Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

Amendment No. 1

(MARK ONE)

☒ ANNUAL

REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED: APRIL

30, 2017

☐ TRANSITION

REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________

to ___________.

Commission file number

000-51126

|

BLOCKCHAIN INDUSTRIES, INC.

|

|

(Exact name of small business issuer as specified in its charter)

|

|

Nevada

|

|

88-0355407

|

(State or other jurisdiction of

incorporation or organization)

|

|

(IRS Employer

Identification No.)

|

730 Arizona Ave, Suite 220,

Santa Monica, CA 90401

(Address of principal executive offices)

(866)

995-7521

(Issuer's telephone number)

Omni Global Technologies, Inc.

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required

to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether

the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate by check mark whether

the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required

to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months

(or for such shorter period that the registrant was required to submit and post such files). Yes ☐ No ☒

Indicate by check mark if disclosure

of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will

not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference

in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging

growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

|

Non-accelerated filer ☐ (Do not check if a smaller reporting company)

|

Smaller reporting company ☒

|

|

Emerging growth company ☐

|

|

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether

the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO ☒

The aggregate market value of the

registrant’s voting and non-voting common stock held by non-affiliates of the registrant on July 31, 2017, the last business

day of the registrant’s most recently completed fiscal quarter, computed by reference to the last sale price of the registrant’s

common stock as reported by The NASDAQ Global Select Market on such date, was approximately $3,687. This computation assumes that

all executive officers, directors and persons known to the registrant to be the beneficial owners of more than ten percent of

the registrant’s common stock are affiliates of the registrant. Such assumption should not be deemed conclusive for any

other purpose.

State the number of shares outstanding

of each of the issuer's classes of common equity, as of the latest practicable date: As of August 25, 2017 the issuer had 20,368,703

shares of its common stock issued and outstanding.

BLOCKCHAIN INDUSTRIES, INC.

TABLE

OF CONTENTS TO

FORM

10-K FOR THE YEAR

ENDED

APRIL 30, 2017

Certification of Principal Executive Officer and

Principal Financial Officer pursuant to Section 302 Certification of Principal Executive Officer and Principal Financial

Officer pursuant to Section 906

EXPLANATORY

NOTE

Blockchain

Industries, Inc. (f/k/a Omni Global Technologies, Inc.) (the “Company”) filed its Annual Report on Form 10-K for the

fiscal year ended April 30, 2017 (the “Original Form 10-K”), with the U.S. Securities and Exchange Commission (the

“SEC”) on August 30, 2017. The Company is filing this Amendment No. 1 to the Original Form 10-K (this “Form

10-K/A”) solely for the limited purpose of amending our disclosure under “Item 9A. Controls and Procedures” and

to amend and update our disclosure as of the date of this Form 10-K/A filing under “Item 10. Directors, Executive Officers

and Corporate Governance”, “Item 11. Executive Compensation”, “Item 12. Security Ownership of Certain Beneficial

Owners and Management and Related Stockholder Matters”, “Item 13. Certain Relationships and Related Transactions, and

Director Independence”, and “Item 14. Principal Accounting Fees and Services” on the Original Form 10-K as requested

pursuant a comment letter issued by the Securities and Exchange Commission.

In addition,

the cover page has been amended from the Original Form 10-K to reflect the current name of the Company. On November 13, 2017, the

Registrant filed a Certificate of Amendment to its Articles of Incorporation with the State of Nevada for the purpose of changing

the name of the Registrant from Omni Global Technologies, Inc. to Blockchain Industries, Inc.

Pursuant

to Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), this Form 10-K/A also contains

new certifications pursuant to Sections 302 and 906 of the Sarbanes-Oxley Act of 2002. Accordingly, this Form 10-K/A includes the

currently dated certifications as exhibits.

Except

as expressly set forth above, this Amendment No. 1 does not, and does not purport to, amend, update, change or restate the information

in any other item of the Original Form 10-K or reflect any events that have occurred after the date of the Original Form 10-K.

Item 9A. Controls

and Procedures

|

a)

|

Evaluation of Disclosure and Controls Procedures

|

In connection with the preparation

and filing of this Annual Report, we completed an evaluation of the effectiveness of our disclosure controls and procedures under

the supervision and with the participation of our Chief Executive Officer and Principal Financial Officer. This evaluation was conducted

pursuant to the Securities Exchange Act of 1934, as amended.

