UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-Q/A

(Amendment No. 1)

(Mark One)

[X] QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the quarterly period ended June 30, 2009

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the transition period from ____________ to____________

Commission file number 0-7473

Amexdrug Corporation

(Exact name of registrant as specified in its charter)

NEVADA 95-2251025

--------------------------------- -------------------

(State or other jurisdiction of (I.R.S. Employer

incorporation or organization) identification No.)

8909 West Olympic Boulevard, Suite 208

Beverly Hills, California 90211

-------------------------------

(Address of principal executive offices)

|

Registrant's telephone number: (310) 855-0475

Indicate by check mark whether the registrant (1) has filed all reports required

to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during

the preceding 12 months (or for such shorter period that the registrant was

required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and

posted on its corporate Web site, if any, every Interactive Data File required

to be submitted and posted pursuant to Rule 405 of Regulation S-T (ss.232.405 of

this chapter) during the preceding 12 months (or for such shorter period that

the registrant was required to submit and post such files).

Yes [ ] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of "large accelerated filer," "accelerated filer" and "smaller

reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] Accelerated filer [ ]

Non-accelerated filer [ ] Smaller reporting company [ X ]

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in

Rule 12b-2 of the Exchange Act). Yes [ ] No [ X ]

APPLICABLE ONLY TO CORPORATE ISSUERS

State the number of shares outstanding of each of the issuer's classes of common

equity, as of the latest practicable date: As of August 6, 2009, there were

8,470,481 shares of the issuer's common stock issued and outstanding.

Explanatory Note:

This quarterly report is being amended for the purpose of adding Exhibits A, B

and C to each of Exhibits 10.1 and 10.2 and also to add Exhibit Nos. 10. 6

through 10.16.

1

AMEXDRUG CORPORATION

FORM 10-Q

TABLE OF CONTENTS

PART I - FINANCIAL INFORMATION

Page

----

Item 1. Financial Statements (Unaudited)...................................3

Consolidated Balance Sheets -- As of June 30, 2009 (Unaudited)

and December 31, 2008 (Audited)...................................5

Consolidated Statements of Operations for the Three and Six

Months Ended June 30, 2009 and 2008 (Unaudited)...................6

Consolidated Statements of Cash Flows for the Six Months

Ended June 30, 2009 and 2008 (Unaudited)..........................7

Notes to Consolidated Financial Statements (Unaudited)..............8

Item 2. Management's Discussion and Analysis of Financial Condition

and Results of Operations........................................10

Item 3. Quantitative and Qualitative Disclosures About Market Risk........15

Item 4. Controls and Procedures...........................................15

PART II - OTHER INFORMATION

Item 1. Legal Proceedings.................................................15

Item 1A. Risk Factors.......................................................15

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.......15

Item 3. Defaults Upon Senior Securities...................................15

Item 4. Submission of Matters to a Vote of Security Holders...............15

Item 5. Other Information.................................................16

Item 6. Exhibits..........................................................16

|

2

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements.

The consolidated balance sheets of Amexdrug Corporation, a Nevada

corporation, and subsidiaries as of June 30, 2009 (unaudited) and December 31,

2008 (unaudited), the related unaudited consolidated statements of operations

for the three and six month periods ended June 30, 2009 and June 30, 2008, the

related unaudited consolidated statements of cash flows for the six month

periods ended June 30, 2009 and June 30, 2008 and the notes to the unaudited

consolidated financial statements follow. The consolidated financial statements

have been prepared by Amexdrug's management, and are condensed; therefore they

do not include all information and notes to the financial statements necessary

for a complete presentation of the financial position, results of operations and

cash flows, in conformity with accounting principles generally accepted in the

United States of America, and should be read in conjunction with the annual

consolidated financial statements included in Amexdrug's annual report on Form

10-K for the year ended December 31, 2008.

The accompanying consolidated financial statements reflect all

adjustments which are, in the opinion of management, necessary to present fairly

the results of operations and financial position of Amexdrug Corporation

consolidated with Allied Med, Inc., Dermagen, Inc., and BioRx Pharmaceuticals,

Inc., its wholly owned subsidiaries, and all such adjustments are of a normal

recurring nature. The names "Amexdrug", "we", "our" and "us" used in this report

refer to Amexdrug Corporation.

Operating results for the quarter ended June 30, 2009, are not

necessarily indicative of the results that can be expected for the year ending

December 31, 2009.

