Liberty Gold Corp. (TSX: LGD; OTCQX: LGDTF) (“Liberty Gold”

or the “Company”) is pleased to report results from Phase 4B and 4C

metallurgical bottle roll and column testing of gold mineralization

in 36 variability composites taken from the Black Pine Oxide Gold

Project (“Black Pine”) in southeastern Idaho. Additionally,

final assay results are released on the remaining 4 metallurgical

core holes drilled in 2023 to provide samples for the Phase 5

metallurgical test program.

HIGHLIGHTS

- 36 variability composites from the

Phase 4B and 4C test programs were selected from large-diameter

(”PQ”) drill core from Discovery Zone, F Zone, Tallman, M Zone, and

C/D Zone, representing a range of sample types across lithology and

gold (“Au”) grade.

- Key results include:

- 84.2% weighted average gold

extraction1 from column leach

tests for the 31 oxide composites.

- Gold extractions ranged

from 52.7% to 94.2% for the oxide composites.

- >80% of leachable gold

extracted within 10 days.

-

Metallurgical testwork results on 149 composites and six bulk

samples over five years are highly consistent, showing rapid leach

kinetics, predictable grade-recovery and size-recovery

relationships.

- Phase 5 composite selection and

sample preparation is under way on an additional 25 variability

composites from previously untested areas.

Jon Gilligan, President & Chief

Operating Officer for Liberty Gold said, “The results of

this latest phase of metallurgical column testwork add key infill

data to the gold recovery model at Black Pine. The consistency of

results across all phases of test work is encouraging and

demonstrates the predictable nature of gold recovery across this

extensive Carlin-style oxide gold system. With more than 150

columns completed the test results provide a strong level of

confidence for the proposed run of mine heap leach processing

approach.”

BLACK PINE METALLURGICAL TEST WORK

Liberty Gold has completed multiple phases of

metallurgical testing at Black Pine including:

-

Bulk sample column tests

- Phase 1A2 (6 x 300

kilogram surface bulk samples):

- 78.9% weighted

average gold extraction, ranging up to 92.8%

- Variability

composite column tests (149 composites from PQ drill core)

- Phase 1B3 (29

composites):

- 82.9% weighted

average gold extraction, ranging up to 94.5%

- Phase 24 (45

composites):

- 80.8% weighted

average gold extraction, ranging up to 94.8%

- Phase 3 (15

low-grade composites):

- 65.2% weighted

average gold extraction ranging up to 80.8% (see press release

dated October 27, 2021)

- Phase 4A (24

composites):

- 86.9% weighted

average gold extraction, ranging up to 95.8% (see press release

dated March 22, 2023)

- Phase 4B

and 4C (36 composites):

- 84.2%

weighted average gold extraction, ranging up to

94.2%.

Phase 4B and 4C composites and the pending Phase

5 variability test program filled gaps in the Black Pine resource

metallurgical database. The Phase 4B and 4C data have updated the

metallurgical recovery equations supporting the deposit-wide gold

recovery model. Phase 5 initial results are expected in Q2 2024 and

will support the on-going pre-feasibility engineering and economic

study at Black Pine.

Phase 4B Test Results

Phase 4B focused on gap filling in Discovery

Zone, E-Pit, F Zone, Tallman, I-Pit and M Zone, sampling across

rock types, gold grades and geo-metallurgical zones with 25

composites taken. Twenty (20) of these composites represent typical

oxide (database Au cyanide solubility > 65%) material at Black

Pine, while 5 additional composites were made up to test leach

recoveries in lower gold solubility oxide materials (Au Cyanide

solubility between 25% and 65%). Bottle roll and column leach test

results are in linked table below.

Phase 4B column tests produced the following

results:

- Oxide material

produced a weighted average 86.1% gold extraction,

with a range from 56.9% to 94.2% gold

extraction.

Phase 4C Test Results

Phase 4C focused exclusively on the C/D Pit area

with 11 composites of oxide gold mineralization taken. Bottle roll

and column leach test results are in linked table below.

Phase 4C column tests produced the following

results:

- A weighted average

73.4% gold extraction, with a range from

52.7% to 89.8% gold extraction.

For a graph of results of the Liberty Gold Phase

4B and 4C oxide variability composite results compared to previous

test work, see Figure 1 below.

