As filed with the Securities and Exchange Commission

on June 29, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ACURX PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of

incorporation or organization) |

2834

(Primary Standard Industrial

Classification Code Number) |

82-3733567

(I.R.S. Employer

Identification Number) |

259 Liberty Avenue

Staten Island, New York 10305

(917) 533-1469

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

David P. Luci

President and Chief Executive Officer

Acurx Pharmaceuticals, Inc.

259 Liberty Avenue

Staten Island, New York 10305

(917) 533-1469

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

Ivan K. Blumenthal

Daniel A. Bagliebter

Jeffrey D. Cohan

Mintz, Levin, Cohn, Ferris, Glovsky and Popeo,

P.C.

666 Third Avenue

New York, New York 10017

212-935-3000

Approximate date of commencement of proposed

sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following

box. x

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment

filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number

of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

¨ |

Accelerated filer |

¨ |

| |

|

|

|

| Non-accelerated filer |

x |

Smaller reporting company |

x |

| |

|

|

|

| |

|

Emerging growth company |

x |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ¨

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION

STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT

WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF

THE SECURITIES ACT OF 1933, AS AMENDED, OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE SECURITIES AND

EXCHANGE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND

MAY BE CHANGED. THE SELLING STOCKHOLDER MAY NOT RESELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES

AND EXCHANGE COMMISSION IS DECLARED EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IS NOT SOLICITING AN OFFER

TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

SUBJECT TO COMPLETION, DATED JUNE 29,

2023

PROSPECTUS

Acurx Pharmaceuticals, Inc.

2,666,666 Shares of Common Stock

The selling stockholder of Acurx Pharmaceuticals, Inc.

(“Acurx,” “we,” “us” or the “Company”) listed beginning on page 13 of this prospectus

may offer and resell under this prospectus (i) up to 1,333,333 shares of our common stock, par value $0.001 per share (the “common

stock”), issuable upon exercise of series C warrants (the “series C warrants”) acquired by the selling stockholder under

the Purchase Agreement (defined below) and (ii) up to 1,333,333 shares of our common stock issuable upon exercise of series D warrants

(the “series D warrants” and, together with the series C warrants, the “warrants”) acquired by the selling stockholder

under the Purchase Agreement. The selling stockholder acquired the warrants from us pursuant to a securities purchase agreement (the “Purchase

Agreement”), dated May 16, 2023, by and between the Company and the purchaser named therein.

We are registering the resale of the shares of

common stock covered by this prospectus as required by the Purchase Agreement. The selling stockholder will receive all of the proceeds

from any sales of the shares of common stock offered hereby. We will not receive any of the proceeds, but we will incur expenses in connection

with the offering. To the extent the warrants are exercised for cash, if at all, we will receive the exercise price of the warrants.

The selling stockholder may sell these shares

through public or private transactions at market prices prevailing at the time of sale or at negotiated prices. The timing and amount

of any sale are within the sole discretion of the selling stockholder. Our registration of the shares of common Stock covered by this

prospectus does not mean that the selling stockholder will offer or sell any of the shares. For further information regarding the possible

methods by which the shares may be distributed, see “Plan of Distribution” beginning on page 15 of this prospectus.

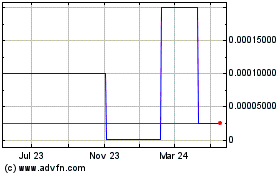

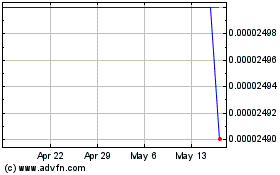

Our common stock is listed on The Nasdaq Capital

Market under the symbol “ACXP.” The last reported sale price of our common stock on June 28, 2023 was $2.56 per share.

We are an “emerging growth company”

under applicable Securities and Exchange Commission rules and, as such, we are subject to reduced public company reporting requirements.

Investing in our common stock is highly speculative

and involves a significant degree of risk. Please consider carefully the specific factors set forth under “Risk Factors” beginning

on page 7 of this prospectus and in our filings with the Securities and Exchange Commission.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of this prospectus is ,

2023.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

The registration statement we filed with the Securities

and Exchange Commission (the “SEC”) includes exhibits that provide more detail of the matters discussed in this prospectus.

You should read this prospectus, the related exhibits filed with the SEC, and the documents incorporated by reference herein before making

your investment decision. You should rely only on the information provided in this prospectus and the documents incorporated by reference

herein or any amendment thereto. In addition, this prospectus contains summaries of certain provisions contained in some of the documents

described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their

entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated

by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents

as described below under the heading “Where You Can Find More Information.”

The selling

stockholder named in this prospectus may sell up to 2,666,666 shares of our common stock

previously issued and issuable upon exercise of warrants to purchase shares of our common stock from time to time. This prospectus

also covers any shares of common stock that may become issuable as a result of share splits, share dividends, or similar transactions.

We have agreed to pay the expenses incurred in registering these shares, including legal and accounting fees.

We have not, and the selling stockholder has not,

authorized anyone to provide any information or to make any representations other than those contained in this prospectus, the documents

incorporated by reference herein or in any free writing prospectuses prepared by or on behalf of us or to which we have referred you.

We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you.

The information contained in this prospectus, the documents incorporated by reference herein or in any applicable free writing prospectus

is current only as of its date, regardless of its time of delivery or any sale of our securities. Our business, financial condition, results

of operations and prospects may have changed since that date.

The selling stockholder is offering to sell, and

seeking offers to buy, shares of our common stock only under circumstances and in jurisdictions where it is lawful to do so. The selling

stockholder is not making an offer to sell these securities in any state or jurisdiction where the offer or sale is not permitted.

Unless the context otherwise requires, “Acurx,”

“ACXP,” “the Company,” “we,” “us,” “our” and similar terms refer to Acurx

Pharmaceuticals, Inc.

Industry and Market Data

This prospectus or

the documents incorporated by reference herein includes statistical and other industry and market data that we obtained from industry

publications and research, surveys and studies conducted by third parties. Industry publications and third-party research, surveys and

studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee

the accuracy or completeness of such information.

PROSPECTUS SUMMARY

The following is a

summary of what we believe to be the most important aspects of our business and the offering of our securities under this prospectus.

We urge you to read this entire prospectus, including the more detailed audited and unaudited financial statements, notes to the financial

statements and other information incorporated by reference from our other filings with the SEC or included in any applicable prospectus

supplement. Investing in our securities involves risks. Therefore, carefully consider the risk factors set forth in any prospectus supplements

and in our most recent annual and quarterly filings with the SEC, as well as other information in this prospectus and any prospectus supplements

and the documents incorporated by reference herein or therein, before purchasing our securities. Each of the risk factors could adversely

affect our business, operating results and financial condition, as well as adversely affect the value of an investment in our securities.