3

AMEXDRUG CORPORATION AND SUBSIDIARIES

INDEX TO FINANCIAL STATEMENTS

Page

----

Consolidated Balance Sheets - June 30, 2009 (Unaudited)

and December 31, 2008 (Audited)...........................................5

Consolidated Statements of Operations (Unaudited) for the Three

and Six Months Ended June 30, 2009 and 2008..............................6

Consolidated Statements of Cash Flows (Unaudited) for the Six

Months Ended June 30, 2009 and 2008......................................7

Notes to Consolidated Financial Statements..................................8

|

4

AMEXDRUG CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Unaudited)

June 30, December 31,

2009 2008

------------ ------------

Assets

Current Assets

Cash and cash equivalents $ 123,144 $ 96,390

Investment 275 2,681

Accounts receivable, net of allowance

of $22,100 501,330 314,397

Inventory 215,543 211,538

Deferred tax asset 12,000 16,345

Other receivable 7,038 8,288

Advances officer 1,504 5,360

Prepaid insurance - 7,900

------------ ------------

Total Current Assets 860,834 662,899

------------ ------------

Property and Equipment, at cost

Office and computer equipment 191,763 182,880

Leasehold improvements 15,700 15,700

------------ ------------

207,463 198,580

Less accumulated depreciation (187,421) (183,350)

------------ ------------

Net Property and Equipment 20,042 15,230

------------ ------------

Other Assets

Other deposits 12,158 12,158

Intangibles

Customer base, net of accumulated

amortization of $18,259 - -

Trademark, net of accumulated

amortization of $340 1,268 1,351

Goodwill 17,765 17,765

------------ ------------

Total Other Assets 31,191 31,274

------------ ------------

Total Assets $ 912,067 $ 709,403

============ ============

Liabilities and Shareholders' Equity

Current Liabilities:

Accounts payable $ 415,180 $ 430,818

Accrued liabilities 17,635 14,286

Corporate tax payable 34,097 9,270

Notes payable related parties 109,202 109,202

Business lines of credit 178,282 91,287

------------ ------------

Total Current Liabilities 754,396 654,863

------------ ------------

Shareholders' Equity

Common stock, $0.0001 par value;

50,000,000 authorized common

shares 8,470,481 shares issued

and outstanding 8,471 8,471

Additional paid in capital 83,345 83,345

Treasury stock at cost (6,551) -

Accumulated deficit 72,406 (37,276)

------------ ------------

Total Shareholders' Equity 157,671 54,540

------------ ------------

Total Liabilities and

Shareholders' Equity $ 912,067 $ 709,403

============ ============

|

The accompanying notes are an integral part of these

consolidated financial statements.

5

AMEXDRUG CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

The Three Months Ended The Six Months Ended

June 30, June 30, June 30, June 30,

2009 2008 2009 2008

--------------------------- ---------------------------

Sales $ 2,435,174 $ 1,469,772 $ 4,377,709 $ 2,772,986

Cost of Goods Sold 2,178,246 1,386,701 3,922,204 2,570,287

------------ ------------ ------------ ------------

Gross Profit 256,928 83,071 455,505 202,699

------------ ------------ ------------ ------------

Operating Expenses

Selling, general and administrative expense 115,493 94,657 207,603 177,832

Research and development 28,147 1,050 89,795 2,063

------------ ------------ ------------ ------------

Total Operating Expenses 143,640 95,707 297,398 179,895

------------ ------------ ------------ ------------

Income/(Loss) before depreciation expense 113,288 (12,636) 158,107 22,804

Depreciation and amortization expense 2,097 5,882 4,154 9,484

------------ ------------ ------------ ------------

Income/(Loss) before Other Income/(Expenses) 111,191 (18,518) 153,953 13,320

------------ ------------ ------------ ------------

Other Income/(Expenses)

Penalty - - (268) (344)

Unrealized gain/(loss) (2,306) (327) (2,406) (327)

Interest expense (5,519) (3,333) (10,825) (6,233)

------------ ------------ ------------ ------------

Total Other Income/(Expenses) (7,825) (3,660) (13,499) (6,904)

------------ ------------ ------------ ------------

Income/(Loss) before Provision for Income Taxes 103,366 (22,178) 140,454 6,416

Income tax benefit/(expense) (24,207) 12,832 (30,772) 6,412

------------ ------------ ------------ ------------

Net Income/(Loss) $ 79,159 $ (9,346) $ 109,682 $ 12,828

============ ============ ============ ============

BASIC AND DILUTED INCOME/(LOSS) PER SHARE $ 0.01 $ (0.00) $ 0.01 $ 0.00

============ ============ ============ ============

WEIGHTED-AVERAGE COMMON SHARES OUTSTANDING

BASIC AND DILUTED 8,470,481 8,470,481 8,470,481 8,470,481

============ ============ ============ ============

The accompanying notes are an integral part of these

consolidated financial statements.

