Crowflight Announces Underwritten Flow-Through Private Placement Financing of $4 Million

December 02 2008 - 6:41AM

Marketwired Canada

NOT FOR DISSEMINATION IN THE UNITED STATES OR THROUGH U.S. NEWSWIRE SERVICES

CROWFLIGHT MINERALS INC. (Crowflight, the Company) (TSX VENTURE:CML) is pleased

to announce that it has entered into an agreement with a syndicate of

underwriters led by Macquarie Capital Markets Canada Ltd. and including Cormark

Securities Inc. and TD Securities Inc. (collectively the "Underwriters"). Under

the agreement, the Underwriters will agree to find substitute purchasers or

purchase, on an underwritten private placement basis, 23,615,000 common shares

of the Company which qualify as flow-through shares for the purposes of the

Income Tax Act (Canada) (the "Flow-Through Shares") at a price of $0.18 (the

"Issue Price") for each Flow-Through Share for total gross proceeds from the

private placement of $4,250,700. Crowflight will grant the Underwriters an

option, to purchase up to an additional 15,278,000 Flow-Through Shares

($2,750,040), exercisable at the Issue Price at any time up to 24 hours prior to

the closing of the offering (the "Closing Date").

Commented Mike Hoffman, President and CEO of Crowflight, "The proceeds of the

flow-through financing will be used primarily for the continued development of

the main access ramp from surface to the 1,000 foot level which is expected to

connect in June of 2009. The main ramp will facilitate access to multiple mining

areas and allow operational flexibility for material and personnel transport. In

addition, the completion of the ramp offers the potential for future expansion

of the mine."

Closing of the offering is anticipated to occur on or about December 17, 2008

and is subject to receipt of applicable regulatory approvals including approval

of the TSX Venture Exchange, or such other stock exchange as the common shares

of the Company are then listed for trading at the relevant time(s). The

Flow-Through Shares are subject to resale restrictions for a period of four

months plus one day from the Closing Date.

The Underwriters will receive a commission of 6.0% of the gross proceeds raised

in the brokered private placement in cash. The Underwriters will also receive

compensation options (the "Compensation Options") equal to 6.0% of that number

of Flow-Through Shares issued in connection with the brokered private placement.

Each Compensation Option will entitle the Underwriters to purchase one non

flow-through common share of the Company at a price of $0.18 per share for a

period of 24 months following the Closing Date.

The proceeds received by the Company from the sale of the Flow-Through Shares

will be used to incur eligible Canadian exploration expenses on the Bucko Lake

Nickel Project and other regional exploration that qualify as Canadian

exploration expenses for purposes of the Income Tax Act (Canada) and which will

be renounced in favour of the holders with an effective date of no later than

December 31, 2008.

Crowflight Minerals - Canada's Next Nickel Producer

Crowflight Minerals Inc. (TSX VENTURE:CML) is a Canadian junior mining company

that is bringing the Bucko Lake Nickel Mine near Wabowden, Manitoba into

production. Full commercial production is expected to be achieved at Bucko in

early 2009. The Company is also focused on nickel, copper and Platinum Group

Mineral (PGM) projects in the Thompson Nickel Belt and Sudbury Basin.

Cautionary Note on Forward-Looking Information

Except for statements of historical fact contained herein, the information in

this press release constitutes "forward-looking information" within the meaning

of Canadian securities law. Such forward-looking information may be identified

by words such as "plans", "proposes", "estimates", "intends", "expects",

"believes", "may", "will" and include without limitation, statements regarding

estimated capital and operating costs, expected production timeline, benefits of

updated development plans, foreign exchange assumptions and regulatory

approvals. There can be no assurance that such statements will prove to be

accurate; actual results and future events could differ materially from such

statements. Factors that could cause actual results to differ materially

include, among others, metal prices, competition, risks inherent in the mining

industry, and regulatory risks. Most of these factors are outside the control of

the Company. Investors are cautioned not to put undue reliance on

forward-looking information. Except as otherwise required by applicable

securities statutes or regulation, the Company expressly disclaims any intent or

obligation to update publicly forward-looking information, whether as a result

of new information, future events or otherwise.

Further information is available on the Company's website at www.crowflight.com.

This news release does not constitute an offer to sell or a solicitation of an

offer to sell any of the securities in the United States. The securities have

not been and will not be registered under the United States Securities Act of

1933, as amended (the "U.S. Securities Act") or any state securities laws and

may not be offered or sold within the United States or to U.S. Persons unless

registered under the U.S. Securities Act and applicable state securities laws or

an exemption from such registration is available.

TSX-V Trading Symbol: CML

Total Shares Outstanding: 269.7MM

Fully Diluted: 327.7MM

52-Week Trading Range: C$0.09 - $0.80

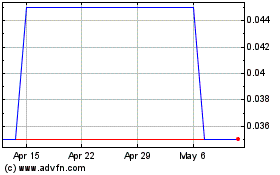

Canickel Mining (TSXV:CML)

Historical Stock Chart

From Jan 2025 to Feb 2025

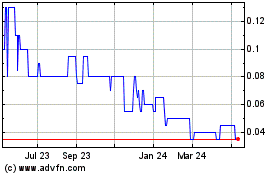

Canickel Mining (TSXV:CML)

Historical Stock Chart

From Feb 2024 to Feb 2025

Real-Time news about Canickel Mining Limited (TSX Venture Exchange): 0 recent articles

More Crowflight Minerals Inc. News Articles