Northern Graphite Announces Significant Increase in Measured and Indicated Resources

May 07 2013 - 7:45AM

Marketwired Canada

Northern Graphite Corporation (TSX VENTURE:NGC)(OTCQX:NGPHF) is pleased to

announce a new resource estimate for the Bissett Creek graphite project based on

results from a recent 61 hole, 3,782 meter drill program. The drill program

successfully achieved its objective of upgrading a significant portion of

inferred resources to the measured and indicated categories. Measured and

indicated resources are now estimated at 69.8 million tonnes grading 1.74%

graphitic carbon ("Cg") based on a 1.02% Cg cutoff grade compared to the

previous estimate of 26 million tonnes grading 1.81% Cg at a cutoff of 0.98% Cg.

There are an additional 24 million tonnes of inferred resources grading 1.65% Cg

(at a 1.02% Cg cutoff) in the new resource estimate.

The mine plan in the existing bankable Feasibility Study ("FS") will be revised

based on the new resource model and the FS project economics updated. The

current mine plan includes 1.5 million tonnes of inferred resources that are

treated as waste with zero grade and it excludes a substantial amount of higher

grade resources previously categorized as inferred. It is estimated that revised

FS economics will be available in 4-6 weeks.

The revised FS economics will also contain a number of modifications to the

original capital and operating cost assumptions. Contract mining will be

replaced by owner mining which is expected to reduce operating costs by over

$100 per tonne of concentrate. Approximately $7 million in capital will be added

for mining equipment but will be substantially offset by a number of reductions

including removal of costs for detailed engineering, which is already underway,

and modifications to the SAG mill drive and discharge layout. The Company now

plans to build a compressor station at the TransCanada pipeline and transport

compressed natural gas ("CNG") to site by truck due to a substantial increase in

the estimated cost of a pipeline. The CNG option will result in slightly higher

capital and operating costs than those used in the FS.

Gregory Bowes, CEO, commented that: "The objective of the revised FS economics

is to offset the effects of a recent decline in the graphite price which we feel

is at or near the bottom of the cycle. It is anticipated that the new model will

show an increase in grade and throughput, a reduction in costs and a much longer

mine life."

Bissett Creek Resource Estimate, May 6, 2013

-----------------------------------------------------------------

Measured + Indicated Resources Inferred Resources

------ ------------------------------- -------------------------------

In Situ In Situ

Cutoff Tonnage Cg% Graphite (t) Tonnage Cg% Graphite (t)

---------------------------------------------------------------------------

1.02 69,791,000 1.74 1,213,000 24,038,000 1.65 396,000

---------------------------------------------------------------------------

1.50 37,565,000 2.14 803,000 11,971,000 2.02 242,000

---------------------------------------------------------------------------

1.75 23,439,000 2.45 574,000 6,274,000 2.39 150,000

---------------------------------------------------------------------------

2.00 15,902,000 2.73 435,000 3,564,000 2.79 100,000

---------------------------------------------------------------------------

Notes: Resource shell is based on Measured, Indicated and Inferred

material, tonnages rounded to the nearest thousand.

Graphite price used is US$1,800 per tonne with an exchange rate of

$1Cdn=$1 US.

Dilution and ore loss are considered to be zero.

Feasibility Study costs and information have been used for Resource

Shell generation:

Overburden Mining Cost $1.85 per tonne material

Waste Mining Cost $3.24 per tonne material

Ore Mining Cost $4.15 per tonne ore

Process Cost $9.61 per tonne ore

General and Administrative $3.41 per tonne ore

Recovery 95%

Royalty $20 per tonne of concentrate

No mining restrictions relating to permitting were applied.

Wall slopes of 45 degrees in rock and 30 degrees in overburden.

Base mining cutoff of 1.02% Cg.

Mineral resources are estimated in conformance with the CIM Mineral Resource

definitions referred to in NI 43-101 Standards of Disclosure for Mineral

Projects. Pierre Desautels, P.Geo., Principal Resource Geologist, and Gordon

Zurowski, P.Eng., Principal Mining Engineer, both of AGP Mining Consultants and

Qualified Persons under NI 43-101 who are independent of the Company, have

prepared and authorized the release of the mineral resource estimates presented

herein. This mineral resource estimate is an update of the G Mining Services

Inc. NI 43-101 resource estimate presented in the Feasibility Study dated August

23rd, 2012.

