UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1/A

Amendment No. 1

REGISTRATION STATEMENT UNDER THE

SECURITIES ACT OF 1933

AIM Exploration Inc.

(Exact name of registrant as specified

in its charter)

Nevada

(State or other jurisdiction of incorporation

or organization)

1090

(Primary Standard Industrial Classification

Code Number)

67-0682135

(I.R.S. Employer Identification Number)

170 S Green Valley Pkwy, Suite 300

Henderson, Nevada 89012

Telephone: (844) 246-7378

(Address, including zip code, and

telephone number,

including area code, of registrant’s

principal executive offices)

IncSmart.biz, Inc.

3609 Hammerkop Dr.

North Las Vegas, NV 89084

Las Vegas, NV 89169-6014

(888) 681-9777

(Name, address, including zip code,

and telephone number, including area code, of agent for service)

Copy to:

Scott P. Doney, Esq.

The Doney Law Firm

4955 S. Durango Rd. Ste. 165

Las Vegas, NV 89113

Telephone: (982) 702-5686

From time to time after the effective

date of this registration statement.

(Approximate date of commencement

of proposed sale to the public)

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933 check the following box:

☑

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check

the following box and list the Securities Act registration statement number of the earlier effective registration statement for

the same offering.

☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

Indicate by check mark whether the registrant is

a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company.

See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company"

and "emerging growth company" in Rule 12b-2 of the Exchange Act:

|

Large accelerated filer

|

|

☐

|

|

Accelerated filer

|

|

☐

|

|

Non-accelerated filer

|

|

☐ (Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

|

☑

|

|

|

|

|

|

Emerging growth company

|

|

☑

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act.

☑

The information in this prospectus is

not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and

Exchange Commission is declared effective. This prospectus is not an offer to sell these securities and it is not soliciting an

offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, Dated January

26, 2018

Prospectus

AIM Exploration Inc.

115,000,000 Shares

Common Stock

_________________________________

This prospectus relates to the offer

and resale of up to 115,000,000 shares of our common stock, par value $0.001 per share, by the selling stockholder identified

on page 16. These shares represent shares that L2 Capital, LLC (“L2 Capital”) has agreed to purchase from us

pursuant to the terms and conditions of an Equity Purchase Agreement we entered into with them on September 11, 2017 (the “Equity

Purchase Agreement”). Subject to the terms and conditions of the Equity Purchase Agreement, we have the right

to “put,” or sell, up to $5,000,000 worth of shares of our common stock to L2 Capital. This arrangement

is also sometimes referred to herein as the “Equity Line.”

For more information about the selling

stockholders, please see the section of this prospectus entitled “Selling Stockholders” beginning on page 16.

The selling stockholder may sell any

shares offered under this prospectus at prices of between $0.0005 and $0.01 until our common stock is listed on a national securities

exchange or is quoted on the OTCQB or OTCQX Marketplace; after which, the selling stockholder may sell its shares at prevailing

market or privately negotiated prices, including (without limitation) in one or more transactions that may take place by ordinary

broker’s transactions, privately-negotiated transactions or through sales to one or more dealers for resale.

L2 Capital is an “underwriter”

within the meaning of the Securities Act of 1933, as amended (the “Securities Act”), in connection with the resale

of our common stock under the Equity Line, and any broker-dealers or agents that are involved in such resales may be deemed to

be “underwriters” within the meaning of the Securities Act in connection therewith. In such event, any commissions

received by such broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting

commissions or discounts under the Securities Act. For more information, please see the section of this prospectus

titled “Plan of Distribution” beginning on page 17.

We will not receive any proceeds

from the resale of shares of common stock by the selling stockholder. We will, however, receive proceeds from the sale

of shares directly to L2 Capital pursuant to the Equity Line.

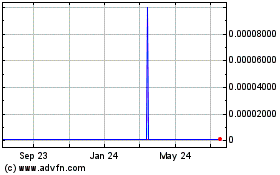

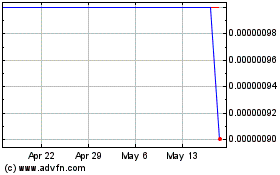

Our common stock is quoted under

the symbol AEXE operated by OTC Markets Group, Inc. On January 22, 2018, the closing price of our common stock was $0.0018 per

share.

Investing in our common stock involves

risk. See “Risk Factors” beginning on page 7 of this prospectus.

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is January

26, 2018.

TABLE OF CONTENTS

You should rely only on the information

that we have provided in this prospectus and any applicable prospectus supplement. We have not authorized anyone to provide you

with different information. No dealer, salesperson or other person is authorized to give any information or to represent anything

not contained in this prospectus and any applicable prospectus supplement. You must not rely on any unauthorized information or

representation. This prospectus is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions

where it is lawful to do so. You should assume that the information in this prospectus and any applicable prospectus supplement

is accurate only as of the date on the front of the document, regardless of the time of delivery of this prospectus, any applicable

prospectus supplement, or any sale of a security.

PROSPECTUS SUMMARY

This summary highlights information

contained elsewhere in this prospectus; it does not contain all of the information you should consider before investing in our

common stock. You should read the entire prospectus before making an investment decision.

As used

in this prospectus, the terms “we,” “us,” the “Company” and “AIM Energy” mean AIM

Exploration Inc., and our consolidated subsidiaries. All dollar amounts refer to U.S. dollars unless otherwise indicated.

Our Business

We are an exploration stage company

engaged in the acquisition and exploration of mineral properties with the intent to take properties into production. We were

incorporated as a Nevada state corporation on February 18, 2010. We acquired mining concession properties in Peru during

the fiscal year ended August 31, 2014.

We are considered an exploratory

stage company, as we are involved in the examination and investigation of land that we believe may contain valuable minerals, for

the purpose of discovering the presence of ore, if any, and its extent. There is no assurance that a commercially viable mineral

deposit exists on the Peruvian properties, and further exploration will be required before a final evaluation as to the economic

and legal feasibility for our future exploration is determined. We have no known reportable reserves of any type of mineral.

To date, we have not discovered an economically viable mineral deposit on the property, and there is no assurance that we

will discover one.

As of August 31, 2017, we had

cash reserves of $802 and a working capital deficit of $2,273,317. We do not have sufficient funds to

enable us to complete the initial phase of our exploration programs for the mining claims, and will require additional

financing in order to do so. There is no assurance that we will be able to obtain additional financing. Both

advanced exploration and an economic determination will be contingent upon the results of our preliminary exploration

programs and our ability to raise additional financing in order to proceed with advanced exploration and an economic

evaluation. There is no assurance that we will be able to obtain any additional financing to fund our exploration

activities.

Our principal executive office is

located at 170 S Green Valley Pkwy, Suite 300 Henderson, Nevada 89012. Our telephone number is (844) 246-7378 and our internet

address is http://www.aimexploration.com/. Unless expressly noted, none of the information on our website is part of this prospectus

or any prospectus supplement.