Management assessed the effectiveness

of our internal control over financial reporting as of April 30, 2017. In making this assessment, management used the framework

set forth in the report Internal Control — Integrated Framework issued by the Committee of Sponsoring Organizations of the

Treadway Commission (2013), or COSO (2013).

Based on the evaluation, management

concluded that our disclosure controls and procedures were not effective as of April 30, 2017 due to the material weaknesses noted

below in “Management’s Report on Internal Control over Financial Reporting”. A material weakness is a control

deficiency, or combination of control deficiencies, that results in more than a remote likelihood that a material misstatement

of the financial statements will not be prevented or detected on a timely basis by employees in the normal course of their work.

|

(b)

|

Management’s Report on Internal Control over Financial Reporting

|

Our Chief Executive Officer

and Principal Financial Officer are responsible for establishing and maintaining adequate internal control over financial

reporting as defined under Rule 13a-15(f) and Rule 15d-15(f) under the Securities Exchange Act of 1934. As of April 30, 2017,

our Chief Executive Officer and Principal Financial Officer assessed the effectiveness of the Company’s internal

control over financial reporting based on the internal control framework promulgated by the Committee of Sponsoring

Organizations of the Treadway Commission (“COSO”), “Internal Control — Integrated Framework”

(“COSO 2013”) provides guidance for designing, implementing and conducting internal control and assessing its

effectiveness. Our Chief Executive Officer and Principal Financial Officer used the COSO 2013 framework to assess the

effectiveness of the Firm’s internal control over financial reporting as of April 30, 2017. Based on that evaluation,

our Chief Executive Officer and Principal Financial Officer concluded that, during the period covered by this report, such

internal controls and procedures were not effective to detect the inappropriate application of US GAAP rules as more fully

described below. This was due to deficiencies that existed in the design or operation of our internal control over financial

reporting that adversely affected our internal controls.

The matters involving internal controls

and procedures that the Company’s Chief Executive Officer and Principal Financial Officer considered to be material weaknesses

under the standards of the Public Company Accounting Oversight Board were: (1) lack of a functioning audit committee and lack of

a sufficient number of directors on the Company's board of directors, resulting in ineffective oversight in the establishment and

monitoring of required internal controls and procedures; (2) inadequate segregation of duties consistent with control objectives;

(3) insufficient written policies and procedures for accounting and financial reporting with respect to the requirements and application

of US GAAP and SEC disclosure requirements; and (4) ineffective controls over period end financial disclosure and reporting processes.

The aforementioned material weaknesses were identified by the Company's Chief Executive Officer and Principal Financial Officer in

connection with his review of our financial statements as of April 30, 2017.

Our Chief Executive Officer and

Principal Financial Officer believe that the material weaknesses set forth above did not have an effect on the Company's financial

results. However, our Chief Executive Officer and Principal Financial Officer believe that the lack of a functioning audit committee

and lack of a sufficient number of directors on the Company's board of directors, results in ineffective oversight of the establishment

and monitoring of required internal controls and procedures.

We will continue to monitor and

evaluate the effectiveness of our internal controls and procedures and our internal controls over financial reporting on an ongoing

basis and are committed to taking action and implementing additional enhancements or improvements as funds allow. To remediate

deficiencies in our internal controls over financial reporting, the Company expects to hire a Principal Financial Officer or other

person(s) with the necessary qualifications for overseeing the development and implementation of internal controls over financial

reporting.

|

(c)

|

Changes in Internal Control over Financial Reporting

|

There were no significant changes to our

internal control over financial reporting (as defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act) during our fourth

fiscal quarter, that could materially affect, or are reasonably likely to materially affect, our internal control over financial

reporting.

PART III

Item 10. Directors, Executive

Officers and Corporate Governance.