6

|

AMEXDRUG CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

The Six Months Ended

June 30, June 30,

2009 2008

------------ ------------

CASH FLOWS FROM OPERATING ACTIVITIES:

Net income/(loss) $ 109,682 $ 12,828

Adjustment to reconcile net loss to net cash

used in operating activities

Depreciation and amortization 4,154 9,484

Unrealized gain/(loss) on investment 2,406 -

(Increase) Decrease in:

Accounts receivable (186,933) (70,499)

Allowance for doubtful accounts - -

Inventory (4,005) 58,781

Prepaid expenses 7,900 (1,397)

Account settlement receivable 1,250 -

Deferred tax asset 4,345 (3,200)

Increase (Decrease) in:

Accounts payable and accrued liabilities (12,289) (223,084)

Corporate income tax payable 24,827 173

------------ ------------

NET CASH USED IN OPERATING ACTIVITIES (48,663) (216,914)

------------ ------------

Net CASH FLOWS USED IN INVESTING ACTIVITIES:

Purchase of fixed assets (8,883) (50,064)

------------ ------------

NET CASH USED IN INVESTING ACTIVITIES (8,883) (50,064)

------------ ------------

CASH FLOWS FROM FINANCING ACTIVITIES:

Advance, officer 3,856 -

Loan payable, Dell - 1,005

Loan payable, AFS/IBEX - 437

Purchase of treasury stock (6,551) -

Proceeds from credit line 86,995 12,044

Proceeds from related parties - 60,000

------------ ------------

NET CASH PROVIDED BY FINANCING ACTIVITIES 84,300 73,486

------------ ------------

NET INCREASE (DECREASE) IN CASH 26,754 (193,492)

CASH, BEGINNING OF PERIOD 96,390 217,549

------------ ------------

CASH, END OF PERIOD $ 123,144 $ 24,057

============ ============

SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION

Interest paid $ 6,457 $ 3,848

============ ============

Income taxes $ 800 $ 800

============ ============

|

The accompanying notes are an integral part of these

consolidated financial statements.

7

AMEXDRUG CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-UNAUDITED

JUNE 30, 2009

1. Basis of Presentation

The accompanying unaudited consolidated financial statements have been

prepared in accordance with accounting principles generally accepted in

the United States of America for interim financial information and with

the instructions to Form 10-Q and Rule 10-01 of Regulation S-X.

Accordingly, they do not include all of the information and footnotes

required by generally accepted accounting principles for complete

financial statements. In the opinion of management, all normal recurring

adjustments considered necessary for a fair presentation have been

included. Operating results for the six months ended June 30, 2009 are not

necessarily indicative of the results that may be expected for the year

ending December 31, 2009. For further information refer to the financial

statements and footnotes thereto included in the Company's Form 10-K for

the year ended December 31, 2008.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

This summary of significant accounting policies of AmexDrug Corporation is

presented to assist in understanding the Company's financial statements.

The financial statements and notes are representations of the Company's

management, which is responsible for their integrity and objectivity.

These accounting policies conform to accounting principles generally

accepted in the United States of America and have been consistently

applied in the preparation of the financial statements.

Income per Share Calculations

The Company adopted Statement of Financial Standards ("SFAS") No. 128 for

the calculation of "Income per Share". SFAS No. 128 dictates the

calculation of basic earnings per share and diluted earnings per share.

Basic earnings per share are computed by dividing income available to

common shareholders by the weighted-average number of common shares

available. Diluted earnings per share is computed similar to basic

earnings per share except that the denominator is increased to include the

number of additional common shares that would have been outstanding if the

potential common shares had been issued and if the additional common

shares were dilutive. The Company's diluted income per share is the same

as the basic income per share for the six months ended June 30, 2009,

because there are no outstanding dilutive instruments.

Recently Issued Accounting Pronouncements

In May 2009, the FASB issued SFAS No. 165, "Subsequent Events" ("SFAS

165"), which establish general standards of accounting for and disclosure

of events that occur after the balance sheet date but before financial

statements are issued. SFAS 165 is for interim or annual periods ending

after June 15, 2009. The adoption of SFAS 165 did not have a material

effect on the Company's financial statements.

8

AMEXDRUG CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-UNAUDITED

JUNE 30, 2009

3. CAPITAL STOCK

During the six months ended June 30, 2009, the Company issued no shares of

common stock.

4. INCOME TAXES

The Company files income tax returns in the U.S. Federal jurisdiction, and

the state of California. With few exceptions, the Company is no longer

subject to U.S. federal, state and local, or non-U.S. income tax

examinations by tax authorities for years before 2000.