The Offering

|

Common

stock that may be offered by selling stockholders

|

|

115,000,000 shares

|

|

|

|

|

|

Common

stock outstanding before the offering

|

|

982,959,893

shares as of January 22, 2018

|

|

|

|

|

|

Common

stock outstanding after the offering

|

|

1,097,959,893

shares (1)

|

|

|

|

|

|

Total proceeds raised by offering

|

|

We will not receive any proceeds from the resale or other

disposition of the shares covered by this prospectus by the selling stockholder. We will receive proceeds from the sale of shares

to L2 Capital. L2 Capital has committed to purchase up to $5,000,000 worth of shares of our common stock over a period

of time terminating on the earlier of the date on which L2 Capital shall have purchased shares under the Equity Purchase Agreement

for an aggregate purchase price of $5,000,000 or September 11, 2020.

L2 Capital will pay a purchase price equal to 75% of the

“Market Price,” which is defined as the lowest trading price on the Principal Market, as reported by Bloomberg Finance

L.P., during the five consecutive trading days including and immediately prior to the “Put Date,” or the date on which

the applicable put notice is delivered to L2 Capital. The number of shares to be purchased by L2 Capital may not exceed the number

of shares that, when added to the number of shares of our common stock then beneficially owned by L2 Capital, would exceed 9.99%

of our shares of common stock outstanding.

For further information, see “The Offering”

beginning on page 14.

|

|

|

|

|

|

Plan of Distribution

|

|

The sale of shares may be at fixed or negotiated

prices; provided, however, until such time that our common stock is listed on a national securities exchange or is quoted

on the OTCQB or OTCQX Marketplace, the selling stockholder may only sell the shares at prices between $0.0005 and $0.01

per share.

For further information, see “Plan of Distribution”

beginning on page 17.

|

|

|

|

|

|

Risk Factors

|

|

There

are significant risks involved in investing in our company. For a discussion of risk factors you should consider before buying

our common stock, see “Risk Factors” beginning on page 7.

|

_____________

|

(1)

|

Assumes the issuance of 115,000,000 shares offered hereby that are issuable under our Equity Purchase Agreement with L2 Capital.

|

RISK FACTORS

An investment in our common stock

involves a number of very significant risks. You should carefully consider the following risks and uncertainties in addition to

other information in this prospectus in evaluating our company and our business before purchasing our securities. Our business,

operating results and financial condition could be seriously harmed as a result of the occurrence of any of the following risks.

You could lose all or part of your investment due to any of these risks. You should invest in our common stock only if you can

afford to lose your entire investment.

Risks Related to Our Company

Because of the speculative nature

of exploration of mining properties, there is substantial risk that no commercially exploitable minerals will be found and our

business will fail.

We are in the initial stages of exploration

of the property covered by our Peru claims, and thus have no way to evaluate the likelihood that we will be successful in establishing

commercially exploitable reserves of anthracite coal or other valuable minerals on the property. Potential investors should

be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises.

The search for valuable minerals as a business is extremely risky. We may not find commercially exploitable reserves

of anthracite coal or other minerals on the property. Exploration for minerals is a speculative venture necessarily involving

substantial risk. The expenditures to be made by us on our exploration program may not result in the discovery of commercial

quantities of anthracite coal. The likelihood of success must be considered in light of the problems, expenses, difficulties,

complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. Problems

such as unusual or unexpected formations, the inability to obtain suitable or adequate machinery, equipment or labor, and other

risks involved in mineral exploration, often result in unsuccessful exploration efforts. In such a case, we would be unable

to complete our business plan. In addition, any determination that the property contains commercially recoverable quantities

of ore may not be reached until such time that final comprehensive feasibility studies have been concluded that establish that

a potential mine is likely to be economically viable. There is a substantial risk that any preliminary or final feasibility

studies carried out by us will not result in a positive determination that the property can be commercially developed.

We will require significant additional

financing in order to continue our exploration activities and our assessment of the commercial viability of our property. Even

if we discover commercial reserves of coal or other minerals on our property, we can provide no assurance that we will be able

to successfully advance our claim into commercial production.

Our property was acquired based on the

assumption that it is rich in high grade anthracite coal. Currently there are 20 small tunnels on the property already producing

anthracite coal which was being mined by illegal miners. Testing of the coal samples was performed indicating the presence of high-grade

anthracite coal. Prior to acquisition we reviewed a non-compliant technical report prepared by Engineers/Geologists together with

hiring a US based firm Gustavson Associates to visit the property and review the reports. The firm provided us with a report, which

included recommendation for further exploration. Our business plan calls for significant expenditures in connection with the exploration

of the property. We will, however, require additional financing in order to complete the remaining phases of the exploration

program, and to conduct the economic evaluation that would be necessary for us to assess whether sufficient mineral reserves exist

to justify commercial exploitation of Peru claims. We currently are in the exploration stage and have no revenue from operations.

We currently do not have any arrangements in place for additional financing, and we may not be able to obtain financing on

terms that are acceptable to us, or at all. If we are unable to obtain additional financing, we will not be able to continue

our exploration activities and our assessment of the commercial viability of the property. Further, if we are able to establish

that development of the property is commercially viable, our inability to raise additional financing at this stage would result

in our inability to place the property into production and recover our investment.

Our exploration activities may

not be commercially successful, which could lead us to abandon our plans to develop the property and our investments in exploration.

Our long-term success depends on our

ability to establish commercially recoverable quantities of minerals on the properties that are the subject of Peru claims. Mineral

exploration is highly speculative in nature, involves many risks and is frequently non-productive. Substantial expenditures

are required to establish proven and probable reserves through drilling and analysis, to develop metallurgical processes to extract

minerals, and to develop the mining and processing facilities and infrastructure at any site chosen for mining. Whether a

mineral deposit will be commercially viable depends on a number of factors, which include, without limitation, the particular attributes

of the deposit, such as size, grade and proximity to infrastructure; metal prices, which fluctuate widely; and government regulations,

including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting

of minerals and environmental protection. We may invest significant capital and resources in exploration activities and abandon

such investments if it is unable to identify commercially exploitable mineral reserves. The decision to abandon a project

may reduce the trading price of our common stock and impair our ability to raise future financing. We cannot provide any

assurance to investors that we will discover or acquire any mineralized material in sufficient quantities on any of our properties

to justify commercial operations. Further, we will not be able to recover the funds that we spend on exploration if we are

not able to establish commercially recoverable quantities of minerals on the properties.

As we undertake exploration of

our Peru claims, we will be subject to compliance with government regulation that may increase the anticipated time and cost of

our exploration program.