Figure 1: Black Pine Oxide Column Test

Results – All Phases

*Data from columns of lower gold solubility are

not shown in the above graph

For a table of laboratory test results of the

Phase 4B and 4C variability composites click here:

http://ml.globenewswire.com/Resource/Download/0560ade5-e852-4a75-8457-532a5f860657

Gold extraction was rapid, with >80% of the

leachable gold extracted within the first 10 days of column

leaching for both phases of testing.

Five composites of lower gold solubility oxide

materials were also tested and are not included in these results

and are highlighted in orange in the table.

For graphs of results of the Phase 4B and 4C

variability composite leach curves click here:

http://ml.globenewswire.com/Resource/Download/012ee6fd-9fff-437c-9be5-d7c8c7eda0a5

Laboratory Test Program

Samples for Phase 4B and 4C test work were

obtained through drilling PQ core holes. Composites were

selected through consideration of rock type, alteration, and gold

grade to achieve a wide range of geo-metallurgical types.

Composites were assembled in Elko, Nevada by Liberty Gold staff,

utilizing one-half or three-quarter sawed core, then shipped to

Kappes, Cassiday and Associates in Reno, Nevada for metallurgical

testing, comprising bottle rolls, column testing and

geo-metallurgical characterization, including gold and silver

assays, cyanide solubility, sulphur and carbon speciation,

preg-robbing analysis, ICP geochemical assays, whole rock analysis,

QXRD, load-permeability tests and environmental chemistry.

For a map showing locations of all Black Pine

bulk samples and core drill holes used for metallurgical testing,

including Phase 4B and 4C, plus the upcoming Phase 5 test work see

Figure 2, below.

Figure 2: Map of all Black Pine Bulk Sample and

Metallurgical Core Locations

Program details included:

-

Direct Leach (“DL”) and Carbon-in-Leach (“CIL”) coarse bottle roll

tests (target of 80% passing 10 mesh or 1.7 millimeter (“mm”)

particle size)

-

DL and CIL fine bottle roll tests (target of 80% passing 200 mesh

or 75 micron particle size)

-

The DL samples were rolled/agitated in bottles in a 1.0 grams per

liter (“g/l”) dilute sodium cyanide (“NaCN”) solution for 72 hours

(for 200 mesh) or 144 hours (for 10 mesh).

-

The CIL samples were rolled/agitated in bottles for 72 hours in a

1.0 g/l dilute NaCN solution, containing 20 g/l of activated

carbon.

-

Column composites were leached in 10.2 mm and 15.2 mm (four and six

inch) diameter columns between 93 and 107 days. And were leached

with low strength (0,50 g/l) NaCN solution. Gold and silver were

recovered from column leach pregnant solutions by passing it

through a small (separate) column containing activated carbon.

BLACK PINE METALLURGICAL DRILL CORE –

PHASE 5

Results for the final four core holes from the

2023 PQ drill program are summarized in Table 1 below:

Table 1: Core Drilling Results from the

2023 PQ Drill Program*

|

Hole ID (Az, Dip) (degrees) |

From (m) |

To (m) |

Intercept (m) |

Au (g/t) |

Au Cut-Off |

Hole Length (m) |

Target |

|

LBP973C (280, -70) |

7.3 |

14.5 |

7.2 |

0.69 |

0.15 |

44.9 |

Rangefront |

|

LBP979C (310, -75) |

56.0 |

80.2 |

24.2 |

0.66 |

0.15 |

110.5 |

M Zone |

|

and |

88.2 |

109.2 |

21.0 |

0.76 |

|

incl |

96.0 |

100.8 |

4.8 |

1.62 |

1.00 |

|

LBP980C (10, -46) |

78.1 |

84.7 |

6.6 |

0.86 |

0.15 |

47.9 |

M Zone |

|

and |

89.9 |

92.4 |

2.4 |

0.30 |

|

and |

99.3 |

100.4 |

1.1 |

2.37 |

|

and |

136.9 |

142.1 |

5.2 |

0.82 |

|

LBP991C (80, -65) |

50.6 |

56.2 |

5.6 |

0.57 |

0.15 |

190.2 |

Rangefront |

|

and |

78.6 |

109.1 |

30.5 |

0.22 |

|

and |

113.6 |

146.6 |

33.0 |

0.37 |

|

and |

163.3 |

173.1 |

9.8 |

1.41 |

|

incl |

165.8 |

173.1 |

7.3 |

1.80 |

1.00 |

|

and |

174.4 |

180.1 |

5.6 |

0.35 |

0.15 |

* Results are reported as drilled thicknesses,

with true thicknesses approximately 50% to 90% of drilled

thickness. Gold grades are uncapped. Au (g/t) = grams per tonne of

gold; m=meters.

