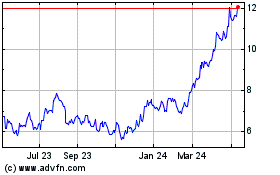

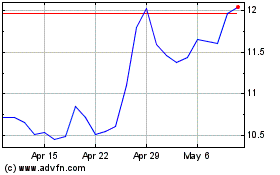

Hudbay Minerals Inc. (“Hudbay” or the “company”)

(TSX, NYSE: HBM) today announced the

results of the enhanced pre-feasibility study (“PFS”) for Phase I

of its 100%-owned Copper World project in Arizona. All dollar

amounts are in US dollars, unless otherwise noted. "Tonnes” refer

to metric tonnes and “tons” refer to imperial or U.S. short tons.

“The PFS for Phase I of Copper World

significantly enhances the economics and de-risks the project

through higher levels of engineering, a simplified project design,

lower upfront capex and a longer mine life,” said Peter Kukielski,

Hudbay’s President and Chief Executive Officer. “Copper World is an

attractive copper growth project for Hudbay and our stakeholders,

generating strong project returns and bringing many benefits to the

community and local economy in Arizona. We will continue to be

prudent with our financing plans for Copper World as we remain

focused on meeting all of the prerequisites for project sanctioning

as laid out in our 3-P plan in October 2022.”

2023 PFS Summary

The PFS reflects the results of the company’s

further technical work on the first phase of the Copper World

project. Phase I is a standalone operation requiring state and

local permits only. Phase I has a mine life of 20 years, which is

four years longer than the Phase I mine life that was presented in

the preliminary economic assessment published in June 2022 (“2022

PEA”) due to an increase in the capacity for tailings and waste

deposition as a result of optimizing the site layout. The second

phase of the project is expected to involve an expansion onto

federal lands with an extended mine life and enhanced project

economics. Phase II would be subject to the federal permitting

process and has not been included in the PFS results.

Phase I contemplates average annual copper

production of 85,000 tonnes over a 20-year mine life, at average

cash costs and sustaining cash costs of $1.47 and $1.81 per pound

of copperi, respectively. A variable cut-off grade strategy allows

for higher mill head grades in the first ten years, which increases

annual production to approximately 92,000 tonnes of copper at

average cash costs and sustaining cash costs of $1.53 and $1.95 per

pound of copperi, respectively.

At a copper price of $3.75 per pound, the

after-tax net present value (“NPV”) of Phase I using an 8% discount

rate is $1.1 billion and the internal rate of return (“IRR”) is

19%. The valuation metrics are leveraged to higher copper

prices and at a price of $4.25 per pound, the after-tax NPV (8%) of

Phase I increases to $1.7 billion, and the IRR increases to 25.5%.

In the flotation only scenario, the project has an after-tax NPV

(8%) of $863 million, an after-tax IRR of 18.7% and a payback

period of 5.3 years at $3.75 per pound copper. At a copper price of

$4.25 per pound, the flotation only NPV (8%) increases to $1.5

billion and the IRR increases to 25.7%. These economics demonstrate

the project is robust even without the concentrate leach facility,

providing Hudbay with flexibility to optimize the project in the

future through funding the addition of the concentrate leach

facility with operating cash flows or potential government

incentives for critical minerals processing.

A summary of key valuation, production and cost

details from the PFS can be found below. For further details,

including operating and cash flow metrics provided on an annual

basis, please refer to Exhibit 1 at the end of this news

release.

|

Summary of Key Metrics (at $3.75/lb Cu) |

|

Valuation Metrics

(Unlevered)1 |

Unit |

|

Phase I |

|

|

Net present value @ 8% (after-tax) |

$ millions |

|

$1,100 |

|

|

Net present value @ 10% (after-tax) |

$ millions |

|

$771 |

|

|

Internal rate of return (after-tax) |

% |

|

19.2% |

|

|

Payback period |

# years |

|

5.9 |

|

|

Project Metrics |

Unit |

|

Phase I |

|

|

Growth capital – initial |

$ millions |

|

$1,323 |

|

|

Construction length – conc process plant |

# years |

|

2.5 |

|

|

Growth capital – conc leach facility (yr 4) |

$ millions |

|

$367 |

|

|

Construction length – conc leach facility |

# years |

|

1.0 |

|

|

Operating Metrics |

Unit |

Year 1-10 |

Year 11-20 |

Phase I |

|

Copper production (annual avg.)2 |

000 tonnes |

92.3 |

77.5 |

85.3 |

|

EBITDA (annual avg.)3 |

$ millions |

$404 |

339 |

$372 |

|

Sustaining capital (annual avg.)4 |

$ millions |

$33.9 |

19.4 |

$27.1 |

|

Cash cost5 |

$/lb Cu |

$1.53 |

1.39 |

$1.47 |

|

Sustaining cash cost5 |

$/lb Cu |

$1.95 |

1.62 |

$1.81 |

1 Calculated assuming the following commodity prices: copper

price of $3.75 per pound, copper cathode premium of $0.02 per pound

(net of cathode freight charges), gold stream price of $450 per

ounce, silver stream price of $3.90 per ounce and molybdenum price

of $12.00 per pound. Reflects the terms of the existing Wheaton

Precious Metals stream, including an upfront deposit of $230

million in the first year of Phase I construction in exchange for

the delivery of 100% of gold and silver produced.2 Copper

production includes copper contained in concentrate sold and copper

cathode produced from the concentrate leach facility. Average

annual copper production excludes partial year of production in

year 20.3 EBITDA is a non-IFRS financial performance measure with

no standardized definition under IFRS. For further information,

please refer to the company's Management's Discussion and Analysis

for the three and six months ended June 30, 2023.4 Sustaining

capital expenditures include the benefit of capital leasing of

mobile equipment.5 Cash cost and sustaining cash cost exclude the

cost of purchasing external concentrate, which may vary in price

and or potentially be replaced with additional internal feed.

By-product credits calculated using amortization of deferred

revenue for gold and silver stream sales as per the company’s

approach in its quarterly financial reporting. By-product credits

also include the revenue from the sale of excess acid produced at a

price of $145 per tonne. Sustaining cash cost includes sustaining

capital expenditures and royalties. Cash cost and sustaining cash

cost are non-IFRS financial performance measures with no

standardized definition under IFRS. For further details on why

Hudbay believes cash costs are a useful performance indicator,

please refer to the company's Management's Discussion and Analysis

for the three and six months ended June 30, 2023.

