Firm Capital American Realty Partners Trust Announces April Rent Collections and Trustee Resignation

April 14 2020 - 4:25PM

Firm Capital American Realty Partners Trust (the

“

Trust”), (TSXV: FCA.UN), (TSXV: FCA.U) is issuing

this press release to announce April rent collections to date and

the resignation of Robert Janson from the board of trustees.

The Trust is pleased to announce that it has

collected approximately 71% of its expected rental revenue.

Collections to date are in line with historical results. It should

be noted that the majority of rent is collected typically by the

10th of every month with almost all rent collections completed by

the 20th of every month. These dates are based on a variety of

factors including, but not limited to state legislation with

respect to rent collections and the receipt of federal

government-funded rents, otherwise known as “Section 8” rent.

Approximately 5% of the Trust’s rental revenue is generated from

Section 8 tenants. Further, requests for rent deferral arrangements

from tenants have been less than 1% of expected rental revenue.

Overall, by state, 87% of expected rental

revenue has been collected in Georgia, followed by Texas (82%), New

Jersey (76%), Maryland (73%), Florida (66%), Connecticut (62%) and

New York (59%).

Senior management continues to monitor the

impact of the COVID-19 pandemic and its rental revenue

situation.

The Trust is also announcing the resignation of

Robert Janson as a Trustee of the Trust, effective immediately.

Robert has been a member of the board of trustees, and a director

of its predecessor entity, Firm Capital American Realty Partners

Corp. (the "Corporation"), since 2016. Robert

joined the board of directors of the Corporation at a time when the

previous series of convertible debentures were being restructured

as Robert represented an entity that was the largest convertible

debenture holder. As such, Robert helped oversee the restructuring

of the Corporation. It was always contemplated that when the

restructuring was completed, Robert would resign from the board.

Robert provided excellent advice and oversight during the

restructuring and throughout his tenure. With the completion of the

restructuring and the ultimate conversion of the Corporation into

an investment trust, Robert has decided to resign. The Trust wishes

to thank Robert for his valuable contribution to the Trust over the

years and every success in his future endeavors.

ABOUT FIRM CAPITAL AMERICAN REALTY

PARTNERS TRUSTFirm Capital American Realty Partners Trust

is a U.S. focused real estate investment entity that pursues income

producing real estate and mortgage debt investments through the

following platforms:

- Income Producing Real

Estate Investments:

-

- Core Markets Wholly Owned

Investments: The Trust is focused on growing its wholly

owned multi-residential property portfolio in large core markets

with attention to cities located in Texas, Florida, New Jersey,

North and South Carolina, Colorado, Georgia and New York.

- Core and Non-Core Markets:

Joint Venture Investments: The Trust will also purchase in

both core and non-core markets where it lacks knowledge or

experience, partial ownership interests in multi-residential

properties with industry leaders as partners. These partners bring

both expertise in operations and knowledge, especially in non-core

markets. The Trust strives to have a minimum 50% ownership interest

and will fund the equity in a combined preferred/common equity

investment structure. The preferred equity provides a fixed rate of

return for investors in the Trust, resulting in a secured structure

ahead of the partners ownership interest, while the common equity

provides investors an upside return for investors as the investment

meets its targeted objectives.

- Mortgage Debt

Investments: The Trust, using Firm Capital’s 30-year plus

experience as a leader in the mortgage lending industry, provides

bridge lending of mortgage and preferred capital secured by

residential/multi-residential properties.

FORWARD LOOKING

INFORMATIONCertain information in this news release

constitutes forward-looking statements under applicable securities

law. Any statements that are contained in this news release that

are not statements of historical fact may be deemed to be

forward-looking statements. Forward-looking statements are often

identified by terms such as “may”, “should”, “anticipate”,

“expect”, “intend” and similar expressions. Forward-looking

statements in this press release include statements relating to the

timing of trading of the Trust's securities. Forward-looking

statements necessarily involve known and unknown risks, including,

without limitation, risks associated with general economic

conditions; adverse factors affecting the U.S. real estate market

generally or those specific markets in which the Trust holds

properties; volatility of real estate prices; inability to access

sufficient capital from internal and external sources, and/or

inability to access sufficient capital on favourable terms;

industry and government regulation; changes in legislation, income

tax and regulatory matters; the ability of the Trust to implement

its business strategies; competition; currency and interest rate

fluctuations and other risks, including those described in the

Trust’s public disclosure documents on SEDAR at www.sedar.com.

Readers are cautioned that the foregoing list is

not exhaustive. Readers are further cautioned not to place undue

reliance on forward-looking statements as there can be no assurance

that the plans, intentions or expectations upon which they are

placed will occur. Such information, although considered reasonable

by management at the time of preparation, may prove to be incorrect

and actual results may differ materially from those anticipated.

Forward-looking statements contained in this news release are

expressly qualified by this cautionary statement.

Neither the TSX Venture

Exchange nor its Regulation Services Provider (as that term is

defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

Additional information about the Trust is available at

www.firmcapital.com or www.sedar.com.

For further information, please contact:

| Eli DadouchPresident & Chief Executive Officer(416)

635-0221 |

Sandy PoklarChief Financial Officer(416) 635-0221 |

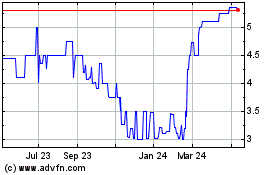

Firm Capital Apartment R... (TSXV:FCA.UN)

Historical Stock Chart

From Oct 2024 to Nov 2024

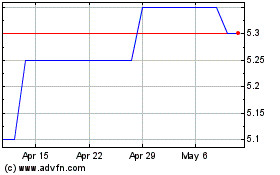

Firm Capital Apartment R... (TSXV:FCA.UN)

Historical Stock Chart

From Nov 2023 to Nov 2024