CYGAM Energy Inc. (TSX VENTURE:CYG) ("CYGAM", or the "Company"), an emerging oil

and gas company with interests in Tunisia and Italy, announced today that InSite

Petroleum Consultants Ltd. of Calgary, Alberta, ("InSite") has completed the

annual update to CYGAM's Reserve Report for the Bir Ben Tartar Concession ("the

Concession") in the Sud Remada Permit in Tunisia, effective December 31, 2013

(the "Report"). The Report was prepared in accordance with National Instrument

51-101 - Standards of Disclosure for Oil and Gas Activities ("NI 51-101") and

the Canadian Oil and Gas Evaluation Handbook ("COGEH"). The report is based on

InSite's review of technical data including geology, geophysics and reservoir.

CYGAM holds a 14% interest in the Concession which contains the TT Field and a

14% interest in the Sud Remada Permit.

The Company's production from the Concession is governed by a production sharing

agreement ("PSA") with ETAP, the Tunisian national oil company. All amounts set

forth herein relate to CYGAM's net share, after ETAP participation and taxes,

and are reported in Canadian dollars.

Year-End 2013 Reserves

Based on a static, volumetric geological model developed by a third party,

InSite evaluated the total TT Field to contain an estimated total Discovered

Petroleum Initially in Place ("DPIIP") of 201.7 million barrels, which is

unchanged from December 31, 2012.

The following summarizes the changes in CYGAM's net reserves:

----------------------------------------------------------------------------

December 31, December 31,

Oil Reserves (barrels) 2013(1) 2012(2) Increase

----------------------------------------------------------------------------

Proved 472,600 430,200 10%

----------------------------------------------------------------------------

Proved plus Probable 891,600 807,100 10%

----------------------------------------------------------------------------

Proved plus Probable plus Possible 1,320,000 1,180,100 12%

----------------------------------------------------------------------------

1. Information derived from the Report.

2. Information derived from a report (the "2012 Report") prepared by InSite

effective December 31, 2012, which was prepared in accordance with NI

51-101 and COGEH.

Following 2013 net CYGAM production of 83,067 barrels, reserves replacement

ratios are as follows:

----------------------------------------------------------------------------

Proved 151%

----------------------------------------------------------------------------

Proved plus Probable 203%

----------------------------------------------------------------------------

Proved plus Probable plus Possible 268%

----------------------------------------------------------------------------

Estimated Future Net Revenues

All evaluations and reviews of future net cash flows are stated prior to any

provision for interest costs or general and administrative costs and after the

deduction of estimated future capital expenditures for wells to which reserves

have been assigned.

----------------------------------------------------------------------------

Future Net Revenue

(after ETAP and taxes)(1) (2)

----------------------------------------------------------------------------

Net Remaining

Reserve Gross Remaining Reserves (after

Category Reserves ETAP)(1) Undiscounted 5% 10%

----------------------------------------------------------------------------

(barrels) (barrels) (M$) (M$) (M$)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Proved

Developed 2,285,900 191,200 10,754 9,944 9,246

----------------------------------------------------------------------------

Proved

Undeveloped 3,363,800 281,400 10,539 8,014 6,106

----------------------------------------------------------------------------

Total

Proved 5,649,700 472,600 21,293 17,958 15,352

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Probable 5,567,100 419,000 23,002 17,321 13,271

----------------------------------------------------------------------------

Total

Proved +

Probable 11,216,800 891,600 44,295 35,279 28,623

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Possible 7,032,600 428,400 26,159 17,510 12,242

----------------------------------------------------------------------------

Total

Proved +

Probable +

Possible 18,249,400 1,320,000 70,454 52,789 40,865

----------------------------------------------------------------------------

1. Under the PSA, the Company receives a share of the production under a

sliding scale formula. The calculation includes a cost oil component

which enables the Company to recover all of its costs and a profit

sharing component whereby profits are split between the Company and

ETAP. In addition, ETAP is responsible for paying all income taxes

arising from production from the Concession.

2. It should not be assumed that the estimates of future net revenues

presented herein represent the fair market value of the reserves.

Changes in the Net Present Value ("NPV") of future net revenues are summarized

below:

----------------------------------------------------------------------------

NPV (M$) December 31, 2013(1) December 31, 2012(2) Increase

------------------------------------------------------------

Undiscounted NPV10 Undiscounted NPV10 Undiscounted NPV10

----------------------------------------------------------------------------

Proved 21,293 15,352 19,370 14,410 9.9% 6.5%

----------------------------------------------------------------------------

Proved +

Probable 44,295 28,623 38,402 25,720 15.3% 11.3%

----------------------------------------------------------------------------

Proved +

Probable+Possib

le 70,454 40,865 60,223 37,385 17.0% 9.3%

----------------------------------------------------------------------------

1. Information derived from the Report.

2. Information derived from the 2012 Report.

Crude produced from the TT Field sells at close to Brent prices. Future revenues

in the Report were estimated using the following price forecast for Brent crude:

----------------------------------------------------------------------------

2014 2015 2016 2017 2018

----------------------------------------------------------------------------

C$/barrel (1) 110.53 107.89 105.47 102.84 103.16

----------------------------------------------------------------------------

1. Assumes exchange rate US$1.00 = C$1.05.

Contingent Resources

In the Report reserves have only been assigned to a portion of the mapped field

area with the remaining field areas classified as contingent resources:

----------------------------------------------------------------------------

Gross Contingent

Resources Company Contingent

Resource Category (bbls) Resources (bbls)

----------------------------------------------------------------------------

Low 10,816,000 782,300

----------------------------------------------------------------------------

Best 13,520,000 977,900

----------------------------------------------------------------------------

High 18,026,000 1,303,800

----------------------------------------------------------------------------

Because of uncertainty of commerciality, the estimated Contingent resources

cannot be classified as reserves as of the effective date of this report.

Uncertainties include - but are not limited to - insufficient delineation of the

discovered oil and gas accumulation as well as a lack of demonstrated funding.

The Contingent resource estimates are provided as a means of comparison to other

Contingent resources and are not to be directly compared to reserves. There is

no certainty that it will be commercially viable to produce any portion of the

resources and the economic status of contingent resources summarized in this

report is undetermined.

The Report was prepared by InSite, an independent international petroleum

consulting firm registered in the province of Alberta. Summary data from the

Report will be filed on the Company's SEDAR profile at www.sedar.com on or

around March 7, 2014 and will also be available on the Company's website at

www.cygamenergy.com. CYGAM recommends that readers refer to the summary data as

it details the process for determining the reserve estimates, the assumptions

underpinning the modeling, and defines technical terms used.

"Additional data from wells drilled in 2013 together with longer production

history has increased our knowledge of the property and it is gratifying that we

have more than replaced production over the past year," said David Taylor,

President and CEO of CYGAM. "The joint venture has now embarked on a third phase

of development drilling with six vertical wells planned to be completed and put

on production during the first half of 2014."

About InSite Petroleum Consultants Ltd.

InSite is a Calgary based petroleum consulting firm who specialize in evaluation

of reserves and resources for domestic and international oil and gas companies,

governments, financial institutions and the investment industry. For more detail

on InSite, please visit their website, at: www.insitepc.com.

About CYGAM Energy Inc.

CYGAM is a Calgary based exploration company with extensive international

exploration permits and a producing property in Tunisia. The main focus of CYGAM

is the acquisition, exploration and development of international oil and gas

permits, primarily in Italy, Tunisia and the Mediterranean Basin. CYGAM

currently holds various interests in five exploratory permits in Italy plus

three exploratory permits and the BBT Production Concession in Tunisia which

together encompass a total of approximately 2.5 million gross acres.

Cautionary Statements

In the interest of providing shareholders and potential investors with

information regarding CYGAM, including management's assessment of the future

plans and operations of CYGAM, certain statements contained in this news release

constitute forward-looking statements or information (collectively

"forward-looking statements") within the meaning of applicable securities

legislation. In particular, this news release contains, without limitation,

forward-looking statements pertaining to: future drilling operations; production

and reserve growth; reserve, resource and future net revenue estimates; and the

filing of the summary data from the Report.

With respect to the forward-looking statements contained in this news release,

CYGAM has made assumptions regarding, among other things: the ability of the

Operator to continue to operate in Tunisia with limited logistical, security and

operational issues; the ability of the Operator to obtain equipment in a timely

manner to carry out drilling and completion operations; the results of

geological, geophysical and reservoir analysis and testing operations; commodity

prices; the receipt of required regulatory approvals; global economic

conditions. Although CYGAM believes that the expectations reflected in the

forward-looking statements contained in this news release, and the assumptions

on which such forward-looking statements are made, are reasonable, there can be

no assurance that such expectations will prove to be correct. Readers are

cautioned not to place undue reliance on forward-looking statements included in

this news release, as there can be no assurance that the plans, intentions or

expectations upon which the forward-looking statements are based will occur. By

their nature, forward-looking statements involve numerous assumptions, known and

unknown risks and uncertainties that contribute to the possibility that the

forward-looking statements will not occur, which may cause CYGAM's actual

performance and financial results in future periods to differ materially from

any estimates or projections of future performance or results expressed or

implied by such forward-looking statements.