Overview

We are a clinical stage

biopharmaceutical company developing a new class of antibiotics for infections caused by bacteria listed as priority pathogens by the

World Health Organization (“WHO”), the U.S. Centers for Disease Control and Prevention (“CDC”) and the U.S. Food

and Drug Administration (“FDA”). Priority pathogens are those which require new antibiotics to address the worldwide crisis

of antimicrobial resistance (“AMR”) as identified by the WHO, CDC and FDA. The CDC estimates that, in the U.S., antibiotic-resistant

pathogens infect one individual every 11 seconds and result in one death every 15 minutes. The WHO recently stated that growing antimicrobial

resistance is equally as dangerous as the ongoing COVID-19 pandemic, threatens to unwind a century of medical progress and may leave us

defenseless against infections that today can be treated easily. According to the WHO, the current clinical development pipeline remains

insufficient to tackle the challenge of the increasing emergence and spread of antimicrobial resistance.

Our approach is to develop

a new class of antibiotic candidates that block the DNA polymerase IIIC (“Pol IIIC”). We believe we are developing the first

Pol IIIC inhibitor to enter clinical trials and have clinically validated the bacterial target by demonstrating the efficacy of our lead

antibiotic candidate in a Phase 2a clinical trial. Pol IIIC is the primary catalyst for DNA replication of several Gram-positive bacterial

cells. Our research and development pipeline includes clinical stage and early stage antibiotic candidates that target Gram-positive bacteria

for oral and/or parenteral treatment of infections caused by Clostridium difficile (“C. difficile”), Enterococcus (including

vancomycin-resistant strains (“VRE”)), Staphylococcus (including methicillin-resistant strains (“MRSA”)), and

Streptococcus (including antibiotic resistant strains).

Pol IIIC is required

for the replication of DNA in certain Gram-positive bacterial species. By blocking this enzyme, our antibiotic candidates are believed

to be bactericidal and inhibit proliferation of several common Gram-positive bacterial pathogens, including both sensitive and resistant

C. difficile, MRSA, vancomycin-resistant Enterococcus, penicillin-resistant Streptococcus pneumonia (“PRSP”) and other resistant

bacteria.

We intend to “de-risk”

this new class of antibiotics through our drug development activities and potentially partner with a fully-integrated pharmaceutical company

for late-stage clinical trials and commercialization.

Our lead antibiotic candidate,

ibezapolstat (formerly named ACX-362E), has a novel mechanism of action that targets the Pol IIIC enzyme, a previously unexploited scientific

target. Phase 2a clinical efficacy of our lead antibiotic candidate validate the Pol IIIC bacterial target. On December 3, 2021,

we commenced enrollment in a Phase 2b 64-patient, randomized (1-to-1), non-inferiority, double-blind trial of oral ibezapolstat compared

to oral vancomycin, a standard of care to treat C. difficile infections (“CDI”).

Prior to that, we completed

our Phase 2a clinical trial of ibezapolstat to treat patients with CDI and reported the top-line data in November 2020. The Phase

2a clinical trial was terminated early based upon the recommendation of our Scientific Advisory Board (the “SAB”). The SAB

reviewed the study data presented by management, including adverse events and efficacy outcomes, and discussed its clinical impressions.

The SAB unanimously supported the early termination of the Phase 2a trial after 10 patients were enrolled in the trial instead of 20 patients

as originally planned. The early termination was further based on the evidence of meeting the treatment goals of eliminating the infection

with an acceptable adverse event profile.

The SAB noted that 10

out of 10 patients enrolled in the Phase 2a trial reached the Clinical Cure primary endpoint, defined in the study protocol as the resolution

of diarrhea in the 24-hour period immediately before the end-of-treatment that is maintained for 48 hours after end of treatment. Such

cure was sustained, meaning that the patients showed no sign of infection recurrence, for 30 days thereafter. This was the secondary endpoint.

This outcome constitutes a 100% response rate for the primary and secondary endpoints of the trial. All 10 patients enrolled in the Phase

2a trial met the study’s primary and secondary efficacy endpoints, namely, Clinical Cure at end of treatment and Sustained Clinical

Cure of no recurrence of CDI at the 28-day follow-up visit. No treatment-related serious adverse events (“SAEs”) were reported

by the investigators who enrolled patients in the trial. We believe these results represent the first-ever clinical data showing Pol IIIC

has potential as a therapeutically-relevant antibacterial target. Our Phase 2b clinical trial commenced enrollment on December 3,

2021 and we continue to enroll patients

Currently available antibiotics

used to treat CDI infections utilize other mechanisms of action. We believe ibezapolstat is the first antibiotic candidate to work by

blocking the DNA Pol IIIC enzyme in C. difficile. This enzyme is necessary for replication of the DNA of certain Gram-positive bacteria,

like C. difficile.

We also have an early-stage

pipeline of antibiotic product candidates with the same previously unexploited mechanism of action which has established proof of concept

in animal studies. This pipeline includes ACX-375C, a potential oral and parenteral treatment targeting Gram-positive bacteria, including

MRSA, VRE and PRSP. Additionally, we continue to apply for non-dilutive grants to fund our research and development pipeline and anticipate

receiving a potential decision on at least one grant in the second half of 2023.

Recent Developments

In April 2023, we

provided two presentations at the 33rd Annual European Congress of Clinical Microbiology and Infectious Disease (“ECCMID”)

in Copenhagen. First, a scientific poster entitled “Novel Pharmacology and Susceptibility of Ibezapolstat Against C. difficile Isolates

with Reduced Susceptibility to C. difficile-directed Antibiotics” was co-presented by Dr. Kevin Garey, Professor and Chair,

University of Houston College of Pharmacy, and the Principal Investigator for microbiome aspects of our ibezapolstat clinical trial program,

and by Dr. Eugénie Bassères, Research Scientist Faculty at the University of Houston. Second, Executive Chairman, Robert

J. DeLuccia, presented an update on our preclinical, systemic oral and IV program for treatment of other gram-positive infections caused

by MRSA, VRE and PRSP at the “Pipeline Corner” featured session at ECCMID, organized by Dr. Ursula Theuretzbacher, a

world-renowned microbiology expert involved in antibacterial drug research, discovery and development strategies and policies for clinical

and public health needs.

On March 16, 2023,

we announced that based on the blinded observed data from the ongoing Phase 2b clinical trial to date, in January 2023, we filed

a protocol amendment to our Investigational New Drug Application with the FDA to allow for an Independent Data Monitoring Committee (“IDMC”)

to review interim clinical data. The FDA accepted our protocol amendment in March 2023 which will allow the IDMC to review the clinical

data upon enrollment of 36 patients in the Phase 2b clinical trial. We currently have enrolled 26 patients in the Phase 2b clinical trial.

The IDMC will determine and recommend to us whether the most appropriate course of action forward is to early terminate the Phase 2b clinical

trial (as we had done with the Phase 2a clinical trial) or to continue patient enrollment. We intend to report available data promptly

after the IDMC conducts this interim review. We assembled our IDMC during this first quarter of 2023 for this purpose.