There are several governmental regulations

that materially restrict the exploration of minerals. We will be subject to the mining laws and regulations of the anthracite

coal mines as we carry out our exploration program. We may be required to obtain work permits, post bonds and perform remediation

work for any physical disturbance to the land in order to comply with these regulations. In addition, to maintain a safe

and healthy work environment, strict compliance with all rule and regulations embodied under the Mines Administrative Order known

as “Mine Safety Rules and Regulations” will be required to be followed. A qualified Safety Engineer will be required

to be designated and safety and health programs must be undertaken for the entire duration of the project.

We are subject to risks inherent

in the mining industry and at present we do not have any insurance against such risks. Any losses we may incur that are associated

with such risks may cause us to incur substantial costs which will have a material adverse effect upon our results of operations.

Any mining operations that we may undertake

in the future will be subject to risks normally encountered in the mining business. Mining for anthracite coal, coal and

other valuable minerals is generally subject to a number of risks and hazards including environmental hazards, industrial accidents,

labor disputes, unusual or unexpected geological conditions, pressures, cave-ins, changes in the regulatory environment and natural

phenomena such as inclement weather conditions, floods, blizzards and earthquakes. At the present we do not intend to obtain

insurance coverage and even if we were to do so, no assurance can be given that such insurance will continue to be available or

that it will be available at economically feasible premiums. Insurance coverage may not continue to be available or may not

be adequate to cover any resulting liability. Moreover, insurance against risks such as environmental pollution or other

hazards as a result of exploration and production is not generally available to companies in the mining industry on acceptable

terms. We might also become subject to liability for pollution or other hazards which may not be insured against or which

we may elect not to insure against because of premium costs or other reasons. Losses from these events may cause us to incur

significant costs that could have a material adverse effect upon our financial performance and results of operations. Such

costs could potentially exceed our asset value and cause us to liquidate all of our assets, resulting in the loss of your entire

investment in our common stock.

Because our directors and officers

have no experience in mineral exploration and do not have formal training specific on the technicalities of mineral exploration,

there is a higher risk our business will fail.

Our directors and officers have no

experience in mineral exploration and do not have formal training as geologists or in the technical aspects of management of

a mineral exploration company. As a result of this inexperience there is a higher risk of our being unable to complete

our business plan for the exploration of our Peru claims. In addition, we will have to rely on the technical services

of others with expertise in geological exploration in order for us to carry out planned exploration program. If we are

unable to contract for the services of such individuals, it will make it difficult and maybe impossible to pursue our

business plan. There is thus a higher risk that our operations, earnings and ultimate financial success

could suffer irreparable harm and our business will likely fail and you will lose your entire investment in our common stock.

Conducting business in Peru includes

various risks which could materially affect our business.

Mineral resource production and related

operations in Peru are subject to extensive rules and regulations of federal, state and local agencies. We may be required

to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with

these laws. There is a risk that new regulations could increase our costs of doing business and prevent us from carrying

out exploration program.

Failure to comply with these rules and

regulations can result in substantial penalties. Our cost of doing business may be affected by the regulatory burden on the

mineral industry.

The Jobs Act will allow us to postpone

the date by which we must comply with some of the laws and regulations intended to protect investors and to reduce the amount of

information we provide in our reports filed with the SEC, which could undermine investor confidence in our company and adversely

affect the market price of our common stock.

For so long as we remain an “emerging

growth company” as defined in the JOBS Act, we may take advantage of certain exemptions from various requirements that are

applicable to public companies that are not “emerging growth companies” including:

|

|

§

|

the provisions of Section 404(b) of the Sarbanes-Oxley

Act requiring that our independent registered public accounting firm provide an attestation report on the effectiveness of our

internal control over financial reporting;

|

|

|

§

|

the “say on pay” provisions (requiring

a non-binding shareholder vote to approve compensation of certain executive officers) and the “say on golden parachute”

provisions (requiring a non-binding shareholder vote to approve golden parachute arrangements for certain executive officers in

connection with mergers and certain other business combinations) of the Dodd-Frank Act and some of the disclosure requirements

of the Dodd-Frank Act relating to compensation of its chief executive officer;

|

|

|

§

|

the

requirement to provide detailed compensation discussion and analysis in proxy statements

and reports filed under the Securities Exchange Act of 1934, and instead provide a reduced

level of disclosure concerning executive compensation; and

|

|

|

§

|

any

rules that may be adopted by the Public Company Accounting Oversight Board requiring

mandatory audit firm rotation or a supplement to the auditor’s report on the financial

statements.

|

We may take advantage of these exemptions until we are no

longer an “emerging growth company.” We would cease to be an “emerging growth company” upon the

earliest of: (i) the first fiscal year following the fifth anniversary of this offering; (ii) the first fiscal year after our

annual gross revenues are $1 billion or more; (iii) the date on which we have, during the previous three-year period, issued more

than $1 billion in non-convertible debt securities; or (iv) as of the end of any fiscal year in which the market value of our

common stock held by non-affiliates exceeded $700 million as of the end of the second quarter of that fiscal year.

Although we are still evaluating the

JOBS Act, we currently intend to take advantage of some, but not all, of the reduced regulatory and reporting requirements that

will be available to us so long as we qualify as an “emerging growth company.” For example, we have irrevocably

elected not to take advantage of the extension of time to comply with new or revised financial accounting standards available under

Section 102(b) of the JOBS Act. Our independent registered public accounting firm will not be required to provide an attestation

report on the effectiveness of our internal control over financial reporting so long as we qualify as an “emerging growth

company,” which may increase the risk that weaknesses or deficiencies in our internal control over financial reporting go

undetected. Likewise, so long as we qualify as an “emerging growth company,” we may elect not to provide you

with certain information, including certain financial information and certain information regarding compensation of our executive

officers, that we would otherwise have been required to provide in filings we make with the SEC, which may make it more difficult

for investors and securities analysts to evaluate our company. We cannot predict if investors will find our common stock

less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a

result, there may be a less active trading market for our common stock, and our stock price may be more volatile and may decline.

Provisions in the Nevada Revised

Statutes and our Bylaws could make it very difficult for an investor to bring any legal actions against our directors or officers

for violations of their fiduciary duties or could require us to pay any amounts incurred by our directors or officers in any such

actions.

Members of our board of directors and

our officers will have no liability for breaches of their fiduciary duty of care as a director or officer, except in limited circumstances,

pursuant to provisions in the Nevada Revised Statutes and our Bylaws as authorized by the Nevada Revised Statutes. Specifically,

Section 78.138 of the Nevada Revised Statutes provides that a director or officer is not individually liable to the company or

its shareholders or creditors for any damages as a result of any act or failure to act in his or her capacity as a director or

officer unless it is proven that (1) the director’s or officer’s act or failure to act constituted a breach of his

or her fiduciary duties as a director or officer and (2) his or her breach of those duties involved intentional misconduct, fraud

or a knowing violation of law. This provision is intended to afford directors and officers protection against and to limit their

potential liability for monetary damages resulting from suits alleging a breach of the duty of care by a director or officer. Accordingly,

you may be unable to prevail in a legal action against our directors or officers even if they have breached their fiduciary duty

of care. In addition, our Bylaws allow us to indemnify our directors and officers from and against any and all costs, charges and

expenses resulting from their acting in such capacities with us. This means that if you were able to enforce an action against

our directors or officers, in all likelihood, we would be required to pay any expenses they incurred in defending the lawsuit and

any judgment or settlement they otherwise would be required to pay. Accordingly, our indemnification obligations could divert needed

financial resources and may adversely affect our business, financial condition, results of operations and cash flows, and adversely

affect prevailing market prices for our common stock.