The Company adopted the provisions of FASB Interpretation No. 48,

Accounting for Uncertainty in Income Taxes, on January 1, 2007. FIN 48

clarifies the accounting for uncertainty in tax positions by prescribing a

minimum recognition threshold required for recognition in the financial

statements. FIN 48 also provides guidance on de-recognition, measurement

classification, interest and penalties, accounting in interim periods,

disclosure and transition.

The Company's policy is to recognize interest accrued related to

unrecognized tax benefits in interest expense and penalties in operating

expenses.

5. SUBSEQUENT EVENTS

Management has evaluated subsequent events as of August 7, 2009, and has

determined there are no subsequent events to be reported.

9

Item 2. Management's Discussion and Analysis of Financial Condition and

Results of Operations.

Overview

Amexdrug Corporation is located at 8909 West Olympic Boulevard, Suite

208, Beverly Hills, California 90211. Its phone number is (310) 855-0475. Its

fax number is (310) 855-0477. Its website is www.amexdrug.com. Shares of

Amexdrug common stock are traded on the OTC Bulletin Board under the symbol

AXRX.OB. The President of Amexdrug has had experience working in the

pharmaceutical industry for the past 26 years.

Amexdrug Corporation, through its wholly-owned subsidiaries, Dermagen,

Inc., Allied Med, Inc., Royal Health Care, Inc. and BioRx Pharmaceuticals, Inc.

is a rapidly growing pharmaceutical and cosmeceutical company specializing in

the research and development, manufacturing and distribution of pharmaceutical

drugs, cosmetics and distribution of prescription and over-the-counter drugs,

private manufacturing and labeling and a quality control laboratory. At Amexdrug

Corporation, it is our anticipation to give our clientele the opportunity to

purchase cost effective products while maximizing the return of investments to

our shareholders.

Amexdrug Corporation distributes its products through its subsidiaries,

Dermagen, Inc., Allied Med, Inc., Royal Health Care, Inc. and BioRx

Pharmaceuticals, Inc. primarily to independent pharmacies and secondarily to

small and medium-sized pharmacy chains, alternative care facilities and other

wholesalers and retailers in the state of California.

We have introduced five pharmaceutical over the counter (OTC) and

natural products in 2008 and plan to add three more products, in various stages

of development, in 2009. We presently market twelve products under the Sponix

name. Our team of professionals fully pledges the effectiveness of our distinct

products.

At this time, we have certain distribution channels with suppliers and

customers whom we know and trust, such as CVS, Target, Amazon, and hundreds of

independent pharmacies. Of the estimated 100,000 retailers (drug stores and food

mass), we expect to have 25,000 stores carry our products in 2009. Our mission

is to expand the sales of our products to more than 40,000 stores in 2010.

Amexdrug Corporation was initially incorporated under the laws of the

State of California on April 30, 1963 under the name of Harlyn Products, Inc.

Harlyn Products, Inc. was engaged in the business of selling jewelry to

department stores and retail jewelry stores until the mid-1990s.

The name of the Company was changed to Amexdrug Corporation in April

2000 to reflect the change in the Company's business to the sale of

pharmaceutical products. The officers and directors of the Company also changed

in April 2000. The domicile of the Company was changed from California to Nevada

in December 2001. At that time the Company changed its fiscal year end from June

30 to December 31.

References in this report to "we," "our," "us," the "company" and

"Amexdrug" refer to Amexdrug Corporation and also to our subsidiaries, Dermagen,

Inc., Allied Med, Inc., Royal Health Care, Inc. and BioRx Pharmaceuticals, Inc.

Amexdrug currently has 50,000,000 shares of authorized common stock

$.001 par value, of which 8,470,481 are issued and outstanding as of June 30,

2009.

Allied Med, Inc.

On December 31, 2001, Amexdrug acquired all of the issued and

outstanding common shares of Allied Med, Inc., an Oregon corporation, ("Allied

Med") in a related party transaction.

10

Allied Med was formed as an Oregon corporation in October 1997, to

operate in the pharmaceutical wholesale business of selling a full line of brand

name and generic pharmaceutical products, over the counter (OTC) drug and

non-drug products and health and beauty products to independent and chain

pharmacies, alternative care facilities and other wholesalers.

Amexdrug has assumed the operations of Allied Med, and Amexdrug intends

to build on the pharmaceutical wholesale operations of Allied Med.

The accompanying financial information includes the operations of

Allied Med for all periods presented and the operations of Amexdrug Corporation

from April 25, 2000.

Dermagen, Inc.

Amexdrug completed its purchase of Dermagen, Inc. on October 7, 2005.

