Apogee Minerals Ltd. (“

Apogee” or the

“

Company”) (TSXV: APMI) announces that the Company

has amended the minimum financing requirements and adjusted the

consolidation ratio applicable to the reverse take-over transaction

described in its press releases dated January 25, 2022, March 17,

2022 and May 30, 2022.

The Company, Alto Verde Copper Inc.

(“Alto Verde”) and 1000136714 Ontario Inc.

(“APMI Subco”), a wholly-owned

subsidiary of the Company, entered into a definitive business

combination agreement dated March 17, 2022, as amended on May 27,

2022 (the “Definitive Agreement”), pursuant to

which, following a consolidation of the Company’s common shares on

the basis described below, the Company will acquire all the issued

and outstanding shares in the capital of Alto Verde (the

“Transaction”). Pursuant to the Definitive

Agreement, the Transaction is to be effected by way of a

“three-cornered” amalgamation, in which: (a) APMI Subco will

amalgamate with Alto Verde to form an amalgamated company

(“Amalco”); (b) all issued and outstanding common

shares of Alto Verde will be exchanged for post-Consolidation

common shares of the Company on a 1:1 basis (“Resulting

Issuer Shares”); (c) all outstanding convertible

securities to purchase Alto Verde common shares will be exchanged,

on a 1:1 post-Consolidation basis, for equivalent securities; and

(d) Amalco will become a wholly-owned subsidiary of the

Company.

The parties have entered into an amendment to

the Definitive Agreement in order to: (a) update the condition that

Alto Verde must complete one or more private placements for

aggregate gross proceeds of at least CAD $2.25 million; (b) adjust

the ratio of consolidation of the Company’s common shares from a

4.25:1 basis as originally contemplated to a 2:1 basis (the

“Consolidation”); and (c) to update the finder’s

fee payable upon closing of the Transaction to 1,070,000

post-Consolidation Resulting Issuer Shares. The finder’s fee is

payable to an arm’s length party.

The Transaction and the Financing (as defined

below) remain subject to the approval of the TSX Venture Exchange

(the “TSXV”).

Financing:

Prior to the completion of the Transaction, Alto

Verde is now expected to complete a non-brokered private placement

of a minimum of 7,500,000 subscription receipts

(“Subscription Receipts”) at a price of $0.30 per

Subscription Receipt for aggregate gross proceeds to Alto Verde of

a minimum of $2,250,000 (the “Financing”). The

Subscription Receipts will be issued pursuant to subscription

agreements entered into by Alto Verde and each of the subscribers.

Each Subscription Receipt will be automatically converted, without

payment of additional consideration or further action by the holder

thereof, into one Alto Verde common share and one warrant to

purchase one additional Alto Verde common share, at an exercise

price of $0.40 per Alto Verde common share for a period of 24

months from the Financing closing date, upon satisfaction of the

escrow release conditions in accordance with the subscription

agreements.

Further details regarding the conversion terms

of the Subscription Receipts are disclosed in the Company’s new

release dated March 17, 2022.

Additionally, as previously announced in the

Company’s news release dated March 17, 2022, it is anticipated that

a finders’ fee will be paid to certain arm’s length finders in

relation to the Financing consisting of: (a) a cash payment in an

amount equal to 7% of the gross proceeds of the Financing directly

resulting from the introductions of such finders; and (ii) that

number of common share purchase warrants as is equal to 7% of the

Subscription Receipts sold pursuant to the Financing directly

resulting from the introductions of such finders (the

“Finder Warrants”). The Finder Warrants will now

be exercisable at a price of $0.30 per Resulting Issuer Share for a

period of 24 months from the Financing closing date. The finders

will consist of registered arm’s length dealers or other permitted

individuals under Canadian securities laws.

Further details regarding the Transaction,

Financing and Alto Verde are disclosed in the Company’s news

releases dated January 25, 2022, March 17, 2022 and May 30,

2022.

About Alto

Verde:

Alto Verde Copper Inc. is a private mining

company focused on its portfolio of prospective exploration assets

located in the Central Volcanic Zone, within the prolific Chilean

Copper belt.