|

Sensitivity Analysis |

|

|

|

|

|

|

|

|

Copper Price |

Unit |

$3.25/lb |

$3.50/lb |

$3.75/lb |

$4.00/lb |

$4.25/lb |

$4.50/lb |

|

Net present value1 @ 8% |

$ millions |

$463 |

$786 |

$1,100 |

$1,409 |

$1,710 |

$2,006 |

|

Net present value1 @ 10% |

$ millions |

$227 |

$503 |

$771 |

$1,033 |

$1,289 |

$1,540 |

|

Internal rate of return1 |

% |

12.70% |

16.00% |

19.20% |

22.40% |

25.50% |

28.50% |

|

Payback period |

# years |

7.9 |

6.7 |

5.9 |

5.4 |

5 |

4.4 |

|

EBITDA (annual avg.)2 |

$ millions |

288 |

330 |

$372 |

413 |

455 |

497 |

|

Concentrate Leach Facility (at $3.75/lb Cu) |

Unit |

No Conc Leach (Flotation Only) |

50% Capacity in Year 5 (Base Case) |

50% Capacity in Year 1 |

100% Capacity in Year 5 |

100% Capacity in Year 1 |

|

Net present value1 @ 8% |

$ millions |

$863 |

$1,100 |

$1,222 |

$1,302 |

$1,523 |

|

Net present value1 @ 10% |

$ millions |

$605 |

$771 |

$869 |

$922 |

$1,105 |

|

Internal rate of return1 |

% |

18.70% |

19.20% |

19.60% |

20.00% |

21.00% |

|

Payback period |

# years |

5.3 |

5.9 |

5.1 |

6 |

4.8 |

|

EBITDA (annual avg.) 2 |

$ millions |

$296 |

$372 |

$389 |

$413 |

$441 |

|

Copper production (annual avg.)3 |

000 tonnes |

85.8 |

85.3 |

85.1 |

118 |

124.5 |

|

Cash cost4 |

$/lb Cu |

$1.81 |

$1.47 |

$1.39 |

$1.43 |

$1.34 |

|

Sustaining cash cost4 |

$/lb Cu |

$2.15 |

$1.81 |

$1.73 |

$1.77 |

$1.69 |

1 Net present value and internal rate of return are shown on an

after-tax basis.2 EBITDA is a non-IFRS financial performance

measure with no standardized definition under IFRS. For further

information, please refer to the company's Management's Discussion

and Analysis for the three and six months ended June 30, 2023.3

Copper production includes copper contained in concentrate sold and

copper cathode produced from the concentrate leach facility. In the

100% Albion scenarios, the production facilities are assumed to

have an increased annual capacity of 140,000 tonnes of copper

cathode, providing the opportunity to purchase third party

concentrate to maximize the utilization of the SX/EW facility.

Average annual copper production excludes partial year of

production in year 20.4 Cash cost and sustaining cash cost exclude

the cost of purchasing external concentrate, which may vary in

price and or potentially be replaced with additional internal feed.

By-product credits calculated using amortization of deferred

revenue for gold and silver stream sales as per the company’s

approach in its quarterly financial reporting. By-product credits

also include the revenue from the sale of excess acid produced at a

price of $145 per tonne. Sustaining cash cost includes sustaining

capital expenditures and royalties. Cash cost and sustaining cash

cost are non-IFRS financial performance measures with no

standardized definition under IFRS. For further details on why

Hudbay believes cash costs are a useful performance indicator,

please refer to the company's Management's Discussion and Analysis

for the three and six months ended June 30, 2023.

Simplified Project Design

Copper World is planned to be a traditional open

pit shovel and truck operation with a conventional flotation

concentrator producing copper concentrate and molybdenum

concentrate, with an expansion of the processing facility to

include a copper concentrate leach facility in year 5, producing

copper cathode and silver/gold doré.

The overall mining operation is expected to

consist of four open pits in Phase I, as shown in Figure 1, with

similar processing infrastructure as contemplated in the 2022 PEA.

The mine plan for Phase I is now optimized solely on the flotation

of both copper sulfides and oxides.

The concentrator during Phase I will have an

installed capacity of 60,000 tons per day with conventional

crushing, grinding, flotation, molybdenum separation, concentrate

dewatering and tailings thickening. For the first 4 years, the

final product is a copper concentrate sold to market. The

processing plant is expected to be expanded by year 5 with the

construction of a concentrate leach facility in year 4, which will

produce copper cathodes and silver/gold doré. The concentrate leach

facility will also include sulfur flotation, an acid plant, an

SX/EW plant and a Merrill Crowe circuit for precious metals. Please

refer to Figure 2 for an overview of the plant layout. The

concentrate leach facility will also produce sulfur which will be

processed into sulfuric acid at the acid plant. When sulfur

production from the concentrate leach process is insufficient to

fill the sulfuric acid plant capacity, sulfur will be purchased at

local market price. When sulfuric acid production exceeds the

concentrate leach requirements, the excess will be sold.

As part of the PFS, detailed test work was

completed on the different concentrate leach technologies,

including Glencore Technology’s Albion Process (“Albion”) as well

as low and high temperature pressure oxidation. The tests indicate

Albion and high temperature pressure oxidation yield the highest

copper extraction rates in the range of 97% to 99% for all samples.

Albion was selected as the preferred concentrate leach technology

because it is simpler to operate, is modular and offers flexibility

to scale the plant and has significantly lower acid neutralization

requirements when compared to high temperature pressure

oxidation.

The concentrate leach facility is sized at

70,000 tonnes of copper cathode during Phase I, which represents

50% of the maximum 140,000-tonne design capacity. In the PFS, there

remains the opportunity to process third party feed during the last

two years of the mine life to maximize the utilization of the SX/EW

facility. Given the modular nature of the Albion technology, there

also remains the opportunity to increase the scale of the

concentrate leach facility up to the maximum design capacity, which

will allow for the processing of additional internal concentrates

or third party feed and further increase the NPV and IRR as shown

in the sensitivity analysis table on the previous page.

The PFS contemplates the construction of three

tailings storage facilities for Phase I and provides storage for

385 million tonnes, sufficient for 20 years of mine life on land

requiring state and local permits only. Please refer to Figure 3

for a layout of the tailings storage facilities.

Total initial capital costs are estimated to be

$1.3 billion for Phase I ($1.1 billion net of existing stream

agreement), including all costs associated with the construction of

the concentrator and associated infrastructure. The construction of

the concentrate leach facility in year 4 is estimated at $367

million and includes the cost for the SX/EW plant, acid plant,

sulfur burner and precious metals plant. Contingency costs have

been applied to direct capital costs at 20% and the PFS assumes

capital leasing of mobile equipment. For further details on the

capital cost estimates, please refer to Exhibit 1.

Significant Social & Environmental

Benefits

Global copper market fundamentals are expected

to be strong with a structural deficit emerging in the medium term.

Global mine production and available smelter capacity are expected

to struggle to keep pace with metal demand boosted by the green

energy revolution. The U.S. is expected to remain a net copper

importer during this period, and domestic supply will be required

to help secure growing U.S. metal demand related to increased

manufacturing capacity, infrastructure development, bolstering the

country’s energy independence and domestic EV battery supply chain

and production needs.

The “Made in America” copper cathode produced at

Copper World is expected to be sold entirely to domestic U.S.

customers and would make Copper World the third largest domestic

cathode producer in the United Statesii. Producing copper cathode

would reduce the operation’s total energy requirements, and

greenhouse gas (“GHG”) and sulfur (SO2) emissions by eliminating

overseas shipping, smelting and refining activities relating to

copper concentrate. The company estimates that the project will

reduce total energy consumption by more than 10%, including a more

than 30% decline in energy consumption relating to downstream

processing, when compared to a project design that produces copper

concentrates for overseas smelting and refining. The PFS base case

is expected to result in an approximate 14% reduction in scope 1, 2

and 3 GHG emissions compared to the flotation only scenario, as

highlighted in Figure 4. Hudbay is targeting further reductions in

the project’s GHG emissions as part of the company’s specific

emissions reduction targets for its existing operations to align

with the global 50% by 2030 climate change goal, which are

discussed in the section titled “Project Optimization and Upside

Opportunities” below.