Risks Related to Our Common Stock

If a market for our common stock

does not develop, shareholders may be unable to sell their shares

.

Our common stock is quoted under the

symbol “AEXE” on the OTCPink operated by OTC Markets Group, Inc, an electronic inter-dealer quotation medium for equity

securities. We do not currently have an active trading market. There can be no assurance that an active and liquid trading market

will develop or, if developed, that it will be sustained.

Our securities are very thinly traded.

Accordingly, it may be difficult to sell shares of our common stock without significantly depressing the value of the stock. Unless

we are successful in developing continued investor interest in our stock, sales of our stock could continue to result in major

fluctuations in the price of the stock.

Our common stock price may be volatile

and could fluctuate widely in price, which could result in substantial losses for investors.

The market price of our common stock

is likely to be highly volatile and could fluctuate widely in price in response to various factors, many of which are beyond our

control, including:

|

|

§

|

government regulation

of our products and services;

|

|

|

§

|

intellectual property

disputes;

|

|

|

§

|

additions or departures

of key personnel;

|

|

|

§

|

sales of our common stock;

|

|

|

§

|

our ability to integrate

operations, technology, products and services;

|

|

|

§

|

our ability to execute

our business plan;

|

|

|

§

|

operating results below

expectations;

|

|

|

§

|

loss of any strategic

relationship;

|

|

|

§

|

economic and other external

factors; and

|

|

|

§

|

period-to-period fluctuations

in our financial results.

|

Because we have no revenues to date,

you should consider any one of these factors to be material. Our stock price may fluctuate widely as a result of any of the above.

In addition, the securities markets

have from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of

particular companies. These market fluctuations may also materially and adversely affect the market price of our common stock.

We have the right to issue shares

of preferred stock. If we were to issue preferred stock, it is likely to have rights, preferences and privileges that may adversely

affect the common stock.

We are authorized to issue 10,000,000

shares of “blank check” preferred stock, with such rights, preferences and privileges as may be determined from time-to-time

by our board of directors. Our board of directors is empowered, without stockholder approval, to issue preferred stock in one or

more series, and to fix for any series the dividend rights, dissolution or liquidation preferences, redemption prices, conversion

rights, voting rights, and other rights, preferences and privileges for the preferred stock. We currently have 1,000,000 shares

of our preferred stock outstanding, the features of which are contained elsewhere in this Prospectus. We also have designation

Series A, Series B, Series C and Series D stock, none of which have any shares outstanding, but the features of which are contained

elsewhere in this Prospectus.

The issuance of shares of preferred

stock, depending on the rights, preferences and privileges attributable to the preferred stock, could reduce the voting rights

and powers of the common stock and the portion of our assets allocated for distribution to common stockholders in a liquidation

event, and could also result in dilution in the book value per share of the common stock we are offering. The preferred stock could

also be utilized, under certain circumstances, as a method for raising additional capital or discouraging, delaying or preventing

a change in control of the Company, to the detriment of the investors in the common stock offered hereby. We cannot assure you

that we will not, under certain circumstances, issue shares of our preferred stock.

We have not paid dividends in

the past and have no immediate plans to pay dividends.

We plan to reinvest all of our earnings,

to the extent we have earnings, in order to market our products and to cover operating costs and to otherwise become and remain

competitive. We do not plan to pay any cash dividends with respect to our securities in the foreseeable future. We cannot assure

you that we would, at any time, generate sufficient surplus cash that would be available for distribution to the holders of our

common stock as a dividend. Therefore, you should not expect to receive cash dividends on our common stock.

Because we are subject to the

“Penny Stock” rules, the level of trading activity in our stock may be reduced.

The Securities and Exchange Commission

has adopted regulations which generally define "penny stock" to be any listed, trading equity security that has a market

price less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exemptions. The penny stock

rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized

risk disclosure document that provides information about penny stocks and the risks in the penny stock market. The broker-dealer

must also provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer

and its salesperson in the transaction, and monthly account statements showing the market value of each

penny stock held in the customer’s account. In addition,

the penny stock rules generally require that prior to a transaction in a penny stock, the broker-dealer make a special written

determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement

to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary

market for a stock that becomes subject to the penny stock rules which may increase the difficulty Purchasers may experience in

attempting to liquidate such securities.

Risks Relating to our Equity Line with L2 Capital

Resales of shares purchased

by L2 Capital under the Equity Purchase Agreement may cause the market price of our common stock to decline.

Subject to the terms and conditions

of the Equity Purchase Agreement, we have the right to “put,” or sell, up to $5,000,000 worth of shares of our common

stock to L2 Capital. Unless terminated earlier, L2 Capital’s purchase commitment will automatically terminate on the earlier

of the date on which L2 Capital shall have purchased shares pursuant to the Equity Purchase Agreement for an aggregate purchase

price of $5,000,000 or September 11, 2020. This arrangement is also sometimes referred to herein as the “Equity Line.”

The common stock to be issued to L2 Capital pursuant to the Equity Purchase Agreement will be purchased at a price equal to 75%

of the “Market Price,” which is defined as the lowest trading price on the Principal Market, as reported by Bloomberg

Finance L.P., during the five consecutive trading days including and immediately prior to the settlement date of the sale, which

in most circumstances will be the trading day immediately following the date that a put notice is delivered to L2 Capital. L2 Capital

will have the financial incentive to sell the shares of our common stock issuable under the Equity Purchase Agreement in advance

of or upon receiving such shares and to realize the profit equal to the difference between the discounted price and the current

market price of the shares. This may cause the market price of our common stock to decline.

Puts under Equity Purchase

Agreement may cause dilution to existing stockholders.

From time to time during the term

of the Equity Purchase Agreement, and at our sole discretion, we may present L2 Capital with a put notice requiring L2 Capital

to purchase shares of our common stock. As a result, our existing stockholders will experience immediate dilution upon the purchase

of any of the shares by L2 Capital. L2 Capital may resell some, if not all, of the shares that we issue to it under the Equity

Purchase Agreement and such sales could cause the market price of our common stock to decline significantly. To the extent of any

such decline, any subsequent puts would require us to issue and sell a greater number of shares to L2 Capital in exchange for each

dollar of the put amount. Under these circumstances, the existing stockholders of our company will experience greater dilution.