The Board of Directors and Executive Officers

of the Company

The following table and text sets forth

the names and ages of all our directors and executive officers and our key management personnel as of May 21, 2018. All of our

directors serve until the next annual meeting of stockholders and until their successors are elected and qualified, or until their

earlier death, retirement, resignation or removal. Executive officers serve at the discretion of the Board of Directors.

|

Name

|

Position

|

Age

|

|

Patrick Moynihan (1)

|

Chief Executive Officer and Director

|

50

|

|

Robert

Kalkstein (2)

|

Principal Financial Officer

|

36

|

|

Max Robbins (3)

|

Director

|

47

|

|

(1)

|

Patrick Moynihan was appointed Chief Executive Officer and Director on November 15, 2017.

|

|

(2)

|

Robert Kalkstein was appointed Principal Financial Officer on May 18, 2018.

|

|

(3)

|

Max Robbins was appointed a Director on February 1, 2018.

|

Patrick Moynihan, Chief Executive Officer, age 50

Mr. Moynihan brings to the position a deep

understanding of the blockchain and cryptocurrency industries and a global set of relationships with software engineers, ICO originators

and miners. Mr. Moynihan served as Managing Director for Corona Associates Capital Management from August 2015 through November

2017, Managing Director at Ithaca Partners LLC from June 2011 through October 2017, and Founder & Chief Executive Officer at

PayLock Inc from April 2004 through January 2013.

Mr. Moynihan holds an English Major

and Business Minor from Ithaca College in 1990.

Robert Kalkstein, Principal Financial

Officer, age 36

Mr. Kalkstein has served as the Chief

Financial Officer of Immudyne, Inc. since October 2017 and has served as a private consultant to emerging growth companies

since July 2012, providing services as a chief financial officer, chief operating officer or other advisory positions to

management. Previously, Mr. Kalkstein held positions at Peerless System Corp. from October 2010 to June 2012, Jefferies &

Co. from November 2009 to October 2010 and PricewaterhouseCoopers from April 2007 to October 2009. He has more than 10 years

of experience in the areas of accounting, finance, SEC filings and operations.

Mr. Kalkstein is a CPA and received a

Bachelor of Engineering in Biomedical Engineering and a Masters of Engineering in Engineering Management at Stevens Institute

of Technology in Hoboken, NJ.

Max Robbins, Director, age

47

Mr. Robbins has served as the owner

of aiScaler since January 2008, a software company specialized in web acceleration, DDos mitigation and traffic management. From

2003 to 2006, he served as President of McBride & Associates, a government contracting organization.

Under

Mr. Robbins leadership McBride grew from eighty to over two hundred million USD profitability.

From 1993 to 1996, Mr. Robbins

was the Chief Technical Officer for IDT Corporation (“IDT”) where he created the internet division, resulting in a

successful public offering in 1997. IDT trades under the symbol IDTC on the New York Stock Exchange.

Mr. Robbins is a serial entrepreneur with a wide gambit

of experience growing companies from concept to public offering. He is a speaker on blockchain technology and advisor to fintech

companies in the blockchain space, such as Modex and Trakinvest.

Family Relationships

There are no family relationships between any of our officers or directors.

Compliance with Section 16(A) of the

Exchange Act

Section 16(a) of the Exchange Act requires

the Company’s directors, executive officers and persons who beneficially own 10% or more of a class of securities registered

under Section 12 of the Securities and Exchange Act of 1934 to file reports of beneficial ownership and changes in beneficial ownership

with the SEC. Directors, executive officers and greater than 10% stockholders are required by the rules and regulations of the

SEC to furnish the Company with copies of all reports filed by them in compliance with Section 16(a).

Since we currently do not have securities

registered under Section 12 of the Securities and Exchange Act of 1934, we are not subject to Section 16(A) filing requirements.

Board Committees

We have no audit, compensation or nominating

committee. The functions of these committees are performed by our sole director. We do not have any independent directors.

Code of Ethics

We have not adopted a code of ethics as

of the date of this report.

Legal Proceedings

To the best of our knowledge, our director

and executive officer has not, during the past ten years:

|

|

·

|

been convicted in a criminal proceeding or been subject to a pending criminal proceeding (excluding traffic violations and other minor offenses);

|

|

|

|

|

|

|

·

|

had any bankruptcy petition filed by or against the business or property of the person, or of any partnership, corporation or business association of which he was a general partner or executive officer, either at the time of the bankruptcy filing or within two years prior to that time;

|

|

|

|

|

|

|

·

|

been subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction or federal or state authority, permanently or temporarily enjoining, barring, suspending or otherwise limiting, his involvement in any type of business, securities, futures, commodities, investment, banking, savings and loan, or insurance activities, or to be associated with persons engaged in any such activity;

|

|

|

|

|

|

|

·

|

been found by a court of competent jurisdiction in a civil action or by the Securities and Exchange Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated;

|

|

|

|

|

|

|

·

|

been the subject of, or a party to, any federal or state judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated (not including any settlement of a civil proceeding among private litigants), relating to an alleged violation of any federal or state securities or commodities law or regulation, any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order, or any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or

|

|

|

|

|

|

|

·

|

been the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member.

