Churchill Resources Inc. (“

Churchill” or the

“

Company”) (

TSXV: CRI) is pleased

to announce a best-efforts, non-brokered private placement (the

“

Offering”) of up to C$1,000,000 from the sale of

up to 6,666,667 flow-through units of the Company (each, a

“

FT Unit”) at a price of C$0.15 per FT Unit.

Each FT Unit will consist of one common share of the Company to be

issued as a “flow-through share” within the meaning of the Income

Tax Act (Canada) (each, a “

FT Share”) and one half

of one common share purchase warrant (each whole warrant, a

“

Warrant”). Each Warrant shall entitle the holder

to purchase one common share of the Company (each, a

“

Warrant Share”) at a price of C$0.22 at any time

on or before that date which is 24 months after the closing date of

the Offering. .

The Company intends to use the proceeds of the

Offering for the exploration of the Company’s key projects in

Newfoundland and Labrador. The gross proceeds from the issuance of

the FT Shares will be used for “Canadian Exploration Expenses”

(within the meaning of the Income Tax Act (Canada)) (the

“Qualifying Expenditures”), and that qualify for

the federal 30% Critical Mineral Exploration Tax Credit announced

in the federal budget on April 7, 2022, which will be renounced

with an effective date no later than December 31, 2022 to the

purchasers of the FT Units in an aggregate amount not less than the

gross proceeds raised from the issue of the FT Shares. If the

Qualifying Expenditures are reduced by the Canada Revenue Agency,

the Company will indemnify each subscriber of FT Units for any

additional taxes payable by such subscriber as a result of the

Company’s failure to renounce the Qualifying Expenditures.

The Offering is scheduled to close on or around

December 30, 2022 and is subject to certain conditions including,

but not limited to, the receipt of all necessary approvals

including the approval of the TSXV. The FT Shares and Warrants will

have a hold period of four months and one day from the closing date

of the Offering.

As consideration for their services, eligible

finders will receive a commission of 7.0% of the gross proceeds of

the Offering as well as broker warrants in an amount equal to 7.0%

of the aggregate number of FT Units sold pursuant to the

Offering. Each broker warrant will be exercisable to purchase

one common share of the Company at a price of C$0.15 for a period

of 24 months from the closing date of the Offering.

About Churchill Resources Inc.

Churchill is managed by career mining industry

professionals and currently holds four exploration projects, namely

Taylor Brook in Newfoundland, Florence Lake in Labrador, Pelly Bay

in Nunavut and White River in Ontario. All projects are at the

evaluation stage, with known mineralized Nickel-Copper-Cobalt

showings at Taylor Brook, Florence Lake and Pelly Bay, and

significantly diamondiferous kimberlitic intrusives at White River

and Pelly Bay. The primary focus of Churchill is on the continued

exploration and development of the Taylor Brook and Florence Lake

Nickel Projects.

Further Information

For further information regarding Churchill, please contact:

Churchill Resources Inc.Paul Sobie, Chief Executive OfficerTel.

+1 416.365.0930 (o) +1 647.988.0930 (m)Email

psobie@churchillresources.com

Alec Rowlands, Corporate Consultant Tel. +1 416.721.4732 (m)

Email arowlands@churchillresources.com

Cautionary Note Regarding Forward Looking

Information

This news release contains "forward-looking

information" and "forward-looking statements" (collectively,

forward-looking statements") within the meaning of the applicable

Canadian securities legislation. All statements, other than

statements of historical fact, are forward-looking statements and

are based on expectations, estimates and projections as at the date

of this news release. Any statement that involves discussions with

respect to predictions, expectations, beliefs, plans, projections,

objectives, assumptions, future events or performance (often but

not always using phrases such as "expects", or "does not expect",

"is expected", "anticipates" or "does not anticipate", "plans",

“proposed”, "budget", "scheduled", "forecasts", "estimates",

"believes" or "intends" or variations of such words and phrases or

stating that certain actions, events or results "may" or "could",

"would", "might" or "will" be taken to occur or be achieved) are

not statements of historical fact and may be forward-looking

statements. In this news release, forward-looking statements relate

to, among other things, the completion of the Offering, including

receipt of all necessary regulatory approvals, the Company’s

objectives, goals and exploration activities conducted and proposed

to be conducted at the Company’s properties; future growth

potential of the Company, including whether any proposed

exploration programs at any of the Company’s properties will be

successful; exploration results; and future exploration plans and

costs and financing availability.

These forward-looking statements are based on

reasonable assumptions and estimates of management of the Company

at the time such statements were made. Actual future results may

differ materially as forward-looking statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of the Company to

materially differ from any future results, performance or

achievements expressed or implied by such forward-looking

statements. Such factors, among other things, include: the expected

benefits to the Company relating to the exploration conducted and

proposed to be conducted at the Company’s properties; the receipt

of all applicable regulatory approvals for the Offering; the

completion of the Offering on the terms described herein, or at

all; failure to identify any mineral resources or significant

mineralization; the preliminary nature of metallurgical test

results; uncertainties relating to the availability and costs of

financing needed in the future, including to fund any exploration

programs on the Company’s properties; fluctuations in general

macroeconomic conditions; fluctuations in securities markets;

fluctuations in spot and forward prices of gold, silver, base

metals or certain other commodities; fluctuations in currency

markets (such as the Canadian dollar to United States dollar

exchange rate); change in national and local government,

legislation, taxation, controls, regulations and political or

economic developments; risks and hazards associated with the

business of mineral exploration, development and mining (including

environmental hazards, industrial accidents, unusual or unexpected

formations pressures, cave-ins and flooding); inability to obtain

adequate insurance to cover risks and hazards; the presence of laws

and regulations that may impose restrictions on mining and mineral

exploration; employee relations; relationships with and claims by

local communities and indigenous populations; availability of

increasing costs associated with mining inputs and labour; the

speculative nature of mineral exploration and development

(including the risks of obtaining necessary licenses, permits and

approvals from government authorities); the unlikelihood that

properties that are explored are ultimately developed into

producing mines; geological factors; actual results of current and

future exploration; changes in project parameters as plans continue

to be evaluated; soil sampling results being preliminary in nature

and are not conclusive evidence of the likelihood of a mineral

deposit; title to properties; and those factors described in the

most recently filed management’s discussion and analysis of the

Company. Although the forward-looking statements contained in this

news release are based upon what management of the Company

believes, or believed at the time, to be reasonable assumptions,

the Company cannot assure shareholders that actual results will be

consistent with such forward-looking statements, as there may be

other factors that cause results not to be as anticipated,

estimated or intended. Accordingly, readers should not place undue

reliance on forward-looking statements and information. There can

be no assurance that forward-looking information, or the material

factors or assumptions used to develop such forward-looking

information, will prove to be accurate. The Company does not

undertake to release publicly any revisions for updating any

voluntary forward-looking statements, except as required by

applicable securities law.

Neither the TSXV nor its Regulation Services

Provider (as that term is defined in the policies of the TSXV)

accepts responsibility for the adequacy or accuracy of this news

release.

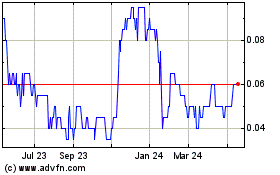

Churchill Resources (TSXV:CRI)

Historical Stock Chart

From Dec 2024 to Jan 2025

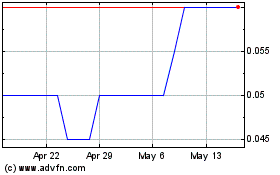

Churchill Resources (TSXV:CRI)

Historical Stock Chart

From Jan 2024 to Jan 2025