Mineral resources that are not mineral reserves do not have demonstrated

economic viability. The estimate of mineral resources may be materially affected

by environmental, permitting, legal, title, taxation, sociopolitical, marketing,

or other relevant issues.

The quantity and grade of reported inferred mineral resources in this estimation

are uncertain in nature and there has been insufficient exploration to define

these inferred mineral resources as indicated or measured mineral resources and

it is uncertain if further exploration will result in upgrading them to

indicated or measured mineral resources.

SEE ADDITIONAL NOTES ON RESOURCE ESTIMATION METHODOLOGY AT END OF PRESS RELEASE

Environmental Permitting

On October 31, 2012, the Company submitted the Mine Closure Plan ("MCP") for the

Bissett Creek project to the Ministry of Northern Development and Mines. The

Government of Ontario advertises a 45 day turnaround as part of their efforts to

promote the province as a mining friendly jurisdiction. However, the process is

still ongoing despite Bissett Creek being a relatively benign operation with no

major environmental issues. It has strong community support and consultations

with First Nation communities have been positive and constructive. The Company

is hopeful the MCP will be approved this month which would enable construction

to commence, subject to financing. The MCP is an all-encompassing document that

describes in detail, the nature of the operations that will be carried out, the

current baseline environmental conditions, and the Company's plan for

rehabilitating the site and returning it to its natural state. A number of other

permits relating to air, noise, water, species at risk, etc. are required prior

to the commencement of operations and follow in the normal course after

acceptance of the MCP. Most of these issues are already addressed in the MCP.

Graphite Market Update

Prices have declined from their highs of approximately $2,800/tonne for high

purity, large flake graphite to the $1,400 to $1,800/tonne range due to the

slowdown in China and continued economic weakness in the US and Europe. It

appears that prices are now close to the Chinese marginal cost of production. In

addition, Chinese costs are increasing as mines get deeper and older, labour,

power and transportation costs escalate, environmental regulations become more

stringent and the country's currency appreciates. China currently produces 70%

of the world's graphite and an export tax and a licensing system have been

instituted to restrict exports and encourage value added processing in China. No

new graphite mines were built during the past economic cycle and the supply

situation will become more acute as economic growth recovers. Both the European

Union and the United States have declared graphite a supply critical mineral.

Don Baxter, P.Eng., President of the Company and a "Qualified Person" under

43-101, is responsible for and has reviewed and approved the technical content

of this press release.

Northern Retains Services of Renmark Financial

Northern is also pleased to announce that it has retained the services of

Renmark Financial Communications Inc. ("Renmark") to handle its investor

relations activities. In consideration of the services to be provided by

Renmark, Northern has agreed to pay Renmark a retainer of $5,000 per month for

May and June, unless extended by mutual agreement of the parties. Renmark does

not have any interest, directly or indirectly, in Northern or its securities, or

any right or intent to acquire such an interest.

Northern Graphite Corporation

Northern is a Canadian company that has a 100% interest in the Bissett Creek

graphite deposit located in eastern Ontario and is well positioned to benefit

from the favourable supply/demand outlook for graphite. Northern is the only

graphite company to have completed a bankable Feasibility Study. Bissett Creek

is a large flake, high purity, scalable deposit with low engineering, technical

and political risk, reasonable capital costs and competitive operating costs.

Additional information is available under the Company's profile on SEDAR at

www.sedar.com and on the Company's website at www.northerngraphite.com.

This press release contains forward-looking statements, which can be identified

by the use of statements that include words such as "could", "potential",

"believe", "expect", "anticipate", "intend", "plan", "likely", "will" or other

similar words or phrases. These statements are only current predictions and are

subject to known and unknown risks, uncertainties and other factors that may

cause our or our industry's actual results, levels of activity, performance or

achievements to be materially different from those anticipated by the

forward-looking statements. The Company does not intend, and does not assume any

obligation, to update forward-looking statements, whether as a result of new

information, future events or otherwise, unless otherwise required by applicable

securities laws. Readers should not place undue reliance on forward-looking

statements.