The Copper World project is expected to generate

significant benefits for the community and local economy in

Arizona. Over the anticipated 20-year life of the operation, the

company expects to contribute more than $850 million in U.S. taxes,

including approximately $170 million in taxes to the state of

Arizona. Hudbay also expects Copper World to create more than 400

direct jobs and up to 3,000 indirect jobs in Arizona. Copper World

will offer competitive wages and benefits and the company intends

to engage in partnerships with local apprenticeship readiness

programs and community-based workforce training programs across the

skilled and technical levels to fill and maintain all positions.

The project is also expected to generate approximately $250 million

in property taxes over the 20-year mine life.

In July 2023, the U.S. Department of Energy

announced the designation of copper as a critical material for

energy. Hudbay has applied for tax credits under the Inflation

Reduction Act that are being awarded by the U.S. Department of

Energy in conjunction with the Internal Revenue Agency for

qualifying projects that construct processing facilities for

Critical Material for Sustainable Energy Initiatives. The copper

cathode produced at Copper World, together with the significant

social benefits for the community and local economy, position the

project as a strong candidate for government tax incentives. The

financial analysis in the PFS does not incorporate any potential

benefits from these tax incentives.

Simplified Permitting

Process

The permitting process for Copper World is

expected to only require state and local permits for Phase I. In

July 2022, Hudbay received approval from the Arizona State Mine

Inspector for its amended Mined Land Reclamation Plan (“MLRP”), the

first key state permit required for Copper World. The MLRP was

initially approved in October 2021 and was subsequently amended to

reflect a larger private land project footprint. This approval by

the Arizona State Mine Inspector was challenged in state court but

the challenge was dismissed in May 2023 as having no basis. In late

2022, Hudbay submitted the applications for an Aquifer Protection

Permit and an Air Quality Permit to the Arizona Department of

Environmental Quality. The company expects to receive these two

outstanding state permits in mid-2024.

In May 2023, the U.S. Supreme Court issued a

favourable decision in the case of Sackett v EPA that clarified the

definition of “Waters of the U.S.” and rejected the "significant

nexus" test that the agencies had previously used to assert

jurisdiction over relatively remote dry washes like those at the

Copper World site. This decision strengthens Hudbay's position that

no 404 Permit or other Clean Water Act approvals are required for

the Copper World project.

Also, in May 2023, Hudbay received a favourable

ruling from the U.S. Court of Appeals for the Ninth Circuit that

reversed the U.S. Fish and Wildlife Service's designation of the

Copper World area as jaguar critical habitat. While this ruling

does not impact the state permitting process for Phase I of Copper

World, it is expected to simplify the federal permitting process

for Phase II.

Mineral Reserve and Resource

Estimates

The PFS and mine plan are based on updated

mineral resource estimates for the Copper World deposits, which

include the Peach-Elgin, West, Broadtop Butte and East deposits, as

shown in Figure 5. Based on the new model, contained copper in

measured and indicated mineral resources, inclusive of mineral

reserves, has increased by 4% as compared to the mineral resources

in the 2022 PEA. In addition, contained copper in mill feed

increased by 41% in the PFS compared to the contained copper in

milled resources in Phase I of the PEA mine plan due to higher

grades and the flotation of both copper sulfides and oxides.

The mineral reserves milled is lower than the

mineral resources mined in the PFS due to limitations on tailings

capacity beyond 20 years in Phase I. There are approximately 40

million tonnes of resources that are economic to mine in the PFS

but are excluded from the reserves and cash flow analysis. This

additional material provides upside potential that could be

included in the mine plan if additional land is accessed for

tailings capacity.

The current mineral reserve and resource

estimates for Copper World (effective as of July 1,

2023) are summarized below and replace the prior mineral

resource estimates set forth in the 2022 PEA.

|

Copper World ProjectMineral Reserve and

Resource

Estimates1,2,3,4 |

Tonnes(millions) |

Cu Grade (%) |

Soluble Cu Grade (%) |

Mo Grade (g/t) |

Au Grade (g/t) |

Ag Grade (g/t) |

|

Proven reserves |

319 |

0.54 |

0.11 |

110 |

0.03 |

5.68 |

|

Probable reserves |

66 |

0.52 |

0.14 |

96 |

0.02 |

4.31 |

|

Total Proven and Probable Reserves |

385 |

0.54 |

0.12 |

108 |

0.02 |

5.44 |

|

Measured resources |

888 |

0.43 |

0.10 |

121 |

0.02 |

4.46 |

|

Indicated resources |

317 |

0.38 |

0.10 |

108 |

0.02 |

3.52 |

|

Total Measured and Indicated |

1,205 |

0.42 |

0.10 |

117 |

0.02 |

4.22 |

|

Inferred resources |

275 |

0.32 |

0.10 |

106 |

0.01 |

2.82 |

Note: totals may not add up correctly due to rounding.1 Mineral

resource estimates are inclusive of mineral reserves and have been

calculated using assumed long-term metal prices of $3.75 per pound

copper, $12.00 per pound molybdenum, $1,650 per ounce gold and

$22.00 per ounce silver. 2 Mineral resource estimates that are not

mineral reserves do not have demonstrated economic viability.

Mineral resource estimates are based on resource pit design and do

not include factors for mining recovery or dilution.3 Mineral

resource estimates are constrained to a Lerch Grossman pit shell

with a revenue factor of 1.0 or inside the reserve pit.4 Mineral

resource estimates are using a 0.1% soluble copper cut-off grade

and an oxidation ratio higher than 50% for leach material.

|

Copper World Comparison of Mineral Resource

Estimates1,2 |

|

|

2022 |

2023 |

% Change |

|

|

Tonnes (millions) |

Cu(%) |

Cu (000 tonnes) |

Tonnes (millions) |

Cu(%) |

Cu (000 tonnes) |

Cu (000 tonnes) |

|

Measured and Indicated |

1,173 |

0.41 |

4,829 |

1,205 |

0.42 |

5,020 |

4% |

|

Inferred |

262 |

0.37 |

957 |

275 |

0.32 |

893 |

-7% |

Note: totals may not add up correctly due to rounding.1 2023

mineral resource estimates are inclusive of mineral reserve

estimates.2 2022 mineral resource estimates include both flotation

and leach material and were based on metals prices and other

assumptions set forth in the 2022 PEA.

|

Copper World Comparison of Phase I Mill Feed |

|

|

2022 PEA |

2023 PFS |

% Change |

|

|

Tonnes (millions) |

Cu(%) |

Cu (000 tonnes) |

Tonnes (millions) |

Cu(%) |

Cu (000 tonnes) |

Cu (000 tonnes) |

|

Mill Feed |

316 |

0.47 |

1,473 |

385 |

0.54 |

2,082 |

41% |

Note: totals may not add up correctly due to rounding.

Project Optimization and Upside

Opportunities

The company has identified many opportunities

that may further enhance project economics, reduce environmental

impacts, increase annual production and extend mine life, which

have not been considered in the Phase I PFS.

- Mine Life Extension Potential –

There remains approximately 60% of the total copper contained in

measured and indicated mineral resources excluding the PFS

reserves, providing significant potential for the Phase II

expansion and mine life extension. In addition, the inferred

mineral resources estimates are at a comparable copper grade and

also provide significant upside potential.

- Increased Concentrate Leach

Capacity – The selected concentrate leach technology allows the

facility to be scalable in the future to be large enough to process

all of the internally produced copper concentrates, further

enhancing project economics and IRR. Operating the Albion plant at

100% capacity is estimated to reduce total GHG emissions by 25%

compared to an operation that only produces copper

concentrate.

