Gran Colombia Reports First Quarter 2020 Gold Production and Update On April Production Expectations

April 14 2020 - 6:00AM

Gran Colombia Gold Corp. (TSX: GCM; OTCQX: TPRFF) announced today

that it produced a total of 19,072 ounces of gold in March bringing

the total for the first quarter of 2020 to 56,247 ounces compared

with 60,601 ounces in the first quarter of 2019.

Lombardo Paredes, Chief Executive Officer of

Gran Colombia, commenting on the Company’s latest production

results, said, “While we are pleased with our first quarter 2020

production, it came in slightly lower than expected due to the

impact of the national quarantine in Colombia on Segovia’s

production in the final week of March. We continue to operate at

both Segovia and Marmato in April but at reduced production rates

compared to normal as the national quarantine has limited the

number of available workers in both operations. In the second half

of April, we expect to see an increase in the number of workers at

both operations compared to the first half of the month, but we are

continuing to proceed with caution, ensuring all safety measures

remain in effect and limiting discretionary capital and operating

expenditures. At March 31, 2020, Gran Colombia’s cash position

stood at US$81.6 million and Caldas Gold had a cash position of

US$14.0 million. Both companies remain well financed to weather the

challenges during the COVID-19 situation and to advance progress on

their core business objectives.”

The Segovia Operations processed an average of

1,287 tonnes per day (“tpd”) in March 2020 with an average head

grade of 14.7 g/t resulting in gold production of 16,933 ounces.

This brought Segovia’s total production for the first quarter of

2020 to 50,346 ounces compared with 54,386 ounces in the first

quarter of 2019. In the first quarter of 2020, the Segovia

Operations processed an average of 1,284 tpd, up from 1,112 tpd in

the first quarter last year, at an average head grade of 14.9 g/t.

Segovia’s first quarter 2019 production had benefitted from

material sourced from some very high grade stopes at the

Providencia mine which had had boosted Segovia’s head grade in the

first quarter of 2019 to 18.8 g/t while Segovia’s average head

grade for all of 2019 was 16.4 g/t. As previously announced, in

response to COVID-19, the Colombian government implemented a

national quarantine which went into effect on March 25, 2020.

Although operations at Segovia have continued, the quarantine has

placed limitations on the number of available workers, including

the contract miners at the El Silencio and Providencia mines. Over

the final week of March, the Company used its stockpile to

complement the feed to the Maria Dama processing plant in lieu of

higher grade material from the contract miners. In April, the

Company anticipates that Segovia’s gold production will range

between 60% and 75% of normal expectations due to the continuing

restrictions affecting the availability of workers during the

month. During the slowdown, the Company is taking the opportunity

to complete some important maintenance and revamping its

infrastructure, including the crushing section of the Maria Dama

plant, a primary apique at El Silencio and installing new brakes on

the hoisting equipment at Providencia. Gran Colombia’s drilling

program at Segovia is proceeding with three of the six rigs in

operation focusing on the high priority targets at El Silencio and

Sandra K.

At the Marmato Operations owned by Caldas Gold

Corp. (TSX-V: CGC), the plant processed an average of 973 tpd in

March at an average grade of 2.5 g/t resulting in gold production

of 2,139 ounces. This brought Marmato’s total gold production for

the first quarter of 2020 to 5,901 ounces compared with 6,215

ounces in the first quarter of 2019. The previously announced

temporary explosives shortage at the beginning of the year had

limited material available for processing to an average of 696 tpd

in January 2020, about 30% below normal. This contributed to the

lower production in the first quarter of 2020 compared with the

first quarter last year as total material processed averaged 930

tpd in the first quarter of 2020 compared with an average of 1,015

tpd in the first quarter last year. Mill recovery improved to an

average of 88.6% in the first quarter of 2020 compared with 86.6%

in the first quarter last year. Mine optimization activities

continued to make progress in March. Similar to Segovia, operations

at Marmato have continued in April during the COVID-19 quarantine

but with a lower complement of workers due to the travel

restrictions between the outside communities where workers live and

Marmato. As such, Caldas Gold anticipates that April’s gold

production will range between 50% and 65% of normal expectations.

During the slowdown, Caldas Gold is taking the opportunity to

finish the optimization of the Knelson concentrator and the new

flotation cell at the processing plant which will improve its mill

recovery. With the completion of the Phase 2 drilling program in

2019 to upgrade the inferred resources in the Deeps Zone, as

announced on February 3, 2020, the work on the prefeasibility study

is proceeding as planned at this time.

About Gran Colombia Gold

Corp.

Gran Colombia is a Canadian-based mid-tier gold

producer with its primary focus in Colombia where it is currently

the largest underground gold and silver producer with several mines

in operation at its high-grade Segovia Operations. Gran Colombia

owns approximately 74% of Caldas Gold Corp., a Canadian mining

company currently advancing a prefeasibility study for a major

expansion and modernization of its underground mining operations at

its Marmato Project in Colombia. Gran Colombia’s project pipeline

includes its Zancudo Project in Colombia together with an

approximately 21% equity interest in Gold X Mining Corp. (TSXV:

GLDX) (Guyana – Toroparu) and an approximately 20% equity interest

in Western Atlas Resources Inc. (“Western Atlas”) (TSX-V: WA)

(Nunavut – Meadowbank).

Additional information on Gran Colombia can be

found on its website at www.grancolombiagold.com and by reviewing

its profile on SEDAR at www.sedar.com.

Cautionary Statement on Forward-Looking

Information:

This news release contains "forward-looking

information", which may include, but is not limited to, statements

with respect to production guidance and anticipated business plans

or strategies. Often, but not always, forward-looking statements

can be identified by the use of words such as "plans", "expects",

"is expected", "budget", "scheduled", "estimates", "forecasts",

"intends", "anticipates", or "believes" or variations (including

negative variations) of such words and phrases, or state that

certain actions, events or results "may", "could", "would", "might"

or "will" be taken, occur or be achieved. Forward-looking

statements involve known and unknown risks, uncertainties and other

factors which may cause the actual results, performance or

achievements of Gran Colombia to be materially different from any

future results, performance or achievements expressed or implied by

the forward-looking statements. Factors that could cause actual

results to differ materially from those anticipated in these

forward-looking statements are described under the caption "Risk

Factors" in the Company's Annual Information Form dated as of March

30, 2020 which is available for view on SEDAR at www.sedar.com.

Forward-looking statements contained herein are made as of the date

of this press release and Gran Colombia disclaims, other than as

required by law, any obligation to update any forward-looking

statements whether as a result of new information, results, future

events, circumstances, or if management's estimates or opinions

should change, or otherwise. There can be no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, the reader is

cautioned not to place undue reliance on forward-looking

statements.

For Further Information,

Contact:Mike DaviesChief Financial Officer(416)

360-4653investorrelations@grancolombiagold.com

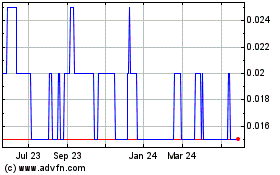

Western Atlas Resources (TSXV:WA)

Historical Stock Chart

From Jan 2025 to Feb 2025

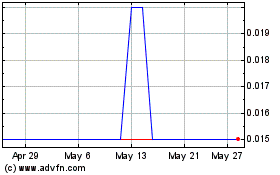

Western Atlas Resources (TSXV:WA)

Historical Stock Chart

From Feb 2024 to Feb 2025