Dermagen, Inc. is now an operating subsidiary of Amexdrug. The acquisition of

Dermagen, Inc. is not considered to be an acquisition of a significant amount of

assets which would require audited financial statements of Dermagen, Inc.

Dermagen, Inc. is a growing manufacturing company specializing in the

manufacturing and distribution of certain pharmaceuticals, medical devices,

health and beauty products. Dermagen, Inc. has a U.S.-FDA registered and state

FDA approved manufacturing facility licensed to develop high margin skin and

novel health and beauty products for niche markets. Dermagen's competitive

advantage is in its superior product research and development for large leading

domestic and international companies.

Royal Health Care Company

In October 2003, Allied Med acquired 100% of the assets of Royal Health

Care Company. Royal Health Care Company is a health and beauty company which has

sold specially manufactured facial and body creams, arthritic pain relief

medications and an exclusive patented hair care product to pharmacies, beauty

salons, beauty supply stores and other fine shops. Royal Health Care Company

uses the highest quality ingredients for the finest quality products. Each

product has been formulated with the essential ingredients and plant extracts to

achieve optimum potential and quality. Royal Health Care Company products are

manufactured by Dermagen, Inc., in an FDA approved manufacturing facility.

The Royal Health Care Company assets acquired include the "Royal Health

Care Company" name, logo, and related trademarks, all formulas to products

manufactured for sale under the Royal Health Care Company name, and the Royal

Health Care Company list of customers. These intellectual property rights were

acquired without cost from a company in which Jack Amin's wife is a principal

shareholder. Mr. Amin is the CEO and Chairman of Amexdrug Corporation and Allied

Med, Inc. Management believes this acquisition will provide the Company with an

opportunity to increase the number of products sold by the Company, and expand

the Company's customer base.

On October 28, 2004, Amexdrug formed a new subsidiary, Royal Health

Care, Inc. as a Nevada corporation. Royal Health Care, Inc. was formed to

manufacture and sell health and beauty products.

BioRx Pharmaceuticals

On November 8, 2004, Amexdrug formed a new subsidiary, BioRx

Pharmaceuticals, Inc. as a Nevada corporation. BioRx Pharmaceuticals, Inc. is

committed to offer over the counter (OTC) products that are recommended with

trust and faith by physicians, primarily podiatrists and dermatologists. The

focus and mission of BioRx Pharmaceuticals, Inc. is to create, develop and

manufacture products to help ease pain and restore and maintain the overall

well-being of our customers. We strive for high performance and quality. Our

commitment is to offer natural and OTC products that are recommended with

confidence by doctors and pharmacists and that the customer can use with

pleasure. Our compliance program is diligently followed through the Company.

BioRx Pharmaceuticals, Inc. maintains high ethics for animal welfare and our

products are never tested on animals. All products are made in the USA.

11

A total of twelve products have been manufactured for sale by BioRx

Pharmacenticals, Inc., and a total of ten products are currently under different

stages of development, three of which should be available in 2009. These

over-the-counter and natural products are effective for treatment of fungus,

arthritis, sunburn protection and for healthy feet and nails. BioRx

Pharmaceuticals is planning to sell these products to national chain drugstores,

sport chain stores, natural food markets and other mass markets. These products

will be marketed under the names of Sponix and Bactivex, and will be sold under

the name of BioRx Pharmaceuticals.

Lease Agreements and Certain Other Contracts

The Company has a written lease agreement covering the property in

Fullerton, California leased by the Company which is filed as an exhibit. The

Beverly Hills property leased by the Company is under a month to month verbal

lease since the original lease on the property has expired. The Company's

Manila, Philippines location is also leased under a verbal lease agreement. The

Company's loan agreement with Nora Amin is verbal. The Company does not have

written contracts with its major suppliers or buyers. The Company has a written

line of credit agreement with National Bank of California which is filed as an

exhibit.

Results of Operations

For the Three Months Ended June 30, 2009.

Revenues.

For the three months ended June 30, 2009, Amexdrug reported sales of

$2,435,174, comprised of $2,369,486 of sales from the Company's pharmaceutical

wholesale business of selling brand name and generic pharmaceutical products and

over the counter (OTC) health and beauty products, and $65,688 of sales of

health and beauty products manufactured by the Company. This is $965,402 more

than the $1,469,772 of sales reported for the three months ended June 30, 2008,

which was comprised primarily of $1,344,436 sales from the Company's

pharmaceutical wholesale distribution business of selling brand name and generic

pharmaceutical products and over the counter (OTC) health and beauty products,

and $125,336 of sales of health and beauty products manufactured by the Company.

During the three month period ended June 30, 2009, Amexdrug experienced an

increase in total sales due, in part, to the increased marketing efforts of the

Company.

