Marathon Gold Corporation (“

Marathon” or the

“

Company”; TSX: MOZ) is pleased to announce that

leading independent proxy advisory firms Institutional Shareholder

Services Inc. (“

ISS”) and Glass Lewis & Co.

(“

Glass Lewis”) have each recommended that

Marathon shareholders (“

Marathon Shareholders”)

vote “

FOR” Marathon’s proposed plan of arrangement

(“

Arrangement”) with Calibre Mining Corp.

(“

Calibre”) at the upcoming special meeting of

Marathon Shareholders (the “

Special Meeting”) to

be held on Tuesday, January 16, 2024 at 10:00 a.m. (Toronto Time).

In making its recommendation, ISS commented:

“Vote FOR this resolution as the strategic

rationale makes sense, the merger consideration represents a

significant premium to the unaffected price, the special committee

engaged in a credible process, and non-approval risk remains

elevated.”

Glass Lewis commented:

“All told, we believe the board has presented a

sufficient case to support its view that the strategic opportunity

presented by the proposed merger is attractive. We highlight that

the combined company is expected to benefit from geographical

diversification, economies of scale, peer leading production growth

and enhanced market presence, among other potential benefits, as

well as that the implied value of the merger consideration offers

meaningful premiums.”

Matt Manson, President & CEO of Marathon,

commented:

"We are pleased to have received positive

recommendations from ISS and Glass Lewis, which reaffirm our

strategic rationale for the Arrangement and the resulting benefits

to Marathon Shareholders."

Voting is easy, and important - Vote FOR

the Arrangement TODAY

Marathon Shareholders are encouraged to vote FOR

the Arrangement by no later than 10:00 a.m. (Eastern Time) on

Friday, January 12, 2024, being the proxy cut-off time for voting

for the Special Meeting. The Special Meeting will be held at the

offices of Norton Rose Fulbright Canada LLP at 222 Bay Street,

Suite 3000, Toronto, Ontario, Canada M5K 1E7 on January 16, 2024 at

10:00 a.m. (Toronto time).

Please visit the Special Meeting page on our

website for complete details and links to all relevant documents at

marathon-gold.com/investors/special-meeting/. This webpage also

includes dial-in information for those who wish to listen in to the

Special Meeting.

Questions & Voting

If you have questions about the meeting matters or require

voting assistance, please contact Marathon‘s proxy solicitation

agent, Laurel Hill Advisory Group, at:

Laurel Hill Advisory GroupNorth

American Toll Free: 1-877-452-7184 (1-416-304-0211 outside

North America)Email: assistance@laurelhill.com

About Marathon

Marathon (TSX:MOZ) is a Toronto based gold

company advancing its 100%-owned Valentine Gold Project located in

the central region of Newfoundland & Labrador, one of the top

mining jurisdictions in the world. The Valentine Gold Project

comprises a series of five mineralized deposits along a

32-kilometre system. A December 2022 Updated Feasibility Study

outlined an open pit mining and conventional milling operation

producing 195,000 ounces of gold a year for 12 years within a

14.3-year mine life. The Valentine Gold Project was released from

federal and provincial environmental assessment in 2022 and

construction commenced in October 2022.

For more information, please

contact:

|

Amanda MalloughManager, Investor RelationsTel: 416

855-8202amallough@marathon-gold.com |

Matt MansonPresident & CEOmmanson@marathon-gold.com |

Julie RobertsonCFOjrobertson@marathon-gold.com |

To find out more information on Marathon Gold

Corporation and the Valentine Gold Project, please visit

www.marathon-gold.com.

Cautionary Statement Regarding

Forward-Looking Information

Certain information contained in this news

release, constitutes forward-looking information within the meaning

of Canadian securities laws (“forward-looking

statements”). All statements in this news release, other

than statements of historical fact, which address events, results,

outcomes or developments that Marathon expects to occur are

forward-looking statements. Forward-looking statements include

statements that are predictive in nature, depend upon or refer to

future events or conditions, or include words such as “expects”,

“anticipates”, “plans”, “believes”, “estimates”, “considers”,

“intends”, “targets”, or negative versions thereof and other

similar expressions, or future or conditional verbs such as “may”,

“will”, “should”, “would” and “could”. We provide forward-looking

statements for the purpose of conveying information about our

current expectations and plans relating to the future, and readers

are cautioned that such statements may not be appropriate for other

purposes.

Forward-looking statements necessarily involve

assumptions, risks and uncertainties, certain of which are beyond

Marathon’s control. These forward-looking statements are qualified

in their entirety by cautionary statements and risk factor

disclosure contained in filings made by Marathon with the Canadian

securities regulators, including Marathon’s annual information form

for the year ended December 31, 2022, its financial statements and

related MD&A for the financial year ended December 31, 2022,

and its interim financial statements and related MD&A for the

three and nine months ended September 30, 2023.

Marathon’s forward-looking statements are based

on the applicable assumptions and factors management considers

reasonable as of the date hereof, based on the information

available to management of Marathon at such time. Marathon does not

assume any obligation to update forward-looking statements if

circumstances or management’s beliefs, expectations or opinions

should change other than as required by applicable securities laws.

There can be no assurance that forward-looking statements will

prove to be accurate, and actual results, performance or

achievements could differ materially from those expressed in, or

implied by, these forward-looking statements. Accordingly, undue

reliance should not be placed on forward-looking statements.

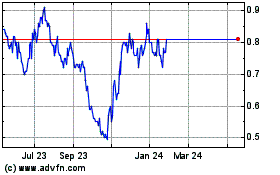

Marathon Gold (TSX:MOZ)

Historical Stock Chart

From Feb 2025 to Mar 2025

Marathon Gold (TSX:MOZ)

Historical Stock Chart

From Mar 2024 to Mar 2025