- Access to Federal Green Funding

Incentives – Hudbay is exploring options for government incentives

to help fund the future development of the concentrate leach

facility, which may offer attractive financing terms and allow the

construction of the concentrate leach facility to occur earlier and

potentially at a larger capacity with improved project

economics.

- Earlier Receipt of Federal Permits

for Phase II Expansion – Hudbay is optimistic that it will be able

to secure federal permits well before the end of the life of Phase

I, which could allow the mining of more high-value tonnes earlier

in the mine life and significantly increase annual copper

production, the project economics and IRR.

- Green Opportunities – There are

several emission reduction opportunities the company will evaluate

with future studies, including the potential to source renewable

energy from local providers at a nominal cost, the use of

autonomous or electric haul trucks at the operation and various

post-reclamation land uses such as domestic renewable energy

production. Also, if Hudbay is able to secure additional private

land to improve the tailings configuration, there is the potential

to accelerate dry stack tailings deposition into Phase I, which

would reduce water consumption.

Prudent Financing Plan and Disciplined

Capital Allocation

As part of Hudbay’s disciplined financial

planning approach to Copper World, the company has introduced a

three prerequisites plan (“3-P”), including specific leverage

targets that it would need to achieve prior to making an investment

decision in the project:

- Permits – receipt of all state level permits required for

Phase I

- Plan – completion of a definitive feasibility study with

an internal rate of return of greater than 15%

- Prudent Financing Strategy – multi-faceted financing

strategy including

- a committed minority joint venture partner;

- a renegotiated precious metals stream agreement optimized for

the current project;

- net debt to EBITDA ratio of less than 1.2 times;

- a minimum cash balance of $600 million; and,

- limited non-recourse project level debt of up to $500

million.

Under the existing precious metals stream

agreement with Wheaton Precious Metals, Hudbay is entitled to

receive a deposit payment of $230 million for delivery of gold and

silver production from Copper World. The estimated total initial

funding requirement for Phase I of Copper World, net of the stream

agreement, amounts to approximately $1.1 billion.

Hudbay intends to complete a minority joint

venture partner process after receiving permits and prior to

commencing a definitive feasibility study, which will allow the

potential joint venture partner to participate in the funding of

definitive feasibility study activities in 2024 as well as in the

final project design for Copper World. The opportunity to sanction

Copper World is not expected until 2025 based on current estimated

timelines. The decision to sanction Copper World will ultimately be

evaluated against other competing investment opportunities as part

of Hudbay’s capital allocation process.

Conference Call and Webcast

|

Date: |

Friday, September 8, 2023 |

| |

|

| Time: |

8:30 a.m. ET |

| |

|

| Webcast: |

www.hudbay.com |

| |

|

| Dial in: |

1-416-915-3239 or

1-800-319-4610 |

| |

|

Non-IFRS Financial Performance Measures

Cash cost and sustaining cash cost per pound of

copper produced are shown because the company believes they help

investors and management assess the performance of its operations,

including the margin generated by the operations and the company.

Unit operating costs are shown because these measures are used by

the company as a key performance indicator to assess the

performance of its mining and processing operations. EBITDA is

shown to provide additional information about the cash generating

potential in order to assess the company’s capacity to service and

repay debt, carry out investments and cover working capital needs.

These measures do not have a meaning prescribed by IFRS and are

therefore unlikely to be comparable to similar measures presented

by other issuers. These measures should not be considered in

isolation or as a substitute for measures prepared in accordance

with IFRS and are not necessarily indicative of operating profit or

cash flow from operations as determined under IFRS. Other companies

may calculate these measures differently. For further details on

these measures, please refer to page 42 of Hudbay’s management’s

discussion and analysis for the three and six months ended June 30,

2023 available on SEDAR+ at www.sedarplus.ca and EDGAR at

www.sec.gov.

Qualified Person and NI

43-101

The scientific and technical information

contained in this news release has been approved by Olivier

Tavchandjian, P. Geo, Hudbay’s Senior Vice-President, Exploration

and Technical Services. Mr. Tavchandjian is a qualified person

pursuant to Canadian Securities Administrators’ National Instrument

43-101 - Standards of Disclosure for Mineral Projects (“NI

43-101”).

A copy of the NI 43-101 technical report for the

PFS will be made available on Hudbay’s SEDAR+ profile at

www.sedarplus.ca and on Hudbay’s EDGAR profile at www.sec.gov. The

new technical report supports the disclosure in this news release

and will be the current technical report in respect of all the

mineral properties that form part of the Copper World project and

shall supersede and replace the 2022 PEA in its entirety.

Cautionary Note to United States

Investors

This news release has been prepared in

accordance with the requirements of the securities laws in effect

in Canada, which differ from the requirements of United States

securities laws. Canadian reporting requirements for disclosure of

mineral properties are governed NI 43-101.

For this reason, information contained in this

news release in respect of the Copper World project may not be

comparable to similar information made public by United States

companies subject to the reporting and disclosure requirements

under the United States federal securities laws and the rules and

regulations thereunder. For further information on the differences

between the disclosure requirements for mineral properties under

the United States federal securities laws and NI 43-101, please

refer to the company’s annual information form, a copy of which has

been filed under Hudbay’s profile on SEDAR+ at www.sedarplus.ca and

the company’s Form 40-F, a copy of which has been filed under

Hudbay’s profile on EDGAR at www.sec.gov.

Cautionary Note Regarding Forward-Looking

Information

This news release contains forward-looking

information within the meaning of applicable Canadian and United

States securities legislation. All information contained in this

news release, other than statements of current and historical fact,

is forward-looking information. Often, but not always,

forward-looking information can be identified by the use of words

such as “plans”, “expects”, “budget”, “guidance”, “scheduled”,

“estimates”, “forecasts”, “strategy”, “target”, “intends”,

“objective”, “goal”, “understands”, “anticipates” and “believes”

(and variations of these or similar words) and statements that

certain actions, events or results “may”, “could”, “would”,

“should”, “might” “occur” or “be achieved” or “will be taken” (and

variations of these or similar expressions). All of the

forward-looking information in this news release is qualified by

this cautionary note.

Forward-looking information includes, but is not

limited to, the results and findings of the PFS, including the

production, operating cost, capital cost and cash cost estimates,

the projected valuation metrics and rates of return, the cash flow

and EBITDA projections, statements regarding the anticipated

permitting requirements and project design, including processing

and tailings facilities, metal recoveries, mine life and production

rates for the Copper World project, the expected funding

requirements for the Copper World project, the potential to further

enhance the economics of the Copper World project and optimize the

design in the future, the possibility of extending the life of the

mine, plans for future feasibility studies and a potential joint

venture partner, the expected social and environmental benefits of

the Copper World project, as well as potential timelines for

obtaining the required permits and financing and sanctioning the

Copper World project. Forward-looking information is not, and

cannot be, a guarantee of future results or events. Forward-looking

information is based on, among other things, opinions, assumptions,

estimates and analyses that, while considered reasonable by us at

the date the forward-looking information is provided, inherently

are subject to significant risks, uncertainties, contingencies and

other factors that may cause actual results and events to be

materially different from those expressed or implied by the

forward-looking information.

