West Red Lake Gold Mines Ltd. (“West Red Lake Gold” or the

“Company”) (TSXV: WRLG) (OTCQB: WRLGF) is pleased to

report that a test mining and bulk sample program (the “Program”)

is now underway at the Madsen Mine, adding a key derisking

component to the efforts being made to prepare the mine for a

targeted restart in 2025.

“Data and experience are invaluable in mining,”

said Shane Williams, President and CEO of West Red Lake Gold. “Test

mining will provide data on how best to mine at Madsen, bulk

samples will allow us to compare modeled and actual mine resources,

and the process will give our team another layer of operational

experience. As we continue to push towards restarting the Madsen

Mine in 2025, I am very excited this program is underway.”

Overall Approach

Test mining has already begun. Crews are

currently developing top and bottom access (sills) ahead of long

hole stoping in the Austin 1099/1100 area. The process has already

been informative, and the Company expects to report on stoping

progress in the next mine site update in early October.

The Program is expected to run for four months.

Bulk samples will be batch stockpiled on site. The Company expects

to process these bulk sample stockpiles soon after restarting the

mill.

The test mining and bulk sample program is

designed around three goals.

- To understand,

prior to restart, the best methods to mine safely and efficiently

in the various underground environments at Madsen.

- To inform

mineability decisions for mineralization near old stopes. Historic

stopes are currently wrapped in 2-metre, null-resource buffers that

could potentially be reduced or removed if trial mining

demonstrates these buffer areas are mineable. This represents

potential upside to the overall mineable inventory.

- To create bulk

samples that the Company can batch process on mill startup to

complete reconciliation calculations between expected and actual

tonnes, grade, and ounces of mined material.

The Company chose four target areas in the

Madsen resource that represent the range of mining environments,

average gold grades, definition drilling density, and assumed

mining methods. Trial mining across these variables will inform a

confident and safe plan for mining the high-grade gold resources at

Madsen.

Figure 1: A section view of the Madsen project

with the four target areas for the test mining and bulk sample

program noted. Green shapes are planned stopes, blue lines are

planned sills, red, green and orange lines are future development

of varying sizes, and grey shapes are historic stopes.

The four test mining target areas collectively

host 114,600 tonnes of total material with an average grade of 5.98

grams per tonne gold (g/t Au). The Company expects to bulk sample

approximately 5,000 tonnes from each area in this test mining

program.

Mining will be a mixture of Long Hole Stoping

(LHS) and Mechanized Cut and Fill (MCF).

LHS will be used wherever resource shape and

geometry allow and will ideally include 3-metre by 3-metre overcuts

and undercuts (sills). Maximum level spacing will be 20 metres

vertical. Production drilling will be done with Boart Stopemate

drills; mucking will be completed with a 2.5-yard Scooptram.

MCF will be used in remnant mining areas. MCF

stopes will have a minimum size of 3 metres by 3 metres,

slashed wider in places for selective mining. MCF will be

accomplished with either Long Tom drills or a single-boom Jumbo

combined with a 2-yard Scooptram.

Test Mining Areas

The Company plans to mine, stockpile, and batch

process approximately 5,000 tonnes from each of the four areas

described below as part of the Program.

McVeigh Lenses 1453 and

1406

Lenses 1453 and 1406 are a near-surface part of

the McVeigh resource block. This area has an overall expected

26,300 tonnes at 7.15 g/t gold grade and will be mined exclusively

with LHS. The sill levels are 18 metres vertically spaced, which

leaves 15 metres for stoping.

This area was selected to add information to the

resource model in the McVeigh area, which has higher geologic

complexity than other parts of the Madsen resource, and to bulk

sample a higher-grade part of the resource.

South Austin Lens 1155

The 1155 mining area is near the midpoint of the

current mine, approximately 400 metres vertical below surface. This

area has an overall expected 73,300 tonnes at 5.66 g/t gold grade.

This complex is a fresh mining area with no historical workings and

will be mined via LHS.

This test area will confirm geological modelling

practices and the reliability of the sill engineering process.

Drilling is currently ongoing in this area; results are expected to

refine the total targeted tonnes and grade before test mining

begins.

Austin Lens 1099/1100

The Austin Lens 1099/1100 is in an area of

remnant mining. It has an overall expected 6,700 tonnes at

5.39 g/t gold grade. This area will be mined with a mixture of MCF

and LHS.

This area will be test-mined to establish

remnant mining procedures, partly by confirming the geotechnical

competence of historical backfill, and to confirm historical

data.

Figure 2: An orthogonal view of the Austin

1099/1100 mining area showing planned sills (blue), stopes (light

green), and access (dark green).

South Austin Lenses 1136 and

1148

This test mining area has an overall expected

8,300 tonnes at 5.60 g/t gold grade.

This area is being targeted to determine the

accuracy of previous resource models and drilled areas, including

understanding how best to assess sills that previous operators

started in this area but did not complete.

QUALIFIED PERSON

The technical information presented in this news

release has been reviewed and approved by Maurice Mostert, P.Eng.,

Vice President of Technical Services for West Red Lake Gold and the

Qualified Person for Reserves at the West Red Lake Project, as

defined by National Instrument 43-101 Standards of Disclosure for

Mineral Projects.