On May 16, 2023,

we entered into a securities purchase agreement (the “Purchase Agreement”) with a single healthcare-focused U.S. institutional

investor (the “Investor”) pursuant to which we issued and sold in a registered direct offering an aggregate of 601,851 shares

of our common stock and pre-funded warrants to purchase an aggregate of 731,482 shares of our common stock (the “Registered Direct

Offering”). The pre-funded warrants sold to the Investor have an exercise price of $0.0001, were immediately exercisable and may

be exercised at any time until fully exercised. These securities were offered pursuant to an effective shelf registration statement on

Form S-3 (File No. 333-265956) previously filed with the SEC on July 1, 2022, and which was declared effective by the SEC

on July 11, 2022.

In a concurrent private

placement (the “Private Placement” and, together with the Registered Direct Offering, the “Offerings”), we issued

to the Investor (i) series C warrants exercisable for an aggregate of 1,333,333 shares of common

stock at an exercise price of $3.26 per share and (ii) series D warrants exercisable for an aggregate of 1,333,333 shares of common

stock at an exercise price of $3.26 per share. These securities were offered pursuant to the exemption provided in Section 4(a)(2) under

the Securities Act of 1933, as amended (the “Securities Act”), and Rule 506(b) promulgated

thereunder.

In connection with the

Offerings, we entered into a Placement Agent Agreement with Maxim Group LLC (the “Placement Agent”), pursuant to which the

Placement Agent acted as the exclusive placement agent in connection with the Offerings. Pursuant to the Placement Agent Agreement, we

agreed to pay the Placement Agent a fee equal to 5.75% of the aggregate gross proceeds from the Offerings.

In connection with the

Offerings, we also entered into a warrant amendment agreement (the “Warrant Amendment Agreement”) with the Investor. Under

the Warrant Amendment Agreement, we agreed to amend our existing Series A warrants to purchase up to an aggregate of 1,230,769 shares

of our common stock and Series B warrants to purchase up to an aggregate of 1,230,769 shares of our common stock (collectively, the

“Existing Warrants”) that were previously issued in July 2022, such that effective upon the closing of the offering,

the amended Existing Warrants will have a termination date of May 18, 2029.

The gross proceeds to

us from the Offerings were approximately $4.0 million and net proceeds after deducting the placement agent’s fees and other offering

expenses payable by us were approximately $3.5 million.

Implication of Being an Emerging Growth

Company

We are an “emerging

growth company” as defined in the Jumpstart Our Business Startups Act of 2012, as amended (the “JOBS Act”). We will

remain an emerging growth company until the earlier of (1) the last day of the fiscal year following the fifth anniversary of the

completion of our initial public offering, (2) the last day of the fiscal year in which we have total annual gross revenues of at

least $1.07 billion, (3) the date on which we are deemed to be a “large accelerated filer” as defined in Rule 12b-2

under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which would occur if the market value of our common

stock held by non-affiliates exceeded $700.0 million as of the last business day of our most recently completed second fiscal quarter

or (4) the date on which we have issued more than $1.0 billion in non-convertible debt securities during the prior three-year period.

An emerging growth company may take advantage of specified reduced reporting requirements and is relieved of certain other significant

requirements that are otherwise generally applicable to public companies. As an emerging growth company,

· we may

reduce our executive compensation disclosure;

· we may

present only two years of audited financial statements, plus unaudited condensed financial statements for any interim period, and related

Management’s Discussion and Analysis of Financial Condition and Results of Operations in this Prospectus;

· we may

avail ourselves of the exemption from the requirement to obtain an attestation and report from our auditors on the assessment of our

internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002; and

· we

may not require stockholder non-binding advisory votes on executive compensation or golden parachute arrangements.

We have availed ourselves

in this Prospectus of the reduced reporting requirements described above with respect to compensation disclosure requirements and selected

financial data. As a result, the information that we provide stockholders may be less comprehensive than what you might receive from other

public companies. When we are no longer deemed to be an emerging growth company, we will not be entitled to the exemptions provided in

the JOBS Act discussed above. We have not elected to avail ourselves of the exemption that allows emerging growth companies to extend

the transition period for complying with new or revised financial accounting standards. This election is irrevocable.

As a company with less

than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company.”

Smaller Reporting Company

We are also currently

a “smaller reporting company,” meaning that we are not an investment company, an asset-backed issuer, or a majority-owned

subsidiary of a parent company that is not a smaller reporting company, and have a public float of less than $250 million or annual revenues

of less than $100 million during the most recently completed fiscal year. In the event that we are still considered a “smaller reporting

company,” at such time as we cease being an “emerging growth company,” the disclosure we will be required to provide

in our SEC filings will increase, but will still be less than it would be if we were not considered either an “emerging growth company”

or a “smaller reporting company.” Specifically, similar to “emerging growth companies,” “smaller reporting

companies” are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of

Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation

report on the effectiveness of internal control over financial reporting; and have certain other decreased disclosure obligations in their

SEC filings, including, among other things, only being required to provide two years of audited financial statements in annual reports.

Decreased disclosures in our SEC filings due to our status as an “emerging growth company” or “smaller reporting company”

may make it harder for investors to analyze our results of operations and financial prospects.

Risks Associated with Our Business

Our business and our

ability to implement our business strategy are subject to numerous risks, as more fully described in the section entitled “Risk

Factors” in this prospectus and in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, incorporated

herein by reference. You should read these risks before you invest in our securities. We may be unable, for many reasons, including those

that are beyond our control, to implement our business strategy.

Corporate Information and History

We were organized as a limited liability company

in the State of Delaware in July 2017 and we commenced operations in February 2018 upon acquiring the rights to our lead antibiotic

product candidate from GLSynthesis, Inc. Our principal executive offices are located at 259 Liberty Avenue, Staten Island, NY 10305

and our telephone number is (917) 533-1469. Our website address is www.acurxpharma.com. The information contained on, or that can be

accessed through, our website is not a part of this prospectus. We have included our website address in this prospectus solely as an

inactive textual reference. On June 23, 2021, we converted from a Delaware limited liability company into a Delaware corporation

pursuant to a statutory conversion, and changed our name to Acurx Pharmaceuticals, Inc.

THE OFFERING

| Shares of Common Stock that May be Offered by the Selling Stockholder |

|

Up to 2,666,666 shares of common stock. |

| |

|

|

| Use of Proceeds |

|

We will not receive any proceeds from the sale of the common stock by the selling stockholder. However, if all of the warrants were exercised for cash, we would receive gross proceeds of approximately $8.7 million. See the section entitled “Use of Proceeds” in this prospectus. |

| |

|

|

| Offering Price |

|

The selling stockholder may sell all or a portion of their shares through public or private transactions at prevailing market prices or at privately negotiated prices. |

| |

|

|

| Nasdaq Capital Market Symbol |

|

ACXP |

| |

|

|

| Risk Factors |

|

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 7 of this prospectus, and any other risk factors described in the documents incorporated by reference herein, for a discussion of certain factors to consider carefully before deciding to invest in our common stock. |

Throughout this prospectus, when we refer to the

shares of our common stock being registered on behalf of the selling stockholder for offer and sale, we are referring to the shares of

common stock issuable upon exercise of the warrants, each as described under “The Private Placement” and “Selling Stockholder.”

