Optimum Ventures Ltd. (“Optimum” or the

“Company”) (TSXV: OPV) is pleased to announce that

it has entered into an arrangement agreement with Blackwolf Copper

and Gold Ltd. ("

Blackwolf") dated as of July 6,

2023 (the "

Arrangement Agreement"), pursuant to

which Blackwolf has agreed to acquire all of the issued and

outstanding common shares of Optimum (collectively, the

"

Company Shares") by way of a statutory plan of

arrangement under the Business Corporations Act (British Columbia)

(the "

Arrangement").

Tyler Ross, CEO of Optimum, stated, “This is a

transformational opportunity for Optimum's shareholders to join the

vision of Blackwolf in becoming a leading mining company in the

Golden Triangle. With experienced leadership under Morgan Lekstrom,

strategic investment from Frank Giustra, Rob McLeod leading the

Geological programs and the addition of Andrew Bowering to the

board of the resulting issuer, the combined entity is well situated

to unlock the large-scale potential of these complementary projects

in the Golden Triangle.”

Summary of the Arrangement

Pursuant to the terms of the Arrangement,

shareholders of Optimum (the "Company

Shareholders") will receive common shares of Blackwolf

("Blackwolf Shares") on the basis of an exchange

ratio of 0.65 (the "Exchange Ratio") of a common

share of Blackwolf for each share of Optimum held, resulting in

existing Company Shareholders collectively owning approximately 26%

of the outstanding share capital of the resulting company upon

closing of the Arrangement and all outstanding stock options of the

Company will be cancelled. Each of Optimum’s directors and officers

and certain other significant Optimum shareholders, collectively

holding in aggregate at least 41% of the outstanding shares of

Optimum, have entered into voting support agreements in favour of

the proposed transaction. The proposed consideration for the

Arrangement values Optimum at approximately C$0.196 per share,

representing a premium of approximately 8.97% to Company

Shareholders based on the trailing 10-day volume weighted average

price of each company as of the close of trading on June 20, 2023

at the time the proposed Arrangement was initially announced.

The Arrangement is subject to a number of

closing conditions, including: the Company having minimum working

capital of C$675,000 (net of costs and expenses of the Company in

connection with the Arrangement); reconstitution of the board of

directors of Blackwolf to consist of six (6) members, five (5) of

which will be existing members of the board of directors of

Blackwolf or chosen by Blackwolf and one of which will be Andrew

Bowering, a nominee of the Company; the approval of the Supreme

Court of British Columbia (the “Court”); the approval of the TSX

Venture Exchange (the “TSXV”) and all other

applicable third party and regulatory consents for the Arrangement;

the Company obtaining the requisite approval of its shareholders

(the "Optimum Shareholders") and optionholders; no

more than 5% of the Company's shareholders exercising their rights

of dissent in connection with the Arrangement, and the satisfaction

of certain other closing conditions customary for a transaction of

this nature.

The Arrangement Agreement includes customary

provisions, including non-solicitation, right to match, and

fiduciary out provisions, as well as certain representations,

covenants and conditions which are customary for a transaction of

this nature. The Arrangement Agreement provides for a termination

fee payable by either party in certain circumstances in the event

the Arrangement does not close. The Arrangement is an arm’s length

transaction in accordance with the policies of the TSXV.

Further information regarding the Arrangement

will be contained in a management information circular that Optimum

will prepare, file and mail to the Optimum securityholders (the

"Circular") in connection with the special meeting

of the Optimum securityholders to be held to consider the

Arrangement (the "Meeting"). All securityholders

are urged to read the Circular once available as it will contain

additional important information concerning the Arrangement. The

Arrangement Agreement will be filed on SEDAR. Only Optimum

Shareholders of record and optionholders of Optimum at the close of

business on the record date will be entitled to vote at the

Meeting. The Arrangement will require the approval of (i) at least

66⅔% of the votes cast by Optimum securityholders; (ii) at least

66⅔% of the votes cast by Optimum shareholders; and (iii) if

applicable, a majority of the votes cast by Optimum shareholders

present in person or represented by proxy at the Optimum annual

general and special meeting, excluding, for this purpose, votes

attached to Optimum shares held by persons described in items (a)