The effect of this dilution may, in turn, cause the price of our common stock to decrease further, both because of the downward

pressure on the stock price that would be caused by a large number of sales of our shares into the public market by L2 Capital,

and because our existing stockholders may disagree with a decision to sell shares to L2 Capital at a time when our stock price

is low, and may in response decide to sell additional shares, further decreasing our stock price. If we draw down amounts under

the Equity Line when our share price is decreasing, we will need to issue more shares to raise the same amount of funding.

There is no guarantee that

we will satisfy the conditions to the Equity Purchase Agreement.

Although the Equity Purchase Agreement

provides that we can require L2 Capital to purchase, at our discretion, up to $5,000,000 worth of shares of our common stock in

the aggregate, our ability to put shares to L2 Capital and obtain funds when requested is limited by the terms and conditions of

the Equity Purchase Agreement, including restrictions on when we may exercise our put rights, restrictions on the amount we may

put to L2 Capital at any one time, which is determined in part by the trading volume of our common stock, and a limitation on our

ability to put shares to L2 Capital to the extent that it would cause L2 Capital to beneficially own more than 9.99% of the outstanding

shares of our common stock.

We may not have access to the

full amount available under the Equity Purchase Agreement with L2 Capital.

Our ability to draw down funds and

sell shares under the Equity Purchase Agreement requires that a registration statement be declared effective and continue to be

effective registering the resale of shares issuable under the Equity Purchase Agreement. The registration statement of which this

prospectus is a part registers the resale of 115,000,000 shares of our common stock issuable under the Equity Line. Our ability

to sell any additional shares under the Equity Purchase Agreement will be contingent on our ability to prepare and file one or

more additional registration statements registering the resale of such additional shares. These registration statements (and any

post-effective amendments thereto) may be subject to review and comment by the staff of the Securities and Exchange Commission,

and will require the consent of our independent registered public accounting firm. Therefore, the timing of effectiveness of these

registration statements (and any post-effective amendments thereto) cannot be assured. Even if we are successful in causing one

or more registration statements registering the resale of some or all of the shares issuable under the Equity Purchase Agreement

to be declared effective by the Securities and Exchange Commission in a timely manner, we may not be able to sell the shares unless

certain other conditions are met. For example, we might have to increase the number of our authorized shares in order to issue

the shares to L2 Capital. Increasing the number of our authorized shares will require board and stockholder approval. Accordingly,

because our ability to draw down any amounts under the Equity Purchase Agreement with L2 Capital is subject to a number of conditions,

there is no guarantee that we will be able to draw down all of the proceeds of $5,000,000 under the Equity Purchase Agreement.

CAUTIONARY STATEMENT ON FORWARD-LOOKING

STATEMENTS

This prospectus may contain certain

“forward-looking” statements as such term is defined by the Securities and Exchange Commission in its rules, regulations

and releases, which represent the registrant’s expectations or beliefs, including but not limited to, statements concerning

the registrant’s operations, economic performance, financial condition, growth and acquisition strategies, investments, and

future operational plans. For this purpose, any statements contained herein that are not statements of historical fact may be deemed

to be forward-looking statements. Without limiting the generality of the foregoing, words such as “may,” “will,”

“expect,” “believe,” “anticipate,” “intent,” “could,” “estimate,”

“might,” “plan,” “predict” or “continue” or the negative or other variations thereof

or comparable terminology are intended to identify forward-looking statements. These statements by their nature involve substantial

risks and uncertainties, certain of which are beyond the registrant’s control, and actual results may differ materially depending

on a variety of important factors, including uncertainty related to acquisitions, governmental regulation, managing and maintaining

growth, the operations of the company and its subsidiaries, volatility of stock price, commercial viability of any mineral deposits

and any other factors discussed in this and other registrant filings with the Securities and Exchange Commission.

These risks and uncertainties and

other factors include, but are not limited to those set forth under

“Risk Factors”

of this prospectus.

Given these risks and uncertainties, readers are cautioned not to place undue reliance on our forward-looking statements. All subsequent

written and oral forward-looking statements attributable to us or to persons acting on our behalf are expressly qualified in their

entirety by these cautionary statements. Except as otherwise required by applicable law, we undertake no obligation to publicly

update or revise any forward-looking statements or the risk factors described in this prospectus or in the documents we incorporate

by reference, whether as a result of new information, future events, changed circumstances or any other reason after the date of

this prospectus.

This prospectus contains forward-looking

statements, including statements regarding, among other things:

|

|

§

|

our ability to continue as a going concern;

|

|

|

§

|

we will require additional financing in the future

to start production at our property and to bring it into sustained commercial production;

|

|

|

§

|

our anticipated needs for working capital;

|

|

|

§

|

our ability to secure financing;

|

|

|

§

|

our dependence on our property for our future operating

revenue;

|

|

|

§

|

our mineralized material calculations at the property

are only estimates and are based principally on historic data;

|

|

|

§

|

actual capital costs, operating costs, production

and economic returns may differ significantly from those that we have anticipated;

|

|

|

§

|

exposure to all of the risks associated with starting

and establishing new mining operations, if the development of our mineral project is found to be economically feasible;

|

|

|

§

|

title to some of our mineral properties may be uncertain

or defective;

|

|

|

§

|

land reclamation and mine closure may be burdensome

and costly;

|

|

|

§

|

significant risk and hazards associated with mining

operations;

|

|

|

§

|

the requirements that we obtain, maintain and renew

environmental, construction and mining permits, which is often a costly and time-consuming process and may be opposed by local

environmental group;

|

|

|

§

|

our exposure to material costs, liabilities and obligations

as a result of environmental laws and regulations (including changes thereto) and permits;

|

|

|

§

|

changes in the price of the coal and minerals;

|

|

|

§

|

extensive regulation by the U.S. government as well

as state and local governments;

|

|

|

§

|

our projected sales and profitability;

|

|

|

§

|

anticipated trends in our industry;

|

|

|

§

|

unfavorable weather conditions;

|

|

|

§

|

the lack of commercial acceptance of our product

or by-products;

|

|

|

§

|

problems regarding availability of materials and

equipment; and

|

|

|

§

|

failure of equipment to process or operate in accordance

with specifications, including expected throughput, which could prevent the production of commercially viable output.

|

Actual events or results may differ

materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the

risks outlined under “

Risk Factors

” and matters described in prospectus generally. In light of these

risks and uncertainties, there can be no assurance that the forward-looking statements contained in this prospectus will in fact

occur. We caution you not to place undue reliance on these forward-looking statements. In addition to the information expressly

required to be included in this prospectus, we will provide such further material information, if any, as may be necessary to make

the required statements, in light of the circumstances under which they are made, not misleading.

These risks and uncertainties and

other factors include, but are not limited to, those set forth under “

Risk Factors

.