All metallurgical work at Black Pine has been

supervised by Gary Simmons MMSA, formerly the Director of

Metallurgy and Technology for Newmont Mining Corp. Mr. Simmons has

managed or supervised many metallurgical testing programs on

similar Carlin-style sedimentary rock-hosted deposits.

QUALIFIED PERSON

Peter Shabestari, P.Geo., Vice-President

Exploration, Liberty Gold, is the Company's designated Qualified

Person for this news release within the meaning of National

Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI

43-101") and has reviewed and validated that the information

contained in the release is accurate.

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring for and

developing open pit oxide deposits in the Great Basin of the United

States, home to large-scale gold projects that are ideal for

open-pit mining. This region is one of the most prolific

gold-producing regions in the world and stretches across Nevada and

into Idaho and Utah. We know the Great Basin and are driven

to discover and advance big gold deposits that can be mined

profitably in open-pit scenarios.

For more information, visit libertygold.ca or contact:

Susie Bell, Manager, Investor Relations Phone:

604-632-4677 or Toll Free 1-877-632-4677 info@libertygold.ca

QUALITY ASSURANCE – QUALITY CONTROL

Drill composites were calculated using a cut-off

of 0.10 g/t Au. Drill intersections are reported as drilled

thicknesses. True widths of the mineralized intervals vary between

30% and 100% of the reported lengths due to varying drill hole

orientations but are typically in the range of 50% to 90% of true

width. Drill samples were assayed by ALS Limited in Reno, Nevada

for gold by Fire Assay of a 30 gram (1 assay ton) charge with an AA

finish, or if over 5.0 g/t Au were re-assayed and completed with a

gravimetric finish. For these samples, the gravimetric data were

utilized in calculating gold intersections. For any samples

assaying over 0.10 parts per million an additional cyanide leach

analysis is done where the sample is treated with a 0.25% NaCN

solution and rolled for an hour. An aliquot of the final leach

solution is then centrifuged and analyzed by Atomic Absorption

Spectroscopy. QA/QC for all drill samples consists of the insertion

and continual monitoring of numerous standards and blanks into the

sample stream, and the collection of duplicate samples at random

intervals within each batch. Selected holes are also analyzed for a

51 multi-element geochemical suite by ICP-MS. ALS Geochemistry-Reno

is ISO 17025:2005 Accredited, with the Elko and Twin Falls prep lab

listed on the scope of accreditation.

All statements in this press release, other than

statements of historical fact, are "forward-looking information"

with respect to Liberty Gold within the meaning of applicable

securities laws, including statements that address potential

quantity and/or grade of minerals, the potential size of the

mineralized zone, the potential recovery in a future mine at Black

Pine, the proposed timing of exploration and development plans, the

expansion and future resource growth expected at Black Pine,

expected capital costs at Black Pine, expected gold recoveries from

the Black Pine mineralized material, the potential upgrade of

inferred mineral resources to measured and indicated mineral

resources, the potential for future additions to the current

mineral resource estimate, the 2023 work program and the results

thereof, and the planned development work at Black Pine.

Forward-looking information is often, but not always, identified by

the use of words such as "seek", "anticipate", "plan", "continue",

"planned", "expect", "project", "predict", "potential",

"targeting", "intends", "believe", "potential", and similar

expressions, or describes a "goal", or variation of such words and

phrases or state that certain actions, events or results "may",

"should", "could", "would", "might" or "will" be taken, occur or be

achieved. Forward-looking information is not a guarantee of future

performance and is based upon a number of estimates and assumptions

of management at the date the statements are made including, among

others, assumptions about future prices of gold, and other metal

prices, currency exchange rates and interest rates, favourable

operating conditions, political stability, obtaining governmental

approvals and financing on time, obtaining renewals for existing

licenses and permits and obtaining required licenses and permits,

labour stability, stability in market conditions, availability of

equipment, the availability of drill rigs, successful resolution of

disputes and anticipated costs and expenditures. Many assumptions

are based on factors and events that are not within the control of

Liberty Gold and there is no assurance they will prove to be

correct.