|

Except as set forth in our discussion below

in “Certain Relationships and Related Transactions,” our director and executive officer has not been involved in any

transactions with us or any of our affiliates or associates which are required to be disclosed pursuant to the rules and regulations

of the Commission.

Item 11. Executive Compensation.

The following summary compensation table

indicates the cash and non-cash compensation earned during the years ended April 30, 2017 and 2016 by each person who served as

chief executive officer and chief financial officer during the year ended December 31, 2016.

|

Summary Compensation Table

|

|

Name and Principal Position

|

|

Year

|

|

|

Option

Awards

($)

|

|

|

|

Non-Equity

Incentive Plan

Compensation

($)

|

|

|

|

All Other

Compensation

($)

|

|

|

|

Total ($)

|

|

|

Olivia Funk, Chief Executive Officer, and Director (1)

|

|

2017

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

|

2016

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

(1)

From the period from May 15, 2016 through March 22, 2017 we were under the control of a Receiver in Nevada’s Eighth Judicial

District pursuant to #A14- 715484-P. During that period the Receiver ran the Company and incurred expenses to maintain its status

as public company and to locate a potential buyer for the Company. On May 23, 2017 the Company entered into a Share Purchase Agreement

(“SPA”) with JOJ Holdings (the “Purchaser”, LLC maintaining an address at 53 Calle Palmeras, San Juan Puerto

Rico. Under the terms of the SPA, the Purchaser agreed to purchase 20,000,000 of our $0.001 par value common stock; and to assume

the liability of a judgement creditor in the amount of $25,690.41. Additionally, and concurrent with the signing of the SPA by

the Company; the Receiver resigned from the Company, and the Purchaser elected Olivia Funk as the sole officer and director of

the Company.

Olivia Funk resigned

as Chairman and Chief Executive Officer of the Company on November 15, 2017.

Executive Employment Contracts

The Company entered

into a consulting agreement with our Chief Executive Officer, Patrick Moynihan, effective as of November 1, 2017. Pursuant to the

terms of the agreement, the Company will pay Mr. Moynihan an annual fee of $240,000, payable in equal monthly installments. The

term of the agreement is for five (5) years. The Company will also reimburse Mr. Moynihan for all reasonable expenses incurred

in performing his responsibilities under the agreement.

The Company entered

into a consulting agreement with our Principal Financial Officer, Robert Kalkstein, effective as of December 1, 2017. Pursuant

to the terms of the agreement, the Company will pay Mr. Kalkstein with 1,000,000 shares of restricted stock, of which 500,000

shall vest on June 1, 2018 and the remaining 500,000 shall vest on December 1, 2018. The term of the agreement is for two (2)

years. The Company will also reimburse Mr. Kalkstein for all reasonable expenses incurred in performing his responsibilities under

the agreement.

Compensation of Directors

Director Agreement – Max Robbins

On February

1, 2018, the Company entered into a Director Agreement with Max Robbins. Pursuant to the terms of the agreement, the Director shall

receive a non-qualified stock options to purchase up to One Hundred Twenty Thousand (120,000) shares of the Company’s common

stock, pursuant and subject to the Company’s Equity Incentive Plan, at the following exercise prices and vesting schedule:

|

Exercise Price

|

Quantity Vested

|

Vesting Date

|

Expiration Date

|

|

$1.00

|

40,000

|

6/1/2018

|

12/31/2023

|

|

$1.00

|

40,000

|

6/1/2019

|

12/31/2023

|

|

$1.00

|

40,000

|

6/31/2020

|

12/31/2023

|

Mr. Robbins shall hold office until

such time that such Director’s successor is duly elected and qualified, or until such Director’s death or removal from

office. The Director will be automatically removed from the Board if such Director resigns his office by writing delivered to the

Board, becomes prohibited by law from acting as a director or commits a material breach of this Agreement.

