholders can tender their Augusta

common shares to the Offer. For assistance in depositing Augusta

common shares to the Offer, Augusta shareholders should contact the

depositary for the Offer, Equity Financial Trust Company at

1-866-393-4891 (North

American Toll Free) or 416-361-0930 ext. 205

(outside North America) or by email at

corporateactions@equityfinancialtrust.com or the Information Agent

for the Offer, Kingsdale Shareholder Services at 1-866-229-8874 (North

American Toll Free Number) or 1-416-867-2272

(outside North America) or by email at

contactus@kingsdaleshareholder.com.

About the Offer

Augusta shareholders who tender to the Offer will be entitled to

receive 0.315 of a Hudbay common share for each Augusta common

share held. The Offer is for all of the issued and outstanding

common shares of Augusta not already owned by Hudbay, including any

common shares of Augusta that may become issued and outstanding

after the date of the Offer but before 5:00 p.m. (Toronto time) on

May 27, 2014 upon the exercise, exchange or conversion of any

securities of Augusta exercisable or exchangeable for, convertible

into or otherwise conferring a right to acquire, any common shares

of Augusta or other securities of Augusta, including, without

limitation, any option, warrant or convertible debenture, together

with the associated rights issued under Augusta's shareholder

rights plan agreement dated as of April 18, 2013 between Augusta

and Computershare Investor Services Inc. Hudbay currently owns

23,058,585 common shares of Augusta, representing approximately 16%

of the issued and outstanding common shares of Augusta. In

accordance with United States tender offer rules, Hudbay discloses

that as of 4:00 p.m. on May 16, 2014, 1,000,790 Augusta common

shares had been tendered to and not withdrawn from the Offer.

The full details of the Offer are set out in the Offer

Documents, which Hudbay has filed (or will be filing) with the

Canadian securities regulatory authorities. Hudbay has also filed a

registration statement on Form F-10 (as amended, the "Registration

Statement"), which contains a prospectus relating to the Offer (the

"Prospectus"), and a tender offer statement on Schedule TO (as

amended, the "Schedule TO") with the Securities and Exchange

Commission (the "SEC"). This news release is not a substitute for

the Offer Documents, the Prospectus, the Registration Statement or

the Schedule TO. AUGUSTA SHAREHOLDERS AND OTHER INTERESTED PARTIES

ARE URGED TO READ THESE DOCUMENTS, ALL DOCUMENTS INCORPORATED BY

REFERENCE, ALL OTHER APPLICABLE DOCUMENTS AND ANY AMENDMENTS OR

SUPPLEMENTS TO ANY SUCH DOCUMENTS WHEN THEY BECOME AVAILABLE,

BECAUSE EACH WILL CONTAIN IMPORTANT INFORMATION ABOUT HUDBAY,

AUGUSTA AND THE OFFER. Materials filed with the Canadian securities

regulatory authorities are available electronically without charge

at www.sedar.com. Materials filed with the SEC are available

electronically without charge at the SEC's website at www.sec.gov.

All such materials may also be obtained without charge at Hudbay's

website, www.hudbayminerals.com or by directing a written or oral

request to the Information Agent for the Offer, Kingsdale

Shareholder Services at 1-866-229-8874 (North

American Toll Free Number) or 1-416-867-2272

(outside North America) or by email at

contactus@kingsdaleshareholder.com or to the Vice President, Legal

and Corporate Secretary of Hudbay at 25 York Street, Suite 800,

Toronto, Ontario, telephone (416)

362-8181.

Important Notice

This news release does not constitute an offer to buy or the

solicitation of an offer to sell any of the securities of Hudbay or

Augusta.

Cautionary Note Regarding Forward Looking Statements

This news release contains "forward-looking statements" and

"forward-looking information" (collectively, "forward-looking

information") within the meaning of applicable Canadian and United

States securities legislation. Forward-looking information includes

information that relates to, among other things, statements with

respect to the anticipated timing, mechanics, completion and

settlement of the Offer, including the permitting of the Rosemont

project. Forward-looking information is not, and cannot be, a

guarantee of future results or events.

Forward-looking information is based on, among other things,

opinions, assumptions, estimates and analyses that, while

considered reasonable by us at the date the forward-looking

information is provided, inherently are subject to significant

risks, uncertainties, contingencies and other factors that may

cause actual results and events to be materially different from

those expressed or implied by the forward-looking information. The

material factors or assumptions that we identified and were applied

by us in drawing conclusions or making forecasts or projections set

out in the forward looking information include, but are not limited

to, the accuracy of Augusta's public disclosure; no significant and

continuing adverse changes in general economic conditions or

conditions in the financial markets; that all required regulatory

and governmental approvals for the Offer will be obtained and all

other conditions to completion of the Offer will be satisfied or

waived.

The risks, uncertainties, contingencies and other factors that

may cause actual results to differ materially from those expressed

or implied by the forward-looking information may include, but are

not limited to, the market value of the Hudbay shares received as

consideration under the Offer and the impact of such issuance on

the market price of the Hudbay shares, the development of the

Rosemont project not occurring as planned, the inaccuracy of

Augusta's public disclosure upon which the Offer is predicated, the

triggering of change of control provisions in Augusta's agreements

leading to adverse consequences, Augusta becoming a minority-owned

or majority-owned subsidiary of Hudbay after consummation of the

Offer, the possibility that Hudbay may remain a minority

shareholder of Augusta after consummation of the Offer without the

ability to control the management or direction of Augusta, as well

as the risks discussed under the heading "Risk Factors" in the

Offer Documents and other documents filed (or to be filed) with

Canadian and U.S. securities regulatory authorities. Should one or

more risk, uncertainty, contingency or other factor materialize or

should any factor or assumption prove incorrect, actual results

could vary materially from those expressed or implied in the

forward-looking information. Accordingly, the reader should not

place undue reliance on forward-looking information. Hudbay does

not assume any obligation to update or revise any forward-looking

information after the date of this news release or to explain any

material difference between subsequent actual events and any

forward-looking information, except as required by applicable

law.

About Hudbay

Hudbay (TSX:HBM) (NYSE:HBM) is a Canadian integrated mining

company with assets in North and South America principally focused

on the discovery, production and marketing of base and precious

metals. Hudbay's objective is to maximize shareholder value through

efficient operations, organic growth and accretive acquisitions,

while maintaining its financial strength. A member of the

S&P/TSX Composite Index and the S&P/TSX Global Mining

Index, Hudbay is committed to high standards of corporate

governance and sustainability. Further information about Hudbay can

be found on www.hudbayminerals.com.

For shareholder inquiries, please contactKingsdale Shareholder

Services1-866-229-8874 (North American Toll Free

Number)1-416-867-2272 (Outside North

America)contactus@kingsdaleshareholder.comHudBay Minerals

Inc.Candace BrûléDirector, Investor Relations(416)

814-4387candace.brule@hudbayminerals.comHudBay Minerals Inc.Scott

BrubacherDirector, Corporate Communications(416)

814-4373scott.brubacher@hudbayminerals.com

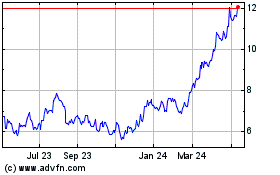

Hudbay Minerals (TSX:HBM)

Historical Stock Chart

From Dec 2024 to Jan 2025

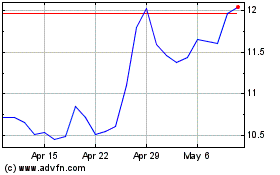

Hudbay Minerals (TSX:HBM)

Historical Stock Chart

From Jan 2024 to Jan 2025