TSX VENTURE COMPANIES

ADVENTURE GOLD INC. ("AGE")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: December 27, 2007

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the documentation relating

to a Purchase Agreement dated October 12, 2007 between the Company and

IAMGOLD-Quebec Management Inc. ("the Vendor"), whereby the Company is

acquiring a 100% of the Vendor's interests in 33 claims located near Val

D'Or, in the Province of Quebec.

The Company is required to issue a total of 250,000 common shares upon

signing the agreement.

The Vendor shall retain a 2% Net Smelter Royalty in the property, half of

which (1%) may be redeemable by the Company at any time for $1,000,000.

For further information, please refer to the Company's press release

dated December 6, 2007.

ADVENTURE GOLD INC. ("AGE")

TYPE DE BULLETIN : Convention d'achat de propriete, d'actif ou d'actions

DATE DU BULLETIN : Le 27 decembre 2007

Societe du groupe 2 de TSX Croissance

Bourse de croissance TSX a accepte le depot de documents en vertu d'une

convention d'achat datee du 12 octobre 2007 entre la societe et IAMGOLD-

Quebec Management Inc. ("le vendeur"), selon laquelle la societe acquiert

100 % de l'interet du vendeur dans 33 claims situes pres de Val D'Or,

dans la province de Quebec.

La societe doit emettre un total de 250 000 actions ordinaires a la

signature de l'entente.

Le vendeur conservera une royaute de 2 % du produit net de la vente des

metaux dont la moitie (1 %) est rachetable par la societe en tout temps

en contrepartie de 1 000 000 $.

Pour plus d'information, veuillez vous referer au communique de presse

emis par la societe le 6 decembre 2007.

TSX-X

---------------------------------------------------------------------------

ARCTURUS VENTURES INC. ("AZN")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 27, 2007

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced December 20, 2007:

Number of Shares: 300,000 flow through shares

462,500 non-flow through shares

Purchase Price: $0.10 per flow through share

$0.08 per non-flow through shares

Warrants: 762,500 share purchase warrants to purchase

762,500 shares

Warrant Exercise Price: $0.10 for a two year period

Number of Placees: 7 placees

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

TSX-X

---------------------------------------------------------------------------

AURAMEX RESOURCE CORP. ("AUX")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: December 27, 2007

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for expedited filing documentation

pertaining to an amendment agreement dated December 11, 2007 between the

Company's Mexican subsidiary, Exploracion Auramex S.A. de C.V. and

Exploracion Azteca S.A. de C.V. which extends the exercise date of the

Company's option to acquire an 85% interest in the El Fierro Exploration

Concession located in Culiacan district, Sinaloa, Mexico. To option date

has been extended one year to December 31, 2008 by the issuance of 25,000

shares.

TSX-X

---------------------------------------------------------------------------

COPPER CANYON RESOURCES LTD. ("CPY")

BULLETIN TYPE: Property-Asset or Share Disposition Agreement

BULLETIN DATE: December 27, 2007

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation relating to an

Option Agreement dated October 23, 2007 between Copper Canyon Resources

Ltd. ("the Company") and Egoli Resources Limited ("Egoli") whereby, Egoli

will have the option to earn a 75% interest in the Company's Abo Group of

Mineral Claims.

For further information, please refer to the Company's news releases

dated November 29, 2007 and December 19, 2007.

TSX-X

---------------------------------------------------------------------------

COPPER CREEK VENTURES LTD. ("CPV")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 27, 2007

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced December 5, 2007:

Number of Shares: 820,000 flow through shares

100,000 non-flow through shares

Purchase Price: $0.12 per flow through share

$0.10 per non-flow through share

Warrants: 820,000 warrants attached to flow through

shares to purchase 820,000 shares at a price

of $0.17 per share in the first year and at a

price of $0.22 per share in the second year.

100,000 warrants attached to non-flow through

shares to purchase 100,000 shares at a price

of $0.15 per share in the first year and at a

price of $0.20 per share in the second year.