Such forward-looking information, involves known

and unknown risks, which may cause the actual results to be

materially different from any future results expressed or implied

by such forward-looking information, including, risks related to

the interpretation of results and/or the reliance on technical

information provided by third parties as related to the Company’s

mineral property interests; changes in project parameters as plans

continue to be refined; current economic conditions; future prices

of commodities; possible variations in grade or recovery rates; the

costs and timing of the development of new deposits; failure of

equipment or processes to operate as anticipated; the failure of

contracted parties to perform; the timing and success of

exploration activities generally; the timing of the publication of

any updated resources; delays in permitting; possible claims

against the Company; labour disputes and other risks of the mining

industry; delays in obtaining governmental approvals, financing or

in the completion of exploration well as those factors discussed in

the Annual Information Form of the Company dated March 28, 2023 in

the section entitled "Risk Factors", under Liberty Gold’s SEDAR+

profile at www.sedarplus.ca.

Although Liberty Gold has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in

forward-looking information, there may be other factors that cause

actions, events or results not to be as anticipated, estimated or

intended. There can be no assurance that such information will

prove to be accurate as actual results and future events could

differ materially from those anticipated in such statements.

Liberty Gold disclaims any intention or obligation to update or

revise any forward-looking information, whether as a result of new

information, future events or otherwise.

Cautionary Note for United States Investors

The information in this news release, including

any information incorporated by reference, and disclosure documents

of Liberty Gold that are filed with Canadian securities regulatory

authorities concerning mineral properties have been prepared in

accordance with the requirements of securities laws in effect in

Canada, which differ from the requirements of United States

securities laws.

Without limiting the foregoing, these documents

use the terms “measured resources”, “indicated resources”,

“inferred resources” and “probable mineral reserves”. Shareholders

in the United States are advised that, while such terms are defined

in and required by Canadian securities laws, the United States

Securities and Exchange Commission (the “SEC”) does not recognize

them. Under United States standards, mineralization may not be

classified as a reserve unless the determination has been made that

the mineralization could be economically and legally produced or

extracted at the time the reserve determination is made. United

States investors are cautioned not to assume that all or any part

of measured or indicated resources will ever be converted into

reserves. Further, inferred resources have a great amount of

uncertainty as to their existence and as to whether they can be

mined legally or economically. It cannot be assumed that all or any

part of the inferred resources will ever be upgraded to a higher

resource category. Under Canadian rules, estimates of inferred

mineral resources may not form the basis of feasibility,

pre-feasibility or other technical reports or studies, except in

rare cases. Therefore, United States investors are also cautioned

not to assume that all or any part of the inferred resources exist,

or that they can be mined legally or economically. Disclosure of

contained ounces is permitted disclosure under Canadian

regulations; however, the SEC normally only permits issuers to

report resources as in place tonnage and grade without reference to

unit measures. Accordingly, information concerning descriptions of

mineralization and resources contained in these documents may not

be comparable to information made public by United States companies

subject to the reporting and disclosure requirements of the

SEC.

1 Weighted average gold extraction is obtained using the

following equation: (composite head grade (grams/tonnes) multiplied

by extraction (%) for all head grades)/sum of all head grades for

composites defined as “Oxide” mineralization having a cyanide gold

solubility greater than 65%. Using arithmetic averages tends to

over-represent low grade composites and under-represent high grade

composites. The arithmetic extraction average of the 36

column tests is 74.1%.2 Previously referred to as “Phase 1” – see

press release dated June 16, 20203 Previously referred to as “Phase

2” – see press release dated August 18, 20204 Previously referred

to as “Phase 3” – see press release dated October 27, 2021

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/14c6973f-e9bf-4382-b1de-f7fd7af198dc

https://www.globenewswire.com/NewsRoom/AttachmentNg/19f9ee6e-9004-4700-8a45-9fe3a5ee4098

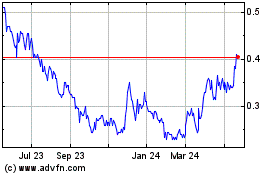

Liberty Gold (TSX:LGD)

Historical Stock Chart

From Nov 2024 to Dec 2024

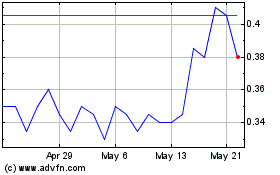

Liberty Gold (TSX:LGD)

Historical Stock Chart

From Dec 2023 to Dec 2024