Sprott Physical Uranium Trust Announces Updated "At-The-Market" Equity Program

September 13 2021 - 5:32PM

Sprott Asset Management LP (“Sprott Asset Management”), on behalf

of the Sprott Physical Uranium Trust (TSX: U.UN) (TSX: U.U) (the

“Trust” or “SPUT”), a closed-ended trust created to invest and hold

substantially all of its assets in physical uranium, today

announced that it has updated its at-the-market equity program (the

“ATM Program”) to issue up to an additional US$1.0 billion of units

of the Trust (“Units”) in Canada.

Distributions under the ATM Program, if any,

will be completed in accordance with the terms of an amended and

restated sales agreement (the “Sales Agreement”) dated September

13, 2021 between Sprott Asset Management (as the manager of the

Trust), the Trust, Cantor Fitzgerald Canada Corporation and Virtu

ITG Canada Corp. (collectively, the “Agents”). The Sales Agreement

is available at www.sedar.com.

Sales of Units through the Agents, acting as

agent, will be made through “at the market” issuances on the

Toronto Stock Exchange (“TSX”) or other existing trading markets in

Canada at the market price prevailing at the time of each sale,

and, as a result, sale prices may vary. The Agents may only sell

Units on marketplaces in Canada.

The volume and timing of distributions under the

ATM Program, if any, will be determined in the Trust's sole

discretion. The Trust intends to use the proceeds from the ATM

Program, if any, to acquire physical uranium in accordance with the

Trust's objective and subject to the Trust's investment and

operating restrictions.

The offering under the ATM Program is being made

pursuant to a prospectus supplement dated September 13, 2021 (the

“Prospectus Supplement”) to the Trust’s Canadian amended and

restated short form base shelf prospectus dated September 9, 2021

(the “Base Shelf Prospectus”, and together with the Prospectus

Supplement, the “Offering Documents”). The Offering Documents are

available at www.sedar.com.

Before you invest, you should read the Offering

Documents and other documents that the Trust has filed for more

complete information about the Trust, the Sales Agreement and the

ATM Program.

Listing of the Units sold pursuant to the ATM

Program on the TSX will be subject to fulfilling all applicable

listing requirements.

This press release shall not constitute an offer

to sell or a solicitation of an offer to buy, nor shall there be

any sale of these securities in any jurisdiction in which an offer,

solicitation or sale would be unlawful prior to registration or

qualifications under the securities laws of any such

jurisdiction.

About Sprott Asset Management and the

TrustSprott Asset Management, a subsidiary of Sprott Inc.

(NYSE/TSX: SII), is the investment manager to the Trust. Important

information about the Trust, including its investment objectives

and strategies, applicable management fees, and expenses, is

contained in the Offering Document and the management information

circular of Uranium Participation Corporation, both of which can be

found on www.sprott.com/uranium and on www.sedar.com. Commissions,

management fees, or other charges and expenses may be associated

with investing in the Trust. The performance of the Trust is not

guaranteed, its value changes frequently and past performance is

not an indication of future results.

To learn more about the Trust, please visit

www.sprott.com/uranium.

Caution Regarding Forward-Looking

StatementsThis press release contains forward-looking

information within the meaning of applicable Canadian securities

laws ("forward-looking statements"). Forward-looking statements in

this press release include, without limitation, statements

regarding the ATM Program, including the intended use of proceeds

from any sale of Units, and the timing and ability of the Trust to

obtain all necessary regulatory approvals, the size and liquidity

of the Trust and value creation for unitholders. With respect to

the forward-looking statements contained in this press release, the

Trust has made numerous assumptions regarding, among other things:

the price of uranium and anticipated costs and the impact of the

COVID-19 pandemic on the Trust's business, financial condition and

results of operations. While the Trust considers these assumptions

to be reasonable, these assumptions are inherently subject to

significant business, economic, competitive, market and social

uncertainties and contingencies. Additionally, there are known and

unknown risk factors that could cause the Trust's actual results,

performance or achievements to be materially different from any

future results, performance or achievements expressed or implied by

the forward-looking statements contained in this press release. A

discussion of risks and uncertainties facing the Trust appears in

the Offering Documents, each as updated by the Trust's continuous

disclosure filings, which are available at www.sedar.com. All

forward-looking statements herein are qualified in their entirety

by this cautionary statement, and the Trust disclaims any

obligation to revise or update any such forward-looking statements

or to publicly announce the result of any revisions to any of the

forward-looking statements contained herein to reflect future

results, events or developments, except as required by law.

For more information:

Glen WilliamsManaging Director, Investor and

Institutional Client RelationsTel: 416.943.4394Email:

gwilliams@sprott.com

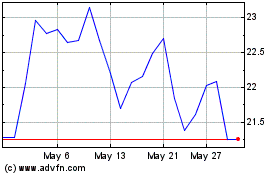

Sprott Physical Uranium (TSX:U.U)

Historical Stock Chart

From Oct 2024 to Nov 2024

Sprott Physical Uranium (TSX:U.U)

Historical Stock Chart

From Nov 2023 to Nov 2024