VANCOUVER, BC, April 27, 2021 /CNW/ - (TSXV: OGN)

Orogen Royalties Inc. ("Orogen" or the "Company") is pleased to

announce that it has signed an option agreement (the "Agreement")

with Stampede Metals Corp. ("Stampede"), a private Nevada company, whereby Stampede can acquire a

100% interest in the Manhattan Gap porphyry/polymetallic carbonate

replacement project in eastern Nevada, USA. To earn a 100% interest in

Manhattan Gap, Stampede will make a cash payment of US$18,243, issue 7.5% of Stampede's shares

outstanding (approximately US$158,000

in value), incur up to 7,500 metres of drilling over a six-year

period, and grant to Orogen a 1.5% net smelter return ("NSR")

royalty.

"Part of Orogen's value and royalty creation strategy is to use

exploration alliances and joint ventures to advance our property

portfolio toward exploration discovery," commented Orogen CEO

Paddy Nicol. "Our flagship

royalty assets Ermitaño and Silicon were created in this manner and

having eight active partner-funded joint ventures and alliances

increases our opportunity for additional royalties. We

welcome Stampede Metals' option on the Manhattan Gap project and

look forward to their exploration programs in 2021."

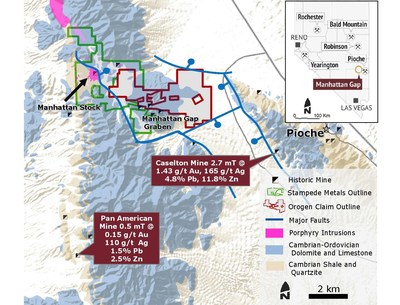

About the Manhattan Gap Project

The Manhattan Gap project is a porphyry and polymetallic

carbonate replacement target located in the historic Pioche mining district in Lincoln County, Nevada. Multiple target

areas exist in the district associated with a large zoned

Cretaceous porphyry system that has been tilted and dismembered by

post-mineral faulting (Figure 1). By combining Orogen's 8.2

square kilometre land package with Stampede Metals' 8.5 square

kilometre land package, the project can be explored effectively as

a unified district-scale project.

Orogen's claim block covers a four-kilometre-long polymetallic

fissure vein swarm hosted in Cambrian and Ordovician

carbonates. The vein swarm is preserved in a down-dropped

graben, which extends from the Manhattan Stock to the eastern edge

of exposures with rock samples returning <0.005 to 4.9 grams per

tonne ("g/t") gold, <0.1 to 422 g/t silver, and <0.005 to 1%

copper. A possible igneous source for mineralizing fluids is

the porphyritic Manhattan Stock complex, which occurs just west of

Orogen's claim block within Stampede Metals' project area.

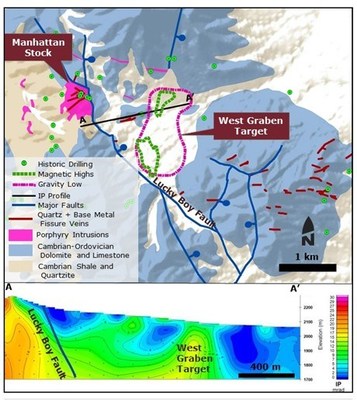

The top of the Manhattan Stock has been cut off by the Lucky Boy

Fault and the hanging wall portion of the porphyry has not been

identified. Multiple targets exist in the hanging wall of the

Lucky Boy Fault including the West Graben Target on Orogen's claim

block. This target is defined by a spatially coincident

gravity low and magnetic high in an alluvial covered basin (Figure

2). Recent IP work carried out by Stampede Metals has

identified a high resistivity -and high chargeability anomaly in

the West Graben Target. The geophysical signature of this target is

similar in size and style to that of the breccia pipes hosting the

Peñasquito deposit in the Sierra Madre Oriental in Mexico (12.7 million ounces gold, 527 million

ounces silver, 3,600 million pounds lead, 8,000 million pounds

zinc)1. Stampede Metals is planning a 6,000 metre

drilling program for 2021 to explore for porphyry-style copper-gold

mineralization. The program will include a minimum of 500

metres of drilling on Orogen's West Graben Target.