Costs of Goods Sold.

Cost of goods sold for the three months ended June 30, 2009 was

$2,178,246, an increase of $791,545 from the $1,386,701 cost of goods sold for

the three months ended June 30, 2008.

Gross Profit.

During the three months ended June 30, 2009 gross profit increased by

$173,857 to $256,928, or 10.6% of sales, from the $83,071, or 5.7% of sales

recorded for the three months ended June 30, 2008. The change in gross profit

margin is attributable to an increase in sales as well as an increased

percentage of sales made from higher gross margin products manufactured and sold

in the three month period ended June 30, 2009.

Expenses.

Selling, general and administrative expense was $115,493 for the three

months ended June 30, 2009, an increase of $20,836 from the $94,657 of selling,

general and administrative expense recorded for the three months ended June 30,

2008. This increase in selling, general and administrative expense is

attributable to increases in certain administrative expenses.

12

Net Income.

During the three months ended June 30, 2009, Amexdrug earned net income

of $79,159, as compared to the net loss of $9,346 experienced in the three

months ended June 30, 2008. Amexdrug's improvement during the three month period

ended June 30, 2009 is attributable largely to the significant increase in sales

and resulting increase in gross profits in the later period.

For the Six Months Ended June 30, 2009.

Revenues.

For the six months ended June 30, 2009, Amexdrug reported sales of

$4,377,709, comprised of $4,256,428 of sales from the Company's pharmaceutical

wholesale business of selling brand name and generic pharmaceutical products and

over the counter (OTC) health and beauty products, and $121,281 of sales of

health and beauty products manufactured by the Company. This is $1,604,723 more

than the $2,772,986 of sales reported for the six months ended June 30, 2008

which was comprised primarily of $2,620,406 of sales from the Company's

pharmaceutical wholesale distribution business of selling brand name and generic

pharmaceutical products and over the counter (OTC) health and beauty products,

and $152,580 of sales of health and beauty products manufactured by the Company.

During the six month period ended June 30, 2009, Amexdrug experienced an

increase in total sales due, in part, to increased marketing efforts of the

Company.

Costs of Goods Sold.

Cost of goods sold for the six months ended June 30, 2009 was

$3,922,204, an increase of $1,351,917 from the $2,570,287 cost of goods sold for

the six months ended June 30, 2008.

Gross Profit.

During the six months ended June 30, 2009 gross profit increased by

$252,806 to $455,505, or 10.4% of sales, from the $202,699, or 7.3% of sales

recorded for the six months ended June 30, 2008. The change in gross profit

margin is attributable to an increase in sales as well as an increased

percentage of sales of higher gross margin products manufactured and sold in the

first six months of 2009.

Expenses.

Selling, general and administrative expense was $207,603 for the six

months ended June 30, 2009, an increase of $29,771 from the $177,832 of selling,

general and administrative expense recorded for the six months ended June 30,

2008. This increase in selling, general and administrative expense is

attributable to increases in certain administrative expenses.

Net Income.

During the six months ended June 30, 2009, Amexdrug earned net income

of $109,682, an increase of $96,854 from the net income of $12,828 experienced

in the six months ended June 30, 2008. Amexdrug's increase in net income during

the six month period ended June 30, 2009 is attributable largely to the increase

of sales and the resulting increase in gross profits earned in the later period.

Liquidity and Capital Resources - June 30, 2009

As of June 30, 2009, Amexdrug reported total current assets of

$860,834, comprised primarily of cash and cash equivalents of $123,144, accounts

receivable of $501,330, inventory of $215,543, a deferred tax asset of $12,000

and other receivable of $7,038. Total assets as of June 30, 2009 were $912,067,

which included total current assets, plus net property and equipment of $20,042,

other deposits of $12,158, customer base of $1,268, and goodwill of $17,765.

13

Amexdrug's liabilities as of June 30, 2009 consisted primarily of

accounts payable of $415,180, notes payables to related parties of $109,202,

business line of credit of $178,282, corporate tax payable of $34,097 and

accrued liabilities of $17,635.

During the six months ended June 30, 2009, Amexdrug used $48,663 cash

in operating activities compared to $216,914 cash used in operating activities

in the six months ended June 30, 2008. The primary adjustments to reconcile net

income to net cash used in operating activities during the six months ended June

30, 2009 were as follows: an increase in accounts receivable of $186,933, a

decrease in accounts payable and accrued liabilities of $12,289, and an increase

in corporate income tax payable of $24,827. Amexdrug had $123,144 in cash and

cash equivalents at June 30, 2009. Operations have primarily been funded through

cash generated from operations, and from loans made from the wife of our

President. Management does not anticipate that Amexdrug will need to seek

additional financing during the next twelve months.