The material factors or assumptions that Hudbay

identified and were applied by the company in drawing conclusions

or making forecasts or projections set out in the forward-looking

information include, but are not limited to:

- obtaining all required permits to

develop the Copper World project on anticipated timelines;

- no delays or disruption due to

litigation challenging the permitting requirements for the Copper

World project and no significant unanticipated litigation;

- the implementation of the

concentrate leach facility in year 5 of the mine plan;

- the success of exploration and

development activities at Copper World;

- the accuracy of geological, mining

and metallurgical estimates;

- anticipated metals prices and the

costs of production;

- the supply and demand for metals

Hudbay produces;

- the supply and availability of all

forms of energy, fuels and molten sulfur at reasonable prices;

- no significant unanticipated

operational or technical difficulties;

- the availability of additional

financing, if needed;

- the ability to complete project

targets on time and on budget;

- the availability of personnel for

the company’s exploration, development and operational projects and

ongoing employee relations;

- maintaining good relations with the

communities in which the company operates, including the

neighbouring communities and local governments in Arizona;

- no significant unanticipated

challenges with stakeholders at Copper World;

- no significant unanticipated events

or changes relating to regulatory, environmental, health and safety

matters;

- no contests over title to Hudbay’s

properties, including as a result of rights or claimed rights of

Indigenous peoples or challenges to the validity of its unpatented

mining claims;

- an upfront stream deposit of $230

million will be paid by Wheaton Precious Metals at the commencement

of construction;

- no offtake commitments in respect

of production from the Copper World project;

- certain tax matters, including, but

not limited to the mining tax regime in Arizona; and

- no significant and continuing

adverse changes in general economic conditions or conditions in the

financial markets (including commodity prices and foreign exchange

rates).

The risks, uncertainties, contingencies and

other factors that may cause actual results to differ materially

from those expressed or implied by the forward-looking information

may include, but are not limited to, risks generally associated

with the mining industry and the current geopolitical environment,

including future commodity prices, currency and interest rate

fluctuations, energy and consumable prices, supply chain

constraints and general cost escalation in the current inflationary

environment, risks related to project delivery and financing;

ongoing and potential litigation processes and other legal

challenges that could affect the permitting timeline for the Copper

World project, risks related to political or social instability and

changes in government and government policy, risks related to

changes in law, risks in respect of community relations, risks

related to contracts that were entered into in respect of the

former Rosemont mine project, uncertainties related to the geology,

continuity, grade and estimates of mineral reserves and resources,

and the potential for variations in grade and recovery rates, risks

related to the timing and implementation of the concentrate leach

facility, climate change risks and uncertainties, as well as the

risks discussed under the heading “Risk Factors” in the company’s

annual information form and under the heading “Financial Risk

Management” in the company’s management’s discussion and

analysis.

Should one or more risk, uncertainty,

contingency or other factor materialize or should any factor or

assumption prove incorrect, actual results could vary materially

from those expressed or implied in the forward-looking information.

Accordingly, you should not place undue reliance on forward-looking

information. The company does not assume any obligation to update

or revise any forward-looking information after the date of this

news release or to explain any material difference between

subsequent actual events and any forward-looking information,

except as required by applicable law.

About Hudbay

Hudbay (TSX, NYSE: HBM) is a copper-focused

mining company with three long-life operations and a world-class

pipeline of copper growth projects in tier-one mining-friendly

jurisdictions of Canada, Peru and the United States.

Hudbay’s operating portfolio includes the

Constancia mine in Cusco (Peru), the Snow Lake operations in

Manitoba (Canada) and the Copper Mountain mine in British Columbia

(Canada). Copper is the primary metal produced by the company,

which is complemented by meaningful gold production. Hudbay’s

growth pipeline includes the Copper World project in Arizona, the

Mason project in Nevada (United States), the Llaguen project in La

Libertad (Peru) and several expansion and exploration opportunities

near its existing operations.

The value Hudbay creates and the impact it has

is embodied in its purpose statement: “We care about our people,

our communities and our planet. Hudbay provides the metals the

world needs. We work sustainably, transform lives and create better

futures for communities.” Hudbay’s mission is to create sustainable

value and strong returns by leveraging its core strengths in

community relations, focused exploration, mine development and

efficient operations.

For further information, please contact:

Candace BrûléVice President, Investor

Relations (416) 814-4387 investor.relations@hudbay.com

Exhibit 1: Detailed Cash Flow Model and

Key Assumptions A detailed cash flow model containing

annual production and cost information is shown below. Overall

assumptions for commodity prices, marketing parameters, operating

costs and capital costs are also provided.

|

Phase I: Physicals |

UNIT |

TOTAL |

Y-01 |

Y01 |

Y02 |

Y03 |

Y04 |

Y05 |

Y06 |

Y07 |

Y08 |

Y09 |

Y10 |

Y11 |

Y12 |

Y13 |

Y14 |

Y15 |

Y16 |

Y17 |

Y18 |

Y19 |

Y20 |

| Material

Moved |

|

|

Pre-strip |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Resources mined |

