Hamilton Thorne Ltd. (TSX-V: HTL) ("Hamilton Thorne" or the

"Company"), a leading provider of advanced laser systems for the

regenerative medicine, fertility and stem cell research markets,

today announced the closing of the second tranche of its previously

announced non-brokered private placement (the "Offering") of common

shares ("Common Shares") of the Company. On closing, the Company

issued an aggregate of 831,830 Common Shares at a price (the

"Offering Price") of CDN$0.20 per Common Share for additional

proceeds of US$166,731, resulting in total gross proceeds for the

Offering of US$2,716,731. In this tranche 103,380 Common Shares,

representing gross proceeds of US$20,000, were issued to an insider

of the Company pursuant to this second tranche of the Offering.

Loewen, Ondaatje, McCutcheon Limited received aggregate cash

finder's fees of US$6,783 and an aggregate of 35,000 finder's

warrants for introducing qualified private placement subscribers to

Hamilton Thorne. Each finder's warrant is exercisable for one

Common Share at an exercise price of CDN$0.20 for a period of 24

months from the date of issuance. All securities issued in

connection with the Offering, including any finder's warrants, are

subject to a four month hold period in accordance with applicable

securities laws.

The Company also announced the conversion (the "Debenture

Conversion") of a total of CDN$1,604,250 of principal amount

convertible subordinated debentures (the "Debentures") issued in

August 2010 and March 2011, plus accrued interest, into an

aggregate of 8,589,002 Common Shares. The principal amount of the

Debentures was converted at a price of CDN$0.20 per Common Share

for the August 2010 Debentures and CDN$0.24 per Common Shares for

the March 2010 Debenture, in accordance with the respective terms

of such Debentures. Any interest accrued on all such Debentures was

converted at the Offering Price of CDN$0.20. Concurrently with the

conversion of the Debentures, the Company also completed the

conversion of a principal amount US$50,000 convertible promissory

note (the "Note") issued in October 2009. The principal amount of

the Note, together with all interest accrued thereon, was converted

into 279,876 Common Shares at a conversion price equal to the

Offering Price of CDN$0.20. Following the completion of the

Offering and debt conversions referenced herein, the Company has a

total of 46,615,365 Common Shares issued and outstanding.

For further details about the Offering and the Debenture

Conversion, please refer to the Company's press releases issued on

August 8, 2011, August 25, 2011 and August 30, 2011.

The Company also announced that it has granted David Wolf, the

Company's President and Chief Executive Officer, incentive stock

options ("Options") to acquire 388,371 Common Shares pursuant to

the Company's incentive option plan. The Options are exercisable at

CDN$0.18 per Common Share, vest within the first year, and expire

on November 4, 2019. The Options were issued in replacement for

certain non-qualified stock options issued to Mr. Wolf in November

2009 with an exercise price of CDN$0.40 per Common Share. As the

issuance of the Options involves an adjustment to the exercise

price, the Company has obtained the conditional approval of the

TSXV Venture Exchange and the consent of a majority of the

disinterested shareholders of the Company to issue such

Options.

Related Party Disclosure

Certain insiders of the Company, including Louisa Spencer,

participated in the Debenture Conversion. The CDN$521,700 principal

amount Debenture issued to Ms. Spencer in August 2010, including

all interest accrued thereon, was converted into an aggregate of

2,904,368 Common Shares at a conversion price of CDN$0.20. The

Debentures, and the Common Shares issued upon the conversion of the

Debentures, were issued to Ms. Spencer in reliance on the U.S.

accredited investor exemption. Following the completion of the

Debenture Conversion, Ms. Spencer will own an aggregate of

8,978,455 Common Shares representing approximately 19.26% of the

currently issued and outstanding Common Shares, and warrants to

acquire an aggregate of 1,060,000 Common Shares exercisable at a

price of CDN$0.60 per Common Share until October 28, 2012. A report

required under section 102.1 of the Securities Act (Ontario) will

be filed by Ms. Spencer within the prescribed time period. Copies

of such report shall be available by contacting David Wolf,

President and Chief Executive Officer of the Company, at

978-921-2050 or ir@hamiltonthorne.com. The Debentures and

underlying Common Shares were acquired for investment purposes. Ms.

Spencer has a long-term view of the investment and does not intend

at this time to acquire additional Common Shares, but may acquire

additional Common Shares either on the open market or through

private acquisitions or sell the Common Shares either on the open

market or through private dispositions in the future depending on

market conditions, reformulation of plans and/or other relevant

factors.