Number of Placees: 5 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

Bing Jung Y 500,000 f/t

Finder's Fee: $1,000 payable to Canaccord Capital

Corporation

8,400 non-flow through units with terms as

above payable to John D. Davies

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

TSX-X

---------------------------------------------------------------------------

EQUUS ENERGY CORPORATION ("EQE")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 27, 2007

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced December 20, 2007:

Number of Shares: 5,031,400 shares

Purchase Price: $0.05 per share

Warrants: 5,031,400 share purchase warrants to purchase

5,031,400 shares

Warrant Exercise Price: $0.10 for a two year period

Number of Placees: 5 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P # of Shares

Stanley Lanzet Y 3,135,000

Benjamin Lanzet Y 457,240

Alexis Lanzet Y 862,660

John Denton Y 126,500

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

TSX-X

---------------------------------------------------------------------------

EXPLOR RESOURCES INC. ("EXS")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: December 27, 2007

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the documentation with

respect to a Brokered Private Placement, announced on December 21, 2007:

Number of Shares: 1,142,857 flow-through common shares

Purchase Price: $0.35 per flow-through common share

Warrants: 571 429 warrants to purchase 571 429 common

shares

Warrant Exercise Price: $0.50 per share until December 21, 2009

Number of Placees: 33 placees

Insider/Pro Group Participation:

Name Insider equals Y /

Pro Group equals P Number of Shares

Jean-Yves Bourgeois P 42,855

Nathalie Archambault P 28,570

Denis Amaroso P 71,424

Judy Taylor P 28,570

Line Rivard P 57,140

Josee Dupont P 85,710

Tammy Ougler P 14,285

Agent's Fee: $32,000 in cash and 114,286 brokers' warrants

payable to Canaccord Capital Corporation.

Each warrant can be exercised at $0.35

per share for a period of 12 months following

the closing of the Private Placement.

The Company has announced the closing of the above-mentioned Private

Placement by way of a press release

EXPLOR RESOURCES INC. ("EXS")

TYPE DE BULLETIN : Placement prive par l'entremise d'un courtier

DATE DU BULLETIN : Le 27 decembre 2007

Societe du groupe 2 TSX Croissance

Bourse de croissance TSX a accepte le depot de la documentation en vertu

d'un placement prive par l'entremise d'un courtier, tel qu'annonce le 21

decembre 2007 :

Nombre d'actions : 1 142 857 actions ordinaires accreditives

Prix : 0,35 $ par action ordinaire accreditive

Bons de souscription : 571 429 bons de souscription permettant de

souscrire a 571 429 actions ordinaires

Prix d'exercice des bons : 0,50 $ par action jusqu'au 21 decembre 2009

Nombre de souscripteurs : 33 souscripteurs

Participation initie / Groupe Pro :

Nom Initie egale Y /

Groupe Pro egale P Nombre d'actions

Jean-Yves Bourgeois P 42 855

Nathalie Archambault P 28 570

Denis Amaroso P 71 424

Judy Taylor P 28 570

Line Rivard P 57 140

Josee Dupont P 85 710

Tammy Ougler P 14 285

Frais aux agents : 32 000 $ au comptant et 114 286 bons de

souscription payables a Corporation

Canaccord Capital. Chaque bon de souscription

permet de souscrire a une action au prix de

0,35 $ l'action pendant une periode de 12 mois

suivant la cloture du placement prive.

La societe a annonce la cloture de ce placement prive par voie d'un

communique de presse.

TSX-X

---------------------------------------------------------------------------

GLASS EARTH GOLD LIMITED ("GEL")

(formerly Glass Earth Limited ("GEL"))

BULLETIN TYPE: Name Change

BULLETIN DATE: December 27, 2007

TSX Venture Tier 2 Company

Pursuant to a resolution passed by the Directors dated October 15, 2007,

the Company has changed its name as follows. There is no consolidation of

capital.

Effective at the opening on December 28, 2007, the common shares of Glass

Earth Gold Limited will commence trading on TSX Venture Exchange, and the

common shares of Glass Earth Limited will be delisted. The Company is

classified as a 'Mineral Exploration/Development' company.

Capitalization: Unlimited shares with no par value of which

152,042,633 shares are issued and outstanding

Escrow: 6,152,808 shares

Transfer Agent: Computershare Trust Company of Canada

Trading Symbol: GEL (same)

CUSIP Number: 37713P 10 4 (new)

TSX-X

---------------------------------------------------------------------------

GOLDEYE EXPLORATIONS LIMITED ("GGY")

BULLETIN TYPE: Private Placement-Brokered, Private Placement-Non-Brokered

BULLETIN DATE: December 27, 2007

TSX Venture Tier 2 Company

Private Placement #1 (Brokered):

TSX Venture Exchange has accepted for filing documentation with respect

to a Brokered Private Placement announced December 21, 2007:

Number of Shares: 1,500,000 flow through shares

Purchase Price: $0.14 per flow through share

Number of Placees: 1 placee

Agent's Fee: $16,800, plus 150,000 broker's warrants (each

exercisable into 1 common share at a price of

$0.14 for a period of 2 years), payable to

Blackmont Capital Inc.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

Private Placement #2 (Brokered):

TSX Venture Exchange has accepted for filing documentation with respect

to a Brokered Private Placement announced December 21, 2007:

Number of Shares: 2,000,000 flow through shares

Purchase Price: $0.15 per flow through share

Number of Placees: 1 placee

Agent's Fee: $30,000, plus 200,000 broker's warrants (each

exercisable into 1 common share at a price of

$0.15 for a period of 2 years), payable to

Octagon Capital Corporation

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

Private Placement #3 (Non-Brokered):

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced December 21, 2007:

Number of Shares: 2,200,000 flow through shares

Purchase Price: $0.14 per share

Number of Placees: 4 placees

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

TSX-X

---------------------------------------------------------------------------

HARTE GOLD CORP. ("HRT")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: December 27, 2007

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Brokered Private Placement announced December 24, 2007:

Number of Shares: 2,975,000 flow-through shares

Purchase Price: $0.20 per share

Warrants: 1,487,500 share purchase warrants to purchase

1,487,500 shares

Warrant Exercise Price: $0.25 until December 31, 2008

Number of Placees: 7 placees

Agents' Fee: An aggregate of $53,550 in cash and 297,500

broker warrants payable to HDL Capital Corp.

and IBK Capital Corp. Each broker warrant

entitles the holder to acquire one unit at

$0.20 for a two year period.

Note that in certain circumstances the Exchange may later extend the

expiry date of the warrants, if they are less than the maximum permitted

term.

For further details, please refer to the Company's news release dated

December 24, 2007.

TSX-X

---------------------------------------------------------------------------

HORIZON INDUSTRIES LIMITED ("HRZ")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 27, 2007

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced December 7, 2007 and

December 12, 2007:

Number of Shares: 2,720,750 shares

Purchase Price: $0.20 per share

Warrants: 2,720,750 share purchase warrants to purchase

2,720,750 shares

Warrant Exercise Price: $0.30 for a two year period

Number of Placees: 13 placees

Insider / Pro Group Participation:

Nom Insider equals Y /

Name ProGroup equals P / # of Shares

Christopher Wensley Nom Y 25,000

Patrick Forseille Nom Y 25,000

Scott Purkis Nom P 25,000

Sextant Strategic Hybrid

Hedge Resource Fund Nom P 1,000,000

Sextant Strategic

Opportunities Fund Nom P 1,000,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

TSX-X

---------------------------------------------------------------------------

INNOVOTECH INC. ("IOT")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: December 27, 2007

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced December 6, 2007:

Number of Shares: 3,000,000 shares

Purchase Price: $0.60 per share

Warrants: 1,500,000 warrants to purchase 1,500,000

common shares

Exercise Price: $0.75 per share for a period of one year

Number of Placees: 14 placees

Insider / Pro Group Participation:

Nom Insider equals Y /

Name ProGroup equals P / # of Units

Kerry Brown Y 269,784

Jim Timourian Y 269,784

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s).

TSX-X

---------------------------------------------------------------------------

KIK POLYMERS INC. ("KPI.H")

(formerly Kik Polymers Inc. ("KPI"))

BULLETIN TYPE: Property-Asset or Share Disposition Agreement, Transfer

and New Addition to NEX, Symbol Change

BULLETIN DATE: December 27, 2007

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pursuant to a

Sale Agreement dated September 12, 2007 between Kik Polymers Inc. (the

'Company') and AD Capital Industries Inc. ('AD Capital') wherein the

Company has agreed to sell its interest in KIK Technology International,

Inc. ('KTII') to AD Capital in exchange for a promissory note in the

amount of US$230,000 ('Note'). The Note is structured such that US$30,000

is payable upon closing while the balance is payable on demand.

Alternatively, in the event that AD Capital becomes a tradable company on

any stock exchange, the balance of the Note will be convertible at the

Company's option into shares of the new trading company. Following the

disposition of its interest in KTII, the Company will have no ongoing

operations.

In accordance with TSX Venture Policy 2.5, the Company has not maintained

the requirements for a TSX Venture Tier 2 company. Therefore, effective

December 28, 2007, the Company's listing will transfer to NEX, the

Company's Tier classification will change from Tier 2 to NEX, and the

Filing and Service Office will change from Calgary to NEX.