through (d) of Section 8.1(2) of Multilateral Instrument 61-101 –

Protection of Minority Security Holders in Special

Transactions. The Transaction is anticipated to be

completed at or about the beginning of September 2023.The Plan of

Arrangement is subject to Court approval by way of receipt of an

interim order (the “Interim Order”) and a final

order (the “Final Order”). The Interim Order will

provide for, among other things, the holding of the Meeting to

approve the Arrangement. The Interim Order will also set out other

conditions that must be met for the Company to apply for the Final

Order of the Court to approve the Plan of Arrangement.

The Blackwolf Shares to be issued under the

Arrangement have not been and will not be registered under the U.S.

Securities Act of 1933, and may not be offered or sold in the

United States absent registration or applicable exemption from

registration requirements. It is anticipated that any securities to

be issued under the Arrangement will be offered and issued in

reliance upon the exemption from the registration requirements of

the U.S. Securities Act of 1933 provided by Section 3(a)(10)

thereof.

Board of Directors’ and Special

Committee Recommendations

The Arrangement Agreement has been approved by

the Boards of Directors of Optimum and Blackwolf. The Board of

Directors of Optimum has evaluated the Arrangement Agreement with

the Company's management and advisors and, following receipt and

review of a unanimous recommendation from the special committee of

the Board of Directors (the "Optimum Special

Committee"), comprised entirely of independent directors

of Optimum, in favour of the Transaction, the Optimum Board of

Directors unanimously determined that the Arrangement Agreement is

in the best interests of the Company, and unanimously recommend

that Optimum securityholders vote in favour of the Transaction.

RwE Growth Partners, Inc. has provided a

fairness opinion to Optimum Special Committee. The opinion stated

that, as of the date of such opinion, and based upon and subject to

the assumptions, limitations and qualifications stated in such

opinion, the consideration to be paid under the Arrangement is

fair, from a financial point of view, to Optimum shareholders.

Strategic Rationale for the

Arrangement

- The resulting entity following

completion of the Arrangement will provide the Optimum Shareholders

a direct interest in a company with a strong base of strategically

located high potential projects in the Golden Triangle area in

Northern British Columbia and Alaska with significant capital and

an experienced management team to pursue further exploration and

development of the projects;

- Complementary management teams with

a combined skill set of mining development, operations, finance,

exploration and community relations experience; locally-based team

of miners, drillers and support team; and

- Strong, supportive combined

corporate, retail and institutional shareholder base of the

resulting issuer providing enhanced market visibility.

Advisors and Counsel

DuMoulin Black LLP is acting as legal counsel to

Blackwolf and Fiore Management and Advisory Corp. has acted as

advisor to Blackwolf in connection with the Transaction and will

receive a 2% advisory fee payable in Blackwolf Shares on closing of

the Arrangement.

Boughton Law Corporation is acting as legal

counsel to Optimum. RwE Growth Partners, Inc. provided a fairness

opinion to Optimum’s Special Committee of the board of directors

that the Arrangement is fair from a financial point of view to the

shareholders of Optimum subject to the assumptions, limitations and

qualifications set out in such fairness opinion.

About Blackwolf

Blackwolf’s founding vision is to be an industry

leader in transparency, inclusion and innovation. Guided by our

Vision and through collaboration with local and Indigenous

communities and stakeholders, Blackwolf builds shareholder value

through our technical expertise in mineral exploration, engineering

and permitting. Blackwolf holds a 100% interest in the high-grade

Niblack copper-gold-zinc-silver VMS project, located adjacent to

tidewater in southeast Alaska as well as five Hyder Area

gold-silver and VMS properties in southeast Alaska and northwest

British Columbia in the Golden Triangle, including the

high-priority wide gold-silver veins at the Cantoo Property. For

more information on Blackwolf, please visit the their website at

www.blackwolfcopperandgold.com.