These risks and uncertainties include, without limitation: political and

security risks associated with the Operator's Tunisian operations, risks

associated with oil and gas exploration, development, exploitation, production,

marketing and transportation, loss of markets, volatility of commodity prices,

currency fluctuations, imprecision of reserve and resource estimates, results of

geological, geophysical and reservoir analysis and testing operations, the

inability to retain drilling rigs and other services, capital expenditure costs,

including drilling, completion and facilities costs, unexpected decline rates in

wells, delays in projects and/or operations, wells not performing as expected,

delays resulting from or inability to obtain the required regulatory approvals,

CYGAM's ability to access sufficient capital from internal and external sources,

results of seismic and drilling operations; and risks associated with the

operation of CYGAM's assets by third parties, including the limited ability of

CYGAM to exercise influence over the operation of those assets or their

associated costs, the timing and amount of capital expenditures, the operator's

expertise and financial resources, the approval of other participants, and the

selection of technology and risk management practices. As a consequence, actual

results may differ materially from those anticipated in the forward-looking

statements. Readers are cautioned that the forgoing list of factors is not

exhaustive. Additional information on these and other factors that could affect

CYGAM's operations and financial results are included in reports on file with

Canadian securities regulatory authorities and may be accessed through the SEDAR

website (www.sedar.com). Furthermore, the forward-looking statements contained

in this news release are made as at the date of this news release and CYGAM does

not undertake any obligation to update publicly or to revise any of the

forward-looking statements, whether as a result of new information, future

events or otherwise, except as may be required by applicable securities laws.

All "total oil in place" other than, cumulative production, reserves and

contingent resources has been categorized as undiscovered.

Definitions of Reserves Categories:

-- "Proved" reserves are those reserves that can be estimated with a high

degree of certainty to be recoverable. It is likely that the actual

remaining quantities recovered will exceed the estimated proved

reserves.

-- "Probable" reserves are those additional reserves that are less certain

to be recovered than proved reserves. It is equally likely that the

actual remaining quantities recovered will be greater or less than the

sum of the estimated proved plus probable reserves.

-- "Possible" reserves are those additional reserves that are less certain

to be recovered than probable reserves. There is a 10% probability that

the quantities actually recovered will equal or exceed the sum of proved

plus probable plus possible reserves.

"Contingent Resources" are those quantities of oil estimated, as of a given

date, to be potentially recoverable from known accumulations using established

technology or technology under development, but which are not currently

considered to be commercially recoverable due to one or more contingencies.

Contingencies may include factors such as distance from existing production,

economic, legal, environmental, political, and regulatory matters or a lack of

markets. Some of the specific contingencies identified by InSite to convert

contingent resources into reserves include, without limitation, insufficient

delineation of the discovered oil and gas accumulation as well as a lack of

demonstrated funding. It is also appropriate to classify as contingent resources

the estimated discovered recoverable quantities associated with a project in the

early evaluation stage. Contingent resources are further classified in

accordance with the level of certainty associated with the estimates and may be

sub classified based on project maturity and/or characterized by their economic

status.

Uncertainty Ranges are described by the COGEH as low, best, and high estimates

for reserves and resources as follows:

Low Estimate: This is considered to be a conservative estimate of the quantity

that will actually be recovered. It is likely that the actual remaining

quantities recovered will exceed the low estimate. If probabilistic methods are

used, there should be at least a 90 percent probability (P90) that the

quantities actually recovered will equal or exceed the low estimate.

Best Estimate: This is considered to be the best estimate of the quantity that

will actually be recovered. It is equally likely that the actual remaining

quantities recovered will be greater or less than the best estimate. If

probabilistic methods are used, there should be at least a 50 percent

probability (P50) that the quantities actually recovered will equal or exceed

the best estimate.

High Estimate: This is considered to be an optimistic estimate of the quantity

that will actually be recovered. It is unlikely that the actual remaining

quantities will exceed the high estimate. If probabilistic methods are used,

there should be at least a 10 percent probability (P10) that the quantities

actually recovered will equal or exceed the high estimate.

The "reserves replacement ratio" is determined by dividing the yearly change in

reserves before production by the actual annual production for the year (eg

Total Proved plus Probable (((807,100-547,100)+89,762)/89,762=3.9).

Disclosure provided herein in respect of BOEs may be misleading, particularly if

used in isolation. A BOE conversion ratio of 6 Mcf: 1 Bbl is based on an energy

equivalency conversion method primarily applicable at the burner tip and does

not represent a value equivalency at the wellhead. Given that the value ratio

based on the current price of crude oil as compared to natural gas is

significantly different from the energy equivalency of 6:1, utilizing a

conversion on a 6:1 basis may be misleading as an indication of value.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this release

FOR FURTHER INFORMATION PLEASE CONTACT:

CYGAM Energy Inc

David Taylor

President and Chief Executive Officer

403 605 5117

david.taylor@cygamenergy.com

CYGAM Energy Inc

Al Robertson

Chief Financial Officer

403 452 6883

al.robertson@cygamenergy.com

www.cygamenergy.com

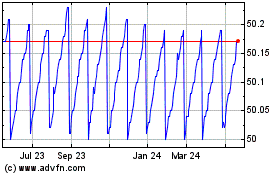

Purpose High Interest Sa... (TSX:PSA)

Historical Stock Chart

From Apr 2024 to May 2024

Purpose High Interest Sa... (TSX:PSA)

Historical Stock Chart

From May 2023 to May 2024