As of December 28, 2007, the Company is subject to restrictions on share

issuances and certain types of payments as set out in the NEX policies.

The trading symbol for the Company will change from KPI to KPI.H. There

is no change in the Company's name, no change in its CUSIP number and no

consolidation of capital. The symbol extension differentiates NEX symbols

from Tier 1 or Tier 2 symbols within the TSX Venture market.

TSX-X

---------------------------------------------------------------------------

MACARTHUR MINERALS LIMITED ("MMS")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 27, 2007

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced November 21, 2007:

Number of Shares: 2,000,000 shares

Purchase Price: $1.40 per share

Warrants: 2,000,000 share purchase warrants to purchase

2,000,000 shares

Warrant Exercise Price: $2.00 for an eighteen month period

Number of Placees: 3 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P # of Shares

Pinetree Resource Partnership Y 500,000

Longview Capital Partners Y 500,000

Finder's Fee: $84,000 cash payable to Unlimited Business

Strategies Pty Ltd. (Joe Phillips)

$42,000 cash payable to PowerOne Capital

Markets Limited.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. Note that in certain circumstances the Exchange may later

extend the expiry date of the warrants, if they are less than the maximum

permitted term.

TSX-X

---------------------------------------------------------------------------

NORTH AMERICAN GEM INC. ("NAG")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 27, 2007

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced December 10, 2007:

Number of Shares: 8,310,000 flow-through shares and 1,760,000

non flow-through shares

Purchase Price: $0.10 per share

Warrants: 5,915,000 share purchase warrants to purchase

5,915,000 shares

Warrant Exercise Price: $0.12 for a one year period

$0.15 in the second year

Number of Placees: 37 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

Vikki Belack P 200,000 flow-through shares

Dean Duke P 175,000 flow-through shares

Roy Ruppert P 250,000 flow-through shares

Ivano Veschini P 100,000 flow-through shares

Neil Adshead P 120,000 flow-through shares

Kerry Chow P 500,000 flow-through shares

Judy Chu P 50,000 non flow-through shares

Finder's Fee: $30,000 cash and 300,000 warrants exercisable

at $0.10 for two years payable to Pacific

International Financial Corp.

$7,700 cash and 77,000 warrants (same terms

as above) payable to Bolder Investment

Partners.

$34,000 cash and 340,000 warrants (same terms

as above) payable to West Oak Capital

Partners.

$6,250 cash and 62,500 warrants (same terms

as above) payable to Kris Begic.

$6,250 cash and 62,500 warrants (same terms

as above) payable to Northern Precious Metals

Management Inc.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

TSX-X

---------------------------------------------------------------------------

PHARMENG INTERNATIONAL INC. ("PII")

BULLETIN TYPE: Shares for Bonuses

BULLETIN DATE: December 27, 2007

TSX Venture Tier 1 Company

The TSX Venture Exchange (the "Exchange") has accepted for filing a loan

and security agreement (the "Agreement") dated December 21, 2007, between

Pharmeng International Inc. (the "Company"), Pharmeng USA, Inc., Pharmeng

Technology Inc., Keata Pharma, Inc., Pharmeng Learning Institute Inc.,

Pharmeng International (China) Inc. and BHC Interim Funding II, L.P. (the

"Lender"), pursuant to which the Lender shall provide a loan of

$5,000,000 to the Company. The loan matures December 20, 2009, with

interest of 13% per annum, increasing to 18% per annum in the event of a

default.

The Exchange has also accepted an aggregate bonus of up to 2,700,000

common share purchase warrants. Each warrant is exercisable into one

common share at a price of $0.50 for a two year period.

TSX-X

---------------------------------------------------------------------------

PHARMENG INTERNATIONAL INC. ("PII")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: December 27, 2007

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation pertaining to

a purchase and sale agreement (the "Agreement") dated December 18, 2007,

between Pharmeng International Inc. (the "Company"), Keata Pharma Inc.,

an indirect wholly-owned subsidiary of the Company, and Pfizer Canada

Inc. (the "Vendor"). Pursuant to the Agreement, the Company will purchase

the Vendor's manufacturing facility in Arnprior, Ontario, including

inventory.

As consideration, the Company must pay the Vendor $6,262,383.54.

For further information, please refer to the Company's press release

dated December 19, 2007.