Notes on Mineral Resource Estimation Methodology

1. The updated mineral resource is based on 268 diamond drill holes

totalling 14,361 metres of historic and recent drilling. This includes

117 surface diamond drill holes totalling 6,919 metres completed under

Northern's supervision from 2007 to 2012.

2. All drill holes are diamond drill core and were sampled and assayed over

their entire length in the mineralize section of the core of mostly 1 m

sample intervals. A QA/QC program was in place since the 2010 drill

program, which included the insertion of standards, duplicates and

blanks.

3. Specific gravities were determined by ALS Mineral services for a

representative number of rock and mineralization types provided by

Northern Graphite. A total of 657 determinations exist in the database.

The specific gravity was weighted by the lithology count for each of the

domains. There was no variation from the average specific gravity of all

mineralized domains and a value of 2.72 was applied to the entire block

model.

4. A detailed review of the geological mapping, geological logs and grade

distribution led to the development of three-dimensional (3D) domain

models based primarily on grade boundaries and partially on lithological

units. The wireframing resulted in two higher grade envelopes based on a

natural cut-off grade ranging between 2.5% and 2.8% Cg. These two

envelopes reside within a lower grade graphitic gneiss domain averaging

1.4% Cg. A mostly barren zone exists below these high grade units and

forms the bottom footwall contact of the mineralization. Seven minor

barren units were also modelled within the mineralized zone to tie the

surface mapping with the drilling. These domains were utilized in the

variography studies and in grade interpolation constraints. The model

prepared for the May 6, 2013 resource estimate was updated based on the

new 2012 diamond drilling information.

5. For treatment of outliers each statistical domain was evaluated

separately and no top cut was necessary. However, a search restriction

was used on threshold values of 6% Cg to restrict the influence of the

highest values during the interpolation.

6. The composite intervals selected were 3.0 metres.

7. A 3D geological block model was generated using GEMS(C) software. The

block model matrix size is 8 metres x 8 metres x 3 metres in

consideration of Northern Graphite planning to use a 6 meter bench

height for drilling and blasting but sampling and mining in 3 meter

flitches. Ordinary kriging was used for all domains with inverse

distance and nearest neighbour check models. The interpolation was

carried out in multiple passes with increasing search ellipsoid

dimensions. Classification for all models was based primarily on the

pass number, distance to the closest composite and drill density map.

The measured classification was downgraded in areas where the

interpolation of the grade relied mostly on historical drill holes.

8. The reported mineral resources are considered to have reasonable

prospects of economic extraction. A Lerchs Grossman optimized

constraining shell was generated to constrain the potential open pit

material. This shell was designed using design parameters from the

recently completed Feasibility Study. The constraining shell extends

down to the barren unit at the bottom of the model.

9. The rounding of tonnes as required by NI 43-101 reporting guidelines may

result in apparent differences between tonnes, grade and contained

graphite.

FOR FURTHER INFORMATION PLEASE CONTACT:

Northern Graphite Corporation

Gregory Bowes

CEO

(613) 241-9959

Northern Graphite Corporation

Don Baxter, P.Eng.

President

(705) 789-9706

www.northerngraphite.com

Renmark Financial Communications Inc.

John Boidman

(416) 644-2020 or (514) 939-3989

jboidman@renmarkfinancial.com

Renmark Financial Communications Inc.

Bettina Filippone

(416) 644-2020 or (514) 939-3989

bfilippone@renmarkfinancial.com

www.renmarkfinancial.com

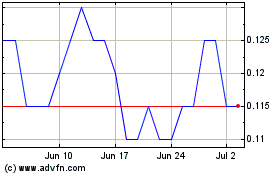

Northern Graphite (TSXV:NGC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Northern Graphite (TSXV:NGC)

Historical Stock Chart

From Jul 2023 to Jul 2024