Mtonne |

426.0 |

18.1 |

27.4 |

33.8 |

42.8 |

25.3 |

25.0 |

20.7 |

21.1 |

22.9 |

23.1 |

21.4 |

19.9 |

19.9 |

19.9 |

17.1 |

15.3 |

15.3 |

12.6 |

14.4 |

9.8 |

- |

| Waste mined |

Mtonne |

776.6 |

36.3 |

43.7 |

51.9 |

46.0 |

61.8 |

62.4 |

65.0 |

67.4 |

63.7 |

66.7 |

54.4 |

43.6 |

43.6 |

39.1 |

17.5 |

10.9 |

2.0 |

0.3 |

0.1 |

0.1 |

- |

|

Rehandle |

Mtonne |

62.4 |

- |

1.5 |

0.5 |

1.1 |

2.7 |

2.4 |

4.1 |

1.3 |

3.2 |

- |

1.2 |

- |

0.0 |

- |

2.7 |

4.5 |

4.5 |

7.3 |

5.4 |

10.0 |

9.9 |

| Total material moved |

Mtonne |

1,265.0 |

54.4 |

72.6 |

86.2 |

89.8 |

89.8 |

89.8 |

89.8 |

89.8 |

89.8 |

89.8 |

77.1 |

63.5 |

63.5 |

59.0 |

37.3 |

30.8 |

21.8 |

20.2 |

20.0 |

20.0 |

9.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Strip

Ratio |

|

|

Pre-strip |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Strip ratio |

X:X |

1.82 |

2.01 |

1.59 |

1.54 |

1.08 |

2.44 |

2.49 |

3.15 |

3.19 |

2.78 |

2.89 |

2.54 |

2.20 |

2.20 |

1.97 |

1.02 |

0.71 |

0.13 |

0.02 |

0.01 |

0.01 |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reserves

Milled |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reserves milled |

Mtonne |

385.1 |

- |

17.6 |

19.9 |

19.9 |

19.9 |

19.9 |

19.9 |

19.9 |

19.9 |

19.9 |

19.9 |

19.9 |

19.9 |

19.9 |

19.9 |

19.9 |

19.9 |

19.9 |

19.9 |

19.9 |

9.9 |

| Headgrade - Cu |

% |

0.54 % |

- |

0.64 |

0.54 |

0.50 |

0.49 |

0.54 |

0.79 |

0.60 |

0.59 |

0.58 |

0.58 |

0.48 |

0.44 |

0.48 |

0.58 |

0.53 |

0.56 |

0.54 |

0.58 |

0.41 |

0.24 |

| Headgrade - Au |

g/tonne |

0.03 |

- |

0.02 |

0.02 |

0.02 |

0.01 |

0.02 |

0.03 |

0.03 |

0.03 |

0.04 |

0.03 |

0.03 |

0.03 |

0.03 |

0.04 |

0.03 |

0.03 |

0.03 |

0.04 |

0.03 |

0.01 |

| Headgrade - Ag |

g/tonne |

6.00 |

- |

3.73 |

4.09 |

4.28 |

4.11 |

8.00 |

8.06 |

8.12 |

5.27 |

7.89 |

7.21 |

6.01 |

6.41 |

6.91 |

7.89 |

4.56 |

4.79 |

5.41 |

7.76 |

5.06 |

2.29 |

| Headgrade - Mo |

% |

0.01 % |

- |

0.02 |

0.01 |

0.01 |

0.01 |

0.01 |

0.01 |

0.01 |

0.01 |

0.01 |

0.01 |

0.01 |

0.01 |

0.01 |

0.01 |

0.01 |

0.01 |

0.01 |

0.01 |

0.01 |

0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Recovery to

Concentrate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cu |

% |

79.00% |

- |

82.91 |

81.78 |

83.02 |

83.18 |

82.50 |

70.14 |

82.20 |

82.31 |

84.13 |

84.29% |

83.39% |

83.16% |

83.27% |

69.02% |

68.08% |

82.02% |

71.49% |

82.37 |

67.54 |

63.23 |

| Au |

% |

41.21% |

- |

42.65 |

40.58 |

42.85 |

43.16 |

41.88 |

38.03 |

41.33 |

41.52 |

45.02 |

45.32% |

43.57% |

43.11% |

43.33% |

37.65% |

37.33% |

41.01% |

38.48% |

41.65% |

37.15% |

35.66% |

| Ag |

% |

56.43% |

- |

57.95 |

55.56 |

58.17 |

58.53 |

57.06 |

52.60 |

56.43 |

56.66 |

60.65 |

60.99% |

59.00% |

58.48% |

58.73% |

52.16% |

51.79% |

56.06% |

53.13% |

56.80% |

51.58% |

49.83% |

| Mo |

% |

53.67% |

- |

56.19 |

52.26 |

56.56 |

57.16 |

54.71 |

47.57 |

53.67 |

54.04 |

60.76 |

61.36% |

57.95% |

57.07% |

57.49% |

46.88% |

46.31% |

53.08% |

48.39% |

54.27% |

45.98% |

43.33% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cu Conc

Produced - Sold to Market |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cu Concentrate |

Ktonne |

2,991 |

- |

401 |

456 |

398 |

319 |

48 |

130 |

130 |

139 |

127 |

82 |

57 |

76 |

99 |

57 |

129 |

150 |

111 |

81 |

- |

- |

| Grade - Cu |

% |

23.16 % |

- |

23.22% |

19.36% |

20.51% |

25.21% |

33.21% |

29.12% |

25.26% |

24.58% |

25.34% |

29.73% |

25.44% |

21.92% |

22.29% |

25.28% |

18.64% |

22.33% |

20.84% |

28.61% |

- |

- |

| Grade - Au |

g/tonne |

0.51 |

- |

0.36 |

0.29 |

0.35 |

0.32 |

0.65 |

0.68 |

0.55 |

0.70 |

1.05 |

0.71 |

0.72 |

0.73 |

0.84 |

0.84 |

0.53 |

0.64 |

0.63 |

0.89 |

- |

- |

| Grade -

Ag |

g/tonne |

157.86 |

- |

94.61 |

98.86 |

124.25 |

149.86 |

340.27 |

222.62 |

235.48 |

150.38 |

248.45 |

267.41 |

224.95 |

224.42 |

227.22 |

261.56 |

121.93 |

131.63 |

155.86 |

261.78 |

- |

- |

| Cu cont'd in concentrate |

Ktonne |

693 |

- |

93 |

88 |

82 |

80 |

16 |

38 |

33 |

34 |

32 |

25 |

14 |

17 |

22 |

14 |

24 |

33 |

23 |

23 |

- |

- |

| Au cont'd in concentrate |

Koz |

49 |

- |

5 |

4 |

4 |

3 |

1 |

3 |

2 |

3 |

4 |

2 |

1 |

2 |

3 |

2 |

2 |

3 |

2 |

2 |

- |

- |

| Ag cont'd in concentrate |

Koz |

15,181 |

- |

1,219 |

1,451 |

1,591 |

1,535 |

530 |

934 |

986 |

672 |

1,015 |

709 |

410 |

549 |

725 |

480 |

505 |

633 |

556 |

682 |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cu Conc Produced - To Conc Leach Facility |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cu Concentrate |