TSX-X

---------------------------------------------------------------------------

PISCES CAPITAL CORP. ("PCP.P")

BULLETIN TYPE: Remain Halted

BULLETIN DATE: December 27, 2007

TSX Venture Tier 2 Company

Further to TSX Venture Exchange Bulletin dated December 21, 2007,

effective at 8:05 a.m. PST, December 27, 2007 trading in the shares of

the Company will remain halted pending receipt and review of acceptable

documentation regarding the Qualifying Transaction pursuant to Listings

Policy 2.4.

TSX-X

---------------------------------------------------------------------------

PUMA EXPLORATION INC. ("PUM")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: December 27, 2007

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the documentation with

respect to a Brokered Private Placement announced on November 27, 2007:

Number of Shares: 6,025,269 flow-through shares common shares

Purchase Price: $0.55 per flow-through common share

Number of Placees: 20 placees

Agent: Northern Securities Inc.

Agent's Fee: A cash commission of $265,111.84 equal to 8%

of the proceeds raised and an option to

purchase 602,527 common shares at a price of

$0.55 per share up to December 19, 2009.

The Company has confirmed the closing of the above-mentioned Private

Placement by way of a press release dated December 20, 2007.

EXPLORATION PUMA INC. ("PUM")

TYPE DE BULLETIN : Placement prive par l'entremise d'un courtier

DATE DU BULLETIN : Le 27 decembre

Societe du groupe 2 de TSX Croissance

Bourse de croissance TSX a accepte le depot de la documentation en vertu

d'un placement prive par l'entremise d'un courtier, tel qu'annonce le 27

novembre 2007 :

Nombre d'actions : 6 025 269 actions ordinaires accreditives

Prix : 0,55 $ par action ordinaire accreditive

Nombre de souscripteurs : 20 souscripteurs

Agent : Northern Securities Inc.

Frais aux agents : 265 111,84 $ au comptant et 114 286 equivalant

a 8 % du produit du financement et l'option

d'acquerir 602 527 actions ordinaires au prix

de 0,55 $ l'action jusqu'au 19 decembre 2009.

La societe a annonce la cloture de ce placement prive par voie d'un

communique de presse date du 20 decembre 2007.

TSX-X

---------------------------------------------------------------------------

ROCKWELL DIAMONDS INC. ("RDI")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: December 27, 2007

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Brokered Private Placement announced November 28, 2007:

Number of Shares: 24,101,285 shares

Purchase Price: $0.60 per share

Number of Placees: 53 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

John William Bristow Y 24,100

Agent's Fee: Allan Hochreiter (Pty) Ltd. will receive

$300,000 and 500,000 shares

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

TSX-X

---------------------------------------------------------------------------

SABLE RESOURCES LTD. ("SAE")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 27, 2007

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced November 30, 2007:

Number of Shares: 1,428,600 shares

Purchase Price: $0.70 per share

Warrants: 714,300 share purchase warrants to purchase

714,300 shares

Warrant Exercise Price: $0.95 for a two year period

Number of Placees: 10 placees

Finder's Fee: $60,001.20 and 38,000 non-transferable

warrants payable to Blackmont Capital Inc.

Each warrant is exercisable for one share at

a price of $0.95 per share for a two year

period.

76,287 non transferable warrants payable to

NovaDX Ventures Corp. Each warrant is

exercisable for one share at a price of $0.95

per share for a two year period.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

TSX-X

---------------------------------------------------------------------------

SEGO RESOURCES INC. ("SGZ")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 27, 2007

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced October 30, 2007 and

amended December 19, 2007:

Number of Shares: 3,710,704 flow through shares

1,700,000 non-flow through shares

Purchase Price: $0.27 per flow through share

$0.25 per non-flow through share

Warrants: 1,855,352 share purchase warrants attached to

flow through shares to purchase 1,855,352

non-flow through shares

1,700,000 share purchase warrants attached to

non-flow through shares to purchase 1,700,000

non-flow through shares

Warrant Exercise Price: $0.32 for a two year period

Number of Placees: 37 placees

Finder's Fees: Limited Market Dealer Inc. receives $20,000

and 74,075 non-transferable warrants, each

exercisable at a price of $0.25 per share

for a two year period to purchase non-flow

through units with terms as above.

