Argentex Mining Issues 474,171 Common Shares on Partial Conversion of US$2.3M Convertible Debenture

February 18 2014 - 12:30PM

Marketwired

Argentex Mining Issues 474,171 Common Shares on Partial Conversion

of US$2.3M Convertible Debenture

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Feb 18, 2014) -

Argentex Mining Corporation ("Argentex" or the "Company")

(TSX-VENTURE:ATX)(OTCQB:AGXMF) is pleased to announce the

conversion of an additional US$130,000 of the outstanding principal

amount of the Convertible Debenture held by Austral Gold Argentina

S.A. In the partial conversion, which was effected on February 17,

2014 at a conversion price of US$0.274163 per Unit, Argentex issued

474,171 Units, consisting of 474,171 common shares and 237,086

warrants. Each whole warrant entitles the holder to purchase one

additional common share at an exercise price of CDN$0.40 until July

2, 2018.

Details about the

Convertible Debenture and the private placement in which it was

issued were previously disclosed in a press release dated July 3,

2013.

After adjusting for

this partial conversion, the principal balance remaining under the

Convertible Debenture is US$130,000, which is anticipated to be

repaid in March of 2014. Under the terms of the Convertible

Debenture, this amount can be repaid only by conversion into

additional Units at the conversion price of US$0.274163 per Unit.

These conversions coincide with repayments to Argentex of principal

amounts outstanding under a U.S. dollar linked loan intended to

minimise currency risk. Loan repayments are made in Argentine pesos

in amounts linked to the value of the U.S. dollar at the time of

repayment.

None of the

securities issued upon the partial conversion have been or will be

registered under the United States Securities Act of 1933, as

amended (the "Act"), and none of them may be offered or sold in the

United States absent registration or an applicable exemption from

the registration requirements of the Act. These securities are

"restricted securities" under the Act and are subject to a hold

period in the United States of at least six months from the date

issued. Subject to certain exceptions, there are additional

restrictions on transfer of these securities described in an

Investment Agreement between Argentex and Austral Gold Limited. The

Investment Agreement, together with all of the other material

agreements related to the July 2, 2013 financing, are available on

SEDAR at www.sedar.com.

In addition,

Argentex announces the departure of Peter Ball to pursue other

opportunities. Peter Ball has resigned as Corporate Secretary and

EVP Corporate Development effective March 1, 2014. The Company

wishes him well in his new endeavors. Jeff Finkelstein, the

Company's Chief Financial Officer and Treasurer will assume the

additional responsibility of Corporate Secretary.

About Argentex

Argentex Mining

Corporation is an exploration company focused on developing its

advanced Pinguino silver-gold project located in Santa Cruz,

Patagonia, Argentina. In total, Argentex owns 100% of 100,000+

hectares of highly prospective land located in the Santa Cruz and

Rio Negro provinces. Shares of Argentex common stock trade under

the symbol ATX on the TSX Venture Exchange and under the symbol

AGXMF on the OTCQB.

Neither TSX Venture

Exchange nor its Regulation Services Provider (as that term is

defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

On behalf of

Argentex Mining Corporation:

Michael

Brown, President and CEO

Statements in

this news release that are not historical facts are forward-looking

statements that are subject to risks and uncertainties. Words such

as "expects", "intends", "plans", "may", "could", "should",

"anticipates", "likely", "believes" and words of similar import

also identify forward-looking statements. Forward-looking

statements in this news release include the statement after

adjusting for this partial conversion, the principal balance

remaining under the Convertible Debenture is US$130,000 and a

repayment of US$130,000 is anticipated in March of 2014 and Jeff

Finkelstein, the Company's Chief Financial Officer and Treasurer

will assume the additional responsibility of Corporate Secretary.

Actual results may differ materially from those currently

anticipated due to a number of factors beyond the Company's

control. These risks and uncertainties include, among other things,

management's assumptions about the availability of the necessary

consultants and capital and the risks inherent in Argentex's

operations, including the risks that the Company may not find any

minerals in commercially feasible quantity or raise enough money to

fund its exploration plans. These and other risks are described in

the Company's Annual Information Form and other public disclosure

documents filed on the SEDAR website maintained by the Canadian

Securities Administrators and the EDGAR website maintained by the

Securities and Exchange Commission.

Argentex Mining CorporationMichael BrownPresident and

CEO604-568-2496 (ext. 105) or 1-888-227-5285 (ext.

105)604-568-1540mike@argentexmining.comwww.argentexmining.com

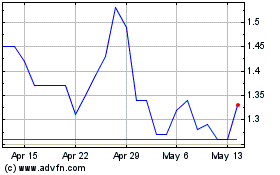

Atex Resources (TSXV:ATX)

Historical Stock Chart

From Feb 2025 to Mar 2025

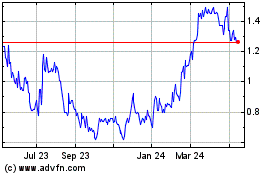

Atex Resources (TSXV:ATX)

Historical Stock Chart

From Mar 2024 to Mar 2025