Crowflight Now Debt Free After Closing Out Hedge

February 26 2009 - 12:55PM

Marketwired

CROWFLIGHT MINERALS INC. (the "Company") (TSX: CML) today announced

that it has monetized their hedge position of 2.97 million pounds

of nickel and corresponding foreign exchange price protection for

2009, thereby allowing the Company to repay its remaining CAD$7.6

million of debt. As a result of this transaction, Crowflight is now

debt free and adds another CAD$5.5 million in cash to its treasury

including the $3.0 million in the Debt Reserve Account.

Crowflight monetized the 2.97 million pound hedge at an average

realized price of US$7.74 per pound nickel (which included a

CAD$1.19 to US$1.00 exchange rate) for net proceeds of

CAD$10,134,725, with CAD$7,648,257.61 of the proceeds to be used to

pay off Crowflight's remaining debt.

Crowflight has also signed a letter of intent with Auramet

Trading LLC for a working capital line of credit of US$10 million.

Finalization of the facility remains subject to due diligence and

final binding agreements. Crowflight intends to use the facility as

an in-process working capital facility to support the Company's

mining activities and for general corporate purposes. Auramet,

based in Fort Lee, New Jersey, is a leading metals trading,

merchant banking and advisory firm specializing in the global

resource sector.

Commented Mike Hoffman, President and CEO of Crowflight, "We

have been very fortunate to have a partner such as RMB Resources

Inc. who arranged the $55 million debt facility early in 2008 with

FirstRand (Ireland) PLC, which allowed us to build the Bucko Lake

Nickel Mine. Working closely with RMB and managing exposures by

both debt and nickel hedges, Crowflight was able to create a

win-win situation in the midst of one of the most difficult times

in the nickel industry in many years. Monetizing the hedge that was

put in place to secure the debt facility, both in October 2008 and

this week, has allowed us to repay our $55 million debt facility

four years early, as well as generate over $25 million of

additional cash resources to Crowflight with no dilution to our

shareholders. We now have a first class mine and processing

facility, no debt and approximately 1 billion pounds of nickel

resources within 20 kilometres of Bucko. The working capital line

of credit from Auramet will assist Crowflight in managing working

capital as nickel concentrate is delivered to the smelter."

Crowflight continues shipping nickel concentrate from the Bucko

Lake Nickel Mine to Xstrata's smelter in Sudbury. Concentrate

quality continues to meet specifications and recovery has also

improved with recent milling, which recently achieved recoveries of

over 70%.

Crowflight Minerals - Canada's Newest Nickel Producer

Crowflight Minerals Inc. (TSX: CML) is a Canadian junior mining

company that is producing nickel at the Bucko Lake Nickel Mine near

Wabowden, Manitoba. Full commercial production is expected to be

achieved at Bucko early in the second quarter of 2009. The Company

is also focused on nickel, copper and Platinum Group Mineral (PGM)

projects in the Thompson Nickel Belt and Sudbury Basin.

Cautionary Note on Forward-Looking Information

Except for statements of historical fact contained herein, the

information in this press release constitutes "forward-looking

information" within the meaning of Canadian securities law. Such

forward-looking information may be identified by words such as

"plans", "proposes", "estimates", "intends", "expects", "believes",

"may", "will" and include without limitation, statements regarding

use of proceeds from the hedge close-out, planned production,

timing and revenue generated from production, access to financing

on acceptable terms, and closing of the working line of credit.

Estimates regarding future production and revenues are based on

mining plans developed by management and knowledge regarding

current market prices. There can be no assurance that such

statements will prove to be accurate; actual results and future

events could differ materially from such statements. Factors that

could cause actual results to differ materially include, among

others, third party risks, production risks, metal prices,

competition, risks inherent in the mining industry, and regulatory

risks. Most of these factors are outside the control of the

Company. Investors are cautioned not to put undue reliance on

forward-looking information. Except as otherwise required by

applicable securities statutes or regulation, the Company expressly

disclaims any intent or obligation to update publicly

forward-looking information, whether as a result of new

information, future events or otherwise.

Further information is available on the Company's website at

www.crowflight.com.

Total Shares Outstanding: 293.3MM

Fully Diluted: 332.1MM

52-Week Trading Range: C$0.09 - $0.80

Contacts: Crowflight Minerals Mike Hoffman President and CEO

(416) 861-2964 Crowflight Minerals Heather Colpitts Manager,

Investor and Public Relations (416) 861-5803 Email:

info@crowflight.com Website: www.crowflight.com

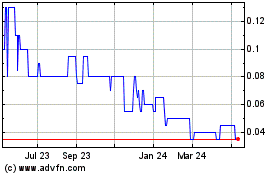

Canickel Mining (TSXV:CML)

Historical Stock Chart

From Dec 2024 to Jan 2025

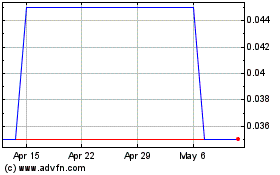

Canickel Mining (TSXV:CML)

Historical Stock Chart

From Jan 2024 to Jan 2025