Northern Securities Inc. receives $122,689 and

466,996 transferable warrants, each

exercisable at a price of $0.25 per share for

a two year period to purchase non-flow through

units with terms as above.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

TSX-X

---------------------------------------------------------------------------

SYSCAN INTERNATIONAL INC. ("SYA")

BULLETIN TYPE: Regional Office Change

BULLETIN DATE: December 27, 2007

TSX Venture Tier 2 Company

Pursuant to Policy 1.2, TSX Venture Exchange has been advised of, and

accepted the change of the Filing and Regional Office from Toronto,

Ontario to Montreal, Quebec.

TSX-X

---------------------------------------------------------------------------

TRI-GOLD RESOURCES CORP. ("TAL")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: December 27, 2007

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing an option agreement dated

December 4, 2007 between Tri-Gold Resources Corp. (the 'Company') and

Falcon Mineral Exploration Limited, whereby the Company will acquire a

100% interest in the Phyllis Lake Property located in Northwestern

Ontario.

Total consideration consists of $225,000 in cash payments and 350,000

shares of the Company over a three year period.

In addition, there is a 2% net smelter return relating to the

acquisition. The Company may at any time purchase 1% of the net smelter

return for $1,000,000 in order to reduce the total net smelter return to

1%.

TSX-X

---------------------------------------------------------------------------

UNITED REEF LIMITED ("URP")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 27, 2007

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced December 21, 2007:

Number of Shares: 1,437,500 shares

Purchase Price: $0.08 per share

Warrants: 1,437,500 share purchase warrants to purchase

1,437,500 shares

Warrant Exercise Price: $0.12 until December 19, 2009

Number of Placees: 8 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

Michael Coulter Y 156,250

Marilyn Turner Y 156,250

For further details, please refer to the Company's news release dated

December 21, 2007.

TSX-X

---------------------------------------------------------------------------

VANTEX RESOURCES LTD. ("VTX")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 27, 2007

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the documentation with

respect to a Non-Brokered Private Placement, announced on December 19,

2007:

Number of Shares: 693,334 flow-through common shares and 227,333

common shares.

Purchase Price: $0.15 per flow-through common share and $0.15

per common share.

Number of Placees: 10 placees

Insider/Pro Group Participation:

Name Insider equals Y /

Pro Group equals P Number of Shares

Guy Morissette Y 166,667

Finder's Fee: $5,600 payable to Societe de gestion Morisco

Inc.

Pursuant to the Exchange's Corporate Finance Policy 4.1, section 1.11

(d), the Company must issue a press release announcing the closing of the

Private Placement and setting out the expiry dates of the hold period(s).

The Company must also issue a press release if the Private Placement does

not close promptly.

RESSOURCES VANTEX LTEE ("VTX")

TYPE DE BULLETIN: Placement prive sans l'entremise d'un courtier

DATE DU BULLETIN: Le 27 decembre 2007

Societe du groupe 2 de TSX Croissance

Bourse de croissance TSX a accepte le depot de la documentation en vertu

d'un placement prive sans l'entremise d'un courtier, tel qu'annonce le 19

decembre 2007:

Nombre d'actions : 693 334 actions ordinaires accreditives et 227

333 actions ordinaires.

Prix : 0,15 $ par action ordinaire accreditive et

0,15 $ par action ordinaire.

Nombre de souscripteurs : 10 souscripteurs

Participation initie / Groupe Pro :

Nom Initie egale Y /

Groupe Pro egale P Nombre d'actions

Guy Morissette Y 166 667

Frais d'intermediation : 5 600 $ payable a Societe de gestion

Morisco Inc.

En vertu de la section 1.11 (d) de la Politique de financement des

societes 4.1 de la Bourse, la societe doit emettre un communique de

presse annoncant la cloture du placement prive, divulguant notamment les

dates d'echeance des periodes de detention obligatoires des titres emis

en vertu du placement prive. La societe doit aussi emettre un communique

de presse si le placement prive ne cloture pas dans les delais.

TSX-X

---------------------------------------------------------------------------

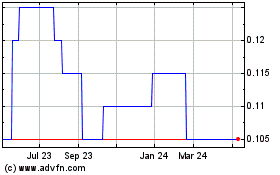

Pender Street Capital (TSXV:PCP.P)

Historical Stock Chart

From Nov 2024 to Dec 2024

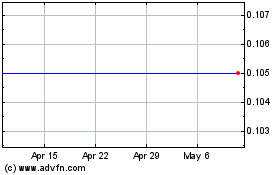

Pender Street Capital (TSXV:PCP.P)

Historical Stock Chart

From Dec 2023 to Dec 2024