Changes in Control

We are not aware of any arrangements that

may result in “changes in control” as that term is defined by the provisions of Item 403(c) of Regulation S-K.

Item 12. Security Ownership of

Certain Beneficial Owners and Management and Related Stockholder Matters.

The following sets

forth information as of May 18, 2018, regarding the number of shares of our common stock beneficially owned by (i) each

person that we know beneficially owns more than 5% of our outstanding common stock, (ii) each of our directors and named

executive officer and (iii) all of our directors and named executive officer as a group.

The amounts and percentages of our

common stock beneficially owned are reported on the basis of SEC rules governing the determination of beneficial ownership of securities.

Under the SEC rules, a person is deemed to be a “beneficial owner” of a security if that person has or shares “voting

power,” which includes the power to vote or to direct the voting of such security, or “investment power,” which

includes the power to dispose of or to direct the disposition of such security. A person is also deemed to be a beneficial owner

of any securities of which that person has the right to acquire beneficial ownership within 60 days through the exercise of any

stock option, warrant or other right. Under these rules, more than one person may be deemed a beneficial owner of the same securities

and a person may be deemed to be a beneficial owner of securities as to which such person has no economic interest. Unless otherwise

indicated, each of the shareholders named in the table below, or his or her family members, has sole voting and investment power

with respect to such shares of our common stock. Except as otherwise indicated, the address of each of the shareholders listed

below is: c/o Blockchain Industries, Inc., 730 Arizona Ave, Suite 220, Santa Monica, CA 90401.

|

Name and Address of Beneficial Owner

|

|

Amount of Common Stock Beneficially Owned

|

|

|

Percentage Ownership of Common stock

(1)

|

|

|

|

|

|

|

|

|

|

Patrick Moynihan, CEO and Chairman

(2)

730 Arizona Ave, Suite 220

Santa Monica, CA 90401

|

|

|

10,000,000

|

|

|

|

25.12%

|

|

|

|

|

|

|

|

|

|

|

|

|

Robert Kalkstein, Principal Financial Officer

(3)

|

|

|

|

|

|

|

|

|

|

730 Arizona Ave, Suite 220

|

|

|

|

|

|

|

|

|

|

Santa Monica, CA 90401

|

|

|

|

|

|

|

|

|

|

|

|

|

800,000

|

|

|

|

2.01

%

|

|

Max Robbins, Director

(4)

730 Arizona Ave, Suite 220

Santa Monica, CA 90401

|

|

|

40,000

|

|

|

|

0.10%

|

|

|

All Directors and Officers as a group

|

|

|

18,040,000

|

|

|

|

27.23%

|

|

|

|

|

|

|

|

|

|

|

|

Gary Goodman

14 Dorado Beach East

Dorado, PR 00646

|

|

|

3,000,000

|

|

|

|

7.53%

|

|

|

|

|

|

|

|

|

|

|

|

Robert Miketich

286 Dorado Beach East

Dorado, PR 00646

|

|

|

3,000,000

|

|

|

|

7.53%

|

|

|

|

|

|

|

|

|

|

|

|

Lawrence Partners

(5)

15 Manor Lane

Lawrence, NY 11559

|

|

|

2,775,000

|

|

|

|

6.95%

|

|

|

|

|

|

|

|

|

|

|

|

|

Immudyne, Inc.

(6)

1460 Broadway

New York, NY 10036

|

|

|

2,000,000

|

|

|

|

5.02%

|

|

|

(1)

|

Applicable percentage ownership is based on 39,815,246 shares outstanding as of May 18, 2018.

|

|

(2)

|

Mr. Kalkstein presently owns 200,000 shares, and

will receive 500,000 restricted shares within sixty (60) days of this filing. In addition, he owns 100,000 warrants which are

currently exercisable.

|

|

(3)

|

Mr. Moynihan owns 9,200,000 shares through the Santa Monica Trust, which he is trustee, and an aggregate of 800,000 shares as custodian for four of his children, each of whom own 200,000 shares.

|

|

(4)

|

Mr. Robbins joined the Board of Directors on February 1, 2018. For compensation for Mr. Robbins’ service as a member of our Board of Directors, he was issued an option to purchase 120,000 shares, which vests equally at 40,000 shares each on June 1, 2018, June 1, 2019, and June 1, 2020.