Terms of the Manhattan Gap Option Agreement

Stampede can earn a 100% interest in the Manhattan Gap project

subject to the following terms:

- Cash payment on signing of US$18,243;

- Equity interest of 7.5% of the capital structure of

Stampede;

- A minimum of 500 metres of drilling prior to the first

anniversary from the date of the Agreement; and

- A minimum of 7,500 metres of drilling prior to the sixth

anniversary from the date of the Agreement.

In the event Stampede has not completed the 7,500 metres on the

sixth anniversary, Stampede will make a cash payment of

US$500,000 to Orogen. Upon

commencement of commercial production, Stampede will pay to Orogen

US$2.50 per gold-equivalent ounces

classified as Mineral Reserves under JORC (2012) guidelines.

Stampede will also grant a 1.5% NSR royalty to Orogen.

Qualified Person Statement

All technical data, as disclosed in this press release, has been

verified by the Company's qualified person Mr. Daniel Pace, M.Sc., Vice President of

Exploration, who is Registered Member 4202658 of the Society for

Mining, Metallurgy and Exploration.

About Orogen Royalties Inc.

Orogen Royalties Inc. is engaged in project generation for

precious and base metal discoveries in western North America with a focus on organic royalty

creation and royalty acquisitions. Orogen's royalty portfolio

includes the Ermitaño West gold deposit in Sonora, Mexico (2% NSR) being developed by

First Majestic Silver Corp. and the Silicon gold project (1% NSR)

in Nevada, USA, being advanced by

AngloGold Ashanti N.A. The Company is well financed with several

projects actively being developed by joint venture partners.

On Behalf of the Board

OROGEN ROYALTIES

INC.

Paddy Nicol

President &

CEO

Visit our website at www.orogenroyalties.com.

Orogen Royalties Inc.

1201 - 510 West Hastings Street

Vancouver, BC

Canada V6B 1L8

info@orogenroyalties.com

|

1.

|

Dromundo et. Al.

2020, The Peñasquito Gold-(Silver-Lead-Zine) Deposit, Zacatecas,

Mexico, Society of Economic

Geology Special Publication no. 23. Pp. 399-414.

|

Forward Looking Information

This news release includes certain statements that may be deemed

"forward looking statements". All statements in this presentation,

other than statements of historical facts, that address events

or developments that Orogen Royalties Inc. (the "Company") expect

to occur, are forward looking statements. Forward looking

statements are statements that are not historical facts and are

generally, but not always, identified by the words "expects",

"plans", "anticipates", "believes", "intends", "estimates",

"projects", "potential" and similar expressions, or that events or

conditions "will", "would", "may", "could" or "should"

occur.

Forward looking information relates to statements concerning the

Company's future outlook and anticipated events or results, as well

as the Company's management expectations with respect to the

proposed business combination (the "Transaction"). This document

also contains forward-looking statements regarding the anticipated

completion of the Transaction and timing thereof. Forward-looking

statements in this document are based on certain key expectations

and assumptions made by the Company, including expectations and

assumptions concerning the receipt, in a timely manner, of

regulatory and stock exchange approvals in respect of the

Transaction.

Although the Company believe the expectations expressed in such

forward looking statements are based on reasonable assumptions,

such statements are not guarantees of future performance and actual

results may differ materially from those in the forward looking

statements. Factors that could cause the actual results to differ

materially from those in forward looking statements include market

prices, exploitation and exploration successes, and continued

availability of capital and financing, and general economic, market

or business conditions. Furthermore, the extent to which

COVID-19 may impact the Company's business will depend on future

developments such as the geographic spread of the disease, the

duration of the outbreak, travel restrictions, physical distancing,

business closures or business disruptions, and the effectiveness of

actions taken in Canada and other

countries to contain and treat the disease. Although it is not

possible to reliably estimate the length or severity of these

developments and their financial impact as of the date of approval

of these condensed interim consolidated financial statements,

continuation of the prevailing conditions could have a significant

adverse impact on the Company's financial position and results of

operations for future periods.

Investors are cautioned that any such statements are not

guarantees of future performance and actual results or developments

may differ materially from those projected in the forward looking

statements. Forward looking statements are based on the beliefs,

estimates and opinions of the Company's management on the date the

statements are made. Except as required by securities laws, the

Company undertakes no obligation to update these forward looking

statements in the event that management's beliefs, estimates or

opinions, or other factors, should change.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release

SOURCE Orogen Royalties Inc.