Aequus Pharmaceuticals Inc. (TSX-V: AQS, OTCQB: AQSZF) (“Aequus” or

the “Company”), a specialty pharmaceutical company with a focus on

developing, advancing and promoting differentiated products, today

reported financial results for the three months ended March 31,

2020 (“First Quarter 2020”) and associated Company developments.

Unless otherwise noted, all figures are in Canadian currency.

Today the Company reported record quarterly

revenues of $579,450 for Q1 2020, a 76% increase in revenues

compared to Q1 2019,” said Doug Janzen, Chairman and CEO of Aequus.

“We ended 2019 with strong sales momentum and are pleased to report

a record quarter in Q1 2020, almost doubling revenues over the same

period 12 months ago. The revenue growth was primarily due to

increases in market access and generally higher sales volume. We

also have progressed our launch plans for the Evolve line up of

dry-eye products and recently completed a large patient and

physician engagement survey which gave us a positive indication of

demand and has provided us the insights necessary for a successful

launch.”

Operational Highlights

Revenues in Fourth Quarter 2020 were $579,450,

an increase of 76% compared to revenue of $328,996 recognized in

First Quarter 2019. The increases can be attributed to increased

product acceptance in certain provinces which occurred during the

last quarter of 2019.

In Q1 2020, the Company reduced research and

marketing expenses as it continues to focus current efforts on

growing commercial revenues. Responding to the inaccessibility of

physicians due to COVID-19, the Company saw a reduction in sales

and marketing expenses with field representatives not able to

travel to see customers in person as of the beginning of March

2020. As our promoted products treat chronic conditions, this

temporary reduction in physician interactions is not expected to

have a significant impact on revenues.

The Company reported a loss of $405,815 for

First Quarter 2020, a decrease of 44% from the loss of $730,215 in

First Quarter 2019. The lower loss was primarily due to higher

sales and an overall decrease in expenses. The improvement in loss

was offset by $152,854 in combined interest and accretion expenses

recognized in general administration expenses which related to the

debenture issued May 2, 2019. The Company did not recognize any

debenture related expenses during First Quarter 2019.

Sales and marketing costs in First Quarter 2020

were $451,146 when compared to $509,096 in First Quarter 2019, a

decrease of 11% or $57,950. The majority of the decrease related to

a reduction in sales activities due to the COVID-19 pandemic

impacts and the removal of Zepto from the Company’s product line.

Non-cash expenses for depreciation and amortization and share-based

payments in First Quarter 2020 were $43,886 and $31,948

respectively, compared to $47,400 and $34,119 respectively in First

Quarter 2019.

Research and development project maintenance

expenses in First Quarter 2020 were $14,317 when compared to

$69,078 in First Quarter 2019, a decrease of 79% or $54,762. The

change was attributable to a decrease in resources directed toward

development programs and is the result of the Company’s focus

moving toward revenue generating commercial products.

General administration expenses in the First

Quarter 2020 were $522,693 when compared to $482,351 in First

Quarter 2019, an increase of 8% or $140,162 due to the May 2019

Convertible Debentures that were issued, resulting in interest and

accretion expenses relating to the debenture of $69,735 and $93,651

respectively being recognized in First Quarter 2020, whereas no

similar debt existed in First Quarter 2019. Legal expenses were

$18,457 or 48% higher in First Quarter 2020 relative to the same

period last year to support business development efforts. The

Company recognized cost reductions in all other expense categories

generally due to our response to COVID-19 and reduced business

activity during the quarantine period relative to the comparable

period last year.

Correction Notice:

The news release dated April 29, 2020

incorrectly stated that “On May 2, 2020, the Company issued

Convertible Debenture units for gross proceeds of

$2,348,000”. The statement should have read “On May 2, 2019,

the Company issued Convertible Debenture units for gross proceeds

of $2,348,000” to be consistent with other references in the

release. We apologize for any confusion that resulted from this

disclosure.

ABOUT AEQUUS PHARMACEUTICALS INC.