|

|

(5)

|

Lawrence Partners LLC holds 2,650,000 shares of common stock and 125,000 warrants that are currently exercisable at $0.25 per share. Jessica Beren has voting or investment control over the shares held by Lawrence Partners LLC.

|

|

(6)

|

Justin Schreiber as Chief Executive Officer

and Robert Kalkstein as Chief Financial Officer have voting or investment control over the shares held by Immudyne,

Inc.

|

Changes in Control

We are not aware of any arrangements

that may result in changes in control as that term is defined by the provisions of Item 403(c) of Regulation S-K.

Item 13. Certain Relationships

and Related Transactions, and Director Independence.

None

of our officers, directors, proposed director nominees, beneficial owners of more than 10% of our shares of common stock, or any

relative or spouse of any of the foregoing persons, or any relative of such spouse who has the same house as such person or who

is a director or officer of any parent or subsidiary of our Company, has any direct or indirect material interest in any transaction

to which we are a party since our incorporation or in any proposed transaction to which we are proposed to be a party.

In

the event a related party transaction is proposed, such transaction will be presented to our board of directors for consideration

and approval. Any such transaction will require approval by a majority of the disinterested directors and such transactions will

be on terms no less favorable than those available to disinterested third parties.

Director Independence

Since our common stock is not currently

listed on a national securities exchange, we have used the definition of “independence” of The NASDAQ Stock Market

to make this determination. NASDAQ Listing Rule 5605(a)(2) provides that an “independent director” is a person other

than an officer or employee of the company or any other individual having a relationship that, in the opinion of the company’s

board of directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

The NASDAQ listing rules provide that a director cannot be considered independent if:

|

|

·

|

the director is, or at any time during the past three years was, an employee of the company;

|

|

|

|

|

|

|

·

|

the director or a family member of the director accepted any compensation from the company in excess of $120,000 during any period of 12 consecutive months within the three years preceding the independence determination (subject to certain exclusions, including, among other things, compensation for board or board committee service);

|

|

|

|

|

|

|

·

|

a family member of the director is, or at any time during the past three years was, an executive officer of the company;

|

|

|

|

|

|

|

·

|

the director or a family member of the director is a partner in, controlling stockholder of, or an executive officer of an entity to which the company made, or from which the company received, payments in the current or any of the past three fiscal years that exceed 5% of the recipient’s consolidated gross revenue for that year or $200,000, whichever is greater (subject to certain exclusions);

|

|

|

|

|

|

|

·

|

the director or a family member of the director is employed as an executive officer of an entity where, at any time during the past three years, any of the executive officers of the company served on the compensation committee of such other entity; or

|

|

|

|

|

|

|

·

|

The director or a family member of the director is a current partner of the company’s outside auditor, or at any time during the past three years was a partner or employee of the company’s outside auditor, and who worked on the company’s audit.

|

|

|

|

|

|

|

|

Based upon the above criteria, we have no independent directors.

|

Based upon the above criteria, we have determined that

we have no independent board members.

Item 14. Principal Accounting

Fees and Services.

Our Board of Directors has selected

BF Borgers CPA PC ("Borgers") as the independent registered public accounting firm to audit our books and accounts for

the fiscal years ending April 30, 2017 and 2016. Borgers has served as our independent auditor since October 31, 2016. The aggregate

fees billed, or expected to be billed, for the last two fiscal years ended April 30, 2017 and 2016, for professional services rendered

by Borgers were as follows:

|

|

|

2017

|

|

|

2016

|

|

|

Audit Fees (1)

|

|

$

|

2,910

|

|

|

$

|

2,910

|

|

|

Audit Related fees

|

|

|

–

|

|

|

|

–

|

|

|

Tax Fees

|

|

|

–

|

|

|

|

–

|

|

|

All Other Fees

|

|

|

–

|

|

|

|

–

|

|

|

Total

|

|

$

|

2,910

|

|

|

$

|

2,910

|

|

________________

(1) Our independent auditor was paid an aggregate

of $5,820 to perform our audit for fiscal years 2016 and 2017.