” All subsequent

written and oral forward-looking statements attributable to the company or to persons acting on our behalf are expressly qualified

in their entirety by these cautionary statements. Except as required by federal securities laws, we do not intend to update or

revise any forward-looking statements, whether as a result of new information, future events or otherwise.

USE OF PROCEEDS

We will not receive any proceeds

from the sale of the common stock by the selling stockholders. However, we will receive proceeds from the sale of shares of our

common stock pursuant to L2 Capital under the Equity Purchase Agreement. We will use these proceeds for general corporate and working

capital purposes, or for other purposes that our Board of Directors, in its good faith, deems to be in the best interest of our

Company. We have agreed to bear the expenses relating to the registration of the offer and resale by the selling stockholder of

the shares being offered hereby.

THE OFFERING

The selling stockholder may offer

and resale of up to 115,000,000 shares of our common stock, par value $0.001 per share, pursuant to this prospectus. These

shares represent shares that L2 Capital has agreed to purchase from us pursuant to the terms and conditions of an Equity

Purchase Agreement we entered into with them on September 11, 2017 (the “Equity Purchase Agreement”), which are described

below.

Equity Purchase Agreement and Registration Rights

Agreement with L2 Capital, LLC

Subject to the terms and conditions

of the Equity Purchase Agreement, as amended, we have the right to “put,” or sell, up to $5,000,000 worth of shares

of our common stock to L2 Capital. Unless terminated earlier, L2 Capital’s purchase commitment will automatically

terminate on the earlier of the date on which L2 Capital shall have purchased shares pursuant to the Equity Purchase Agreement

for an aggregate purchase price of $5,000,000 or September 11, 2020. We have no obligation to sell any shares under the Equity

Purchase Agreement. This arrangement is also sometimes referred to herein as the “Equity Line.”

As provided in the Equity Purchase

Agreement, we may require L2 Capital to purchase shares of common stock from time to time by delivering a put notice to L2 Capital

specifying the total number of shares to be purchased (such number of shares multiplied by the purchase price described below,

the “Investment Amount”); provided there must be a minimum of ten trading days between delivery of each put notice.

We may determine the Investment Amount, provided that such amount may not be more than the average daily trading volume in dollar

amount for the our common stock during the 10 trading days preceding the date on which we deliver the applicable put notice. Additionally,

such amount may not be lower than $25,000 and (ii) in a maximum amount of the lesser of (a) 100% of the Average Daily Trading Volume

and (b) $250,000. L2 Capital will have no obligation to purchase shares under the Equity Line to the extent that such purchase

would cause L2 Capital to own more than 9.99% of the our common stock.

For each share of the our common

stock purchased under the Equity Line, L2 Capital will pay a purchase price equal to 75% of the “Market Price,” which

is defined as the lowest trading price on the Principal Market, as reported by Bloomberg Finance L.P., during the five consecutive

trading days including and immediately prior to the settlement date of the sale, which in most circumstances will be the trading

day immediately following the “Put Date,” or the date that a put notice is delivered to L2 Capital. On the settlement

date, L2 Capital will purchase the applicable number of shares subject to customary closing conditions, including without limitation

a requirement that a registration statement remain effective registering the resale by L2 Capital of the shares to be issued under

the Equity Line as contemplated by the Registration Rights Agreement described below. The Equity Purchase Agreement is not

transferable and any benefits attached thereto may not be assigned.

The Equity Purchase Agreement

contains covenants, representations and warranties of us and L2 Capital that are typical for transactions of this type. In addition,

we and L2 Capital have granted each other customary indemnification rights in connection with the Equity Purchase Agreement. The

Equity Purchase Agreement may be terminated by us at any time.

In connection with the Equity Purchase

Agreement, we also entered into Registration Rights Agreement with L2 Capital requiring us to prepare and file, by October 15,

2017, a registration statement registering the resale by L2 Capital of shares to be issued under the Equity Line, to use commercially

reasonable efforts to cause such registration statement to become effective, and to keep such registration statement effective

until (i) the date when L2 Capital may sell all the shares under Rule 144 without restrictions, or (ii) the date L2 Capital no

longer owns any of the shares.

The 115,000,000 shares being

offered pursuant to this prospectus by L2 Capital represent less than 30% of our shares of common stock issued and outstanding

held by non-affiliates of our Company as of the date of this prospectus.

The foregoing description of the

terms of the Equity Purchase Agreement and Registration Rights Agreement does not purport to be complete and is subject to and

qualified in its entirety by reference to the agreements and instruments themselves, copies of which are filed as Exhibits 10.5

and 10.6 to our Current Report on Form 8-K dated August 26, 2017. The benefits and representations and warranties set forth in

such agreements and instruments are not intended to and do not constitute continuing representations and warranties of the Company

or any other party to persons not a party thereto.

We intend to sell L2 Capital periodically

our common stock under the Equity Purchase Agreement and L2 Capital may, in turn, sell such shares to investors in the market at

the market price or at negotiated prices. This may cause our stock price to decline, which will require us to issue increasing

numbers of common shares to L2 Capital to raise the intended amount of funds, as our stock price declines.

Likelihood of Accessing the Full Amount of the Equity

Line

Notwithstanding that the Equity

Line is in an amount of $5,000,000, we anticipate that the actual likelihood that we will be able access the full amount of the

Equity Line is low due to several factors, including that our ability to access the Equity Line is impacted by our average daily

trading volume, which may limit the maximum dollar amount of each put we deliver to L2 Capital, and our stock price. Our use of

the Equity Line will continue to be limited and restricted if our share trading volume or and market price of our stock continue

at their current levels or decrease further in the future from the volume and stock prices reported over the past year. Further,

if the price of our stock remains at $0.00225 per share (which represents the average of the high and low reported sales prices

of our common stock on January 22, 2018), the sale by L2 Capital of all 115,000,000 of the shares registered in this prospectus

would mean we would receive only $258,750 from our sale of shares under the Equity Line. Our ability to issue shares in excess

of the 115,000,000 shares covered by the registration statement of which this prospectus is a part will be subject to our filing

a subsequent registration statement with the SEC and the SEC declaring it effective.

In addition, we may have to increase

the number of our authorized shares in order to issue shares to L2 Capital in the future. Increasing the number of our authorized

shares will require further board and stockholder approval. Accordingly, because our ability to deliver puts to L2 Capital under

the Equity Purchase Agreement is subject to a number of conditions, there is no guarantee that we will receive all or any portion

of the $5,000,000 that is available to us under the Equity Line.