When we refer to the selling stockholder in this prospectus, we are referring to the selling stockholder identified in this prospectus

and, as applicable, its donees, pledgees, transferees or other successors-in-interest selling shares of common stock or interests in shares

of common stock received after the date of this prospectus from the selling stockholder as a gift, pledge, partnership distribution or

other transfer.

RISK FACTORS

Investing in our securities involves a high degree

of risk. You should carefully consider and evaluate all of the information contained in this prospectus and in the documents we incorporate

by reference into this prospectus before you decide to purchase our securities. In particular, you should carefully consider and evaluate

the risks and uncertainties described under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022. Any of the risks and uncertainties set forth below and in the Annual Report, as updated by annual, quarterly

and other reports and documents that we file with the SEC and incorporate by reference into this prospectus, or any prospectus, could

materially and adversely affect our business, results of operations and financial condition, which in turn could materially and adversely

affect the value of any securities offered by this prospectus. As a result, you could lose all or part of your investment.

THE PRIVATE PLACEMENT

On May 16, 2023, we entered into the Purchase

Agreement with a single healthcare-focused U.S. institutional investor named therein (the “Investor”),

pursuant to which we issued and sold, in a private placement (the “Private Placement”), (i) series

C warrants exercisable for an aggregate of 1,333,333 shares of Common Stock at an exercise price of $3.26 per share and (ii) series

D warrants exercisable for an aggregate of 1,333,333 shares of common stock at an exercise price of $3.26 per share. Each series C warrant

will be exercisable commencing on November 18, 2023 and will expire two years from the initial exercise date. Each series D warrant

will be exercisable commencing on November 18, 2023 and will expire six years from the initial exercise date.

In connection with the Offerings, we entered into

a Placement Agent Agreement with the Placement Agent, pursuant to which the Placement Agent acted as the exclusive placement agent in

connection with the Offerings. Pursuant to the Placement Agent Agreement, we agreed to pay the Placement Agent a fee equal to 5.75% of

the aggregate gross proceeds from the Offerings.

Pursuant

to the terms of the Purchase Agreement, we agreed to use commercially reasonable efforts to cause a registration statement on Form S-1

providing for the resale by holders of shares of our common stock issuable upon the exercise of the warrants, to become effective by November 14,

2023 and to keep such registration statement effective at all times.

The foregoing descriptions of the form of Purchase

Agreement, the Placement Agent Agreement, the form of series C warrant and the form of series D warrant are not complete and are subject

to and qualified in their entirety by reference to the form of Purchase Agreement, the form of Placement Agent Agreement, the form of

series C warrant and the form of series D warrant, respectively, copies of which are attached as Exhibits 10.1, 1.1, 4.1 and 4.2, respectively,

to the Current Report on Form 8-K dated May 17, 2023, and are incorporated herein by reference.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated

by reference in this prospectus include forward-looking statements within the meaning of Section 27A of the Securities Act, and Section 21E

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that relate to future events or our future financial

performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity,

performance or achievements to differ materially from any future results, levels of activity, performance or achievements expressed or

implied by these forward-looking statements. Words such as, but not limited to, “believe,” “expect,” “anticipate,”

“estimate,” “intend,” “may,” “plan,” “potential,” “predict,” “project,”

“targets,” “likely,” “will,” “would,” “could,” “should,” “continue,”

and similar expressions or phrases, or the negative of those expressions or phrases, are intended to identify forward-looking statements,

although not all forward-looking statements contain these identifying words. Although we believe that we have a reasonable basis for each

forward-looking statement contained in this prospectus and incorporated by reference in this prospectus, we caution you that these statements

are based on our projections of the future that are subject to known and unknown risks and uncertainties and other factors that may cause

our actual results, level of activity, performance or achievements expressed or implied by these forward-looking statements, to differ.

The sections in our periodic reports, including our most recent Annual Report on Form 10-K, as revised or supplemented by our subsequent

Quarterly Reports on Form 10-Q or our Current Reports on Form 8-K, entitled “Business,” “Risk Factors,”

and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” as well as other sections

in this prospectus and the other documents or reports incorporated by reference in this prospectus, discuss some of the factors that could

contribute to these differences. These forward-looking statements include, among other things, statements about:

| · | our ability to enroll patients in our ongoing Phase 2b clinical trial; |

| · | our ability to obtain and maintain regulatory approval of ibezapolstat and/or our other product candidates; |

| · | our ability to successfully commercialize and market ibezapolstat and/or our other product candidates, if approved; |

| · | our ability to contract with third-party suppliers, manufacturers and other service providers and their ability to perform adequately; |

| · | the potential market size, opportunity and growth potential for ibezapolstat and/or our other product candidates, if approved; |

| · | our ability to build our own sales and marketing capabilities, or seek collaborative partners, to commercialize ibezapolstat and/or

our other product candidates, if approved; |

| · | our ability to obtain funding for our operations; |

| · | the initiation, timing, progress and results of our preclinical studies and clinical trials, and our research and development programs; |

| · | the timing of anticipated regulatory filings; |

| · | the timing of availability of data from our clinical trials; |

| · | the impact of the ongoing COVID-19 pandemic and our response to it; |

| · | the accuracy of our estimates regarding expenses, capital requirements and needs for additional financing; |

| · | our ability to retain the continued service of our key professionals and to identify, hire and retain additional qualified professionals; |

| · | our ability to advance product candidates into, and successfully complete, clinical trials; |

| · | our ability to recruit and enroll suitable patients in our clinical trials and the timing of enrollment; |

| · | the timing or likelihood of the accomplishment of various scientific, clinical, regulatory and other product development objectives; |

| · | the pricing and reimbursement of our product candidates, if approved; |

| · | the rate and degree of market acceptance of our product candidates, if approved; |

| · | the implementation of our business model and strategic plans for our business, product candidates and technology; |

| · | the scope of protection we are able to establish and maintain for intellectual property rights covering our product candidates and

technology; |

| · | developments relating to our competitors and our industry; |

| · | the development of major public health concerns, including the novel coronavirus outbreak or other pandemics arising globally, and

the future impact of it and COVID19 on our clinical trials, business operations and funding requirements; |

| · | the effects of the recent disruptions to and volatility in the credit and financial markets in the United States and worldwide from

the conflict between Russia and Ukraine; |

| · | the volatility of the price of our common stock; |

| · | our financial performance; and |

| · | other factors described from time to time in documents that we file with the SEC. |

We may not actually achieve the plans, intentions

or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements.

Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements

we make. We have included important cautionary statements in this prospectus and in the documents incorporated by reference in this prospectus,

particularly in the “Risk Factors” section, that we believe could cause actual results or events to differ materially from

the forward-looking statements that we make. For a summary of such factors, please refer to the section entitled “Risk Factors”

in this prospectus, as updated and supplemented by the discussion of risks and uncertainties under “Risk Factors” contained

in any supplements to this prospectus and in our most recent Annual Report on Form 10-K, as revised or supplemented by our subsequent

Quarterly Reports on Form 10-Q or our Current Reports on Form 8-K, as well as any amendments thereto, as filed with the SEC

and which are incorporated herein by reference. The information contained in this document is believed to be current as of the date of

this document. We do not intend to update any of the forward-looking statements after the date of this document to conform these statements

to actual results or to changes in our expectations, except as required by law.

In light of these assumptions, risks and uncertainties,

the results and events discussed in the forward-looking statements contained in this prospectus or in any document incorporated herein

by reference might not occur. Investors are cautioned not to place undue reliance on the forward-looking statements, which speak only

as of the date of this prospectus or the date of the document incorporated by reference in this prospectus. We are not under any obligation,

and we expressly disclaim any obligation, to update or alter any forward-looking statements, whether as a result of new information, future

events or otherwise. All subsequent forward-looking statements attributable to us or to any person acting on our behalf are expressly

qualified in their entirety by the cautionary statements contained or referred to in this section.

USE OF PROCEEDS

We are not selling any shares of our common stock

in this offering and we will not receive any of the proceeds from the sale of shares of our common stock by the selling stockholder. The

selling stockholder will receive all of the proceeds from any sales of the shares of our common stock offered hereby. However, we will

incur expenses in connection with the registration of the shares of our common stock offered hereby.

We will receive the exercise price upon any exercise

of the warrants, to the extent exercised on a cash basis. If all the warrants were exercised for cash, we would receive gross proceeds

of approximately $8.7 million. However, the holders of the warrants are not obligated to exercise the warrants, and we cannot predict

whether or when, if ever, the holders of the warrants will choose to exercise the warrants, in whole or in part. Accordingly, any proceeds

from such exercise will be used for general corporate purposes and working capital.

MARKET FOR COMMON STOCK AND DIVIDEND POLICY

Our common stock is traded on the Nasdaq Capital

Market under the symbol “ACXP.” The last reported sale price of our common stock on June 28, 2023 on the Nasdaq Capital

Market was $2.56 per share. As of June 28, 2023, there were 211 stockholders of record of our common stock.

We have never declared or paid any cash dividend

on our common stock. We intend to retain any future earnings and do not expect to pay dividends in the foreseeable future.

SELLING STOCKHOLDER

The common stock being offered by the selling

stockholder are those issuable to the selling stockholder upon exercise of the warrants. For additional information regarding the issuance

of the warrants, see “The Private Placement” above. We are registering the shares of common stock in order to permit the selling

stockholder to offer the shares for resale from time to time. Except as described below, to our knowledge, the selling stockholder has

not been an officer or director of ours or of our affiliates within the past three years or has any material relationship with us or our

affiliates within the past three years. Our knowledge is based on information provided by the selling stockholder in connection with the

filing of this prospectus.

The table below lists the selling stockholder

and other information regarding the beneficial ownership of the shares of common stock by the selling stockholder. The second column lists

the number of shares of common stock beneficially owned by the selling stockholder, based on its ownership of the shares of common stock,

options to purchase common stock, and warrants, as of June 1, 2023, assuming exercise of the warrants held by the selling stockholder

on that date, without regard to any limitations on exercises. The third column lists the maximum number of shares of common stock that

may be sold or otherwise disposed of by the selling stockholder pursuant to the registration statement of which this prospectus forms

a part. The selling stockholder may sell or otherwise dispose of some, all or none of its shares. Pursuant to Rules 13d-3 and 13d-5

of the Exchange Act, beneficial ownership includes any shares of our common stock as to which a stockholder has sole or shared voting

power or investment power, and also any shares of our common stock which the stockholder has the right to acquire within 60 days of June 1,

2023. The percentage of beneficial ownership for the selling stockholder is based on 12,939,128 shares of our common stock outstanding

as of June 1, 2023 and the number of shares of our common stock issuable upon exercise or conversion of convertible securities that

are currently exercisable or convertible or are exercisable or convertible within 60 days of June 1, 2023 beneficially owned by the

selling stockholder. The fourth column assumes the sale of all of the shares of common stock offered by the selling stockholder pursuant

to this prospectus.

Under the terms of the warrants, the selling stockholder

may not exercise the warrants to the extent such exercise would cause such selling stockholder, together with its affiliates and attribution

parties, to beneficially own a number of shares of common stock which would exceed 4.99% (or for certain holders, 9.99%) of our then outstanding

common stock following such exercise, excluding for purposes of such determination shares of common stock issuable upon exercise of the

warrants which have not been exercised. The number of shares in the second column does not reflect this limitation. The selling stockholder

may sell all, some or none of its shares in this offering. See “Plan of Distribution.”

Information about the selling stockholder may

change over time. Any changed information will be set forth in an amendment to the registration statement or supplement to this prospectus,

to the extent required by law. Unless otherwise noted below, the address of the selling stockholder listed on the table is c/o Acurx Pharmaceuticals, Inc.,

259 Liberty Avenue, Staten Island, NY 10305.

| | |

Beneficial Ownership Prior to the

Offering(1) | | |

| | |

Beneficial Ownership After the

Offering(2) | |

| Name of Selling Stockholder | |

Number of

Shares of

Common

Stock

Beneficially

Owned Prior

to the

Offering | | |

Percentage

of

Outstanding

Common

Stock(2) | | |

Maximum

Number of

Shares of

Common

Stock

To Be Sold

Pursuant

to this

Prospectus | | |

Number of

Shares of

Common

Stock

Beneficially

Owned

After the

Offering | | |

Percentage of

Outstanding

Common

Stock(2) | |

| Armistice Capital, LLC(3) | |

| 6,390,204 | | |

| 35.2 | % | |

| 2,666,666 | | |

| 3,723,538 | | |

| 24.1 | % |

| |

(1) |

Assumes all warrants are exercised. |

| |

(2) |

Assumes that (i) all of the shares of common stock to be registered by the registration statement of which this prospectus is a part are sold in this offering and (ii) the selling stockholder does not acquire additional shares of our common stock after the date of this prospectus and prior to completion of this offering. The percentage of beneficial ownership after the offering is based on 15,605,794 shares of common stock, consisting of (a) 12,939,128 shares of our common stock outstanding on June 1, 2023, and (b) the 2,666,666 shares of our common stock underlying the warrants offered under this prospectus. The number of shares listed do not take into account any limitations on exercise of the warrants. |

| |

(3) |

Consists of (i) 1,196,000 shares of common stock and (ii) 5,194,204 shares of common stock issuable upon the exercise of warrants. The securities are directly held by Armistice Capital Master Fund Ltd., a Cayman Islands exempted company (the “Master Fund”), and may be deemed to be indirectly beneficially owned by: (i) Armistice Capital, LLC (“Armistice Capital”), as the investment manager of the Master Fund; and (ii) Steven Boyd, as the Managing Member of Armistice Capital. The warrants are subject to a beneficial ownership limitation of 4.99%, which such limitation restricts the Selling Stockholder from exercising that portion of the warrants that would result in the Selling Stockholder and its affiliates owning, after exercise, a number of shares of common stock in excess of the beneficial ownership limitation. The address of Armistice Capital Master Fund Ltd. is c/o Armistice Capital, LLC, 510 Madison Avenue, 7th Floor, New York, NY 10022. |