Inflation

In the opinion of management, inflation has not and will not have a

material effect on our operations in the immediate future. Management will

continue to monitor inflation and evaluate the possible future effects of

inflation on our business and operations.

Capital Expenditures

The Company expended $8,883 and $50,064 on capital expenditures during

the three month periods ended June 30, 2009 and 2008, respectively. The Company

has no current plans for any significant capital expenditures.

Critical Accounting Policies

In the notes to the audited consolidated financial statements for the

year ended December 31, 2008, included in the Company's Annual Report on Form

10-K, the Company discusses those accounting policies that are considered to be

significant in determining the results of operations and its financial position.

The Company believes that the accounting principles utilized by it conform to

accounting principles generally accepted in the United States of America.

The preparation of financial statements requires Company management to

make significant estimates and judgments that affect the reported amounts of

assets, liabilities, revenues and expenses. By their nature, these judgments are

subject to an inherent degree of uncertainty. On an on-going basis, the Company

evaluates estimates. The Company bases its estimates on historical experience

and other facts and circumstances that are believed to be reasonable, and the

results form the basis for making judgments about the carrying value of assets

and liabilities. The actual results may differ from these estimates under

different assumptions or conditions.

Forward-looking statements

This document includes various forward-looking statements with respect

to future operations of Amexdrug that are subject to risks and uncertainties.

Forward-looking statements include information concerning expectations of future

results of operations and such statements preceded by, followed by or that

otherwise include the words "believes," "expects," "anticipates," "intends,"

"estimates" or similar expressions. For those statements, Amexdrug claims the

protection of the safe harbor for forward-looking statements contained in the

Private Litigation Reform Act of 1995. Actual results may vary materially.

14

Item 3. Quantitative and Qualitative Disclosures About Market Risk.

A "smaller reporting company" (as defined by Item 10 of the Regulation

S-K) is not required to provide the information required by this Item.

Item 4. Controls and Procedures.

Under the supervision and with the participation of management, our

principal executive officer and principal financial officer evaluated the

effectiveness of the design and operation of our disclosure controls and

procedures, as defined in Rules 13a-15(e) and 15d-15(e) under the Securities

Exchange Act of 1934 ("Exchange Act"), as of June 30, 2009. Based on this

evaluation, our principal executive officer and our principal financial officer

concluded that, as of the end of the period covered by this report, our

disclosure controls and procedures were effective and adequately designed to

ensure that the information required to be disclosed by us in the reports we

submit under the Exchange Act is recorded, processed, summarized and reported

within the time periods specified in the applicable rules and forms and that

such information was accumulated and communicated to our chief executive officer

and chief financial officer, in a manner that allowed for timely decisions

regarding required disclosure.

During the last fiscal quarter ended June 30, 2009, there has been no

change in internal control over financial reporting that has materially

affected, or is reasonably likely to materially affect, our internal control

over financial reporting.

ANY FORWARD-LOOKING STATEMENTS INCLUDED IN THIS FORM 10-Q REPORT

REFLECT MANAGEMENT'S BEST JUDGMENT BASED ON FACTORS CURRENTLY KNOWN AND INVOLVE

RISKS AND UNCERTAINTIES. ACTUAL RESULTS MAY VARY MATERIALLY.

PART II - OTHER INFORMATION

Item 1. Legal Proceedings.

Amexdrug is not presently a party to any material pending legal

proceedings. To the best of Amexdrug's knowledge, no governmental authority or

other party has threatened or is contemplating the filing of any material legal

proceeding against Amexdrug.

Item 1A. Risk Factors.

A "smaller reporting company" (as defined by Item 10 of the Regulation

S-K) is not required to provide the information required by this Item.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

During the three month period ended June 30, 2009, the Company did not

issue any shares of its unregistered common stock. For a description of any

sales of shares of the Company's unregistered stock made in the past three

years, please refer to the Company's Annual Reports on Form 10-KSB or Form 10-K,

and the Company's Quarterly Reports on Form 10-QSB or Form 10-Q filed since

December 31, 2005

Item 3. Defaults Upon Senior Securities.

None; not applicable.

Item 4. Submission of Matters to a Vote of Security Holders.

None; not applicable.

15

Item 5. Other Information.

None; not applicable.

Item 6. Exhibits.

(a) Exhibits.