Aequus Pharmaceuticals Inc. (TSX-V: AQS, OTCQB:

AQSZF) is a growing specialty pharmaceutical company focused on

developing and commercializing high quality, differentiated

products. Aequus has grown its sales and marketing efforts to

include several commercial products in ophthalmology and

transplant. Aequus plans to build on its Canadian commercial

platform through the launch of additional products that are either

created internally or brought in through an acquisition or license;

remaining focused on highly specialized therapeutic areas. For

further information, please visit www.aequuspharma.ca.

FORWARD-LOOKING STATEMENT DISCLAIMER

This release may contain forward-looking

statements or forward-looking information under applicable Canadian

securities legislation that may not be based on historical fact,

including, without limitation, statements containing the words

“believe”, “may”, “plan”, “will”, “estimate”, “continue”,

“anticipate”, “intend”, “expect”, “potential” and similar

expressions. Forward- looking statements are necessarily based on

estimates and assumptions made by us in light of our experience and

perception of historical trends, current conditions and expected

future developments, as well as the factors we believe are

appropriate. Forward-looking statements include but are not limited

to statements relating to: the implementation of our business model

and strategic plans; revenue growth trends into the future;

expected timing for product launch; the Company’s expected

revenues; the continued revenue growth of its products; given our

current run rate we expect to offset that step down in the

following quarters; the regulatory approval of the Evolve line of

products expected in 2020; a regulatory audit of Medicom’s

manufacturing facility required by Health Canada to be completed in

2020; ongoing discussions with potential partners to further grow

our product portfolio; announcements regarding a medically focused

cannabis collaboration and the timing thereof. Such statements

reflect our current views with respect to future events and are

subject to risks and uncertainties and are necessarily based upon a

number of estimates and assumptions that, while considered

reasonable by Aequus, are inherently subject to significant

business, economic, competitive, political and social uncertainties

and contingencies. Many factors could cause our actual results,

performance or achievements to be materially different from any

future results, performance, or achievements that may be expressed

or implied by such forward-looking statements. In making the

forward looking statements included in this release, the Company

has made various material assumptions, including, but not limited

to: obtaining positive results of clinical trials; obtaining

regulatory approvals; general business and economic conditions; the

Company’s ability to successfully out license or sell its current

products and in-license and develop new products; the assumption

that the Company’s current good relationships with its manufacturer

and other third parties will be maintained; the availability of

financing on reasonable terms; the Company’s ability to attract and

retain skilled staff; market competition; the products and

technology offered by the Company’s competitors; and the Company’s

ability to protect patents and proprietary rights. In evaluating

forward looking statements, current and prospective shareholders

should specifically consider various factors set out herein and

under the heading “Risk Factors” in the Company’s Annual

Information Form dated April 28, 2020, a copy of which is available

on Aequus’ profile on the SEDAR website at www.sedar.com, and as

otherwise disclosed from time to time on Aequus’ SEDAR profile.

Should one or more of these risks or uncertainties, or a risk that

is not currently known to us materialize, or should assumptions

underlying those forward-looking statements prove incorrect, actual

results may vary materially from those described herein. These

forward-looking statements are made as of the date of this release

and we do not intend, and do not assume any obligation, to update

these forward-looking statements, except as required by applicable

securities laws. Investors are cautioned that forward-looking

statements are not guarantees of future performance and are

inherently uncertain. Accordingly, investors are cautioned not to

put undue reliance on forward looking statements.

VistitanTM: Trademark owned or used under

license by Sandoz Canada Inc.

CONTACT INFORMATION Aequus Investor Relations

Email: investors@aequuspharma.ca Phone: 604-336-7906

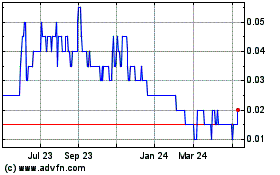

Aequus Pharmaceuticals (TSXV:AQS)

Historical Stock Chart

From Jan 2025 to Feb 2025

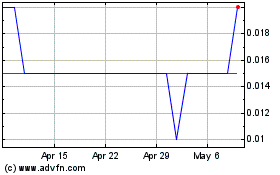

Aequus Pharmaceuticals (TSXV:AQS)

Historical Stock Chart

From Feb 2024 to Feb 2025