SELLING STOCKHOLDERS

This prospectus covers the resale

by the selling stockholder of 115,000,000 shares of our common stock. These shares may be issued by us to L2 Capital under

the Equity Purchase Agreement. L2 Capital is an “underwriter” within the meaning of the Securities Act in connection

with its resale of our common stock pursuant to this prospectus. The selling stockholder has not had any position or office, or

other material relationship with us or any of our affiliates over the past three years. The following table sets forth certain

information regarding the beneficial ownership of shares of common stock by the selling stockholders as of January 24, 2018 and

the number of shares of our common stock being offered pursuant to this prospectus.

|

Name of selling

stockholder

|

Shares beneficially

owned as of the date

of this prospectus (1)

|

Number of shares

being offered

|

Number of shares to be beneficially

owned and percentage of beneficial

ownership after the offering (1)(2)

|

|

Number of

shares

|

Percentage of

class (3)

|

|

L2 Capital LLC (4)

|

0

|

115,000,000

|

0

|

0%

|

|

|

(1)

|

Beneficial ownership is determined in accordance with Securities and Exchange Commission rules

and generally includes voting or investment power with respect to shares of common stock. Shares of common stock subject to options

and warrants currently exercisable, or exercisable within 60 days, are counted as outstanding for computing the percentage of the

person holding such options or warrants but are not counted as outstanding for computing the percentage of any other person.

|

|

|

(2)

|

The amount and percentage of shares of our common stock that will be beneficially owned by the

selling stockholder after completion of the offering assumes that it will sell all shares of our common stock being offered pursuant

to this prospectus.

|

|

|

(3)

|

Based

on 982,959,893 shares of our common stock issued and outstanding as of January 24, 2018.

All shares of our common stock being offered pursuant to this prospectus by each selling

stockholder are counted as outstanding for computing the percentage beneficial ownership

of such selling stockholder (but not for computing the percentage beneficial ownership

of the other selling stockholder).

|

|

|

(4)

|

Edward M. Liceaga possesses voting and investment power over shares owned by L2 Capital.

|

PLAN OF DISTRIBUTION

The selling stockholder may,

from time to time, sell any or all of shares of our common stock covered hereby on the Principal Market operated by the OTC Markets

Group, Inc., or any other stock exchange, market or trading facility on which the shares are traded or in private transactions.

These sales may be at fixed or negotiated prices; provided, however, until such time that our common stock is listed on a national

securities exchange or is quoted on the OTCQB or OTCQX Marketplace, the selling stockholder may only sell the shares at prices

between $0.0005 and $0.01 per share. The selling stockholder may use any one or more of the following methods when selling securities:

|

|

§

|

ordinary brokerage transactions and transactions

in which the broker-dealer solicits purchasers;

|

|

|

§

|

block trades in which the broker-dealer will attempt

to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

§

|

purchases by a broker-dealer as principal and resale

by the broker-dealer for its account;

|

|

|

§

|

an exchange distribution in accordance with the rules

of the applicable exchange;

|

|

|

§

|

privately negotiated transactions;

|

|

|

§

|

in transactions through broker-dealers that agree

with the selling stockholders to sell a specified number of such securities at a stipulated price per security;

|

|

|

§

|

through the writing or settlement of options or other

hedging transactions, whether through an options exchange or otherwise;

|

|

|

§

|

a combination of any such methods of sale; or

|

|

|

§

|

any other method permitted pursuant to applicable

law.

|

The selling stockholder may also

sell securities under Rule 144 under the Securities Act, if available, rather than under this prospectus.

Broker-dealers engaged by the selling

stockholder may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts

from the selling stockholders (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser) in

amounts to be negotiated, provided such amounts are in compliance with FINRA Rule 2121. Discounts, concessions, commissions and

similar selling expenses, if any, that can be attributed to the sale of common stock will be paid by the selling stockholders

and/or the purchasers.

L2 Capital, LLC is an underwriter

within the meaning of the Securities Act and any broker-dealers or agents that are involved in selling the shares may be deemed

to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions

received by such broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting

commissions or discounts under the Securities Act. Because L2 Capital is an underwriter within the meaning of the Securities Act,

it will be subject to the prospectus delivery requirements of the Securities Act.

Under applicable rules and regulations

under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously engage in market

making activities with respect to the common stock for the applicable restricted period, as defined in Regulation M, prior to the

commencement of the distribution. In addition, the selling stockholder will be subject to applicable provisions of the Exchange

Act and the rules and

regulations thereunder, including Regulation M, which

may limit the timing of purchases and sales of securities of the common stock by the selling stockholder or any other person.

We will make copies of this prospectus available to the selling security holder and have informed it of the need to deliver a

copy of this prospectus to each purchaser at or prior to the time of the sale.

Although L2 Capital has agreed not

to enter into any “short sales” of our common stock, sales after delivery of a put notice of a number of shares

reasonably expected to be purchased under a put notice shall not be deemed a “short sale.” Accordingly, L2 Capital

may enter into arrangements it deems appropriate with respect to sales of shares of our common stock after it receives a put notice

under the Equity Purchase Agreement so long as such sales or arrangements do not involve more than the number of put shares reasonably

expected to be purchased by L2 Capital under such put notice.

DESCRIPTION OF SECURITIES

Capital Stock

Pursuant to our articles of incorporation,

as amended to date, our authorized capital stock consists of 1,510,000,000 shares, comprised of 1,500,000,000 shares of common

stock, par value $.001 per share, and 10,000,000 shares of preferred stock, par value $.001 per share. As of January 23, 2018,

there were 982,959,893 shares of common stock and 100,000 shares of preferred stock issued and outstanding. Our common stock is

quoted on the Principal Market operated by the OTC Markets Group, Inc., under the trading symbol “AEXE.”

The following description summarizes

the material terms of our capital stock. This summary is, however, subject to the provisions of our articles of incorporation

and bylaws. For greater detail about our capital stock, please refer to our articles of incorporation and bylaws.

Common Stock

Voting.

Holders

of our common stock are entitled to one vote for each outstanding share of common stock owned by such stockholder on every matter

properly submitted to the stockholders for their vote. Stockholders are not entitled to vote cumulatively for the election of

directors. At any meeting of the stockholders, a quorum as to any matter shall consist of a majority of the votes entitled to

be cast on the matter, except where a larger quorum is required by law, by our articles of incorporation or by our bylaws.

Dividend Rights.

Holders

of our common stock are entitled to receive ratably dividends and other distributions of cash or any other right or property as

may be declared by our Board of Directors out of our assets or funds legally available for such dividends or distributions. The

dividend rights of holders of common stock are subject to the dividend rights of the holders of any series of preferred stock

that may be issued and outstanding from time to time.

Liquidation Rights.

In

the event of any voluntary or involuntary liquidation, dissolution or winding up of our affairs, holders of our common stock would

be entitled to share ratably in our assets that are legally available for distribution to stockholders after payment of liabilities.

If we have any preferred stock outstanding at such time, the holders of such preferred stock may be entitled to distribution and/or

liquidation preferences that require us to pay the applicable distribution to the holders of preferred stock before paying distributions

to the holders of common stock.

Conversion, Redemption and Preemptive

Rights.