EXHIBIT INDEX

Exhibit Exhibit

Number Description Location

------- ----------- --------

2.1 Agreement and Plan of Merger *

(to change domicile from California

2.2 Agreement and Plan of Reorganization **

3.1 Articles of Incorporation ***

3.2 By-Laws ***

10.1 Lease Agreement between Fullerton Business This Filing

Center, Lessor, and Allied Med, Inc.,

Lessee, dated September 23, 2005 (Unit K)

10.2 Lease Agreement between Fullerton Business This Filing

Center, Lessor, and Allied Med, Inc.,

Lessee, dated September 23, 2005 (Units I

& J)

10.3 Third Amendment to Lease Agreement between *****

Fullerton Business Center, Lessor, and

Allied Med, Inc., Lessee, dated November 5,

2008 (Units I and J)

10.4 Promissory Note with National Bank of *****

California dated June 23, 2008

10.5 Change in Terms Agreement with National *****

Bank of California dated June 9, 2009

10.6 First Amendment to Lease Agreement This Filing

between Fullerton Business Center, Lessor,

and Allied Med, Inc., Lessee, dated

September 11, 2006 (Unit K)

10.7 First Amendment to Lease Agreement between This Filing

Fullerton Business Center, Lessor, and

Allied Med, Inc., Lessee, dated September 11,

2006 (Units I & J)

10.8 Second Amendment to Lease Agreement between This Filing

Fullerton Business Center, Lessor, and Allied

Med, Inc., Lessee, dated October 25, 2007

(Unit K)

10.9 Second Amendment to Lease Agreement between This Filing

Fullerton Business Center, Lessor, and

Allied Med, Inc., Lessee, dated October 25,

2007 (Units I & J)

10.10 Third Amendment to Lease Agreement between This Filing

Fullerton Business Center, Lessor, and

Allied Med, Inc., Lessee, dated November 5,

2008 (Unit K)

10.11 Change in Terms Agreement with National This Filing

Bank of California dated March 3, 2009

10.12 Subordination Agreement between Nora Y. This Filing

Amin, National Bank of California, Amexdrug

and its subsidiaries dated June 9, 2009

10.13 Business Loan Agreement between National This Filing

Bank of California, Amexdrug and its

subsidiaries dated June 23, 2008

10.14 Commercial Security Agreement between This Filing

National Bank of California, Amexdrug and

its subsidiaries dated June 23, 2008

10.15 Commercial Guarantee between National This Filing

Bank of California, Jack N. Amin, Amexdrug

and its subsidiaries

10.16 Commercial Guarantee between National This Filing

Bank of California, Nora Y. Amin, Amexdrug

and its subsidiaries

|

16

14.1 Code of Ethics ****

21.1 List of Subsidiaries of Amexdrug This Filing

Corporation

31.1 Certification of Chief Executive Officer This Filing

pursuant to Section 302 of the Sarbanes-

Oxley Act of 2002

31.2 Certification of Chief Financial Officer This Filing

pursuant to Section 302 of the Sarbanes-

Oxley Act of 2002

32.1 Certification of Chief Executive Officer This Filing

pursuant to Section 906 of the Sarbanes-

Oxley Act of 2002

32.2 Certification of Chief Financial Officer This Filing

pursuant to Section 906 of the Sarbanes-

Oxley Act of 2002

Summaries of all exhibits contained

within this report are modified in their

entirety by reference to these Exhibits.

|

* Exhibit 2.1 is incorporated by

reference from Amexdrug's Form 8-K

Current Report filed December 21, 2001

as Exhibit No. 10.01.

** Exhibit 2.2 is incorporated by

reference from Amexdrug's Form 8-K

Current Report filed January 15, 2002

as Exhibit No. 10.01.

*** Exhibit 3.1 and 3.2 are incorporated

by reference from Amexdrug's Form

10-KSB for the years ended December

31, 2001 filed on April 1, 2002.

**** Exhibit 14.1 is incorporated by

retference from Amexdrug's Form 10-K

for the year ended December 31, 2008

filed April 13, 2009

**** Exhibits 10.3, 10.4 and 10.5 are

incorporated by reference From

Amexdrug's Form 10-Q for the period

ended June 30, 2009 filed August 14,

2009

17

SIGNATURES

In accordance with the requirements of the Securities Exchange Act of

1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

AMEXDRUG CORPORATION

Date: September 18, 2009 By: /s/ Jack Amin

----------------------------

Jack Amin

Director, President, Chief Executive

Officer, Chief Financial Officer and

Chief Accounting Officer

|

18

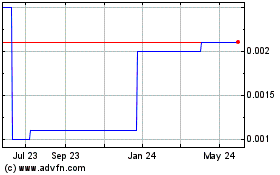

AmexDrug (CE) (USOTC:AXRX)

Historical Stock Chart

From Nov 2024 to Dec 2024

AmexDrug (CE) (USOTC:AXRX)

Historical Stock Chart

From Dec 2023 to Dec 2024