Audit Fees — This category

includes the audit of our annual financial statements, review of financial statements included in our Form 10-Q Quarterly Reports

and services that are normally provided by the independent auditors in connection with engagements for those fiscal years. This

category also includes advice on audit and accounting matters that arose during, or as a result of, the audit or the review of

interim financial statements.

Audit-Related Fees — This

category consists of assurance and related services by the independent auditors that are reasonably related to the performance

of the audit or review of our financial statements and are not reported above under “Audit Fees.” The services for

the fees disclosed under this category include consultation regarding our correspondence with the SEC and acquisition audits

Tax Fees — This category consists

of professional services rendered by our independent auditors for tax compliance and tax advice. The services for the fees disclosed

under this category include tax return preparation and technical tax advice.

All Other Fees — This category

consists of fees for other miscellaneous items.

Our Board of Directors has adopted

a procedure for pre-approval of all fees charged by our independent auditors. Under the procedure, the Board approves the engagement

letter with respect to audit, tax and review services. Other fees are subject to pre-approval by the Board, or, in the period between

meetings, by a designated member of Board. Any such approval by the designated member is disclosed to the entire Board at the next

meeting. The audit fees paid to the auditors with respect to fiscal years 2017 and 2016 were pre-approved by the entire Board

of Directors.

PART IV

Item 15. Exhibits, Financial Statement Schedules.

Reference is made

to the Index to Financial Statements at page 10 of the Original Filing for a list of financial statements filed as part of

the Annual Report on Form 10-K.

|

EXHIBIT

|

|

|

|

NUMBER

|

|

DESCRIPTION

|

|

|

|

|

|

3.1*

|

|

Articles of Incorporation of the Company Filed September 15, 1995

(Incorporated by reference to Form 10SB12G/A filed on June 30, 2006)

|

|

3.1(a)*

|

|

Certificate of Amendment to the Articles of Incorporation, dated November 17, 2017

(Incorporated by Reference to Form 8-K filed on November 15, 2017)

|

|

4.1*

|

|

Form of Common Stock Certificate

(Incorporated by reference to Form 10SB12G/A filed on June 30, 2006)

|

|

10.1*

|

|

Business.com.vn MOU

(Incorporated by reference to Form 10SB12G/A filed on June 30, 2006)

|

|

10.2*

|

|

Hotels.vn Marketing agreement (Business.com.vn agreement)

(Incorporated by reference to Form 10SB12G/A filed on June 30, 2006)

|

|

10.3*

|

|

Hotels Extension document (Business.com.vn extension)

(Incorporated by reference to Form 10SB12G/A filed on June 30, 2006)

|

|

10.4*

|

|

Hi-Tek Reservation Engine agreement

(Incorporated by reference to Form 10SB12G/A filed on June 30, 2006)

|

|

10.5*

|

|

Maxsima discount card

(Incorporated by reference to Form 10SB12G/A filed on June 30, 2006)

|

|

10.6*

|

|

Hi-Tek service agreement

(Incorporated by reference to Form 10SB12G/A filed on June 30, 2006)

|

|

10.8*

|

|

My BajaGuide.com MOU

(Incorporated by reference to Form 10SB12G/A filed on June 30, 2006)

|

|

10.9*

|

|

Mexican association agreement

(Incorporated by reference to Form 10SB12G/A filed on June 30, 2006)

|

|

10.10*

|

|

DotVN agreement

(Incorporated by reference to Form 10SB12G/A filed on June 30, 2006)

|

|

10.11*

|

|

VTIC MOU

(Incorporated by reference to Form 10SB12G/A filed on June 30, 2006)

|

|

10.12*

|

|

Consulting Agreement

(Incorporated by reference to Form 10SB12G/A filed on June 30, 2006)

|

|

10.13*

|

|

Hi-Tek interest agreement

(Incorporated by reference to Form 10SB12G/A filed on June 30, 2006)

|

|

10.14*

|

|

Hi-Tek Reservation Engine Extension

(Incorporated by reference to Form 10SB12G/A filed on June 30, 2006)

|

|

10.15*

|

|

Independent contractors' agreement

(Incorporated by reference to Form 10SB12G/A filed on June 30, 2006)

|

|

10.16*

|

|

Independent contractors' agreement

(Incorporated by reference to Form 10SB12G/A filed on June 30, 2006)

|

|

10.17*

|

|

Hi-Tek Service agreement with attached schedule “A”