About Optimum

Optimum is a Canadian-based mineral exploration

company actively seeking opportunities in the resource sector. Its

properties and projects are all located in British Columbia and the

extensions of the Golden Triangle area of Northern British Columbia

into Alaska. The Company has an option agreement with Teuton

Resources Corp. pursuant to which Teuton has agreed to grant to

Optimum the option to acquire an up to 80-per-cent interest in the

Harry and Outland Silver Bar properties, located near Stewart,

B.C.

Neither the TSXV nor its Regulation Services

Provider (as that term is defined in the policies of the TSXV)

accepts responsibility for the adequacy or accuracy of this

release.

Completion of the Arrangement is subject

to a number of conditions, including but not limited to, TSXV

acceptance and shareholder approval. The Arrangement cannot close

until the required approvals are obtained. There can be no

assurance that the Arrangement will be completed as proposed or at

all.

Investors are cautioned that, except as

disclosed in the management information circular to be prepared in

connection with the Arrangement, any information released or

received with respect to the Arrangement may not be accurate or

complete and should not be relied upon. Trading in the securities

of the Company should be considered highly

speculative.

Neither the TSX Venture Exchange, Inc.

nor its Regulation Services Provider (as that term is defined in

the polices of the TSX Venture Exchange) has in any way passed upon

the merits of the Arrangement and associated transactions and

neither of the foregoing entities accepts responsibility for the

adequacy or accuracy of this release or has in any way approved or

disapproved of the contents of this press release.

Forward Looking Statements

This release includes certain statements and

information that may constitute forward-looking information within

the meaning of applicable Canadian securities laws. Forward-looking

statements relate to future events or future performance and

reflect the expectations or beliefs of management of the Company

regarding future events. Generally, forward-looking statements and

information can be identified by the use of forward-looking

terminology such as "intends" or "anticipates", or variations of

such words and phrases or statements that certain actions, events

or results "may", "could", "should", "would" or "occur". The

Company cautions that all forward-looking statements are inherently

uncertain, and that actual performance may be affected by a number

of material factors, many of which are beyond the Company’s

control. Important factors that could cause actual results to

differ materially from the Company's expectations include risks

associated with the business of Optimum and Blackwolf; risks

related to the satisfaction or waiver of certain conditions to the

closing of the Arrangement including obtaining all required

securityholder approvals and third party and regulatory consents;

non-completion of the Arrangement due to the exercise of dissent

rights by Optimum shareholders; risks related to reliance on

technical information provided by Optimum and Blackwolf; risks

related to exploration and potential development of Optimum and

Blackwolf projects; business and economic conditions in the mining

industry generally; fluctuations in commodity prices and currency

exchange rates; uncertainties relating to interpretation of drill

results and the geology, continuity and grade of mineral deposits;

uncertainty as to timely availability of permits and other

governmental approvals; and those risks set out in the filings on

SEDAR made by the Company with securities regulators. In making the

forward looking statements in this news release, the Company has

applied several material assumptions that the Company believes are

reasonable, including without limitation: the Company's ability to

complete the proposed Arrangement; and the Company's ability to

achieve the synergies expected as a result of the Arrangement.

Although the Company believes that the assumptions and factors used

in preparing the forward-looking information in this news release

are reasonable, undue reliance should not be placed on such

information, which only applies as of the date of this news

release, and no assurance can be given that such events will occur

in the disclosed time frames or at all. The Company expressly

disclaims any intention or obligation to update or revise any

forward-looking statements whether as a result of new information,

future events or otherwise, other than as required by applicable

securities legislation.

FOR FURTHER INFORMATION PLEASE CONTACT:

Tyler Ross

Optimum Ventures Ltd.

Tel: (604) 428-6128

info@optimumventures.ca

Optimum Ventures (TSXV:OPV)

Historical Stock Chart

From Nov 2024 to Dec 2024

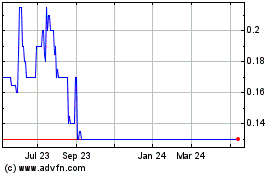

Optimum Ventures (TSXV:OPV)

Historical Stock Chart

From Dec 2023 to Dec 2024