Alto Verde’s portfolio includes three copper

exploration projects: Pitbull in the Tarapaca Region and Tres

Marias and Zenaida in the Antofagasta Region. Alto Verde holds a

significant land package covering an area of 19,850 hectares with

the projects situated proximal to several of the world’s largest

mines.

Alto Verde’s leadership team is comprised of

senior mining industry executives who have a wealth of technical

and capital markets experience and a strong track record of

discovering, financing, developing, and operating mining projects

on a global scale. Alto Verde is committed to sustainable and

responsible business activities in line with industry best

practices, supportive of all stakeholders, including the local

communities in which it operates.

About Apogee Minerals

Ltd.:

Apogee Minerals Ltd. is a mineral exploration

company. Our goal is to build shareholder value through mineral

project acquisitions and advancement, as well as new mineral

discoveries.

To find out more about Apogee Minerals Ltd.

(TSX-V: APMI) visit the Company’s website:

www.apogeemineralsltd.com

Apogee Minerals Ltd.

“Jim

Pettit”

James PettitCEO and Director

For further information, please contact:

Apogee Minerals Ltd. Riley Trimble,

DirectorEmail: rtrimble@sentinelmarket.com Tel: (604) 416-2978

Alto Verde Copper Inc. Chris Buncic, President,

CEO, & DirectorEmail: investors@altoverdecopper.com

Completion of the Transaction is subject to a

number of conditions, including but not limited to, TSXV acceptance

and if applicable, disinterested shareholder approval. Where

applicable, the Transaction cannot close until the required

shareholder approval is obtained. There can be no assurance that

the transaction will be completed as proposed or at all.

Investors are cautioned that, except as

disclosed in the management information circular or filing

statement to be prepared in connection with the Transaction, any

information released or received with respect to the Transaction

may not be accurate or complete and should not be relied upon.

Trading in the securities of Apogee Minerals Ltd. should be

considered highly speculative. The TSXV has in no way passed upon

the merits of the proposed transaction and has neither approved nor

disapproved the contents of this news release.

The TSXV has in no way passed upon the merits of

the Transaction and has neither approved nor disapproved the

contents of this news release.

Neither the TSXV nor its

Regulation Services Provider (as that term

is defined in the policies of the TSXV) accepts responsibility for

the adequacy or accuracy of this news release.

Cautionary Statements Regarding

Forward-Looking Information

This news release contains forward-looking

information within the meaning of Canadian securities laws. Such

information includes, without limitation, information regarding the

structure of the Transaction and the Financing. Although the

Company believes that such information is reasonable, it can give

no assurance that such expectations will prove to be correct.

Forward looking information is typically

identified by words such as: “believe”, “expect”, “anticipate”,

“intend”, “estimate”, “postulate” and similar expressions, or are

those, which, by their nature, refer to future events. The Company

cautions investors that any forward-looking information provided by

the Company is not a guarantee of future results or performance,

and that actual results may differ materially from those in forward

looking information as a result of various factors, including, but

not limited to: the Company’s ability to complete the Transaction;

Alto Verde’s ability to complete the Financing, the expected timing

and terms of the Transaction and the Financing; the state of the

financial markets for the Company’s securities; the state of the

natural resources sector in the event the Transaction is completed;

recent market volatility and potentially negative capital raising

conditions resulting from the continued COVID-19 pandemic and risks

relating to the extent and duration of such pandemic and its impact

on global markets; the conflict in Eastern Europe; the Company’s

ability to raise the necessary capital or to be fully able to

implement its business strategies; and other risks and factors that

the Company is unaware of at this time.

The forward-looking statements contained in this

news release are made as of the date of this news release. The

Company disclaims any intention or obligation to update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise, except as required by

law.

Apogee Minerals (TSXV:APMI)

Historical Stock Chart

From Nov 2024 to Dec 2024

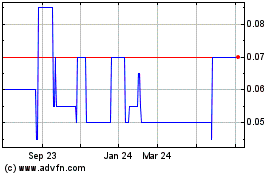

Apogee Minerals (TSXV:APMI)

Historical Stock Chart

From Dec 2023 to Dec 2024