Ktonne |

3,870 |

- |

- |

- |

- |

- |

218 |

248 |

256 |

256 |

256 |

244 |

256 |

256 |

256 |

256 |

256 |

256 |

256 |

253 |

227 |

122 |

| Grade - Cu |

% |

24.61 % |

- |

- |

- |

- |

- |

33.21% |

29.12% |

25.26% |

24.58% |

25.34% |

29.73% |

25.44% |

21.92% |

22.29% |

25.28% |

18.64% |

22.33% |

20.84% |

28.61% |

24.02% |

12.24% |

| Grade - Au |

g/tonne |

0.72 |

- |

- |

- |

- |

- |

0.65 |

0.68 |

0.55 |

0.70 |

1.05 |

0.71 |

0.72 |

0.73 |

0.84 |

0.84 |

0.53 |

0.64 |

0.63 |

0.89 |

0.84 |

0.39 |

| Grade -

Ag |

g/tonne |

214.74 |

- |

- |

- |

- |

- |

340.27 |

222.62 |

235.48 |

150.38 |

248.45 |

267.41 |

224.95 |

224.42 |

227.22 |

261.56 |

121.93 |

131.63 |

155.86 |

261.78 |

228.70 |

92.69 |

| Cu cont'd in concentrate |

Ktonne |

952 |

- |

- |

- |

- |

- |

72 |

72 |

65 |

63 |

65 |

73 |

65 |

56 |

57 |

65 |

48 |

57 |

53 |

72 |

54 |

15 |

| Au cont'd in concentrate |

Koz |

90 |

- |

- |

- |

- |

- |

5 |

5 |

4 |

6 |

9 |

6 |

6 |

6 |

7 |

7 |

4 |

5 |

5 |

7 |

6 |

2 |

| Ag cont'd in concentrate |

Koz |

26,722 |

- |

- |

- |

- |

- |

2,387 |

1,776 |

1,940 |

1,236 |

2,041 |

2,099 |

1,853 |

1,844 |

1,867 |

2,149 |

1,005 |

1,082 |

1,281 |

2,131 |

1,666 |

364 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mo Conc

Produced |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mo Concentrate |

Ktonne |

44.5 |

- |

3.4 |

3.0 |

2.7 |

2.4 |

2.0 |

2.6 |

1.7 |

2.3 |

3.0 |

2.1 |

2.4 |

2.8 |

1.9 |

1.4 |

1.6 |

2.2 |

2.0 |

2.4 |

2.1 |

0.6 |

| Grade -

Mo |

% |

50.00 % |

- |

50.00% |

50.00% |

50.00% |

50.00% |

50.00% |

50.00% |

50.00% |

50.00% |

50.00% |

50.00% |

50.00% |

50.00% |

50.00% |

50.00% |

50.00% |

50.00% |

50.00% |

50.00% |

50.00% |

50.00% |

| Mo cont'd in concentrate |

Ktonne |

22.3 |

- |

1.7 |

1.5 |

1.4 |

1.2 |

1.0 |

1.3 |

0.9 |

1.1 |

1.5 |

1.1 |

1.2 |

1.4 |

0.9 |

0.7 |

0.8 |

1.1 |

1.0 |

1.2 |

1.0 |

0.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Purchased Cu

Conc |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cu Concentrate |

Ktonne |

129.7 |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

29.7 |

100.0 |

| Grade - Cu |

% |

28.00 % |

- |

- |

- |

- |

- |

28.00% |

28.00% |

28.00% |

28.00% |

28.00% |

28.00% |

28.00% |

28.00% |

28.00% |

28.00% |

28.00% |

28.00% |

28.00% |

28.00% |

28.00% |

28.00% |

| Grade - Au |

g/tonne |

0.30 |

- |

- |

- |

- |

- |

0.30 |

0.30 |

0.30 |

0.30 |

0.30 |

0.30 |

0.30 |

0.30 |

0.30 |

0.30 |

0.30 |

0.30 |

0.30 |

0.30 |

0.30 |

0.30 |

| Grade - Ag |

g/tonne |

110.00 |

- |

- |

- |

- |

- |

110.00 |

110.00 |

110.00 |

110.00 |

110.00 |

110.00 |

110.00 |

110.00 |

110.00 |

110.00 |

110.00 |

110.00 |

110.00 |

110.00 |

110.00 |

110.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Recovery to Cu

Cathode |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| From Mill |

% |

98.12 % |

- |

- |

- |

- |

- |

98.10% |

98.22% |

98.11% |

98.11% |

98.00% |

97.99% |

98.05% |

98.06% |

98.05% |

98.23% |

98.25% |

98.12% |

98.21% |

98.10% |

98.25% |

98.31% |

| From Purchased |

% |

97.80 % |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

97.80% |

97.80% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cu Cathode

Produced |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| From Mill |

Ktonne |

934.5 |

- |

- |

- |

- |

- |

71.1 |

71.0 |

63.5 |

61.6 |

63.5 |

71.1 |

63.9 |

54.9 |

55.8 |

63.5 |

46.9 |

56.0 |

52.3 |

71.1 |

53.5 |

14.7 |

| From

Purchased |

Ktonne |

35.5 |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

8.1 |

27.4 |

| Total Cu cathode |

Ktonne |

970.0 |

- |

- |

- |

- |

- |

71.1 |

71.0 |

63.5 |

61.6 |

63.5 |

71.1 |

63.9 |

54.9 |

55.8 |

63.5 |

46.9 |

56.0 |

52.3 |

71.1 |

61.6 |

42.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Doré

Produced |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| From Mill |

Moz |

27.3 |

- |

- |

- |

- |

- |

2.4 |

1.8 |

2.0 |

1.3 |

2.1 |

2.1 |

1.9 |

1.9 |

1.9 |

2.2 |

1.0 |

1.1 |

1.3 |

2.2 |

1.7 |

0.4 |

| From

Purchased |

Moz |

0.4 |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

0.1 |

0.3 |

| Total Dore |

Moz |

27.7 |

- |

- |

- |

- |

- |

2.4 |

1.8 |

2.0 |

1.3 |

2.1 |

2.1 |

1.9 |

1.9 |

1.9 |

2.2 |

1.0 |

1.1 |

1.3 |

2.2 |

1.8 |

0.7 |

| Au in Doré |

% |

86 |

- |

- |

- |

- |

- |

4 |

5 |

4 |

5 |

8 |

5 |

6 |

6 |

7 |

7 |

4 |

5 |

5 |

7 |

6 |

2 |

| Ag in Doré |

% |

25,520 |

- |

- |

- |

- |

- |

2,245 |

1,671 |

1,825 |

1,162 |

1,920 |

1,975 |

1,743 |

1,734 |

1,756 |

2,021 |

945 |

1,017 |

1,204 |

2,004 |

1,656 |

642 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Acid

Plant |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Purchased sulphur |

Ktonne |

1,721.7 |

- |

- |

- |

- |

- |

107.8 |

108.2 |

106.6 |

107.8 |

105.8 |

104.2 |

106.8 |

108.1 |

108.4 |

110.7 |

111.5 |

107.5 |

110.0 |

106.3 |

109.2 |

102.8 |

| Excess acid produced |

Ktonne |

5,994.5 |

- |

- |

- |

- |

- |

374.7 |

374.7 |

374.7 |

374.6 |

374.7 |

374.7 |

374.7 |

374.7 |

374.7 |

374.7 |

374.6 |

374.6 |

374.6 |

374.7 |

374.7 |

374.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total

Production |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cu - contained in conc

sold |

Ktonne |

693 |

- |

93 |

88 |

82 |

80 |

16 |

38 |

33 |

34 |

32 |

25 |

14 |

17 |

22 |

14 |

24 |

33 |

23 |

23 |

- |

- |

| Cu -

cathode from conc leach |

Ktonne |

970 |

- |

- |

- |

- |

- |

71 |

71 |

64 |

62 |

63 |

71 |

64 |

55 |

56 |

63 |

47 |

56 |

52 |

71 |

62 |

42 |

| Cu - total production |

Ktonne |

1,663 |

- |

93 |

88 |

82 |

80 |

87 |

109 |

96 |

96 |

96 |

96 |

78 |

72 |

78 |

78 |

71 |

89 |

75 |

94 |

62 |

42 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cu Eq Production |

Ktonne |

1,974.3 |

- |

102.7 |

97.9 |

91.2 |

88.9 |

105.3 |

128.3 |

114.5 |

112.5 |

117.3 |

114.2 |

95.8 |

90.2 |

96.0 |

95.0 |

85.2 |

105.5 |

91.4 |

113.6 |

77.1 |

51.7 |

|

Phase I: Unit Costs |

Unit |

Phase I |

Y01 |

Y02 |

Y03 |

Y04 |

Y05 |

Y06 |

Y07 |

Y08 |

Y09 |

Y10 |

Y11 |

Y12 |

Y13 |

Y14 |

Y15 |

Y16 |

Y17 |

Y18 |

Y19 |

Y20 |

|

Mining ($/t material moved excl. Pre-strip) |

| Mining |

$/tonne |

2.48 |

1.80 |

1.74 |

1.85 |

2.02 |

2.23 |

2.30 |

2.29 |

2.29 |

2.30 |

2.60 |

2.93 |

2.83 |

3.03 |

3.57 |

3.76 |

4.24 |

4.20 |

4.13 |

3.73 |

2.24 |

|

Deferred stripping |

$/tonne |

(0.30) |

(0.00) |

(0.40) |

(0.22) |

(0.62) |

(0.27) |

(0.57) |

(0.61) |

(0.42) |

(0.49) |

(0.34) |

(0.12) |

(0.12) |

- |

- |

- |

- |

- |

- |

- |

- |

|

Mining ex def stripping |

$/tonne |

2.18 |

1.79 |

1.35 |

1.63 |

1.41 |

1.96 |

1.72 |

1.68 |

1.87 |

1.81 |

2.26 |

2.81 |

2.71 |

3.03 |

3.57 |

3.76 |

4.24 |

4.20 |

4.13 |

3.73 |

2.24 |

| Processing

($/tonne Ore Milled) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Flotation |