(Incorporated by reference to Form 10SB12G/A filed on June 30, 2006)

|

|

10.18*

|

|

Share Purchase Agreement

(Incorporated by reference to Form 10-K filed on August 30, 2017)

|

|

10.19**

|

|

Consulting Agreement with Patrick Moynihan, dated November 1, 2017

|

|

10.20*

*

|

|

Director Agreement with Max Robbins, dated February 1, 2018

|

|

10.21

|

|

Consulting Agreement with Robert Kalkstein dated December 1, 2017

|

|

31.1**

|

|

Certification of the Principal Executive Officer of Registrant pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 (Rule 13a-14(a) or Rule 15d-149a))

|

|

31.2**

|

|

Certification of the Principal Financial Officer of Registrant pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 (Rule 13a-14(a) or Rule 15d-149a))

|

|

32.1***

|

|

Certification of Principal Executive Officer pursuant to 18 U.S.C. 1350 as adopted to Section 906 of the Sarbanes-Oxley Act of 2002.

|

|

32.2***

|

|

Certification of the Principal Financial Officer pursuant to 18 U.S.C. 1350 as adopted to Section 906 of the Sarbanes-Oxley Act of 2002.

|

|

|

|

|

|

101.INS*

|

|

XBRL Instances Document (incorporated by reference to Form 10-K filed on August 30, 2017)

|

|

101.SCH*

|

|

XBRL Taxonomy Extension Schema Document (incorporated by reference to Form 10-K filed on August 30, 2017)

|

|

101.CAL*

|

|

XBRL Taxonomy Extension Calculation Linkbase Document (incorporated by reference to Form 10-K filed on August 30, 2017)

|

|

101.DEF*

|

|

XBRL Taxonomy Extension Definition Linkbase Document (incorporated by reference to Form 10-K filed on August 30, 2017)

|

|

101.LAB*

|

|

XBRL Taxonomy Extension Label Linkbase Document (incorporated by reference to Form 10-K filed on August 30, 2017)

|

|

101.PRE*

|

|

XBRL Taxonomy Extension Presentation Linkbase Document (incorporated by reference to Form 10-K filed on August 30, 2017)

|

___________

* These documents are incorporated herein by reference

as exhibits hereto. Following the description of each such exhibit is a reference to the document as it appeared in a specified

report previously filed with the SEC, to which there have been no amendments or changes.

** Filed herewith.

***Furnished herewith.

SIGNATURES

In accordance with Section 13 or 15(d) of the Exchange Act,

the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

BLOCKCHAIN INDUSTRIES, INC.

|

|

|

|

|

|

|

|

Date: May 21, 2018

|

By:

|

/s/

Patrick Moynihan

|

|

|

|

|

Patrick Moynihan

Chief

Executive Officer, Principal Executive Officer and Director

|

|

|

Date: May 21, 2018

|

By:

|

/s/ Robert Kalkstein

|

|

|

|

|

Robert Kalkstein

Principal Financial Officer

|

|

In accordance with the Exchange Act, this report has been signed

by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

|

BLOCKCHAIN INDUSTRIES, INC.

|

|

|

|

|

|

|

|

Date: May 21, 2018

|

By:

|

/s/

Patrick Moynihan

|

|

|

|

|

Patrick Moynihan

Chief Executive Officer, Principal Executive Officer and Director

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: May 21, 2018

|

By:

|

/s/

Robert Kalkstein

|

|

|

|

|

Robert Kalkstein, Principal Financial Officer

|

|

|

|

|

|

|

|

|

|

|

|

Date: May 21, 2018

|

By:

|

/s/

Max Robbins

|

|

|

|

|

Max Robbins, Director

|

|

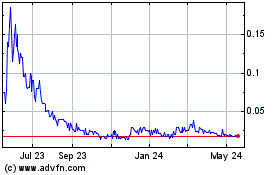

BCII Enterprises (PK) (USOTC:BCII)

Historical Stock Chart

From Nov 2024 to Dec 2024

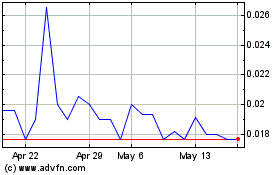

BCII Enterprises (PK) (USOTC:BCII)

Historical Stock Chart

From Dec 2023 to Dec 2024