PLAN OF DISTRIBUTION

The selling stockholder of the securities and

any of their pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their securities covered hereby

on The Nasdaq Capital Market or any other stock exchange, market or trading facility on which the securities are traded or in private

transactions. These sales may be at fixed or negotiated prices. The selling stockholder may use any one or more of the following methods

when selling securities:

| |

• |

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

• |

block trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| |

• |

purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

• |

an exchange distribution in accordance with the rules of the applicable exchange; |

| |

• |

privately negotiated transactions; |

| |

• |

settlement of short sales; |

| |

• |

in transactions through broker-dealers that agree with the selling stockholder to sell a specified number of such securities at a stipulated price per security; |

| |

• |

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

• |

a combination of any such methods of sale; or |

| |

• |

any other method permitted pursuant to applicable law. |

The selling stockholder may also sell securities

under Rule 144 or any other exemption from registration under the Securities Act of 1933, as amended (the “Securities Act”),

if available, rather than under this prospectus.

Broker-dealers engaged by the selling stockholder

may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the selling stockholder

(or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser) in amounts to be negotiated, but, except

as set forth in a supplement to this Prospectus, in the case of an agency transaction not in excess of a customary brokerage commission

in compliance with FINRA Rule 2121; and in the case of a principal transaction a markup or markdown in compliance with FINRA Rule 2121.

In connection with the sale of the securities

or interests therein, the selling stockholder may enter into hedging transactions with broker-dealers or other financial institutions,

which may in turn engage in short sales of the securities in the course of hedging the positions they assume. The selling stockholder

may also sell securities short and deliver these securities to close out their short positions, or loan or pledge the securities to broker-dealers

that in turn may sell these securities. The selling stockholder may also enter into option or other transactions with broker-dealers or

other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer or other financial

institution of securities offered by this prospectus, which securities such broker-dealer or other financial institution may resell pursuant

to this prospectus (as supplemented or amended to reflect such transaction).

The selling stockholder and any broker-dealers

or agents that are involved in selling the securities may be deemed to be “underwriters” within the meaning of the Securities

Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale

of the securities purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. The selling stockholder

has informed the Company that it does not have any written or oral agreement or understanding, directly or indirectly, with any person

to distribute the securities.

The Company is required to pay certain fees and

expenses incurred by the Company incident to the registration of the securities. The Company has agreed to indemnify the selling stockholder

against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

We agreed to use commercially reasonable efforts

to keep this registration statement effective at all times until the selling stockholder no longer own any Warrants or shares of Common

Stock issuable upon the exercise of the Warrants.

Under applicable rules and regulations under

the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously engage in market making activities

with respect to the Common Stock for the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution.

In addition, the selling stockholder will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder,

including Regulation M, which may limit the timing of purchases and sales of the Common Stock by the selling stockholder or any other

person. We will make copies of this prospectus available to the selling stockholder and have informed them of the need to deliver a copy

of this prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule 172 under the Securities

Act).

DESCRIPTION OF OUR SECURITIES TO BE REGISTERED

The securities to be registered on this registration

statement on Form S-1 include up to an aggregate amount of 2,666,666 shares of common stock, consisting of (i) up to 1,333,333

shares of our common stock issuable upon exercise of series C warrants acquired by the selling stockholder under the Purchase Agreement

and (ii) up to 1,333,333 shares of our common stock issuable upon exercise of series D warrants acquired by the selling stockholder

under the Purchase Agreement.

General

The following is a summary of material characteristics

of our capital stock as set forth in our certificate of incorporation and bylaws, and certain provisions of Delaware law. The following

description does not purport to be complete and is subject to and qualified in its entirety by, and should be read in conjuncture with,

our certificate of incorporation and bylaws, each of which are filed as exhibits to this Registration Statement and are incorporated herein

by reference. The summaries and descriptions below do not purport to be complete statements of the Delaware General Corporation Law (“DGCL”).

Authorized Capital Stock

Our certificate of incorporation authorizes us

to issue 200,000,000 shares of common stock, par value $0.001 per share, and 10,000,000 shares of preferred stock, par value $0.001 per

share.

Common Stock

Voting. The holders of our common stock

are entitled to one vote for each share held of record on all matters on which the holders are entitled to vote (or consent to).

Dividends. The holders of our common stock

are entitled to receive, ratably, dividends only if, when and as declared by our board of directors out of funds legally available therefor

and after provision is made for each class of capital stock having preference over the common stock.

Liquidation Rights. In the event of our

liquidation, dissolution or winding-up, the holders of our common stock may be entitled to share, ratably, in all assets remaining available

for distribution after payment or provision for payment of all debts and other liabilities and subject to the rights of each class or

series of capital stock having preference over, or right to participate with, the common stock.

Preemptive and Similar Rights. The holders

of our common stock have no preemptive or similar rights.

Forum Selection

Our certificate of incorporation and our bylaws

provide that the Court of Chancery of the State of Delaware is the exclusive forum for any derivative action or proceeding brought on

our behalf; any action asserting a breach of fiduciary duty; any action asserting a claim against us arising pursuant to the DGCL, our

certificate of incorporation or our bylaws; or any action asserting a claim against us that is governed by the internal affairs doctrine.

Notwithstanding the foregoing, the exclusive forum provision does not apply to suits brought to enforce any liability or duty created

by the Exchange Act, the Securities Act or any other claim for which the federal courts have exclusive jurisdiction. Unless we consent

in writing to the selection of an alternative forum, the federal district courts of the United States of America shall, to the fullest

extent permitted by applicable law, be the sole and exclusive forum for the resolution of any complaint asserting a cause of action arising

under the Securities Act. The choice of forum provision may limit a stockholder’s ability to bring a claim in a judicial forum that

it finds favorable for disputes with us or our directors, officers or other employees, which may discourage such lawsuits against us and

our directors, officers and other employees.