$/tonne |

4.07 |

4.11 |

4.11 |

4.09 |

4.06 |

4.04 |

4.08 |

4.09 |

4.09 |

4.08 |

4.06 |

4.06 |

4.06 |

4.07 |

4.06 |

4.09 |

4.09 |

4.08 |

4.06 |

4.03 |

4.03 |

| Concentrate Leach Facility |

$/tonne |

2.04 |

- |

- |

- |

- |

2.48 |

2.52 |

2.51 |

2.51 |

2.50 |

2.48 |

2.51 |

2.50 |

2.51 |

2.55 |

2.52 |

2.49 |

2.51 |

2.52 |

2.52 |

3.88 |

| Tailings & water |

$/tonne |

0.80 |

0.79 |

0.79 |

0.80 |

0.79 |

0.79 |

0.79 |

0.80 |

0.79 |

0.79 |

0.79 |

0.80 |

0.79 |

0.79 |

0.79 |

0.80 |

0.79 |

0.79 |

0.79 |

0.80 |

0.79 |

|

Labor & other |

$/tonne |

0.74 |

0.54 |

0.54 |

0.54 |

0.54 |

0.79 |

0.79 |

0.79 |

0.79 |

0.79 |

0.79 |

0.79 |

0.79 |

0.79 |

0.79 |

0.79 |

0.79 |

0.79 |

0.79 |

0.79 |

0.79 |

| Total |

$/tonne |

7.65 |

5.44 |

5.45 |

5.43 |

5.39 |

8.11 |

8.19 |

8.19 |

8.18 |

8.17 |

8.13 |

8.16 |

8.16 |

8.17 |

8.19 |

8.19 |

8.17 |

8.17 |

8.17 |

8.14 |

9.50 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other Unit

Costs ($/tonne ore milled) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Onsite G&A |

$/tonne |

0.90 |

0.91 |

0.80 |

0.80 |

0.80 |

0.80 |

0.85 |

0.85 |

0.85 |

0.85 |

0.85 |

0.90 |

0.90 |

0.90 |

0.90 |

0.90 |

1.05 |

1.05 |

1.05 |

1.05 |

1.05 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash Cost

($/lb Cu - ex. purchased conc) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash cost |

$/lb |

1.47 |

1.68 |

1.83 |

2.07 |

1.89 |

1.48 |

1.18 |

1.34 |

1.44 |

1.28 |

1.35 |

1.63 |

1.73 |

1.69 |

1.38 |

1.59 |

1.13 |

1.22 |

0.86 |

1.35 |

1.87 |

| Sustaining cash cost |

$/lb |

1.81 |

2.01 |

2.20 |

2.38 |

2.42 |

1.85 |

1.71 |

1.84 |

1.86 |

1.74 |

1.72 |

1.95 |

2.05 |

1.95 |

1.63 |

1.79 |

1.31 |

1.41 |

1.03 |

1.54 |

2.17 |

|

PHASE I: CASH FLOWS |

Unit |

TOTAL |

Y-03 |

Y-02 |

Y-01 |

Y01 |

Y02 |

Y03 |

Y04 |

Y05 |

Y06 |

Y07 |

Y08 |

Y09 |

Y10 |

Y11 |

Y12 |

Y13 |

Y14 |

Y15 |

Y16 |

Y17 |

Y18 |

Y19 |

Y20 |

Y21 |

Y22 |

Y23 |

Y24 |

Y25 |

|

Cash Flows |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross revenue - internal |

$M |

14,993 |

- |

- |

- |

786 |

738 |

684 |

674 |

817 |

1,000 |

884 |

882 |

899 |

888 |

749 |

697 |

737 |

734 |

667 |

828 |

713 |

882 |

541 |

192 |

- |

- |

- |

- |

- |

|

Gross revenue - purchased |

$M |

305 |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

70 |

236 |

- |

- |

- |

- |

- |

|

TC/RC |

$M |

(440) |

- |

- |

- |

(56) |

(58) |

(52) |

(44) |

(10) |

(22) |

(18) |

(21) |

(21) |

(14) |

(12) |

(14) |

(15) |

(8) |

(17) |

(22) |

(17) |

(15) |

(4) |

(1) |

- |

- |

- |

- |

- |

|

Freight |

$M |

(602) |

- |

- |

- |

(75) |

(86) |

(75) |

(60) |

(13) |

(27) |

(27) |

(28) |

(27) |

(19) |

(13) |

(17) |

(21) |

(14) |

(26) |

(30) |

(23) |

(18) |

(3) |

(1) |

- |

- |

- |

- |

- |

|

Royalty |

$M |

(339) |

- |

- |

- |

(17) |

(15) |

(14) |

(15) |

(20) |

(24) |

(21) |

(20) |

(22) |

(22) |

(18) |

(16) |

(17) |

(17) |

(14) |

(18) |

(15) |

(21) |

(12) |

(3) |

- |

- |

- |

- |

- |

|

Opex - Mining |

$M |

(2,641) |

- |

- |

- |

(130) |

(116) |

(146) |

(126) |

(176) |

(155) |

(151) |

(168) |

(163) |

(174) |

(178) |

(172) |

(179) |

(133) |

(116) |

(93) |

(85) |

(83) |

(75) |

(22) |

- |

- |

- |

- |

- |

|

Opex - Processing |

$M |

(2,947) |

- |

- |

- |

(96) |

(108) |

(108) |

(107) |

(161) |

(163) |

(163) |

(163) |

(162) |

(162) |

(162) |

(162) |

(162) |

(163) |

(163) |

(162) |

(162) |

(162) |

(162) |

(94) |

- |

- |

- |

- |

- |

|

Opex - Purch Cu Conc |

$M |

(272) |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

(62) |

(210) |

- |

- |

- |

- |

- |

|

Opex - Onsite G&A |

$M |

(348) |

- |

- |

- |

(16) |

(16) |

(16) |

(16) |

(16) |

(17) |

(17) |

(17) |

(17) |

(17) |

(18) |

(18) |

(18) |

(18) |

(18) |

(21) |

(21) |

(21) |

(21) |

(10) |

- |

- |

- |

- |

- |

|

Opex - Property tax |

$M |

(247) |

- |

- |

- |

(24) |

(23) |

(23) |

(22) |

(21) |

(20) |

(18) |

(17) |

(15) |

(14) |

(12) |

(10) |

(8) |

(6) |

(6) |

(2) |

(2) |

(2) |

(2) |

(2) |

- |

- |

- |

- |

- |

|

Opex - Surety bond fees |

$M |

(27) |

- |

- |

- |

(1) |

(1) |

(1) |

(1) |

(1) |

(1) |

(1) |

(1) |

(1) |

(1) |

(1) |

(1) |

(1) |

(1) |

(1) |

(1) |

(1) |

(1) |

(1) |

(1) |

- |

- |

- |

- |

- |

|

Closure Costs1 |

$M |

(133) |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

(36) |

(36) |

(2) |

(2) |

(20) |

| End

of life salvage/scrap |

$M |

62 |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

62 |

- |

- |

- |

- |

|

Pre-operating costs |

$M |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

| Tax

- Federal income |

$M |

(441) |

(3) |

(3) |

- |

- |

- |

- |

- |

- |

(3) |

(1) |

(3) |

(7) |

(26) |

(22) |

(24) |

(31) |

(43) |

(34) |

(67) |

(53) |

(83) |

(31) |

(6) |

- |

- |

- |

- |

- |

| Tax

- State income |

$M |

(113) |

- |

(3) |

- |

- |

- |

- |

- |

- |

- |

- |

- |

(2) |

(9) |

(6) |

(6) |

(8) |

(11) |

(8) |

(17) |

(13) |

(21) |

(8) |

(1) |

- |

- |

- |

- |

- |

| Tax

- State severance |

$M |

(55) |

- |

- |

- |