Holders of our common stock have no conversion, redemption, preemptive, subscription or similar rights.

The transfer agent and registrar

for our common stock is American Stock Transfer and Trust, 6201 15th Avenue | Brooklyn, NY 11219.

Preferred

Stock

On August 8, 2014, we filed a Certificate

of Designation of Series A Preferred Stock with the Nevada Secretary of State designating 1,000,000 of the Company's previously

authorized preferred stock. The holders of the Series A Preferred Stock are granted 67% voting power on all matters to be

voted on by the holders of the Company’s common stock and is not convertible into any shares of the Company's common stock.

With respect to rights on liquidation, dissolution or winding up, shares of Series A Preferred Stock rank on a parity with the

Company's common stock.

We have 100,000 shares of Series

A Preferred Stock outstanding.

On August 3, 2017, pursuant to Article

III of our Articles of Incorporation, our Board of Directors voted to designate a class of preferred stock entitled Series B Preferred

Stock, consisting of up to eight thousand (8,000) shares, par value $0.001. Under the Certificate of Designation, holders of Series

B Preferred Stock will participate on an equal basis per-share with holders of our common stock and Series A Preferred Stock in

any distribution upon winding up, dissolution, or liquidation. Holders of Series B Preferred Stock are entitled to convert each

share of Series B Preferred Stock into one hundred thousand (100,000) shares of common stock. The conversion rate shall not adjust

with any combination or reserve split of our outstanding common stock. Holders of Series B Preferred Stock are not entitled to

vote, except as it pertains to amendments of the Certificate of Designation, or to receive dividends. Each share of Series B Preferred

Stock shall have anti-dilution protection such that any issuance of common stock shall result in an equal number of shares issued

to holders of Series B Preferred Stock.

On August 3 2017, pursuant to Article

III of our Articles of Incorporation, our Board of Directors voted to designate a class of preferred stock entitled Series C Preferred

Stock, consisting of up to one thousand (1,000) shares, par value $0.001. Under the Certificate of Designation, holders of Series

C Preferred Stock will participate on an equal basis per-share with holders of our common stock, Series A Preferred Stock and Series

B Preferred Stock in any distribution upon winding up, dissolution, or liquidation. Holders of Series C Preferred Stock are entitled

to convert each share of Series C Preferred Stock into fifty thousand (50,000) shares of common stock. The conversion rate shall

not adjust with any combination or reserve split of our outstanding common stock. Holders of Series C Preferred Stock are not entitled

to vote, except as it pertains to amendments of the Certificate of Designation, or to receive dividends.

On August 3 2017, pursuant to Article

III of our Articles of Incorporation, our Board of Directors voted to designate a class of preferred stock entitled Series D Preferred

Stock, consisting of up to one million (1,000,000) shares, par value $0.001. Under the Certificate of Designation, holders of Series

D Preferred Stock will participate on an equal basis per-share with holders of our common stock, Series A Preferred Stock, Series

B Preferred Stock and Series C Preferred Stock in any distribution upon winding up, dissolution, or liquidation. At any time before

or on 12 months from issuance, Holders of Series D Preferred Stock are entitled to convert each share of Series D Preferred Stock

into shares of common stock at 20% of the closing price of our common stock, provided that the closing price is at least $3.00

per share. At any time after 12 months from issuance, Holders of Series D Preferred Stock are entitled to convert each share of

Series D Preferred Stock into shares of common stock at 20% of the closing price of our common stock or, alternatively, into a

convertible promissory note which shall accrue interest at 10% per annum and shall be convertible into our shares of common stock

at 20% of the closing price of our common stock. If not sooner converted as provided above, at two years from issuance, we are

required to redeem all outstanding shares of Series D Preferred Stock by paying the holders 115% of the stated value of their shares.

We may also exercise this right of redemption before two years in our sole discretion. Holders of Series D Preferred Stock are

not entitled to vote, except as it pertains to amendments of the Certificate of Designation, or to receive dividends.

Anti-Takeover Provisions

Some features of the Nevada Revised

Statutes, which are further described below, may have the effect of deterring third parties from making takeover bids for control

of our company or may be used to hinder or delay a takeover bid.

This would decrease the chance that

our stockholders would realize a premium over market price for their shares of common stock as a result of a takeover bid.

Acquisition of Controlling

Interest

The Nevada Revised Statutes contain

provisions governing acquisition of controlling interest of a Nevada corporation. These provisions provide generally that any person

or entity that acquires a certain percentage of the outstanding voting shares of a Nevada corporation may be denied voting rights

with respect to the acquired shares, unless the holders of a majority of the voting power of the corporation, excluding shares

as to which any of such acquiring person or entity, an officer or a director of the corporation, and an employee of the corporation

exercises voting rights, elect to restore such voting rights in whole or in part. These provisions apply whenever a person or entity

acquires shares that, but for the operation of these provisions, would bring voting power of such person or entity in the election

of directors within any of the following three ranges:

|

|

§

|

20% or more but less than 33-1/3%;

|

|

|

§

|

33-1/3% or more but less than or equal to 50%; or

|

The stockholders or board of directors

of a corporation may elect to exempt the stock of the corporation from these provisions through adoption of a provision to that

effect in the articles of incorporation or bylaws of the corporation. Our articles of incorporation and bylaws do not exempt our

common stock from these provisions.

These provisions are applicable only

to a Nevada corporation, which:

|

|

§

|

has 200 or more stockholders of record, at least

100 of whom have addresses in Nevada appearing on the stock ledger of the corporation; and

|

|

|

§

|

does business in Nevada directly or through an affiliated

corporation

|

At this time, we do not believe that

these provisions apply to acquisitions of our shares and will not until such time as these requirements have been met. At such

time as they may apply to us, these provisions may discourage companies or persons interested in acquiring a significant interest

in or control of our company, regardless of whether such acquisition may be in the interest of our stockholders.

Combination with Interested

Stockholder

The Nevada Revised Statutes contain

provisions governing combination of a Nevada corporation that has 200 or more stockholders of record with an interested stockholder.

As of February 24, 2017, we had approximately 1,421 stockholders of record. Therefore, we believe that these provisions governing

combination of a Nevada corporation apply to us and may have the effect of delaying or making it more difficult to effect a change

in control of our company.

A corporation affected by these

provisions may not engage in a combination within three years after the interested stockholder acquires his, her or its shares

unless the combination or purchase is approved by the board of directors before the interested stockholder acquired such shares.

Generally, if approval is not obtained, then after the expiration of the three-year period, the business combination may be consummated

with the approval of the board of directors before the person became an interested stockholder or a majority of the voting power

held by disinterested stockholders, or if the consideration to be received per share by disinterested stockholders is at least

equal to the highest of:

|

|

§

|

the highest price per share paid by the interested

stockholder within the three years immediately preceding the date of the announcement of the combination or within three years