Anti-Takeover Provisions

Our certificate of incorporation and bylaws contain

provisions that may delay, defer or discourage another party from acquiring control of us. We expect that these provisions, which are

summarized below, will discourage coercive takeover practices or inadequate takeover bids. These provisions are also designed to encourage

persons seeking to acquire control of us to first negotiate with our board of directors, which we believe may result in an improvement

of the terms of any such acquisition in favor of our stockholders. However, they also give our board of directors the power to discourage

acquisitions that some stockholders may favor.

Authorized but unissued shares. The authorized

but unissued shares of our common stock and our preferred stock are available for future issuance without stockholder approval, subject

to the requirements of any national securities exchange on which our common stock is listed, should we so qualify for listing. These additional

shares may be used for a variety of corporate finance transactions, acquisitions and employee benefit plans. The existence of authorized

but unissued and unreserved common stock and preferred stock could make more difficult or discourage an attempt to obtain control of us

by means of a proxy contest, tender offer, merger or otherwise.

Elimination of Stockholder Action by Written

Consent. Our certificate of incorporation will eliminate the right of stockholders to act by written consent without a meeting.

Special meetings of stockholders. Our certificate

of incorporation and bylaws provide that, except as otherwise required by law or provided by the resolution or resolutions adopted by

our board of directors designating the rights, powers and preferences of any series of preferred stock, special meetings of our stockholders

may be called only by (a) our board of directors pursuant to a resolution approved by a majority of the total number of our directors

that we would have if there were no vacancies or (b) the chair of our board of directors, and any power of our stockholders to call

a special meeting is specifically denied.

Advance notice requirements for stockholder

proposals and director nominations. Our bylaws provide for an advance notice procedure for stockholder proposals to be brought before

an annual meeting of stockholders, including proposed nominations of candidates for election to our board of directors. In order for any

matter to be “properly brought” before a meeting, a stockholder must comply with advance notice and duration of ownership

requirements and provide us with certain information. Stockholders at an annual meeting may only consider proposals or nominations specified

in the notice of meeting or brought before the meeting by or at the direction of our board of directors or by a qualified stockholder

of record on the record date for the meeting, who is entitled to vote at the meeting and who has delivered timely written notice in proper

form to our secretary of the stockholder’s intention to bring such business before the meeting. These provisions could have the

effect of delaying stockholder actions that are favored by the holders of a majority of our outstanding voting securities until the next

stockholder meeting.

Amendment of Certificate of Incorporation or

Bylaws. The DGCL provides generally that the affirmative vote of a majority of the shares entitled to vote on any matter is required

to amend a corporation’s certificate of incorporation, unless a corporation’s certificate of incorporation requires a greater

percentage. Our certificate of incorporation provides that certain provisions of our certificate of incorporation (namely, those provisions

relating to (i) directors; (ii) limitation of director liability, indemnification and advancement of expenses and renunciation

of corporate opportunities; (iii) meetings of stockholders; and (iv) certain amendments to our certificate of incorporation

and bylaws) may not be altered, amended or repealed in any respect (including by merger, consolidation or otherwise), nor may any provision

inconsistent therewith be adopted, unless such alteration, amendment, repeal or adoption is approved by the affirmative vote of the holders

of at least sixty-six and two-thirds percent (66 2∕3%) of the voting power of all of our then-outstanding shares then entitled to

vote generally in an election of directors, voting together as a single class. Our certificate of incorporation and bylaws also provide

that approval of stockholders holding sixty-six and two-thirds percent (66 2∕3%) of the voting power of all of our then-outstanding

shares entitled to vote generally in an election of directors, voting together as a single class, is required for stockholders to make,

alter, amend, or repeal any provision of our bylaws. Our board of directors retains the right to alter, amend or repeal our bylaws.

Classified Board of Directors. Our certificate

of incorporation provides for a classified board of directors consisting of three classes of approximately equal size, each serving staggered

three-year terms. Only the directors in one class will be subject to election by a plurality of the votes cast at each annual meeting

of stockholders, with the directors in the other classes continuing for the remainder of their respective three-year terms. Stockholders

do not have the ability to cumulate votes for the election of directors.

Limitations on Liability and Indemnification of Officers and Directors

Our certificate of incorporation and bylaws provides

indemnification for our directors and officers to the fullest extent permitted by the DGCL. We have entered into Indemnification Agreements

with each of our directors that may be, in some cases, broader than the specific indemnification provisions contained under the DGCL.

In addition, as permitted by the DGCL, our certificate of incorporation and bylaws includes provisions that eliminate the personal liability

of our directors for monetary damages resulting from breaches of certain fiduciary duties as a director. The effect of this provision

is to restrict our rights and the rights of our stockholders in derivative suits to recover monetary damages against a director for breach

of fiduciary duties as a director. These provisions may be held not to be enforceable for violations of the federal securities laws of

the United States.

Section 203 of the Delaware General Corporation Law

We are subject to the provisions of Section 203

of the DGCL. In general, Section 203 prohibits a publicly-held Delaware corporation from engaging in a “business combination”

with an “interested stockholder” for a three-year period following the time that such stockholder becomes an interested stockholder,

unless the business combination is approved in a prescribed manner. A “business combination” includes, among other things,

a merger, asset or stock sale or other transaction resulting in a financial benefit to the interested stockholder. An “interested

stockholder” is a person who, together with affiliates and associates, owns, or did own within three years prior to the determination

of interested stockholder status, 15% or more of the corporation’s voting stock.

Under Section 203, a business combination

between a corporation and an interested stockholder is prohibited unless it satisfies one of the following conditions:

| |

• |

before the stockholder became interested, the board of directors approved either the business combination or the transaction that resulted in the stockholder becoming an interested stockholder; |

| |

• |

upon consummation of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding for purposes of determining the voting stock outstanding, shares owned by persons who are directors and also officers, and employee stock plans, in some instances; or |

| |

• |

at or after the time the stockholder became interested, the business combination was approved by the board of directors of the corporation and authorized at an annual or special meeting of the stockholders by the affirmative vote of at least two-thirds of the outstanding voting stock that is not owned by the interested stockholder. |

A Delaware corporation may “opt out”

of these provisions with an express provision in its original certificate of incorporation or an express provision in its amended and

restated certificate of incorporation or by-laws resulting from a stockholders’ amendment approved by at least a majority of the

outstanding voting shares. We have not opted out of these provisions. As a result, mergers or other takeover or change in control attempts

of us may be discouraged or prevented.

Listing

Our common stock is listed on The Nasdaq Capital

Market under the symbol “ACXP.”

Transfer Agent and Registrar

The transfer agent and registrar of our common

stock is VStock Transfer, LLC. They are located at 18 Lafayette Place, Woodmere, New York 11598. Their telephone number is (212) 828-8436.

LEGAL MATTERS

Mintz, Levin, Cohn, Ferris, Glovsky and Popeo,

P.C., New York, New York, will pass upon the validity of the issuance of the securities to be offered by this prospectus.

EXPERTS

The financial statements of Acurx Pharmaceuticals, Inc.