Pursuant to Multilateral Instrument 61-101 -- Protection of

Minority Security Holders in Special Transactions ("MI 61-101"),

the conversion of any Debentures by insiders constitutes a "related

party transaction." The Company is exempt from the formal valuation

requirement of MI 61-101 in connection with such Debenture

Conversion in reliance on section 5.5(b) of MI 61-101, as no

securities of the Company are listed or quoted for trading on the

Toronto Stock Exchange, the New York Stock Exchange, the American

Stock Exchange, the NASDAQ stock market or any other stock exchange

outside of Canada and the United States. Additionally, the Company

is exempt from obtaining minority shareholder approval in

connection with the Debenture Conversion in reliance on section

5.7(1)(b) of MI 61-101 as, in addition to the foregoing, (i)

neither the fair market value of the Common Shares issuable to

insiders in connection with the Debenture Conversion nor the

consideration received in respect thereof from insiders exceeds

CDN$2.5 million, (ii) the Company has one or more independent

directors in respect of the Debenture Conversion who are not

employees of the Company, and (iii) all of the independent

directors have approved the Debenture Conversion.

Furthermore, the previously announced insider private placement

subscription also constitutes a "related party transaction." The

Company is exempt from the formal valuation requirement of MI

61-101 in connection with such transaction in reliance on section

5.5(b) of MI 61-101. Additionally, the Company is exempt from

obtaining minority shareholder approval in connection with such

transaction in reliance on section 5.7(1)(b) of MI 61-101.

There will be less than 21 days between the date of filing of

its material change report in respect of the Debenture Conversion

and the closing of the second tranche of the Offering and the

completion date of such transactions. The Company considers this is

reasonable and necessary in order to provide the Company with the

opportunity to finalize the list of participants in the voluntary

Debenture Conversion and in order to address the Company's

immediate funding requirements and corporate operations.

About Hamilton Thorne Ltd.

(www.hamiltonthorne.com)

Hamilton Thorne provides novel solutions for Life Science that

reduce cost, increase productivity and enable research

breakthroughs in regenerative medicine, stem cell research and

fertility markets. The Company's new LYKOS™, Staccato™ and

Stiletto™ laser systems offer significant scientific advantages in

the fields of developmental biology, cancer research and other

segments of cell biology. Hamilton Thorne's laser products attach

to standard inverted microscopes and operate as robotic

micro-surgeons, enabling a wide array of scientific applications

and procedures.

Hamilton Thorne's growing customer base includes pharmaceutical

companies, biotechnology companies, fertility clinics, university

research centers, and other commercial and academic research

establishments worldwide. Current customers include world-leading

research labs such as Harvard University, MIT, Yale, McGill

University, DuPont, Monsanto, Charles River Labs, Jackson Labs,

Merck, Novartis, Pfizer, Oxford University, and Cambridge.

Neither the Toronto Venture Exchange, nor its regulation

services provider (as that term is defined in the policies of the

exchange), accepts responsibility for the adequacy or accuracy of

this release.

Certain information in this press release may contain

forward-looking statements. This information is based on current

expectations that are subject to significant risks and

uncertainties that are difficult to predict including the risk that

the Company may not be able to obtain the necessary regulatory

approvals. Actual results might differ materially from results

suggested in any forward-looking statements. The Company assumes no

obligation to update the forward-looking statements, or to update

the reasons why actual results could differ from those reflected in

the forward-looking statements unless and until required by

securities laws applicable to the Company. Additional information

identifying risks and uncertainties is contained in filings by the

Company with the Canadian securities regulators, which filings are

available at www.sedar.com.

Add to Digg Bookmark with del.icio.us Add to Newsvine

For more information, please contact: David Wolf

President and CEO Hamilton Thorne Ltd. 978-921-2050 Email Contact

Lisa Rivero Director of Corporate Communications Hamilton Thorne

Ltd. 978-921-2050 Email Contact

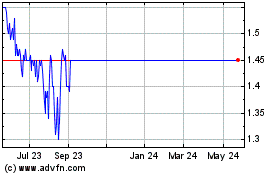

Hamilton Thorne (TSXV:HTL)

Historical Stock Chart

From Oct 2024 to Nov 2024

Hamilton Thorne (TSXV:HTL)

Historical Stock Chart

From Nov 2023 to Nov 2024