Hudson to Advance Sarfartoq Rare Earth Element Project After New Uranium Legislation Passed in Greenland

November 15 2021 - 8:00AM

HUDSON RESOURCES INC. (“

Hudson” or the

“

Company”) (TSX Venture Exchange “HUD”; OTC

“HUDRF”) is pleased to announce that based on new mining

legislation passed on November 8th by the Greenland Government, it

will focus efforts on advancing its 100% owned Sarfartoq rare earth

element (REE) project.

The new legislation, which was passed by a

narrow majority, bans the development of mineral projects with a

uranium content greater than 100 parts per million (“ppm”). The ban

does not apply to prospecting, exploration and

exploitation directed at non-uranium

resources if the average uranium content is less than 100

ppm. This is good news for the Company’s advanced ST1 Sarfartoq REE

project which contains low levels of uranium (10ppm) and high

levels of REE’s neodymium oxide (Nd2O3) and praseodymium oxide

(Pr6O11), which are the key elements needed for permanent magnets

used in wind turbines and the motors in electric and hybrid

vehicles.

Hudson’s Sarfartoq ST1 REE project highlights

include:

- 27M kg of neodymium oxide and 8M kg

of praseodymium oxide defined as indicated and inferred

resources

- 31,000 meters drilled to date with

numerous high-grade sections including 14 meters of 4.8% TREO

(diamond drill hole SAR11-45) and 6 meters of 6.05% TREO (diamond

drill hole SAR12-03)

- A Preliminary Economic Assessment

(“PEA") completed by Tetra Tech in 2011 (see NR2011-15) which

outlined the following:

- 31.2% internal rate of return

(IRR)

- 2.7 year payback on US$ 343 million

initial capital

- US$ 616 million net present value

(NPV10) at a 10% discount rate, pre-tax

- 21-year life of mine

- Nd and Pr oxide price assumptions

of US$88.30/kg and US$76.90/kg, respectively (FOB three-year

average – Metal Pages, October 2011)

- Neodymium and Praseodymium oxides

currently selling at US$154.40/kg each (Kitco Strategic Metals

pricing November 12, 2021)

- Project is located near tidewater and

close to the Hudson built White Mountain anorthosite mine

Jim Cambon, President commented “We are very

excited about the future of the Sarfartoq REE project and the

ability to be part of the critical metal supply chain into Europe

and the Americas. We believe there is an excellent opportunity to

build on and improve our 2011 PEA to outline a very robust project

given the current strong REE pricing based on fundamental supply

and demand. We will provide updates on an ongoing basis.”

The global neodymium market is forecast to grow

at CAGR (“compound annual growth rate”) of 5.4% to US $3.39 billion

by 2028 led by automotive (Electric Vehicle), wind energy, and

electronics (Research and Markets, November, 2021).

Hudson’s Nukittooq niobium-tantalum project,

which hosts some of the highest reported niobium assays in the

industry (see NR2020-15), contains uranium values more than 100 ppm

and as such the Company is reviewing its options for this project

under the new legislation.

The high-grade Nukittooq niobium-tantalum

project and the Sarfartoq rare earth element (“REE”) project are

both located on the Company’s 100% owned Sarfartoq exploration

license located in southwestern Greenland. Hudson also has a 31.1%

equity interest in the White Mountain anorthosite mine and rights

to acquire 100%. The White Mountain mine is unaffected by the new

uranium legislation.

J.R. Goode, P. Eng., is a Qualified Person, as

defined by National Instrument 43-101, and reviewed the preparation

of the metallurgical and technical information in this press

release. Michael Druecker, P.Geo., is a Qualified Person, as

defined by National Instrument 43-101, and reviewed the preparation

of geological and technical information in this press release.

ON BEHALF OF THE BOARD OF DIRECTORS

“Jim

Cambon”

President and Director

For further information:Ph:

604-628-5002

Forward-Looking

StatementsCAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

INFORMATION: This News Release includes certain "forward-looking

statements" which are not comprised of historical facts. Forward

looking statements include estimates and statements that describe

the Company’s future plans, objectives or goals, including words to

the effect that the Company or management expects a stated

condition or result to occur. Forward-looking statements may be

identified by such terms as “believes”, “anticipates”, “expects”,

“estimates”, “may”, “could”, “would”, “will”, or “plan”.

Since forward-looking statements are based on

assumptions and address future events and conditions, by their very

nature they involve inherent risks and uncertainties. Although

these statements are based on information currently available to

the Company, the Company provides no assurance that actual results

will meet management’s expectations. Risks, uncertainties and other

factors involved with forward-looking information could cause

actual events, results, performance, prospects and opportunities to

differ materially from those expressed or implied by such

forward-looking information. Forward looking information in this

news release includes, but is not limited to, the Company’s

objectives, goals or future plans, statements, exploration results,

potential mineralization, the estimation of mineral resources,

exploration and mine development plans, timing of the commencement

of operations and estimates of market conditions. Factors that

could cause actual results to differ materially from such

forward-looking information include, but are not limited to failure

to identify mineral resources, failure to convert estimated mineral

resources to reserves, the inability to complete a feasibility

study which recommends a production decision, the preliminary

nature of metallurgical test results, delays in obtaining or

failures to obtain required governmental, environmental or other

project approvals, political risks, inability to fulfill the duty

to accommodate indigenous peoples, uncertainties relating to the

availability and costs of financing needed in the future, changes

in equity markets, inflation, changes in exchange rates,

fluctuations in commodity prices, delays in the development of

projects, capital and operating costs varying significantly from

estimates and the other risks involved in the mineral exploration

and development industry, an inability to complete the Offering on

the terms or on the timeline as announced or at all, an inability

to predict and counteract the effects of COVID-19 on the business

of the Company, including but not limited to the effects of

COVID-19 on the price of commodities, capital market conditions,

restriction on labour and international travel and supply chains,

and those risks set out in the Company’s public documents filed on

SEDAR. Although the Company believes that the assumptions and

factors used in preparing the forward-looking information in this

news release are reasonable, undue reliance should not be placed on

such information, which only applies as of the date of this news

release, and no assurance can be given that such events will occur

in the disclosed time frames or at all. The Company disclaims any

intention or obligation to update or revise any forward-looking

information, whether as a result of new information, future events

or otherwise, other than as required by law.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

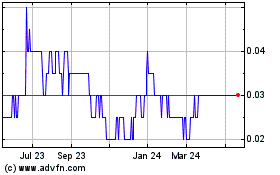

Hudson Resources (TSXV:HUD)

Historical Stock Chart

From Nov 2024 to Dec 2024

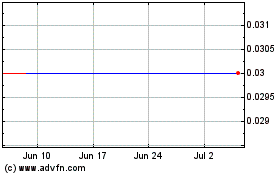

Hudson Resources (TSXV:HUD)

Historical Stock Chart

From Dec 2023 to Dec 2024