(formerly Acurx Pharmaceuticals, LLC) for the two years ended December 31, 2022 appearing in Acurx Pharmaceuticals, Inc.’s

Annual Report on Form 10-K for the year ended December 31, 2022, have been audited by CohnReznick LLP, independent registered

public accounting firm, as set forth in their report thereon, included therein, and incorporated by reference herein. Such financial statements

are incorporated by reference herein in reliance upon such report, which includes an explanatory paragraph on Acurx Pharmaceuticals, Inc.’s

ability to continue as a going concern, given on the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We have filed a registration statement on Form S-1

with respect to the shares of common stock offered by this prospectus with the SEC in accordance with the Securities Act and the rules and

regulations enacted under its authority. This prospectus, which constitutes a part of the registration statement, does not contain all

of the information included in the registration statement and its exhibits and schedules. Any statement made in this prospectus concerning

the contents of any contract, agreement or other document is only a summary of the actual contract, agreement or other document. If we

have filed or incorporated by reference any contract, agreement or other document as an exhibit to the registration statement, you should

read the exhibit for a more complete understanding of the document or matter involved. Each statement regarding a contract, agreement

or other document is qualified by reference to the actual document. For further information regarding us and the shares of common stock

offered by this prospectus, we refer you to the full registration statement, including its exhibits and schedules, filed under the Securities

Act.

The SEC maintains a website at http://www.sec.gov

that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

Our registration statement, of which this prospectus constitutes a part, can be downloaded from the SEC’s website.

We also file annual, quarterly and current reports,

proxy statements and other information with the SEC. You can read our SEC filings on the SEC’s website at http://www.sec.gov.

Our website address is http://www.acurxpharma.com.

There we make available free of charge, on or through the investor relations section of our website, annual reports on Form 10-K,

quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed pursuant to Section 13(a) or

15(d) of the Exchange Act as soon as reasonably practicable after we electronically file such material with the SEC. The information

contained on, or that can be accessed through, our website is not a part of this prospectus, and our reference to the address for our

website is intended to be an inactive textual reference only.

INCORPORATION OF DOCUMENTS BY REFERENCE

The rules of the SEC allow us to incorporate

by reference into this prospectus the information we file with the SEC. This means that we are disclosing important information to you

by referring to other documents. The information incorporated by reference is considered to be part of this prospectus, except for any

information superseded by information contained directly in this prospectus. We incorporate by reference the documents listed below (other

than any portions thereof, which under the Exchange Act, and applicable SEC rules, are not deemed “filed” under the Exchange

Act):

| |

• |

the description of our common stock contained in our Registration Statement on Form 8-A initially filed on June 23, 2021, including any amendment or report filed for the purpose of updating such description. |

The SEC file number for each of the documents

listed above is 001-40536.

In addition, all documents subsequently filed

by us with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, prior to the termination of the offering,

shall be deemed to be incorporated by reference into this prospectus; provided, however, that all reports, exhibits and other information

that we “furnish” to the SEC will not be considered incorporated by reference into this prospectus. If we have incorporated

by reference any statement or information in this prospectus and we subsequently modify that statement or information with information

contained in this prospectus, the statement or information previously incorporated in this prospectus is also modified or superseded in

the same manner.

You may request, orally or in writing, a copy

of any or all of the documents incorporated herein by reference. These documents will be provided to you at no cost, by contacting:

Acurx Pharmaceuticals, Inc.

259 Liberty Avenue

Staten Island, NY 10305

Telephone: (917) 533-1469

You may also access these documents on our website,

http://www.acurxpharma.com. The information contained on, or that can be accessed through, our website is not a part of this prospectus.

We have included our website address in this prospectus solely as an inactive textual reference.

You should rely only on information contained

in, or incorporated by reference into, this prospectus and any prospectus supplement. We have not authorized anyone to provide you with

information different from that contained in this prospectus or incorporated by reference in this prospectus. We are not making offers

to sell the securities in any jurisdiction in which such an offer or solicitation is not authorized or in which the person making such

offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make such offer or solicitation.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

ITEM 13.

Other Expenses of Issuance and Distribution.

The following table sets forth the costs and expenses,

payable by the Company in connection with the registration and sale of the Common Stock being registered. All amounts are estimates except

the SEC registration fee.

| | |

Amount | |

| SEC registration fee | |

$ | 761.12 | |

| Accounting fees and expenses | |

| 7,500.00 | |

| Legal fees and expenses | |

| 25,000.00 | |

| Miscellaneous | |

| 3,038.88 | |

| Total expenses | |

$ | 36,300.00 | |

ITEM 14. Indemnification of Directors and Officers.

The Delaware General Corporation Law and certain

provisions of our certificate of incorporation and bylaws under certain circumstances provide for indemnification of our officers, directors

and controlling persons against liabilities which they may incur in such capacities. A summary of the circumstances in which such indemnification

is provided for is contained herein, but this description is qualified in its entirety by reference to our certificate of incorporation,

bylaws and to the statutory provisions.

In general, any officer, director, employee or

agent may be indemnified against expenses, fines, settlements or judgments arising in connection with a legal proceeding to which such

person is a party, if that person’s actions were in good faith, were believed to be in our best interest, and with respect to any

criminal action or proceeding, such person had no reasonable cause to believe their actions were unlawful. Unless such person is successful

upon the merits in such an action, indemnification may be awarded only after a determination by independent decision of the board of directors,

by legal counsel, or by a vote of the stockholders, that the applicable standard of conduct was met by the person to be indemnified.

The circumstances under which indemnification

is granted in connection with an action brought on our behalf is generally the same as those set forth above; however, with respect to

such actions, indemnification is granted only with respect to expenses actually incurred in connection with the defense or settlement

of the action. In such actions, unless the court determines otherwise, the person to be indemnified must have acted in good faith and

in a manner believed to have been in our best interest, and have not been adjudged liable to the corporation.

Indemnification may also be granted pursuant to

the terms of agreements which we are currently party to with each of our directors and executive officers, agreements which we may enter

into in the future or pursuant to a vote of stockholders or directors. Delaware law and our certificate of incorporation also grant the

power to us to purchase and maintain insurance which protects our officers and directors against any liabilities incurred in connection

with their service in such a position, and such a policy may be obtained by us.

A stockholder’s investment may be adversely

affected to the extent we pay the costs of settlement and damage awards against directors and officers as required by these indemnification

provisions. There is no pending litigation or proceeding involving any of our directors, officers or employees regarding which indemnification

by us is sought, nor are we aware of any threatened litigation that may result in claims for indemnification.

Insofar as indemnification for liabilities arising

under the Securities Act may be permitted to directors, officers or persons controlling us pursuant to the foregoing provisions, we have

been informed that, in the opinion of the SEC, this indemnification is against public policy as expressed in the Securities Act and is

therefore unenforceable.

ITEM 15. Recent Sales of Unregistered Securities.