ABOUT WEST RED LAKE GOLD

MINES

West Red Lake Gold Mines Ltd. is a mineral

exploration company that is publicly traded and focused on

advancing and developing its flagship Madsen Gold Mine and the

associated 47 km2 highly prospective land package in the Red

Lake district of Ontario. The highly productive Red Lake Gold

District of Northwest Ontario, Canada has yielded over 30 million

ounces of gold from high-grade zones and hosts some of the world’s

richest gold deposits. WRLG also holds the wholly owned Rowan

Property in Red Lake, with an expansive property position covering

31 km2 including three past producing gold mines – Rowan,

Mount Jamie, and Red Summit.

ON BEHALF OF WEST RED LAKE GOLD MINES

LTD.

“Shane Williams”

Shane Williams

President & Chief Executive Officer

FOR FURTHER INFORMATION, PLEASE CONTACT:

Investor Relations

Tel: (604) 609-6132

Email: investors@wrlgold.com or visit the Company’s

website at https://www.westredlakegold.com

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

CAUTIONARY STATEMENT AND FORWARD-LOOKING

INFORMATION

The decision to continue with the advancement of

the Madsen Mine restart and the Company’s operations and plans with

respect thereto, as described herein (the “Madsen Mine Restart”),

are based on economic models prepared by the Company in conjunction

with management’s knowledge of the property and the existing

estimate of indicated and inferred mineral resources on the

property set out in the report entitled, “Independent NI 43-101

Technical Report and Updated Mineral Resource Estimate for the

PureGold Mine, Canada,” with an effective date of July 31, 2022, as

amended on April 24, 2024, a copy of which is available on SEDAR+

at www.sedarplus.ca. The Madsen Mine Restart is not based on a

preliminary economic assessment, a pre-feasibility study or a

feasibility study of mineral reserves demonstrating economic and

technical viability. Accordingly, there is increased uncertainty

and economic and technical risks of failure associated with the

Madsen Mine Restart, in particular: the risk that mineral grades

will be lower than expected; the risk that additional ongoing

mining operations are more difficult or more expensive than

expected; and the risk that production and economic variables may

vary considerably, due to the absence of a detailed economic and

technical analysis undertaken in accordance with National

Instrument 43-101 - Standards of Disclosure for Mineral

Projects.

Certain statements contained in this news

release may constitute “forward-looking information” within the

meaning of applicable securities laws. Forward-looking information

generally can be identified by words such as “anticipate”,

“expect”, “estimate”, “forecast”, “planned”, and similar

expressions suggesting future outcomes or events. Forward-looking

information is based on current expectations of management;

however, it is subject to known and unknown risks, uncertainties

and other factors that may cause actual results to differ

materially from the forward-looking information in this news

release and include without limitation, statements relating to

plans for the potential restart of mining operations at the Madsen

Mine, the potential of the Madsen Mine; any untapped growth

potential in the Madsen deposit or Rowan deposit; and the Company’s

future objectives and plans. Readers are cautioned not to place

undue reliance on forward-looking information.

Forward-looking information involve numerous

risks and uncertainties and actual results might differ materially

from results suggested in any forward-looking information. These

risks and uncertainties include, among other things, market

volatility; the state of the financial markets for the Company’s

securities; fluctuations in commodity prices; timing and results of

the cleanup and recovery at the Madsen Mine; and changes in the

Company’s business plans. Forward-looking information is based on a

number of key expectations and assumptions, including without

limitation, that the Company will continue with its stated business

objectives and its ability to raise additional capital to proceed.

Although management of the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking information,

there may be other factors that cause results not to be as

anticipated, estimated or intended. There can be no assurance that

such forward-looking information will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such forward-looking information. Accordingly,

readers should not place undue reliance on forward-looking

information. Readers are cautioned that reliance on such

information may not be appropriate for other purposes. Additional

information about risks and uncertainties is contained in the

Company’s management’s discussion and analysis for the year ended

November 30, 2023, and the Company’s annual information form for

the year ended November 30, 2023, copies of which are available on

SEDAR+ at www.sedarplus.ca.

The forward-looking information contained herein

is expressly qualified in its entirety by this cautionary

statement. Forward-looking information reflects management’s

current beliefs and is based on information currently available to

the Company. The forward-looking information is made as of the date

of this news release and the Company assumes no obligation to

update or revise such information to reflect new events or

circumstances, except as may be required by applicable law.

For more information on the Company, investors

should review the Company’s continuous disclosure filings that are

available on SEDAR+ at www.sedarplus.ca.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/d75b5f1a-bdea-4e93-b3b3-5818e68e34d1

https://www.globenewswire.com/NewsRoom/AttachmentNg/f714b684-3bfb-41d9-8fc1-1949494c10be

https://www.globenewswire.com/NewsRoom/AttachmentNg/8aaf80c3-b417-4667-a0bf-bea01948995c

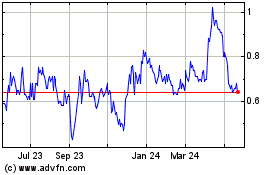

West Red Lake Gold Mines (TSXV:WRLG)

Historical Stock Chart

From Feb 2025 to Mar 2025

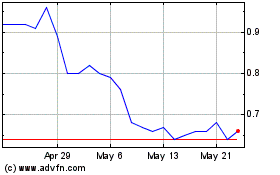

West Red Lake Gold Mines (TSXV:WRLG)

Historical Stock Chart

From Mar 2024 to Mar 2025